Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

22 Février 2024 - 6:57PM

Edgar (US Regulatory)

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS

January 31, 2024 (unaudited)

| Name of Issuer and Title of Issue | |

Shares | | |

| | |

Value (Note A) | |

| COMMON STOCK | |

| | | |

| | | |

| | |

| CHINA — “A” SHARES | |

| | | |

| | | |

| | |

| Banks — 5.0% | |

| | | |

| | | |

| | |

| China Merchants Bank Co., Ltd. — A | |

| 1,248,447 | | |

| | | |

$ | 5,333,962 | |

| Beverages — 3.0% | |

| | | |

| | | |

| | |

| Shanxi Xinghuacun Fen Wine Factory Co., Ltd. — A | |

| 50,300 | | |

| | | |

| 1,397,893 | |

| Wuliangye Yibin Co., Ltd. — A | |

| 101,096 | | |

| | | |

| 1,773,713 | |

| | |

| | | |

| | | |

| 3,171,606 | |

| Capital Markets — 0.7% | |

| | | |

| | | |

| | |

| East Money Information Co., Ltd. — A | |

| 435,480 | | |

| | | |

| 753,806 | |

| Electrical Equipment — 3.4% | |

| | | |

| | | |

| | |

| Contemporary Amperex Technology Co., Ltd. — A | |

| 88,040 | | |

| | | |

| 1,854,136 | |

| Sungrow Power Supply Co., Ltd. — A | |

| 157,400 | | |

| | | |

| 1,710,160 | |

| | |

| | | |

| | | |

| 3,564,296 | |

| Electronic Equipment, Instruments & Components — 2.0% | | |

| | | |

| | |

| Wingtech Technology Co., Ltd. — A* | |

| 254,154 | | |

| | | |

| 1,179,296 | |

| Zhejiang Supcon Technology Co., Ltd. — A | |

| 196,380 | | |

| | | |

| 960,808 | |

| | |

| | | |

| | | |

| 2,140,104 | |

| Food Products — 1.9% | |

| | | |

| | | |

| | |

| Anjoy Foods Group Co., Ltd. — A | |

| 87,500 | | |

| | | |

| 905,156 | |

| Guangdong Haid Group Co., Ltd. — A | |

| 209,100 | | |

| | | |

| 1,098,351 | |

| | |

| | | |

| | | |

| 2,003,507 | |

| Health Care Equipment & Supplies — 2.0% | |

| | | |

| | | |

| | |

| Shenzhen Mindray Bio-Medical Electronics Co., Ltd. — A | |

| 56,300 | | |

| | | |

| 2,103,427 | |

| Household Durables — 2.0% | |

| | | |

| | | |

| | |

| Midea Group Co., Ltd. — A | |

| 258,829 | | |

| | | |

| 2,094,246 | |

| Machinery — 1.7% | |

| | | |

| | | |

| | |

| Estun Automation Co., Ltd. — A | |

| 377,100 | | |

| | | |

| 684,380 | |

| Shenzhen Inovance Technology Co., Ltd. — A | |

| 142,604 | | |

| | | |

| 1,107,716 | |

| | |

| | | |

| | | |

| 1,792,096 | |

| Media — 1.9% | |

| | | |

| | | |

| | |

| Focus Media Information Technology Co., Ltd. — A | |

| 2,579,200 | | |

| | | |

| 2,029,054 | |

| Semiconductors & Semiconductor Equipment — 1.1% | |

| | | |

| | | |

| | |

| NAURA Technology Group Co., Ltd. — A | |

| 18,902 | | |

| | | |

| 595,178 | |

| Zhejiang Jingsheng Mechanical & Electrical Co., Ltd. — A | |

| 116,200 | | |

| | | |

| 527,799 | |

| | |

| | | |

| | | |

| 1,122,977 | |

| Software — 1.0% | |

| | | |

| | | |

| | |

| Shanghai Baosight Software Co., Ltd. — A | |

| 178,896 | | |

| | | |

| 1,020,201 | |

| Specialty Retail — 0.6% | |

| | | |

| | | |

| | |

| China Tourism Group Duty Free Corp., Ltd. — A | |

| 70,900 | | |

| | | |

| 785,479 | |

| Transportation Infrastructure — 1.1% | |

| | | |

| | | |

| | |

| Shanghai International Airport Co., Ltd. — A* | |

| 272,100 | | |

| | | |

| 1,250,198 | |

| TOTAL CHINA — “A” SHARES — (Cost $40,505,436) | |

| | | |

| 27.4 | % | |

| 29,164,959 | |

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

January 31, 2024 (unaudited)

| Name of Issuer and Title of Issue | |

Shares | | |

| | |

Value (Note A) | |

| COMMON STOCK (continued) | |

| | | |

| | | |

| | |

| HONG KONG | |

| | | |

| | | |

| | |

| Automobiles — 0.3% | |

| | | |

| | | |

| | |

| Yadea Group Holdings, Ltd. 144A | |

| 238,000 | | |

| | | |

$ | 326,682 | |

| Broadline Retail — 15.8% | |

| | | |

| | | |

| | |

| Alibaba Group Holding, Ltd. | |

| 912,308 | | |

| | | |

| 8,246,142 | |

| JD.com, Inc. | |

| 331,704 | | |

| | | |

| 3,739,503 | |

| PDD Holdings, Inc. ADR* | |

| 38,066 | | |

| | | |

| 4,829,433 | |

| | |

| | | |

| | | |

| 16,815,078 | |

| Capital Markets — 1.0% | |

| | | |

| | | |

| | |

| Hong Kong Exchanges & Clearing, Ltd. | |

| 34,000 | | |

| | | |

| 1,032,120 | |

| Consumer Staples Distribution & Retail — 0.9% | |

| | | |

| | | |

| | |

| JD Health International, Inc. 144A* | |

| 295,700 | | |

| | | |

| 975,920 | |

| Diversified Consumer Services — 0.9% | |

| | | |

| | | |

| | |

| China Education Group Holdings, Ltd. | |

| 1,897,000 | | |

| | | |

| 942,930 | |

| Entertainment — 2.3% | |

| | | |

| | | |

| | |

| Tencent Music Entertainment Group ADR* | |

| 255,796 | | |

| | | |

| 2,404,482 | |

| Gas Utilities — 1.1% | |

| | | |

| | | |

| | |

| ENN Energy Holdings, Ltd. | |

| 150,400 | | |

| | | |

| 1,118,523 | |

| Ground Transportation — 1.6% | |

| | | |

| | | |

| | |

| DiDi Global, Inc. ADR* | |

| 477,872 | | |

| | | |

| 1,672,552 | |

| Hotels, Restaurants & Leisure — 10.1% | |

| | | |

| | | |

| | |

| Galaxy Entertainment Group, Ltd. | |

| 415,000 | | |

| | | |

| 2,157,936 | |

| Luckin Coffee, Inc. ADR* | |

| 70,428 | | |

| | | |

| 1,454,338 | |

| Meituan 144A* | |

| 571,150 | | |

| | | |

| 4,580,020 | |

| Trip.com Group, Ltd. ADR* | |

| 37,231 | | |

| | | |

| 1,361,165 | |

| Yum China Holdings, Inc. | |

| 33,890 | | |

| | | |

| 1,172,255 | |

| | |

| | | |

| | | |

| 10,725,714 | |

| Household Durables — 1.3% | |

| | | |

| | | |

| | |

| Man Wah Holdings, Ltd. | |

| 2,395,600 | | |

| | | |

| 1,497,423 | |

| Interactive Media & Services — 11.4% | |

| | | |

| | | |

| | |

| Baidu, Inc.* | |

| 82,150 | | |

| | | |

| 1,087,351 | |

| Kuaishou Technology Co., Ltd. 144A* | |

| 275,600 | | |

| | | |

| 1,393,729 | |

| Tencent Holdings, Ltd. | |

| 275,600 | | |

| | | |

| 9,623,921 | |

| | |

| | | |

| | | |

| 12,105,001 | |

| Life Sciences Tools & Services — 1.1% | |

| | | |

| | | |

| | |

| Wuxi Biologics Cayman, Inc. 144A* | |

| 445,500 | | |

| | | |

| 1,172,923 | |

| Real Estate Management & Development — 5.5% | |

| | | |

| | | |

| | |

| CIFI Holdings Group Co., Ltd.* | |

| 21,016,968 | | |

| | | |

| 596,130 | |

| Country Garden Services Holdings Co., Ltd.(1) | |

| 1,238,000 | | |

| | | |

| 819,115 | |

| KE Holdings, Inc. ADR | |

| 292,893 | | |

| | | |

| 4,150,293 | |

| Times China Holdings, Ltd.*(1) | |

| 8,477,000 | | |

| | | |

| 244,323 | |

| | |

| | | |

| | | |

| 5,809,861 | |

| TOTAL HONG KONG — (Cost $91,090,510) | |

| | | |

| 53.3 | % | |

| 56,599,209 | |

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

January 31, 2024 (unaudited)

| Name of Issuer and Title of Issue | |

Shares | | |

| | |

Value (Note A) | |

| COMMON STOCK (continued) | |

| | | |

| | | |

| | |

| HONG KONG — “H” SHARES | |

| | | |

| | | |

| | |

| Banks — 2.1% | |

| | | |

| | | |

| | |

| China Construction Bank Corp. | |

| 3,716,000 | | |

| | | |

$ | 2,209,882 | |

| Beverages — 0.7% | |

| | | |

| | | |

| | |

| Tsingtao Brewery Co., Ltd. | |

| 134,000 | | |

| | | |

| 765,201 | |

| Capital Markets — 7.6% | |

| | | |

| | | |

| | |

| China International Capital Corp., Ltd. 144A | |

| 2,654,800 | | |

| | | |

| 3,159,426 | |

| China Merchants Securities Co., Ltd. 144A | |

| 2,194,600 | | |

| | | |

| 1,640,128 | |

| CITIC Securities Co., Ltd. | |

| 1,697,125 | | |

| | | |

| 3,316,666 | |

| | |

| | | |

| | | |

| 8,116,220 | |

| Health Care Providers & Services — 1.1% | |

| | | |

| | | |

| | |

| Sinopharm Group Co., Ltd. | |

| 452,800 | | |

| | | |

| 1,191,663 | |

| Insurance — 4.2% | |

| | | |

| | | |

| | |

| PICC Property & Casualty Co., Ltd. | |

| 980,000 | | |

| | | |

| 1,218,053 | |

| Ping An Insurance Group Co., of China Ltd. | |

| 762,000 | | |

| | | |

| 3,203,631 | |

| | |

| | | |

| | | |

| 4,421,684 | |

| Oil, Gas & Consumable Fuels — 3.1% | |

| | | |

| | | |

| | |

| PetroChina Co., Ltd. | |

| 4,548,000 | | |

| | | |

| 3,291,364 | |

| TOTAL HONG KONG — “H” SHARES — (Cost $24,802,247) | |

| | | |

| 18.8 | % | |

| 19,996,014 | |

| TOTAL HONG KONG (INCLUDING “H” SHARES) — (Cost $115,892,757) | |

| | | |

| 72.1 | % | |

| 76,595,223 | |

| TOTAL COMMON STOCK — (Cost $156,398,193) | |

| | | |

| 99.5 | % | |

| 105,760,182 | |

| | |

| | | |

| | | |

| | |

| COLLATERAL FOR SECURITIES ON LOAN | |

| | | |

| | | |

| | |

| Money Market Funds — 0.8% | |

| | | |

| | | |

| | |

| Fidelity Investments Money Market Government Portfolio, 5.26%∞ (Cost $813,865) | |

| 813,865 | | |

| | | |

| 813,865 | |

| TOTAL COLLATERAL FOR SECURITIES ON LOAN — (Cost $813,865) | |

| | | |

| 0.8 | % | |

| 813,865 | |

| | |

Principal | | |

| | |

| |

| | |

Amount | | |

| | |

| |

| SHORT TERM INVESTMENTS | |

| | | |

| | | |

| | |

| Time Deposits — 0.1% | |

| | | |

| | | |

| | |

| Citibank - New York, 4.67%, 2/1/2024 | |

USD | 152,080 | | |

| | | |

| 152,080 | |

| TOTAL SHORT TERM INVESTMENTS — (Cost $152,080) | |

| | | |

| 0.1 | % | |

| 152,080 | |

| TOTAL INVESTMENTS — (Cost $157,364,138) | |

| | | |

| 100.4 | % | |

| 106,726,127 | |

| OTHER ASSETS AND LIABILITIES | |

| | | |

| (0.4 | %) | |

| (472,760 | ) |

| NET ASSETS | |

| | | |

| 100.0 | % | |

$ | 106,253,367 | |

Footnotes to Schedule of Investments

| * | Denotes non-income producing security. |

| ∞ | Rate shown is the 7-day yield as of January 31, 2024. |

| (1) | A security (or a portion of the security) is on loan. As of January 31, 2024, the market value of securities

loaned was $766,627. The loaned securities were secured with cash collateral of $813,865. Collateral is calculated based on prior day’s

prices. |

THE CHINA FUND, INC.

SCHEDULE OF INVESTMENTS (continued)

January 31, 2024 (unaudited)

144A Securities exempt from registration under Rule 144A of the Securities

Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At January

31, 2024, these restricted securities amounted to $13,248,828, which represented 12.47% of net assets.

ADR — American Depositary Receipt

USD — United States dollar

THE CHINA FUND, INC.

NOTES TO SCHEDULE OF INVESTMENTS

January 31, 2024 (unaudited)

NOTE A — Security Valuation:

Security Valuation: Portfolio securities listed

on recognized U.S. or foreign security exchanges are valued at the last quoted sales price in the principal market where they are traded.

Listed securities with no such sales price and unlisted securities are valued at the mean between the current bid and asked prices, if

any, from brokers. Short-term investments having maturities of sixty days or less are valued at amortized cost (original purchase cost

as adjusted for amortization of premium or accretion of discount) which when combined with accrued interest approximates market value.

Securities for which market quotations are not readily available or are deemed unreliable are valued at fair value in good faith by or

at the direction of the Board of Directors (the “Board”) considering relevant factors, data and information including, if

relevant, the market value of freely tradable securities of the same class in the principal market on which such securities are normally

traded. For securities listed on non-North American exchanges, the Fund fair values those securities daily using fair value factors provided

by a third-party pricing service if certain thresholds determined by the Board are met. Direct Investments and derivatives investments,

if any, are valued at fair value as determined by or at the direction of the Board based on financial and other information supplied by

the Direct Investment Manager or a third-party pricing service.

Factors used in determining fair value

may include, but are not limited to, the type of security, the size of the holding, the initial cost of the security, the existence of

any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the

issuer or of comparable companies, the availability of quotations from broker-dealers, the availability of values of third parties other

than the Investment Manager, information obtained from the issuer, analysts, and/or the appropriate stock exchange (if available), an

analysis of the company’s financial statements, an evaluation of the forces that influence the issuer and the market(s) in which

the security is purchased and sold and with respect to debt securities, the maturity, coupon, creditworthiness, currency denomination,

and the movement of the market in which they trade.

The Fund has adopted fair valuation accounting

standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional

disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes

in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| ¨ | Level 1 — Inputs that reflect unadjusted quoted prices

in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| ¨ | Level 2 — Inputs other than quoted prices that are observable

for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| ¨ | Level 3 — Inputs that are unobservable. |

The following is a summary of the inputs used as of January 31, 2024

in valuing the Fund’s investments carried at value:

ASSETS VALUATION INPUT

| Description* | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stock | |

$ | 18,064,721 | | |

$ | 87,695,461 | | |

$ | — | | |

$ | 105,760,182 | |

| Collateral For Securities On Loan | |

| 813,865 | | |

| — | | |

| — | | |

| 813,865 | |

| Short Term Investments | |

| 152,080 | | |

| — | | |

| — | | |

| 152,080 | |

| TOTAL INVESTMENTS | |

$ | 19,030,666 | | |

$ | 87,695,461 | | |

$ | — | | |

$ | 106,726,127 | |

| * | Please refer to the Schedule of Investments for additional security

details. |

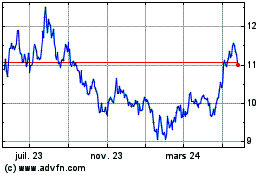

China (NYSE:CHN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

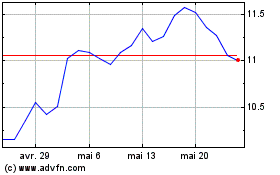

China (NYSE:CHN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024