0001856525false00018565252023-12-052023-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

___________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2023

___________________________

Core & Main, Inc.

(Exact name of registrant as specified in its charter)

___________________________

| | | | | | | | |

| Delaware | 001-40650 | 86-3149194 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | |

| 1830 Craig Park Court | | |

St. Louis, Missouri | | 63146 |

| (Address of principal executive offices) | | (Zip Code) |

(314) 432-4700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

___________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Each Exchange

on Which Registered |

| Class A common stock, par value $0.01 per share | | CNM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Conditions

On December 5, 2023, Core & Main, Inc. (“Core & Main”) issued a press release announcing its results of operations for the fiscal third quarter ended October 29, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

On December 5, 2023, Core & Main posted to the “Investor Relations” section of its website the presentation that accompanied the earnings conference call. A copy of the investor presentation is attached hereto as Exhibit 99.2.

The information provided pursuant to this Item 2.02 and in Exhibit 99.1 and Exhibit 99.2 is being “furnished” herewith and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by Core & Main under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in any such filings.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document)* |

* Filed herewith.

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Core & Main, Inc. |

| | |

| By: | /s/ Stephen O. LeClair |

| Name: | Stephen O. LeClair |

| Title: | Chief Executive Officer |

Date: December 5, 2023

FOR IMMEDIATE RELEASE

Core & Main Announces Fiscal 2023 Third Quarter Results

ST. LOUIS, Dec. 5, 2023—Core & Main Inc. (NYSE: CNM), a leader in advancing reliable infrastructure with local service, nationwide, today announced financial results for the third quarter ended October 29, 2023.

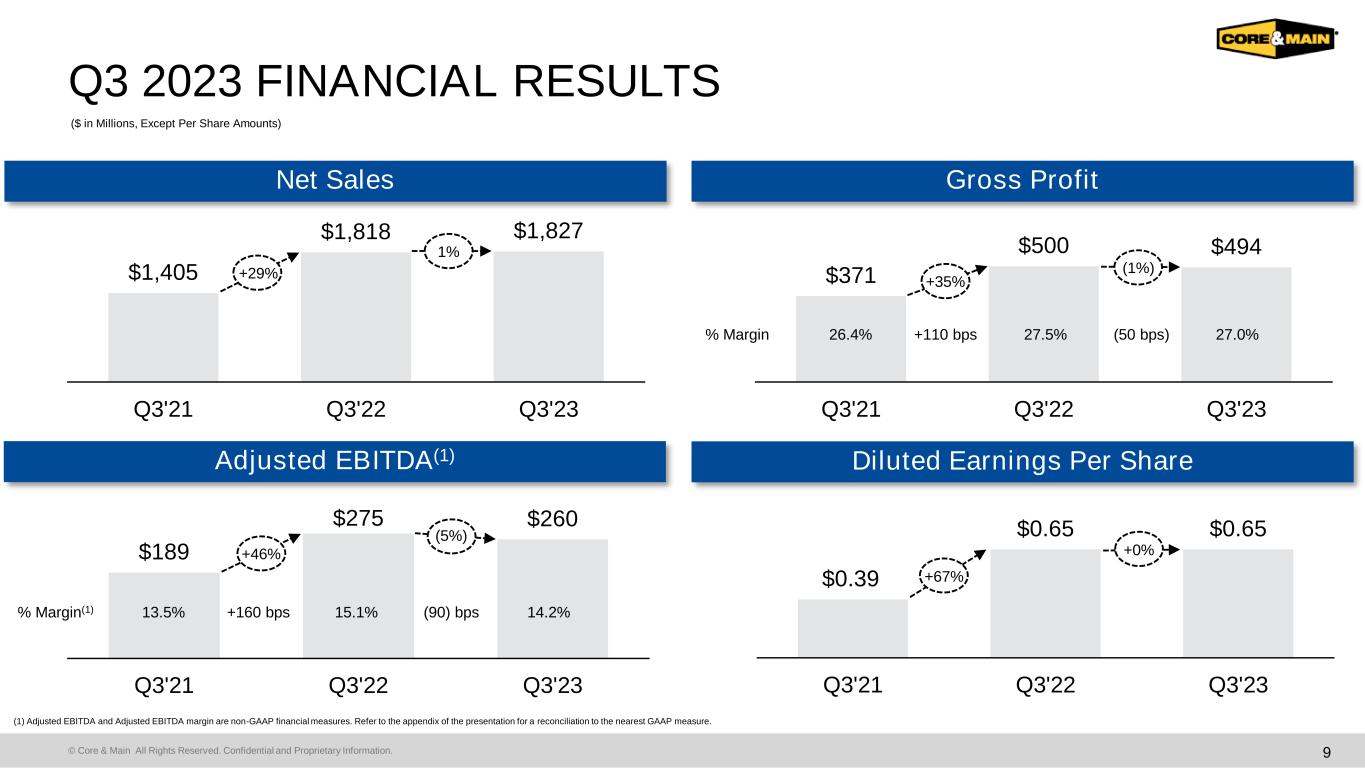

Fiscal 2023 Third Quarter Results (Compared with Fiscal 2022 Third Quarter)

•Net sales increased 0.5% to $1,827 million

•Gross profit margin decreased 50 basis points to 27.0%

•Net income decreased 11.2% to $158 million

•Adjusted EBITDA (Non-GAAP) decreased 5.5% to $260 million

•Adjusted EBITDA margin (Non-GAAP) decreased 90 basis points to 14.2%

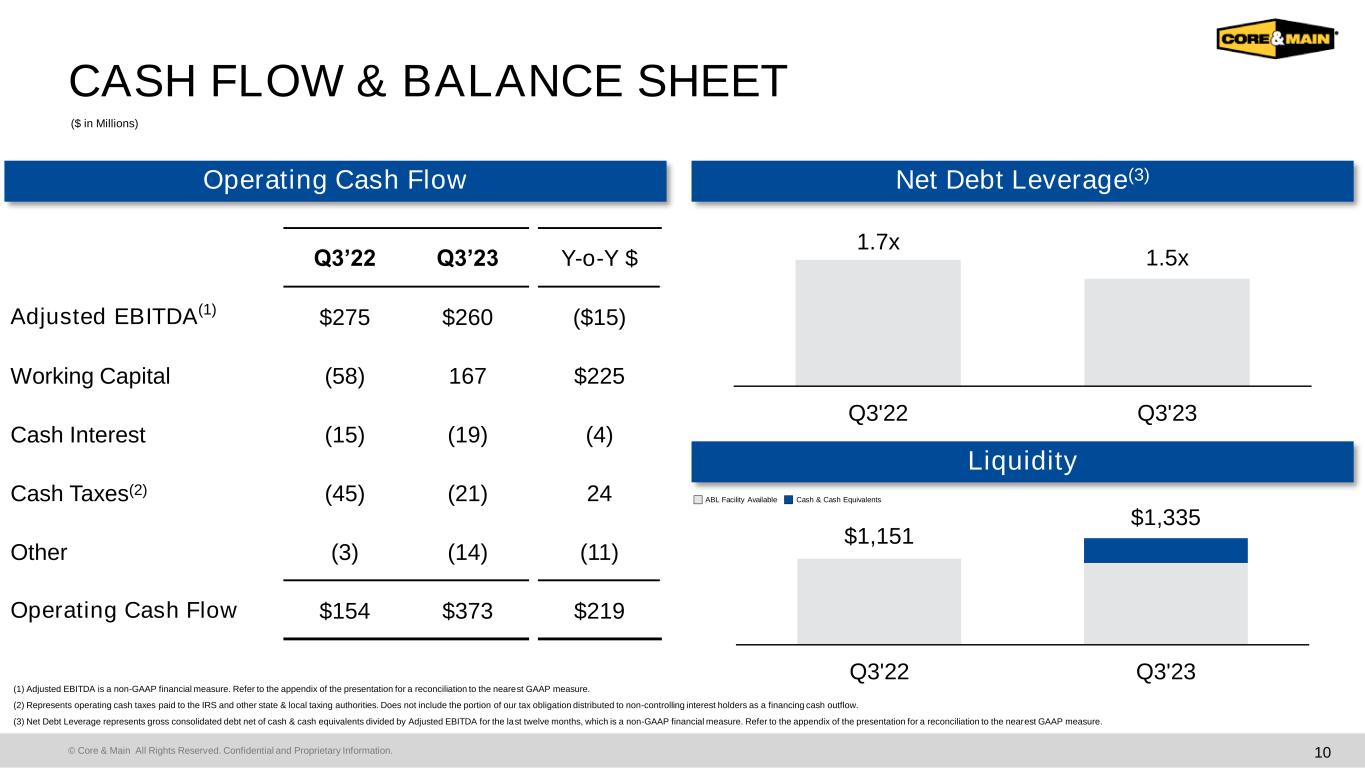

•Net cash provided by operating activities was $373 million compared with $154 million in the prior year

•Opened two new locations: one in Spokane, WA and one in Fontana, CA

•Executed one share repurchase transaction during the quarter and another after the quarter, deploying nearly $300 million of capital to retire 10 million shares

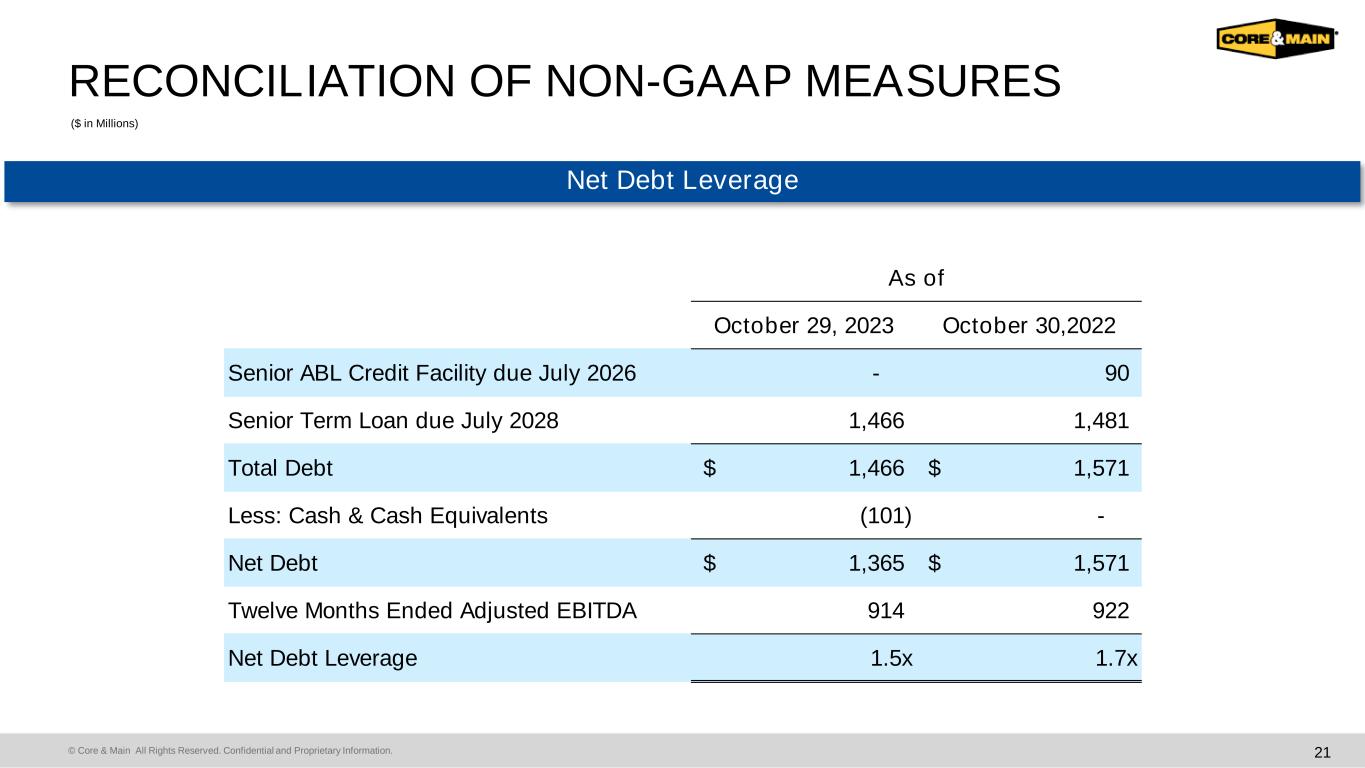

•Net Debt Leverage (Non-GAAP) was 1.5x despite investments in organic growth, acquisitions and share repurchases in fiscal 2023

•Raising expectation for fiscal 2023 Adjusted EBITDA to be in the range of $890 to $910 million

•Announced three acquisitions after the quarter: Enviroscape, Granite Water Works and Lee Supply Company

"We are pleased to have delivered another quarter of strong results," said Steve LeClair, chief executive officer of Core & Main.

"Demand from our customers remains resilient and we continue to execute on both our organic and inorganic growth initiatives. Gross margins were 50 basis points lower than last year as inventory costs continue to catch up with current market prices, but we are pleased to see gross margins sustain at higher levels as we work to drive our margin initiatives through our nationwide branch network."

"Cash generation remains a key strength of our business and we delivered an impressive $373 million of operating cash flow during the third quarter. This provided us the capacity to reinvest in organic and inorganic growth, while returning capital to shareholders. Along those lines, we executed one share repurchase transaction during the quarter and another after the quarter, deploying nearly $300 million of capital to retire 10 million shares. We have deployed $770 million of capital so far this year to repurchase and retire 30 million shares in total."

"Our team has never been more energized about the growth opportunities ahead, and we look forward to executing on the long-term targets we presented during our Investor Day in October. We have numerous levers to drive profitable growth and cash flow, and we have the right team and resources in place to do so. I want to thank our associates for their continued commitment to providing our customers with local knowledge, local experience and local service, nationwide."

Three Months Ended October 29, 2023

Net sales for the three months ended October 29, 2023 increased $9 million, or 0.5%, to $1,827 million compared with $1,818 million for the three months ended October 30, 2022. Net sales increased primarily due to acquisitions partially offset by comparably lower end-market volumes. Net sales declines for pipes, valves & fittings were due to lower end-market volume partially offset by acquisitions. Net sales growth for storm drainage products benefited from higher volume primarily related to acquisitions. Net sales for fire protection products declined due to lower selling prices and lower volume on steel pipe. Net sales of meter products benefited from acquisitions and higher volumes due to an increasing adoption of smart meter technology.

Gross profit for the three months ended October 29, 2023 decreased $6 million, or 1.2%, to $494 million compared with $500 million for the three months ended October 30, 2022. Gross profit as a percentage of net sales for the three months ended October 29, 2023 was 27.0% compared with 27.5% for the three months ended October 30, 2022. The overall decline in gross profit as a percentage of net sales was primarily attributable to larger prior year benefits from strategic inventory investments during an inflationary environment, partially offset by favorable impacts from the execution of our gross margin initiatives.

Selling, general and administrative (“SG&A”) expenses for the three months ended October 29, 2023 increased $9 million, or 3.9%, to $240 million compared with $231 million during the three months ended October 30, 2022. The increase was primarily attributable to an increase of $3 million in personnel expenses along with higher facility and other distribution costs related to inflation and acquisitions. SG&A expenses as a percentage of net sales were 13.1% for the three months ended October 29, 2023 compared with 12.7% for the three months ended October 30, 2022. The increase was attributable to inflationary cost impacts.

Net income for the three months ended October 29, 2023 decreased $20 million, or 11.2%, to $158 million compared with $178 million for the three months ended October 30, 2022. The decrease in net income was primarily attributable to a decrease in operating income.

The Class A common stock basic earnings per share for the three months ended October 29, 2023 and the three months ended October 30, 2022 was $0.65 in each period. The Class A common stock diluted earnings per share for the three months ended October 29, 2023 and the three months ended October 30, 2022 was $0.65 in each period. The basic earnings per share was flat due to an increase in net income attributable to Core & Main, Inc. offset by higher Class A share counts from exchanges of partnership interests of our subsidiary, Core & Main Holdings, L.P. The diluted earnings per share was flat due to lower share counts following the share repurchase transactions executed throughout fiscal 2023 and was offset by a decline in net income.

Adjusted EBITDA for the three months ended October 29, 2023 decreased $15 million, or 5.5%, to $260 million compared with $275 million for the three months ended October 30, 2022. The decrease in Adjusted EBITDA was primarily attributable to lower gross profit and higher SG&A expenses. Adjusted EBITDA margin decreased 90 basis points to 14.2% from 15.1% in the prior year period.

Nine Months Ended October 29, 2023

Net sales for the nine months ended October 29, 2023 decreased $15 million, or 0.3%, to $5,262 million compared with $5,277 million for the nine months ended October 30, 2022. The decrease in net sales was primarily attributable to a reduction in volume from comparably lower end-market volumes partially offset by higher selling prices and acquisitions. Net sales declines for pipes, valves & fittings were due to lower end-market volume partially offset by higher selling prices and acquisitions. Net sales growth for storm drainage products benefited from higher selling prices and acquisitions. Net sales for fire protection products declined due to lower selling prices and lower volume on steel pipe. Net sales of meter products benefited from higher selling prices, higher volumes due to an increasing adoption of smart meter technology by municipalities and acquisitions.

Gross profit for the nine months ended October 29, 2023 increased $12 million, or 0.8%, to $1,434 million compared with $1,422 million for the nine months ended October 30, 2022. Gross profit increased, despite a net sales decline, due to an increase in gross profit as a percentage of net sales. Gross profit as a percentage of net sales for the nine months ended October 29, 2023 was 27.3% compared with 26.9% for the nine months ended October 30, 2022. The overall increase in gross profit as a percentage of net sales was primarily attributable to execution of our gross margin initiatives partially offset by larger prior year benefits from strategic inventory investments during an inflationary environment.

SG&A expenses for the nine months ended October 29, 2023 increased $34 million, or 5.1%, to $701 million compared with $667 million during the nine months ended October 30, 2022. The increase was primarily attributable to an increase of $13 million in personnel expenses along with higher facility and other distribution costs related to inflation and acquisitions. SG&A expenses as a percentage of net sales were 13.3% for the nine months ended October 29, 2023 compared with 12.6% for the nine months ended October 30, 2022. The increase was primarily attributable to inflationary cost impacts.

Core & Main Announces Fiscal 2023 Third Quarter Results

Net income for the nine months ended October 29, 2023 decreased $42 million, or 8.5%, to $455 million compared with $497 million for the nine months ended October 30, 2022. The decrease in net income was primarily attributable to a decrease in operating income and higher interest expense.

The Class A common stock basic earnings per share for the nine months ended October 29, 2023 decreased 2.2% to $1.81 compared with $1.85 for the nine months ended October 30, 2022. The Class A common stock diluted earnings per share for the nine months ended October 29, 2023 decreased 1.1% to $1.80 compared with $1.82 for the nine months ended October 30, 2022. The decrease in basic earnings per share was attributable to a decline in net income attributable to Core & Main, Inc. and higher Class A share counts from exchanges of partnership interests of our subsidiary, Core & Main Holdings, L.P. Diluted earnings per share decreased due to a decline in net income partially offset by lower share counts following the share repurchase transactions executed throughout fiscal 2023.

Adjusted EBITDA for the nine months ended October 29, 2023 decreased $21 million, or 2.7%, to $750 million compared with $771 million for the nine months ended October 30, 2022. The decrease in Adjusted EBITDA was primarily attributable to higher SG&A expenses partially offset by higher gross profit. Adjusted EBITDA margin decreased 30 basis points to 14.3% from 14.6% in the prior year period.

Liquidity and Capital Resources

Net cash provided by operating activities for the three months ended October 29, 2023 was $373 million compared with $154 million for the three months ended October 30, 2022. The $219 million improvement in operating cash flow was primarily driven by a reduction in inventory due to more predictable product lead times in fiscal 2023 partially offset by an increase in interest payments.

Net debt, calculated as gross consolidated debt net of cash and cash equivalents, as of October 29, 2023 was $1,365 million. Net Debt Leverage (defined as the ratio of net debt to Adjusted EBITDA for the last 12 months) was 1.5x, an improvement of 0.2x from October 30, 2022. The improvement was attributable to lower borrowings under our Senior ABL Credit Facility and higher cash and cash equivalents.

As of October 29, 2023, we had no outstanding borrowings on our Senior ABL Credit Facility, which provides for borrowings of up to $1,250 million, subject to borrowing base availability. As of October 29, 2023, after giving effect to approximately $16 million of letters of credit issued under the Senior ABL Credit Facility, Core & Main LP would have been able to borrow approximately $1,234 million under the Senior ABL Credit Facility, subject to borrowing base availability. Our short-term debt obligations of $15 million are related to quarterly amortization principal payments on the Senior Term Loan Facility.

Fiscal 2023 Outlook

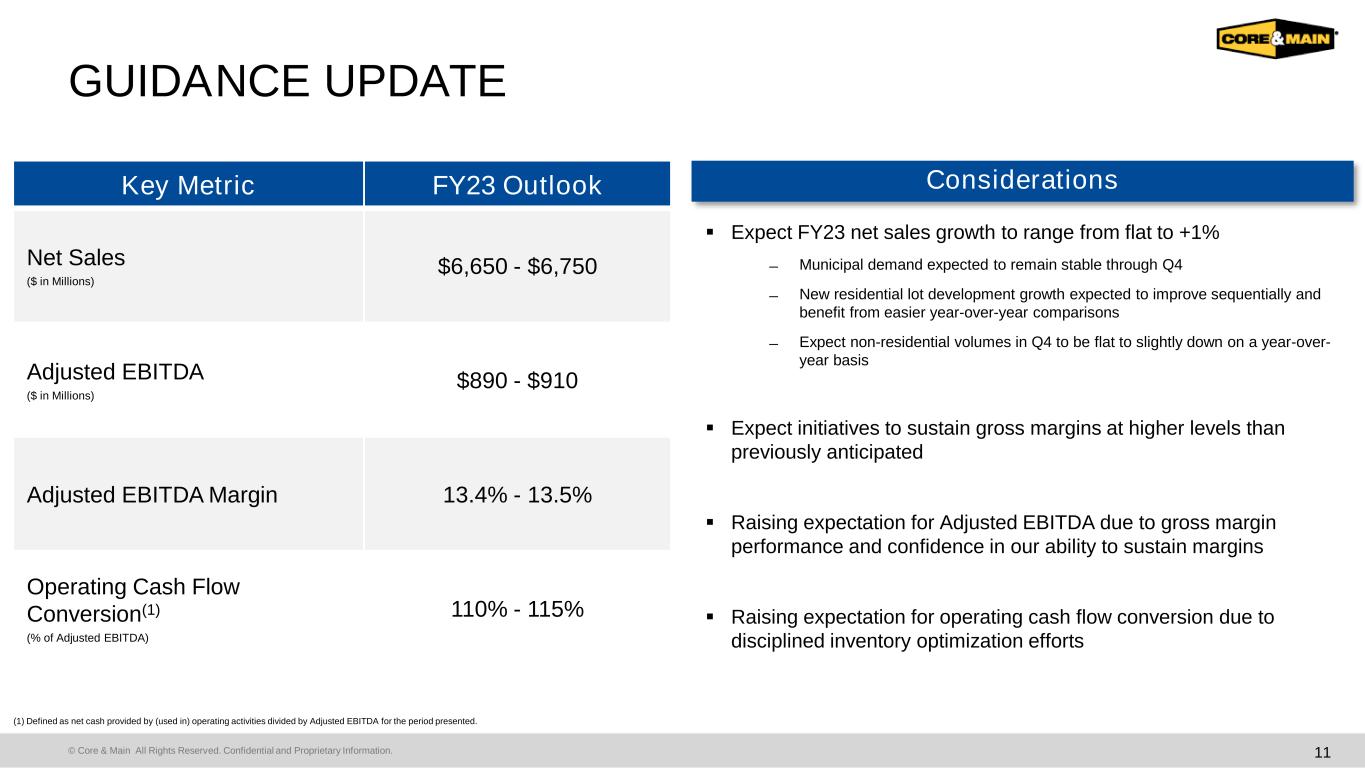

"Our sales results through the third quarter have largely played out as expected," LeClair continued. "As a result, we are narrowing our expectation for net sales to be in the range of $6.65 to $6.75 billion. We are raising our expectation for Adjusted EBITDA to be in the range of $890 to $910 million due to our strong margin performance in the third quarter, as well as confidence in our ability to better sustain margins through the end of the year. We are also raising our expectation for operating cash flow conversion to be in the range of 110% to 115% of Adjusted EBITDA as a result of our disciplined inventory optimization efforts. We expect to continue deploying capital on initiatives that will result in accelerated growth, including executing on our robust M&A pipeline and delivering on our organic growth initiatives. We also maintain significant liquidity and expect to continue driving shareholder value through share repurchases or dividends."

Conference Call & Webcast Information

Core & Main will host a conference call and webcast on December 5, 2023 at 8:30 a.m. ET to discuss the Company's financial results. The live webcast will be accessible via the events calendar at ir.coreandmain.com. The conference call may also be accessed by dialing (833) 470-1428 or +1 (404) 975-4839 (international). The passcode for the live call is 916295. To ensure participants are connected for the full call, please dial in at least 10 minutes prior to the start of the call.

An archived version of the webcast will be available immediately following the call. A slide presentation highlighting Core & Main’s results will also be made available on the Investor Relations section of Core & Main’s website prior to the call.

Core & Main Announces Fiscal 2023 Third Quarter Results

About Core & Main

Based in St. Louis, Core & Main is a leader in advancing reliable infrastructure™ with local service, nationwide®. As a leading specialized distributor with a focus on water, wastewater, storm drainage and fire protection products, and related services, Core & Main provides solutions to municipalities, private water companies and professional contractors across municipal, non-residential and residential end markets, nationwide. With approximately 320 locations across the U.S., the company provides its customers local expertise backed by a national supply chain. Core & Main’s 4,500 associates are committed to helping their communities thrive with safe and reliable infrastructure. Visit coreandmain.com to learn more.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this press release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Core & Main’s financial and operating outlook, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements.

Factors that could cause actual results and outcomes to differ from those reflected in forward-looking statements include, without limitation, declines, volatility and cyclicality in the U.S. residential and non-residential construction markets; slowdowns in municipal infrastructure spending and delays in appropriations of federal funds; our ability to competitively bid for municipal contracts; price fluctuations in our product costs; our ability to manage our inventory effectively, including during periods of supply chain disruptions; risks involved with acquisitions and other strategic transactions, including our ability to identify, acquire, close or integrate acquisition targets successfully; the fragmented and highly competitive markets in which we compete and consolidation within our industry; the development of alternatives to distributors of our products in the supply chain; our ability to hire, engage and retain key personnel, including sales representatives, qualified branch, district and region managers and senior management; our ability to identify, develop and maintain relationships with a sufficient number of qualified suppliers and the potential that our exclusive or restrictive supplier distribution rights are terminated; the availability and cost of freight; the ability of our customers to make payments on credit sales; changes in supplier rebates or other terms of our supplier agreements; our ability to identify and introduce new products and product lines effectively; the spread of, and response to, public health crises, and the inability to predict the ultimate impact on us; costs and potential liabilities or obligations imposed by environmental, health and safety laws and requirements; regulatory change and the costs of compliance with regulation; changes in stakeholder expectations in respect of ESG and sustainability practices; exposure to product liability, construction defect and warranty claims and other litigation and legal proceedings; potential harm to our reputation; difficulties with or interruptions of our fabrication services; safety and labor risks associated with the distribution of our products as well as work stoppages and other disruptions due to labor disputes; impairment in the carrying value of goodwill, intangible assets or other long-lived assets; interruptions in the proper functioning of our and our third-party service providers' information technology systems, including from cybersecurity threats; our ability to continue our customer relationships with short-term contracts; risks associated with exporting our products internationally; our ability to maintain effective internal controls over financial reporting and remediate any material weaknesses; our indebtedness and the potential that we may incur additional indebtedness; the limitations and restrictions in the agreements governing our indebtedness, the Second Amended and Restated Agreement of Limited Partnership of Core & Main Holdings, LP, as amended, and the Tax Receivable Agreements (each as defined in our Quarterly Report on Form 10-Q for the three months ended October 29, 2023); increases in interest rates and the impact of transitioning away from the London Interbank Offered Rate, generally to the Secured Overnight Financing Rate, as the benchmark rate in contracts; changes in our credit ratings and outlook; our ability to generate the significant amount of cash needed to service our indebtedness; our organizational structure, including our payment obligations under the Tax Receivable Agreements, which may be significant; our ability to sustain an active, liquid trading market for our Class A common stock; the significant influence that Clayton, Dubilier & Rice, LLC ("CD&R") has over us and potential conflicts between the interests of CD&R and other stockholders; and risks related to other factors discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 29, 2023 and Quarterly Report on Form 10-Q for the three months ended October 29, 2023.

Core & Main Announces Fiscal 2023 Third Quarter Results

Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise.

Contact:

Investor Relations:

Robyn Bradbury, 314-995-9116

InvestorRelations@CoreandMain.com

Core & Main Announces Fiscal 2023 Third Quarter Results

CORE & MAIN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Amounts in millions (except share and per share data), unaudited

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | October 29, 2023 | | October 30, 2022 | | October 29, 2023 | | October 30, 2022 |

| | | | | | | | |

| Net sales | | $ | 1,827 | | | $ | 1,818 | | | $ | 5,262 | | | $ | 5,277 | |

| Cost of sales | | 1,333 | | | 1,318 | | | 3,828 | | | 3,855 | |

| Gross profit | | 494 | | | 500 | | | 1,434 | | | 1,422 | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 240 | | | 231 | | | 701 | | | 667 | |

| Depreciation and amortization | | 37 | | | 35 | | | 109 | | | 104 | |

| Total operating expenses | | 277 | | | 266 | | | 810 | | | 771 | |

| Operating income | | 217 | | | 234 | | | 624 | | | 651 | |

| Interest expense | | 20 | | | 16 | | | 59 | | | 46 | |

| | | | | | | | |

| Income before provision for income taxes | | 197 | | | 218 | | | 565 | | | 605 | |

| Provision for income taxes | | 39 | | | 40 | | | 110 | | | 108 | |

| Net income | | 158 | | | 178 | | | 455 | | | 497 | |

| Less: net income attributable to non-controlling interests | | 46 | | | 67 | | | 147 | | | 185 | |

| Net income attributable to Core & Main, Inc. | | $ | 112 | | | $ | 111 | | | $ | 308 | | | $ | 312 | |

| | | | | | | | |

| Earnings per share | | | | | | | | |

| Basic | | $ | 0.65 | | | $ | 0.65 | | | $ | 1.81 | | | $ | 1.85 | |

| Diluted | | $ | 0.65 | | | $ | 0.65 | | | $ | 1.80 | | | $ | 1.82 | |

| Number of shares used in computing EPS | | | | | | | | |

| Basic | | 170,999,291 | | | 170,027,629 | | | 169,989,859 | | | 168,485,011 | |

| Diluted | | 224,686,413 | | | 246,262,224 | | | 232,485,740 | | | 246,198,822 | |

Core & Main Announces Fiscal 2023 Third Quarter Results

CORE & MAIN, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

Amounts in millions (except share and per share data), unaudited

| | | | | | | | | | | |

| October 29, 2023 | | January 29, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 101 | | | $ | 177 | |

| Receivables, net of allowance for credit losses of $13 and $9, respectively | 1,215 | | | 955 | |

| Inventories | 824 | | | 1,047 | |

| Prepaid expenses and other current assets | 31 | | | 32 | |

| Total current assets | 2,171 | | | 2,211 | |

| Property, plant and equipment, net | 142 | | | 105 | |

| Operating lease right-of-use assets | 184 | | | 175 | |

| Intangible assets, net | 782 | | | 795 | |

| Goodwill | 1,552 | | | 1,535 | |

| Deferred income taxes | 151 | | | — | |

| Other assets | 85 | | | 88 | |

| Total assets | $ | 5,067 | | | $ | 4,909 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 15 | | | $ | 15 | |

| Accounts payable | 646 | | | 479 | |

| Accrued compensation and benefits | 100 | | | 123 | |

| Current operating lease liabilities | 54 | | | 54 | |

| Other current liabilities | 106 | | | 55 | |

| Total current liabilities | 921 | | | 726 | |

| Long-term debt | 1,436 | | | 1,444 | |

| Non-current operating lease liabilities | 130 | | | 121 | |

| Deferred income taxes | 48 | | | 9 | |

| Payable to related parties pursuant to Tax Receivable Agreements | 299 | | | 180 | |

| Other liabilities | 18 | | | 19 | |

| Total liabilities | 2,852 | | | 2,499 | |

| Commitments and contingencies | | | |

| Class A common stock, par value $0.01 per share, 1,000,000,000 shares authorized, 173,340,005 and 172,765,161 shares issued and outstanding as of October 29, 2023 and January 29, 2023, respectively | 2 | | | 2 | |

| Class B common stock, par value $0.01 per share, 500,000,000 shares authorized, 47,889,727 and 73,229,675 shares issued and outstanding as of October 29, 2023 and January 29, 2023, respectively | — | | | 1 | |

| Additional paid-in capital | 1,227 | | | 1,241 | |

| Retained earnings | 491 | | | 458 | |

| Accumulated other comprehensive income | 49 | | | 45 | |

| Total stockholders’ equity attributable to Core & Main, Inc. | 1,769 | | | 1,747 | |

| Non-controlling interests | 446 | | | 663 | |

| Total stockholders’ equity | 2,215 | | | 2,410 | |

| Total liabilities and stockholders’ equity | $ | 5,067 | | | $ | 4,909 | |

Core & Main Announces Fiscal 2023 Third Quarter Results

CORE & MAIN, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Amounts in millions, unaudited

| | | | | | | | | | | |

| Nine Months Ended |

| October 29, 2023 | | October 30, 2022 |

| Cash Flows From Operating Activities: | | | |

| Net income | $ | 455 | | | $ | 497 | |

| Adjustments to reconcile net cash from operating activities: | | | |

| Depreciation and amortization | 114 | | | 110 | |

| | | |

| | | |

| Equity-based compensation expense | 8 | | | 9 | |

| | | |

| Other | 11 | | | (10) | |

| Changes in assets and liabilities: | | | |

| (Increase) decrease in receivables | (236) | | | (373) | |

| (Increase) decrease in inventories | 256 | | | (255) | |

| (Increase) decrease in other assets | 1 | | | (10) | |

| Increase (decrease) in accounts payable | 157 | | | 84 | |

| Increase (decrease) in accrued liabilities | 8 | | | 42 | |

| Increase (decrease) in other liabilities | 1 | | | — | |

| Net cash provided by operating activities | 775 | | | 94 | |

| Cash Flows From Investing Activities: | | | |

| Capital expenditures | (34) | | | (20) | |

| Acquisitions of businesses, net of cash acquired | (151) | | | (114) | |

| | | |

| Proceeds from the sale of property and equipment | 3 | | | 1 | |

| Net cash used in investing activities | (182) | | | (133) | |

| Cash Flows From Financing Activities: | | | |

| | | |

| | | |

| | | |

| Repurchase and retirement of partnership interests | (618) | | | — | |

| | | |

| Distributions to non-controlling interest holders | (33) | | | (39) | |

| Payments pursuant to Tax Receivable Agreements | (5) | | | — | |

| | | |

| | | |

| Borrowings on asset-based revolving credit facility | 235 | | | 244 | |

| Repayments on asset-based revolving credit facility | (235) | | | (154) | |

| | | |

| Repayments of long-term debt | (11) | | | (11) | |

| | | |

| | | |

| Debt issuance costs | — | | | (2) | |

| Other | (2) | | | — | |

| Net cash (used in) provided by financing activities | (669) | | | 38 | |

| Decrease in cash and cash equivalents | (76) | | | (1) | |

| Cash and cash equivalents at the beginning of the period | 177 | | | 1 | |

| Cash and cash equivalents at the end of the period | $ | 101 | | | $ | — | |

| | | |

| Cash paid for interest (excluding effects of interest rate swap) | $ | 89 | | | $ | 47 | |

| Cash paid for taxes | 82 | | | 107 | |

Core & Main Announces Fiscal 2023 Third Quarter Results

Non-GAAP Financial Measures

In addition to providing results that are determined in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"), we present EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage, all of which are non-GAAP financial measures. These measures are not considered measures of financial performance or liquidity under GAAP and the items excluded therefrom are significant components in understanding and assessing our financial performance or liquidity. These measures should not be considered in isolation or as alternatives to GAAP measures such as net income or net income attributable to Core & Main, Inc., as applicable, cash provided by or used in operating, investing or financing activities or other financial statement data presented in our financial statements as an indicator of our financial performance or liquidity.

We define EBITDA as net income or net income attributable to Core & Main, Inc., as applicable, adjusted for non-controlling interests, depreciation and amortization, provision for income taxes and interest expense. We define Adjusted EBITDA as EBITDA as further adjusted for certain items management believes are not reflective of the underlying operations of our business, including (a) loss on debt modification and extinguishment, (b) equity-based compensation, (c) expenses associated with the public offerings and (d) expenses associated with acquisition activities. Net income attributable to Core & Main, Inc. is the most directly comparable GAAP measure to EBITDA and Adjusted EBITDA. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net sales. We define Operating Cash Flow Conversion as net cash provided by (used in) operating activities divided by Adjusted EBITDA for the period presented. We define Net Debt Leverage as total consolidated debt (gross of unamortized discounts and debt issuance costs), net of cash and cash equivalents, divided by Adjusted EBITDA for the last twelve months.

We use EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage to assess the operating results and effectiveness and efficiency of our business. Adjusted EBITDA includes amounts otherwise attributable to non-controlling interests as we manage the consolidated company and evaluate operating performance in a similar manner. We present these non-GAAP financial measures because we believe that investors consider them to be important supplemental measures of performance, and we believe that these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Non-GAAP financial measures as reported by us may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. For example, EBITDA and Adjusted EBITDA:

•do not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on debt;

•do not reflect income tax expenses, the cash requirements to pay taxes or related distributions;

•do not reflect cash requirements to replace in the future any assets being depreciated and amortized; and

•exclude certain transactions or expenses as allowed by the various agreements governing our indebtedness.

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage are not alternative measures of financial performance or liquidity under GAAP and therefore should be considered in conjunction with net income, net income attributable to Core & Main, Inc. and other performance measures such as gross profit or net cash provided by or used in operating, investing or financing activities and not as alternatives to such GAAP measures. In evaluating Adjusted EBITDA, you should be aware that, in the future, we may incur expenses similar to those eliminated in this presentation.

No reconciliation of the estimated range for Adjusted EBITDA, Adjusted EBITDA margin or Operating Cash Flow Conversion for fiscal 2023 is included herein because we are unable to quantify certain amounts that would be required to be included in net income attributable to Core & Main, Inc. or cash provided by or used in operating activities, the most directly comparable GAAP measures, without unreasonable efforts due to the high variability and difficulty to predict certain items excluded from Adjusted EBITDA. Consequently, we believe such reconciliation would imply a degree of precision that would be misleading to investors. In particular, the effects of acquisition expenses cannot be reasonably predicted in light of the inherent difficulty in quantifying such items on a forward-looking basis. We expect the variability of these excluded items may have an unpredictable, and potentially significant, impact on our future GAAP financial results.

Core & Main Announces Fiscal 2023 Third Quarter Results

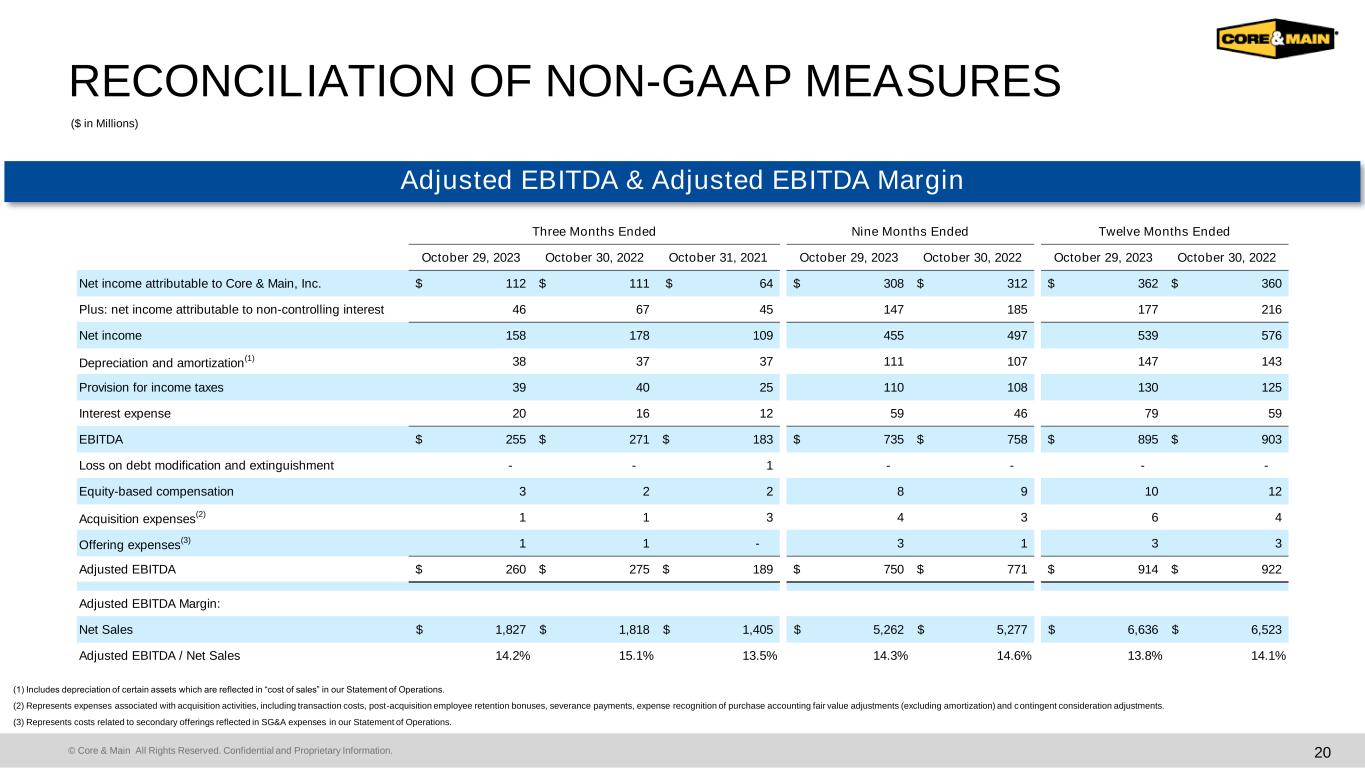

The following table sets forth a reconciliation of net income or net income attributable to Core & Main, Inc. to EBITDA and Adjusted EBITDA for the periods presented, as well as a calculation of Adjusted EBITDA margin for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in millions) | Three Months Ended | | Nine Months Ended |

| October 29, 2023 | | October 30, 2022 | | October 29, 2023 | | October 30, 2022 |

| Net income attributable to Core & Main, Inc. | $ | 112 | | | $ | 111 | | | $ | 308 | | | $ | 312 | |

| Plus: net income attributable to non-controlling interest | 46 | | | 67 | | | 147 | | | 185 | |

| Net income | 158 | | | 178 | | | 455 | | | 497 | |

Depreciation and amortization (1) | 38 | | | 37 | | | 111 | | | 107 | |

| Provision for income taxes | 39 | | | 40 | | | 110 | | | 108 | |

| Interest expense | 20 | | | 16 | | | 59 | | | 46 | |

| EBITDA | $ | 255 | | | $ | 271 | | | $ | 735 | | | $ | 758 | |

| Equity-based compensation | 3 | | | 2 | | | 8 | | | 9 | |

Acquisition expenses (2) | 1 | | | 1 | | | 4 | | | 3 | |

Offering expenses (3) | 1 | | | 1 | | | 3 | | | 1 | |

| Adjusted EBITDA | $ | 260 | | | $ | 275 | | | $ | 750 | | | $ | 771 | |

| | | | | | | |

Adjusted EBITDA Margin: | | | | | | | |

Net Sales | $ | 1,827 | | | $ | 1,818 | | | $ | 5,262 | | | $ | 5,277 | |

Adjusted EBITDA / Net Sales | 14.2% | | 15.1% | | 14.3% | | 14.6% |

| | | | | | | | | | | |

| (Amounts in millions) | Twelve Months Ended |

| October 29, 2023 | | October 30, 2022 |

| Net income attributable to Core & Main, Inc. | $ | 362 | | | $ | 360 | |

| Plus: net income attributable to non-controlling interest | 177 | | | 216 | |

| Net income | 539 | | | 576 | |

Depreciation and amortization (1) | 147 | | | 143 | |

| Provision for income taxes | 130 | | | 125 | |

| Interest expense | 79 | | | 59 | |

| EBITDA | $ | 895 | | | $ | 903 | |

| | | |

| Equity-based compensation | 10 | | | 12 | |

Acquisition expenses (2) | 6 | | | 4 | |

Offering expenses (3) | 3 | | | 3 | |

| Adjusted EBITDA | $ | 914 | | | $ | 922 | |

(1)Includes depreciation of certain assets which is reflected in “cost of sales” in our Statement of Operations.

(2)Represents expenses associated with acquisition activities, including transaction costs, post-acquisition employee retention bonuses, severance payments, expense recognition of purchase accounting fair value adjustments (excluding amortization) and contingent consideration adjustments.

(3)Represents costs related to secondary offerings reflected in SG&A expenses in our Statement of Operations.

Core & Main Announces Fiscal 2023 Third Quarter Results

The following table sets forth a calculation of Net Debt Leverage for the periods presented:

| | | | | | | | | | | | | | |

| (Amounts in millions) | | As of |

| | October 29, 2023 | | October 30, 2022 |

Senior ABL Credit Facility due July 2026 | | $ | — | | | $ | 90 | |

Senior Term Loan due July 2028 | | 1,466 | | | 1,481 | |

Total Debt | | 1,466 | | | 1,571 | |

Less: Cash & Cash Equivalents | | (101) | | | — | |

Net Debt | | $ | 1,365 | | | $ | 1,571 | |

Twelve Months Ended Adjusted EBITDA | | 914 | | | 922 | |

Net Debt Leverage | | 1.5x | | 1.7x |

Core & Main Announces Fiscal 2023 Third Quarter Results

Fiscal 2023 Third Quarter Results DECEMBER 5, 2023

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 2 CAUTIONARY STATEMENTS Cautionary Note Regarding Forward-Looking Statements This presentation and accompanying discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, all statements other than statements of historical or current facts relating to our intentions, beliefs, assumptions or current expectations concerning, among other things, our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected growth, future capital expenditures, capital allocation and debt service obligations, and the anticipated impact on our business. Som e of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words o r other comparable terms. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be outside our control. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition, cash flows and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 29, 2023 and our Quarterly Report on Form 10-Q for the three months ended October 29, 2023, could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Furthermore, new risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. Factors that could cause actual results and outcomes to differ from those reflected in forward-looking statements include, without limitation: declines, volatility and cyclicality in the U.S. residential and non-residential construction markets; slowdowns in municipal infrastructure spending and delays in appropriations of federal funds; our ability to competitively bid for municipal contracts; price fluctuations in our product costs; our ability to manage our inventory effectively, including during periods of supply chain disruptions; our ability to continue our customer relationships with short-term contracts; risks involved with acquisitions and other strategic transactions, including our ability to identify, acquire, close or integrate acquisition targets successfully; the fragmented and highly competitive markets in which we compete and consolidation within our industry; the development of alternatives to distributors of our products in the supply chain; our ability to hire, engage and retain key personnel, including sales representatives, qualified branch, district and regional managers and senior management; our ability to identify, develop and maintain relationships with a sufficient number of qualified suppliers and the potential that our exclusive or restrictive supplier distribution rights are terminated; the availability and cost of freight; the ability of our customers to make payments on credit sales; changes in supplier rebates or other terms of our supplier agreements; our ability to identify and introduce new products and product lines effectively; the spread of, and response to public health crises and the inability to predict the ultimate impact on us; costs and potential liabilities or obligations imposed by environmental, health and safety laws and requirements; regulatory change and the costs of compliance with regulation; changes in stakeholder expectations in respect of environmental, social and governance and sustainability practices; exposure to product liability, construction defect and warranty claims and other litigation and legal proceedings; potential harm to our reputation; difficulties with or interruptions of our fabrication services; safety and labor risks associated with the distribution of our products as well as work stoppages and other disruptions due to labor disputes; impairment in the carrying value of goodwill, intangible assets or other long-lived assets; interruptions in the proper functioning of our and our third-party service providers’ information technology systems, including from cybersecurity threats; risks associated with exporting our products internationally; our ability to m aintain effective internal controls over financial reporting and remediate any material weaknesses; our indebtedness and the potential that we may incur additional indebtedness; the limitations and restrictions in the agreements governing our indebtedness, the Second Amended and Restated Agreement of Limited Partnership of Core & Main Holdings, LP as amended, and the Tax Receivable Agreements (as defined in our Quarterly Report on Form 10-Q); increases in interest rates and the impact of transitioning away from LIBOR, generally to Term SOFR (as defined in our Quarterly Report on Form 10-Q), as a benchmark rate in contracts; changes in our credit ratings and outlook; our ability to generate the significant amount of cash needed to service our indebtedness; our organizational structure, including our payment obligations under the Tax Receivable Agreements, which may be significant; our ability to sustain an active, liquid trading market for our Class A common stock; the significant influence that CD&R (as defined in our Quarterly Report on Form 10-Q) has over us and potential conflicts between the interests of CD&R and other stockholders; and risks related to other factors described under “Risk Factors” in our Annual Report on Form 10-K and our Quarterly Report on Form 10-Q for the three months ended October 29, 2023. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact our business. Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, which speak only as of the date of this presentation. Use of Non-GAAP Financial Measures In addition to providing results that are determined in accordance with U.S. Generally Accepted Accounting Principles (“GAAP” ), we present EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage, all of which are non-GAAP financial measures. These measures are not considered measures of financial performance or liquidity under GAAP and the items excluded therefrom are significant components in understanding and assessing our financial performance or liquidity. These measures should not be considered in isolation or as alternatives to GAAP measures such as net income or net income attributable to Core & Main, Inc., as applicable, cash provided by or used in operating, investing or financing activities, or other financial statement data presented in the financial statements as an indicator of our financial performance or liquidity. We use EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Operating Cash Flow Conversion and Net Debt Leverage to assess the operating results and effectiveness and efficiency of our business. We present these non-GAAP financial measures because we believe investors consider them to be important supplemental measures of performance, and we believe that these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Non-GAAP financial measures as reported by us may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Reconciliations of such non- GAAP measures to the most directly comparable GAAP measure and calculations of the non-GAAP measures are set forth in the appendix of this presentation. No reconciliation of the estimated range for Adjusted EBITDA, Adjusted EBITDA margin or Operating Cash Flow Conversion for fiscal 2023 are included herein because we are unable to quantify certain amounts that would be required to be included in net income attributable to Core & Main, Inc. or cash provided by or used in operating activities, the most directly comparable GAAP measures, without unreasonable efforts due to the high variability and difficulty to predict certain items excluded from Adjusted EBITDA. Consequently, we believe such reconciliation would imply a degree of precision that would be misleading to investors. In particular, the effects of acquisition expenses cannot be reasonably predicted in light of the inherent difficulty in quantifying such items on a forward-looking basis. We expect the variability of these excluded items may have an unpredictable, and potentially significant, impact on our future GAAP results. Presentation of Financial Information The accompanying financial information presents the results of operations, financial position and cash flows of Core & Main, Inc. (“Core & Main” or the “Company”) and its subsidiaries, which includes the consolidated financial information of Core & Main Holdings, LP, a Delaware limited partnership (“Holdings”) and its consolidated subsidiary, Core & Main LP, as the legal entity that conducts the operations of the Company. Core & Main is the primary beneficiary and general partner of Holdings and has decision making authority that significantly af fects the economic performance of the entity. As a result, Core & Main consolidates the consolidated financial statements of Holdings. All intercompany balances and transactions have been eliminated in consolidation. The Company records non-controlling interests related to Partnership Interests (as defined in our Quarterly Report on Form 10-Q) held by the Continuing Limited Partners (as defined in our Quarterly Report on Form 10-Q) in Holdings. The Company’s fiscal year is a 52 or 53-week period ending on the Sunday nearest to January 31st. Quarters within the fiscal year include 13-week periods, unless a fiscal year includes a 53rd week, in which case the fourth quarter of the fiscal year will be a 14-week period. Each of the three months ended October 29, 2023 and three months ended October 30, 2022 included 13 weeks and each of the nine months ended October 29, 2023 and nine months ended October 30, 2022 included 39 weeks.

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 3 TODAY’S PRESENTERS Steve LeClair Chief Executive Officer Mark Witkowski Chief Financial Officer Robyn Bradbury VP, Finance & Investor Relations

Business Update STEVE LECLAIR

© Core & Main All Rights Reserved. Confidential and Proprietary Information. ▪ Municipal repair & replacement activity remains stable ▪ New residential lot development continues to improve ▪ Non-residential demand supported by diverse project exposure ▪ Medium to long-term market fundamentals remain positive 5 BUSINESS UPDATE End Markets Pricing Margins Cash Flow & Capital Allocation ▪ Roughly flat price contribution to net sales growth in Q3 ▪ Expect low single-digit price contribution for fiscal 2023 ▪ Non-discretionary nature of demand provides a resilient pricing framework ▪ Gross margins continue to normalize at a slower pace than previously anticipated ▪ Margin initiatives and M&A synergies continue to drive structural margin improvement ▪ Exceptional operating cash flow performance in Q3 supporting capital allocation priorities ▪ Executed one share repurchase transaction during the quarter and another after the quarter, deploying nearly $300M of capital ▪ Repurchased and retired 30 million shares year-to-date for $770M ▪ Ample capacity to continue executing organic and inorganic growth strategies, while returning capital to shareholders

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 6 DRIVING SUSTAINABLE GROWTH THROUGH M&A Status Closed November 2023 Signed November 2023 Signed November 2023 # of Locations 1 1 4 Geography Ohio Minnesota Pennsylvania, South Carolina & West Virginia Product Lines Geosynthetics & Erosion Control Pipes, Valves & Fittings Storm Drainage Pipes, Valves & Fittings Fusible HDPE Solutions Combined Annualized Net Sales of ~$135M Enviroscape Granite Water Works Lee Supply Company

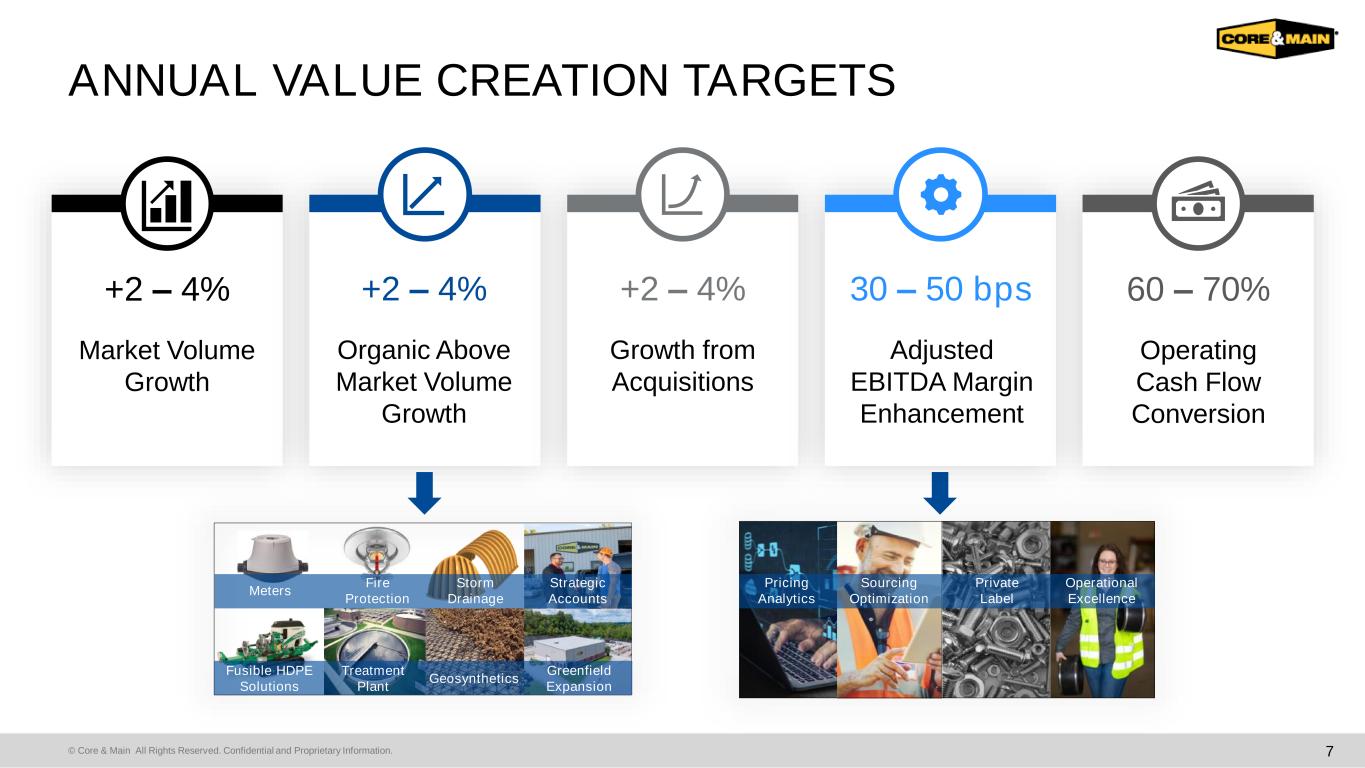

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 7 60 – 70% Operating Cash Flow Conversion 30 – 50 bps Adjusted EBITDA Margin Enhancement +2 – 4% Growth from Acquisitions +2 – 4% Organic Above Market Volume Growth +2 – 4% Market Volume Growth Meters Fire Protection Storm Drainage Strategic Accounts Fusible HDPE Solutions Treatment Plant Geosynthetics Greenfield Expansion Pricing Analytics Sourcing Optimization Private Label Operational Excellence ANNUAL VALUE CREATION TARGETS

Financial Results MARK WITKOWSKI

© Core & Main All Rights Reserved. Confidential and Proprietary Information. $0.39 $0.65 $0.65 Q3'21 Q3'22 Q3'23 9 Q3 2023 FINANCIAL RESULTS Net Sales Gross Profit Adjusted EBITDA(1) Diluted Earnings Per Share ($ in Millions, Except Per Share Amounts) (1) Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. $1,405 $1,818 $1,827 Q3'21 Q3'22 Q3'23 $371 $500 $494 Q3'21 Q3'22 Q3'23 $189 $275 $260 Q3'21 Q3'22 Q3'23 +29% 1% 26.4% 27.5%+110 bps 27.0%(50 bps)% Margin % Margin(1) 13.5% 15.1%+160 bps 14.2%(90) bps (5%) +46% (1%) +35% +67% +0%

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 10 CASH FLOW & BALANCE SHEET Operating Cash Flow Net Debt Leverage(3) Liquidity ($ in Millions) ABL Facility Available Cash & Cash Equivalents (1) Adjusted EBITDA is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. (2) Represents operating cash taxes paid to the IRS and other state & local taxing authorities. Does not include the portion of our tax obligation distributed to non-controlling interest holders as a financing cash outflow. (3) Net Debt Leverage represents gross consolidated debt net of cash & cash equivalents divided by Adjusted EBITDA for the last twelve months, which is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. Q3’22 Q3’23 Y-o-Y $ Adjusted EBITDA(1) $275 $260 ($15) Working Capital (58) 167 $225 Cash Interest (15) (19) (4) Cash Taxes(2) (45) (21) 24 Other (3) (14) (11) Operating Cash Flow $154 $373 $219 1.7x 1.5x Q3'22 Q3'23 $1,151 $1,335 Q3'22 Q3'23

© Core & Main All Rights Reserved. Confidential and Proprietary Information. GUIDANCE UPDATE 11 Key Metric FY23 Outlook Net Sales ($ in Millions) $6,650 - $6,750 Adjusted EBITDA ($ in Millions) $890 - $910 Adjusted EBITDA Margin 13.4% - 13.5% Operating Cash Flow Conversion(1) (% of Adjusted EBITDA) 110% - 115% ▪ Expect FY23 net sales growth to range from flat to +1% ̶ Municipal demand expected to remain stable through Q4 ̶ New residential lot development growth expected to improve sequentially and benefit from easier year-over-year comparisons ̶ Expect non-residential volumes in Q4 to be flat to slightly down on a year-over- year basis ▪ Expect initiatives to sustain gross margins at higher levels than previously anticipated ▪ Raising expectation for Adjusted EBITDA due to gross margin performance and confidence in our ability to sustain margins ▪ Raising expectation for operating cash flow conversion due to disciplined inventory optimization efforts Considerations (1) Defined as net cash provided by (used in) operating activities divided by Adjusted EBITDA for the period presented.

Appendix

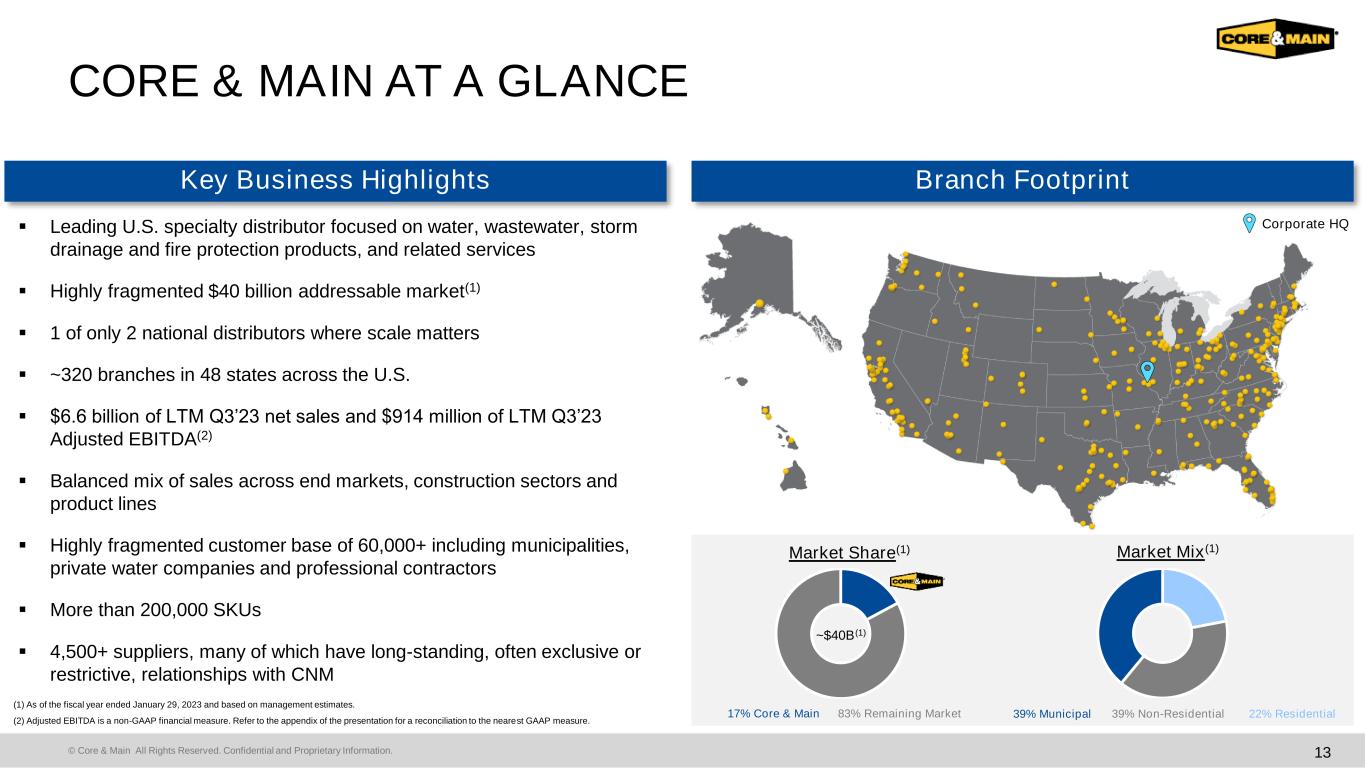

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 13 CORE & MAIN AT A GLANCE Key Business Highlights Branch Footprint Corporate HQ (1) As of the fiscal year ended January 29, 2023 and based on management estimates. (2) Adjusted EBITDA is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. ▪ Leading U.S. specialty distributor focused on water, wastewater, storm drainage and fire protection products, and related services ▪ Highly fragmented $40 billion addressable market(1) ▪ 1 of only 2 national distributors where scale matters ▪ ~320 branches in 48 states across the U.S. ▪ $6.6 billion of LTM Q3’23 net sales and $914 million of LTM Q3’23 Adjusted EBITDA(2) ▪ Balanced mix of sales across end markets, construction sectors and product lines ▪ Highly fragmented customer base of 60,000+ including municipalities, private water companies and professional contractors ▪ More than 200,000 SKUs ▪ 4,500+ suppliers, many of which have long-standing, often exclusive or restrictive, relationships with CNM Market Share(1) Market Mix(1) ~$40B(1) 17% Core & Main 83% Remaining Market 39% Non-Residential39% Municipal 22% Residential

© Core & Main All Rights Reserved. Confidential and Proprietary Information. PRODUCT & SERVICE OFFERING 14

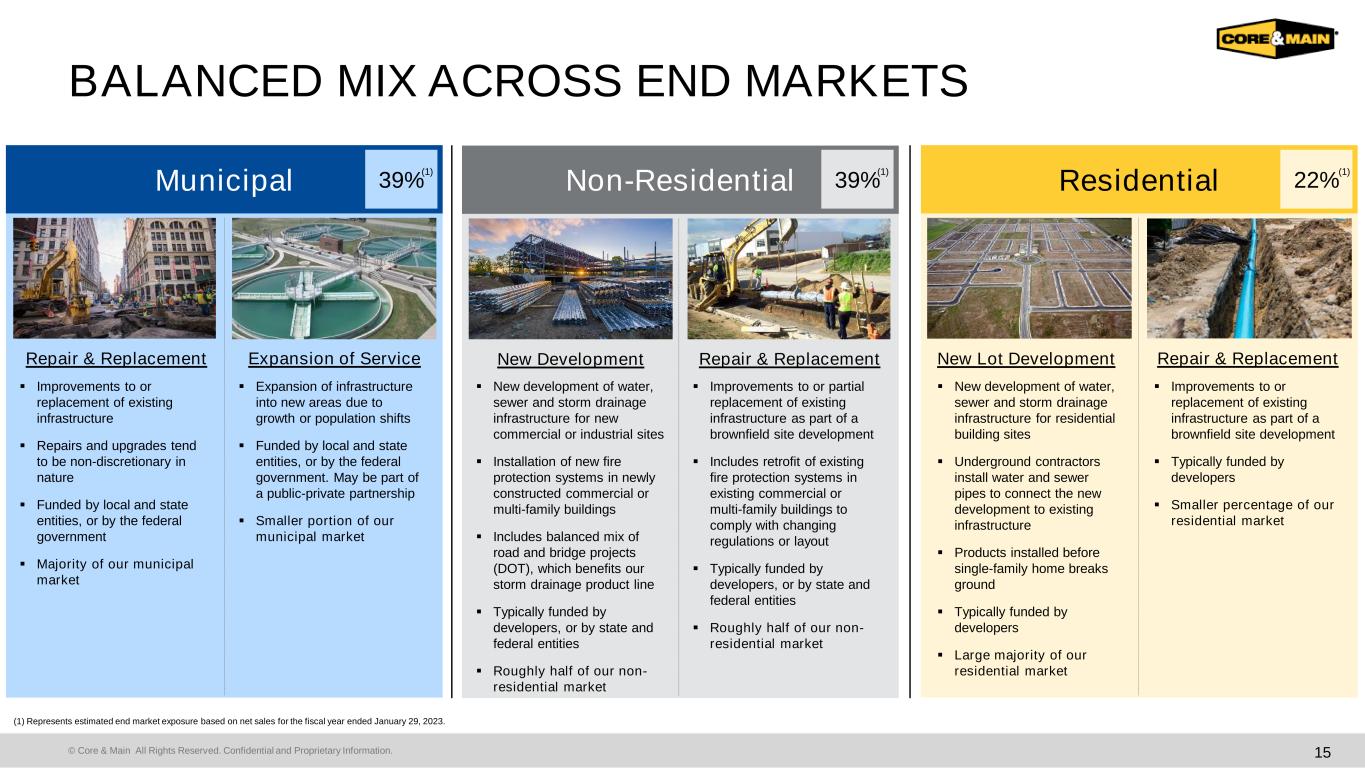

© Core & Main All Rights Reserved. Confidential and Proprietary Information. BALANCED MIX ACROSS END MARKETS 15 ResidentialNon-ResidentialMunicipal New Lot Development Repair & ReplacementNew Development Repair & ReplacementRepair & Replacement Expansion of Service ▪ New development of water, sewer and storm drainage infrastructure for residential building sites ▪ Underground contractors install water and sewer pipes to connect the new development to existing infrastructure ▪ Products installed before single-family home breaks ground ▪ Typically funded by developers ▪ Large majority of our residential market ▪ Improvements to or replacement of existing infrastructure as part of a brownfield site development ▪ Typically funded by developers ▪ Smaller percentage of our residential market ▪ New development of water, sewer and storm drainage infrastructure for new commercial or industrial sites ▪ Installation of new fire protection systems in newly constructed commercial or multi-family buildings ▪ Includes balanced mix of road and bridge projects (DOT), which benefits our storm drainage product line ▪ Typically funded by developers, or by state and federal entities ▪ Roughly half of our non- residential market ▪ Improvements to or partial replacement of existing infrastructure as part of a brownfield site development ▪ Includes retrofit of existing fire protection systems in existing commercial or multi-family buildings to comply with changing regulations or layout ▪ Typically funded by developers, or by state and federal entities ▪ Roughly half of our non- residential market ▪ Improvements to or replacement of existing infrastructure ▪ Repairs and upgrades tend to be non-discretionary in nature ▪ Funded by local and state entities, or by the federal government ▪ Majority of our municipal market ▪ Expansion of infrastructure into new areas due to growth or population shifts ▪ Funded by local and state entities, or by the federal government. May be part of a public-private partnership ▪ Smaller portion of our municipal market 39% 39% 22% (1) Represents estimated end market exposure based on net sales for the fiscal year ended January 29, 2023. (1) (1) (1)

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 16 WELL-POSITIONED TO WIN WITHIN COMPLEX INDUSTRY Differentiated Industry Highly Complex Specification & Regulation Specialized Product Requirements Limited Distribution Rights Fragmented Industry ▪ Local regulation and specification needs; strong participation in governing / regulating bodies ▪ Pre-project specification influence ▪ Local, regional & national product specialists required to support complex project needs ▪ Suppliers require local knowledge & experience to secure limited distribution rights ▪ Highly diversified supplier base & fragmented customer base creates need for scaled distribution Branch Network & Logistics ▪ Coordinated jobsite delivery & customer support ▪ Differentiated delivery capabilities Our Competitive Advantages Deep knowledge of products and local specifications, supported by consultative sales approach and delivery expertise Industry Expertise 320 branches across 48 states Partnering with 4,500+ suppliers to reach 60,000+ diverse customers Size & Unique Scalability Strong, long-standing customer & supplier relationships with access to 200K+ products with limited distribution rights Deep Customer & Supplier Relationships “One-stop-shop” for customer solutions, enabled by project value engineering and jobsite support Differentiated Services & Deep Product Portfolio Proprietary technology platforms drive operational efficiency and enhance customer experience Technology & Innovation Specific to our Industry Best Industry Talent People-first approach is critical to developing industry leaders and enabling local expertise, nationwide

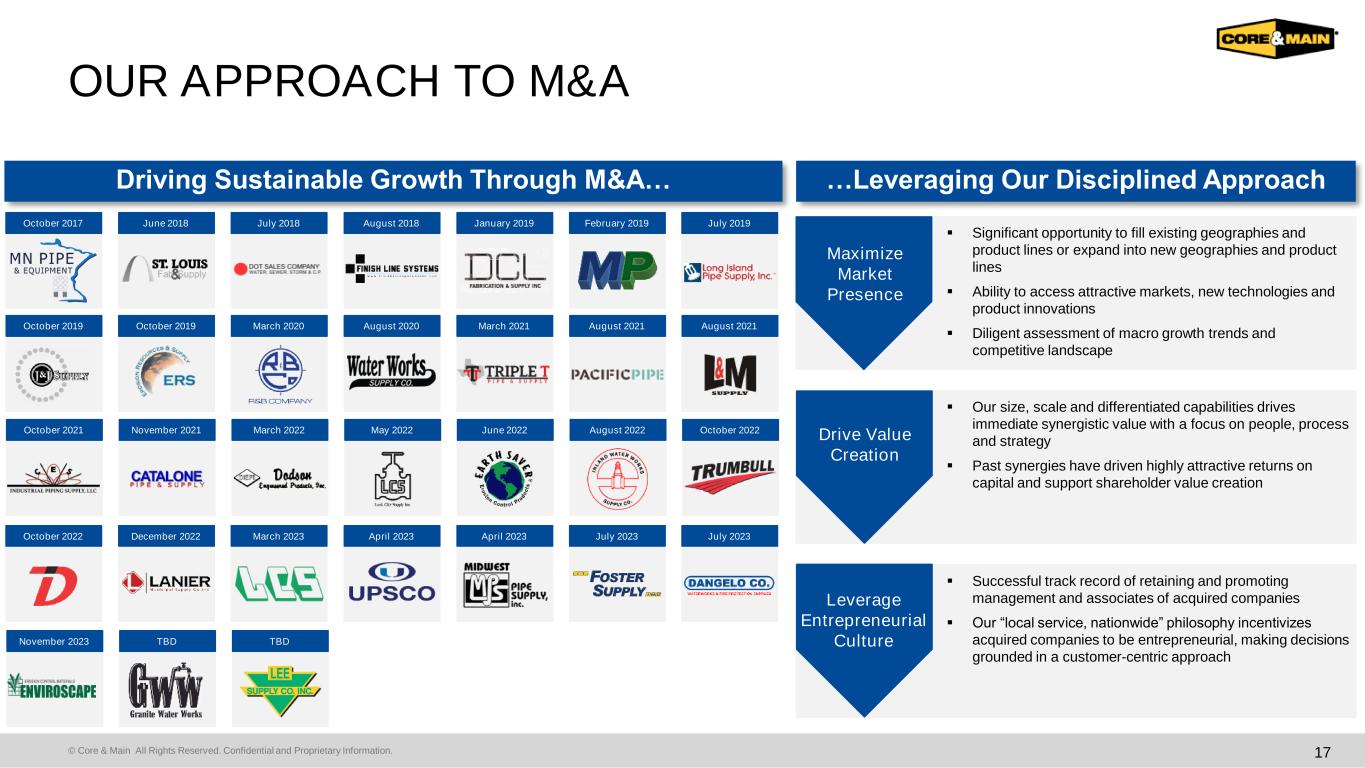

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 17 OUR APPROACH TO M&A October 2017 June 2018 July 2018 August 2018 January 2019 February 2019 October 2019 October 2019 March 2020 August 2020 March 2021 August 2021 October 2021 November 2021 March 2022 May 2022 June 2022 August 2022 October 2022 December 2022 March 2023 April 2023 April 2023 July 2023 November 2023 TBD TBD Driving Sustainable Growth Through M&A… July 2019 August 2021 October 2022 July 2023 …Leveraging Our Disciplined Approach Maximize Market Presence Drive Value Creation Leverage Entrepreneurial Culture ▪ Significant opportunity to fill existing geographies and product lines or expand into new geographies and product lines ▪ Ability to access attractive markets, new technologies and product innovations ▪ Diligent assessment of macro growth trends and competitive landscape ▪ Our size, scale and differentiated capabilities drives immediate synergistic value with a focus on people, process and strategy ▪ Past synergies have driven highly attractive returns on capital and support shareholder value creation ▪ Successful track record of retaining and promoting management and associates of acquired companies ▪ Our “local service, nationwide” philosophy incentivizes acquired companies to be entrepreneurial, making decisions grounded in a customer-centric approach

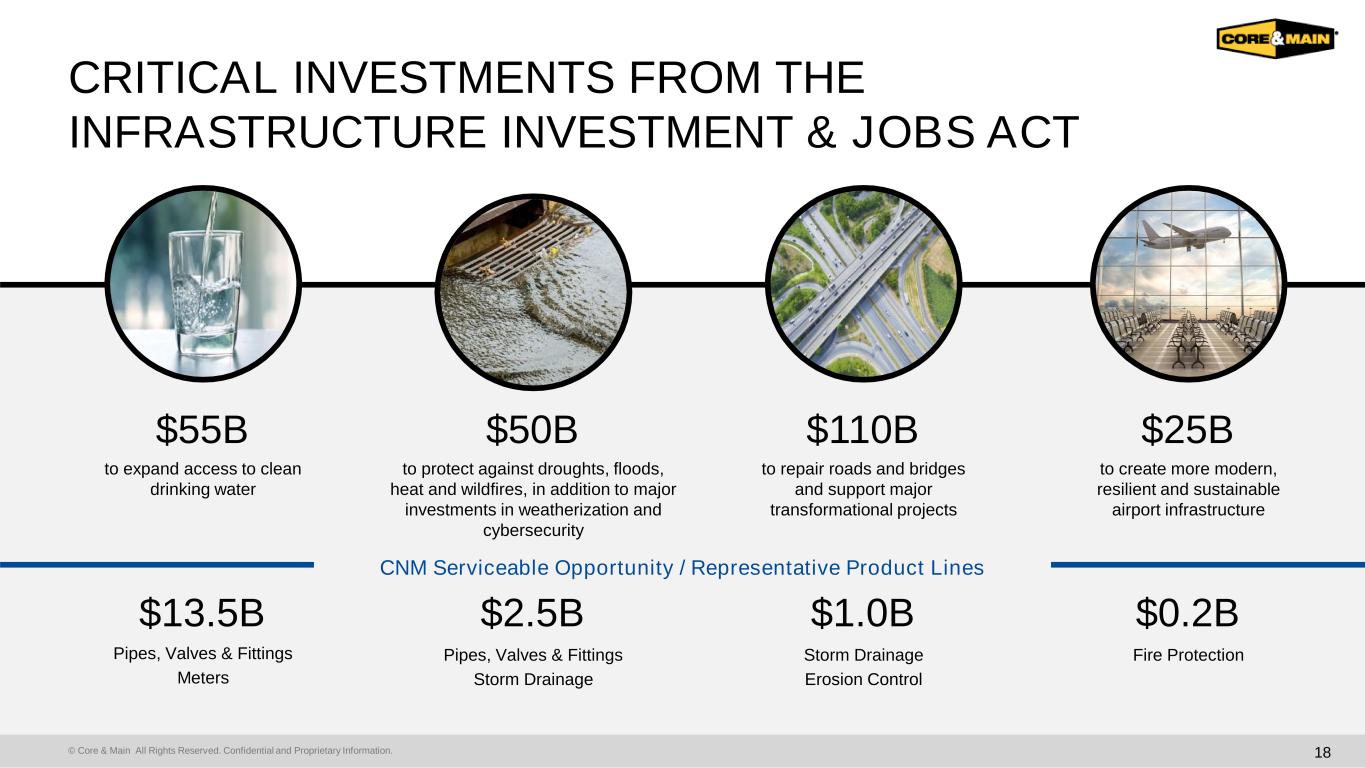

© Core & Main All Rights Reserved. Confidential and Proprietary Information. Pipes, Valves & Fittings Meters $55B to expand access to clean drinking water $13.5B $50B to protect against droughts, floods, heat and wildfires, in addition to major investments in weatherization and cybersecurity $2.5B Pipes, Valves & Fittings Storm Drainage $110B to repair roads and bridges and support major transformational projects $1.0B Storm Drainage Erosion Control $25B to create more modern, resilient and sustainable airport infrastructure $0.2B Fire Protection CNM Serviceable Opportunity / Representative Product Lines 18 CRITICAL INVESTMENTS FROM THE INFRASTRUCTURE INVESTMENT & JOBS ACT

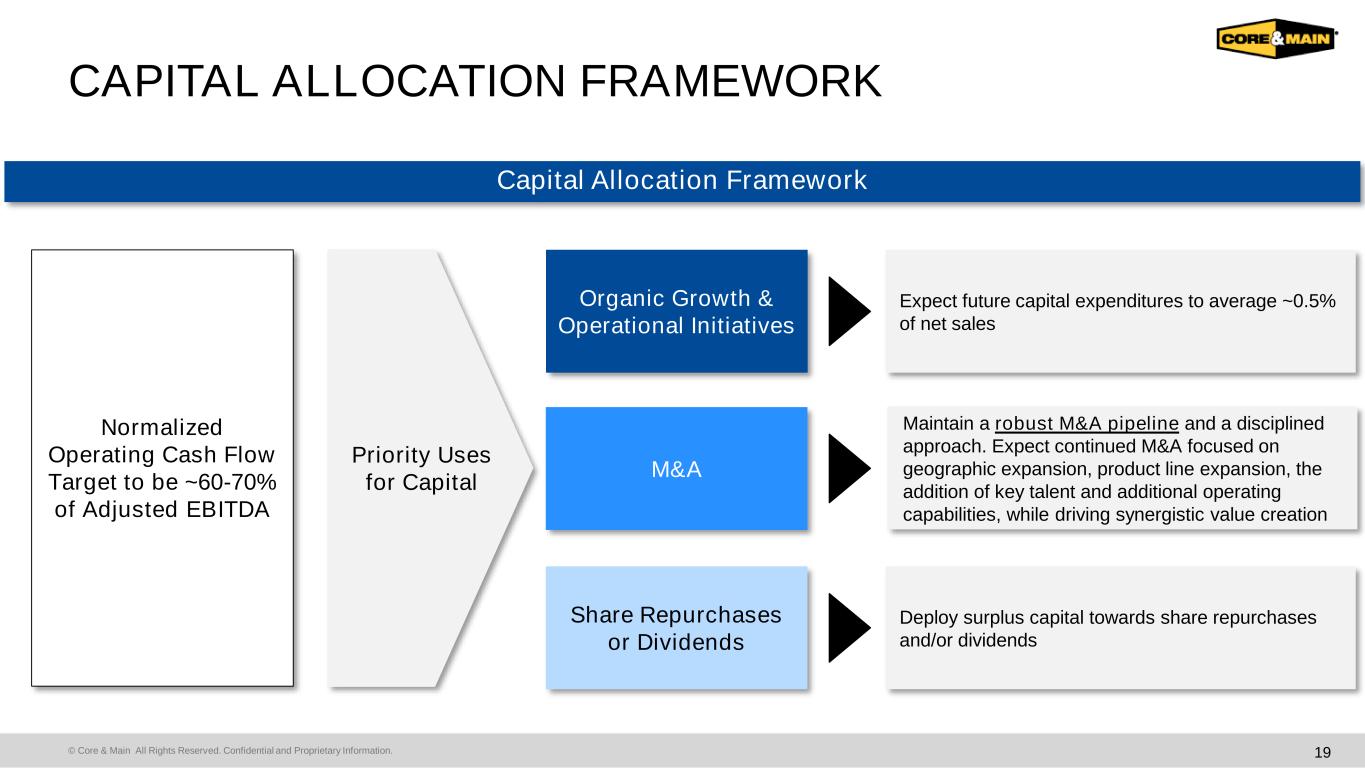

© Core & Main All Rights Reserved. Confidential and Proprietary Information. CAPITAL ALLOCATION FRAMEWORK 19 Priority Uses for Capital Normalized Operating Cash Flow Target to be ~60-70% of Adjusted EBITDA Organic Growth & Operational Initiatives M&A Share Repurchases or Dividends Expect future capital expenditures to average ~0.5% of net sales Maintain a robust M&A pipeline and a disciplined approach. Expect continued M&A focused on geographic expansion, product line expansion, the addition of key talent and additional operating capabilities, while driving synergistic value creation Deploy surplus capital towards share repurchases and/or dividends Capital Allocation Framework

© Core & Main All Rights Reserved. Confidential and Proprietary Information. RECONCILIATION OF NON-GAAP MEASURES 20 (1) Includes depreciation of certain assets which are reflected in “cost of sales” in our Statement of Operations. (2) Represents expenses associated with acquisition activities, including transaction costs, post-acquisition employee retention bonuses, severance payments, expense recognition of purchase accounting fair value adjustments (excluding amortization) and contingent consideration adjustments. (3) Represents costs related to secondary offerings reflected in SG&A expenses in our Statement of Operations. ($ in Millions) Adjusted EBITDA & Adjusted EBITDA Margin October 29, 2023 October 30, 2022 October 31, 2021 October 29, 2023 October 30, 2022 October 29, 2023 October 30, 2022 Net income attributable to Core & Main, Inc. 112$ 111$ 64$ 308$ 312$ 362$ 360$ Plus: net income attributable to non-controlling interest 46 67 45 147 185 177 216 Net income 158 178 109 455 497 539 576 Depreciation and amortization (1) 38 37 37 111 107 147 143 Provision for income taxes 39 40 25 110 108 130 125 Interest expense 20 16 12 59 46 79 59 EBITDA 255$ 271$ 183$ 735$ 758$ 895$ 903$ Loss on debt modification and extinguishment - - 1 - - - - Equity-based compensation 3 2 2 8 9 10 12 Acquisition expenses (2) 1 1 3 4 3 6 4 Offering expenses (3) 1 1 - 3 1 3 3 Adjusted EBITDA 260$ 275$ 189$ 750$ 771$ 914$ 922$ Adjusted EBITDA Margin: Net Sales 1,827$ 1,818$ 1,405$ 5,262$ 5,277$ 6,636$ 6,523$ Adjusted EBITDA / Net Sales 14.2% 15.1% 13.5% 14.3% 14.6% 13.8% 14.1% Three Months Ended Twelve Months EndedNine Months Ended

© Core & Main All Rights Reserved. Confidential and Proprietary Information. RECONCILIATION OF NON-GAAP MEASURES 21 ($ in Millions) Net Debt Leverage As of October 29, 2023 October 30,2022 Senior ABL Credit Facility due July 2026 - 90 Senior Term Loan due July 2028 1,466 1,481 Total Debt 1,466$ 1,571$ Less: Cash & Cash Equivalents (101) - Net Debt 1,365$ 1,571$ Twelve Months Ended Adjusted EBITDA 914 922 Net Debt Leverage 1.5x 1.7x

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Core and Main (NYSE:CNM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024