false

0001764046

00-0000000

0001764046

2024-01-22

2024-01-22

0001764046

us-gaap:CommonStockMember

2024-01-22

2024-01-22

0001764046

us-gaap:SeriesAPreferredStockMember

2024-01-22

2024-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

January 22, 2024

Date of Report (date of earliest event

reported)

CLARIVATE PLC

(Exact name of registrant as specified in its

charter)

Jersey, Channel Islands

(State or other jurisdiction of incorporation or organization)

001-38911

(Commission File Number)

N/A

(I.R.S. Employer Identification No.)

70 St. Mary Axe

London

EC3A

8BE

United

Kingdom

(Address of Principal Executive Offices)

(44) 207-433-4000

Registrant’s telephone

number, including area code

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Ordinary Shares, no par value |

CLVT |

New York Stock Exchange |

| 5.25% Series A Mandatory Convertible Preferred Shares, no par value |

CLVT PR A |

New York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On January 22, 2024, Clarivate Plc (“Clarivate”

or the “Company” or “we” or “us” or “our”) issued a press release announcing that it

is launching a process to refinance its outstanding senior secured term loans under its existing term loan B, scheduled to mature in

October 2026. As part of this effort, the Company will seek to enter into a new, seven-year senior secured $2.2 billion term loan B credit

facility. The strategic refinancing is intended to improve financial flexibility, including extending the company's debt maturities.

In connection with the launch of the debt refinancing

process, Clarivate is announcing that it expects to incur a goodwill impairment charge in the range of $800 million to $900 million across

the Intellectual Property and Life Sciences & Healthcare segment reporting units in the fourth quarter 2023. We perform goodwill

impairment testing during the fourth quarter of each year, or more frequently if events or changes in circumstances indicate that carrying

value may not be recoverable. In assessing whether a potential impairment event has occurred, we evaluate various factors, many of which

are subjective and require significant judgment.

The charge is expected to lower the

Company’s 2023 forecast of a GAAP net loss but will have no impact on the 2023 full year outlook for Revenues, Organic Revenue

Growth, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Diluted EPS and Free Cash Flow as outlined in its third quarter 2023

earnings press release issued on November 7, 2023.

The press release has been furnished with this

Form 8-K as Exhibit 99.1 and is posted on the investor relations section of the Company’s website (http://ir.clarivate.com/).

The information in this Item 2.02, including

Exhibit 99.1 furnished herewith, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section

and shall not be incorporated by reference into any filing pursuant to the Securities Act of 1933, as amended (the "Securities Act"),

or the Exchange Act, except as otherwise expressly stated in such filing.

Forward-Looking Statements

This communication contains “forward-looking

statements” as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management’s

current views concerning future business, events, trends, contingencies, financial performance, or financial condition, appear at various

places in this communication and may use words like “aim,” “anticipate,” “assume,” “believe,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “future,”

“goal,” “intend,” “likely,” “may,” “might,” “plan,” “potential,”

“predict,” “project,” “see,” “seek,” “should,” “strategy,” “strive,”

“target,” “will,” and “would” and similar expressions, and variations or negatives of these words.

Examples of forward-looking statements include, among others, statements we make regarding: guidance outlook and predictions relating

to expected operating results, such as revenue growth and earnings; strategic actions such as acquisitions, joint ventures, and dispositions,

including the anticipated benefits therefrom, and our success in integrating acquired businesses; anticipated levels of capital expenditures

in future periods; our ability to successfully realize cost savings initiatives and transition services expenses; our belief that we

have sufficient liquidity to fund our ongoing business operations; expectations of the effect on our financial condition of claims, litigation,

environmental costs, the impact of inflation, the impact of foreign currency fluctuations, the COVID-19 pandemic and governmental responses

thereto, international hostilities, contingent liabilities, and governmental and regulatory investigations and proceedings; and our strategy

for customer retention, growth, product development, market position, financial results, and reserves. Forward-looking statements are

neither historical facts nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations,

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy,

and other future conditions. Because forward-looking statements relate to the future, they are difficult to predict and many of which

are outside of our control. Important factors that could cause our actual results and financial condition to differ materially from those

indicated in the forward-looking statements include those factors discussed under the caption “Risk Factors” in our annual

report on Form 10-K/A, along with our other filings with the U.S. Securities and Exchange Commission (“SEC”). However, those

factors should not be considered to be a complete statement of all potential risks and uncertainties. Additional risks and uncertainties

not known to us or that we currently deem immaterial may also impair our business operations. Forward-looking statements are based only

on information currently available to our management and speak only as of the date of this communication. We do not assume any obligation

to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments

or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Please consult our public

filings with the SEC or on our website at www.clarivate.com.

Item 9.01. Financial

Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CLARIVATE PLC |

| |

|

| Date: January 22, 2024 |

By: /s/ Jonathan

M. Collins |

| |

Name: Jonathan M. Collins |

| |

Executive Vice President & Chief Financial

Officer |

Exhibit 99.1

Clarivate Announces

Commencement of Term Loan Refinancing Transaction

London, U.K., January 22, 2024 –

Clarivate Plc (NYSE: CLVT) (the “Company” or “Clarivate”),

a global leader in connecting people and organizations to intelligence they can trust to transform their world, announced today the launch

of a process to refinance the Company’s 2026 Term Loan B credit facility that would extend the maturity to 2031 for a new combined

term loan amount of $2.2 billion.

“We are proactively capitalizing on the favorable debt market

environment in order to provide further flexibility within our capital structure,” said Jonathan Collins, Executive Vice President

and Chief Financial Officer. “With our strong free cash flow, we continue to focus on investing for growth and reducing our debt

to drive long-term shareholder value.”

The Company also announced that it expects

to record a non-cash goodwill impairment charge in the range of approximately $800 million to $900 million in the fourth quarter

2023, across the Intellectual Property and Life Sciences & Healthcare segments. The charge is expected to lower the

Company’s 2023 forecast of a GAAP net loss but will have no impact on the 2023 full year outlook for Revenues, Organic Revenue

Growth, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Diluted EPS and Free Cash Flow as outlined in its third quarter 2023

earnings press release issued on November 7, 2023.

Terms of the potential refinancing will be disclosed upon the completion

of the transaction. The proposed refinancing is subject to market and other conditions, and there can be no assurance that it will be

completed on favorable terms or at all.

About Clarivate

Clarivate™ is a leading global information services provider.

We connect people and organizations to intelligence they can trust to transform their perspective, their work and our world. Our subscription

and technology-based solutions are coupled with deep domain expertise and cover the areas of Academia & Government, Intellectual Property

and Life Sciences & Healthcare. For more information, please visit clarivate.com.

Use of Non-GAAP Financial Measures

Non-GAAP results are not presentations made in accordance with U.S.

generally accepted accounting principles ("GAAP") and are presented only as a supplement to our financial statements based on

GAAP. Non-GAAP financial information is provided to enhance the reader’s understanding of our financial performance, but none of

these non-GAAP financial measures are recognized terms under GAAP. They are not measures of financial condition or liquidity, and should

not be considered as an alternative to profit or loss for the period determined in accordance with GAAP or operating cash flows determined

in accordance with GAAP. As a result, you should not consider such measures in isolation from, or as a substitute for, financial measures

or results of operations calculated or determined in accordance with GAAP.

We use non-GAAP measures in our operational and financial

decision-making. We believe that such measures allow us to focus on what we deem to be a more reliable indicator of ongoing

operating performance and our ability to generate cash flow from operations, and we also believe that investors may find these

non-GAAP financial measures useful for the same reasons. Non-GAAP measures are frequently used by securities analysts, investors,

and other interested parties in their evaluation of companies comparable to us, many of which present non-GAAP measures when

reporting their results. These measures can be useful in evaluating our performance against our peer companies because we believe

the measures provide users with valuable insight into key components of GAAP financial disclosures. However, non-GAAP measures have

limitations as analytical tools and because not all companies use identical calculations, our presentation of non-GAAP financial

measures may not be comparable to other similarly titled measures of other companies.

Definitions and reconciliations of non-GAAP measures, such as Adjusted

EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted EPS, Free Cash Flow and Standalone Adjusted EBITDA to the most directly

comparable GAAP measures are provided within the schedules attached to this release. Our presentation of non-GAAP measures should not

be construed as an inference that our future results will be unaffected by any of the adjusted items, or that any projections and estimates

will be realized in their entirety or at all.

Forward-Looking Statements

This communication contains “forward-looking statements”

as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management’s current views

concerning future business, events, trends, contingencies, financial performance, or financial condition, appear at various places in

this communication and may use words like “aim,” “anticipate,” “assume,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “goal,”

“intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,”

“project,” “see,” “seek,” “should,” “strategy,” “strive,” “target,”

“will,” and “would” and similar expressions, and variations or negatives of these words. Examples of forward-looking

statements include, among others, statements we make regarding: guidance outlook and predictions relating to expected operating results,

such as revenue growth and earnings; strategic actions such as acquisitions, joint ventures, and dispositions, including the anticipated

benefits therefrom, and our success in integrating acquired businesses; anticipated levels of capital expenditures in future periods;

our ability to successfully realize cost savings initiatives and transition services expenses; our belief that we have sufficient liquidity

to fund our ongoing business operations; expectations of the effect on our financial condition of claims, litigation, environmental costs,

the impact of inflation, the impact of foreign currency fluctuations, the COVID-19 pandemic and governmental responses thereto, international

hostilities, contingent liabilities, and governmental and regulatory investigations and proceedings; and our strategy for customer retention,

growth, product development, market position, financial results, and reserves. Forward-looking statements are neither historical facts

nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations, and assumptions

regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other

future conditions. Because forward-looking statements relate to the future, they are difficult to predict and many of which are outside

of our control. Important factors that could cause our actual results and financial condition to differ materially from those indicated

in the forward-looking statements include those factors discussed under the caption “Risk Factors” in our annual report on

Form 10-K/A, along with our other filings with the U.S. Securities and Exchange Commission (“SEC”). However, those factors

should not be considered to be a complete statement of all potential risks and uncertainties. Additional risks and uncertainties not

known to us or that we currently deem immaterial may also impair our business operations. Forward-looking statements are based only on

information currently available to our management and speak only as of the date of this communication. We do not assume any obligation

to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments

or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Please consult our public

filings with the SEC or on our website at www.clarivate.com.

The following table presents our calculation of Adjusted EBITDA and Adjusted EBITDA Margin for the 2023 outlook and reconciles these measures to our Net loss for the same period:

| | |

AS PRESENTED -

Q3'23 | | |

UPDATED FOR

EXPECTED

IMPAIRMENT | | |

CHANGE | |

| | |

Year Ending

December 31, 2023

(Forecasted) | | |

Year Ending

December 31, 2023

(Forecasted) | | |

Year Ending

December 31, 2023

(Forecasted) | |

| (in millions, except percentages) | |

Low | | |

High | | |

Low | | |

High | | |

Low | | |

High | |

| Net loss attributable to ordinary shares | |

$ | (182 | ) | |

$ | (132 | ) | |

$ | (1,082 | ) | |

$ | (932 | ) | |

$ | (900 | ) | |

$ | (800 | ) |

| Dividends on preferred shares(1) | |

| 75 | | |

| 75 | | |

| 75 | | |

| 75 | | |

| - | | |

| - | |

| Net loss | |

$ | (107 | ) | |

$ | (57 | ) | |

$ | (1,007 | ) | |

$ | (857 | ) | |

$ | (900 | ) | |

$ | (800 | ) |

| (Benefit) provision for income taxes | |

| (63 | ) | |

| (63 | ) | |

| (63 | ) | |

| (63 | ) | |

| - | | |

| - | |

| Depreciation and amortization | |

| 707 | | |

| 707 | | |

| 707 | | |

| 707 | | |

| - | | |

| - | |

| Interest expense, net | |

| 292 | | |

| 292 | | |

| 292 | | |

| 292 | | |

| - | | |

| - | |

| Restructuring and lease impairments(2) | |

| 30 | | |

| 30 | | |

| 30 | | |

| 30 | | |

| - | | |

| - | |

| Goodwill and intangible asset impairments(3) | |

| 135 | | |

| 135 | | |

| 1,035 | | |

| 935 | | |

| 900 | | |

| 800 | |

| Transaction related costs | |

| 5 | | |

| 5 | | |

| 5 | | |

| 5 | | |

| - | | |

| - | |

| Mark to market adjustment on financial instruments | |

| (14 | ) | |

| (14 | ) | |

| (14 | ) | |

| (14 | ) | |

| - | | |

| - | |

| Share-based compensation expense | |

| 130 | | |

| 130 | | |

| 130 | | |

| 130 | | |

| - | | |

| - | |

| Other(4) | |

| (25 | ) | |

| (25 | ) | |

| (25 | ) | |

| (25 | ) | |

| - | | |

| - | |

| Adjusted EBITDA | |

$ | 1,090 | | |

$ | 1,140 | | |

$ | 1,090 | | |

$ | 1,140 | | |

$ | 0 | | |

$ | 0 | |

| Adjusted EBITDA margin | |

| 42.0 | % | |

| 42.5 | % | |

| 42.0 | % | |

| 42.5 | % | |

| 0.0 | % | |

| 0.0 | % |

(1) Dividends on our mandatory convertible preferred shares (“MCPS”) are payable quarterly at an annual rate of 5.25% of the liquidation preference of $100 per share. For the purposes of calculating net loss attributable to Clarivate, we have excluded the accrued and anticipated MCPS dividends.

(2) Reflects restructuring costs expected to be incurred in 2023 associated with the ProQuest acquisition and Segment Optimization restructuring programs.

(3) Primarily represents goodwill impairment related to the quantitative goodwill impairment assessment performed over the Company’s reporting units and intangible assets impairment related to Assets Held-for-Sale.

(4) Primarily includes the gain on legal settlement partially offset by a net loss on foreign exchange re-measurement.

Category: Debt

Source: Clarivate Plc

Investor Relations Contact

Mark Donohue, Head of Investor Relations

investor.relations@clarivate.com

Media Contact

Amy Bourke-Waite, Senior Director, Corporate Communications

newsroom@clarivate.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

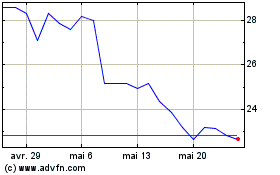

Clarivate (NYSE:CLVT-A)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Clarivate (NYSE:CLVT-A)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024