Chewy, Inc. Announces Pricing of Offering of Class A Common Stock by Selling Stockholder and Concurrent Repurchase

12 Décembre 2024 - 4:30AM

Business Wire

Chewy, Inc. (NYSE: CHWY) (“Chewy”), a trusted destination for

pet parents and partners everywhere, announced today the pricing of

an underwritten public offering of 15,852,886 shares of its Class A

common stock, par value $0.01 per share, by Buddy Chester Sub LLC

(the “Selling Stockholder”), which is an entity affiliated with

funds advised by BC Partners Advisors LP (“BC Partners”), Chewy’s

largest shareholder (the “Offering”). The Selling Stockholder

granted the underwriter a 30-day option to purchase up to an

additional 2,377,932 shares of Class A common stock. Chewy will not

sell any shares of its Class A common stock in the Offering and

will not receive any proceeds from the sale of the shares of Class

A common stock being offered by the Selling Stockholder.

In addition, as previously announced, concurrent with the

closing of the Offering, Chewy has agreed to purchase from the

Selling Stockholder $50 million of Chewy’s Class A common stock at

a price per share equal to the per share purchase price to be paid

by the underwriter in the Offering (the “Concurrent Repurchase”).

The Concurrent Repurchase was approved by a special committee of

Chewy’s Board of Directors, consisting solely of independent and

disinterested directors not affiliated with BC Partners. The

repurchased shares will be cancelled and retired upon completion of

the Concurrent Repurchase. The Concurrent Repurchase is being

executed separately from the Company’s existing $500 million share

repurchase program authorized on May 24, 2024, which will be

unaffected by this transaction. The Concurrent Repurchase is

expected to be consummated concurrently with the Offering. The

Offering is not conditioned upon the closing of the Concurrent

Repurchase, but the Concurrent Repurchase is conditioned upon the

closing of the Offering.

Prior to the Offering and Concurrent Repurchase, Chewy had

approximately 162 million shares of Class A common stock and 247

million shares of Class B common stock outstanding. If the Offering

and Concurrent Repurchase are completed (assuming no exercise of

the underwriter’s option to purchase additional shares of Class A

Common Stock), Chewy will have approximately 178 million shares of

Class A common stock and approximately 229 million shares of Class

B common stock outstanding. The Offering and Concurrent Repurchase

are expected to close by December 13, 2024, subject to customary

closing conditions.

Barclays is acting as the sole underwriter for the Offering.

Chewy has filed a registration statement (including a prospectus)

with the Securities and Exchange Commission (the “SEC”) for the

Offering. A preliminary prospectus supplement and accompanying

prospectus relating to the Offering will be filed with the SEC and

will be available on the SEC’s website. Before you invest, you

should read the preliminary prospectus supplement and accompanying

prospectus and other documents Chewy has filed with the SEC for

more complete information about Chewy and the Offering. You may get

these documents for free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, Chewy or Barclays will arrange to send

you the preliminary prospectus supplement and accompanying

prospectus relating to the Offering if you contact Barclays:

Barclays Capital Inc., c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717 (or by email at

barclaysprospectus@broadridge.com or telephone at

1-888-603-5847).

This press release shall not constitute an offer to sell, a

solicitation to buy or an offer to purchase or sell any securities,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Chewy

Our mission is to be the most trusted and convenient destination

for pet parents and partners everywhere. We believe that we are the

preeminent online source for pet products, supplies and

prescriptions as a result of our broad selection of high-quality

products and services, which we offer at competitive prices and

deliver with an exceptional level of care and a personal touch to

build brand loyalty and drive repeat purchasing. We seek to

continually develop innovative ways for our customers to engage

with us, as our websites and mobile applications allow our pet

parents to manage their pets’ health, wellness, and merchandise

needs, while enabling them to conveniently shop for our products.

We partner with approximately 3,500 of the best and most trusted

brands in the pet industry, and we create and offer our own private

brands. Through our websites and mobile applications, we offer our

customers approximately 115,000 products and services offerings, to

bring what we believe is a high-bar, customer-centric experience to

our customers.

Forward-Looking

Statements

This communication contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the Private Securities Litigation Reform Act of

1995 (“PSLRA”), and such statements are intended to qualify for the

protection of the safe harbor provided by the PSLRA. All statements

other than statements of historical facts contained in this

communication are forward-looking statements, which involve

substantial risks and uncertainties. In some cases, you can

identify forward-looking statements because they contain words such

as “anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” or “would,” or the negative of these words or other similar

terms or expressions. Although we believe that these

forward-looking statements are based on reasonable assumptions, you

should be aware that many factors could cause actual results to

differ materially from those in such forward-looking statements,

including, but not limited to our ability to close the Offering and

Concurrent Repurchase and complete any repurchases under our share

repurchase program following the Offering and Concurrent

Repurchase. You should not rely on forward-looking statements as

predictions of future events, and you should understand that these

statements are not guarantees of performance or results, and our

actual results could differ materially from those expressed in the

forward-looking statements due to a variety of factors. We have

based the forward-looking statements contained in this

communication primarily on our current assumptions, expectations

and projections about future events and trends that we believe may

affect our business, financial condition, and results of

operations. The outcome of the events described in these

forward-looking statements is subject to risks, uncertainties and

other factors described in the section titled “Risk Factors” in our

Quarterly Report on Form 10-Q for the quarterly period ended April

28, 2024, the preliminary prospectus supplement and accompanying

prospectus and elsewhere in our filings with the SEC. Moreover, we

operate in a very competitive and rapidly changing environment. New

risks and uncertainties emerge from time to time, and it is not

possible for us to predict all risks and uncertainties that could

have an impact on the forward-looking statements contained in this

communication. The results, events and circumstances reflected in

the forward-looking statements may not be achieved or occur, and

actual results, events or circumstances could differ materially

from those described in the forward-looking statements. The

forward-looking statements made in this communication relate only

to events as of the date on which the statements are made. We

undertake no obligation to update any forward-looking statements

made in this communication to reflect events or circumstances after

the date of this communication or to reflect new information or the

occurrence of unanticipated events, except as required by law. We

may not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211026978/en/

Investor Contact: ir@chewy.com

Media Contact: Diane Pelkey dpelkey@chewy.com

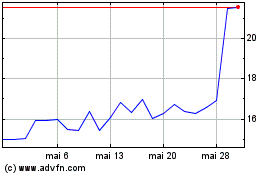

Chewy (NYSE:CHWY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Chewy (NYSE:CHWY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024