UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

|

|

| Investment Company Act file number |

|

811-21619 |

Nuveen S&P 500 Buy-Write Income Fund

(Exact name of registrant as

specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL

60606

(Address of principal

executive offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker

Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area

code: (312) 917-7700

Date of fiscal year end: December

31

Date of reporting period: December 31,

2023

Form N-CSR is to be used by

management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of

1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the

clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Closed-End Funds |

|

|

|

December 31,

2023 |

Nuveen

Closed-End Funds

|

|

|

| |

|

|

| Nuveen S&P 500 Buy-Write Income

Fund |

|

BXMX |

| |

|

|

| Nuveen Dow 30SM Dynamic Overwrite Fund |

|

DIAX |

| |

|

|

| Nuveen S&P 500 Dynamic Overwrite Fund |

|

SPXX |

| |

|

|

| Nuveen Nasdaq 100 Dynamic Overwrite Fund |

|

QQQX |

| |

|

|

| Nuveen Core Equity Alpha Fund |

|

JCE |

| |

Annual

Report

IMPORTANT DISTRIBUTION NOTICE

FOR

SHAREHOLDERS OF THE NUVEEN S&P 500 BUY-WRITE INCOME FUND (BXMX)

NUVEEN DOW 30SM DYNAMIC OVERWRITE

FUND (DIAX)

NUVEEN S&P 500 DYNAMIC OVERWRITE FUND (SPXX)

NUVEEN NASDAQ 100 DYNAMIC OVERWRITE FUND (QQQX)

NUVEEN CORE EQUITY ALPHA FUND (JCE)

SEMI-ANNUAL SHAREHOLDER REPORT FOR THE PERIOD ENDING DECEMBER 31, 2023

The Nuveen S&P 500 Buy-Write Income Fund (BXMX), Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX), Nuveen S&P 500 Dynamic

Overwrite Fund (SPXX), Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) and Nuveen Core Equity Alpha Fund (JCE) seek to offer attractive cash flow to their shareholders, by converting the expected long-term total return potential of the Funds’

portfolio of investments into regular quarterly distributions. Following is a discussion of the Managed Distribution Policy the Funds use to achieve this.

Each

Fund pays quarterly common share distributions that seek to convert the Fund’s expected long-term total return potential into regular cash flow. As a result, the Funds’ regular common share distributions (presently $0.2365, $0.2867,

$0.2940, $0.4200, $0.3200 per share, respectively) may be derived from a variety of sources, including:

· Net investment income consisting of regular interest and dividends

· Realized capital gains or,

· Possibly, returns of capital representing in certain cases unrealized capital appreciation.

Such distributions are sometimes referred to as “managed distributions.” Each Fund seeks to establish a distribution rate that roughly corresponds to the

Adviser’s projections of the total return that could reasonably be expected to be generated by each Fund over an extended period of time. The Adviser may consider many factors when making such projections, including, but not limited to,

long-term historical returns for the asset classes in which each Fund invests. As portfolio and market conditions change, the distribution amount and distribution rate on the Common Shares under the Funds’ Managed Distribution Policy could

change.

When it pays a distribution, each Fund provides holders of its Common Shares a notice of the estimated sources of the Fund’s distributions (i.e., what

percentage of the distributions is estimated to constitute ordinary income, short-term capital gains, long-term capital gains, and/or a non-taxable return of capital) on a year-to-date basis. It does this by posting the notice on its website (www.nuveen.com/cef), and by sending it in written form.

You should not draw any conclusions about the Funds’ investment performance from the amount of this distribution or from the terms of the Funds’ Managed

Distribution Policy. The Funds’ actual financial performance will likely vary from month-to-month and from year-to-year, and there may be extended periods when the distribution rate will exceed the Funds’ actual total returns. The Managed Distribution Policy provides that the Board may amend or terminate the

Policy at any time without prior notice to Fund shareholders. There are presently no reasonably foreseeable circumstances that might cause each Fund to terminate its Managed Distribution Policy.

2

3

|

|

|

|

|

Dear Shareholders, |

| |

Financial markets spent the past year focused on the direction of inflation and

whether policy makers would be able to deliver a soft landing in their economies. After more than a year and a half of interest rate increases by the U.S. Federal Reserve (Fed) and other central banks, financial conditions have tightened and

inflation rates have cooled considerably. The Fed increased the target fed funds rate from near zero in March 2022 to a range of 5.25% to 5.50% at its latest increase in July 2023, then left the rate unchanged through January 2024. At its December

2023 policy meeting, the Fed acknowledged the fed funds rate may have reached its peak, and then in January 2024 removed the suggestion that another hike was possible. But current inflation rates remain above central banks’ targets, and the

trajectory from here is difficult to predict given that monetary policy acts on the economy with long and variable lags. |

| |

Surprisingly, economies were relatively resilient for much of 2023. The

“most predicted recession” did not materialize in the U.S. during 2023, while U.K. and European economic growth had begun to show signs of stagnation or decline in the second half of the year. U.S. gross domestic product rose 3.3% in the

fourth quarter of 2023, slower than 4.9% in the third quarter but still ahead of 2.1% in the second quarter and 2.0% in the first quarter. For 2023 overall, GDP grew 2.5% (from the 2022 annual level to the 2023 annual level), compared to 1.9% in

2022. Much of the growth was driven by a relatively strong jobs market, which kept consumer sentiment and spending elevated despite long-term interest rates nearing multi-year highs, a series of U.S. regional bank failures and shocks from flaring

geopolitical tensions. |

|

|

|

|

While central banks are likely nearing the end of this interest rate hiking cycle, there are still upside risks to inflation and downside risks to the economy. Some labor market and consumer indicators are softening. Government

funding and deficits remain a concern, especially as the U.S. election year gets underway. The markets will continue to try to anticipate monetary policy shifts as the Fed evaluates incoming data and adjusts its rate setting activity on a meeting-by-meeting basis. Geopolitical risks – from relations with China, to wars in Europe and the Middle East – also expand the range of outcomes from economies

and markets around the world. All these uncertainties, and others, will remain sources of short-term market volatility. In this environment, Nuveen remains committed to filtering the market noise for investable opportunities that ultimately serve

long-term investment objectives. Maintaining a long-term perspective is also important for investors, and we encourage you to review your time horizon, risk tolerance and investment goals with your financial professional. |

|

|

|

|

On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead. |

|

|

|

|

|

|

|

|

|

Terence J. Toth |

|

|

|

|

Co-Chair of the Board |

|

|

|

|

February 22, 2024 |

4

Portfolio Manager Update for BXMX

Effective June 30, 2023, Mitchell Trotta was added as a portfolio manager of the Fund. There were no other changes to the portfolio management of the Fund during the

reporting period.

5

|

|

|

| Portfolio Managers’

Comments |

|

|

Nuveen S&P 500 Buy-Write Income Fund (BXMX)

Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX)

Nuveen S&P 500 Dynamic Overwrite Fund (SPXX)

Nuveen Nasdaq 100 Dynamic

Overwrite Fund (QQQX)

Nuveen Core Equity Alpha Fund (JCE)

The

Nuveen S&P 500 Buy-Write Income Fund (BXMX) features portfolio management by Gateway Investment Advisers, LLC (Gateway). The Fund’s portfolio managers are Kenneth Toft, CFA, Michael Buckius, CFA,

Daniel Ashcraft, CFA, and Mitchell Trotta, CFA. The Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX), Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) and Nuveen Nasdaq 100 Dynamic Overwrite Fund

(QQQX) feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Funds’ investment adviser. The Funds’ portfolio managers are David Friar, James (Jim) Campagna, CFA, Lei Liao, CFA

and Darren Tran, CFA. The Nuveen Core Equity Fund (JCE) features portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Fund’s investment adviser. The Fund’s portfolio managers are David

Friar, Maxim Kozlov, CFA, and Pei Chen.

Effective June 30, 2023, Mitchell Trotta was added as a portfolio manager of the Nuveen S&P 500 Buy-Write Income Fund. Michael Buckius, Kenneth Toft and Daniel Ashcraft continue to serve as portfolio managers of the Fund.

Here the Funds’ portfolio management teams review U.S. economic and financial market conditions, key investment strategies and the performance of the Funds for

the twelve-month reporting period ended December 31, 2023. For more information on the Funds’ investment objectives and policies, please refer to the Shareholder Update section at the end of the report.

What factors affected the U.S. economy and financial markets during the twelve-month reporting period ended December 31, 2023?

The U.S. economy performed better than expected despite persistent inflationary pressure and rising interest rates during the twelve-month period ended December 31,

2023. Gross domestic product rose at an annualized rate of 3.3% in the fourth quarter of 2023, after sharply accelerating to 5.2% (annualized) in third quarter of 2023, according to the U.S. Bureau of Economic Analysis initial estimate. For the year

as a whole, GDP was up 2.5% (from the 2022 annual level to the 2023 annual level), compared with an increase of 1.9% in 2022. During the reporting period, price pressures eased in comparison to 2022 given normalization in supply chains, falling

energy prices and aggressive measures by the U.S. Federal Reserve (Fed) and other global central banks to tighten financial conditions and slow demand in their economies. Nevertheless, during the reporting period inflation levels remained higher

than central banks’ target levels.

The Fed raised its target fed funds rate four times during the reporting period, bringing it to a range of 5.25% to 5.50% as

of July 2023 and voting to hold it at that level at its remaining meetings in 2023. During the beginning of the reporting period, the Fed’s activity led to significant volatility in bond and stock markets, given the uncertainty of how rising

interest rates would affect the economy. One of the most highly visible impacts occurred in the U.S. regional banking sector in March 2023, when Silicon Valley Bank, Signature Bank, First Republic Bank and Silvergate Bank failed. In the same month,

Swiss bank UBS agreed to buy Credit Suisse, which was considered vulnerable in the current environment. The Fed’s monetary tightening policy also contributed to an increase in the U.S. dollar’s value relative to major world currencies,

which acts as a headwind to the profits of international companies and U.S. domestic companies with overseas earnings.

During the reporting period, elevated

inflation and higher borrowing costs weighed on some segments of the economy, including the real estate market. Consumer spending, however, has remained more resilient than expected, in part because of a still-strong labor market, another key gauge

of the economy’s health. As of December 2023, the unemployment rate was 3.7%, near its pre-pandemic low, with monthly job growth continuing to moderate. The strong labor market and wage gains helped the

U.S. economy during the reporting period, even as the Fed sought to soften job growth to help curb inflation pressures.

During the reporting period, investors also

continued to monitor government funding and deficits. The U.S. government avoided a default scenario after approving an increase to the debt ceiling limit in June 2023. At the same time, the potential for a government shutdown loomed but was

ultimately avoided with funding resolutions passed in September and November 2023. Notably, in August 2023, ratings agency Fitch downgraded U.S. debt from AAA to AA+ based on concerns about the U.S.’s growing fiscal debt and reduced confidence

in fiscal management.

6

Nuveen S&P 500 Buy-Write Income Fund (BXMX)

What key strategies were used to manage the Fund during the twelve-month reporting period ended December 31, 2023?

BXMX seeks attractive total return with less volatility than the S&P 500® Index by investing in an equity

portfolio that seeks to substantially replicate the price movements of the S&P 500® Index and by selling index call options covering approximately 100% of the Fund’s equity portfolio

value with a goal of enhancing the portfolio’s risk-adjusted returns.

The writing of index call options on a broad equity index, while investing in a portfolio

of equities, has the potential to enhance BXMX’s risk-adjusted returns while exposing the Fund to less risk than unhedged equity investments. Hedging the equity portfolio with index call options may limit the Fund’s participation in market

advances in exchange for the cash premium received for the written index call options. Conversely, market declines are typically buffered by the amount of the cash premium received by the Fund. In flat or declining markets, BXMX’s call option

premium can potentially enhance total return relative to the S&P 500® Index. However, in rising markets, the call options may reduce the Fund’s total return relative to the S&P

500® Index.

During the reporting period, the portfolio management team focused on opportunities in the

written index call option portfolio. The portfolio management team took advantage of elevated implied volatility levels that drove the availability of above-average premiums. These premiums helped to offset a material portion of losses during equity

market declines and offered a high level of market participation during periods of strength.

How did the Fund perform during the twelve-month reporting period

ended December 31, 2023?

For the twelve-month reporting period ended December 31, 2023, BXMX significantly outperformed the Chicago Board Options

Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM). For purposes of this Performance Commentary, references to relative performance are in

comparison to the BXMSM.

The Fund’s options portfolio outperformed the options component of the BXMSM during the reporting period. The portfolio management team’s active adjustments to the Fund’s index call option portfolio were particularly beneficial during periods when the equity market

outperformed the BXMSM. Specifically, the Fund’s options portfolio significantly outperformed the BXMSM during the equity market’s

rapid market advance from mid-March to the end of July 2023 and outperformed the BXMSM to a lesser extent during the equity market advance from the end of

October through December 2023. Additionally, the Fund’s options portfolio outperformed the BXMSM during one of the period’s equity market declines from the end of July through the end of

October 2023. However, the options portfolio underperformed the BXMSM during the other market decline from early February through mid-March 2023. The risk

level of the Fund, as measured by its standard deviation of daily return, was much lower than that of the U.S. equity market and slightly above the BXMSM over the reporting period.

The Fund’s equity portfolio also outperformed the equity component of the BXMSM during the reporting

period. Key drivers of the equity portfolio’s outperformance included stock selection in the information technology, consumer staples and communication services sectors. However, the role of the equity portfolio is to support the option

strategy by closely tracking the S&P 500® Index, so enhancing its return through fundamental stock selection or sector allocation is not a management objective. Relative

performance of the equity portfolio may fluctuate during the short term but is expected to be in line with the S&P 500® Index over longer timeframes.

Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX)

What key strategies were used to manage the Fund during the twelve-month reporting period ended December 31, 2023?

DIAX seeks attractive total return with less volatility than the Dow Jones Industrial Average Index (DJIA) by investing in an equity portfolio that seeks to

substantially replicate the price movements of the DJIA, as well as selling call options on 35% to 75% of the notional value of the Fund’s equity portfolio, with a long-term target of 55% overwrite in an effort to enhance the Fund’s

risk-adjusted returns. The portfolio management team uses its proprietary view of the market’s return and volatility profile to dynamically adjust the option overwrite percentage and other factors.

Generally, if the portfolio management team expects the equity market to appreciate, the option overwrite percentage will be reduced to offer more potential upside

capture. Likewise, if the portfolio management team expects equity markets to be flat or to decline, the option overwrite percentage may be increased, thus managing the Fund to potentially receive additional cash flow from higher sales of call

options. This dynamic option overwrite approach offers the potential for greater equity market upside capture

7

|

|

|

| Portfolio Managers’ Comments

(continued) |

|

|

than the full option overwrite approach, while still offering a measure of downside risk management. The Fund currently

expects to carry out its principal investment strategy by emphasizing options on broad-based indexes, individual stocks in the DJIA, and options on custom baskets of stocks, in addition to exchange-traded funds (ETFs). The Fund also has the

opportunity to utilize call spread strategies and sell put options on a portion of the underlying equity portfolio.

During the reporting period, the portfolio

management team varied the core option overwrite level between 39% and 67%. The average option overwrite level during the reporting period, which consisted primarily of calls written on the S&P

500® Index, was in line with its long-term target.

How did the Fund perform during the twelve-month

reporting period ended December 31, 2023?

For the twelve-month reporting period ended December 31, 2023, DIAX underperformed the DIAX Blended

Benchmark, which is a blended return consisting of 1) 55% Chicago Board Options Exchange (Cboe) DJIA BuyWrite Index (BXDSM) and 2) 45% Dow Jones Industrial Average Index (DJIA). For purposes of

this Performance Commentary, references to relative performance are in comparison to the DIAX Blended Benchmark.

The primary detractor from the Fund’s relative

performance was call options sold on the S&P 500® Index. The BXDSM, which is a component of the DIAX Blended Benchmark, sells index

call options on the DJIA. Because of its investment policies, the Fund is precluded from selling index call options on the DJIA and instead primarily sold call options on the S&P 500®

Index. This combination detracted from the Fund’s relative performance because the S&P 500® Index significantly outperformed the DJIA for the reporting period.

Partially offsetting the Fund’s underperformance was the timing of overwrite levels in the Fund’s options portfolio. During the market’s strong advances

in January, June and November 2023, the portfolio management team opportunistically lowered the Fund’s level of call selling, which benefited performance. However, this positive contribution was slightly offset by not adding enough options

during the September 2023 market pullback.

The portfolio management team was able to generate additional income from selling put options on the S&P 500® Index, taking advantage of the index’s generally upward trajectory over the year. In addition, the portfolio management team sold calls and bought puts on the Russell 2000 Index, bought and

sold single name call options, bought puts and calls on the Chicago Board Options Exchange (Cboe) Volatility Index (the VIX®), and bought and sold calls and puts on several ETFs, which had a

negligible impact on relative performance in 2023.

Nuveen S&P 500 Dynamic Overwrite Fund (SPXX)

What key strategies were used to manage the Fund during the twelve-month reporting period ended December 31, 2023?

SPXX seeks attractive total return with less volatility than the S&P 500® Index by investing in an equity

portfolio that seeks to substantially replicate the price movements of the S&P 500® Index, as well as selling call options on 35% to 75% of the notional value of the Fund’s equity

portfolio, with a long-run target of 55% overwrite in an effort to enhance the Fund’s risk-adjusted returns. The portfolio management team uses its proprietary view of the market’s return and

volatility profile to dynamically adjust the option overwrite percentage and other factors. The strategy will consider the Fund’s tax position and employ techniques to improve after-tax shareholder

outcomes.

Generally, if the portfolio management team expects the equity market to appreciate, the option overwrite percentage will be reduced to offer more

potential upside capture. Likewise, if the portfolio management team expects equity markets to be flat or to decline, the option overwrite percentage may be increased, thus managing the Fund to potentially receive additional cash flow from higher

sales of call options. This dynamic option overwrite approach offers the potential for greater equity market upside capture than the full option overwrite approach, while still offering a measure of downside risk management. The Fund currently

expects to emphasize index call options on the S&P 500® Index and can also employ an expanded range of options including index options on other broad-based indexes and options on custom

baskets of stocks, in addition to single name options. The Fund also has the opportunity to utilize call spread strategies and sell put options on a portion of the underlying equity portfolio.

During the reporting period, the portfolio management team varied the core option overwrite level between 39% and 54%. The average option overwrite level during the

reporting period, which consisted primarily of calls written on the S&P 500® Index, was in line with its long-term target.

8

How did the Fund perform during the twelve-month reporting period ended December 31, 2023?

For the twelve-month reporting period ended December 31, 2023, SPXX performed in line with the SPXX Blended Benchmark, which is a blended return consisting of 1)

55% Chicago Board Options Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM) and 2) 45% S&P 500® Index. For the purposes of this Performance Commentary, references to relative performance are in comparison to the SPXX Blended Benchmark.

The Fund’s equity portfolio outperformed the equity component of the SPXX Blended Benchmark over the reporting period. Key drivers of outperformance were stock

selection in the financials, consumer staples and communication services sectors. The timing of overwrite levels in the Fund’s options portfolio also contributed to relative results. During the market’s strong advances in January, June and

November 2023, the portfolio management team opportunistically lowered the Fund’s level of call selling, which benefited performance. However, this positive contribution was offset by not adding enough options during the September 2023 market

pullback. In addition, the portfolio management team sold calls and bought puts on the Russell 2000 Index, sold call and put options on the S&P 500® Index, bought and sold single name call

options, bought puts and calls on the Chicago Board Options Exchange (Cboe) Volatility Index (the VIX®), and bought and sold calls and puts on several ETFs, however the impact of these

positions on relative performance was minimal.

Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

What key strategies were used to manage the Fund during the twelve-month reporting period ended December 31, 2023?

QQQX seeks attractive total return with less volatility than the Nasdaq 100® Index by investing in an equity

portfolio that seeks to substantially replicate the price movements of the Nasdaq 100® Index, as well as selling call options on 35% to 75% of the notional value of the Fund’s equity

portfolio, with a long-run target of 55% in an effort to enhance the Fund’s risk-adjusted returns. The portfolio management team uses its proprietary view of the market’s return and volatility

profile to dynamically adjust the option overwrite percentage and other factors. The strategy will consider the Fund’s tax position and employ techniques to improve after-tax shareholder outcomes.

Generally, if the portfolio management team expects the equity market to appreciate, the overwrite percentage will be reduced to offer more potential upside capture.

Likewise, if the portfolio management team expects equity markets to be flat or to decline, the overwrite percentage may be increased, thus managing the Fund to potentially receive additional cash flow from higher sales of call options. This dynamic

option overwrite approach offers potential for greater equity market upside capture than the full overwrite approach, while still offering a measure of downside risk management. The Fund, in carrying out its principal options strategy, expects to

primarily write index call options on the Nasdaq 100® Index and other broad-based indexes and can also write call options on a variety of other equity market indexes and options on custom

baskets of stocks, in addition to single name options. The Fund also has the opportunity to utilize call spread strategies and sell put options on a portion of the underlying equity portfolio.

During the reporting period, the portfolio management team varied the core option overwrite level between 38% and 66%. The average option overwrite during the reporting

period, which consisted primarily of calls written on the Nasdaq 100® Index, was in line with its long-term target.

How did the Fund perform during the twelve-month reporting period ended December 31, 2023?

For the twelve-month reporting period ended December 31, 2023, QQQX underperformed the QQQX Blended Benchmark, which is a blended return consisting of 1) 55%

Chicago Board Options Exchange (Cboe) Nasdaq 100 BuyWrite Index (BXNSM) and 2) 45% Nasdaq 100® Index. For the purposes of this Performance

Commentary, references to relative performance are in comparison to the QQQX Blended Benchmark.

The primary detractor from the Fund’s relative performance was

the equity portfolio’s return, driven by unfavorable stock selection in the information technology sector. The information technology sector was not only the strongest performing sector in the Nasdaq 100® Index, but its performance was narrowly led by a small group of mega-cap and artificial intelligence related stocks during the reporting period. Therefore,

underweight positions in NVIDIA Corp, Broadcom Inc., and CrowdStrike Holdings Inc., and lack of exposure to Adobe Incorporated detracted from relative performance.

The Fund’s underperformance was partially offset by the timing of overwrite levels in the Fund’s options portfolio. During the market’s strong advances in

January, June and November 2023, the portfolio management team opportunistically lowered the

9

|

|

|

| Portfolio Managers’ Comments

(continued) |

|

|

Fund’s level of call selling, which benefited performance. However, this positive contribution was slightly offset

by not adding enough options during the September 2023 market pullback.

In addition to selling calls on the Nasdaq

100® Index, the portfolio management team also sold calls and bought puts on the Russell 2000 Index, sold call and put options on the S&P

500® Index, bought and sold single name call options, bought puts and calls on the Chicago Board Options Exchange (Cboe) Volatility Index (the

VIX®), and bought and sold calls and puts on several ETFs; however, the impact of these positions on relative performance was minimal.

Nuveen Core Equity Alpha Fund (JCE)

What key strategies were used to

manage the Fund during the twelve-month reporting period ended December 31, 2023?

JCE seeks to provide an attractive level of total return, primarily

through long-term capital appreciation and secondarily through income and gains. The Fund invests in large capitalization common stocks, using a proprietary quantitative process designed to provide the potential for long-term outperformance. The

Fund also sells call options with a notional value of up to 50% of the Fund’s equity portfolio in seeking to enhance risk-adjusted performance relative to an all-equity portfolio. The portfolio management

team uses its proprietary view of the market’s return and volatility profile to dynamically adjust the option overwrite percentage and other factors.

How

did the Fund perform during the twelve-month reporting period ended December 31, 2023?

For the twelve-month reporting period ended December 31, 2023,

JCE outperformed the JCE Blended Benchmark, which is a blend of returns consisting of 1) 50% S&P 500® Index and 2) 50% Chicago Board Options Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM). For purposes of this Performance Commentary, references to relative performance are in comparison to the JCE Blended

Benchmark.

The primary contributor to relative performance was the timing of overwrite levels in the Fund’s options portfolio. During the market’s strong

advances in January, June and November 2023, the portfolio management team opportunistically lowered the Fund’s level of call selling, which benefited performance. However, this positive contribution was slightly offset by not adding enough

options during the September 2023 market pullback. Also, the portfolio management team was able to generate additional income from selling put options on the S&P 500® Index, taking

advantage of the index’s generally upward trajectory. In addition, the portfolio management team bought and sold single name options, which added modestly to performance in 2023.

The Fund’s outperformance was partially offset by the equity portfolio’s return, which underperformed the S&P 500® Index, primarily due to security selection in the health care and information technology and consumer discretionary sectors. Detractors included overweight positions in Pfizer Inc. and

Mettler-Toledo International Inc. and underweight positions in NVIDIA Corp, Broadcom Inc., Advanced Micro Devices Inc. and Tesla Inc. As part of the model-driven security selection process, which is designed to select constituents from the S&P

500® Index and the Russell 1000® Index, the portfolio management team seeks to minimize tracking error while adhering to tax and

concentration rules.

In addition to selling call and put options on the S&P 500® Index and on single

names, the portfolio management team sold calls on the Russell 2000® Index, bought puts and calls on the Chicago Board Options Exchange (Cboe) Volatility Index (the VIX®) and sold calls on several ETFs; however, the impact of these positions on relative performance was minimal.

This material is not intended to be a recommendation or

investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances

of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as

recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those

anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements

or views expressed herein.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

10

DISTRIBUTION INFORMATION

The

following 19(a) Notice presents the Funds’ most current distribution information as of November 30, 2023 as required by certain exempted regulatory relief the Funds have received.

Because the ultimate tax character of your distributions depends on the Funds’ performance for its entire fiscal year (which is the calendar year for the Funds) as

well as certain fiscal year-end (FYE) tax adjustments, estimated distribution source information you receive with each distribution may differ from the tax information reported to you on your Funds’ IRS

Form 1099 statement.

Each Fund makes regular cash distributions to shareholders of stated dollar amount per share. Subject to approval and oversight by the Board of

Trustees, the Fund seeks to maintain a stable distribution level designed to deliver the long-term return potential of each Fund’s investment strategy through regular distributions (a “Managed Distribution Program”). The practice of

maintaining a stable distribution level had no material effect on each Fund’s investment strategy during the most recent fiscal period and is not expected to have such an effect in future periods, however, distributions in excess of Fund

returns will cause its NAV per share to erode. For additional information, refer to the distribution information section below and in the Notes to Financial Statements herein.

COMMON SHARE DISTRIBUTION INFORMATION – AS OF NOVEMBER 30, 2023

This

notice provides shareholders with information regarding fund distributions, as required by current securities laws. You should not draw any conclusions about the Funds’ investment performance from the amount of this distribution or from the

terms of the Funds’ Managed Distribution Policy.

The following table provides estimates of the Funds’ distribution sources, reflecting year-to-date cumulative experience through the month-end prior to the latest distribution. The Funds attribute these estimates equally

to each regular distribution throughout the year. Consequently, the estimated information as of the specified month-end shown below is for the current distribution, and also represents an updated estimate for

all prior months in the year. For all Funds, it is estimated that the Funds have distributed more than their income and net realized capital gains; therefore, a portion of the distributions may be (and is shown below as being estimated to be) a

return of capital. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund’s investment performance and

should not be confused with “yield” or “income.”

The amounts and sources of distributions set forth below are only estimates and are not being

provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Funds’ investment experience during the remainder of its fiscal year and may be subject to changes based on tax

regulations. Each Fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. More details about the Funds’ distributions

and the basis for these estimates are available on www.nuveen.com/cef.

Data as of November 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Per Share Estimated Sources of Distribution1 |

|

|

Estimated Percentage of Distributions1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Per Share

Distribution |

|

|

Net

Investment Income |

|

|

Long-

Term Gains |

|

|

Short-

Term Gains |

|

|

Return of

Capital |

|

|

Net

Investment Income |

|

|

Long-

Term Gains |

|

|

Short-

Term Gains |

|

|

Return of

Capital |

|

| |

|

| BXMX (FYE 12/31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Quarter |

|

|

$0.2365 |

|

|

|

$0.0285 |

|

|

|

$0.1414 |

|

|

|

$0.0441 |

|

|

|

$0.0225 |

|

|

|

12.0% |

|

|

|

59.8% |

|

|

|

18.6% |

|

|

|

9.5% |

|

| Fiscal YTD |

|

|

$0.9460 |

|

|

|

$0.1138 |

|

|

|

$0.5656 |

|

|

|

$0.1764 |

|

|

|

$0.0902 |

|

|

|

12.0% |

|

|

|

59.8% |

|

|

|

18.6% |

|

|

|

9.5% |

|

| |

|

| DIAX (FYE 12/31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Quarter |

|

|

$0.2867 |

|

|

|

$0.0530 |

|

|

|

$0.0577 |

|

|

|

$0.0000 |

|

|

|

$0.1760 |

|

|

|

18.5% |

|

|

|

20.1% |

|

|

|

0.0% |

|

|

|

61.4% |

|

| Fiscal YTD |

|

|

$1.1468 |

|

|

|

$0.2120 |

|

|

|

$0.2308 |

|

|

|

$0.0000 |

|

|

|

$0.7040 |

|

|

|

18.5% |

|

|

|

20.1% |

|

|

|

0.0% |

|

|

|

61.4% |

|

| |

|

| SPXX (FYE 12/31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Quarter |

|

|

$0.2940 |

|

|

|

$0.0285 |

|

|

|

$0.0701 |

|

|

|

$0.0000 |

|

|

|

$0.1954 |

|

|

|

9.7% |

|

|

|

23.8% |

|

|

|

0.0% |

|

|

|

66.4% |

|

| Fiscal YTD |

|

|

$1.1760 |

|

|

|

$0.1142 |

|

|

|

$0.2804 |

|

|

|

$0.0000 |

|

|

|

$0.7814 |

|

|

|

9.7% |

|

|

|

23.8% |

|

|

|

0.0% |

|

|

|

66.4% |

|

| |

|

| QQQX (FYE 12/31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Quarter |

|

|

$0.4200 |

|

|

|

$0.0000 |

|

|

|

$0.1097 |

|

|

|

$0.0258 |

|

|

|

$0.2845 |

|

|

|

0.0% |

|

|

|

26.1% |

|

|

|

6.1% |

|

|

|

67.7% |

|

| Fiscal YTD |

|

|

$1.6800 |

|

|

|

$0.0000 |

|

|

|

$0.4387 |

|

|

|

$0.1032 |

|

|

|

$1.1381 |

|

|

|

0.0% |

|

|

|

26.1% |

|

|

|

6.1% |

|

|

|

67.7% |

|

| |

|

| JCE (FYE 12/31) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Quarter |

|

|

$0.3200 |

|

|

|

$0.0154 |

|

|

|

$0.0068 |

|

|

|

$0.0000 |

|

|

|

$0.2978 |

|

|

|

4.8% |

|

|

|

2.1% |

|

|

|

0.0% |

|

|

|

93.1% |

|

| Fiscal YTD |

|

|

$1.2800 |

|

|

|

$0.0614 |

|

|

|

$0.0273 |

|

|

|

$0.0000 |

|

|

|

$1.1913 |

|

|

|

4.8% |

|

|

|

2.1% |

|

|

|

0.0% |

|

|

|

93.1% |

|

| |

|

1 Net investment income (NII) is a projection through the end of the current

calendar quarter using actual data through the stated month-end date above. Capital gain amounts are as of the stated date above. The estimated per share sources above include an allocation of the NII based on

prior year attributions which can be expected to differ from the actual final attributions for the current year.

11

|

|

|

| Common Share Information

(continued) |

|

|

The following table provides information regarding the Funds’ distributions and total return performance over

various time periods. This information is intended to help you better understand whether returns for the specified time periods were sufficient to meet its distributions.

Data as of November 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized |

|

|

Cumulative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Inception

Date |

|

|

Quarterly

Distribution |

|

|

Fiscal YTD

Distribution |

|

|

Net Asset

Value (NAV) |

|

|

5-Year

Return on NAV |

|

|

Fiscal YTD

Dist Rate on

NAV1 |

|

|

Fiscal YTD

Return on NAV |

|

|

Fiscal YTD

Dist Rate

on NAV1 |

|

| |

|

| BXMX |

|

|

Oct-2004 |

|

|

|

$0.2365 |

|

|

|

$0.9460 |

|

|

|

$13.89 |

|

|

|

7.40% |

|

|

|

6.81% |

|

|

|

16.44% |

|

|

|

6.81% |

|

| DIAX |

|

|

Apr-2005 |

|

|

|

$0.2867 |

|

|

|

$1.1468 |

|

|

|

$15.96 |

|

|

|

3.80% |

|

|

|

7.19% |

|

|

|

4.11% |

|

|

|

7.19% |

|

| SPXX |

|

|

Nov-2005 |

|

|

|

$0.2940 |

|

|

|

$1.1760 |

|

|

|

$16.11 |

|

|

|

7.17% |

|

|

|

7.30% |

|

|

|

15.06% |

|

|

|

7.30% |

|

| QQQX |

|

|

Jan-2007 |

|

|

|

$0.4200 |

|

|

|

$1.6800 |

|

|

|

$24.18 |

|

|

|

8.99% |

|

|

|

6.95% |

|

|

|

30.08% |

|

|

|

6.95% |

|

| JCE |

|

|

Mar-2007 |

|

|

|

$0.3200 |

|

|

|

$1.2800 |

|

|

|

$13.20 |

|

|

|

9.33% |

|

|

|

9.70% |

|

|

|

18.10% |

|

|

|

9.70% |

|

| |

|

1 As a percentage of 11/30/2023 NAV.

DISTRIBUTION INFORMATION – AS OF DECEMBER 31, 2023

The following tables

provides information regarding the Funds’ common share distributions and total return performance for the fiscal year ended December 31, 2023. This information is intended to help you better understand whether the Funds’ returns for

the specified time period were sufficient to meet its distributions.

Data as of December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Per Share Sources of Distribution |

|

|

Percentage of the Distribution |

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Per Share

Distribution |

|

|

Net

Investment Income |

|

|

Long-Term

Gains |

|

|

Short-Term

Gains |

|

|

Return of

Capital |

|

|

Net

Investment Income |

|

|

Long-Term

Gains |

|

|

Short-Term

Gains |

|

|

Return of

Capital |

|

| |

|

| BXMX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (FYE 12/31) |

|

|

$0.9460 |

|

|

|

$0.1129 |

|

|

|

$0.3980 |

|

|

|

$0.1763 |

|

|

|

$0.2588 |

|

|

|

11.93% |

|

|

|

42.07% |

|

|

|

18.64% |

|

|

|

27.36% |

|

| |

|

| DIAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (FYE 12/31) |

|

|

$1.1469 |

|

|

|

$0.1981 |

|

|

|

$0.0952 |

|

|

|

$0.0000 |

|

|

|

$0.8536 |

|

|

|

17.27% |

|

|

|

8.30% |

|

|

|

0.00% |

|

|

|

74.43% |

|

| |

|

| SPXX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (FYE 12/31) |

|

|

$1.1760 |

|

|

|

$0.1135 |

|

|

|

$0.6283 |

|

|

|

$0.0000 |

|

|

|

$0.4342 |

|

|

|

9.65% |

|

|

|

53.43% |

|

|

|

0.00% |

|

|

|

36.92% |

|

| |

|

| QQQX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (FYE 12/31) |

|

|

$1.6800 |

|

|

|

$0.0000 |

|

|

|

$1.1145 |

|

|

|

$0.1032 |

|

|

|

$0.4623 |

|

|

|

0.00% |

|

|

|

66.34% |

|

|

|

6.14% |

|

|

|

27.52% |

|

| |

|

| JCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (FYE 12/31) |

|

|

$1.2800 |

|

|

|

$0.0631 |

|

|

|

$0.0174 |

|

|

|

$0.0000 |

|

|

|

$1.1995 |

|

|

|

4.93% |

|

|

|

1.36% |

|

|

|

0.00% |

|

|

|

93.71% |

|

| |

|

Data as of December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Annualized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Inception

Date |

|

|

Net Asset

Value (NAV) |

|

|

1-Year

Return on NAV |

|

|

5-Year

Return on NAV |

|

|

Fiscal YTD

Dist Rate on NAV |

|

| |

|

| BXMX |

|

|

Oct-2004 |

|

|

|

$13.94 |

|

|

|

18.84% |

|

|

|

9.17% |

|

|

|

6.79% |

|

| DIAX |

|

|

Apr-2005 |

|

|

|

$16.22 |

|

|

|

7.67% |

|

|

|

6.22% |

|

|

|

7.07% |

|

| SPXX |

|

|

Nov-2005 |

|

|

|

$16.29 |

|

|

|

18.45% |

|

|

|

9.67% |

|

|

|

7.22% |

|

| QQQX |

|

|

Jan-2007 |

|

|

|

$24.68 |

|

|

|

35.03% |

|

|

|

11.69% |

|

|

|

6.81% |

|

| JCE |

|

|

Mar-2007 |

|

|

|

$13.28 |

|

|

|

21.68% |

|

|

|

11.94% |

|

|

|

9.64% |

|

| |

|

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and

can be found on Nuveen’s enhanced closed-end fund resource page, which is at

https://www.nuveen.com/resource-center-closed-end-funds, along with other Nuveen closed-end fund product updates. To ensure

timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

COMMON SHARE EQUITY SHELF PROGRAMS

During the current reporting period, SPXX

and QQQX were authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (Shelf Offering). Under these programs, the Funds, subject to market conditions, may raise additional capital from

time to time in varying amounts and offering methods at a net price at or above each Fund’s NAV per common share. The maximum aggregate offering under these Shelf Offerings are as shown in the accompanying table.

|

|

|

|

|

|

|

|

|

| |

|

SPXX |

|

|

QQQX |

|

| |

|

| Maximum aggregate offering |

|

|

4,993,317 |

|

|

|

Unlimited |

|

| |

|

12

During the current reporting period, QQQX sold common shares through its Shelf Offering at a weighted average premium to

their NAV per common share as shown in the accompanying table.

|

|

|

|

|

| |

|

QQQX |

|

| |

|

| Common shares sold through shelf offering |

|

|

297,524 |

|

| Weighted average premium to NAV per common share sold |

|

|

3.84% |

|

| |

|

Refer to Notes to Financial Statements, for further details of Shelf Offerings and each Fund’s transactions.

COMMON SHARE REPURCHASES

The Funds’ Board of Trustees reauthorized an

open-market share repurchase program, allowing each Fund to repurchase and retire an aggregate of up to approximately 10% of its outstanding common shares.

During

the current reporting period, the Funds did not repurchase any of their outstanding common shares. As of December 31, 2023, (and since the inception of the Funds’ repurchase programs), each Fund has cumulatively repurchased and retired its

outstanding common shares as shown in the accompanying table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

BXMX |

|

|

DIAX |

|

|

SPXX |

|

|

QQQX |

|

|

JCE |

|

| |

|

| Common shares repurchased and retired |

|

|

460,238 |

|

|

|

0 |

|

|

|

383,763 |

|

|

|

0 |

|

|

|

449,800 |

|

| Common shares authorized for repurchase |

|

|

10,415,000 |

|

|

|

3,635,000 |

|

|

|

1,795,000 |

|

|

|

4,845,000 |

|

|

|

1,605,000 |

|

| |

|

OTHER COMMON SHARE INFORMATION

As of

December 31, 2023, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs and trading at an average premium/(discount) to NAV during the current reporting period, as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

BXMX |

|

|

DIAX |

|

|

SPXX |

|

|

QQQX |

|

|

JCE |

|

| |

|

| Common share NAV |

|

|

$13.94 |

|

|

|

$16.22 |

|

|

|

$16.29 |

|

|

|

$24.68 |

|

|

|

$13.28 |

|

| Common share price |

|

|

$12.83 |

|

|

|

$14.00 |

|

|

|

$15.04 |

|

|

|

$23.15 |

|

|

|

$13.55 |

|

| Premium/(Discount) to NAV |

|

|

(7.96)% |

|

|

|

(13.69)% |

|

|

|

(7.67)% |

|

|

|

(6.20)% |

|

|

|

2.03% |

|

| Average premium/(discount) to NAV |

|

|

(3.40)% |

|

|

|

(9.51)% |

|

|

|

(3.29)% |

|

|

|

0.72% |

|

|

|

(1.25)% |

|

| |

|

13

|

|

|

| About the Funds’ Benchmarks |

|

|

Chicago Board Options Exchange (Cboe) Dow Jones Industrial Average

(DJIA) BuyWrite Index (BXDSM): An index designed to measure the performance of a hypothetical

buy-write strategy on the Dow Jones Industrial Average. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

Chicago Board Options Exchange (Cboe) Nasdaq 100 BuyWrite Index

(BXNSM): An index designed to measure the performance of a hypothetical buy-write strategy on the

Nasdaq 100® Index. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

Chicago Board Options Exchange (Cboe) S&P 500® BuyWrite

Index (BXMSM): An index designed to measure the performance of a hypothetical buy-write strategy

on the S&P 500® Index. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

DIAX Blended Benchmark: Consists of: 1) 55% Chicago Board

Options Exchange (Cboe) DJIA BuyWrite Index (BXDSM) (defined herein), and 2) 45% Dow Jones Industrial Average Index (DJIA) (defined herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or

management fees.

Dow Jones Industrial Average Index (DJIA): An index designed to measure the performance of 30 actively traded U.S. large cap stocks. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management

fees.

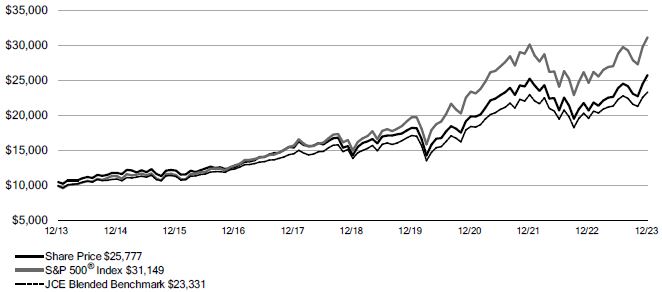

JCE Blended Benchmark: Consists of: 1) 50%

S&P 500® Index (defined herein), and 2) 50% Chicago Board Options Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM) (defined

herein). Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

Nasdaq 100® Index: An index that includes 100 of the largest domestic and international non-financial equity securities listed on the Nasdaq Stock Market based on market capitalization. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management

fees.

QQQX Blended Benchmark: Consists of: 1) 55%

Chicago Board Options Exchange (Cboe) Nasdaq 100 BuyWrite Index (BXNSM) (defined herein), and 2) 45% Nasdaq 100® Index (defined herein). Index returns assume reinvestment of distributions, but

do not reflect any applicable sales charges or management fees.

S&P 500® Index: An index generally considered representative of the U.S. equity

market. The index includes 500 leading companies and covers approximately 80% of available market capitalization. Index returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

SPXX Blended Benchmark: Consists of: 1) 55% Chicago Board

Options Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM) (defined herein), and 2) 45% S&P 500® Index (defined herein). Index

returns assume reinvestment of distributions, but do not reflect any applicable sales charges or management fees.

14

[This page intentionally left blank.]

15

|

|

|

| BXMX |

|

Nuveen S&P 500 Buy-Write Income

Fund Performance Overview and Holding Summaries December 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Returns as of

December 31, 2023 |

| |

|

|

|

Average Annual |

| |

|

Inception

Date |

|

1-Year |

|

5-Year |

|

10-Year |

| |

| BXMX at Common Share NAV |

|

10/26/04 |

|

18.84% |

|

9.17% |

|

7.24% |

| |

| BXMX at Common Share Price |

|

10/26/04 |

|

9.05% |

|

8.60% |

|

7.67% |

| |

| Cboe S&P 500® BuyWrite Index (BXMSM) |

|

– |

|

11.82% |

|

6.08% |

|

5.58% |

| |

*For purposes of Fund performance, relative results are measured against the Cboe S&P 500® BuyWrite Index (BXMSM).

Performance data shown represents past performance and does not predict or guarantee

future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund

expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

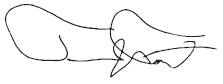

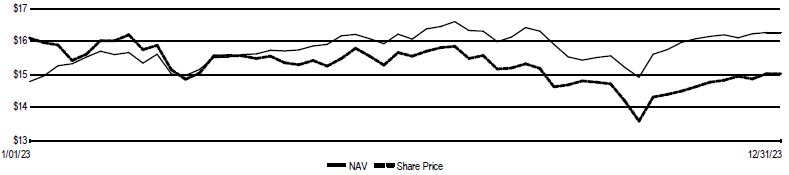

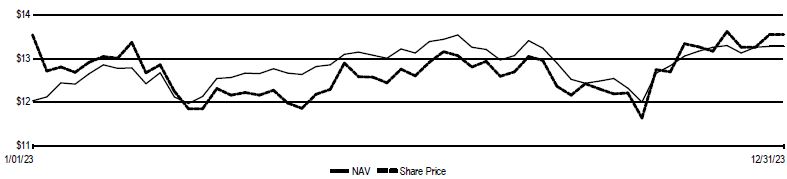

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of December 31, 2023 - Common Share

Price

16

Holdings Summaries as of December 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of

performance for the Fund itself. Holdings are subject to change.

|

|

|

| Fund Allocation

(% of net assets) |

| Common Stocks |

|

99.6% |

| Investments Purchased with

Collateral from Securities

Lending |

|

0.0% |

| Repurchase Agreements |

|

4.3% |

| Other Assets & Liabilities, Net |

|

(3.9)% |

| Net Assets |

|

100% |

|

|

|

| Portfolio Composition

(% of total investments) |

| Software & Services |

|

11.2% |

| Technology Hardware & Equipment |

|

8.4% |

| Semiconductors & Semiconductor Equipment |

|

7.8% |

| Financial Services |

|

7.8% |

| Media & Entertainment |

|

7.7% |

| Pharmaceuticals, Biotechnology & Life Sciences |

|

7.0% |

| Consumer Discretionary Distribution & Retail |

|

5.8% |

| Capital Goods |

|

5.4% |

| Health Care Equipment & Services |

|

5.2% |

| Energy |

|

3.6% |

| Banks |

|

3.3% |

| Food, Beverage & Tobacco |

|

2.5% |

| Materials |

|

2.5% |

| Utilities |

|

2.2% |

| Automobiles & Components |

|

2.0% |

| Equity Real Estate Investment Trusts (REITs) |

|

1.9% |

| Insurance |

|

1.9% |

| Consumer Services |

|

1.9% |

| Consumer Staples Distribution & Retail |

|

1.8% |

| Commercial & Professional Services |

|

1.5% |

| Transportation |

|

1.4% |

| Household & Personal Products |

|

1.4% |

| Consumer Durables & Apparel |

|

0.9% |

| Telecommunication Services |

|

0.7% |

| Investments Purchased with

Collateral from Securities

Lending |

|

0.0% |

| Repurchase Agreements |

|

4.2% |

| Total |

|

100% |

|

|

|

| Top Five Common Stock Holdings

(% of net assets) |

| Microsoft Corp |

|

7.2% |

| Apple Inc |

|

7.2% |

| Amazon.com Inc |

|

3.6% |

| NVIDIA Corp |

|

3.2% |

| Alphabet Inc, Class A |

|

2.2% |

17

|

|

|

| DIAX |

|

Nuveen Dow 30SM Dynamic Overwrite Fund

Performance Overview and Holding Summaries December 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Returns as of

December 31, 2023 |

| |

|

|

|

Average Annual |

| |

|

Inception

Date |

|

1-Year |

|

5-Year |

|

10-Year |

| |

| DIAX at Common Share NAV |

|

4/29/05 |

|

7.67% |

|

6.22% |

|

6.62% |

| |

| DIAX at Common Share Price |

|

4/29/05 |

|

(2.18)% |

|

4.60% |

|

6.21% |

| |

| Dow Jones Industrial Average Index (DJIA) |

|

– |

|

16.18% |

|

12.47% |

|

11.08% |

| |

| DIAX Blended Benchmark |

|

– |

|

12.42% |

|

9.23% |

|

8.01% |

| |

* For purposes of Fund performance, relative results are measured against the DIAX Blended Benchmark. The Fund’s Blended

Benchmark consists of: 1) 55% Chicago Board Options Exchange (Cboe) DJIA BuyWrite Index (BXDSM) and 2) 45% Dow Jones Industrial Average Index (DJIA).

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown.

Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return

information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

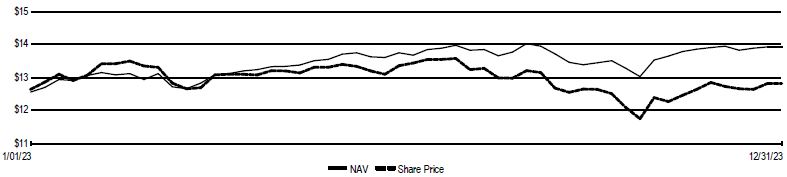

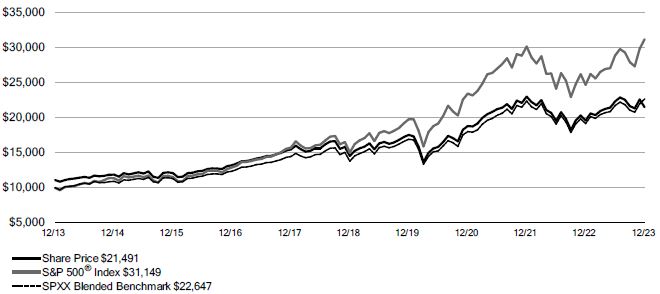

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of December 31, 2023 - Common Share

Price

18

Holdings Summaries as of December 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure

of performance for the Fund itself. Holdings are subject to change.

|

|

|

| Fund Allocation

(% of net assets) |

| Common Stocks |

|

99.7% |

| Exchange-Traded Funds |

|

1.3% |

| Options Purchased |

|

0.0% |

| Investments Purchased with

Collateral from Securities

Lending |

|

0.1% |

| Repurchase Agreements |

|

0.2% |

| Other Assets & Liabilities, Net |

|

(1.3)% |

| Net Assets |

|

100% |

|

|

|

| Portfolio Composition1

(% of total investments) |

| Capital Goods |

|

15.1% |

| Financial Services |

|

14.3% |

| Software & Services |

|

13.8% |

| Pharmaceuticals, Biotechnology & Life Sciences |

|

9.5% |

| Health Care Equipment & Services |

|

9.1% |

| Consumer Discretionary Distribution & Retail |

|

6.0% |

| Consumer Services |

|

5.1% |

| Technology Hardware & Equipment |

|

4.2% |

| Insurance |

|

3.3% |

| Consumer Staples Distribution & Retail |

|

3.2% |

| Banks |

|

2.9% |

| Energy |

|

2.6% |

| Household & Personal Products |

|

2.5% |

| Consumer Durables & Apparel |

|

1.9% |

| Media & Entertainment |

|

1.5% |

| Other |

|

3.4% |

| Exchange-Traded Funds |

|

1.3% |

| Options Purchased |

|

0.0% |

| Investments Purchased with

Collateral from Securities

Lending |

|

0.1% |

| Repurchase Agreements |

|

0.2% |

| Total Investments |

|

100% |

|

|

|

| Top Five Common Stock Holdings

(% of net assets) |

| UnitedHealth Group Inc |

|

9.2% |

| Goldman Sachs Group Inc/The |

|

6.7% |

| Microsoft Corp |

|

6.6% |

| Home Depot Inc/The |

|

6.0% |

| McDonald’s Corp |

|

5.2% |

| 1 |

See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in

the table above. |

19

|

|

|

| SPXX |

|

Nuveen S&P 500 Dynamic Overwrite Fund

Performance Overview and Holding Summaries as of December 31, 2023 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Fund Performance*

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total Returns as of

December 31, 2023 |

| |

|

|

|

Average Annual |

| |

|

Inception

Date |

|

1-Year |

|

5-Year |

|

10-Year |

| |

| SPXX at Common Share NAV |

|

11/22/05 |

|

18.45% |

|

9.67% |

|

7.38% |

| |

| SPXX at Common Share Price |

|

11/22/05 |

|

0.75% |

|

8.71% |

|

7.95% |

| |

| S&P 500® Index |

|

– |

|

26.29% |

|

15.69% |

|

12.03% |

| |

| SPXX Blended Benchmark |

|

– |

|

18.24% |

|

10.42% |

|

8.52% |

| |

*For purposes of Fund performance, relative results are measured against the SPXX Blended Benchmark. The Fund’s Blended Benchmark

consists of: 1) 55% Chicago Board Options Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM) and 2) 45% S&P 500® Index.

Performance data shown represents past performance and does not predict or guarantee future results.

Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and

assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

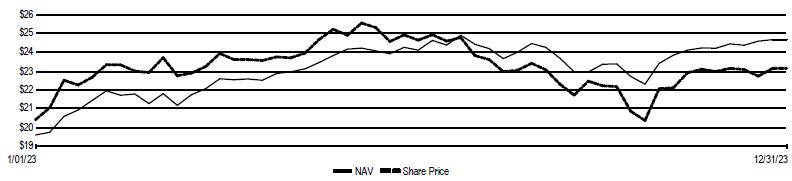

Daily Common Share NAV and Share Price

20

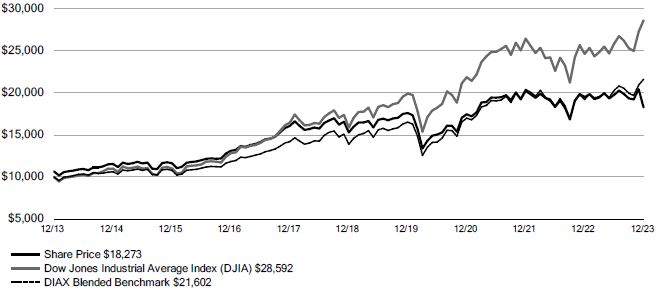

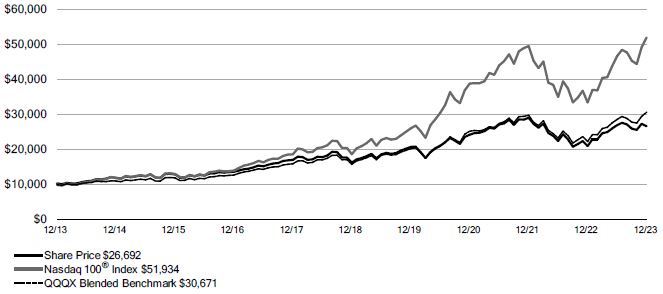

Growth of an Assumed $10,000 Investment as of December 31, 2023 -

Common Share Price

21

Performance Overview and Holdings Summaries December 31, 2023 (continued)

Holdings Summaries as of December 31, 2023

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of

performance for the Fund itself. Holdings are subject to change.

|

|

|

| Fund Allocation

(% of net assets) |

|

|

| Common Stocks |

|

99.3% |

| Exchange-Traded Funds |

|

1.5% |

| Options Purchased |

|

0.0% |

| Investments Purchased with Collateral from Securities

Lending |

|

1.0% |

| Repurchase Agreements |

|

0.2% |

| Other Assets & Liabilities, Net |

|

(2.0)% |

| Net Assets |

|

100% |

|

|

|

| Portfolio Composition1

(% of total investments) |

|

|

| Software & Services |

|

10.4% |

| Technology Hardware & Equipment |

|

8.2% |

| Financial Services |

|

8.1% |

| Media & Entertainment |

|

7.8% |

| Semiconductors & Semiconductor Equipment |

|

7.6% |

| Pharmaceuticals, Biotechnology & Life Sciences |

|

7.3% |

| Health Care Equipment & Services |

|

5.6% |

| Capital Goods |

|

5.6% |

| Consumer Discretionary Distribution & Retail |

|

5.4% |

| Energy |

|

3.9% |

| Banks |

|

3.4% |

| Food, Beverage & Tobacco |

|

2.9% |

| Equity Real Estate Investment Trusts (REITs) |

|

2.7% |

| Utilities |

|

2.6% |

| Insurance |

|

2.3% |

| Consumer Services |

|

2.2% |

| Consumer Staples Distribution & Retail |

|

2.1% |

| Materials |

|

2.1% |

| Automobiles & Components |

|