Ellington Credit Announces Shareholder Approval of Conversion to CLO Closed-End Fund

21 Janvier 2025 - 1:45PM

Business Wire

—Conversion to be Completed in the Near

Future—

Ellington Credit Company (the “Company” or “we”) (NYSE: EARN)

announced today that it has received shareholder approval, at a

special meeting of shareholders (the “Special Meeting”), for the

Company’s conversion (the “Conversion”) to a Delaware registered

closed-end fund. The converted entity will focus on corporate CLO

investments and will be treated as a regulated investment company

(“RIC”) under the Internal Revenue Code. The Conversion is

anticipated to become effective in the near future, and will be

accompanied by a separate press release.

Over 93% of the votes cast at the Special Meeting were in favor

of the Conversion, and excluding abstentions, over 95% of such

votes were cast in favor. The holder of the Company’s Series A

Preferred Shares (the “Preferred Shares”) cast its votes in

proportion to those cast by common shareholders, as required. The

Preferred Shares were automatically redeemed following the

vote.

Laurence Penn, Chief Executive Officer and President,

commented:

“I would like to thank our shareholders for their overwhelming

support throughout this conversion process. We believe that

completing our strategic transformation will greatly enhance our

ability to deliver strong earnings and unlock additional value for

our shareholders moving forward.”

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are not

historical in nature and can be identified by words such as

"anticipate," "estimate," "will," "should," "may," "expect,"

"project," "believe," "intend," "seek," "plan" and similar

expressions or their negative forms, or by references to strategy,

plans, or intentions. Forward-looking statements are based on our

beliefs, assumptions and expectations of our future operations,

business strategies, performance, financial condition, liquidity

and prospects, taking into account information currently available

to us. These beliefs, assumptions, and expectations are subject to

numerous risks and uncertainties and can change as a result of many

possible events or factors, not all of which are known to us. If a

change occurs, our business, financial condition, liquidity,

results of operations and strategies may vary materially from those

expressed or implied in our forward-looking statements. The

following factors are examples of those that could cause actual

results to vary from those stated or implied by our forward-looking

statements: changes in interest rates and the market value of our

investments, market volatility, changes in the default rates on

corporate loans, our ability to borrow to finance our assets,

changes in government regulations affecting our business, our

ability to maintain our exclusion from registration under the

Investment Company Act of 1940, our ability to pivot our investment

strategy to focus on collateralized loan obligations ("CLOs"), a

deterioration in the CLO market, our ability to utilize our net

operating loss carryforwards, our ability to convert to a closed

end fund/RIC, and other changes in market conditions and economic

trends, such as changes to fiscal or monetary policy, heightened

inflation, slower growth or recession, and currency fluctuations.

Furthermore, as stated above, forward-looking statements are

subject to numerous risks and uncertainties, including, among other

things, those described under Item 1A of our Annual Report on Form

10-K, which can be accessed through the link to our SEC filings

under "For Investors" on our website (at www.ellingtoncredit.com)

or at the SEC's website (www.sec.gov). Other risks, uncertainties,

and factors that could cause actual results to differ materially

from those projected or implied may be described from time to time

in reports we file with the SEC, including reports on Forms 10-Q,

10-K and 8-K. We undertake no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

This release and the information contained herein do not

constitute an offer of any securities or solicitation of an offer

to purchase securities.

About Ellington Credit Company

Ellington Credit Company, formerly known as Ellington

Residential Mortgage REIT, was initially formed as a real estate

investment trust ("REIT") that invested primarily in residential

mortgage-backed securities ("MBS"). On March 29, 2024, the

Company’s Board of Trustees approved a strategic transformation of

its investment strategy to focus on corporate CLOs, with an

emphasis on mezzanine debt and equity tranches. In connection with

this transformation, the Company revoked its election to be taxed

as a REIT effective January 1, 2024, and rebranded to Ellington

Credit Company. The Company intends to convert to a closed-end fund

and complete its transition from an MBS-focused company to a

CLO-focused company.

Ellington Credit Company is externally managed and advised by

Ellington Credit Company Management LLC, an affiliate of Ellington

Management Group, L.L.C.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250120332373/en/

Investors: Ellington Credit Company Investor Relations (203)

409-3773 info@ellingtoncredit.com or Media: Amanda Shpiner/Grace

Cartwright Gasthalter & Co. for Ellington Credit Company (212)

257-4170 Ellington@gasthalter.com

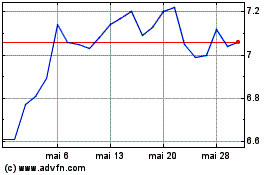

Ellington Credit (NYSE:EARN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Ellington Credit (NYSE:EARN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025