Chevron Corporation** (NYSE: CVX) today announced that it

started water injection operations at two projects to boost oil and

natural gas recovery at the company’s existing Jack/St. Malo and

Tahiti facilities in the deepwater U.S. Gulf of Mexico, where

Chevron operations produce some of the world’s lowest carbon

intensity oil and gas.

“Delivery of these two projects maximizes returns from our

existing resource base and contributes toward growing our

production to 300,000 net barrels of oil equivalent per day in the

U.S. Gulf of Mexico by 2026,” said Bruce Niemeyer, president,

Chevron Americas Exploration & Production. “These achievements

follow the recent production startup at our high-pressure Anchor

field, reinforcing Chevron’s position as a leader in technological

delivery and project execution in the Gulf.”

At the Jack/St. Malo facility, Chevron achieved first water

injection at the St. Malo field, the company’s first waterflood

project in the deepwater Wilcox trend. The project was delivered

under budget, with the addition of water injection facilities, two

new production wells, and two new injection wells. It is expected

to add approximately 175 million barrels of oil equivalent to the

St. Malo field’s gross ultimate recovery.

The St. Malo field and Jack/St. Malo facility are approximately

280 miles (450 km) south of New Orleans, La., in approximately

7,000 feet (2,134 m) of water. Since the fields started production

in 2014, Jack and St. Malo together have cumulatively produced

almost 400 million gross barrels of oil equivalent.

At the Tahiti facility, located approximately 190 miles (306 km)

south of New Orleans in around 4,100 feet (1,250 m) of water,

Chevron started injecting water into its first deepwater Gulf

producer-to-injector conversion wells. The project included

installation of a new water injection manifold and 20,000 feet of

flexible water injection flowline.

Bolstered by multiple development projects since the start of

operations in 2009, the Tahiti facility recently surpassed 500

million gross barrels of oil-equivalent cumulative production. The

company continues to study advanced drilling, completion, and

production technologies that could be employed in future

development phases at Tahiti and Jack/St. Malo with the potential

to further increase recovery from these fields.

Chevron, through its subsidiary Union Oil Company of California,

is operator of the St. Malo field and, together with its subsidiary

Chevron U.S.A. Inc., holds a 51 percent working interest. Co-owners

MP Gulf of Mexico, LLC owns a 25 percent interest; Equinor Gulf of

Mexico LLC, 21.5 percent; Exxon Mobil Corporation, 1.25 percent;

and Eni Petroleum US LLC, 1.25 percent.

Chevron U.S.A Inc. is operator of the Tahiti facility with a 58

percent working interest. Co-owners Equinor Gulf of Mexico LLC and

TotalEnergies E&P USA, Inc. hold 25 percent and 17 percent

stakes, respectively.

About Chevron

Chevron is one of the world’s leading integrated energy

companies. We believe affordable, reliable, and ever-cleaner energy

is essential to enabling human progress. Chevron produces crude oil

and natural gas; manufactures transportation fuels, lubricants,

petrochemicals and additives; and develops technologies that

enhance our business and the industry. We aim to grow our oil and

gas business, lower the carbon intensity of our operations and grow

lower carbon businesses in renewable fuels, carbon capture and

offsets, hydrogen and other emerging technologies. More information

about Chevron is available at www.chevron.com.

Notice

As used in this news release, the term “Chevron” and such terms

as “the company,” “the corporation,” “our,” “we,” “us” and “its”

may refer to Chevron Corporation, one or more of its consolidated

subsidiaries, or to all of them taken as a whole. All of these

terms are used for convenience only and are not intended as a

precise description of any of the separate companies, each of which

manages its own affairs.

Please visit Chevron’s website and Investor Relations page at

www.chevron.com and www.chevron.com/investors, LinkedIn:

www.linkedin.com/company/chevron, Twitter: @Chevron, Facebook:

www.facebook.com/chevron, and Instagram: www.instagram.com/chevron,

where Chevron often discloses important information about the

company, its business, and its results of operations.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR”

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF

1995

This news release contains forward-looking statements relating

to Chevron’s operations and lower carbon strategy that are based on

management’s current expectations, estimates, and projections about

the petroleum, chemicals and other energy-related industries. Words

or phrases such as “anticipates,” “expects,” “intends,” “plans,”

“targets,” “advances,” “commits,” “drives,” “aims,” “forecasts,”

“projects,” “believes,” “approaches,” “seeks,” “schedules,”

“estimates,” “positions,” “pursues,” “progress,” “may,” “can,”

“could,” “should,” “will,” “budgets,” “outlook,” “trends,”

“guidance,” “focus,” “on track,” “goals,” “objectives,”

“strategies,” “opportunities,” “poised,” “potential,” “ambitions,”

“aspires” and similar expressions, and variations or negatives of

these words, are intended to identify such forward-looking

statements, but not all forward-looking statements include such

words. These statements are not guarantees of future performance

and are subject to numerous risks, uncertainties and other factors,

many of which are beyond the company’s control and are difficult to

predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements. The reader should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this news release. Unless legally required, Chevron

undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Among the important factors that could cause actual results to

differ materially from those in the forward-looking statements are:

changing crude oil and natural gas prices and demand for the

company’s products, and production curtailments due to market

conditions; crude oil production quotas or other actions that might

be imposed by the Organization of Petroleum Exporting Countries and

other producing countries; technological advancements; changes to

government policies in the countries in which the company operates;

public health crises, such as pandemics and epidemics, and any

related government policies and actions; disruptions in the

company’s global supply chain, including supply chain constraints

and escalation of the cost of goods and services; changing

economic, regulatory and political environments in the various

countries in which the company operates; general domestic and

international economic, market and political conditions, including

the military conflict between Russia and Ukraine, the conflict in

Israel and the global response to these hostilities; changing

refining, marketing and chemicals margins; actions of competitors

or regulators; timing of exploration expenses; timing of crude oil

liftings; the competitiveness of alternate-energy sources or

product substitutes; development of large carbon capture and offset

markets; the results of operations and financial condition of the

company’s suppliers, vendors, partners and equity affiliates; the

inability or failure of the company’s joint-venture partners to

fund their share of operations and development activities; the

potential failure to achieve expected net production from existing

and future crude oil and natural gas development projects;

potential delays in the development, construction or start-up of

planned projects; the potential disruption or interruption of the

company’s operations due to war, accidents, political events, civil

unrest, severe weather, cyber threats, terrorist acts, or other

natural or human causes beyond the company’s control; the potential

liability for remedial actions or assessments under existing or

future environmental regulations and litigation; significant

operational, investment or product changes undertaken or required

by existing or future environmental statutes and regulations,

including international agreements and national or regional

legislation and regulatory measures related to greenhouse gas

emissions and climate change; the potential liability resulting

from pending or future litigation; the risk that regulatory

approvals with respect to the Hess Corporation (Hess) transaction

are not obtained or are obtained subject to conditions that are not

anticipated by the company and Hess; potential delays in

consummating the Hess transaction, including as a result of

regulatory proceedings or the ongoing arbitration proceedings

regarding preemptive rights in the Stabroek Block joint operating

agreement; risks that such ongoing arbitration is not

satisfactorily resolved and the potential transaction fails to be

consummated; uncertainties as to whether the potential transaction,

if consummated, will achieve its anticipated economic benefits,

including as a result of regulatory proceedings and risks

associated with third party contracts containing material consent,

anti-assignment, transfer or other provisions that may be related

to the potential transaction that are not waived or otherwise

satisfactorily resolved; the company’s ability to integrate Hess’

operations in a successful manner and in the expected time period;

the possibility that any of the anticipated benefits and projected

synergies of the potential transaction will not be realized or will

not be realized within the expected time period; the company’s

future acquisitions or dispositions of assets or shares or the

delay or failure of such transactions to close based on required

closing conditions; the potential for gains and losses from asset

dispositions or impairments; government mandated sales,

divestitures, recapitalizations, taxes and tax audits, tariffs,

sanctions, changes in fiscal terms or restrictions on scope of

company operations; foreign currency movements compared with the

U.S. dollar; higher inflation and related impacts; material

reductions in corporate liquidity and access to debt markets;

changes to the company’s capital allocation strategies; the effects

of changed accounting rules under generally accepted accounting

principles promulgated by rule-setting bodies; the company’s

ability to identify and mitigate the risks and hazards inherent in

operating in the global energy industry; and the factors set forth

under the heading “Risk Factors” on pages 20 through 26 of the

company’s 2023 Annual Report on Form 10-K and in subsequent filings

with the U.S. Securities and Exchange Commission. Other

unpredictable or unknown factors not discussed in this news release

could also have material adverse effects on forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240903501268/en/

For media inquiries contact:

Paula Beasley Paula.beasley@chevron.com +1 281-728-4426

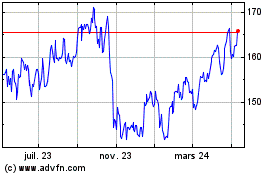

Chevron (NYSE:CVX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

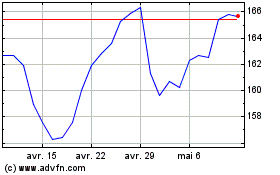

Chevron (NYSE:CVX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024