Civitas Resources, Inc. (NYSE: CIVI) (the "Company" or

"Civitas") today reported its fourth quarter and full year 2024

financial and operating results. A webcast and conference call to

review these results and the Company’s 2025 outlook is planned for

6:30 a.m. MT (8:30 a.m. ET), on Tuesday, February 25, 2025.

Participation details are available in this release, and

supplemental materials can be accessed on the Company's website,

www.civitasresources.com.

Key Fourth Quarter and Full Year 2024 Results

Three Months Ended December

31, 2024

Twelve Months Ended

December 31, 2024

Net Income ($MM)

$151

$839

Adjusted Net Income ($MM)(1)

$171

$842

Operating Cash Flow ($MM)

$858

$2,865

Adjusted EBITDAX ($MM)(1)

$895

$3,652

Sales Volumes (MBoe/d)

352

345

Oil Volumes (MBbl/d)

164

159

Capital Expenditures ($MM)

$278

$1,933

Adjusted Free Cash Flow ($MM)(1)

$519

$1,266

(1) Non-GAAP financial measure; see

attached reconciliation schedules at the end of this release for

reconciliations to the most directly comparable GAAP financial

measures.

Management Quote

“The Civitas team performed well in 2024, establishing a

successful operational track record in our first full year of

operating in the Permian Basin and building on our strong momentum

in the DJ Basin. Our high-quality assets and strong execution

delivered in-line to better-than-expected sales volumes, capital

expenditures, and operating costs. Along with enhancing our

portfolio returns through sustainable capital efficiency gains and

improved cycle times, we also expanded our asset base with

attractive inventory adds in our core areas. All of these actions

strengthened our business and our long-term free cash flow

outlook,” said President and CEO Chris Doyle.

Fourth Quarter 2024 Financial and Operating Results

Total sales and oil volumes increased 1% and 3% sequentially to

352 MBoe/d and 164 MBbl/d, respectively. Sales volumes in the

fourth quarter were split 50% Permian Basin and 50% DJ Basin, as

the DJ Basin grew significantly following a high number of third

quarter turn-in-lines. Supported by strong sales volumes and

commodity price realizations, higher than expected revenues offset

higher cash operating costs, primarily occurring in the Permian

Basin, as a result of winterization efforts and increased workover

and maintenance activities.

Capital expenditures of $278 million were consistent with plan

and reflected continued efficiency gains, as the Company drilled,

completed, and turned to sales 21, 34, and 4 net operated wells,

respectively, in the Permian Basin, and 9, 3, and 28 net operated

wells, respectively, in the DJ Basin. The Company's average lateral

length completed in the quarter was approximately 2.2 miles and 3.0

miles for the Permian Basin and DJ Basin, respectively.

Long-term debt was reduced by $350 million in the fourth

quarter, while the Company also returned $205 million to its

shareholders, including $48 million in dividends and $157 million

in share repurchases. The Company repurchased nearly 3.5% of its

outstanding shares in the fourth quarter.

2024 Financial Highlights

- Generated adjusted free cash flow(1) of nearly $1.3 billion,

representing a yield of 29% (based on year-end 2024 market

capitalization)

- Delivered capital expenditures in the lower half of the

Company's original guidance, with total sales volumes approximately

5% above original guidance and oil volumes at the midpoint,

adjusted for non-core DJ Basin divestments

- Cash operating costs, including lease operating, midstream,

gathering, transportation, and processing, and cash G&A were

below the midpoint of original guidance

- Returned more than $920 million to shareholders throughout the

year, including $494 million in dividends and $427 million of share

repurchases

- Repurchased 7.3 million outstanding shares (approximately 7% of

shares outstanding)

- Increased the Company’s revolving credit facility borrowing

base by $400 million (to $3.4 billion) and its elected commitment

by $350 million (to $2.2 billion)

- Received an upgrade on the Company's long-term issuer rating

from Fitch Ratings to BB+, along with an upgrade from S&P

Global to a positive outlook

(1) Non-GAAP financial measure; see

attached reconciliation schedules at the end of this release for

reconciliations to the most directly comparable GAAP financial

measures.

2024 Operational Highlights

- Established operational track record in the Permian Basin,

delivering sustainably lower well costs through well design

changes, accelerated drilling and completion cycle times, and scale

benefits

- Midland Basin average two-mile well costs (drilling, completion

and equipment) decreased from $850 per lateral foot to less than

$725 per foot by the end of the year, a more than 15%

improvement

- Implemented simulfrac operations late in 2024, increasing fluid

throughput by more than 40% (barrels pumped per day)

- Achieved Permian Basin total recordable incident rate of 0.18

in the first year of operatorship

- Delineated Wolfcamp D development in the Midland Basin, with

higher than anticipated productivity and lower costs, expanding the

economic competitiveness of the Wolfcamp D across Civitas' acreage

position

- Successfully executed 13 four-mile laterals in the DJ Basin,

the longest laterals ever drilled and completed in Colorado,

representing the highest 180-day cumulative oil producing wells in

the state and observing no per foot degradation in

productivity

- Drilled, completed, and commenced production on the Company's

first "U-turn" wells in the Company's northeast extension area of

the DJ Basin, outperforming expected capital cost, cycle times, and

production

- Reported 2024 proved reserves of 798 million barrels of oil

equivalent, a 14% increase from year-end 2023, primarily driven by

the acquisition of Vencer Energy

2024 Strategic Highlights

- Closed on the acquisition of certain oil and gas assets in the

Midland Basin from Vencer Energy at the start of the year,

materially expanding the Company’s Permian Basin position

- Extended the Company's future development inventory through

multiple land transactions and optimized development plans, adding

approximately 100 gross locations in the Permian Basin and 250

gross locations in the DJ Basin

- Divested non-core DJ Basin assets for $215 million, which

included 7 MBoe/d of production (~40% oil) and long-dated future

development inventory in the Company's northeast extension

area

- Reduced regulatory risk in the DJ Basin through a multi-party

regulatory agreement with the governor, industry colleagues, and

environmental groups that defers future ballot measure and

legislative initiatives through at least the end of 2027 (Senate

Bill 24-229 and 24-230)

- Received approval from Colorado’s Energy and Carbon Management

Commission of the Lowry Ranch Comprehensive Area Plan within the

Watkins development area of the DJ Basin

Webcast / Conference Call Information

The Company plans to host a webcast and conference call at 6:30

a.m. MT (8:30 a.m. ET) on February 25, 2025. The dial-in number for

the call is 888-510-2535, with passcode 4872770. A live webcast and

replay of this event will be available on the Investor Relations

section of the Company’s website at www.civitasresources.com.

About Civitas Resources, Inc.

Civitas Resources, Inc. is an independent exploration and

production company focused on the acquisition, development and

production of crude oil and liquids-rich natural gas from its

premier assets in the DJ Basin in Colorado and the Permian Basin in

Texas and New Mexico. Civitas’ proven business model to maximize

shareholder returns is focused on four key strategic pillars:

generating significant free cash flow, maintaining a premier

balance sheet, returning capital to shareholders, and demonstrating

ESG leadership. For more information about Civitas, please visit

www.civitasresources.com.

Schedule 1:

Consolidated Statements of Operations

(in thousands, except for per share

amounts, unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Operating net revenues:

Crude oil, natural gas, and NGL sales

$

1,291,745

$

1,125,730

$

5,202,408

$

3,473,821

Other operating income

1,121

1,045

4,400

5,419

Total operating net revenues

1,292,866

1,126,775

5,206,808

3,479,240

Operating expenses:

Lease operating expense

173,005

109,560

577,837

301,288

Midstream operating expense

11,313

10,039

48,038

45,080

Gathering, transportation, and

processing

97,894

80,880

377,678

290,645

Severance and ad valorem taxes

86,307

88,293

377,388

276,535

Exploration

587

632

14,322

2,178

Depreciation, depletion, and

amortization

544,568

416,634

2,056,427

1,171,192

Transaction costs

682

24,251

31,419

84,328

General and administrative expense

53,223

54,524

226,965

161,077

Other operating expense

6,192

2,182

17,330

7,437

Total operating expenses

973,771

786,995

3,727,404

2,339,760

Other income (expense):

Derivative gain (loss), net

(11,437

)

129,881

37,490

9,307

Interest expense

(113,860

)

(90,071

)

(456,303

)

(182,740

)

Loss on property transactions, net

(1,136

)

—

(2,566

)

(254

)

Other income (expense)

7,099

(695

)

24,670

33,661

Total other income (expense)

(119,334

)

39,115

(396,709

)

(140,026

)

Income from operations before income

taxes

199,761

378,895

1,082,695

999,454

Income tax expense

(48,651

)

(76,028

)

(243,972

)

(215,166

)

Net income

$

151,110

$

302,867

$

838,723

$

784,288

Earnings per common share

Basic

$

1.57

$

3.23

$

8.48

$

9.09

Diluted

$

1.57

$

3.20

$

8.46

$

9.02

Weighted-average common shares

outstanding:

Basic

96,254

93,774

98,865

86,240

Diluted

96,394

94,519

99,176

86,988

Schedule 2:

Consolidated Statement of Cash Flows

(in thousands, unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Cash flows from operating activities:

Net income

$

151,109

$

302,867

$

838,723

$

784,288

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion, and

amortization

544,568

416,634

2,056,427

1,171,192

Stock-based compensation

12,150

9,354

48,272

34,931

Derivative (gain) loss, net

11,437

(129,881

)

(37,490

)

(9,307

)

Derivative cash settlement gain (loss),

net

12,147

(23,339

)

6,435

(68,246

)

Amortization of deferred financing costs

and deferred acquisition consideration

13,775

3,587

52,702

9,293

Loss on property transactions, net

1,136

—

2,566

254

Deferred income tax expense

48,378

106,191

235,773

245,163

Other, net

4,084

(330

)

1,084

(740

)

Changes in operating assets and

liabilities, net

Accounts receivable, net

(58,057

)

760

(23,036

)

(39,869

)

Prepaid expenses and other

(12,856

)

19,141

(17,644

)

19,987

Accounts payable, accrued expenses, and

other liabilities

130,199

138,204

(298,584

)

91,814

Net cash provided by operating

activities

858,070

843,188

2,865,228

2,238,760

Cash flows from investing activities:

Acquisitions of businesses, net of cash

acquired

—

(5,121

)

(905,096

)

(3,655,612

)

Acquisitions of crude oil and natural gas

properties

(23,096

)

(93,880

)

(47,440

)

(154,855

)

Deposits for acquisitions

—

(161,250

)

—

(161,250

)

Capital expenditures for drilling and

completion activities and other fixed assets

(292,319

)

(570,269

)

(1,924,426

)

(1,352,388

)

Proceeds from property transactions

45,544

84,692

208,824

90,456

Purchases of carbon credits and renewable

energy credits

(1,826

)

(287

)

(5,744

)

(6,151

)

Other, net

—

(177

)

2,000

(3,355

)

Net cash used in investing activities

(271,697

)

(746,292

)

(2,671,882

)

(5,243,155

)

Cash flows from financing activities:

Proceeds from credit facility

250,000

1,000,000

1,900,000

2,120,000

Payments to credit facility

(600,000

)

(900,000

)

(2,200,000

)

(1,370,000

)

Proceeds from issuance of senior notes

—

987,500

—

3,653,750

Payment of deferred financing costs and

other

(1,215

)

(2,879

)

(7,724

)

(45,788

)

Dividends paid

(47,629

)

(149,289

)

(493,842

)

(660,320

)

Common stock repurchased and retired

(157,444

)

—

(427,305

)

(320,398

)

Payment of employee tax withholdings in

exchange for the return of common stock

(396

)

(114

)

(12,037

)

(13,416

)

Other, net

(938

)

(727

)

(3,427

)

(752

)

Net cash provided by (used in) financing

activities

(557,622

)

934,491

(1,244,335

)

3,363,076

Net change in cash, cash equivalents, and

restricted cash

28,751

1,031,387

(1,050,989

)

358,681

Cash, cash equivalents, and restricted

cash:

Beginning of period (1)

47,075

95,428

1,126,815

768,134

End of period (1)

$

75,826

$

1,126,815

$

75,826

$

1,126,815

(1) The balance includes $0.1 million of

restricted cash consisting of funds for road maintenance and

repairs that is presented in other noncurrent assets within our

balance sheets for all periods presented prior to September 30,

2024. These funds were released to the Company during the third

quarter of 2024. In addition, the December 31, 2023 balance

includes $1.9 million of interest earned on cash held in escrow

that is presented in deposits for acquisitions within our balance

sheets for the period ended December 31, 2023.

Schedule 3:

Consolidated Balance Sheets

(in thousands)

December 31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

75,826

$

1,124,797

Accounts receivable, net:

Crude oil and natural gas sales

646,290

505,961

Joint interest and other

125,047

247,228

Derivative assets

66,517

35,192

Deposits for acquisitions

—

163,164

Prepaid expenses and other

74,638

68,070

Total current assets

988,318

2,144,412

Property and equipment (successful efforts

method):

Proved properties

16,897,070

12,738,568

Less: accumulated depreciation, depletion,

and amortization

(4,287,752

)

(2,339,541

)

Total proved properties, net

12,609,318

10,399,027

Unproved properties

630,727

821,939

Wells in progress

505,556

536,858

Other property and equipment, net of

accumulated depreciation of $9,382 in 2024 and $9,808 in 2023

48,757

62,392

Total property and equipment, net

13,794,358

11,820,216

Derivative assets

17,037

8,233

Other noncurrent assets

144,407

124,458

Total assets

$

14,944,120

$

14,097,319

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable and accrued expenses

$

560,893

$

565,708

Production taxes payable

322,976

421,045

Crude oil and natural gas revenue

distribution payable

702,130

766,123

Derivative liability

22,178

18,096

Deferred acquisition consideration

478,749

—

Other liabilities

118,168

80,915

Total current liabilities

2,205,094

1,851,887

Long-term liabilities:

Debt, net

4,493,531

4,785,732

Ad valorem taxes

294,058

307,924

Derivative liability

13,016

—

Deferred income tax liabilities, net

800,554

564,781

Asset retirement obligations

399,002

305,716

Other long-term liabilities

110,119

99,958

Total liabilities

8,315,374

7,915,998

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $.01 par value,

25,000,000 shares authorized, none outstanding

—

—

Common stock, $.01 par value, 225,000,000

shares authorized, 93,933,857 and 93,774,901 issued and outstanding

as of December 31, 2024 and 2023, respectively

5,006

5,004

Additional paid-in capital

5,095,298

4,964,450

Retained earnings

1,528,442

1,211,867

Total stockholders’ equity

6,628,746

6,181,321

Total liabilities and stockholders’

equity

$

14,944,120

$

14,097,319

Schedule 4: Average Sales Volumes and

Prices (unaudited)

The following table presents crude oil, natural gas, and NGL

sales volumes by operating region as well as consolidated average

sales prices for the periods presented:

Three Months Ended

Twelve Months Ended

December 31, 2024

September 30, 2024

December 31, 2024

December 31, 2023

Average sales volumes per day

Crude oil (MBbl/d)

DJ Basin

84

71

74

79

Permian Basin

80

88

85

21

Total

164

159

159

100

Natural gas (MMcf/d)

DJ Basin

309

311

320

302

Permian Basin

286

292

278

64

Total

595

603

598

366

Natural gas liquids (MBbl/d)

DJ Basin

41

37

38

39

Permian Basin

49

52

48

12

Total

90

89

86

51

Average sales volumes per day (MBoe/d)

DJ Basin

176

159

165

169

Permian Basin

176

189

179

44

Total(1)

352

348

345

213

Average sales prices (before

derivatives):

Crude oil (per Bbl)

$

69.96

$

75.46

$

75.26

$

75.57

Natural gas (per Mcf)

$

1.14

$

0.17

$

0.77

$

2.28

Natural gas liquids (per Bbl)

$

21.47

$

19.38

$

21.09

$

21.35

Total (per Boe)

$

39.90

$

39.70

$

41.24

$

44.86

____________________

(1) Items may not recalculate due to

rounding.

Schedule 5: Adjusted Net Income (in

thousands, except per share amounts, unaudited)

Adjusted Net Income is a supplemental non-GAAP financial measure

that is used by management to present a more comparable, recurring

profitability between periods. We believe that Adjusted Net Income

provides external users of our consolidated financial statements

with additional information to assist in their analysis of the

Company. The Company defines Adjusted Net Income as net income

after adjusting for (1) the impact of certain non-cash items and

one-time transactions and correspondingly (2) the related tax

effect in each period. Adjusted Net Income is not a measure of net

income as determined by GAAP and should not be considered in

isolation or as a substitute for net income, net cash provided by

operating activities, or other profitability or liquidity measures

prepared under GAAP.

The following table presents a reconciliation of the GAAP

financial measure of net income to the non-GAAP financial measure

of Adjusted Net Income.

Three Months Ended

Twelve Months Ended

December 31, 2024

September 30, 2024

December 31, 2024

December 31, 2023

Net income

$

151,110

$

295,803

$

838,723

$

784,288

Adjustments to net income:

Unused commitments(1)

1,232

1,117

1,730

5,013

Transaction costs

682

140

31,419

84,328

Loss on property transactions, net

1,136

—

2,566

254

Derivative (gain) loss, net

11,437

(151,029

)

(37,490

)

(9,307

)

Derivative cash settlement gain (loss),

net

12,147

18,195

6,435

(68,246

)

Total adjustments to net income before

taxes

26,634

(131,577

)

4,660

12,042

Tax effect of adjustments

(6,499

)

31,578

(1,049

)

(2,589

)

Total adjustments to net income after

taxes

20,135

(99,999

)

3,611

9,453

Adjusted Net Income

$

171,245

$

195,804

$

842,334

$

793,741

Adjusted Net Income per diluted share

$

1.78

$

1.99

$

8.49

$

9.12

Diluted weighted-average common shares

outstanding

96,394

98,224

99,176

86,988

1) Included as a portion of other

operating expense in the consolidated statements of operations.

Schedule 6: Adjusted EBITDAX (in

thousands, unaudited)

Adjusted EBITDAX is a supplemental non-GAAP financial measure

that represents earnings before interest, income taxes,

depreciation, depletion, and amortization, exploration expense, and

other non-cash and non-recurring charges. Adjusted EBITDAX excludes

certain items that we believe affect the comparability of operating

results and can exclude items that are generally non-recurring in

nature or whose timing and/or amount cannot be reasonably

estimated. We present Adjusted EBITDAX because we believe it

provides useful additional information to investors and analysts,

as a performance measure, for analysis of our ability to internally

generate funds for exploration, development, acquisitions, and to

service debt. We are also subject to financial covenants under our

revolving credit facility based on Adjusted EBITDAX ratios. In

addition, Adjusted EBITDAX is widely used by professional research

analysts and others in the valuation, comparison, and investment

recommendations of companies in the crude oil and natural gas

exploration and production industry. Adjusted EBITDAX should not be

considered in isolation or as a substitute for net income, net cash

provided by operating activities, or other profitability or

liquidity measures prepared under GAAP. Because Adjusted EBITDAX

excludes some, but not all items that affect net income and may

vary among companies, the Adjusted EBITDAX amounts presented may

not be comparable to similar metrics of other companies.

The following table presents a reconciliation of the GAAP

financial measure of net income to the non-GAAP financial measure

of Adjusted EBITDAX:

Three Months Ended

Twelve Months Ended

December 31, 2024

September 30, 2024

December 31, 2024

December 31, 2023

Net Income

$

151,110

$

295,803

$

838,723

$

784,288

Total adjustments to net income before

taxes (from schedule 4)

26,634

(131,577

)

4,660

12,042

Exploration

587

861

14,322

2,178

Depreciation, depletion, and

amortization

544,568

523,929

2,056,427

1,171,192

Stock-based compensation(1)

12,150

12,661

48,272

34,931

Interest expense

113,860

117,760

456,303

182,740

Interest income(2)

(2,334

)

(2,650

)

(11,058

)

(33,347

)

Income tax expense

48,651

93,309

243,972

215,166

Adjusted EBITDAX

$

895,226

$

910,096

$

3,651,621

$

2,369,190

(1) Included as a portion of general and

administrative expense in the consolidated statements of

operations.

(2) Included as a portion of other income

in the consolidated statements of operations.

Schedule 7: Adjusted Free Cash Flow

(in thousands, unaudited)

Adjusted Free Cash Flow is a supplemental non-GAAP financial

measure that is calculated as net cash provided by operating

activities before changes in operating assets and liabilities and

less exploration and development of crude oil and natural gas

properties, changes in working capital related to capital

expenditures, and purchases of carbon credits. We believe that

Adjusted Free Cash Flow provides additional information that may be

useful to investors and analysts in evaluating our ability to

generate cash from our existing crude oil and natural gas assets to

fund future exploration and development activities and to return

cash to stockholders. Adjusted Free Cash Flow is a supplemental

measure of liquidity and should not be viewed as a substitute for

cash flows from operations because it excludes certain required

cash expenditures.

The following table presents a reconciliation of the GAAP

financial measure of net cash provided by operating activities to

the non-GAAP financial measure of Adjusted Free Cash Flow:

Three Months Ended

Twelve Months Ended

December 31, 2024

September 30, 2024

December 31, 2024

December 31, 2023

Net cash provided by operating

activities

$

858,070

$

835,038

$

2,865,228

$

2,238,760

Add back: changes in operating assets and

liabilities, net

(59,285

)

(28,270

)

339,264

(71,932

)

Cash flow from operations before changes

in operating assets and liabilities

798,785

806,768

3,204,492

2,166,828

Less: Cash paid for capital expenditures

for drilling and completion activities and other fixed assets

(292,319

)

(541,410

)

(1,924,426

)

(1,352,388

)

Less: Changes in working capital related

to capital expenditures

14,115

103,021

(8,208

)

(12,349

)

Capital expenditures

(278,204

)

(438,389

)

(1,932,634

)

(1,364,737

)

Less: Purchases of carbon credits and

renewable energy credits

(1,826

)

(2,032

)

(5,744

)

(6,151

)

Adjusted Free Cash Flow

$

518,755

$

366,347

$

1,266,114

$

795,940

Capital expenditures by operating

region

DJ Basin

$

78,223

$

208,530

$

813,750

$

890,962

Permian Basin

199,955

228,910

1,117,686

473,933

Other/Corporate

25

951

1,199

(158

)

Total

$

278,203

$

438,391

$

1,932,635

$

1,364,737

Schedule 8: Estimated Proved

Reserves

A summary of our changes in quantities of total proved reserves

for the year ended December 31, 2024 is as follows:

Proved Reserve Roll-Forward

(in MBoe)

Net Proved Reserves

Balance as of December 31, 2023

697,799

Extensions, discoveries, and other

additions

101,817

Production

(126,135

)

Divestiture of reserves

(22,929

)

Removed from capital program

(24,064

)

Acquisition of reserves

179,348

Revisions to previous estimates

(8,112

)

Balance as of December 31, 2024

797,724

The table below sets forth information regarding our estimated

proved reserves by category and operating region as of December 31,

2024:

Operating Region/Area

Crude Oil (MBbls)

Natural Gas (MMcf)

NGL (MBbls)

Crude Oil Equivalent

(MBoe)

Proved developed reserves:

DJ Basin

103,812

647,550

79,431

291,168

Permian Basin

131,814

676,306

123,751

368,283

Total proved developed reserves

235,626

1,323,856

203,182

659,451

Proved undeveloped reserves:

DJ Basin

34,045

99,276

11,883

62,474

Permian Basin

35,690

116,386

20,711

75,799

Total proved undeveloped reserves

69,735

215,662

32,594

138,273

Proved reserves:

DJ Basin

137,857

746,826

91,314

353,642

Permian Basin

167,504

792,692

144,462

444,082

Total proved reserves(1)

305,361

1,539,518

235,776

797,724

____________________

(1) Items may not recalculate due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224936014/en/

For further information, please contact: Investor

Relations: Brad Whitmarsh, 832.736.8909,

bwhitmarsh@civiresources.com Mae Herrington, 832.913.5444,

mherrington@civiresources.com

Media: Rich Coolidge, info@civiresources.com

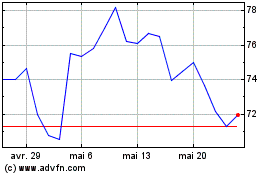

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025