DT Midstream, Inc. (NYSE: DTM) today announced third quarter 2023

reported net income of $91 million, or $0.94 per diluted share. For

the third quarter of 2023, operating earnings were $91 million, or

$0.94 per diluted share. Adjusted EBITDA for the quarter was $236

million.

Reconciliations of operating earnings and adjusted EBITDA

(non-GAAP measures) to reported net income are included at the end

of this news release.

The company also announced that the DT Midstream Board of

Directors declared a $0.69 per share dividend on its common stock

payable January 15, 2024 to stockholders of record at the close of

business December 18, 2023.

“We had another great quarter, and we remain confident in our

ability to deliver on our full-year plan,” said David Slater,

President and CEO. “Our construction team continues to make great

progress on our short-cycle growth projects.”

Slater noted the following accomplishments:

- LEAP Phase 1

expansion project placed in-service ahead of schedule in late

August

- Ohio Utica System

construction is progressing ahead of schedule, with an expected

in-service date of Q1 2024

- NEXUS Pipeline added

approximately 50 MMcf/d of additional leased capacity

“Our third quarter financial results increase our confidence in

meeting our financial goals for the year,” said Jeff Jewell,

Executive Vice President and CFO. “We are also in a strong position

to achieve our goals in 2024 and beyond.”

The company has scheduled a conference call to discuss results

for 9:00 a.m. ET (8:00 a.m. CT) today. Investors, the news media

and the public may listen to a live internet broadcast of the call

at this link. The participant toll-free telephone dial-in number in

the U.S. and Canada is 888.330.2022, and the toll number is

646.960.0690; the passcode is 8347152. International access numbers

are available here. The webcast will be archived on the DT

Midstream website at investor.dtmidstream.com.

About DT Midstream

DT Midstream (NYSE: DTM) is an owner, operator and developer of

natural gas interstate and intrastate pipelines, storage and

gathering systems, compression, treatment and surface facilities.

The company transports clean natural gas for utilities, power

plants, marketers, large industrial customers and energy producers

across the Southern, Northeastern and Midwestern United States and

Canada. The Detroit-based company offers a comprehensive,

wellhead-to-market array of services, including natural gas

transportation, storage and gathering. DT Midstream is

transitioning towards net zero greenhouse gas emissions by 2050,

including a plan of achieving 30% of its carbon emissions reduction

by 2030. For more information, please visit the DT Midstream

website at www.dtmidstream.com.

Why DT Midstream Uses Operating Earnings, Adjusted

EBITDA and Distributable Cash Flow

Use of Operating Earnings Information – Operating Earnings

exclude non-recurring items, certain mark-to-market adjustments and

discontinued operations. DT Midstream management believes that

Operating Earnings provide a more meaningful representation of the

company’s earnings from ongoing operations and uses Operating

Earnings as the primary performance measurement for external

communications with analysts and investors. Internally, DT

Midstream uses Operating Earnings to measure performance against

budget and to report to the Board of Directors.

Adjusted EBITDA is defined as GAAP net income attributable to DT

Midstream before expenses for interest, taxes, depreciation and

amortization, and loss from financing activities, further adjusted

to include the proportional share of net income from equity method

investees (excluding interest, taxes, depreciation and

amortization), and to exclude certain items the company considers

non-routine. DT Midstream believes Adjusted EBITDA is useful to the

company and external users of DT Midstream’s financial statements

in understanding operating results and the ongoing performance of

the underlying business because it allows management and investors

to have a better understanding of actual operating performance

unaffected by the impact of interest, taxes, depreciation,

amortization and non-routine charges noted in the table below. We

believe the presentation of Adjusted EBITDA is meaningful to

investors because it is frequently used by analysts, investors and

other interested parties in the midstream industry to evaluate a

company’s operating performance without regard to items excluded

from the calculation of such measure, which can vary substantially

from company to company depending on accounting methods, book value

of assets, capital structure and the method by which assets were

acquired, among other factors. DT Midstream uses Adjusted EBITDA to

assess the company’s performance by reportable segment and as a

basis for strategic planning and forecasting.

Distributable Cash Flow (DCF) is calculated by deducting

earnings from equity method investees, depreciation and

amortization attributable to noncontrolling interests, cash

interest expense, maintenance capital investment (as defined

below), and cash taxes from, and adding interest expense, income

tax expense, depreciation and amortization, certain items we

consider non-routine and dividends and distributions from equity

method investees to, Net Income Attributable to DT Midstream.

Maintenance capital investment is defined as the total capital

expenditures used to maintain or preserve assets or fulfill

contractual obligations that do not generate incremental earnings.

We believe DCF is a meaningful performance measurement because it

is useful to us and external users of our financial statements in

estimating the ability of our assets to generate cash earnings

after servicing our debt, paying cash taxes and making maintenance

capital investments, which could be used for discretionary purposes

such as common stock dividends, retirement of debt or expansion

capital expenditures.

Forward-Looking Statements

This release contains statements which, to the extent they are

not statements of historical or present fact, constitute

“forward-looking statements” under the securities laws. These

forward-looking statements are intended to provide management’s

current expectations or plans for our future operating and

financial performance, business prospects, outcomes of regulatory

proceedings, market conditions, and other matters, based on what we

believe to be reasonable assumptions and on information currently

available to us.

Forward-looking statements can be identified by the use of words

such as “believe,” “expect,” “expectations,” “plans,” “strategy,”

“prospects,” “estimate,” “project,” “target,” “anticipate,” “will,”

“should,” “see,” “guidance,” “outlook,” “confident” and other words

of similar meaning. The absence of such words, expressions or

statements, however, does not mean that the statements are not

forward-looking. In particular, express or implied statements

relating to future earnings, cash flow, results of operations, uses

of cash, tax rates and other measures of financial performance,

future actions, conditions or events, potential future plans,

strategies or transactions of DT Midstream, and other statements

that are not historical facts, are forward-looking statements.

Forward-looking statements are not guarantees of future results

and conditions, but rather are subject to numerous assumptions,

risks, and uncertainties that may cause actual future results to be

materially different from those contemplated, projected, estimated,

or budgeted. Many factors may impact forward-looking statements of

DT Midstream including, but not limited to, the following: changes

in general economic conditions, including increases in interest

rates and associated Federal Reserve policies, a potential economic

recession, and the impact of inflation on our business; industry

changes, including the impact of consolidations, alternative energy

sources, technological advances, infrastructure constraints and

changes in competition; global supply chain disruptions; actions

taken by third-party operators, processors, transporters and

gatherers; changes in expected production from Southwestern Energy

and other third parties in our areas of operation; demand for

natural gas gathering, transmission, storage, transportation and

water services; the availability and price of natural gas to the

consumer compared to the price of alternative and competing fuels;

our ability to successfully and timely implement our business plan;

our ability to complete organic growth projects on time and on

budget; our ability to finance, complete, or successfully integrate

acquisitions; the price and availability of debt and equity

financing; restrictions in our existing and any future credit

facilities and indentures; the effectiveness of the Company’s

information technology and operational technology systems and

practices to detect and defend against evolving cyber attacks on

United States critical infrastructure; changing laws regarding

cybersecurity and data privacy, and any cybersecurity threat or

event; operating hazards, environmental risks, and other risks

incidental to gathering, storing and transporting natural gas;

natural disasters, adverse weather conditions, casualty losses and

other matters beyond our control; the impact of outbreaks of

illnesses, epidemics and pandemics, and any related economic

effects; the impacts of geopolitical events, including the

conflicts in Ukraine and the Middle East; labor relations and

markets, including the ability to attract, hire and retain key

employee and contract personnel; large customer defaults; changes

in tax status, as well as changes in tax rates and regulations; the

effects and associated cost of compliance with existing and future

laws and governmental regulations, such as the Inflation Reduction

Act of 2022; changes in environmental laws, regulations or

enforcement policies, including laws and regulations relating to

climate change and greenhouse gas emissions; ability to develop low

carbon business opportunities and deploy greenhouse gas reducing

technologies; changes in insurance markets impacting costs and the

level and types of coverage available; the timing and extent of

changes in commodity prices; the success of our risk management

strategies; the suspension, reduction or termination of our

customers’ obligations under our commercial agreements; disruptions

due to equipment interruption or failure at our facilities, or

third-party facilities on which our business is dependent; the

effects of future litigation; the qualification of the spin-off of

DT Midstream from DTE Energy ("the Spin-Off") as a tax-free

distribution; the allocation of tax attributes from DTE Energy in

accordance with the agreement that governs the respective rights,

responsibilities and obligations of DTE Energy and DT Midstream

after the Spin-Off with respect to all tax matters; and the risks

described in our Annual Report on Form 10-K for the year ended

December 31, 2022 and our reports and registration statements filed

from time to time with the SEC.

The above list of factors is not exhaustive. New factors emerge

from time to time. We cannot predict what factors may arise or how

such factors may cause actual results to vary materially from those

stated in forward-looking statements, see the discussion under the

section entitled “Risk Factors” in our Annual Report for the year

ended December 31, 2022, filed with the SEC on Form 10-K and any

other reports filed with the SEC. Given the uncertainties and risk

factors that could cause our actual results to differ materially

from those contained in any forward-looking statement, you should

not put undue reliance on any forward-looking statements.

Any forward-looking statements speak only as of the date on

which such statements are made. We are under no obligation to, and

expressly disclaim any obligation to, update or alter our

forward-looking statements, whether as a result of new information,

subsequent events or otherwise.

| DT

Midstream, Inc. Reconciliation of Reported to

Operating Earnings (non-GAAP) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

September 30, |

|

June 30, |

| |

|

2023 |

|

2023 |

| |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes (1) |

|

Operating Earnings |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes (1) |

|

Operating Earnings |

| |

|

(millions) |

| |

Adjustments |

|

|

$ |

— |

|

$ |

— |

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

Net Income Attributable to DT Midstream |

$ |

91 |

|

$ |

— |

|

$ |

— |

|

$ |

91 |

|

$ |

91 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

91 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

2022 |

| |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes(1) |

|

Operating Earnings |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes(1) |

|

Operating Earnings |

| |

|

(millions) |

| |

Pennsylvania income

tax adjustment |

|

|

$ |

— |

|

$ |

— |

|

|

|

|

|

$ |

— |

|

|

$ |

(25 |

) |

A |

|

| |

Gain on

sale |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

(17 |

) |

B |

|

5 |

|

|

|

| |

Net Income

Attributable to DT Midstream |

$ |

263 |

|

$ |

— |

|

$ |

— |

|

$ |

263 |

|

$ |

285 |

|

$ |

(17 |

) |

|

$ |

(20 |

) |

|

$ |

248 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1 |

) |

Excluding tax

related adjustments, the amount of income taxes was calculated

based on a combined federal and state income tax rate, considering

the applicable jurisdictions of the respective segments and

deductibility of specific operating adjustments |

|

Adjustments Key |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

Pennsylvania state

tax rate reduction impact to deferred income tax expense |

|

B |

Gain on sale of

certain assets in the Utica shale region — recorded in Assets

(gains) losses and impairments, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DT

Midstream, Inc. Reconciliation of Reported to

Operating Earnings per diluted share (2)

(non-GAAP) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

September 30, |

|

June 30, |

| |

|

2023 |

|

2023 |

| |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes (1) |

|

Operating Earnings |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes (1) |

|

Operating Earnings |

| |

|

(per share) |

| |

Adjustments |

|

|

$ |

— |

|

$ |

— |

|

|

|

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

Net Income Attributable to DT Midstream |

$ |

0.94 |

|

$ |

— |

|

$ |

— |

|

$ |

0.94 |

|

$ |

0.93 |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.93 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

2022 |

| |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes(1) |

|

Operating Earnings |

|

Reported Earnings |

|

Pre-tax Adjustments |

|

Income Taxes(1) |

|

Operating Earnings |

| |

|

(per share) |

| |

Pennsylvania income

tax adjustment |

|

|

$ |

— |

|

$ |

— |

|

|

|

|

|

$ |

— |

|

|

$ |

(0.26 |

) |

A |

|

| |

Gain on

sale |

|

|

|

— |

|

|

— |

|

|

|

|

|

|

(0.17 |

) |

B |

|

0.04 |

|

|

|

| |

Net Income

Attributable to DT Midstream |

$ |

2.70 |

|

$ |

— |

|

$ |

— |

|

$ |

2.70 |

|

$ |

2.94 |

|

$ |

(0.17 |

) |

|

$ |

(0.22 |

) |

|

$ |

2.55 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1 |

) |

Excluding tax

related adjustments, the amount of income taxes was calculated

based on a combined federal and state income tax rate, considering

the applicable jurisdictions of the respective segments and

deductibility of specific operating adjustments |

|

(2 |

) |

Per share amounts

are divided by Weighted Average Common Shares Outstanding —

Diluted, as noted on the Consolidated Statements of Operations |

|

Adjustments Key |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

Pennsylvania state

tax rate reduction impact to deferred income tax expense |

|

B |

Gain on sale of

certain assets in the Utica shale region — recorded in Assets

(gains) losses and impairments, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DT

Midstream, Inc. Reconciliation of Net Income

Attributable to DT Midstream to Adjusted EBITDA

(non-GAAP) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

Nine Months Ended |

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

Consolidated |

(millions) |

| |

Net Income Attributable to DT

Midstream |

$ |

91 |

|

|

$ |

91 |

|

|

$ |

263 |

|

|

$ |

285 |

|

| |

Plus: Interest expense |

|

38 |

|

|

|

35 |

|

|

|

111 |

|

|

|

99 |

|

| |

Plus: Income tax expense |

|

33 |

|

|

|

30 |

|

|

|

102 |

|

|

|

65 |

|

| |

Plus: Depreciation and

amortization |

|

46 |

|

|

|

44 |

|

|

|

133 |

|

|

|

126 |

|

| |

Plus: Loss from financing

activities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13 |

|

| |

Plus: EBITDA from equity

method investees (1) |

|

70 |

|

|

|

67 |

|

|

|

212 |

|

|

|

150 |

|

| |

Plus: Adjustments for

non-routine items (2) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(17 |

) |

| |

Less: Interest income |

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(2 |

) |

| |

Less: Earnings from equity

method investees |

|

(41 |

) |

|

|

(41 |

) |

|

|

(132 |

) |

|

|

(107 |

) |

| |

Less: Depreciation and

amortization attributable to noncontrolling interests |

|

(1 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

|

|

(2 |

) |

| |

Adjusted EBITDA |

$ |

236 |

|

|

$ |

224 |

|

|

$ |

685 |

|

|

$ |

610 |

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

Includes share of

our equity method investees’ earnings before interest, taxes,

depreciation and amortization, which we refer to as “EBITDA.” A

reconciliation of earnings from equity method investees to EBITDA

from equity method investees follows: |

| |

|

Three Months Ended |

Nine Months Ended |

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

| |

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(millions) |

| |

Earnings from equity methods

investees |

$ |

41 |

|

|

$ |

41 |

|

|

$ |

132 |

|

|

$ |

107 |

|

| |

Plus: Depreciation and

amortization attributable to equity method investees |

|

20 |

|

|

|

20 |

|

|

|

61 |

|

|

|

36 |

|

| |

Plus: Interest expense

attributable to equity method investees |

|

9 |

|

|

|

6 |

|

|

|

19 |

|

|

|

7 |

|

| |

EBITDA from equity method

investees |

$ |

70 |

|

|

$ |

67 |

|

|

$ |

212 |

|

|

$ |

150 |

|

| |

|

|

|

|

|

|

|

|

|

(2 |

) |

Adjusted EBITDA

calculation excludes certain items we consider non-routine. For the

nine months ended September 30, 2022, adjustments for non-routine

items included a $17 million gain on sale of certain assets in the

Utica shale region. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DT

Midstream, Inc. Reconciliation of Net Income

Attributable to DT Midstream to Adjusted

EBITDAPipeline Segment (non-GAAP) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

Nine Months Ended |

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

Pipeline |

(millions) |

| |

Net Income Attributable to DT

Midstream |

$ |

64 |

|

|

$ |

64 |

|

|

$ |

185 |

|

|

$ |

170 |

|

| |

Plus: Interest expense |

|

13 |

|

|

|

13 |

|

|

|

42 |

|

|

|

41 |

|

| |

Plus: Income tax expense |

|

23 |

|

|

|

21 |

|

|

|

72 |

|

|

|

40 |

|

| |

Plus: Depreciation and

amortization |

|

17 |

|

|

|

17 |

|

|

|

50 |

|

|

|

46 |

|

| |

Plus: Loss from financing

activities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6 |

|

| |

Plus: EBITDA from equity

method investees (1) |

|

70 |

|

|

|

67 |

|

|

|

212 |

|

|

|

150 |

|

| |

Less: Interest income |

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

|

|

(1 |

) |

| |

Less: Earnings from equity

method investees |

|

(41 |

) |

|

|

(41 |

) |

|

|

(132 |

) |

|

|

(107 |

) |

| |

Less: Depreciation and

amortization attributable to noncontrolling interests |

|

(1 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

|

|

(2 |

) |

| |

Adjusted EBITDA |

$ |

145 |

|

|

$ |

139 |

|

|

$ |

425 |

|

|

$ |

343 |

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

Includes share of

our equity method investees’ earnings before interest, taxes,

depreciation and amortization, which we refer to as “EBITDA.” A

reconciliation of earnings from equity method investees to EBITDA

from equity method investees follows: |

| |

|

Three Months Ended |

Nine Months Ended |

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

| |

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(millions) |

| |

Earnings from equity methods

investees |

$ |

41 |

|

|

$ |

41 |

|

|

$ |

132 |

|

|

$ |

107 |

|

| |

Plus: Depreciation and

amortization attributable to equity method investees |

|

20 |

|

|

|

20 |

|

|

|

61 |

|

|

|

36 |

|

| |

Plus: Interest expense

attributable to equity method investees |

|

9 |

|

|

$ |

6 |

|

|

|

19 |

|

|

|

7 |

|

| |

EBITDA from equity method

investees |

$ |

70 |

|

|

$ |

67 |

|

|

$ |

212 |

|

|

$ |

150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DT

Midstream, Inc. Reconciliation of Net Income

Attributable to DT Midstream to Adjusted

EBITDAGathering Segment (non-GAAP) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

Nine Months Ended |

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

2023 |

|

2023 |

|

|

2022 |

|

| |

Gathering |

(millions) |

|

|

Net Income Attributable to DT Midstream |

$ |

27 |

|

$ |

27 |

|

$ |

78 |

|

$ |

115 |

|

| |

Plus: Interest expense |

|

25 |

|

|

22 |

|

|

69 |

|

|

58 |

|

| |

Plus: Income tax expense |

|

10 |

|

|

9 |

|

|

30 |

|

|

25 |

|

| |

Plus: Depreciation and

amortization |

|

29 |

|

|

27 |

|

|

83 |

|

|

80 |

|

| |

Plus: Loss from financing

activities |

|

— |

|

|

— |

|

|

— |

|

|

7 |

|

| |

Plus: Adjustments for

non-routine items (1) |

|

— |

|

|

— |

|

|

— |

|

|

(17 |

) |

| |

Less: Interest income |

|

— |

|

|

— |

|

|

— |

|

|

(1 |

) |

| |

Adjusted EBITDA |

$ |

91 |

|

$ |

85 |

|

$ |

260 |

|

$ |

267 |

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

Adjusted EBITDA

calculation excludes certain items we consider non-routine. For the

nine months ended September 30, 2022, adjustments for non-routine

items included a $17 million gain on sale of certain assets in the

Utica shale region. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| DT

Midstream, Inc. Reconciliation of Net Income

Attributable to DT Midstream to Distributable Cash Flow

(non-GAAP) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

Nine Months Ended |

| |

|

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

(millions) |

| |

Net Income Attributable to DT

Midstream |

$ |

91 |

|

|

$ |

91 |

|

|

$ |

263 |

|

|

$ |

285 |

|

| |

Plus: Interest expense |

|

38 |

|

|

|

35 |

|

|

|

111 |

|

|

|

99 |

|

| |

Plus: Income tax expense |

|

33 |

|

|

|

30 |

|

|

|

102 |

|

|

|

65 |

|

| |

Plus: Depreciation and

amortization |

|

46 |

|

|

|

44 |

|

|

|

133 |

|

|

|

126 |

|

| |

Plus: Loss from financing

activities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

13 |

|

| |

Plus: Adjustments for

non-routine items (1) |

|

— |

|

|

|

(371 |

) |

|

|

(371 |

) |

|

|

(17 |

) |

| |

Less: Earnings from equity

method investees |

|

(41 |

) |

|

|

(41 |

) |

|

|

(132 |

) |

|

|

(107 |

) |

| |

Less: Depreciation and

amortization attributable to noncontrolling interests |

|

(1 |

) |

|

|

(1 |

) |

|

|

(3 |

) |

|

|

(2 |

) |

| |

Plus: Dividends and

distributions from equity method investees |

|

48 |

|

|

|

427 |

|

|

|

557 |

|

|

|

128 |

|

| |

Less: Cash interest

expense |

|

(7 |

) |

|

|

(63 |

) |

|

|

(76 |

) |

|

|

(59 |

) |

| |

Less: Cash taxes |

|

(3 |

) |

|

|

(18 |

) |

|

|

(21 |

) |

|

|

(9 |

) |

| |

Less: Maintenance capital

investment (2) |

|

(11 |

) |

|

|

(8 |

) |

|

|

(22 |

) |

|

|

(15 |

) |

| |

Distributable Cash Flow |

$ |

193 |

|

|

$ |

125 |

|

|

$ |

541 |

|

|

$ |

507 |

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

Distributable Cash

Flow calculation excludes certain items we consider non-routine.

For the three months ended June 30, 2023 and the nine months ended

September 30, 2023, adjustments for non-routine items included the

$371 million NEXUS financing distribution. For the nine months

ended September 30, 2022, adjustments for non-routine items

included a $17 million gain on sale of certain assets in the Utica

shale region. |

|

(2 |

) |

Maintenance

capital investment is defined as the total capital expenditures

used to maintain or preserve assets or fulfill contractual

obligations that do not generate incremental earnings. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Relations

Todd Lohrmann, DT Midstream, 313.774.2424

investor_relations@dtmidstream.com

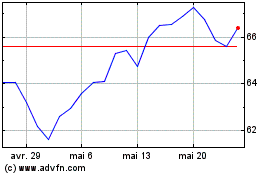

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025