FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October, 2024

001-14832

(Commission File Number)

CELESTICA INC.

(Translation of registrant’s name into English)

5140 Yonge Street, Suite 1900

Toronto, Ontario

Canada M2N 6L7

(416) 448-5800

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate

by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark whether the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Furnished Herewith (and incorporated by reference

herein)

The information contained in Exhibit 99.1 of this Form 6-K

is not incorporated by reference into any registration statement (or into any prospectus that forms a part thereof) filed by Celestica

Inc. with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

CELESTICA INC. |

| |

|

|

| Date: October 30, 2024 |

By: |

/s/ Douglas Parker |

| |

|

Douglas Parker |

| |

|

Chief Legal Officer and Corporate Secretary |

EXHIBIT INDEX

Exhibit 99.1

| FOR IMMEDIATE RELEASE |

October 30,

2024 |

CELESTICA ANNOUNCES TSX ACCEPTANCE OF EARLY

RENEWAL OF ITS NORMAL COURSE ISSUER BID

TORONTO, Canada - Celestica Inc. (NYSE: CLS)

(TSX: CLS), a leader in design, manufacturing, hardware platform and supply chain solutions for the world’s most innovative companies,

today announced that it has terminated its existing normal course issuer bid (the “Existing Bid”), which commenced on December 14,

2023 and had an expiry date of December 13, 2024, and the Toronto Stock Exchange (the “TSX”) has accepted the Company's

notice to launch a Normal Course Issuer Bid (the “New Bid”).

Under the Existing Bid, the Company repurchased

and cancelled a total of 2,923,323 common shares (through October 18, 2024), through the facilities of the TSX or by such other

permitted means, out of the 11,763,330 common shares it was authorized to repurchase, for at a weighted average price of US$43.28 per

share. As a result of the early termination and renewal of the Existing Bid, the 2,923,323 common shares purchased under the Existing

Bid will be deducted from the New Bid’s annual limit as per the requirements of the TSX.

Under the New Bid, the Company may repurchase

on the open market, at its discretion during the period commencing on November 1, 2024 and ending on the earlier of October 31,

2025 and the completion of purchases under the New Bid, up to 8,609,693 common shares, representing approximately 10.0% of the "public

float" (within the meaning of the rules of the TSX) as at October 18, 2024 less the 2,923,323 common shares purchased

under the Existing Bid, subject to the normal terms and limitations of such bids.

Under the TSX rules, the average daily trading

volume of the common shares on the TSX during the six months ended September 30, 2024 was approximately 643,696 and, accordingly,

daily purchases on the TSX pursuant to the New Bid will be limited to 160,924 common shares, other than purchases made pursuant to the

block purchase exception. The actual number of common shares which may be purchased pursuant to the New Bid and the timing of any such

purchases will be determined by the management of the Company, subject to applicable law and the rules of the TSX. In accordance

with the TSX rules, the maximum number of common shares which may be repurchased for cancellation under the New Bid will be reduced by

the number of common shares purchased by non-independent brokers for delivery pursuant to stock-based compensation plans.

Purchases are expected to be made through the

facilities of TSX, the New York Stock Exchange, other designated exchanges and/or alternative Canadian trading systems, or by such other

means as may be permitted by the Ontario Securities Commission or other applicable Canadian Securities Administrators, at prevailing

market prices, including through one or more automatic share purchase plans. The New Bid will be funded using existing cash resources

and draws on its credit facility, and any common shares repurchased by the Company under the New Bid will be cancelled.

As of October 18, 2024, the Company had

116,359,313 issued and outstanding common shares and a "public float" (within the meaning of the rules of the TSX) of

115,330,168 common shares.

The Company believes that the purchases are in

the best interest of the Company and constitute a desirable use of its funds.

About Celestica

Celestica enables the world's best brands. Through

our recognized customer-centric approach, we partner with leading companies in Aerospace and Defense, Communications, Enterprise, HealthTech, Industrial,

and Capital Equipment to deliver solutions for their most complex challenges. As a leader in design, manufacturing, hardware platform

and supply chain solutions, Celestica brings global expertise and insight at every stage of product development — from the drawing

board to full-scale production and after-market services. With talented teams across North America, Europe and Asia, we imagine, develop

and deliver a better future with our customers. For more information on Celestica, visit www.celestica.com. Our securities filings can

be accessed at www.sedarplus.ca and www.sec.gov.

Cautionary Note

Regarding Forward-Looking Statements

This press release

contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E

of the U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws,

including, without limitation, statements related to: the Company's intention to commence the New Bid and terminate the Existing Bid,

the timing, quantity and funding of any purchases of common shares under the New Bid, and the expected facilities through which

any such purchases may be made. For those statements, we claim the protection of the safe harbor for forward-looking statements contained

in the U.S. Private Securities Litigation Reform Act of 1995, and for forward-looking information under applicable Canadian securities

laws.

Forward-looking statements

are provided to assist readers in understanding management’s current expectations and plans relating to the future. Readers are

cautioned that such information may not be appropriate for other purposes. The forward-looking statements herein are not guarantees of

future performance and are subject to risks that could cause actual results to differ materially from those expressed or implied in such

forward-looking statements, including, among others, risks related to: the availability of cash resources for, and the permissibility

under our credit facility of, repurchases of outstanding common shares under the New Bid; compliance with applicable laws and regulations

pertaining to normal course issuer bids; a reduction in the size of our "public float" as a result of repurchases made under

the New Bid; changes to our business model; the Company's future capital requirements; market and general economic conditions; demand

for our customers' products; and unforeseen legal or regulatory developments, as well as the other risks and uncertainties discussed

in our public filings at www.sedarplus.com and www.sec.gov, including in our 2023 Annual Report on Form 20-F (see,

among other risk disclosures, Item 3(D), “Key Information — Risk Factors”, Item 5 “Operating and Financial

Review and Prospects,” and Item 11, “Quantitative and Qualitative Disclosures about Market Risk”) filed with, and our

most recent Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A), and other subsequent reports

on Form 6-K furnished to, the U.S. Securities and Exchange Commission, and as applicable, the Canadian Securities Administrators.

The forward-looking

statements contained in this press release are based on various assumptions, many of which involve factors that are beyond our control.

Our material assumptions include the following: the Company's view with respect to its financial condition and prospects; general economic

and market conditions and currency exchange rates; the availability of cash resources for, and the permissibility under our credit facility

of, repurchases of outstanding common shares under the New Bid; the existence of potentially superior uses for the Company’s cash

resources than common share repurchases; compliance by third parties with their contractual obligations; compliance with applicable laws

and regulations pertaining to the New Bid; that we will continue to have sufficient financial resources to fund currently anticipated

financial actions and obligations and to pursue desirable business opportunities, as well as the other assumptions discussed in our public

filings at www.sedarplus.com and www.sec.gov, under the heading “Cautionary Note Regarding Forward-Looking Statements”,

or similarly named sections, including in our 2023 Annual Report on Form 20-F filed with, and our most recent MD&A, and other

subsequent reports on Form 6-K furnished to, the U.S. Securities and Exchange Commission, and as applicable, the Canadian Securities

Administrators. While management believes these assumptions to be reasonable under the current circumstances, they may prove to be inaccurate,

which could cause actual results to differ materially (and adversely) from those that would have been achieved had such assumptions been

accurate. Forward-looking statements speak only as of the date on which they are made, and we disclaim any intention or obligation to

update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by applicable law

All forward-looking statements attributable to us are expressly

qualified by these cautionary statements.

Contacts:

| Celestica Global Communications | Celestica Investor

Relations |

| (416) 448-2211 | (416) 448-2200 |

| clsir@celestica.com | media@celestica.com |

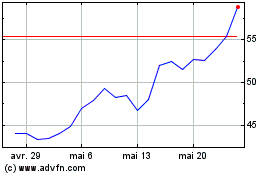

Celestica (NYSE:CLS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Celestica (NYSE:CLS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024