Follows recommendation from Institutional

Shareholder Services (“ISS”) that unitholders vote “FOR” the

transaction

Crestwood’s board of directors of its general

partner (the “Board”) unanimously recommends unitholders vote “FOR”

each of the proposals TODAY

Crestwood Equity Partners LP (NYSE: CEQP) (“Crestwood”) today

announced that leading independent proxy advisory firm Glass Lewis

& Co. (“Glass Lewis”) recommends that unitholders vote “FOR”

the pending transaction (the “Transaction”) with Energy Transfer LP

(NYSE: ET) (“Energy Transfer”) ahead of the special meeting of

unitholders scheduled to be held on October 30, 2023.

In its report dated October 20, 2023, Glass Lewis stated1:

- “We believe the terms of the merger are favorable for Crestwood

and its stockholders [and] combining into the larger entity would

mitigate risks and longer-term challenges associated with Crestwood

business that are inherent for a smaller scale company.”

- “…Crestwood unitholders would benefit from access to a stronger

balance sheet and greater potential for value creation compared to

the standalone status quo…we believe that the proposed transaction

warrants shareholder support at this time.”

Crestwood issued the following statement:

“We are pleased that both Glass Lewis and ISS support the

Board’s unanimous recommendation that unitholders vote “FOR” the

Transaction with Energy Transfer. The recommendation from Glass

Lewis further validates our belief that the Transaction delivers

strong value to Crestwood unitholders through participation in the

long-term success of the combined company. We look forward to

working with Energy Transfer to complete the Transaction and

initiate the next phase of our growth journey.”

The Transaction is expected to close in the fourth quarter of

2023, subject to the approval of Crestwood’s unitholders and other

customary closing conditions.

The special meeting of Crestwood unitholders will be held via

webcast on October 30, 2023, at 9:00 A.M. Central Time. Crestwood

unitholders of record as of September 22, 2023, are entitled to

vote at, or in advance of, the special meeting.

Crestwood unitholders who need

assistance in completing the proxy card or need additional copies

of the proxy materials should contact Crestwood’s proxy

solicitor:

Innisfree M&A

Incorporated

Toll Free: (877) 750-0854 (from

the U.S. and Canada) or

+1 (412) 232-3651 (from other

locations)

10:00 am-7:00 pm ET,

Monday-Friday; 10:00 am-2:00 pm ET, Saturday

1 Permission to use quotes neither sought nor obtained.

Important Information about the Transaction and Where to Find

It

In connection with the Transaction between Energy Transfer and

Crestwood, Energy Transfer filed with the U.S. Securities and

Exchange Commission (the “SEC”) a registration statement on Form

S-4 (the “Registration Statement”) that includes a proxy statement

of Crestwood that also constitutes a prospectus of Energy Transfer

(the “proxy statement/prospectus”), and each party will file other

documents regarding the Transaction with the SEC. The Registration

Statement was declared effective by the SEC on September 29, 2023,

and a definitive proxy statement/prospectus was mailed to Crestwood

unitholders of record as of September 22, 2023. This communication

is not a substitute for the Registration Statement, proxy

statement/prospectus or any other document that Energy Transfer or

Crestwood (as applicable) has filed or may file with the SEC in

connection with the Transaction. BEFORE MAKING ANY VOTING OR

INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF ENERGY

TRANSFER AND CRESTWOOD ARE URGED TO READ THE REGISTRATION

STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS. Investors

and security holders may obtain free copies of the Registration

Statement and the proxy statement/prospectus, as each may be

amended from time to time, as well as other filings containing

important information about Energy Transfer or Crestwood, without

charge at the SEC’s website, at http://www.sec.gov. Copies of the

documents filed with the SEC by Energy Transfer are available free

of charge on Energy Transfer’s website at www.energytransfer.com

under the tab “Investor Relations” and then under the tab “SEC

Filings” or by directing a request to Investor Relations, Energy

Transfer LP, 8111 Westchester Drive, Suite 600, Dallas, TX 75225,

Tel. No. (214) 981-0795 or to investorrelations@energytransfer.com.

Copies of the documents filed with the SEC by Crestwood are

available free of charge on Crestwood’s website at

www.crestwoodlp.com under the tab “Investors” and then under the

tab “SEC Filings” or by directing a request to Investor Relations,

Crestwood Equity Partners LP, 811 Main Street, Suite 3400, Houston,

TX 77002, Tel. No. (832) 519-2200 or to

investorrelations@crestwoodlp.com. The information included on, or

accessible through, Energy Transfer’s or Crestwood’s website is not

incorporated by reference into this communication.

Participants in the Solicitation

Energy Transfer, Crestwood and the directors and certain

executive officers of their respective general partners may be

deemed to be participants in the solicitation of proxies in respect

of the Transaction. Information about the directors and executive

officers of Crestwood’s general partner is set forth in its proxy

statement for its 2023 annual meeting of unitholders, which was

filed with the SEC on March 31, 2023, and in its Annual Report on

Form 10-K for the year ended December 31, 2022, which was filed

with the SEC on February 27, 2023. Information about the directors

and executive officers of Energy Transfer’s general partner is set

forth in its Annual Report on Form 10-K for the year ended December

31, 2022, which was filed with the SEC on February 17, 2023.

Additional information regarding the participants in the proxy

solicitation and a description of their direct or indirect

interests, by security holdings or otherwise, is contained in the

proxy statement/prospectus and other relevant materials filed with

the SEC.

No Offer or Solicitation

This communication is for informational purposes only and is not

intended to, and shall not, constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval, nor shall there be any offer, issuance,

exchange, transfer, solicitation or sale of securities in any

jurisdiction in which such offer, issuance, exchange, transfer,

solicitation or sale would be in contravention of applicable law.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended (the “Securities Act”).

Forward-Looking Statements

This communication contains “forward-looking statements.” In

this context, forward-looking statements often address future

business and financial events, conditions, expectations, plans or

ambitions, and often include, but are not limited to, words such as

“believe,” “expect,” “may,” “will,” “should,” “could,” “would,”

“anticipate,” “estimate,” “intend,” “plan,” “seek,” “see,” “target”

or similar expressions, or variations or negatives of these words,

but not all forward-looking statements include such words.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, such as statements about the

consummation of the Transaction and the anticipated benefits

thereof. All such forward-looking statements are based upon current

plans, estimates, expectations and ambitions that are subject to

risks, uncertainties and assumptions, many of which are beyond the

control of Energy Transfer and Crestwood, that could cause actual

results to differ materially from those expressed in such

forward-looking statements. Important risk factors that may cause

such a difference include, but are not limited to: the completion

of the Transaction on anticipated terms and timing, or at all,

including obtaining Crestwood unitholder approval and any other

approvals that may be required on anticipated terms; anticipated

tax treatment, unforeseen liabilities, future capital expenditures,

revenues, expenses, earnings, synergies, economic performance,

indebtedness, financial condition, losses, future prospects,

business and management strategies for the management, expansion

and growth of the combined company’s operations and other

conditions to the completion of the Transaction, including the

possibility that any of the anticipated benefits of the Transaction

will not be realized or will not be realized within the expected

time period; the ability of Energy Transfer and Crestwood to

integrate their businesses successfully and to achieve anticipated

synergies and value creation; potential litigation relating to the

Transaction that could be instituted against Energy Transfer,

Crestwood or the directors of their respective general partners;

the risk that disruptions from the Transaction will harm Energy

Transfer’s or Crestwood’s business, including current plans and

operations and that management’s time and attention will be

diverted on Transaction-related issues; potential adverse reactions

or changes to business relationships, including with employees,

suppliers, customers, competitors or credit rating agencies,

resulting from the announcement or completion of the Transaction;

rating agency actions and Energy Transfer and Crestwood’s ability

to access short- and long-term debt markets on a timely and

affordable basis; legislative, regulatory and economic

developments, changes in local, national, or international laws,

regulations, and policies affecting Energy Transfer and Crestwood;

potential business uncertainty, including the outcome of commercial

negotiations and changes to existing business relationships during

the pendency of the Transaction that could affect Energy Transfer’s

and/or Crestwood’s financial performance and operating results;

certain restrictions during the pendency of the Transaction that

may impact Crestwood’s ability to pursue certain business

opportunities or strategic transactions or otherwise operate its

business; acts of terrorism or outbreak of war, hostilities, civil

unrest, attacks against Energy Transfer or Crestwood, and other

political or security disturbances; dilution caused by Energy

Transfer’s issuance of additional units representing limited

partner interests in connection with the Transaction; the

possibility that the Transaction may be more expensive to complete

than anticipated, including as a result of unexpected factors or

events; the impacts of pandemics or other public health crises,

including the effects of government responses on people and

economies; changes in the supply, demand or price of oil, natural

gas, and natural gas liquids; those risks described in Item 1A of

Energy Transfer’s Annual Report on Form 10-K, filed with the SEC on

February 17, 2023, and its subsequent Quarterly Reports on Form 10

Q and Current Reports on Form 8-K; those risks described in Item 1A

of Crestwood’s Annual Report on Form 10-K, filed with the SEC on

February 27, 2023, and its subsequent Quarterly Reports on Form

10-Q and Current Reports on Form 8-K; and those risks that are

described in the Registration Statement and the accompanying proxy

statement/prospectus filed with the SEC in connection with the

Transaction.

While the list of factors presented here, in the Registration

Statement and in the proxy statement/prospectus is considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realization of forward-looking statements. Energy Transfer and

Crestwood caution you not to place undue reliance on any of these

forward-looking statements as they are not guarantees of future

performance or outcomes and that actual performance and outcomes,

including, without limitation, our actual results of operations,

financial condition and liquidity, and the development of new

markets or market segments in which we operate, may differ

materially from those made in or suggested by the forward-looking

statements contained in this communication. Neither Energy Transfer

nor Crestwood assumes any obligation to publicly provide revisions

or updates to any forward-looking statements, whether as a result

of new information, future developments or otherwise, should

circumstances change, except as otherwise required by securities

and other applicable laws. Neither future distribution of this

communication nor the continued availability of this communication

in archive form on Energy Transfer’s or Crestwood’s website should

be deemed to constitute an update or re-affirmation of these

statements as of any future date.

About Crestwood Equity Partners LP

Houston, Texas, based Crestwood Equity Partners LP (NYSE: CEQP)

is a master limited partnership that owns and operates midstream

businesses in multiple shale resource plays across the United

States. Crestwood is engaged in the gathering, processing,

treating, compression, storage and transportation of natural gas;

storage, transportation, terminalling and marketing of NGLs;

gathering, storage, terminalling and marketing of crude oil; and

gathering and disposal of produced water. For more information,

visit Crestwood Equity Partners LP at www.crestwoodlp.com; and to

learn more about Crestwood’s sustainability efforts, please visit

https://esg.crestwoodlp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231022084054/en/

Investor Contact Andrew Thorington, 713-380-3028

andrew.thorington@crestwoodlp.com Vice President, Finance and

Investor Relations

Sustainability and Media Contact Joanne Howard,

832-519-2211 joanne.howard@crestwoodlp.com Senior Vice President,

Sustainability and Corporate Communications

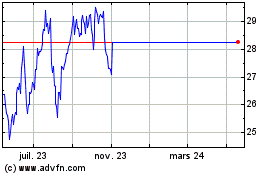

Crestwood Equity Partners (NYSE:CEQP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Crestwood Equity Partners (NYSE:CEQP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024