Acquisition increases Free Cash Flow and

balances portfolio between Permian and DJ Basins

Civitas Resources (NYSE: CIVI) (“Civitas”) today signed an

agreement with Vencer Energy (“Vencer”), a Vitol investment, to

acquire oil producing assets in the Midland Basin of west Texas for

a total consideration of approximately $2.1 billion, subject to

customary terms, conditions, and closing price adjustments (the

“Acquisition”). The Acquisition is expected to close in January

2024 with an effective date of January 1, 2024.

Civitas plans to hold a conference call to discuss the

Acquisition at 7:00 a.m. MDT (9:00 a.m. EDT) on October 4, 2023.

Participation details are included within this release. Additional

details are available in a new slide deck, which can be found at

www.civitasresources.com.

Highlights

- Attractively priced and immediately accretive to Free Cash

Flow per share: The Acquisition is attractively priced at 2.8x

2024 estimated Adjusted EBITDAX at $80/Bbl NYMEX WTI and

$3.50/MMBtu NYMEX Henry Hub, which compares favorably to recent

transactions in the Permian Basin. Approximately 80% of the

purchase price is underwritten by the value of proved developed and

proved developed non-producing reserves, with significant upside in

future developments. The Acquisition is expected to deliver an

estimated 5% uplift to Free Cash Flow per share in 2024. Pro forma,

Civitas expects to generate approximately $1.8 billion of Free Cash

Flow in 2024 at $80/Bbl and $3.50/MMBtu.

- Increases Permian Basin scale, balancing Civitas’ portfolio

between premium Permian and DJ positions: The Acquisition will

add approximately 44,000 net acres in the Midland Basin and current

production of approximately 62 Mboe/d (approximately 50% oil). Pro

forma for the Acquisition, Civitas’ 2024 estimated Permian

production is expected to be about 170 Mboe/d (approximately 50%

oil). Pro forma for the Acquisition, Civitas expects that its 2024

total company production will be 325 – 345 Mboe/d and total capital

expenditures will be $1.95 – $2.25 billion.

- Adds premium, low breakeven oil inventory in the Midland

Basin: The Acquisition will add an estimated 400 gross

development locations located primarily in the Spraberry and

Wolfcamp formations. Approximately 40% of the new locations have an

estimated IRR of more than 40% at $70/Bbl WTI. Pro forma for the

Acquisition, Civitas will have more than 1,200 high-quality oil

development locations in the Permian Basin.

- Maintains peer-leading shareholder return program,

strengthens capital structure: Higher cash flow will benefit

shareholders through Civitas’ existing variable dividend framework.

Civitas expects its Net Debt/Adjusted EBITDAX leverage ratio to be

approximately 1.1x at closing and improve to approximately 0.9x at

year-end 2024 at $80/Bbl NYMEX WTI and $3.50/MMBtu NYMEX Henry Hub.

Civitas intends to optimize its asset portfolio through non-core

asset sales, including its previously announced plans to sell

approximately $300 million in non-core assets in the DJ Basin by

mid-2024, with proceeds allocated to debt reduction.

“This was a unique opportunity to capture high-quality oil

assets at a very attractive price,” said Chris Doyle, Civitas

President & CEO. “In recent months, we have created a quality,

scaled position in the heart of the Permian Basin. We continue to

advance our strategic pillars by adding premium inventory,

increasing Free Cash Flow, and delivering the industry’s best cash

returns to shareholders. Upon closing, our portfolio will be

balanced between the Permian and DJ basins, which reduces

operational risk and makes us a stronger and more sustainable

enterprise.”

Financing

Total consideration for the Acquisition is approximately $2.1

billion, consisting of approximately 7.3 million shares of common

stock to be issued to Vencer and $1.55 billion of cash, of which $1

billion will be due at closing. The remaining $550 million will be

payable on January 3, 2025. Civitas has the option to accelerate

the deferred cash payment to the closing of the Acquisition, which

would lower the total purchase price by $50 million to $2.05

billion. Civitas plans to fund the cash portion of the purchase

price with a combination of debt and equity financings.

Outlook

With three producing basins, Civitas will have the ability to

flex capital investments and activity levels between assets to

maximize returns, ensure desired outcomes, and mitigate potential

operational and timing risks. Civitas’ updated outlook for 2024,

incorporating the positive impacts of the Acquisition, is shown

below (due to the timing of closing in early 2024, previously

provided 2023 guidance remains unchanged).

Civitas Prior 2024

Vencer 2024(1)

Civitas Pro Forma 2024

Combined(1)

Total Production (Mboe/d)

270 − 290

50 – 60

325 – 345

Oil Production (Mboe/d)

130 − 140

23 – 28

155 – 165

% Liquids

71 − 74%

73 − 75%

71 − 74%

Capital Expenditures ($MM)

$1,600 − $1,800

$350 − $450

$1,950 − $2,250

(1) Assumes an estimated close date of

January 1, 2024.

Advisors

BofA Securities is serving as lead financial advisor and J.P.

Morgan Securities LLC and RBC Capital Markets are also providing

financial advice. Kirkland & Ellis is serving as legal advisor,

and DrivePath Advisors is serving as communication advisor for

Civitas.

Vencer was advised by Latham & Watkins LLP.

Conference Call Information

Civitas plans to host a conference call to discuss the

Acquisition at 7:00 a.m. MDT (9:00 a.m. EDT) on October 4, 2023. To

participate in the call, please dial toll free (888) 510-2535 or

(646) 960-0342 and use Conference ID 4872770. A live webcast will

be available on the Investor Relations section of Civitas’ website

at www.civitasresources.com.

About Civitas Resources, Inc.

Civitas Resources, Inc. is an independent, domestic oil and gas

producer focused on development of its premier assets in the

Denver-Julesburg (“DJ”) and Permian Basins. Civitas has a proven

business model combining capital discipline, a strong balance

sheet, cash flow generation and sustainable cash returns to

shareholders. Civitas employs leading ESG practices and was

Colorado’s first carbon neutral oil and gas producer. For more

information about Civitas, please visit

www.civitasresources.com.

About Vitol

Vitol is a leader in the energy sector with a presence across

the spectrum: from oil to power, renewables and carbon. Vitol

trades 7.4 million barrels per day of crude oil and products, and

charters around 6,000 sea voyages every year.

Vitol's counterparties include national oil companies,

multinationals, leading industrial companies and utilities. Founded

in Rotterdam in 1966, today Vitol operates from some 40 offices

worldwide and is invested in energy assets globally including: 17 m

m3 of storage globally, roughly 500 k b/d of refining capacity,

over 7,000 service stations and a growing portfolio of transitional

and renewable energy assets. Revenues in 2022 were $505 billion.

For more information about Vitol, please visit www.vitol.com.

Forward-Looking Statements and Cautionary Statements

Certain statements in this press release concerning future

opportunities for Civitas, future financial performance and

condition, guidance and any other statements regarding Civitas’

future expectations, beliefs, plans, objectives, financial

conditions, returns to shareholders assumptions or future events or

performance that are not historical facts are “forward-looking”

statements based on assumptions currently believed to be valid.

Forward-looking statements are all statements other than statements

of historical facts. The words “anticipate,” “believe,” “ensure,”

“expect,” “if,” “intend,” “estimate,” “probable,” “project,”

“forecasts,” “predict,” “outlook,” “aim,” “will,” “could,”

“should,” “would,” “potential,” “may,” “might,” “anticipate,”

“likely” “plan,” “positioned,” “strategy,” and similar expressions

or other words of similar meaning, and the negatives thereof, are

intended to identify forward-looking statements. Specific

forward-looking statements include statements regarding Civitas’

plans and expectations with respect to the Acquisition and the

anticipated impact of the Acquisition on Civitas’ results of

operations, financial position, growth opportunities, reserve

estimates and competitive position. The forward-looking statements

are intended to be subject to the safe harbor provided by Section

27A of the Securities Act of 1933, as amended, Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995.

These forward-looking statements involve significant risks and

uncertainties that could cause actual results to differ materially

from those anticipated, including, but not limited to, Civitas’

future financial condition, results of operations, strategy and

plans; the ability of Civitas to realize anticipated synergies

related to the Acquisition in the timeframe expected or at all;

changes in capital markets and the ability of Civitas to finance

operations in the manner expected; the effects of commodity prices;

and the risks of oil and gas activities. Additionally, risks and

uncertainties that could cause actual results to differ materially

from those anticipated also include: declines or volatility in the

prices we receive for our oil, natural gas, and natural gas

liquids; general economic conditions, whether internationally,

nationally or in the regional and local market areas in which we do

business, including any future economic downturn, the impact of

continued or further inflation, disruption in the financial markets

and the availability of credit on acceptable terms; our ability to

identify and select possible additional acquisition and disposition

opportunities; the effects of disruption of our operations or

excess supply of oil and natural gas due to world health events and

the actions by certain oil and natural gas producing countries

including Russia; the continuing effects of the COVID-19 pandemic,

including any recurrence or the worsening thereof; the ability of

our customers to meet their obligations to us; our access to

capital on acceptable terms; our ability to generate sufficient

cash flow from operations, borrowings, or other sources to enable

us to fully develop our undeveloped acreage positions; our ability

to pursue potential capital management activities such as share

repurchases, paying dividends at their current level or at all, or

additional mechanisms to return excess capital to shareholders; the

presence or recoverability of estimated oil and natural gas

reserves and the actual future sales volume rates and associated

costs; uncertainties associated with estimates of proved oil and

gas reserves; the possibility that the industry may be subject to

future local, state, and federal regulatory or legislative actions

(including additional taxes and changes in environmental, health

and safety regulation and regulations addressing climate change);

environmental, health and safety risks; seasonal weather

conditions, as well as severe weather and other natural events

caused by climate change; lease stipulations; drilling and

operating risks, including the risks associated with the employment

of horizontal drilling and completion techniques; our ability to

acquire adequate supplies of water for drilling and completion

operations; availability of oilfield equipment, services, and

personnel; exploration and development risks; operational

interruption of centralized oil and natural gas processing

facilities; competition in the oil and natural gas industry;

management’s ability to execute our plans to meet our goals;

unforeseen difficulties encountered in operating in new geographic

areas; our ability to attract and retain key members of our senior

management and key technical employees; our ability to maintain

effective internal controls; access to adequate gathering systems

and pipeline take-away capacity; our ability to secure adequate

processing capacity for natural gas we produce, to secure adequate

transportation for oil, natural gas, and natural gas liquids we

produce, and to sell the oil, natural gas, and natural gas liquids

at market prices; costs and other risks associated with perfecting

title for mineral rights in some of our properties; political

conditions in or affecting other producing countries, including

conflicts in or relating to the Middle East, South America and

Russia (including the current events involving Russia and Ukraine),

and other sustained military campaigns or acts of terrorism or

sabotage; and other economic, competitive, governmental,

legislative, regulatory, geopolitical, and technological factors

that may negatively impact our businesses, operations, or pricing.

Expectations regarding business outlook, including changes in

revenue, pricing, capital expenditures, cash flow generation,

strategies for our operations, oil and natural gas market

conditions, legal, economic and regulatory conditions, and

environmental matters are only forecasts regarding these

matters.

Additional information concerning other risk factors is also

contained in Civitas’ most recently filed Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and other Securities and Exchange Commission filings. All

forward-looking statements speak only as of the date they are made

and are based on information available at that time. Civitas does

not assume any obligation to update forward-looking statements to

reflect circumstances or events that occur after the date the

forward-looking statements were made or to reflect the occurrence

of unanticipated events except as required by federal securities

laws. As forward-looking statements involve significant risks and

uncertainties, caution should be exercised against placing undue

reliance on such statements.

Non-GAAP Measures

To provide investors with additional information in connection

with our results as determined in accordance with generally

accepted accounting principles in the United States (“GAAP”), we

disclose certain non-GAAP financial measures. The non-GAAP

financial measures include Net Debt, Adjusted EBITDAX, Free Cash

Flow and related calculations. We believe the non-GAAP financial

measures provide users of our financial information with additional

meaningful comparisons between the current results and results of

prior periods, as well as comparisons with peer companies. These

non-GAAP financial measures are not measures of financial

performance in accordance with GAAP and may exclude items that are

significant in understanding and assessing our financial results.

Therefore, these measures should not be considered in isolation or

as an alternative or superior to GAAP measures. You should be aware

that our presentation of these measures may not be comparable to

similarly-titled measures used by other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231004846293/en/

For further information, please contact:

Investor Relations: John Wren, ir@civiresources.com

Media: Rich Coolidge, info@civiresources.com

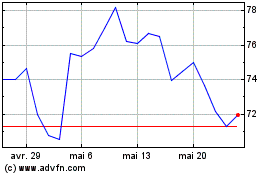

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Civitas Resources (NYSE:CIVI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025