DT Midstream, Inc. (NYSE: DTM) today announced the pricing of its

previously announced underwritten registered public offering. The

size of the offering increased from the previously announced

$300,000,000 of shares of common stock to $366,125,000 of shares of

the company’s common stock at a price to the public of $101 per

share, for gross proceeds of approximately $366,125,000, before the

underwriting discount and estimated offering expenses.

Additionally, the Company has granted the underwriters a 30-day

option to purchase up to an additional 543,750 shares of its common

stock at the public offering price less the underwriting discounts

and commissions. The offering is expected to close on or about

November 21, 2024, subject to market and other customary closing

conditions.

The Company intends to use the net proceeds from this offering,

together with proceeds from the expected issuance of up to $650

million aggregate principal amount of new senior secured notes,

borrowings under our revolving credit facility and cash on hand, to

fund the consideration payable by us in the previously announced,

pending acquisition of all of the equity interests in Guardian

Pipeline, L.L.C., Midwestern Gas Transmission Company and Viking

Gas Transmission Company from ONEOK Partners Intermediate Limited

Partnership and Border Midwestern Company. Barclays Capital Inc. is

acting as lead book-running manager. J.P. Morgan, PNC Capital

Markets LLC, Wells Fargo Securities, TD Securities, Citigroup and

BofA Securities are acting as joint book-running managers. The

closing of the offering is not conditioned upon the closing of the

pending acquisition.

The shares described above are being offered by the Company

pursuant to the Company’s shelf registration statement on Form S-3

(File No. 333-283345), including a base prospectus, that was

previously filed by the Company with the Securities and Exchange

Commission (“SEC”) and that became automatically effective on

November 19, 2024. The offering will be made only by means of a

preliminary prospectus supplement and the accompanying base

prospectus, which are available for free on the SEC’s website

located at http://www.sec.gov. A final prospectus relating to the

offering will be filed with the SEC and may be obtained, when

available, by contacting: Barclays Capital Inc., c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

emailing Barclaysprospectus@broadridge.com or calling (888)

603-5847.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any shares of the Company’s common

stock or any other security, nor is there any offer or sale of

these securities in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About DT Midstream

DT Midstream (NYSE: DTM) is an owner, operator and developer of

natural gas interstate and intrastate pipelines, storage and

gathering systems, compression, treatment and surface facilities.

The company transports clean natural gas for utilities, power

plants, marketers, large industrial customers and energy producers

across the Southern, Northeastern and Midwestern United States and

Canada. The Detroit-based company offers a comprehensive,

wellhead-to-market array of services, including natural gas

transportation, storage and gathering. DT Midstream is

transitioning towards net zero greenhouse gas emissions by 2050,

including a goal of achieving 30% of its carbon emissions reduction

by 2030.

Safe Harbor StatementThis press release

includes forward-looking statements within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, which are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995,

as amended. Words such as “expects” or “intends” or other similar

expressions are intended to identify forward-looking statements.

Such statements relate to the proposed public offering and the

anticipated use of the net proceeds from the offering. No assurance

can be given that the offering discussed above will be completed on

the terms described, or at all.

Forward-looking Statements

This release contains statements which, to the extent they are

not statements of historical or present fact, constitute

“forward-looking statements” under the securities laws. These

forward-looking statements are intended to provide management’s

current expectations or plans for our future operating and

financial performance, business prospects, outcomes of regulatory

proceedings, market conditions, and other matters, based on what we

believe to be reasonable assumptions and on information currently

available to us.

Forward-looking statements can be identified by the use of words

such as “believe,” “expect,” “expectations,” “plans,” “strategy,”

“prospects,” “estimate,” “project,” “target,” “anticipate,” “will,”

“should,” “see,” “guidance,” “outlook,” “confident” and other words

of similar meaning. The absence of such words, expressions or

statements, however, does not mean that the statements are not

forward-looking. In particular, express or implied statements

relating to future earnings, cash flow, results of operations, uses

of cash, tax rates and other measures of financial performance,

future actions, conditions or events, potential future plans,

strategies or transactions of DT Midstream, and other statements

that are not historical facts, are forward-looking statements.

Forward-looking statements are not guarantees of future results

and conditions, but rather are subject to numerous assumptions,

risks, and uncertainties that may cause actual future results to be

materially different from those contemplated, projected, estimated,

or budgeted. Many factors may impact forward-looking statements of

DT Midstream including, but not limited to, the following: changes

in general economic conditions, including increases in interest

rates and associated Federal Reserve policies, a potential economic

recession, and the impact of inflation on our business; industry

changes, including the impact of consolidations, alternative energy

sources, technological advances, infrastructure constraints and

changes in competition; global supply chain disruptions; actions

taken by third-party operators, processors, transporters and

gatherers; changes in expected production from Expand Energy

Corporation and other third parties in our areas of operation;

demand for natural gas gathering, transmission, storage,

transportation and water services; the availability and price of

natural gas to the consumer compared to the price of alternative

and competing fuels; our ability to successfully and timely

implement our business plan; our ability to complete organic growth

projects on time and on budget; our ability to finance, complete,

or successfully integrate acquisitions; the price and availability

of debt and equity financing; our ability to fund and close the

pending transaction, the anticipated timing and terms of the

pending transaction, our ability to realize the anticipated

benefits of the pending transaction, and our ability to manage the

risks of the pending transaction; restrictions in our existing and

any future credit facilities and indentures; the effectiveness of

our information technology and operational technology systems and

practices to prevent, detect and defend against evolving cyber

attacks on United States critical infrastructure; changing laws

regarding cybersecurity and data privacy, and any cybersecurity

threat or event; operating hazards, environmental risks, and other

risks incidental to gathering, storing and transporting natural

gas; geologic and reservoir risks and considerations; natural

disasters, adverse weather conditions, casualty losses and other

matters beyond our control; the impact of outbreaks of illnesses,

epidemics and pandemics, and any related economic effects; the

impacts of geopolitical events, including the conflicts in Ukraine

and the Middle East; labor relations and markets, including the

ability to attract, hire and retain key employee and contract

personnel; large customer defaults; changes in tax status, as well

as changes in tax rates and regulations; the effects and associated

cost of compliance with existing and future laws and governmental

regulations, such as the Inflation Reduction Act; changes in

environmental laws, regulations or enforcement policies, including

laws and regulations relating to climate change and greenhouse gas

emissions; ability to develop low carbon business opportunities and

deploy greenhouse gas reducing technologies; changes in insurance

markets impacting costs and the level and types of coverage

available; the timing and extent of changes in commodity prices;

the success of our risk management strategies; the suspension,

reduction or termination of our customers’ obligations under our

commercial agreements; disruptions due to equipment interruption or

failure at our facilities, or third-party facilities on which our

business is dependent; the effects of future litigation; and the

risks described in our Annual Report on Form 10-K for the year

ended December 31, 2023 and our reports and registration statements

filed from time to time with the SEC.

The above list of factors is not exhaustive. New factors emerge

from time to time. We cannot predict what factors may arise or how

such factors may cause actual results to vary materially from those

stated in forward-looking statements, see the discussion under the

section entitled “Risk Factors” in our Annual Report for the year

ended December 31, 2023, filed with the SEC on Form 10-K and any

other reports filed with the SEC. Given the uncertainties and risk

factors that could cause our actual results to differ materially

from those contained in any forward-looking statement, you should

not put undue reliance on any forward-looking statements.

Any forward-looking statements speak only as of the date on

which such statements are made. We are under no obligation to, and

expressly disclaim any obligation to, update or alter our

forward-looking statements, whether as a result of new information,

subsequent events or otherwise.

Investor Relations

Todd Lohrmann, DT Midstream, 313.774.2424

investor_relations@dtmidstream.com

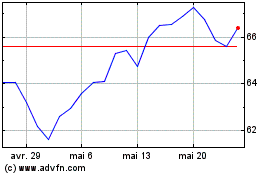

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

DT Midstream (NYSE:DTM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025