0000798359false00007983592024-02-202024-02-200000798359us-gaap:CommonClassAMember2024-02-202024-02-200000798359us-gaap:RedeemableConvertiblePreferredStockMember2024-02-202024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2024

CENTERSPACE

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| North Dakota | | 001-35624 | | 45-0311232 |

(State or Other Jurisdiction

of Incorporation or Organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

3100 10th Street SW, Post Office Box 1988, Minot, ND 58702-1988

(Address of principal executive offices) (Zip code)

(701) 837-4738

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed from last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares of Beneficial Interest, no par value | CSR | New York Stock Exchange |

| Series C Cumulative Redeemable Preferred Shares | CSR -PRC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Centerspace (the "Company") issued an earnings release on February 20, 2024, announcing certain financial and operational results for the year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 2.02 and Item 9.01, including the press release furnished as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 5.02. Departure of Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective February 20, 2024, the Company entered into an executive employment agreement with Bhairav Patel (the “Employment Agreement”). The Employment Agreement provides for at-will employment as Chief Financial Officer. Mr. Patel has served as Chief Financial Officer since January 2022 but previously did not have an employment agreement. As part of his compensation package, Mr. Patel will (i) receive an annual base salary of $400,000, (ii) be eligible for a short-term incentive plan target of 100% of base salary, and (iii) be eligible for a long-term incentive plan target of 100% of base salary. Mr. Patel will also receive a travel reimbursement of up to $25,000 for his commute from his home to the Company’s offices during 2024. In addition, the Company will provide Mr. Patel with a two-bedroom apartment in one of the Company’s communities or will reimburse him for equivalent hotel lodging. Mr. Patel will be eligible to participate in the Company’s employee benefits, including health insurance.

The Employment Agreement provides for severance payments in case of termination of employment by the Company without Cause, or by Mr. Patel for Good Reason (as each term is defined in the Employment Agreement), and such termination is not related to a change in control. Such severance payments include: (i) a lump-sum total gross amount of Mr. Patel’s then-current base salary, plus Mr. Patel’s target annual bonus under the short-term incentive plan for the year his employment terminates; (ii) a gross payment equal to the premium cost of 18 months of Mr. Patel’s monthly premium for the cost of benefit continuation for health benefits; and (iii) up to $10,000 in outplacement assistance. The severance benefits are conditioned on Mr. Patel’s entry into a separation agreement with the Company that provides a general release and waiver of any claims against the Company.

In addition, unvested time-based equity awards and performance-based equity awards will vest according to the Amended and Restated 2015 Incentive Plan (the “Plan”), as amended from time to time. Options to purchase Company stock granted to Mr. Patel under the Plan will become exercisable, in whole or in part, for the shares that remain subject to the option, as of the date of termination and will remain exercisable until three months from the date of termination.

The Employment Agreement imposes customary restrictive covenants on Mr. Patel, including confidentiality and non-solicitation provisions.

The forgoing description of the Employment Agreement is a summary only and is qualified in its entirety by reference to the full text of the Employment Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

ITEM 9.01 Financial Statements and Exhibits

(d)Exhibits

| | | | | |

| |

| Exhibit | |

| Number | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL Document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| Centerspace |

| |

| By | /s/ Anne Olson |

| | Anne Olson |

| Date: February 20, 2024 | | President and Chief Executive Officer |

EXECUTIVE EMPLOYMENT AGREEMENT

This EXECUTIVE EMPLOYMENT AGREEMENT (the “Agreement”) is entered into between Centerspace, a North Dakota real estate investment trust, (the “Company”) and Bhairav Patel (“Executive”) on the latest date appearing on the signature block of this Agreement (the “Agreement Date”). The Company and Executive are, individually, each a “Party,” and, collectively, the “Parties”).

RECITALS

WHEREAS, the Company desires to continue to employ Executive as the Company’s Chief Financial Officer (“CFO”), and Executive desires to continue to be so employed by the Company, subject to the terms, conditions and covenants set forth below.

AGREEMENT

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth below, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and Executive agree as follows:

1.Employment Services.

(a)Term of Employment. Executive’s employment under this Agreement is at-will, to commence on the Agreement Date and will continue until terminated by either Party under Section 3 below (the “Employment Term”).

(b)Title and Position. During the Employment Term, Executive will be the CFO of the Company. Executive’s responsibilities will include all responsibilities as assigned, changed or directed by the Company, and as may be included in a job description. Executive will report to the Chief Executive Officer (“CEO”). Executive represents and warrants that Executive is free to accept continuing employment with the Company and that Executive has no existing commitments or obligations of any kind (including any restrictive covenant(s) for the benefit of any prior employer) that would hinder or interfere with Executive’s obligations under this Agreement.

(c)Duties During Employment. During the Employment Term, Executive will devote Executive’s full time, attention, skill and energy to the business and affairs of the Company and will use Executive’s reasonable best efforts to perform Executive’s responsibilities faithfully in a diligent, trustworthy, efficient and businesslike manner so as to advance the best interests of the Company.

2.Compensation and Benefits.

(a)Base Salary. During the Employment Term, the Company will pay Executive a base salary at the annual rate of $400,000.00 (“Base Salary”), less applicable tax and other authorized withholdings, payable in accordance with the general payroll practices of the Company. The Base Salary will be subject to review annually and may be adjusted by the Company at its discretion, with the adjusted amount becoming the new Base Salary.

(b)Short Term Incentive Plan. During the Employment Term, Executive will be eligible to participate in the Company’s Short Term Incentive Plan (“STIP”) with an annual target value of 100% of Executive’s Base Salary . STIP is subject to the plan documents, as amended by the Board of Trustees (“Board”)from time to time, with no guaranteed minimum.

(c)Long Term Incentive Plan. During the Employment Term, Executive will be eligible to participate in the Company’s Long Term Incentive Plan (“LTIP”), with an annual target award equity mix value of 100% of Executive’s Base Salary. LTIP is subject to the plan documents, as amended by the Board from time to time.

(d)Clawback. Executive’s incentive compensation is subject to the Company’s Executive Incentive Compensation Recoupment Policy, as amended from time to time, and incorporated as if fully restated herein.

(e)Health Care and Benefit Plans. During the Employment Term, Executive will be eligible to participate in all health care and benefit programs normally available to other senior-level employees of the Company (subject to all applicable eligibility and contribution policies and rules), as may be in effect from time to time.

(f)Expense Allowance. Executive may incur, or cause the Company to incur, reasonable, necessary business and travel expenses in connection with the performance of Executive’s duties under this Agreement; provided that such expenses must be properly documented and incurred in a manner consistent with any expense reimbursement policies adopted by the Company from time to time. Travel expenses between the Company’s Minneapolis or Minot offices and Executive’s home shall not be reimbursed except as pursuant to Section 2(h)-(i)) hereof.

(g)Vacation. During the Employment Term, Executive will be entitled to paid time off (“PTO”) equal to and consistent with Company policy for senior-level employees. The timing of Executive’s vacation will be scheduled in a reasonable manner by Executive.

(h)Travel Allowance. Executive has $25,000.00 available during calendar year 2024 for travel reimbursement allowance for use at Executive’s discretion to commute between Company’s Minneapolis or Minot offices and Executive’s home.

(i)Lodging. During the Employment Term, the Company will either provide Executive with a 2-bedroom apartment within the Centerspace portfolio of communities, or reimburse or pay to Executive the cost for equivalent hotel lodging (subject to proper documentation under the Company’s expense reimbursement policies). If and as required by any law or regulation, this benefit shall be reported as taxable income to Executive.

(j)Additional Terms and Conditions of Employment. The terms and conditions of the Executive’s employment will, to the extent not addressed or described in this Employment Agreement, be governed by the Company’s handbook, policies, manuals and existing practices for other senior-level level employees of the Company, which may be modified, changed or rescinded at the discretion of the Company. If a conflict occurs between this Employment Agreement and the any handbook, policy, manual or existing practices, the terms of this Agreement will govern.

3.Termination of Employment.

(a)Notice of Termination. Either Executive or the Company may terminate Executive’s employment with the Company at any time (the effective date of separation being the “Termination Date”), subject to the following:

(i)The Company may terminate Executive’s employment at any time and for any reason, with “Cause” [as defined below in Section 5(a)(ii)] or without Cause, by giving written notice of such termination to Executive designating an immediate or future Termination Date. Upon termination of Executive’s employment by Company without Cause, Executive will be entitled to the “Severance Benefits” as detailed below in Section 3(b).

(ii)Executive may terminate Executive’s employment without “Good Reason” [as defined below in Section 5(a)(v)] by giving the Company 60 calendar days’ prior written notice of termination (“Termination Notice”). Upon receipt of the Termination Notice, the Company may, at its option: (A) make Executive’s termination effective immediately; (B) require Executive to continue to perform Executive’s duties under this Agreement during such 60-calendar-day period, with or without restrictions on Executive’s activities, and/or (C) accept Executive’s notice of termination as Executive’s resignation from the Company at any time during such 60-calendar-day period on behalf of the Company. If the Company elects (A) above, the Company will have no obligation to provide Executive any compensation or benefits beyond the Termination Date except as otherwise required by law or this Agreement. If the Company elects either option (B) or (C) above, the Company will continue to pay Executive’s Base Salary in accordance with Section 2(a) and the premium costs of all benefits as described in Section 2(e) above through the earlier of the 60th calendar day following Executive’s notice of termination or the date on which Executive stops performing services for the Company.

(iii)Executive may terminate Executive’s employment for Good Reason. Executive must provide written notice to the Company within 30 calendar days of the occurrence of an event constituting Good Reason, specifying in reasonable detail the circumstances giving rise to Good Reason. The Company will have 30 calendar days after receiving such written notice from Executive to cure such Good Reason event (the “Company Cure Period”). If the Good Reason event is not cured, Executive must terminate Executive’s employment within 30 calendar days of the end of the Company Cure Period, or the right to terminate employment upon Good Reason will be waived. Upon termination of Executive’s employment for Good Reason, Executive will be entitled to the “Severance Benefits” as detailed below in Section 3(b).

(b)Severance Benefits.

(i)If at any time during the Employment Term the Company terminates Executive’s employment without Cause (which shall include cases of Executive’s Disability or death as may be applicable), or Executive terminates Executive’s employment for Good Reason, and the termination is not related to a Change in Control, the Company will pay Executive a lump-sum total gross amount of one times

Executive’s then current Base Salary, plus one times Executive’s current target annual bonus under STIP, plus Executive’s pro-rated current year target annual bonus under STIP for the year Executive’s employment terminates. Company will also pay Executive a gross payment equal to the premium cost of 18 months of Executive’s monthly premium for the cost of benefit continuation for health benefits (i.e., medical, dental, and vision). These payments will be subject to taxes and withholding and reported on an IRS Form W-2. The Company will provide Executive up to $10,000.00 in outplacement assistance, to be supplied to Executive by a professional and commercially recognized outplacement assistance provider selected by Executive, with costs being directly billed to the Company. Executive’s unvested time-based equity awards and performance-based equity awards will vest according to the Amended and Restated 2015 Incentive Plan (“Plan”) (or other duly adopted equity plan, which is also referred to as the “Plan”), as amended from time to time. Options to purchase Company stock granted to the Executive under the Plan will become exercisable, in whole or in part, for the shares that remain subject to the option, as of the date the Executive’s employment terminates and will remain exercisable until the expiration date of the option (three months from Executive’s Termination Date). All such payments and benefits described in this paragraph shall be, collectively, the “Severance Benefits” and payable to Executive or Executive’s estate as may be applicable.

(ii)If the termination results from a Change in Control, it is governed by the Change in Control Severance Agreement between Executive and the Company, which agreement defines “Change in Control,” may be amended from time to time by agreement of the Parties and is incorporated as if fully restated herein.

(iii)Except as otherwise set forth in Section 3(b)(i) or (ii), the Company will not have to provide Executive with, and Executive will have no entitlement to, any compensation or benefits beyond Executive’s Termination Date, other than as required by applicable law or this Agreement. Executive will not be eligible for severance under any other Company or Affiliate plan, policy or practice.

(iv)To receive the Severance, Executive must execute and return to the Company (and not revoke), within the timeframe designated by Company, a Separation Agreement containing a general release and waiver of claims against the Company and its Affiliates, and each of their respective officers, directors, members, managers, partners and shareholders with respect to Executive’s employment, and other customary terms, as well as Standstill and Clawback provisions, in form and substance reasonably acceptable to the Company. Any obligation of the Company to make the Severance Benefits will cease upon: (A) any determination by a court of competent jurisdiction that Executive has materially breached any of Executive’s obligations in Section 4; or (B) any determination by a court of competent jurisdiction that Executive committed acts constituting Cause during the Employment Term. Notwithstanding anything to the contrary, any payments that would otherwise be payable to Executive before Executive’s execution (and, if applicable, non-revocation) of the Separation Agreement and release will not be paid until the Separation Agreement and release become fully effective under its terms. Once the Separation Agreement and release become fully effective, any

payments to Executive that were delayed under the preceding sentence will be promptly paid in a lump sum and any later payments will be paid to Executive under the schedule otherwise required by Section 3(b)(i). Further, to the extent that Executive’s execution (and any applicable revocation period) of such Separation Agreement and release could include two calendar years, then except as would not violate Section 409A of the Code as applicable, contingent upon the separation agreement and release becoming effective, any payments made under this Agreement will be made in the later of two such calendar years.

4.Restrictive Covenants.

(a)Executive Acknowledgment. Executive agrees and acknowledges that, to ensure that the Company retains its value and goodwill, Executive must not use any Confidential Information, special knowledge of the business of the Company (the “Business”), or the Company’s relationships with its customers, vendors, and employees, all of which Executive will gain access to through Executive’s employment with the Company, other than in furtherance of Executive’s legitimate job duties. Executive also acknowledges that:

(i)The Company currently is engaged in the Business;

(ii)The Business is highly competitive;

(iii)The services to be performed by Executive for the Company are unique in nature and national and international in scope;

(iv)Executive will occupy a position of trust and confidence with the Company and will acquire an intimate knowledge of Confidential Information and the Company’s relationships with its customers, vendors and employees;

(v)The agreements and covenants contained in this Section 4 are essential to protect the Company (and the term the “Company”, as used in this Section 4, will include any successors, assigns or Affiliates), the Confidential Information and the goodwill of the Business;

(vi)The Company would be irreparably damaged if Executive were to disclose or use the Confidential Information, provide services to any person or otherwise take any action in violation of any of the provisions of this Agreement;

(vii)The scope and duration of the covenants set forth in this Section 4 are reasonably designed to protect a protectable interest of the Company and are not excessive given the circumstances; and

(viii)Executive has the means to support Executive and Executive’s dependents other than by engaging in activities prohibited by this Section 4.

(b)Confidential Information. Executive acknowledges that Executive will be entrusted with Confidential Information.

(i)At all times both during Executive’s employment and following the termination of Executive’s employment for any reason, Executive: (A) will hold the Confidential Information in strictest confidence, take all reasonable precautions to prevent the inadvertent disclosure of the Confidential Information to any unauthorized person, and follow all the Company’s policies protecting the Confidential Information; (B) will not use, copy, divulge or otherwise disseminate or disclose any Confidential Information, or any portion thereof, to any unauthorized person; (C) will not make, or permit or cause to be made, copies of the Confidential Information, unless necessary to carry out Executive’s authorized duties as an employee of the Company; and (D) will promptly and fully advise the Company of all facts known to Executive concerning any actual or threatened unauthorized use or disclosure of which Executive becomes aware.

(ii)If Executive receives any subpoena or becomes subject to any legal obligation that might require Executive to disclose Confidential Information, Executive will provide prompt written notice of that fact to the Company, enclosing a copy of the subpoena and any other documents describing the legal obligation. In the event that the Company objects to the disclosure of Confidential Information, by way of a motion to quash or otherwise, Executive agrees to not disclose any Confidential Information while any such objection is pending.

(iii)Executive understands that the Company has and will receive from third parties confidential or proprietary information (“Third Party Information”) under a duty to maintain the confidentiality of such Third Party Information and to use it only for limited purposes. During the term of Executive’s association with the Company and at all times after the termination of such association for any reason, Executive will hold Third Party Information in strict confidence and will not disclose or use any Third Party Information unless expressly authorized by the Company in advance or as may be strictly necessary to perform Executive’s obligations with the Company, subject to any agreements binding on the Company with respect to such Third Party Information.

(iv)Executive will not improperly use or disclose any Confidential Information or trade secrets, if any, of any former employer or of any other person to whom Executive has an obligation of confidentiality, and Executive will not bring onto the Company’s premises any unpublished documents or any property belonging to any former employer or of any other person to whom Executive has an obligation of confidentiality.

(v)Executive acknowledges that Executive has received notice that the Defend Trade Secrets Act of 2016 provides immunity from civil and criminal liability under state and federal trade secret laws for any employee who discloses a trade secret: (1) in a lawsuit or other proceeding filed under seal; or (2) in confidence to a government official or attorney for the sole purpose of reporting or investigating a suspected violation of law. Under the Defend Trade Secrets Act of 2016, this notice must be included in order for a person suing under the Defend Trade Secrets Act of 2016 to be entitled to punitive damages and attorneys’ fees.

(vi)Executive agrees that upon termination of Executive’s employment with the Company, or at any time upon the Company’s demand, Executive will immediately stop using any Confidential Information and return to the Company without retaining any copies: (i) all documents (electronic or otherwise), all electronically stored data, all tangible items and all copies of the foregoing containing Confidential Information or from which Confidential Information may be derived, and (ii) all other property and tangible information belonging to the Company or its Affiliates in Executive’s possession, custody or control. Upon request made by the Company at any time, Executive will provide the Company with a written certification of compliance with this paragraph.

(c)Ownership of Proprietary Information. Executive agrees to disclose promptly in writing, and hereby assigns and conveys, to the Company all right, title and interest of every kind and nature whatsoever in and to all inventions and/or discoveries, including concepts and ideas, whether patentable or not, and whether or not fixed in any mode of expression or reduced to practice, which are related, in whole or in part, to the Company’s Business, to any other business of Company or its Affiliates for which Executive has job responsibilities, or to the related services or products of the Company, including what Executive conceives, creates, discovers, invents, reduces to practice, writes, discusses, develops, secures, or obtains, alone or jointly with others, during Executive’s employment with Company or within 12 months after Executive’s employment terminates. Any such inventions or discoveries arising within the 12 months following Executive’s termination of employment will be presumed to be the same as inventions or discoveries created by Executive during Executive’s employment unless Executive proves otherwise with reasonable certainty. The Company will be the sole owner of all rights related thereto, including, but not limited to, all patents, trademarks, service marks, copyrights and any other rights pertaining to all such inventions and discoveries.

(d)Non-Interference. During the Restricted Period (as defined in Section 5(a)(vi) below), Executive will not (other than in furtherance of Executive’s legitimate job duties on behalf of the Company), directly or indirectly, on Executive’s own behalf or for any other person:

(i)Solicit for employment or hire, attempt to solicit for employment or hire, or employ or seek to influence any current Company employee to leave the Company’s or its Affiliates’ employment or engagement, when such employee was employed or engaged by the Company or its Affiliates at any time within the six (6) months prior to the solicitation;

(ii)Because Executive agrees that it would inevitably require the disclosure of Confidential Information and would not restrain Executive in his profession or business, and without limiting the protections or restrictions above in Section 4(b), solicit or encourage any client, or prospective client that Executive is aware or should be aware Company is pursuing, of the Company or its Affiliates to: (A) terminate or otherwise alter its relationship with the Company or its Affiliates; or (B) commence doing business with any entity that provides a product or service that could otherwise be provided by the Company or its Affiliates; or

(iii)Interfere or attempt to interfere with any Key Business Partner of the Company and its Affiliates. “Key Business Partner” means any vendor, supplier, or business partner of the Company while Executive is employed by the Company as this restriction applies during employment, and those who served such roles within the 12-month period preceding Executive’s Termination Date for any restriction post-Termination Date.

(e)Investment Opportunity. During the period beginning on the Agreement Date and ending on the later of: (i) the Termination Date or (ii) the date on which Executive (or any of Executive’s transferees) no longer owns, directly or indirectly, any equity interest in the Company, if Executive learns of any investment opportunity in a business or any entity engaged in the Business, Executive will promptly present such investment opportunity to the Company in writing.

(f)Equitable Modification. If any court of competent jurisdiction deems any provision in this Section 4 too restrictive, the other provisions will stand, and the court will modify the unduly restrictive provision to the point of greatest restriction permissible by law. To the extent Executive engages in any restricted activity during a Restricted Period, the court will: (i) extend the duration of the covenant by a period equal to the length of time from the last date of Executive’s employment with the company to the cessation of any such breach, or such other period as the court shall deem to be warranted by the equities; and (ii) order the destruction of any work product created by Executive, directly or indirectly, in violation of this Agreement.

(g)Survival. Executive acknowledges and agrees that the restrictive covenants set forth in this Section 4 will survive any termination of Executive’s employment under this Agreement, no matter the reason for such termination.

(h)Remedies. Executive acknowledges and agrees that the covenants set forth in this Section 4 are reasonable and necessary to protect the Company’s business interests, that irreparable injury will result to the Company if Executive were to breach any of the terms of said covenants, and that in the event of actual or threatened breach of any such covenants, the Company will have no adequate remedy at law. Executive accordingly agrees that in the event of any actual or threatened breach by Executive of any of the covenants set forth in this Section 4, the Company will have a right to immediate temporary injunctive and other equitable relief, and attorney’s fees, and the injunction will be without bond, if permitted, and without the necessity of showing actual monetary damages, subject to a hearing as soon thereafter as possible. Nothing contained here will be construed as prohibiting the Company from pursuing any other remedies available to it for such breach or threatened breach, including the recovery of any damages that it is able to prove.

5.Miscellaneous.

(a)Definitions. The following terms used in the Agreement have the meanings set forth below:

(i)“Affiliate” means any trade or business, whether or not incorporated, which together with the Company is treated as a single employer under Internal Revenue

Code section 414(b) or is deemed to be under common control under Internal Revenue Code section 414(c).

(ii)“Cause” means: (A) the Executive’s willful conduct that is demonstrably and materially injurious to the Company or an Affiliate, monetarily or otherwise; (B) the Executive’s material breach of a written agreement between the Executive and the Company or an Affiliate, including, but not limited to, breaches of Section 4, above; (C) the Executive’s breach of the Executive’s fiduciary duties to the Company or an Affiliate; (D) the Executive’s admission to or conviction of any crime (or entering a plea of guilty or nolo contendere to any crime) constituting a felony or a crime of moral turpitude; (E) the Executive’s entering into an agreement or consent decree or being the subject of any regulatory order that in any of such cases prohibits the Executive from serving as an officer or director of a company that has publicly traded securities; (F) any act or omission of Executive constituting (u) a conflict of interest, (v) dishonesty, (w) willful malfeasance, (x) gross negligence, (y) breach of fiduciary duty, or any statutorily imposed, duty related to employment, or (z) conduct deemed outside the scope of the authority granted to Executive by the Company; (G) the Executive’s refusal to perform Executive’s job duties or any specific reasonable directives from the Company that are reasonably consistent with the scope and nature of Executive’s responsibilities (including any incapability arising from a disability, subject to reasonable accommodation); (H) that Executive used or is or had been under the influence of illegal drugs at the workplace or while performing Company business, or refused to submit for a drug test upon the Company’s request; or (I) the Executive’s Disability or death. A termination of the Executive shall not be for “Cause” unless the decision to terminate the Executive is set forth in a notice by the CEO to the Board, and the Board, in its discretion (but without any obligation), could provide an opportunity to the Executive to be heard before the Board. No act or failure to act by the Executive will be deemed “willful” if it was done or omitted to be done by the Executive in good faith or with a reasonable belief on the part of the Executive that the action or omission was in the best interests of the Company or an Affiliate. Any act or failure to act by the Executive based on authority given pursuant to a resolution duly adopted by the Board or based on the advice of counsel to the Company shall be conclusively presumed to be done or omitted to be done by the Executive in good faith and in the best interest of the Company and its Affiliates. If there is any conflict between this definition of “Cause” and “Cause” defined in any other agreement between Executive and the Company, this definition will govern for the purposes of this Agreement.

(iii)“Confidential Information” means any non-public proprietary information of the Company in whatever form or medium, concerning the operations or affairs of the Business or of the Company or any of its Affiliates, including, but not limited to: client information, client lists, prospective client and client records, compilations, analyses, studies, plans, financial data, technology, programs, processes, policies, techniques, flow charts, information regarding Company’s products, techniques, methods, projects, strategies, trade practices, accounting methods, methods of operations, or other data considered by the Company to be Confidential Information; provided,

however, that Confidential Information will not include: (1) knowledge, data and information that is generally known or becomes known in the trade or industry of the Company (other than as a result of a breach of this Agreement or other agreement or instrument to which Executive is bound), and (2) knowledge, data and information gained without a breach of this Agreement on a non-confidential basis from a person who is not legally prohibited from transmitting the information to Executive.

(iv)“Disability” means either: (A) Executive is deemed disabled for purposes of any group or individual long-term disability policy paid for by the Company and at the time in effect, or (B) Executive’s inability to perform Executive’s essential duties for a period of 120 calendar days or more (consecutive or non-consecutive) during any 12 month period, due to mental or physical disability or incapacity, as determined by a board-certified, licensed physician mutually selected by the CEO (or the CEO’s designee) and the Executive or the Executive’s legal representative, with such agreement as to acceptability not to be unreasonably withheld or delayed, and consistent with applicable law.

(v)“Good Reason” means, without the consent of the Executive: (A) a change in the Executive’s position with the Company or an Affiliate that results in a material diminution of the Executive’s authority, duties, or responsibilities; (B) a material reduction by the Company or an Affiliate in the annual rate of the Executive’s Base Salary; or (C) a change in the location of the Executive’s principal office to a different place that is more than fifty miles from the Executive’s principal office immediately prior to such change. A reduction in the Executive’s annual Base Salary will be material if the adjusted rate is less than 90% of the Executive’s highest rate of annual Base Salary as in effect on any date in the preceding 36 months; provided, however, that a reduction in the Executive’s rate of annual Base Salary will be disregarded to the extent that the reduction is applied similarly to the Company’s other officers or executives. Notwithstanding the two preceding sentences, a change in the Executive’s duties or responsibilities or a reduction in the annual rate of the Base Salary in connection with the Executive’s termination of employment (for Cause or retirement) will not constitute Good Reason.

(vi)“Restricted Period” means the period beginning on the Agreement Date and continuing until the first anniversary of the Termination Date.

(b)Notices. Any notices, consents or other communications required or permitted to be sent or given hereunder will be in writing and deemed properly served if: (i) delivered personally, in which case the date of such notice will be the date of delivery; (ii) delivered to a nationally recognized overnight courier service, in which case the date of delivery will be the next business day; or (iii) sent by email (with a copy sent by first-class mail), in which case the date of delivery will be the date of transmission, or if after 5:00 P.M., the next business day. If not personally delivered, notice to a Party will be sent addressed to the address listed for such Party on the signature page of this Agreement, or in either case at such other address for a Party as may later be provided.

(c)Successors and Assigns. This Agreement will be binding upon, and inure to the benefit of, and be enforceable by, the Parties and the Company’s successors and permitted

assigns. This Agreement may be assigned by the Company to: (i) an Affiliate of the Company so long as the Affiliate assumes the Company’s obligations under this Agreement; (ii) in connection with a sale of the Company’s business, whether by sale of assets, sale of equity interests, merger, consolidation or otherwise, so long as the assignee assumes the Company’s obligations hereunder; and (iii) to the Company’s lenders as collateral for security purposes. This Agreement or any right or interest hereunder is one of personal service and may not be assigned by Executive under any circumstance. Nothing in this Agreement, whether expressed or implied, is intended or will be construed to confer upon any person other than the Parties and successors and assigns permitted by this Section 5(c) any right, remedy or claim under or by reason of this Agreement.

(d)Entire Agreement; Amendments. This Agreement, including the Recitals, contains the entire understanding of the Parties with regard to the terms of Executive’s employment, and supersedes all prior agreements, understandings or letters of intent with regard to the terms of the employment relationship addressed herein. Unless specifically included in this Agreement, it does not incorporate any other agreement between the Parties. This Agreement will not be amended, modified or supplemented except by a written instrument signed by each of the Company and Executive.

(e)Interpretation. Article titles and section headings contained herein are inserted for convenience of reference only and are not intended to be a part of or to affect the meaning or interpretation of this Agreement.

(f)Waivers. No provision of this Agreement may be waived except in a writing executed and delivered by the Party against whom waiver is sought. Any such written waiver shall be effective only with respect to the event or circumstance described in it and not for any other event or circumstance unless such waiver expressly provides to the contrary.

(g)Tax Matters. Executive acknowledges that no representative or agent of the Company has provided Executive with any tax advice of any nature, and Executive has had the opportunity to consult with Executive’s own legal, tax and financial advisor(s) as to tax and related matters concerning the compensation to be received under this Agreement. The Company may withhold and deduct from amounts payable hereunder those amounts required to be withheld or deducted under applicable law.

(h)Execution in Counterparts & Delivery by Email. This Agreement may be executed in one or more counterparts, each of which will be considered an original instrument, but all of which will be considered one and the same agreement. Email transmission of a scanned PDF of an executed Agreement will be considered an original.

(i)Required Delay for Deferred Compensation Under 409A. Notwithstanding any other provision of this Agreement, if at the time of separation from service Executive is determined by the Company to be a “specified employee” (as defined in Section 409A of the Code (together, with any state law of similar effect, “Section 409A”) and Section 1.409A-1(i) of the Treasury Regulations), and the Company determines that delayed commencement of any portion of the termination payments and benefits payable to Executive pursuant to this Agreement is required in order to avoid a prohibited distribution under Section 409A(a)(2)(B)(i)

of the Code, then such portion of Executive’s termination payments and benefits will not be provided to Executive until the earliest of: (i) the date that is six months and one day after Executive’s separation from service, (ii) the date of Executive’s death or (iii) such earlier date as is permitted under Section 409A (any such delayed commencement, a “Payment Delay”). Upon the expiration of such Payment Delay, all payments deferred pursuant to a Payment Delay will be paid in a lump sum to Executive (without interest thereon) on the first day following the expiration of the Payment Delay, and any remaining payments due under the Agreement will be paid on the original schedule provided herein.

This Agreement is intended to meet the requirements of Section 409A and will be interpreted and construed consistent with that intent. References to termination of employment, retirement, separation from service and similar or correlative terms in this Agreement will mean a “separation from service” (as defined at Section 1.409A-1(h) of the Treasury Regulations) from the Company and from all other corporations and trades or businesses, if any, that would be treated as a single “service recipient” with the Company under Section 1.409A-1(h)(3) of the Treasury Regulations. Each payment and benefit provided for in this Agreement will be treated as a separate “payment” for purposes of Code Section 409A.

In no event may Executive, directly or indirectly, designate the calendar year of any payment to be made under this Agreement or otherwise which constitutes a “deferral of compensation” within the meaning of Section 409A of the Code. All reimbursements and in-kind benefits provided under this Agreement will be made or provided in accordance with the requirements of Section 409A of the Code. To the extent that any reimbursements pursuant to this Agreement or otherwise are taxable to Executive, any reimbursement payment due to Executive will be paid to Executive on or before the last day of Executive’s taxable year following the taxable year in which the related expense was incurred; provided, that, Executive has provided the Company written documentation of such expenses in a timely fashion and such expenses otherwise satisfy the Company expense reimbursement policies. Reimbursements pursuant to this Agreement or otherwise are not subject to liquidation or exchange for another benefit and the amount of such reimbursements that Executive receives in any other taxable year. Notwithstanding any of the foregoing to the contrary, the Company and their respective officers, directors, partners, general partners, employees or agents make no guarantee that the terms of this Agreement comply with, or are exempt from, the provisions of Code Section 409A, and none of the foregoing will have any liability for the failure of the terms of this Agreement to comply with, or be exempt from, the provisions of Code Section 409A.

(j)Governing Law; Consent to Jurisdiction & Venue; Waiver of Jury. The laws of the State of North Dakota will govern all matters arising out of or relating to this Agreement including, without limitation, its validity, interpretation, construction, and performance and without giving effect to the conflict of laws principles that may require the application of the laws of another jurisdiction. Any Party bringing a legal action or proceeding against any other Party arising out of or relating to this Agreement may bring the legal action or proceeding in the United States District Court for the District of North Dakota or in any court of the State of North Dakota sitting in Minot, North Dakota. Each Party waives, to the fullest extent permitted by law (i) any objection it may now or later have to the laying of venue of any legal action or proceeding arising out of or relating to this Agreement brought in a court described in the preceding

sentence; (ii) any claim that any legal action or proceeding brought in any such court has been brought in an inconvenient forum; and, (3) the right to trial by jury.

(k)Construction. The language used in this Agreement will be deemed to be the language chosen by Executive and the Company to express their mutual intent, and no rule of strict construction will be applied against Executive or the Company.

(l)Severability. In the event that any provision or portion of this Agreement is found to be invalid or unenforceable for any reason, in whole or in part, the remaining provisions of this Agreement will be unaffected thereby and will remain in full force and effect to the fullest extent permitted by law to achieve the purposes of this Agreement. Accordingly, if any provision of this Agreement is adjudicated to be invalid, ineffective or unenforceable, the remaining provisions will not be affected by such adjudication. The invalid, ineffective or unenforceable provision will, without further action by the Parties, be automatically amended or limited, as appropriate, to effect the original and/or lawful purpose and intent of the invalid, ineffective or unenforceable provision; provided, however, that such amendment will apply only with respect to the operation of such provision in the particular jurisdiction where that adjudication is made.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Company has caused this Employment Agreement to be duly executed by an authorized officer, and Executive has executed it the date provided below.

| | | | | | | | |

| COMPANY: | | EXECUTIVE: |

| | |

| CENTERSPACE | | Bhairav Patel |

| | |

| | |

| By: /s/ Anne Olson | | By: /s/ Bhairav Patel |

| | |

| Printed Name: Anne Olson | | Date: |

| | |

| Title: President & Chief Executive Officer | | |

| | |

| Date: | | |

| | |

| | |

| Address: | | |

| 800 LaSalle Avenue, Suite 1600 | | |

| Minneapolis, Minnesota 55402 | | |

Exhibit 99.1

Earnings Release

Centerspace Announces Financial and Operating Results for the Year Ended

December 31, 2023, Provides 2024 Financial Outlook and Dividend Increase

MINNEAPOLIS, MN, February 20, 2024 – Centerspace (NYSE: CSR) announced today its financial and operating results for the year ended December 31, 2023. The tables below show Net Income (Loss), Funds from Operations (“FFO”)1, and Core FFO1, all on a per diluted share basis, for the year ended December 31, 2023; Same-Store Revenues, Expenses, and Net Operating Income (“NOI”)1 over comparable periods; and Same-Store Weighted Average Occupancy for the three months ended December 31, 2023, September 30, 2023, and December 31, 2022 and the twelve months ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| Per Share | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) per share - diluted | | $ | (0.65) | | | $ | (0.24) | | | $ | 2.32 | | | $ | (1.35) | |

FFO - diluted(1) | | 1.11 | | | 1.16 | | | 4.27 | | | 4.32 | |

Core FFO - diluted(1) | | 1.22 | | | 1.17 | | | 4.78 | | | 4.43 | |

| | | | | | | | | | | | | | | | | | | | |

| | | Year-Over-Year Comparison | | Sequential

Comparison | | YTD

Comparison |

| Same-Store Results | | 4Q23 vs 4Q22 | | 4Q23 vs. 3Q23 | | CY23 vs. CY22 |

| Revenues | | 3.9 | % | | 0.5 | % | | 7.2 | % |

| Expenses | | (1.2) | % | | (3.6) | % | | 4.6 | % |

Net Operating Income (“NOI”)(1) | | 7.6 | % | | 3.4 | % | | 9.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Twelve months ended |

| Same-Store Results | | December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Weighted Average Occupancy | | 94.8 | % | | 94.7 | % | | 94.8 | % | | 94.9 | % | | 94.6 | % |

(1)NOI, Funds from Operations, and Core FFO are non-GAAP financial measures. For more information on their usage and presentation, and a reconciliation to the most directly comparable GAAP measures, refer to “Non-GAAP Financial Measures and Reconciliations” and “Non-GAAP Financial Measures and Other Terms” in the Supplemental Financial and Operating Data below.

Highlights for the Year Ended December 31, 2023

•Net Income was $2.32 per diluted share for the year ended December 31, 2023, compared to Net Loss of $1.35 per diluted share for the year ended December 31, 2022;

•Core FFO(1) increased to $4.78 or 7.9% per diluted share for the year ended December 31, 2023, compared to $4.43 for the year ended December 31, 2022;

•Operating income increased to $84.5 million for the year ended December 31, 2023 compared to $13.9 million for the prior year;

•Same-store year-over-year NOI(1) grew to 9.0% driven by same-store revenue growth of 7.2%;

•Continued to grow Colorado portfolio through acquisition of an apartment community in Loveland, Colorado consisting of 303 homes for an aggregate purchase price of $94.5 million;

•Thirteen communities in Minnesota, Nebraska, and North Dakota were sold for an aggregate sales price of $226.8 million. The sale included four communities in the St. Cloud market comprising 692 homes, two communities in the Omaha-Lincoln market comprising 498 homes, three communities in the Minneapolis-St. Paul market comprising 377

homes, and four communities in the Minot market comprising 712 homes and related commercial space.

•216,000 common shares repurchased for total consideration of $11.5 million and an average of $53.44 per share.

Balance Sheet

At December 31, 2023, Centerspace had $234.6 million of total liquidity on its balance sheet, including $226.0 million available on its lines of credit.

Subsequent Events

Subsequent to December 31, 2023, Centerspace entered into definitive purchase and sale agreements for two communities with expected gross proceeds of $18.9 million. The Company believes the sales will close in the first quarter. The closing of pending transactions is subject to certain conditions and restrictions; therefore, there can be no assurance that the transactions will be consummated or that the final terms will not differ in material respects.

Subsequent to December 31, 2023, Centerspace repurchased 87,722 common shares for total consideration of $4.7 million and an average price of $53.62 per share.

Dividend Distributions

Centerspace's Board of Trustees announced a quarterly distribution of $0.75 per share/unit, payable on April 8, 2024, to common shareholders and unitholders of record at the close of business on March 28, 2024. The announced distribution represents a $0.02 increase over the prior distribution.

The Board of Trustees also declared a distribution of $0.4140625 per share on the 6.625% Series C Cumulative Redeemable Preferred Shares (NYSE: CSR PRC), payable on March 28, 2024, to holders of record at the close of business on March 15, 2024. Series C preferred share distributions are cumulative and payable quarterly in arrears at an annual rate of $1.65625 per share.

2024 Financial Outlook

Centerspace is providing the following guidance for its 2024 performance.

| | | | | | | | | | | | | | | | | |

2024 Financial Outlook |

| | | Range for 2024 |

| 2023 Actual | | Low | | High |

| Net income (loss) per Share - diluted | $ | 2.32 | | | $ | (1.31) | | | $ | (0.99) | |

| FFO per Share - diluted | $ | 4.27 | | | $ | 4.54 | | | $ | 4.80 | |

| Core FFO per Share - diluted | $ | 4.78 | | | $ | 4.68 | | | $ | 4.92 | |

Additional assumptions:

•Same-store capital expenditures of $1,075 per home to $1,150 per home

•Value-add expenditures of $25.0 million to $27.0 million

•Proceeds from potential dispositions of $18.8 million to $19.0 million

FFO and Core FFO are non-GAAP financial measures. For more information on their usage and presentation, and a reconciliation to the most directly comparable GAAP measures, please refer to "2024 Financial Outlook" in the Supplemental Financial and Operating Data below.

Earnings Call

| | | | | | | | | | | | | | |

Live webcast and replay: https://www.ir.centerspacehomes.com |

| | | |

| Live Conference Call | | Conference Call Replay |

Wednesday, February 21, 2024 at 10:00 AM ET | | Replay available until March 6, 2024 |

| USA Toll Free Number | 1-833-470-1428 | | USA Toll Free Number | 1-866-813-9403 |

| International Toll Free Number | 1-929-526-1599 | | International Toll Free Number | 1-929-458-6194 |

| Canada Toll Free Number | 1-833-950-0062 | | Canada Toll Free Number | 1-226-828-7578 |

| Conference Number | 373306 | | Conference Number | 297696 |

Supplemental Information

Supplemental Operating and Financial Data for the year ended December 31, 2023, is available in the Investors section on Centerspace’s website at https://www.centerspacehomes.com or by calling Investor Relations at 701-837-7104. Non-GAAP financial measures and other capitalized terms, as used in this earnings release, are defined and reconciled in the Supplemental Financial and Operating Data, which accompanies this earnings release.

About Centerspace

Centerspace is an owner and operator of apartment communities committed to providing great homes by focusing on integrity and serving others. Founded in 1970, as of December 31, 2023, Centerspace owned 72 apartment communities consisting of 13,088 homes located in Colorado, Minnesota, Montana, Nebraska, North Dakota, and South Dakota. In 2022, Centerspace was named the National Apartment Association’s Leading Organization in Diversity, Equity, and Inclusion.. For more information, please visit www.centerspacehomes.com.

Forward-Looking Statements

Certain statements in this press release are based on the Company's current expectations and assumptions, and are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements do not discuss historical fact, but instead include statements related to expectations, projections, intentions or other items related to the future. Forward-looking statements are typically identified by the use of terms such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “assumes,” “may,” “projects,” “outlook,” “future,” and variations of such words and similar expressions. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements to be materially different from the results of operations, financial conditions, or plans expressed or implied by the forward-looking statements. Although the Company believes the expectations reflected in its forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be achieved. Any statements contained herein that are not statements of historical fact should be deemed forward-looking statements. As a result, reliance should not be placed on these forward-looking statements, as these statements are subject to known and unknown risks, uncertainties, and other factors beyond the Company's control and could differ materially from actual results and performance. Such risks and uncertainties are detailed from time to time in filings with the SEC, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” contained in the Company's Annual Report on Form 10-K, in quarterly reports on Form 10-Q, and in other reports the Company files with the SEC from time to time. The Company assumes no obligation to update or supplement forward-looking statements that become untrue due to subsequent events.

Contact Information

Investor Relations

Josh Klaetsch

Phone: 701-837-7104

E-mail: IR@centerspacehomes.com

Marketing & Media

Kelly Weber

Phone: 701-837-7104

E-mail: kweber@centerspacehomes.com

Supplemental Financial and Operating Data

Table of Contents

December 31, 2023

| | | | | |

| Page |

| |

| |

| |

| Key Financial Data | |

| |

| |

| |

| Non-GAAP Financial Measures and Reconciliations | |

| |

| |

| |

| |

| |

| Debt and Capital Analysis | |

| |

| |

| |

| Portfolio Analysis | |

| |

| |

| |

| |

| |

| |

| |

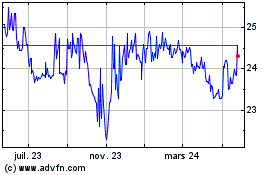

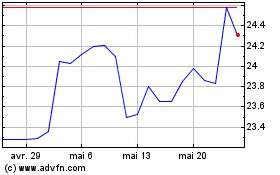

Common Share Data (NYSE: CSR)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| High closing price | | $ | 59.33 | | | $ | 66.57 | | | $ | 64.18 | | | $ | 71.07 | | | $ | 70.20 | |

| Low closing price | | $ | 47.82 | | | $ | 59.39 | | | $ | 53.98 | | | $ | 51.39 | | | $ | 58.50 | |

| Average closing price | | $ | 54.61 | | | $ | 62.52 | | | $ | 58.61 | | | $ | 61.68 | | | $ | 64.64 | |

| Closing price at end of quarter | | $ | 58.20 | | | $ | 60.26 | | | $ | 61.36 | | | $ | 54.63 | | | $ | 58.67 | |

| Common share distributions—annualized | | $ | 2.92 | | | $ | 2.92 | | | $ | 2.92 | | | $ | 2.92 | | | $ | 2.92 | |

| Closing price dividend yield - annualized | | 5.0 | % | | 4.8 | % | | 4.8 | % | | 5.3 | % | | 5.0 | % |

| Closing common shares outstanding (thousands) | | 14,963 | | | 15,052 | | | 14,949 | | | 15,032 | | | 15,020 | |

| Closing limited partnership units outstanding (thousands) | | 861 | | | 864 | | | 961 | | | 967 | | | 971 | |

| Closing Series E preferred units, as converted (thousands) | | 2,078 | | | 2,087 | | | 2,094 | | | 2,103 | | | 2,119 | |

| Total closing common shares, limited partnership units, and Series E preferred units, as converted, outstanding (thousands) | | 17,902 | | | 18,003 | | | 18,004 | | | 18,102 | | | 18,110 | |

| Closing market value of outstanding common shares, plus imputed closing market value of outstanding limited partnership units (thousands) | | $ | 1,041,896 | | | $ | 1,084,861 | | | $ | 1,104,725 | | | $ | 988,912 | | | $ | 1,062,514 | |

CENTERSPACE

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | Twelve months ended |

| | 12/31/2023 | | 9/30/2023 | | 6/30/2023 | | 3/31/2023 | | 12/31/2022 | | | 12/31/2023 | | 12/31/2022 |

| REVENUE | | $ | 64,068 | | | $ | 64,568 | | | $ | 64,776 | | | $ | 67,897 | | | $ | 67,848 | | | | $ | 261,309 | | | $ | 256,716 | |

| EXPENSES | | | | | | | | | | | | | | | |

| Property operating expenses, excluding real estate taxes | | 18,237 | | | 19,602 | | | 17,872 | | | 21,342 | | | 21,755 | | | | 77,053 | | | 80,070 | |

| Real estate taxes | | 6,861 | | | 7,143 | | | 7,174 | | | 7,581 | | | 7,464 | | | | 28,759 | | | 28,567 | |

| Property management expenses | | 2,341 | | | 2,197 | | | 2,247 | | | 2,568 | | | 2,358 | | | | 9,353 | | | 9,895 | |

| Casualty loss | | 853 | | | 937 | | | 53 | | | 252 | | | 335 | | | | 2,095 | | | 1,591 | |

| Depreciation and amortization | | 26,617 | | | 24,697 | | | 24,371 | | | 25,993 | | | 25,768 | | | | 101,678 | | | 105,257 | |

| Impairment of real estate investments | | 5,218 | | | — | | | — | | | — | | | — | | | | 5,218 | | | — | |

| General and administrative expenses | | 4,363 | | | 3,832 | | | 4,162 | | | 7,723 | | | 3,276 | | | | 20,080 | | | 17,516 | |

| TOTAL EXPENSES | | $ | 64,490 | | | $ | 58,408 | | | $ | 55,879 | | | $ | 65,459 | | | $ | 60,956 | | | | $ | 244,236 | | | $ | 242,896 | |

| Gain (loss) on sale of real estate and other investments | | (83) | | | 11,235 | | | (67) | | | 60,159 | | | 14 | | | | 71,244 | | | 41 | |

| Loss on litigation settlement | | (1,000) | | | — | | | (2,864) | | | — | | | — | | | | (3,864) | | | — | |

| Operating income (loss) | | (1,505) | | | 17,395 | | | 5,966 | | | 62,597 | | | 6,906 | | | | 84,453 | | | 13,861 | |

| Interest expense | | (8,913) | | | (8,556) | | | (8,641) | | | (10,319) | | | (9,603) | | | | (36,429) | | | (32,750) | |

| | | | | | | | | | | | | | | |

Interest and other income | | 533 | | | 330 | | | 295 | | | 49 | | | 132 | | | | 1,207 | | | 1,248 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Net income (loss) | | $ | (9,885) | | | $ | 9,169 | | | $ | (2,380) | | | $ | 52,327 | | | $ | (2,565) | | | | $ | 49,231 | | | $ | (17,641) | |

| Dividends to Series D preferred unitholders | | (160) | | | (160) | | | (160) | | | (160) | | | (160) | | | | (640) | | | (640) | |

Net (income) loss attributable to noncontrolling interest – Operating Partnership and Series E preferred units | | 1,917 | | | (1,204) | | | 712 | | | (8,566) | | | 753 | | | | (7,141) | | | 4,299 | |

Net income attributable to noncontrolling interests – consolidated real estate entities | | (29) | | | (31) | | | (35) | | | (30) | | | (34) | | | | (125) | | | (127) | |

Net income (loss) attributable to controlling interests | | (8,157) | | | 7,774 | | | (1,863) | | | 43,571 | | | (2,006) | | | | 41,325 | | | (14,109) | |

| Dividends to preferred shareholders | | (1,607) | | | (1,607) | | | (1,607) | | | (1,607) | | | (1,607) | | | | (6,428) | | | (6,428) | |

| | | | | | | | | | | | | | | |

NET INCOME (LOSS) AVAILABLE TO COMMON SHAREHOLDERS | | $ | (9,764) | | | $ | 6,167 | | | $ | (3,470) | | | $ | 41,964 | | | $ | (3,613) | | | | $ | 34,897 | | | $ | (20,537) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Net income (loss) per common share – basic | | $ | (0.65) | | | $ | 0.41 | | | $ | (0.23) | | | $ | 2.79 | | | $ | (0.24) | | | | $ | 2.33 | | | $ | (1.35) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Net income (loss) per common share – diluted | | $ | (0.65) | | | $ | 0.41 | | | $ | (0.23) | | | $ | 2.76 | | | $ | (0.24) | | | | $ | 2.32 | | | $ | (1.35) | |

CENTERSPACE

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12/31/2023 | | 9/30/2023 | | 6/30/2023 | | 3/31/2023 | | 12/31/2022 |

| ASSETS | | | | | | | | | | |

| Real estate investments | | | | | | | | | | |

| Property owned | | $ | 2,420,146 | | | $ | 2,326,408 | | | $ | 2,434,138 | | | $ | 2,420,911 | | | $ | 2,534,124 | |

| Less accumulated depreciation | | (530,703) | | | (516,673) | | | (543,264) | | | (519,167) | | | (535,401) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total real estate investments | | 1,889,443 | | | 1,809,735 | | | 1,890,874 | | | 1,901,744 | | | 1,998,723 | |

| Cash and cash equivalents | | 8,630 | | | 29,701 | | | 9,745 | | | 8,939 | | | 10,458 | |

| Restricted cash | | 639 | | | 22,496 | | | 566 | | | 48,903 | | | 1,433 | |

| Other assets | | 27,649 | | | 16,349 | | | 18,992 | | | 19,298 | | | 22,687 | |

| TOTAL ASSETS | | $ | 1,926,361 | | | $ | 1,878,281 | | | $ | 1,920,177 | | | $ | 1,978,884 | | | $ | 2,033,301 | |

| | | | | | | | | | |

| LIABILITIES, MEZZANINE EQUITY, AND EQUITY | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | |

| Accounts payable and accrued expenses | | $ | 62,754 | | | $ | 62,674 | | | $ | 56,713 | | | $ | 56,639 | | | $ | 58,812 | |

| Revolving line of credit | | 30,000 | | | — | | | 18,989 | | | 143,469 | | | 113,500 | |

| Notes payable, net of unamortized loan costs | | 299,459 | | | 299,443 | | | 299,428 | | | 299,412 | | | 399,007 | |

| Mortgages payable, net of unamortized loan costs | | 586,563 | | | 539,245 | | | 563,079 | | | 474,999 | | | 495,126 | |

| TOTAL LIABILITIES | | $ | 978,776 | | | $ | 901,362 | | | $ | 938,209 | | | $ | 974,519 | | | $ | 1,066,445 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SERIES D PREFERRED UNITS | | $ | 16,560 | | | $ | 16,560 | | | $ | 16,560 | | | $ | 16,560 | | | $ | 16,560 | |

| EQUITY | | | | | | | | | | |

| Series C Preferred Shares of Beneficial Interest | | 93,530 | | | 93,530 | | | 93,530 | | | 93,530 | | | 93,530 | |

| Common Shares of Beneficial Interest | | 1,165,694 | | | 1,169,025 | | | 1,169,501 | | | 1,176,059 | | | 1,177,484 | |

| Accumulated distributions in excess of net income | | (548,273) | | | (527,586) | | | (522,796) | | | (508,420) | | | (539,422) | |

| Accumulated other comprehensive loss | | (1,119) | | | (1,434) | | | (1,758) | | | (1,917) | | | (2,055) | |

| Total shareholders’ equity | | $ | 709,832 | | | $ | 733,535 | | | $ | 738,477 | | | $ | 759,252 | | | $ | 729,537 | |

| Noncontrolling interests – Operating Partnership and Series E preferred units | | 220,544 | | | 226,205 | | | 226,294 | | | 227,920 | | | 220,132 | |

| Noncontrolling interests – consolidated real estate entities | | 649 | | | 619 | | | 637 | | | 633 | | | 627 | |

| TOTAL EQUITY | | $ | 931,025 | | | $ | 960,359 | | | $ | 965,408 | | | $ | 987,805 | | | $ | 950,296 | |

| TOTAL LIABILITIES, MEZZANINE EQUITY, AND EQUITY | | $ | 1,926,361 | | | $ | 1,878,281 | | | $ | 1,920,177 | | | $ | 1,978,884 | | | $ | 2,033,301 | |

CENTERSPACE

NON-GAAP FINANCIAL MEASURES AND RECONCILIATIONS (unaudited)

This release contains certain non-GAAP financial measures. The non-GAAP financial measures should not be considered a substitute for operating results determined in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The definitions and calculations of these non-GAAP financial measures, as calculated by the Company may not be comparable to non-GAAP measures reported by other REITs that do not define each of the non-GAAP financial measures exactly as Centerspace does. The non-GAAP financial measures are defined and further explained on pages S-18 through S-20, “Non-GAAP Financial Measures and Other Terms.”

The Company provides certain information on a same-store and non-same-store basis. Same-store apartment communities are owned or in service for substantially all of the periods being compared, and, in the case of development properties, have achieved a target level of physical occupancy of 90%. On the first day of each calendar year, Centerspace determines the composition of the same-store pool for that year and adjusts the previous year, to evaluate full period-over-period operating comparisons for existing apartment communities and their contribution to Net Operating Income. Measuring performance on a same-store basis allows investors to evaluate how a fixed pool of communities are performing year-over-year. Centerspace uses this measure to assess success in increasing NOI (defined and reconciled below), raising average rental revenue, renewing leases on existing residents, controlling operating costs, and making prudent capital improvements.

CENTERSPACE

RECONCILIATIONS OF OPERATING INCOME TO NET OPERATING INCOME (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (dollars in thousands) |

| | Three Months Ended | | | Sequential | | Year-Over-Year |

| 12/31/2023 | | 9/30/2023 | | 12/31/2022 | | | $ Change | | % Change | | $ Change | | % Change |

| Operating income (loss) | $ | (1,505) | | | $ | 17,395 | | | $ | 6,906 | | | | $ | (18,900) | | | (108.7) | % | | $ | (8,411) | | | (121.8) | % |

| Adjustments: | | | | | | | | | | | | | | |

| Property management expenses | 2,341 | | | 2,197 | | | 2,358 | | | | 144 | | | 6.6 | % | | (17) | | | (0.7) | % |

| Casualty loss | 853 | | | 937 | | | 335 | | | | (84) | | | (9.0) | % | | 518 | | | 154.6 | % |

| Depreciation and amortization | 26,617 | | | 24,697 | | | 25,768 | | | | 1,920 | | | 7.8 | % | | 849 | | | 3.3 | % |

| Impairment | 5,218 | | | — | | | — | | | | 5,218 | | | N/A | | 5,218 | | | N/A |

| General and administrative expenses | 4,363 | | | 3,832 | | | 3,276 | | | | 531 | | | 13.9 | % | | 1,087 | | | 33.2 | % |

| (Gain) loss on sale of real estate and other investments | 83 | | | (11,235) | | | (14) | | | | 11,318 | | | 100.7 | % | | 97 | | | * |

| Loss on litigation settlement | 1,000 | | | — | | | — | | | | 1,000 | | | N/A | | 1,000 | | | N/A |

Net Operating Income(1) | $ | 38,970 | | | $ | 37,823 | | | $ | 38,629 | | | | $ | 1,147 | | | 3.0 | % | | $ | 341 | | | 0.9 | % |

| | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | |

| Same-store | $ | 58,262 | | | $ | 57,949 | | | $ | 56,055 | | | | $ | 313 | | | 0.5 | % | | $ | 2,207 | | | 3.9 | % |

| Non-same-store | 5,209 | | | 3,556 | | | 3,497 | | | | 1,653 | | | 46.5 | % | | 1,712 | | | 49.0 | % |

| Other | 587 | | | 676 | | | 581 | | | | (89) | | | (13.2) | % | | 6 | | | 1.0 | % |

| Dispositions | 10 | | | 2,387 | | | 7,715 | | | | (2,377) | | | (99.6) | % | | (7,705) | | | (99.9) | % |

| Total | 64,068 | | | 64,568 | | | 67,848 | | | | (500) | | | (0.8) | % | | (3,780) | | | (5.6) | % |

| Property operating expenses, including real estate taxes | | | | | | | | | | | | | | |

| Same-store | 23,055 | | | 23,906 | | | 23,324 | | | | (851) | | | (3.6) | % | | (269) | | | (1.2) | % |

| Non-same-store | 1,790 | | | 1,469 | | | 1,266 | | | | 321 | | | 21.9 | % | | 524 | | | 41.4 | % |

| Other | 251 | | | 270 | | | 249 | | | | (19) | | | (7.0) | % | | 2 | | | 0.8 | % |

| Dispositions | 2 | | | 1,100 | | | 4,380 | | | | (1,098) | | | (99.8) | % | | (4,378) | | | (100.0) | % |

| Total | 25,098 | | | 26,745 | | | 29,219 | | | | (1,647) | | | (6.2) | % | | (4,121) | | | (14.1) | % |

Net Operating Income(1) | | | | | | | | | | | | | | |

| Same-store | 35,207 | | | 34,043 | | | 32,731 | | | | 1,164 | | | 3.4 | % | | 2,476 | | | 7.6 | % |

| Non-same-store | 3,419 | | | 2,087 | | | 2,231 | | | | 1,332 | | | 63.8 | % | | 1,188 | | | 53.2 | % |

| Other | 336 | | | 406 | | | 332 | | | | (70) | | | (17.2) | % | | 4 | | | 1.2 | % |

| Dispositions | 8 | | | 1,287 | | | 3,335 | | | | (1,279) | | | (99.4) | % | | (3,327) | | | (99.8) | % |

| Total | $ | 38,970 | | | $ | 37,823 | | | $ | 38,629 | | | | $ | 1,147 | | | 3.0 | % | | $ | 341 | | | 0.9 | % |

*Not a meaningful percentage

(1)Net Operating Income is a non-GAAP measure. Refer to pages S-18 through S-21 “Non-GAAP Financial Measures and Other Terms” for additional information.

CENTERSPACE

RECONCILIATIONS OF OPERATING INCOME TO NET OPERATING INCOME (1)

| | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) |

| Twelve Months Ended December 31, |

| 2023 | | 2022 | | $ Change | | % Change |

| Operating income | $ | 84,453 | | | $ | 13,861 | | | $ | 70,592 | | | 509.3 | % |

| Adjustments: | | | | | | | |

| Property management expenses | 9,353 | | | 9,895 | | | (542) | | | (5.5) | % |

| Casualty loss | 2,095 | | | 1,591 | | | 504 | | | 31.7 | % |

| Depreciation and amortization | 101,678 | | | 105,257 | | | (3,579) | | | (3.4) | % |

| Impairment | 5,218 | | | — | | | 5,218 | | | N/A |

| General and administrative expenses | 20,080 | | | 17,516 | | | 2,564 | | | 14.6 | % |

| Gain on sale of real estate and other investments | (71,244) | | | (41) | | | (71,203) | | | * |

| Loss on litigation settlement | 3,864 | | | — | | | 3,864 | | | N/A |

Net Operating Income(1) | $ | 155,497 | | | $ | 148,079 | | | $ | 7,418 | | | 5.0 | % |

| | | | | | | |

| Revenue | | | | | | | |

| Same-store | $ | 230,333 | | | $ | 214,941 | | | $ | 15,392 | | | 7.2 | % |

| Non-same-store | 16,031 | | | 9,434 | | | 6,597 | | | 69.9 | % |

| Other | 2,601 | | | 2,466 | | | 135 | | | 5.5 | % |

| Dispositions | 12,344 | | | 29,875 | | | (17,531) | | | (58.7) | % |

| Total | 261,309 | | | 256,716 | | | 4,593 | | | 1.8 | % |

| Property operating expenses, including real estate taxes | | | | | | | |

| Same-store | 92,847 | | | 88,785 | | | 4,062 | | | 4.6 | % |

| Non-same-store | 5,915 | | | 3,542 | | | 2,373 | | | 67.0 | % |

| Other | 797 | | | 940 | | | (143) | | | (15.2) | % |

| Dispositions | 6,253 | | | 15,370 | | | (9,117) | | | (59.3) | % |

| Total | 105,812 | | | 108,637 | | | (2,825) | | | (2.6) | % |

Net Operating Income(1) | | | | | | | |

| Same-store | 137,486 | | | 126,156 | | | 11,330 | | | 9.0 | % |

| Non-same-store | 10,116 | | | 5,892 | | | 4,224 | | | 71.7 | % |

| Other | 1,804 | | | 1,526 | | | 278 | | | 18.2 | % |

| Dispositions | 6,091 | | | 14,505 | | | (8,414) | | | (58.0) | % |

| Total | $ | 155,497 | | | $ | 148,079 | | | $ | 7,418 | | | 5.0 | % |

*Not a meaningful percentage

(1)Net Operating Income is a non-GAAP measure. Refer to pages S-18 through S-20 “Reconciliations of non-GAAP Financial Measures and Other Terms” for additional information.

CENTERSPACE

RECONCILIATIONS OF SAME-STORE CONTROLLABLE EXPENSES TO TOTAL PROPERTY OPERATING EXPENSES, INCLUDING REAL ESTATE TAXES (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (dollars in thousands) |

| | Three Months Ended December 31, | | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | $ Change | | % Change | | | 2023 | | 2022 | | $ Change | | % Change |

| | | | | | | | | | | | | | | | |

| Controllable expenses | | | | | | | | | | | | | | | | |

On-site compensation (2) | $ | 6,221 | | | $ | 5,931 | | | $ | 290 | | | 4.9 | % | | | $ | 24,594 | | | $ | 22,448 | | | $ | 2,146 | | | 9.6 | % |

| Repairs and maintenance | 3,184 | | | 3,726 | | | (542) | | | (14.5) | % | | | 13,498 | | | 14,084 | | | (586) | | | (4.2) | % |

| Utilities | 3,438 | | | 3,955 | | | (517) | | | (13.1) | % | | | 14,992 | | | 15,663 | | | (671) | | | (4.3) | % |

| Administrative and marketing | 1,541 | | | 1,202 | | | 339 | | | 28.2 | % | | | 5,464 | | | 4,875 | | | 589 | | | 12.1 | % |

| Total | $ | 14,384 | | | $ | 14,814 | | | $ | (430) | | | (2.9) | % | | | $ | 58,548 | | | $ | 57,070 | | | $ | 1,478 | | | 2.6 | % |

| | | | | | | | | | | | | | | | |

| Non-controllable expenses | | | | | | | | | | | | | | | | |

| Real estate taxes | $ | 6,132 | | | $ | 6,118 | | | $ | 14 | | | 0.2 | % | | | $ | 25,231 | | | $ | 23,781 | | | $ | 1,450 | | | 6.1 | % |

| Insurance | 2,539 | | | 2,392 | | | 147 | | | 6.1 | % | | | 9,068 | | | 7,934 | | | 1,134 | | | 14.3 | % |

| Total | $ | 8,671 | | | $ | 8,510 | | | $ | 161 | | | 1.9 | % | | | $ | 34,299 | | | $ | 31,715 | | | $ | 2,584 | | | 8.1 | % |

| | | | | | | | | | | | | | | | |

| Property operating expenses, including real estate taxes - non-same-store | $ | 1,790 | | | $ | 1,266 | | | $ | 524 | | | 41.4 | % | | | $ | 5,915 | | | $ | 3,542 | | | $ | 2,373 | | | 67.0 | % |

| Property operating expenses, including real estate taxes - other | 251 | | | 249 | | | 2 | | | 0.8 | % | | | 797 | | | 940 | | | (143) | | | (15.2) | % |

| Property operating expenses, including real estate taxes - dispositions | 2 | | | 4,380 | | | (4,378) | | | (100.0) | % | | | 6,253 | | | 15,370 | | | (9,117) | | | (59.3) | % |

| Total property operating expenses, including real estate taxes | $ | 25,098 | | | $ | 29,219 | | | $ | (4,121) | | | (14.1) | % | | | $ | 105,812 | | | $ | 108,637 | | | $ | (2,825) | | | (2.6) | % |

(1)Same-store controllable expenses is a non-GAAP measure. Refer to pages S-18 through S-21 “Non-GAAP Financial Measures and Other Terms” for additional information.

(2)On-site compensation for administration, leasing, and maintenance personnel.

CENTERSPACE

RECONCILIATIONS OF NET INCOME (LOSS) AVAILABLE TO COMMON SHAREHOLDERS TO FUNDS FROM OPERATIONS AND CORE FUNDS FROM OPERATIONS (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (in thousands, except per share amounts) |