DT Midstream Announces Pricing of Offering of Senior Secured Notes

21 Novembre 2024 - 10:05PM

DT Midstream, Inc. (“DT Midstream” or the “Company”) (NYSE: DTM)

today announced that it has priced an offering (the “Offering”) of

$650,000,000 of 5.800% Senior Secured Notes due 2034 (the “Notes”).

The Notes will be issued by DT Midstream, guaranteed by certain of

DT Midstream’s subsidiaries and secured by a first priority lien on

certain assets of DT Midstream and its subsidiary guarantors that

secure DT Midstream’s existing credit facilities and existing

senior secured notes. The Offering is expected to close on December

6, 2024, subject to the satisfaction of customary closing

conditions.

DT Midstream intends to use the net proceeds from the sale of

the Notes, together with the proceeds from its recently completed

offering of common stock, borrowings under its revolving credit

facility and cash on hand, to fund the consideration payable by DT

Midstream in the previously announced, pending acquisition of all

of the equity interests in Guardian Pipeline, L.L.C., Midwestern

Gas Transmission Company and Viking Gas Transmission Company from

ONEOK Partners Intermediate Limited Partnership and Border

Midwestern Company (the “Pending Acquisition”).

The Notes are being sold in a private placement to persons

reasonably believed to be “qualified institutional buyers” pursuant

to Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”), and to non-U.S. persons outside the United

States under Regulation S under the Securities Act. The Notes have

not been and will not be registered under the Securities Act and

may not be offered or sold in the United States absent registration

or an applicable exemption from, or in a transaction not subject

to, the registration requirements of the Securities Act and other

applicable securities laws.

This press release is neither an offer to sell nor a

solicitation of an offer to buy the Notes, nor shall there be any

sale of the Notes in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such

jurisdiction.

About DT Midstream

DT Midstream (NYSE: DTM) is an owner, operator and developer of

natural gas interstate and intrastate pipelines, storage and

gathering systems, compression, treatment and surface facilities.

The Company transports clean natural gas for utilities, power

plants, marketers, large industrial customers and energy producers

across the Southern, Northeastern and Midwestern United States and

Canada. The Detroit-based company offers a comprehensive,

wellhead-to-market array of services, including natural gas

transportation, storage and gathering. DT Midstream is

transitioning towards net zero greenhouse gas emissions by 2050,

including a goal of achieving 30% of its carbon emissions reduction

by 2030.

Forward-Looking Statements

This release contains statements which, to the extent they are

not statements of historical or present fact, constitute

“forward-looking statements” under the securities laws.

Forward-looking statements can be identified by the use of words

such as “believe,” “expect,” “expectations,” “plans,” “intends,”

“continues,” “forecasts,” “goals,” “strategy,” “prospects,”

“estimate,” “project,” “scheduled,” “target,” “anticipate,”

“could,” “may,” “might,” “will,” “should,” “see,” “guidance,”

“outlook,” “confident” and other words of similar meaning. The

absence of such words, expressions or statements, however, does not

mean that the statements are not forward-looking.

Forward-looking statements are not guarantees of future results

and conditions, but rather are subject to numerous assumptions,

risks, and uncertainties that may cause actual future results to be

materially different from those contemplated, projected, estimated,

or budgeted. This release contains forward-looking statements about

DT Midstream’s intention to issue the Notes at the closing of the

Offering, DT Midstream’s intended use of proceeds and the Pending

Acquisition. The closing of the Offering of the Notes is subject to

the satisfaction of customary closing conditions. DT Midstream may

not be able to close the Offering of the Notes on the anticipated

timeline or at all. For additional discussion of risk factors which

may affect DT Midstream’s results, please see the discussion under

the section entitled “Risk Factors” in our Annual Report on Form

10-K and any other reports filed with the SEC.

The above list of factors is not exhaustive. New factors emerge

from time to time. DT Midstream cannot predict what factors may

arise or how such factors may cause actual results to vary

materially from those stated in forward-looking statements. Given

the uncertainties and risk factors that could cause our actual

results to differ materially from those contained in any

forward-looking statement, you should not put any undue reliance on

any forward-looking statements.

Any forward-looking statements speak only as of the date on

which such statements are made. We are under no obligation to, and

expressly disclaim any obligation to, update or alter our

forward-looking statements, whether as a result of new information,

subsequent events or otherwise.

Investor Relations

Todd Lohrmann, DT Midstream, 313.774.2424

investor_relations@dtmidstream.com

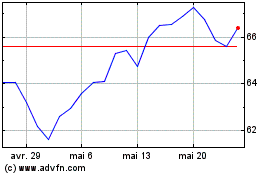

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025