UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number |

811-22784 |

| |

|

| |

BNY Mellon Municipal Bond Infrastructure Fund, Inc. |

|

| |

(Exact name of Registrant as specified in charter) |

|

| |

|

|

| |

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286 |

|

| |

(Address of principal executive offices) (Zip code) |

|

| |

|

|

| |

Deirdre Cunnane, Esq.

240 Greenwich Street

New York, New York 10286 |

|

| |

(Name and address of agent for service) |

|

| |

| Registrant's telephone number, including area code: |

(212) 922-6400 |

| |

|

|

Date of fiscal year end:

|

02/28 |

|

| Date of reporting period: |

08/31/2023

|

|

| |

|

|

|

|

|

|

FORM N-CSR

| Item 1. | Reports to Stockholders. |

BNY Mellon Municipal Bond Infrastructure Fund, Inc.

| |

SEMI-ANNUAL REPORT August

31, 2023 |

| |

|

| |

BNY Mellon Municipal Bond Infrastructure

Fund, Inc. Protecting

Your Privacy

Our Pledge to You THE FUND IS COMMITTED TO YOUR PRIVACY.

On this page, you will find the fund’s policies and practices for collecting, disclosing, and safeguarding

“nonpublic personal information,” which may include financial or other customer information. These

policies apply to individuals who purchase fund shares for personal, family, or household purposes, or

have done so in the past. This notification replaces all previous statements of the fund’s consumer

privacy policy, and may be amended at any time. We’ll keep you informed of changes as required by law. YOUR ACCOUNT IS PROVIDED IN A SECURE ENVIRONMENT. The fund maintains

physical, electronic and procedural safeguards that comply with federal regulations to guard nonpublic

personal information. The fund’s agents and service providers have limited access to customer information

based on their role in servicing your account. THE FUND COLLECTS INFORMATION

IN ORDER TO SERVICE AND ADMINISTER YOUR ACCOUNT. The fund collects a variety of nonpublic

personal information, which may include: • Information

we receive from you, such as your name, address, and social security number. • Information about your transactions with us, such as the purchase

or sale of fund shares. • Information

we receive from agents and service providers, such as proxy voting information. THE

FUND DOES NOT SHARE NONPUBLIC PERSONAL INFORMATION WITH ANYONE, EXCEPT AS PERMITTED BY LAW. Thank you for this opportunity

to serve you. |

| |

The views expressed

in this report reflect those of the portfolio manager(s) only through the end of the period covered and

do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in

the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time

based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility

to update such views. These views may not be relied on as investment advice and, because investment decisions

for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an

indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

| |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s

available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes

a few minutes. |

DISCUSSION

OF FUND PERFORMANCE (Unaudited)

For the period from March 1, 2023, through August 31, 2023,

as provided by Daniel Rabasco, Jeffrey Burger and Thomas Casey, portfolio managers with Insight North

America LLC, the fund’s sub-adviser.

Market and Fund Performance Overview

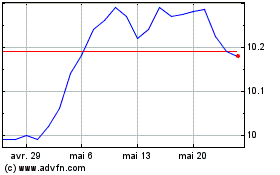

For the six-month period

ended August 31, 2023, BNY Mellon Municipal Bond Infrastructure Fund, Inc. (the “fund”) achieved

a total return of .51% on a net-asset-value basis and −1.61% on a market price basis.1

Over the same period, the fund provided aggregate income dividends of $.24 per share, which reflects

an annualized distribution rate of 4.55%.2 In comparison, the Bloomberg U.S. Municipal

Bond Index (the “Index”), the fund’s benchmark, posted a total return of 1.04% for the same period.3

Municipal bonds gained ground as investors began to anticipate the end of the

Federal Reserve’s (the “Fed”) interest-rate-hiking program. The fund continued to produce competitive

levels of current income through an emphasis on longer-term and revenue bonds.

The Fund’s Investment

Approach

The fund seeks to provide as high a level of current income exempt from regular

federal income tax as is consistent with the preservation of capital. The fund’s portfolio is composed

principally of investments that finance the development, support or improvement of America’s infrastructure.

Under

normal circumstances, the fund pursues its investment objective by investing at least 80% of its Managed

Assets4 in municipal bonds issued to finance infrastructure sectors

and projects in the United States. Also, under normal circumstances, the fund will invest at least 50%

of its Managed Assets in municipal bonds that, at the time of investment, are rated investment grade,

meaning that up to 50% of Managed Assets can be invested in below-investment-grade municipal bonds. Projects

in which the fund may invest include (but are not limited to) those in the transportation, energy and

utilities, social infrastructure, and water and environmental sectors. We focus on identifying undervalued

sectors and securities and minimize the use of interest-rate forecasting. We select municipal bonds using

fundamental credit analysis to estimate the relative value and attractiveness of various sectors and

securities and to exploit pricing inefficiencies.

The fund employs leverage

by issuing preferred stock and participating in tender-option bond programs. The use of leverage can

magnify gain-and-loss potential depending on market conditions.

Easing Inflation Supports Markets

The

Fed continued to make progress in reducing inflation during the reporting period, raising the federal

funds rates three times between March 2023 and August 2023. By the end of the period, the federal funds

target rate was 5.25%–5.50%, up from 4.50%–4.75% at the start of the period.

Despite

the higher rates, the U.S. economy surprised investors by continuing to avoid a long-anticipated recession.

The economy posted respectable gains in the third and fourth

2

quarters of 2022, and growth continued in the first quarter of 2023, with the

economy expanding by 2.0% followed by 2.1% in the second quarter.

As a result of higher-than-expected

inflation early in the year, municipal bond mutual funds experienced significant outflows through much

of the reporting period. The need for fund managers to meet redemptions only added to the downward momentum.

But the market began to rebound as inflation expectations shifted down, and as

economic indicators suggested a slowing economy was on the horizon. Investors also began to anticipate

the end to the Fed’s rate-hiking cycle. For a time, the stalemate in Congress over the federal debt

ceiling also gave investors pause as the outcome appeared uncertain. Nevertheless, the normal seasonal

decline in supply, combined with the seasonal reinvestment of maturing bonds, buoyed the market.

Mutual fund investors, however, have so far been reluctant to return to the market.

It appears investors are wary of continued rate volatility as the Federal Reserve remains committed to

lower inflation to its 2% target. Direct retail investors though continued to invest in municipal bonds,

attracted by higher tax-exempt yields.

The impact of weak mutual fund demand

has been offset in part by relatively manageable issuance. The need to issue new debt has been minimized

somewhat by federal assistance offered in response to the pandemic. In addition, since municipal issuers

use debt to fund capital projects, not operations, they have greater discretion about when they issue

new debt, and high interest rates have made issuance less attractive. Finally, refundings have dropped

off because the Tax Cuts and Jobs Act of 2017 eliminated advance refunding, and today’s high interest

rates make refunding less attractive.

In this environment, lower-quality credits

have performed well, driven by excess yield and spread compression.

Duration and Select Revenue Bonds Sectors Drove

Performance

The fund’s performance was driven mainly by duration and

asset allocation decisions. Specifically, the longer duration, the fund’s use of leverage and its holdings

of longer bonds were detrimental as interest rates rose. In the revenue bond sector, positions in the

special tax segment negatively impacted fund returns. Rising interest rates also raised the cost of the

fund’s leverage, which was a drag on income generation.

On a more positive

note, the fund’s performance was aided by its positioning in some segments. Positions in airport, hospital

and education bonds, especially charter schools, were especially beneficial. Allocations to prepaid gas,

tobacco and transportation also boosted returns. State general obligation bonds contributed positively

to returns, especially those issued by Illinois and Puerto Rico.

A Positive Outlook

We

believe the Fed is approaching the end of its rate-hiking program, though an additional hike in the short-term

rate cannot be discounted and rates may stay high for longer than previously expected. This may provide

an opportunity in longer-duration bonds as the end of the Fed’s rate-hiking approaches.

3

DISCUSSION

OF FUND PERFORMANCE (Unaudited) (continued)

Also, the municipal bond market’s credit fundamentals remain strong, and the

market has made valuations attractive. Additionally, technical factors, such as seasonal reinvestment

may provide support to the market in the coming months. That is, while supply has been relatively manageable,

we believe demand is likely to improve. We believe when mutual fund investors return, flows into municipal

bond mutual funds will improve, providing additional support to the market.

September

15, 2023

1 Total

return includes reinvestment of dividends and any capital gains paid, based upon net asset value per

share or market price per shares, as applicable. Past performance is no guarantee of future results.

Income may be subject to state and local taxes, and some income may be subject to the federal alternative

minimum tax for certain investors. Capital gains, if any, are fully taxable.

2 Annualized distribution rate per share is based upon dividends

per share paid from net investment income during the period, divided by the market price per share at

the end of the period, adjusted for any capital gain distributions.

3 Source: Lipper, Inc. ---The Bloomberg U.S. Municipal Bond

Index covers the U.S. dollar-denominated long-term tax-exempt bond market. Unlike a fund, the Index is

not subject to fees and other expenses. Investors cannot invest directly in any index.

4 “Managed Assets” of the fund means the fund’s total

assets, including any assets attributable to effective leverage, minus certain defined accrued liabilities.

Bonds are subject generally to interest-rate, credit, liquidity and market risks,

to varying degrees. Generally, all other factors being equal, prices of investment grade bonds are inversely

related to interest-rate changes, and rate increases can cause price declines.

High

yield bonds are subject to increased credit and liquidity risk and are considered speculative in terms

of the issuer’s perceived ability to pay interest on a timely basis and to repay principal upon maturity.

Unlike investment-grade bonds, prices of high yield bonds may fluctuate unpredictably and not necessarily

inversely with changes in interest rates.

The use of leverage may magnify the fund’s

gains or losses. For derivatives with a leveraging component, adverse changes in the value or level of

the underlying asset can result in a loss that is much greater than the original investment in the derivative.

4

STATEMENT

OF INVESTMENTS

August 31, 2023 (Unaudited)

| | | | | | | | | | |

| |

Description

| Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% | | | | | |

Alabama

- 3.2% | | | | | |

Alabama Special Care Facilities Financing Authority, Revenue Bonds (Methodist

Home for the Aging Obligated Group) | | 6.00 | | 6/1/2050 | | 3,820,000 | | 3,247,100 | |

Black Belt Energy Gas District, Revenue Bonds, Refunding, Ser.

D1 | | 4.00 | | 6/1/2027 | | 1,000,000 | a | 989,429 | |

Jefferson County, Revenue Bonds, Refunding, Ser. F | | 7.90 | | 10/1/2050 | | 2,500,000 | b | 2,617,379 | |

| | 6,853,908 | |

Arizona - 7.0% | | | | | |

Arizona Industrial Development Authority, Revenue Bonds (Equitable

School Revolving Fund Obligated Group) Ser. A | | 4.00 | | 11/1/2050 | | 3,425,000 | | 2,922,800 | |

Arizona Industrial Development Authority, Revenue Bonds (Legacy

Cares Project) Ser. A | | 7.75 | | 7/1/2050 | | 3,200,000 | c,d | 320,000 | |

Maricopa County Industrial Development Authority, Revenue Bonds

(Benjamin Franklin Charter School Obligated Group) | | 6.00 | | 7/1/2052 | | 2,000,000 | c | 2,023,118 | |

Maricopa County Industrial Development Authority, Revenue Bonds,

Refunding (Legacy Traditional Schools Project) | | 5.00 | | 7/1/2049 | | 1,025,000 | c | 898,488 | |

Phoenix Civic Improvement Corp., Revenue Bonds | | 4.00 | | 7/1/2044 | | 1,905,000 | | 1,818,519 | |

Salt Verde Financial

Corp., Revenue Bonds | | 5.00 | | 12/1/2037 | | 5,000,000 | | 5,124,560 | |

The Phoenix Arizona

Industrial Development Authority, Revenue Bonds, Refunding (BASIS Schools Projects) Ser. A | | 5.00 | | 7/1/2046 | | 2,000,000 | c | 1,803,465 | |

| | 14,910,950 | |

Arkansas - 1.7% | | | | | |

Arkansas Development

Finance Authority, Revenue Bonds (Green Bond) (U.S. Steel Corp.) | | 5.70 | | 5/1/2053 | | 3,500,000 | | 3,514,771 | |

California - 10.7% | | | | | |

California County Tobacco

Securitization Agency, Revenue Bonds, Refunding, Ser. A | | 4.00 | | 6/1/2049 | | 1,000,000 | | 907,162 | |

California Housing Finance Agency, Revenue Bonds, Ser. 2021-1 | | 3.50 | | 11/20/2035 | | 1,446,191 | | 1,330,581 | |

5

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

California

- 10.7% (continued) | | | | | |

California Municipal Finance Authority, Revenue Bonds, Refunding

(HumanGood California Obligated Group) Ser. A | | 5.00 | | 10/1/2044 | | 1,000,000 | | 1,011,224 | |

California Statewide Communities Development Authority, Revenue

Bonds (California Baptist University) Ser. A | | 6.38 | | 11/1/2043 | | 2,035,000 | c | 2,039,553 | |

California Statewide Communities Development Authority, Revenue

Bonds, Refunding (California Baptist University) Ser. A | | 5.00 | | 11/1/2041 | | 1,875,000 | c | 1,826,853 | |

Golden State Tobacco Securitization Corp., Revenue Bonds, Refunding,

Ser. B | | 5.00 | | 6/1/2051 | | 1,000,000 | | 1,038,921 | |

Long Beach Bond Finance

Authority, Revenue Bonds, Ser. A | | 5.50 | | 11/15/2037 | | 5,000,000 | | 5,339,222 | |

Orange County Community Facilities District, Special Tax Bonds,

Ser. A | | 5.00 | | 8/15/2052 | | 1,000,000 | | 989,767 | |

San Diego County Regional

Airport Authority, Revenue Bonds, Ser. B | | 5.00 | | 7/1/2051 | | 3,500,000 | | 3,566,572 | |

Tender Option Bond Trust Receipts (Series 2022-XF3024), (San

Francisco City & County, Revenue Bonds, Refunding, Ser. A) Recourse, Underlying Coupon Rate (%) 5.00 | | 4.05 | | 5/1/2044 | | 4,500,000 | c,e,f | 4,621,016 | |

| | 22,670,871 | |

Colorado - 9.3% | | | | | |

Colorado Health Facilities

Authority, Revenue Bonds (CommonSpirit Health Obligated Group) | | 5.25 | | 11/1/2052 | | 1,000,000 | | 1,019,609 | |

Colorado Health Facilities Authority, Revenue Bonds, Refunding

(Covenant Living Communities & Services Obligated Group) Ser. A | | 4.00 | | 12/1/2050 | | 3,000,000 | | 2,385,568 | |

Colorado Health Facilities Authority, Revenue Bonds, Refunding

(Intermountain Healthcare Obligated Group) Ser. A | | 4.00 | | 5/15/2052 | | 1,255,000 | | 1,147,940 | |

Colorado Health Facilities Authority, Revenue Bonds, Ser. A | | 5.00 | | 1/1/2024 | | 2,500,000 | g | 2,512,475 | |

Denver City & County Airport System, Revenue Bonds, Refunding,

Ser. A | | 5.50 | | 11/15/2053 | | 1,000,000 | | 1,065,214 | |

Denver City & County

Airport System, Revenue Bonds, Ser. A | | 5.25 | | 11/15/2043 | | 5,000,000 | | 5,001,582 | |

6

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Colorado

- 9.3% (continued) | | | | | |

Dominion Water & Sanitation District, Revenue Bonds, Refunding | | 5.88 | | 12/1/2052 | | 2,000,000 | | 1,930,033 | |

Hess Ranch Metropolitan

District No. 6, GO, Ser. A1 | | 5.00 | | 12/1/2049 | | 1,500,000 | | 1,304,465 | |

Rampart Range Metropolitan

District No. 5, Revenue Bonds | | 4.00 | | 12/1/2051 | | 1,000,000 | | 703,242 | |

Tender Option Bond

Trust Receipts (Series 2020-XM0829), (Colorado Health Facilities Authority, Revenue Bonds, Refunding

(CommonSpirit Health Obligated Group) Ser. A1) Recourse, Underlying Coupon Rate (%) 4.00 | | 2.99 | | 8/1/2044 | | 2,455,000 | c,e,f | 2,637,055 | |

| | 19,707,183 | |

Connecticut - 1.7% | | | | | |

Connecticut, Revenue

Bonds, Ser. A | | 5.00 | | 5/1/2041 | | 1,000,000 | | 1,084,060 | |

Connecticut Health

& Educational Facilities Authority, Revenue Bonds (The Hartford University) Ser. P | | 5.38 | | 7/1/2052 | | 1,250,000 | | 1,127,608 | |

Connecticut Health & Educational Facilities Authority,

Revenue Bonds, Refunding (Fairfield University) Ser. T | | 4.00 | | 7/1/2055 | | 1,500,000 | | 1,288,746 | |

| | 3,500,414 | |

Florida

- 5.2% | | | | | |

Florida Higher Educational Facilities Financial Authority, Revenue Bonds (Ringling

College Project) | | 5.00 | | 3/1/2049 | | 2,000,000 | | 1,888,137 | |

Hillsborough County

Port District, Revenue Bonds (Tampa Port Authority Project) Ser. B | | 5.00 | | 6/1/2046 | | 1,250,000 | | 1,255,859 | |

Lee Memorial Health System, Revenue Bonds, Refunding, Ser.

A1 | | 4.00 | | 4/1/2049 | | 1,750,000 | | 1,580,889 | |

Pinellas County Industrial

Development Authority, Revenue Bonds (Foundation for Global Understanding) | | 5.00 | | 7/1/2039 | | 1,000,000 | | 993,449 | |

Seminole County Industrial Development Authority, Revenue Bonds,

Refunding (Legacy Pointe at UCF Project) | | 5.75 | | 11/15/2054 | | 500,000 | | 390,591 | |

7

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Florida

- 5.2% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2020-XF2877), (Greater

Orlando Aviation Authority, Revenue Bonds, Ser. A) Recourse, Underlying Coupon Rate (%) 4.00 | | 0.01 | | 10/1/2049 | | 2,480,000 | c,e,f | 2,255,953 | |

Tender Option Bond Trust Receipts (Series 2022-XF1385), (Fort

Myers FL Utility, Revenue Bonds, Refunding, Ser. A) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 1.06 | | 10/1/2044 | | 1,640,000 | c,e,f | 1,561,207 | |

Village Community Development District No. 15, Special Assessment

Bonds | | 5.25 | | 5/1/2054 | | 1,000,000 | c | 1,004,933 | |

| | 10,931,018 | |

Georgia - 4.5% | | | | | |

Fulton County Development Authority, Revenue Bonds, Ser. A | | 5.00 | | 4/1/2042 | | 1,250,000 | | 1,269,777 | |

Georgia Municipal Electric

Authority, Revenue Bonds (Plant Vogtle Units 3&4 Project) Ser. A | | 5.00 | | 7/1/2052 | | 2,500,000 | | 2,555,742 | |

Tender Option Bond Trust Receipts (Series 2019-XF2847), (Municipal

Electric Authority of Georgia, Revenue Bonds (Plant Vogtle Unis 3&4 Project) Ser. A) Recourse, Underlying

Coupon Rate (%) 5.00 | | 4.66 | | 1/1/2056 | | 2,060,000 | c,e,f | 2,081,792 | |

Tender Option Bond Trust Receipts (Series 2020-XM0825), (Brookhaven

Development Authority, Revenue Bonds (Children's Healthcare of Atlanta) Ser. A) Recourse, Underlying

Coupon Rate (%) 4.00 | | 1.44 | | 7/1/2044 | | 3,600,000 | c,e,f | 3,711,373 | |

| | 9,618,684 | |

Hawaii - .6% | | | | | |

Hawaii Airports System, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2047 | | 1,250,000 | | 1,286,098 | |

Illinois - 15.4% | | | | | |

Chicago Board of Education,

GO, Refunding, Ser. A | | 5.00 | | 12/1/2035 | | 1,500,000 | | 1,528,454 | |

Chicago II, GO, Refunding,

Ser. A | | 6.00 | | 1/1/2038 | | 2,500,000 | | 2,635,906 | |

Chicago II, GO, Ser.

A | | 5.00 | | 1/1/2044 | | 2,000,000 | | 2,020,401 | |

Chicago O'Hare International

Airport, Revenue Bonds (Customer Facility Charge) | | 5.75 | | 1/1/2043 | | 3,750,000 | | 3,754,906 | |

Chicago Transit Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 12/1/2057 | | 2,000,000 | | 2,025,398 | |

8

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Illinois

- 15.4% (continued) | | | | | |

Chicago Transit Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 12/1/2045 | | 1,000,000 | | 1,031,670 | |

Illinois, GO, Ser.

D | | 5.00 | | 11/1/2027 | | 3,500,000 | | 3,684,545 | |

Illinois, GO, Ser.

D | | 5.00 | | 11/1/2028 | | 2,600,000 | | 2,733,276 | |

Illinois, Revenue Bonds

(Auxiliary Facilities System) Ser. A | | 5.00 | | 4/1/2044 | | 2,500,000 | | 2,501,704 | |

Illinois Finance Authority, Revenue Bonds (Plymouth Place Obligated

Group) Ser. A | | 6.63 | | 5/15/2052 | | 1,000,000 | | 1,008,425 | |

Metropolitan Pier &

Exposition Authority, Revenue Bonds (McCormick Place Project) (Insured; National Public Finance Guarantee

Corp.) Ser. A | | 0.00 | | 12/15/2036 | | 1,400,000 | h | 784,613 | |

Metropolitan Pier & Exposition Authority, Revenue Bonds,

Refunding (McCormick Place Expansion Project) | | 5.00 | | 6/15/2050 | | 1,750,000 | | 1,755,329 | |

Tender Option Bond Trust Receipts (Series 2017-XM0492), (Illinois

Finance Authority, Revenue Bonds, Refunding (The University of Chicago)) Non-recourse, Underlying Coupon

Rate (%) 5.00 | | 3.14 | | 10/1/2040 | | 7,000,000 | c,e,f | 7,123,788 | |

| | 32,588,415 | |

Indiana - 2.3% | | | | | |

Indiana Finance Authority, Revenue Bonds (BHI Senior Living

Obligated Group) Ser. A | | 6.00 | | 11/15/2023 | | 3,500,000 | g | 3,514,558 | |

Indiana Finance Authority, Revenue Bonds (Green Bond) | | 7.00 | | 3/1/2039 | | 1,925,000 | c | 1,435,999 | |

| | 4,950,557 | |

Iowa - .6% | | | | | |

Iowa Finance Authority, Revenue Bonds, Refunding (Iowa Fertilizer

Co. Project) | | 5.00 | | 12/1/2050 | | 1,250,000 | | 1,237,057 | |

Kansas

- .1% | | | | | |

Kansas Development Finance Authority, Revenue Bonds, Ser. B | | 4.00 | | 11/15/2025 | | 150,000 | | 141,762 | |

Kentucky - 1.5% | | | | | |

Christian County, Revenue

Bonds, Refunding (Jennie Stuart Medical Center Obligated Group) | | 5.50 | | 2/1/2044 | | 1,000,000 | | 1,007,933 | |

Henderson, Revenue Bonds (Pratt Paper Project) Ser. A | | 4.70 | | 1/1/2052 | | 1,000,000 | c | 944,629 | |

9

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Kentucky

- 1.5% (continued) | | | | | |

Kentucky Public Energy Authority, Revenue Bonds, Ser. A1 | | 4.00 | | 8/1/2030 | | 1,310,000 | a | 1,287,645 | |

| | 3,240,207 | |

Louisiana - .9% | | | | | |

Louisiana Public Facilities

Authority, Revenue Bonds (Impala Warehousing Project) | | 6.50 | | 7/1/2036 | | 1,000,000 | c | 1,000,003 | |

Louisiana Public Facilities Authority, Revenue Bonds, Refunding

(Tulane University) Ser. A | | 4.00 | | 4/1/2050 | | 885,000 | | 803,567 | |

Louisiana Public Facilities

Authority, Revenue Bonds, Refunding (Tulane University) Ser. A | | 4.00 | | 4/1/2030 | | 115,000 | g | 121,290 | |

| | 1,924,860 | |

Maryland

- 2.0% | | | | | |

Maryland Economic Development Corp., Revenue Bonds (Green Bond) (Purple Line Transit

Partners) Ser. B | | 5.25 | | 6/30/2055 | | 1,000,000 | | 1,002,695 | |

Maryland Economic Development

Corp., Revenue Bonds (Green Bond) (Purple Line Transit Partners) Ser. B | | 5.25 | | 6/30/2052 | | 3,200,000 | | 3,213,747 | |

| | 4,216,442 | |

Massachusetts

- 2.7% | | | | | |

Massachusetts Development Finance Agency, Revenue Bonds, Refunding (NewBridge

Charles Obligated Group) | | 5.00 | | 10/1/2057 | | 1,000,000 | c | 861,948 | |

Massachusetts Development Finance Agency, Revenue Bonds, Refunding

(Suffolk University Project) | | 5.00 | | 7/1/2034 | | 1,550,000 | | 1,613,717 | |

Massachusetts Development

Finance Agency, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 7/1/2029 | | 900,000 | | 919,131 | |

Massachusetts Educational Financing Authority, Revenue Bonds,

Ser. B | | 5.00 | | 7/1/2030 | | 1,000,000 | | 1,054,830 | |

Massachusetts Port

Authority, Revenue Bonds, Refunding (Bosfuel Project) Ser. A | | 4.00 | | 7/1/2044 | | 1,500,000 | | 1,372,106 | |

| | 5,821,732 | |

Michigan

- 5.1% | | | | | |

Detroit, GO, Ser. A | | 5.00 | | 4/1/2050 | | 1,000,000 | | 969,709 | |

Michigan Building Authority, Revenue Bonds, Refunding | | 4.00 | | 10/15/2049 | | 2,500,000 | | 2,346,071 | |

10

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Michigan

- 5.1% (continued) | | | | | |

Michigan Finance Authority, Revenue Bonds, Refunding (Insured;

National Public Finance Guarantee Corp.) Ser. D6 | | 5.00 | | 7/1/2036 | | 2,250,000 | | 2,265,052 | |

Michigan Housing Development Authority, Revenue Bonds, Ser.

A | | 3.35 | | 12/1/2034 | | 2,500,000 | | 2,347,098 | |

Michigan Tobacco Settlement

Finance Authority, Revenue Bonds, Refunding, Ser. C | | 0.00 | | 6/1/2058 | | 41,200,000 | h | 1,660,900 | |

Wayne County Airport Authority, Revenue Bonds (Detroit Metropolitan

Wayne County Airport) (Insured; Build America Mutual) Ser. B | | 5.00 | | 12/1/2039 | | 1,250,000 | | 1,259,764 | |

| | 10,848,594 | |

Minnesota

- .9% | | | | | |

Duluth Economic Development Authority, Revenue Bonds, Refunding (Essentia Health

Obligated Group) Ser. A | | 5.00 | | 2/15/2058 | | 2,000,000 | | 1,993,290 | |

Missouri

- 2.6% | | | | | |

St. Louis County Industrial Development Authority, Revenue Bonds (Friendship Village

St. Louis Obligated Group) Ser. A | | 5.13 | | 9/1/2049 | | 1,000,000 | | 866,692 | |

St. Louis County Industrial Development Authority, Revenue

Bonds, Refunding (Friendship Village Sunset Hills) | | 5.00 | | 9/1/2042 | | 1,000,000 | | 890,683 | |

Tender Option Bond Trust Receipts (Series 2023-XM1116), (Jackson

County Missouri Special Obligation, Revenue Bonds, Refunding, Ser. A) Non-recourse, Underlying Coupon

Rate (%) 4.25 | | 0.55 | | 12/1/2053 | | 3,000,000 | c,e,f | 2,787,468 | |

The Missouri Health & Educational Facilities Authority,

Revenue Bonds (Mercy Health) | | 4.00 | | 6/1/2053 | | 1,000,000 | | 888,824 | |

| | 5,433,667 | |

Multi-State - .6% | | | | | |

Federal

Home Loan Mortgage Corp. Multifamily Variable Rate Certificates, Revenue Bonds, Ser. M048 | | 3.15 | | 1/15/2036 | | 1,410,000 | c | 1,233,835 | |

Nevada - 1.4% | | | | | |

Clark

County School District, GO (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 4.25 | | 6/15/2041 | | 2,155,000 | | 2,128,958 | |

11

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Nevada

- 1.4% (continued) | | | | | |

Reno, Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal

Corp.) | | 4.00 | | 6/1/2058 | | 1,000,000 | | 864,232 | |

| | 2,993,190 | |

New Hampshire - 1.1%

| | | | | |

New Hampshire Business Finance Authority, Revenue Bonds, Refunding (Springpoint

Senior Living Obligated Group) | | 4.00 | | 1/1/2051 | | 3,000,000 | | 2,247,393 | |

New

Jersey - 5.7% | | | | | |

New Jersey Economic Development Authority, Revenue Bonds | | 5.38 | | 1/1/2043 | | 2,500,000 | | 2,503,380 | |

New Jersey Economic Development Authority, Revenue Bonds (Continental

Airlines Project) | | 5.13 | | 9/15/2023 | | 685,000 | | 685,021 | |

New Jersey Economic

Development Authority, Revenue Bonds, Refunding, Ser. WW | | 5.25 | | 6/15/2025 | | 1,890,000 | g | 1,959,430 | |

New Jersey Economic Development Authority, Revenue Bonds, Refunding,

Ser. XX | | 5.25 | | 6/15/2027 | | 1,155,000 | | 1,187,797 | |

New Jersey Economic

Development Authority, Revenue Bonds, Ser. WW | | 5.25 | | 6/15/2025 | | 110,000 | g | 114,041 | |

New Jersey Health Care Facilities Financing Authority, Revenue

Bonds (RWJ Barnabas Health Obligated Group) | | 4.00 | | 7/1/2051 | | 1,250,000 | | 1,161,961 | |

New Jersey Transportation Trust Fund Authority, Revenue Bonds | | 5.00 | | 6/15/2046 | | 1,000,000 | | 1,028,801 | |

New Jersey Transportation

Trust Fund Authority, Revenue Bonds | | 5.50 | | 6/15/2050 | | 1,600,000 | | 1,744,098 | |

New Jersey Turnpike Authority, Revenue Bonds, Ser. A | | 4.00 | | 1/1/2048 | | 1,800,000 | | 1,715,083 | |

| | 12,099,612 | |

New York - 14.4% | | | | | |

New

York Liberty Development Corp., Revenue Bonds, Refunding (Class 1-3 World Trade Center Project) | | 5.00 | | 11/15/2044 | | 3,500,000 | c | 3,349,813 | |

New York Transportation Development Corp., Revenue Bonds (JFK

International Air Terminal) | | 5.00 | | 12/1/2040 | | 1,200,000 | | 1,237,755 | |

New York Transportation

Development Corp., Revenue Bonds (JFK International Air Terminal) | | 5.00 | | 12/1/2036 | | 2,000,000 | | 2,102,062 | |

12

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

New

York - 14.4% (continued) | | | | | |

Niagara Area Development Corp., Revenue Bonds, Refunding (Covanta

Project) Ser. A | | 4.75 | | 11/1/2042 | | 2,000,000 | c | 1,748,402 | |

Tender Option Bond Trust Receipts (Series 2017-XF2419), (Metropolitan

Transportation Authority, Revenue Bonds) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 3.40 | | 11/15/2038 | | 15,000,000 | c,e,f | 15,000,050 | |

Tender Option Bond Trust Receipts (Series 2022-XM1004), (Metropolitan

Transportation Authority, Revenue Bonds, Refunding (Green Bond) (Insured; Assured Guaranty Municipal

Corp.) Ser. C) Non-recourse, Underlying Coupon Rate (%) 4.00 | | 2.22 | | 11/15/2047 | | 3,300,000 | c,e,f | 3,097,682 | |

Triborough Bridge & Tunnel Authority, Revenue Bonds, Refunding,

Ser. A1 | | 5.00 | | 5/15/2051 | | 2,410,000 | | 2,534,611 | |

TSASC, Revenue Bonds,

Refunding, Ser. B | | 5.00 | | 6/1/2045 | | 585,000 | | 545,311 | |

Westchester County

Local Development Corp., Revenue Bonds, Refunding (Senior Learning Community) | | 5.00 | | 7/1/2041 | | 1,000,000 | c | 848,563 | |

| | 30,464,249 | |

North

Carolina - 1.1% | | | | | |

North Carolina Medical Care Commission, Revenue Bonds, Refunding

(Lutheran Services for the Aging Obligated Group) | | 4.00 | | 3/1/2051 | | 2,000,000 | | 1,365,237 | |

North Carolina Turnpike Authority, Revenue Bonds (Insured;

Assured Guaranty Municipal Corp.) | | 4.00 | | 1/1/2055 | | 1,000,000 | | 919,145 | |

| | 2,284,382 | |

Ohio

- 7.5% | | | | | |

Buckeye Tobacco Settlement Financing Authority, Revenue Bonds, Refunding, Ser.

B2 | | 5.00 | | 6/1/2055 | | 7,700,000 | | 7,049,165 | |

Cuyahoga County, Revenue

Bonds, Refunding (The MetroHealth System) | | 5.25 | | 2/15/2047 | | 2,500,000 | | 2,470,949 | |

Muskingum County, Revenue Bonds (Genesis HealthCare System

Project) | | 5.00 | | 2/15/2044 | | 7,000,000 | | 6,339,822 | |

| | 15,859,936 | |

13

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Oklahoma

- .7% | | | | | |

Tulsa County Industrial Authority, Revenue Bonds, Refunding (Montereau Project) | | 5.25 | | 11/15/2045 | | 1,500,000 | | 1,448,414 | |

Pennsylvania

- 8.1% | | | | | |

Allentown Neighborhood Improvement Zone Development Authority, Revenue Bonds (City

Center Project) | | 5.00 | | 5/1/2042 | | 1,000,000 | c | 990,362 | |

Allentown School District, GO, Refunding (Insured; Build America

Mutual) Ser. B | | 5.00 | | 2/1/2032 | | 1,455,000 | | 1,578,184 | |

Clairton Municipal

Authority, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 12/1/2042 | | 1,500,000 | | 1,500,348 | |

Clairton Municipal Authority, Revenue Bonds, Refunding, Ser.

B | | 5.00 | | 12/1/2037 | | 4,000,000 | | 4,001,614 | |

Montgomery County Industrial

Development Authority, Revenue Bonds (ACTS Retirement-Life Communities Obligated Group) Ser. C | | 5.00 | | 11/15/2045 | | 1,000,000 | | 939,935 | |

Pennsylvania Economic

Development Financing Authority, Revenue Bonds (The Penndot Major Bridges) | | 6.00 | | 6/30/2061 | | 2,000,000 | | 2,172,255 | |

Pennsylvania Higher Educational Facilities Authority, Revenue

Bonds, Refunding (Thomas Jefferson University Obligated Group) Ser. A | | 5.00 | | 9/1/2045 | | 3,000,000 | | 3,004,850 | |

Pennsylvania Turnpike Commission, Revenue Bonds, Ser. A | | 4.00 | | 12/1/2050 | | 1,000,000 | | 911,989 | |

Tender Option Bond

Trust Receipts (Series 2022-XF1525), (Pennsylvania Economic Development Financing Authority UPMC, Revenue

Bonds, Ser. A) Recourse, Underlying Coupon Rate (%) 4.00 | | 2.91 | | 5/15/2053 | | 2,300,000 | c,e,f | 2,054,732 | |

| | 17,154,269 | |

Rhode

Island - 3.8% | | | | | |

Providence Public Building Authority, Revenue Bonds (Insured; Assured Guaranty

Municipal Corp.) Ser. A | | 5.00 | | 9/15/2037 | | 4,000,000 | | 4,192,646 | |

14

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount

($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Rhode

Island - 3.8% (continued) | | | | | |

Tender Option Bond Trust Receipts (Series 2023-XM1117), (Rhode

Island Infrastructure Bank State Revolving Fund, Revenue Bonds) Ser. A) Non-recourse, Underlying Coupon

Rate (%) 4.13 | | 2.37 | | 10/1/2048 | | 4,000,000 | c,e,f | 3,860,239 | |

| | 8,052,885 | |

South Carolina - 4.3% | | | | | |

South Carolina Jobs-Economic

Development Authority, Revenue Bonds, Refunding (Bon Secours Mercy Health) | | 4.00 | | 12/1/2044 | | 1,500,000 | | 1,393,924 | |

South Carolina Jobs-Economic Development Authority, Revenue

Bonds, Refunding (Lutheran Homes of South Carolina Obligated Group) | | 5.13 | | 5/1/2048 | | 1,750,000 | | 1,379,005 | |

South Carolina Public Service Authority, Revenue Bonds, Refunding

(Santee Cooper) | | 5.13 | | 12/1/2043 | | 5,000,000 | | 5,000,382 | |

South Carolina Public

Service Authority, Revenue Bonds, Refunding (Santee Cooper) Ser. A | | 4.00 | | 12/1/2055 | | 1,500,000 | | 1,302,064 | |

| | 9,075,375 | |

South

Dakota - 1.3% | | | | | |

Tender Option Bond Trust Receipts (Series 2022-XF1409), (South Dakota Heath & Educational Facilities Authority,

Revenue Bonds, Refunding (Avera Health Obligated Group)) Non-recourse, Underlying Coupon Rate (%) 5.00 | | 6.56 | | 7/1/2046 | | 2,680,000 | c,e,f | 2,690,877 | |

Tennessee - .6% | | | | | |

Metropolitan

Government Nashville & Davidson County Health & Educational Facilities Board, Revenue Bonds (Belmont

University) | | 5.25 | | 5/1/2048 | | 1,250,000 | | 1,322,454 | |

Texas

- 12.2% | | | | | |

Clifton Higher Education Finance Corp., Revenue Bonds (IDEA Public Schools) | | 6.00 | | 8/15/2043 | | 1,500,000 | | 1,501,567 | |

Clifton Higher Education

Finance Corp., Revenue Bonds (International Leadership of Texas) Ser. A | | 5.75 | | 8/15/2045 | | 2,500,000 | | 2,415,329 | |

15

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Texas

- 12.2% (continued) | | | | | |

Clifton Higher Education Finance Corp., Revenue Bonds (International

Leadership of Texas) Ser. D | | 5.75 | | 8/15/2033 | | 1,000,000 | | 1,010,224 | |

Clifton Higher Education

Finance Corp., Revenue Bonds (International Leadership of Texas) Ser. D | | 6.13 | | 8/15/2048 | | 3,500,000 | | 3,500,802 | |

Dallas Fort Worth International Airport, Revenue Bonds, Refunding,

Ser. B | | 5.00 | | 11/1/2040 | | 1,500,000 | | 1,601,211 | |

Grand Parkway Transportation

Corp., Revenue Bonds, Refunding | | 4.00 | | 10/1/2045 | | 1,165,000 | | 1,077,253 | |

Houston Airport System,

Revenue Bonds, Refunding (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 4.50 | | 7/1/2053 | | 1,400,000 | | 1,346,478 | |

Houston Airport System, Revenue Bonds, Refunding, Ser. A | | 4.00 | | 7/1/2039 | | 2,480,000 | | 2,364,944 | |

Lamar Consolidated

Independent School District, GO | | 4.00 | | 2/15/2053 | | 1,000,000 | | 918,299 | |

Mission Economic Development

Corp., Revenue Bonds, Refunding (Natgasoline Project) | | 4.63 | | 10/1/2031 | | 2,500,000 | c | 2,443,132 | |

Tender Option Bond Trust Receipts (Series 2023-XM1125), (Medina

Valley Independent School District, GO (Insured; Permanent School Fund Guarantee Program)) Non-recourse,

Underlying Coupon Rate (%) 4.00 | | 0.69 | | 2/15/2053 | | 4,500,000 | c,e,f | 4,237,302 | |

Texas Private Activity Bond Surface Transportation Corp., Revenue

Bonds (Segment 3C Project) | | 5.00 | | 6/30/2058 | | 2,000,000 | | 2,003,860 | |

Waxahachie Independent

School District, GO, (Insured; Permanent School Fund Guarantee Program) | | 4.25 | | 2/15/2053 | | 1,500,000 | | 1,454,946 | |

| | 25,875,347 | |

U.S.

Related - 1.8% | | | | | |

Puerto Rico, GO, Ser. A | | 0.00 | | 7/1/2024 | | 26,648 | h | 25,680 | |

Puerto Rico, GO, Ser. A | | 0.00 | | 7/1/2033 | | 211,359 | h | 128,782 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2037 | | 126,704 | | 113,996 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2041 | | 172,269 | | 148,971 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2046 | | 179,157 | | 149,144 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2035 | | 147,628 | | 135,679 | |

Puerto Rico, GO, Ser. A1 | | 4.00 | | 7/1/2033 | | 164,238 | | 153,789 | |

Puerto Rico, GO, Ser. A1 | | 5.38 | | 7/1/2025 | | 182,915 | | 186,395 | |

16

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

U.S.

Related - 1.8% (continued) | | | | | |

Puerto Rico, GO, Ser. A1 | | 5.63 | | 7/1/2029 | | 2,178,318 | | 2,304,748 | |

Puerto Rico, GO, Ser. A1 | | 5.63 | | 7/1/2027 | | 181,259 | | 189,045 | |

Puerto Rico, GO, Ser. A1 | | 5.75 | | 7/1/2031 | | 173,199 | | 187,329 | |

| | 3,723,558 | |

Utah

- 1.7% | | | | | |

Salt Lake City, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2048 | | 1,000,000 | | 1,014,476 | |

Salt Lake City, Revenue Bonds, Ser. A | | 5.00 | | 7/1/2042 | | 1,205,000 | | 1,223,332 | |

Utah Charter School Finance Authority, Revenue Bonds, Refunding

(Summit Academy) Ser. A | | 5.00 | | 4/15/2039 | | 1,400,000 | | 1,435,005 | |

| | 3,672,813 | |

Virginia - 2.0% | | | | | |

Virginia

Small Business Financing Authority, Revenue Bonds (Transform 66 P3 Project) | | 5.00 | | 12/31/2049 | | 1,000,000 | | 1,001,650 | |

Virginia Small Business Financing Authority, Revenue Bonds,

Refunding | | 5.00 | | 12/31/2057 | | 1,500,000 | | 1,505,399 | |

Virginia Small Business

Financing Authority, Revenue Bonds, Refunding (95 Express Lanes) | | 4.00 | | 1/1/2048 | | 1,000,000 | | 865,203 | |

Williamsburg Economic Development Authority, Revenue Bonds

(William & Marry Project) (Insured; Assured Guaranty Municipal Corp.) Ser. A | | 4.13 | | 7/1/2058 | | 1,000,000 | | 939,258 | |

| | 4,311,510 | |

Washington

- 2.7% | | | | | |

Washington Convention Center Public Facilities District, Revenue Bonds, Ser. B | | 4.00 | | 7/1/2058 | | 1,000,000 | | 838,590 | |

Washington Health Care

Facilities Authority, Revenue Bonds, Refunding, Ser. A | | 5.00 | | 10/1/2042 | | 5,000,000 | | 4,792,245 | |

| | 5,630,835 | |

Wisconsin

- 4.6% | | | | | |

Public Finance Authority, Revenue Bonds (Cone Health) Ser. A | | 5.00 | | 10/1/2052 | | 1,000,000 | | 1,019,053 | |

Public Finance Authority, Revenue Bonds (EMU Campus Living)

(Insured; Build America Mutual) Ser. A1 | | 5.50 | | 7/1/2052 | | 1,200,000 | | 1,296,704 | |

Public Finance Authority, Revenue Bonds (EMU Campus Living)

(Insured; Build America Mutual) Ser. A1 | | 5.63 | | 7/1/2055 | | 1,315,000 | | 1,431,602 | |

17

STATEMENT

OF INVESTMENTS (Unaudited) (continued)

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount ($) | | Value

($) | |

Long-Term

Municipal Investments - 153.6% (continued) | | | | | |

Wisconsin

- 4.6% (continued) | | | | | |

Public Finance Authority, Revenue Bonds, Refunding, Ser. B | | 5.00 | | 7/1/2042 | | 5,000,000 | | 4,874,695 | |

Wisconsin Health &

Educational Facilities Authority, Revenue Bonds (Bellin Memorial Hospital Obligated Group) | | 5.50 | | 12/1/2052 | | 1,000,000 | | 1,058,489 | |

| | 9,680,543 | |

Total Investments (cost $339,466,423) | | 153.6% | 325,211,957 | |

Liabilities, Less Cash and Receivables | | (18.2%) | (38,442,851) | |

RVMTPS, at liquidation

value | | (35.4%) | (75,000,000) | |

Net Assets Applicable

to Common Stockholders | | 100.0% | 211,769,106 | |

a These securities have a put feature; the date shown represents

the put date and the bond holder can take a specific action to retain the bond after the put date.

b Zero

coupon until a specified date at which time the stated coupon rate becomes effective until maturity.

c Security

exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may

be resold in transactions exempt from registration, normally to qualified institutional buyers. At August

31, 2023, these securities were valued at $82,493,630 or 38.95% of net assets.

d Non-income producing—security in default.

e The Variable Rate is determined by the Remarketing Agent in

its sole discretion based on prevailing market conditions and may, but need not, be established by reference

to one or more financial indices.

f Collateral for floating rate borrowings. The coupon rate given

represents the current interest rate for the inverse floating rate security.

g These securities are prerefunded; the date shown represents

the prerefunded date. Bonds which are prerefunded are collateralized by U.S. Government securities which

are held in escrow and are used to pay principal and interest on the municipal issue and to retire the

bonds in full at the earliest refunding date.

h Security issued with a zero coupon. Income is recognized through

the accretion of discount.

18

| | |

Portfolio Summary (Unaudited) † | Value

(%) |

Medical | 19.9 |

General | 19.8 |

Education | 18.5 |

Airport | 16.6 |

Transportation | 15.8 |

Development | 13.1 |

Nursing

Homes | 9.0 |

General Obligation | 7.4 |

Water | 5.8 |

School

District | 5.6 |

Tobacco Settlement | 5.3 |

Power | 5.2 |

Prerefunded | 3.9 |

Utilities | 2.6 |

Housing | 1.3 |

Multifamily Housing | 1.2 |

Single Family Housing | 1.1 |

Student Loan | .5 |

Facilities | .5 |

Special Tax | .5 |

| | 153.6 |

† Based on net assets.

See notes to financial statements.

19

| | | | |

| |

Summary

of Abbreviations (Unaudited) |

| |

ABAG | Association

of Bay Area Governments | AGC | ACE Guaranty Corporation |

AGIC | Asset Guaranty Insurance Company | AMBAC | American Municipal Bond Assurance Corporation |

BAN | Bond Anticipation Notes | BSBY | Bloomberg

Short-Term Bank Yield Index |

CIFG | CDC

Ixis Financial Guaranty | COP | Certificate of Participation |

CP | Commercial Paper | DRIVERS | Derivative

Inverse Tax-Exempt Receipts |

EFFR | Effective

Federal Funds Rate | FGIC | Financial Guaranty Insurance Company |

FHA | Federal Housing Administration | FHLB | Federal Home Loan Bank |

FHLMC | Federal Home Loan Mortgage Corporation | FNMA | Federal National Mortgage Association |

GAN | Grant Anticipation Notes | GIC | Guaranteed

Investment Contract |

GNMA | Government National Mortgage Association | GO | General Obligation |

IDC | Industrial

Development Corporation | LIBOR | London Interbank Offered Rate |

LOC | Letter of Credit | LR | Lease

Revenue |

NAN | Note Anticipation Notes | MFHR | Multi-Family

Housing Revenue |

MFMR | Multi-Family Mortgage Revenue | MUNIPSA | Securities Industry and Financial Markets

Association Municipal Swap Index Yield |

OBFR | Overnight

Bank Funding Rate | PILOT | Payment in Lieu of Taxes |

PRIME | Prime Lending Rate | PUTTERS | Puttable

Tax-Exempt Receipts |

RAC | Revenue Anticipation Certificates | RAN | Revenue Anticipation Notes |

RIB | Residual Interest Bonds | SFHR | Single

Family Housing Revenue |

SFMR | Single

Family Mortgage Revenue | SOFR | Secured Overnight Financing Rate |

TAN | Tax Anticipation Notes | TRAN | Tax

and Revenue Anticipation Notes |

TSFR | Term

Secured Overnight

Financing Rate | U.S.

T-BILL | U.S.

Treasury Bill Money Market Yield |

XLCA | XL

Capital Assurance | RVMTPS | Remarketable Variable Rate MuniFund Term

Preferred Shares |

VMTPS | Variable Rate Muni Term Preferred Shares | | |

See

notes to financial statements.

20

STATEMENT OF ASSETS AND LIABILITIES

August

31, 2023 (Unaudited)

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments | 339,466,423 | | 325,211,957 | |

Cash | | | | | 466,693 | |

Interest

receivable | | 3,934,890 | |

Prepaid expenses | | | | | 63,485 | |

| | | | |

329,677,025 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc.

and affiliates—Note 2(b) | | 185,886 | |

Payable for inverse floater notes issued—Note

3 | | 41,405,000 | |

Dividends payable to Common

Stockholders | | 736,263 | |

Interest and expense payable

related to

inverse floater notes issued—Note 3 | | 462,541 | |

Directors’

fees and expenses payable | | 15,970 | |

Other accrued expenses | | | | | 102,259 | |

| | | | |

42,907,919 | |

RVMTPS, $.001 par value per share (750 shares

issued and outstanding

at $100,000 per share liquidation value)—Note 1 | |

75,000,000 | |

Net Assets Applicable to Common Stockholders

($) | | | 211,769,106 | |

Composition

of Net Assets ($): | | | | |

Common Stock, par value, $.001 per share

(18,405,973

shares issued and outstanding) | | | | | 18,406 | |

Paid-in

capital | | | | | 262,501,288 | |

Total distributable earnings

(loss) | | | | | (50,750,588) | |

Net

Assets Applicable to Common Stockholders ($) | | | 211,769,106 | |

| | | | | |

Shares Outstanding | | |

(250 million shares authorized) | 18,405,973 | |

Net

Asset Value Per Share of Common Stock ($) | | 11.51 | |

| | | | |

See notes to financial statements. | | | | |

21

STATEMENT OF OPERATIONS

Six

Months Ended August 31, 2023 (Unaudited)

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Interest Income | | | 7,648,945 | |

Expenses: | | | | |

Management

fee—Note 2(a) | | | 1,082,275 | |

RVMTPS

interest expense and fees—Note 1(g) and Note 3 | | | 1,762,565 | |

Interest and expense related

to inverse

floater notes issued—Note 3 | | | 789,446 | |

Professional

fees | | | 52,457 | |

Shareholders’

reports | | | 27,599 | |

Directors’

fees and expenses—Note 2(c) | | | 27,351 | |

Registration

fees | | | 11,888 | |

Chief

Compliance Officer fees—Note 2(b) | | | 6,316 | |

Shareholder servicing costs | | | 5,511 | |

Tender

and paying agent fees—Note 2(b) | | | 3,975 | |

Custodian fees—Note 2(b) | | | 2,786 | |

Miscellaneous | | | 38,169 | |

Total

Expenses | | |

3,810,338 | |

Less—reduction in fees due

to earnings credits—Note 2(b) | | | (2,786) | |

Net

Expenses | | | 3,807,552 | |

Net Investment Income | | | 3,841,393 | |

Realized

and Unrealized Gain (Loss) on Investments—Note 3 ($): | | |

Net realized gain (loss) on

investments | (1,716,415) | |

Net change in unrealized appreciation

(depreciation) on investments |

(1,223,991) | |

Net Realized and Unrealized Gain (Loss) on

Investments | | | (2,940,406) | |

Net

Increase in Net Assets Applicable to Common

Stockholders Resulting from Operations | | 900,987 | |

| | | | | | |

See notes to financial statements. | | | | | |

22

STATEMENT OF CASH FLOWS

Six

Months Ended August 31, 2023 (Unaudited)

| | | | | | | |

| | | | | |

| | | | | | |

Cash Flows from Operating Activities ($): | | | | | |

Purchases of portfolio securities | |

(51,842,090) | | | |

Proceeds

from sales of portfolio securities |

47,778,107 | | | |

Interest

income received | | 7,783,287 | | | |

Interest and expense related to inverse floater

notes issued | | (689,078) | | | |

RVMTPS interest expense and fees paid | | (1,762,565) | | | |

Expenses paid to BNY Mellon Investment

Adviser, Inc. and affiliates | | (1,083,380) | | | |

Operating expenses paid | | (150,716) | | | |

Net Cash Provided (or Used) in Operating Activities | | | | 33,565 | |

Cash

Flows from Financing Activities ($): | | | | | |

Dividends paid to Common Stockholders | | (4,417,433) | | | |

Increase in payable for inverse floater notes

issued | | 3,275,000 | | | |

Net

Cash Provided (or Used) in Financing Activities | | (1,142,433) | |

Net Increase (Decrease) in Cash | | (1,108,868) | |

Cash

at beginning of period | | 1,575,561 | |

Cash

at End of Period | |

466,693 | |

Reconciliation

of Net Increase (Decrease) in Net Assets Applicable to | | | |

| Common Stockholders Resulting from Operations to | | | |

| Net Cash Provided (or Used) in Operating Activities ($): | | | |

Net

Increase in Net Assets Resulting From Operations | | 900,987 | |

Adjustments to Reconcile Net Increase (Decrease) in Net Assets | | | |

| Applicable to Common Stockholders Resulting from | | | |

| Operations to Net Cash Provided (or Used) in Operating Activities

($): | | | |

Increase in investments in securities at cost | | (1,401,078) | |

Decrease

in interest receivable | | 134,342 | |

Decrease in prepaid expenses | | 42,965

| |

Increase in Due to BNY Mellon Investment

Adviser, Inc. and affiliates | | 9,186 | |

Decrease in payable for investment securities purchased | | (946,490) | |

Increase

in interest and expense payable related to inverse floater notes issued | | 100,368 | |

Decrease

in Directors' fees and expenses payable | | (20,859) | |

Decrease in other accrued expenses | | (9,847) | |

Net

change in unrealized (appreciation) depreciation on investments | | 1,223,991 | |

Net Cash Provided (or

Used) in Operating Activities | |

33,565 | |

| | | | | | |

See

notes to financial statements. | | | | | |

23

STATEMENT

OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | | | | | | |

| | | | Six

Months Ended

August 31, 2023 (Unaudited) | | Year Ended

February 28, 2023 | |

Operations ($): | | | | | | | | |

Net investment income | | | 3,841,393 | | | | 9,676,287 | |

Net

realized gain (loss) on investments | | (1,716,415) | | | | (4,905,702) | |

Net

change in unrealized appreciation

(depreciation) on investments | | (1,223,991) | | | | (33,909,712) | |

Net Increase

(Decrease) in Net Assets Applicable

to Common Stockholders Resulting from

Operations | 900,987 | | | | (29,139,127) | |

Distributions

($): | |

Distributions to stockholders | | | (4,417,433) | | | | (10,747,044) | |

Distributions

to Common Stockholders | | | (4,417,433) | | | | (10,747,044) | |

Capital

Stock Transactions ($): | |

Distributions reinvested | | | - | | | | 85,319 | |

Increase

(Decrease) in Net Assets

from Capital Stock Transactions | - | | | | 85,319 | |

Total

Increase (Decrease) in Net Assets

Applicable to Common Stockholders | (3,516,446) | | | | (39,800,852) | |

Net Assets

Applicable to Common Stockholders ($): | |

Beginning

of Period | | | 215,285,552 | | | | 255,086,404 | |

End of

Period | | | 211,769,106 | | | | 215,285,552 | |

Capital

Share Transactions (Common Shares): | |

Shares issued for distributions

reinvested | | | - | | | | 6,978 | |

Net

Increase (Decrease) in Shares Outstanding |

- | | | | 6,978 | |

| | | | | | | | | |

See notes to financial statements. | | | | | | | | |

24

FINANCIAL

HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated.

Market price total return is calculated assuming an initial investment made at the market price at the

beginning of the period, reinvestment of all dividends and distributions at market price during the period,

and sale at the market price on the last day of the period. These figures have been derived from the

fund’s financial statements and with respect to common stock, market price data for the fund’s common

shares.

| | | | | | | | | |

| | Six

Months Ended | | | |

| | August

31, 2023 | | Year Ended February 28/29, | |

| | (Unaudited) | | 2023 | 2022 | 2021 | 2020 | 2019 | |

Per Share

Data ($): | | | | | | | | |

Net asset value, beginning of period | 11.70 | | 13.86 | 14.41 | 15.06 | 13.75 | 13.96 | |

Investment Operations: | | | | | | | | |

Net investment incomea | .21 | | .53 | .63 | .66 | .64 | .66 | |

Net realized and unrealized

gain

(loss) on investments | (.16) | | (2.11) | (.54) | (.67) | 1.31 | (.23) | |

Total from Investment

Operations | .05 | | (1.58) | .09 | (.01) | 1.95 | .43 | |

Distributions

to

Common Shareholders: | | | | | | | | |

Dividends

from

net investment income | (.24) | | (.58) | (.64) | (.64) | (.64) | (.64) | |

Net asset value, end of period | 11.51 | | 11.70 | 13.86 | 14.41 | 15.06 | 13.75 | |

Market value, end of period | 10.56 | | 10.97 | 13.17 | 13.95 | 14.18 | 12.67 | |

Market

Price Total Return (%) | (1.61) | b | (12.41) | (1.33) | 3.15 | 17.12 | 8.49 | |

Ratios/Supplemental Data (%): | | | | | | | | |

Ratio

of total expenses

to average net assets | 3.49 | c | 2.60 | 1.68 | 1.87 | 2.12 | 2.19 | |

Ratio of net expenses

to

average net assets | 3.49 | c | 2.60 | 1.68 | 1.87 | 2.12 | 2.19 | |

Ratio

of interest and expense related

to inverse floater notes issued,

RVMTPS

and VMTPS interest expense and fees

to average net assets | 2.34 | c | 1.45 | .55 | .69 | 1.05 | 1.07 | |

Ratio of net investment income

to

average net assets | 3.52 | c | 4.29 | 4.32 | 4.72 | 4.43 | 4.76 | |

Portfolio Turnover

Rate | 14.68 | b | 24.75 | 11.33 | 17.56 | 22.94 | 21.46 | |

Asset coverage of

RVMTPS

and VMTPS, end of period | 382 | | 387 | 440 | 453 | 469 | 437 | |

Net Assets, Applicable

to

Common Shareholders,

end of period ($ x 1,000) | 211,769 | | 215,286 | 255,086 | 264,941 | 276,836 | 252,668 | |

RVMTPS and VMTPS outstanding,

end

of period ($ x 1,000) | 75,000 | | 75,000 | 75,000 | 75,000 | 75,000 | 75,000 | |

Floating Rate Notes

outstanding

($ x 1,000) | 41,405 | | 38,130 | 48,640 | 59,890 | 59,845 | 42,055 | |

a Based

on average common shares outstanding.

b Not annualized.

c Annualized.

See

notes to financial statements.

25

NOTES

TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

BNY

Mellon Municipal Bond Infrastructure Fund, Inc. (the “fund”), which is registered under the Investment

Company Act of 1940, as amended (the “Act”), is a diversified closed-end management investment company.

The fund’s investment objective is to seek to provide as high a level of current income exempt from

regular federal income tax as is consistent with the preservation of capital. BNY Mellon Investment Adviser,

Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY

Mellon”), serves as the fund’s investment adviser. Insight North America LLC (the “Sub-Adviser”),

an indirect wholly-owned subsidiary of BNY Mellon and an affiliate of the Adviser, serves as the fund’s

sub-adviser. The fund’s common stock (“Common Stock”) trades on the New York Stock Exchange (the

“NYSE”) under the ticker symbol DMB.

The fund has outstanding 750 shares of

Remarketable Variable Rate MuniFund Term Preferred Shares (“RVMTPS”). The fund is subject to certain

restrictions relating to the RVMTPS. Failure to comply with these restrictions could preclude the fund

from declaring any distributions to shareholders of Common Stock (“Common Shareholders”) or repurchasing

shares of Common Stock and/or could trigger the mandatory redemption of RVMTPS at their liquidation value

(i.e., $100,000 per share). Thus, redemptions of RVMTPS may be deemed to be outside of the control of

the fund.

The RVMTPS have a mandatory redemption date of October 16, 2049, and are subject

to mandatory tender upon each 42 month anniversary of October 16, 2020 or upon the end of a Special Terms

Period (as defined in the fund’s articles supplementary) (each an Early Term Redemption Date (as defined

in the fund’s articles supplementary)), subject to the option of the holders to retain the RVMTPS.

RVMTPS that are neither retained by the holder nor successfully remarketed by the Early Term Redemption

Date will be redeemed by the fund. The fund is subject to a Tender and Paying Agent Agreement with BNY

Mellon, with respect to the RVMTPS.

The holders of RVMTPS, voting as a separate

class, have the right to elect at least two directors. The holders of RVMTPS will vote as a separate

class on certain other matters, as required by law. The fund’s Board of Directors (the “Board”)

has designated Nathan Leventhal and Benaree Pratt Wiley as directors to be elected by the holders of

RVMTPS.

Dividends

on RVMTPS are normally declared daily and paid monthly. The Dividend Rate on the RVMTPS is, except as

otherwise provided, equal to the rate per annum that results from the sum of (1) the

Index Rate plus (2)

26

the Applicable Spread as determined for the RVMTPS on the Rate Determination Date

immediately preceding such Subsequent Rate Period plus (3) the Failed Remarketing Spread (all defined

terms as defined in the fund’s articles supplementary).

The Financial Accounting

Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference

of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to

be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange

Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC

registrants. The fund is an investment company and applies the accounting and reporting guidance of the

FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared

in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results

could differ from those estimates.

The fund enters into contracts

that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is

unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a)

Portfolio valuation: The fair value of a financial instrument is the amount that would be received

to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes

the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority

to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements)

and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally,

GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly

and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced

disclosures around valuation inputs and techniques used during annual and interim periods.

Various

inputs are used in determining the value of the fund’s investments relating to fair value measurements.

These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted

prices in active markets for identical investments.

27

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

Level 2—other significant observable inputs (including quoted prices

for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level

3—significant

unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication

of the risk associated with investing in those securities.

Changes in valuation

techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation

techniques used to value the fund’s investments are as follows:

The Board has designated

the Adviser as the fund’s valuation designee to make all fair value determinations with respect to

the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under

the Act.

Investments in municipal securities are valued each business day by an independent

pricing service (the “Service”) approved by the Board. Investments for which quoted bid prices are

readily available and are representative of the bid side of the market in the judgment of the Service

are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such

securities) and asked prices (as calculated by the Service based upon its evaluation of the market for

such securities). Municipal investments (which constitute a majority of the portfolio securities) are

carried at fair value as determined by the Service, based on methods which include consideration of the

following: yields or prices of municipal securities of comparable quality, coupon, maturity and type;

indications as to values from dealers; and general market conditions. The Service is engaged under the

general oversight of the Board. All of the preceding securities are generally categorized within Level

2 of the fair value hierarchy.

When market quotations or official closing prices are not

readily available, or are determined not to accurately reflect fair value, such as when the value of

a security has been significantly affected by events after the close of the exchange or market on which

the security is principally traded, but before the fund calculates its net asset value, the fund may

value these investments at fair value as determined in accordance with the procedures approved by the

Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical

data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence

the market in which the securities are purchased and sold, and public trading in similar securities of

the issuer or comparable issuers.

28

These securities are either categorized within Level 2 or 3 of the fair value

hierarchy depending on the relevant inputs used.

For securities where observable inputs

are limited, assumptions about market activity and risk are used and such securities are generally categorized

within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of August

31, 2023 in valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level

2- Other Significant Observable Inputs | | Level 3-Significant Unobservable

Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Municipal

Securities | - | 325,211,957 | | - | 325,211,957 | |

Liabilities

($) | | |

Other Financial Instruments: | | |

Inverse Floater Notes†† | - | (41,405,000) | | - | (41,405,000) | |

RVMTPS†† | - | (75,000,000) | | - | (75,000,000) | |

† See

Statement of Investments for additional detailed categorizations, if any.

†† Certain of the fund’s liabilities are held at carrying amount,

which approximates fair value for financial reporting purposes.

(b) Securities transactions

and investment income: Securities transactions are recorded on a trade date basis. Realized gains and

losses from securities transactions are recorded on the identified cost basis. Interest income, adjusted

for accretion of discount and amortization of premium on investments, is earned from settlement date

and recognized on the accrual basis. Securities purchased or sold on a when-issued or delayed delivery

basis may be settled a month or more after the trade date.

(c) Market Risk: The value of the securities

in which the fund invests may be affected by political, regulatory, economic and social developments,

and developments that impact specific economic sectors, industries or segments of the market. The value

of a security may also decline due to general market conditions that are not specifically related to

a particular company or industry, such as real or perceived adverse economic conditions, changes in the

general outlook for corporate earnings, changes in interest or currency rates, changes to inflation,

adverse changes to credit markets or adverse investor sentiment generally.

Additional

Information section within the annual report dated February 28, 2023, provides more details about the

fund’s principal risk factors.

29

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

(d)

Dividends and distributions to Common Shareholders: Dividends and distributions are recorded

on the ex-dividend date. Dividends from net investment income are normally declared and paid monthly.

Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund

may make distributions on a more frequent basis to comply with the distribution requirements of the Internal

Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can

be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income

and capital gain distributions are determined in accordance with income tax regulations, which may differ

from GAAP.

Common Shareholders will have their distributions reinvested

in additional shares of the fund, unless such Common Shareholders elect to receive cash, at the lower

of the market price or net asset value per share (but not less than 95% of the market price). If market

price is equal to or exceeds net asset value, shares will be issued at net asset value. If net asset

value exceeds market price, Computershare Inc., the transfer agent for the fund’s Common Stock, will

buy fund shares in the open market and reinvest those shares accordingly.

On

August 2, 2023, the Board declared a cash dividend of $.040 per share from net investment income, payable

on September 1, 2023, to Common Shareholders of record as of the close of business on August 17, 2023.

The ex-dividend date was August 16, 2023.

(e) Dividends and distributions to shareholders of RVMTPS:

Dividends on RVMTPS are normally declared daily and paid monthly. The Dividend Rate on the RVMTPS is,

except as otherwise provided, equal to the rate per annum that results from the sum of (1) the Index

Rate plus (2) the Applicable Spread as determined for the RVMTPS on the Rate Determination Date immediately

preceding such Subsequent Rate Period plus (3) the Failed Remarketing Spread. The Applicable Rate of

the RVMTPS was equal to the sum of 1.20% per annum plus the Securities Industry and Financial Markets

Association Municipal Swap Index rate of 4.06% on August 31, 2023. The dividend rate as of August 31,

2023 for the RVMTPS was 5.26% (all defined terms as defined in the fund’s articles supplementary).

(f)

Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment

company, which can distribute tax-exempt dividends, by complying with the applicable provisions of the

Code, and to make distributions of income and net realized capital gain sufficient to relieve it from

substantially all federal income and excise taxes.

30

As of and during the period ended August 31, 2023, the fund did not have any liabilities

for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain

tax positions as income tax expense in the Statement of Operations. During the period ended August 31,

2023, the fund did not incur any interest or penalties.

Each tax year in the

three-year period ended February 28, 2023 remains subject to examination by the Internal Revenue Service

and state taxing authorities.

The fund is permitted to carry forward capital losses for

an unlimited period. Furthermore, capital loss carryovers retain their character as either short-term

or long-term capital losses.

The fund has an unused capital loss carryover of $35,350,204

available for federal income tax purposes to be applied against future net realized capital gains, if

any, realized subsequent to February 28, 2023. The fund has $33,596,732 of short-term capital losses

and $1,753,472 of long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal year

ended February 28, 2023 was as follows: tax-exempt income of $10,747,044. The tax character of current

year distributions will be determined at the end of the current fiscal year.

(g) RVMTPS: The

fund’s RVMTPS aggregate liquidation preference is shown as a liability, if any, since they have stated

mandatory redemption date of October 16, 2049. Dividends paid to RVMTPS are treated as interest expense

and recorded on the accrual basis. Costs directly related to the issuance of the RVMTPS are considered

debt issuance costs which have been fully amortized into the expense over the life of the RVMTPS.

NOTE

2—Management Fee, Sub-Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management

agreement (the “Agreement”) with the Adviser, the management fee is computed at the annual rate of

..65% of the value of the fund’s daily total assets, including any assets attributable to effective

leverage, minus certain defined accrued liabilities (the “Managed Assets”) and is payable monthly.

Pursuant to a sub-investment advisory agreement between the Adviser and the Sub-Adviser,

the Adviser pays the Sub-Adviser a monthly fee at the annual rate of .27% of the value of the fund’s

average daily Managed Assets.

31

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

(b)

The

fund has an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY Mellon

and an affiliate of the Adviser, whereby the fund will receive interest income or be charged overdraft

fees when cash balances are maintained. For financial reporting purposes, the fund includes this interest

income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates

the Custodian under a custody agreement, for providing custodial services for the fund. These fees are

determined based on net assets and transaction activity. During the period ended August 31, 2023,

the