Civitas Resources, Inc. (NYSE: CIVI) (“Civitas” or the

“Company”) today announced that Wouter van Kempen and Deborah Byers

have been named Independent non-executive Chairman and Independent

Director, respectively, of its Board of Directors. Independent

Chairman Ben Dell and Brian Steck have elected to retire from the

Board of Directors. The changes are effective February 22,

2023.

Chris Doyle, the Company’s President and CEO, said, “On behalf

of the Board and our company, we are thankful for Ben and Brian’s

leadership and the numerous contributions they have made toward our

success. As we worked to efficiently integrate companies, their

strategic counsel and expertise strengthened the process and

positioned us well both operationally and financially. We are

pleased to welcome Wouter and Deborah and are confident that their

leadership and diverse experience will add immediate value to our

Board and company.”

Mr. Dell, said, “I am immensely proud of what the company has

accomplished over the last two years as we defined a new E&P

model that prioritizes capital discipline, free cash flow and

sustainable returns to investors, as well as the integration of

leading ESG practices. I would like to thank Brian for his

leadership and partnership which was instrumental as we set the

vision for the company’s future and the Board which has worked

tirelessly to position Civitas as a thought leader in the sector.

As a continuing shareholder, I am confident in Civitas’s future and

look forward to supporting the company as it realizes the

tremendous value in its equity.”

Mr. van Kempen, added, “I have admired Civitas’ vision and

leadership in helping reorientate the industry away from its

traditional model focused on growing production at the expense of

balance sheets to the disciplined returned-focused model which has

become the standard for thriving companies today. I look forward to

working with my fellow Board members, management, and our talented

team to ensure Civitas meets its vast potential.”

In addition to his role as non-executive Independent Board

Chairman, Mr. van Kempen, 53, will serve on the Compensation and

Nominating and Corporate Governance Committees. He has extensive

experience across the energy industry, including oil and gas,

renewables, power generation and industrial equipment

manufacturing. In his most recent role, Mr. van Kempen was the

Chairman, President and CEO of DCP Midstream, a Fortune 500 energy

company, from January 2013 to December 2022. Previously, he was

President and COO of DCP Midstream. Mr. van Kempen has held global,

senior positions in finance, mergers and acquisitions and P&L

leadership roles at General Electric from 1993 to 2003, and Duke

Energy from 2003 to 2010. He graduated from Erasmus University

Rotterdam with a Master of Science degree in Business

Economics.

Ms. Byers, 61, will serve on Civitas’ Audit and ESG Committees.

Following 36 years of service in Public Accounting, she retired in

July 2022 as a Partner from Ernst & Young LLP (EY). From July

2018 to her retirement, she was Americas Industry Leader overseeing

the markets and growth strategy across EY’s primary industry

segments. Ms. Byers was EY’s Houston Office Managing Partner and US

Energy Leader from July 2013 to July 2018, and Managing Partner of

the Southwest Region Strategy & Transactions business unit from

July 2008 to July 2013. In these roles, she helped lead global

energy markets and partnered with corporations and investment funds

in all phases of energy investment across the sector. Ms. Byers

holds a BBA from Baylor University and is a Certified Public

Accountant.

About Civitas Resources, Inc.

Civitas Resources, Inc. is Colorado’s first carbon neutral oil

and gas producer and is focused on developing and producing crude

oil, natural gas, and natural gas liquids in Colorado’s

Denver-Julesburg Basin. The Company is committed to pursuing

compelling economic returns and cash flow while delivering

best-in-class cost leadership and capital efficiency. Civitas is

dedicated to safety, environmental responsibility, and implementing

industry leading practices to create a positive local impact. For

more information about Civitas, please visit

www.civitasresources.com.

Forward-Looking Statements and Cautionary Statements

Certain statements in this press release concerning future

opportunities for Civitas, future financial performance and

condition, guidance, and any other statements regarding Civitas’

future expectations, beliefs, plans, objectives, financial

conditions, assumptions, or future events or performance that are

not historical facts are “forward-looking” statements based on

assumptions currently believed to be valid. Forward-looking

statements are all statements other than statements of historical

facts. The words “anticipate,” “believe,” “ensure,” “expect,” “if,”

“intend,” “estimate,” “probable,” “project,” “forecasts,”

“predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,”

“potential,” “may,” “might,” “anticipate,” “likely,” “plan,”

“positioned,” “strategy,” and similar expressions or other words of

similar meaning, and the negatives thereof, are intended to

identify forward-looking statements. The forward-looking statements

are intended to be subject to the safe harbor provided by Section

27A of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995.

These forward-looking statements involve significant risks and

uncertainties that could cause actual results to differ materially

from those anticipated, including, but not limited to, the ultimate

timing, outcome and results of integrating the legacy operations of

Civitas; changes in capital markets and the ability of Civitas to

finance operations in the manner expected; the effects of commodity

prices; the risks of oil and gas activities; and the fact that

operating costs and business disruption may be greater than

expected. Additionally, risks and uncertainties that could cause

actual results to differ materially from those anticipated also

include: declines or volatility in the prices we receive for our

oil, natural gas, and natural gas liquids; general economic

conditions, whether internationally, nationally, or in the regional

and local market areas in which we do business, including any

future economic downturn, the impact of continued or further

increased inflation, disruption in the financial markets, and the

availability of credit on acceptable terms; the effects of

disruption of our operations or excess supply of oil and natural

gas due to world health events, including the COVID-19 pandemic and

the actions by certain oil and natural gas producing countries,

including Russia; the continuing effects of the COVID-19 pandemic,

including any recurrence or the worsening thereof; the ability of

our customers to meet their obligations to us; our access to

capital on acceptable terms; our ability to generate sufficient

cash flow from operations, borrowings, or other sources to enable

us to fully develop our undeveloped acreage positions; the presence

or recoverability of estimated oil and natural gas reserves and the

actual future sales volume rates and associated costs;

uncertainties associated with estimates of proved oil and gas

reserves; the possibility that the industry may be subject to

future local, state, and federal regulatory or legislative actions

(including additional taxes and changes in environmental regulation

and regulations addressing climate change); environmental risks;

seasonal weather conditions; lease stipulations; drilling and

operating risks, including the risks associated with the employment

of horizontal drilling and completion techniques; our ability to

acquire adequate supplies of water for drilling and completion

operations; availability of oilfield equipment, services, and

personnel; exploration and development risks; operational

interruption of centralized oil and natural gas processing

facilities; competition in the oil and natural gas industry;

management’s ability to execute our plans to meet our goals; our

ability to attract and retain key members of our senior management

and key technical employees; our ability to maintain effective

internal controls; access to adequate gathering systems and

pipeline take-away capacity; our ability to secure adequate

processing capacity for natural gas we produce, to secure adequate

transportation for oil, natural gas, and natural gas liquids we

produce, and to sell the oil, natural gas, and natural gas liquids

at market prices; costs and other risks associated with perfecting

title for mineral rights in some of our properties; political

conditions in or affecting other producing countries, including

conflicts in or relating to the Middle East, South America, and

Russia (including the current events involving Russia and Ukraine),

and other sustained military campaigns or acts of terrorism or

sabotage; and other economic, competitive, governmental,

legislative, regulatory, geopolitical, and technological factors

that may negatively impact our businesses, operations, or pricing.

Expectations regarding business outlook, including changes in

revenue, pricing, capital expenditures, cash flow generation,

strategies for our operations, oil and natural gas market

conditions, legal, economic, and regulatory conditions, and

environmental matters are only forecasts regarding these

matters.

Additional information concerning other risk factors is also

contained in Civitas’ most recently filed Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and other Securities and Exchange Commission filings. Civitas

undertakes no duty to publicly update these statements except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230222005839/en/

Investor Relations: John Wren, ir@civiresources.com

Media: Rich Coolidge, info@civiresources.com

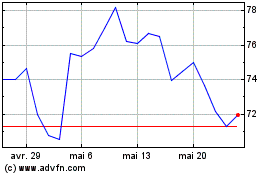

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025