Excelerate Energy, Inc. (NYSE: EE) (the “Company” or

“Excelerate”) today reported its financial results for the second

quarter ended June 30, 2023.

RECENT HIGHLIGHTS

- Reported Net Income of $29.6 million for the second

quarter

- Reported Adjusted EBITDA of $88.6 million for the second

quarter

- Secured contracts to sell four spot LNG cargos into Bangladesh

in 2023, two delivered in the second quarter

- Commenced seasonal regasification services at the Bahia Blanca

GasPort in Argentina in May 2023

- Declared a quarterly dividend of $0.025 per share, payable on

September 7, 2023

CEO COMMENT

“The strong financial results we delivered in the second quarter

of 2023 are a testament to the steady performance of our core

regasification business and the demand for FSRUs around the world.

With global markets continuing to emphasize the need for energy

security, the value of our services has never been greater,” said

President and Chief Executive Officer, Steven Kobos. “I am proud of

the great work the Excelerate team is doing every day to provide

essential regasification services and develop integrated LNG

solutions for customers across our global footprint.

“We remain committed to building a company that is known for

generating predictable earnings and cash flows while providing

opportunistic upside from LNG and gas sales. We are confident this

balanced approach is the right strategy to drive growth and

maximize value for our shareholders.”

SECOND QUARTER 2023 FINANCIAL RESULTS

For the three months

ended

June 30,

March 31,

June 30,

(in millions, except per share

amounts)

2023

2023

2022

Revenues

$

432.4

$

211.1

$

622.9

Operating Income

$

53.7

$

49.6

$

39.3

Net Income (Loss)

$

29.6

$

30.7

$

(4.0

)

Adjusted Net Income (1)

$

29.6

$

32.7

$

20.4

Adjusted EBITDA (1)

$

88.6

$

79.9

$

66.5

Earnings (Loss) Per Share (diluted)

$

0.23

$

0.26

$

(0.08

)

(1)

See the reconciliation of non-GAAP

financial measures to the most comparable GAAP financial measure in

the section titled "Non-GAAP Reconciliation" below.

Net Income and Adjusted EBITDA for the second quarter of 2023

increased over the prior year second quarter primarily due to

higher rates on charters in Finland and Argentina, a contract

extension at a higher rate in the UAE, and lower operating lease

expense resulting from the acquisition of the FSRU Sequoia. The

increase in Net Income was also driven by the early extinguishment

of the FSRU Excellence finance lease liability as part of the

vessel acquisition in 2022.

Adjusted EBITDA increased sequentially primarily due to a full

quarter of operations for the FSRU Excelsior following the

completion of its scheduled drydock in the first quarter, lower

operating lease expense for the Sequoia, and two spot LNG cargo

sales into Bangladesh.

KEY COMMERCIAL UPDATES

Bangladesh

In the second quarter of 2023, Excelerate delivered two spot LNG

cargos into Bangladesh. Year-to-date, Excelerate has secured four

Bangladesh spot LNG cargo tenders, equating to approximately

250,000 tons of LNG. The third and fourth cargos are expected to be

delivered in the third quarter of 2023.

Argentina

In May 2023, the FSRU Excelsior commenced seasonal

regasification services at the Bahia Blanca GasPort terminal in

Argentina. The Excelsior is expected to provide regasification

services for the duration of the Argentine winter season. The FSRU

Excelsior will return to the Germany charter in the third quarter

of 2023.

LIQUIDITY AND CAPITAL RESOURCES

As of June 30, 2023, Excelerate had $462 million in cash and

cash equivalents, $80.9 million of letters of credit issued and no

outstanding borrowings under its $350 million revolving credit

facility.

On August 3, 2023, Excelerate’s Board of Directors approved a

quarterly dividend equal to $0.025 per share of Class A common

stock, which will be paid on September 7, 2023, to shareholders of

record as of the close of business on August 23, 2023.

2023 FINANCIAL OUTLOOK

Excelerate is narrowing its full year 2023 guidance range. The

Company now expects Adjusted EBITDA to range between $325 million

and $335 million for the full year 2023. Maintenance capex for 2023

is expected to range between $20 million and $30 million.

Actual results may differ materially from the Company’s outlook

as a result of, among other things, the factors described under

“Forward-Looking Statements” below.

INVESTOR CONFERENCE CALL AND WEBCAST

The Excelerate management team will host a conference call for

investors and analysts at 8:30 a.m. Eastern Time (7:30 a.m. Central

Time) on Thursday, August 10, 2023. Investors are invited to access

a live webcast of the conference call via the Investor Relations

page on the Company’s website at www.excelerateenergy.com. An

archived replay of the call and a copy of the presentation will be

on the website following the call.

ABOUT EXCELERATE ENERGY

Excelerate Energy, Inc. is a U.S.-based LNG company located in

The Woodlands, Texas. Excelerate is changing the way the world

accesses cleaner forms of energy by providing integrated services

along the LNG value chain with an objective of delivering

rapid-to-market and reliable LNG solutions to customers. The

Company offers a full range of flexible regasification services

from FSRUs to infrastructure development to LNG supply. Excelerate

has offices in Abu Dhabi, Antwerp, Boston, Buenos Aires,

Chattogram, Dhaka, Doha, Dubai, Helsinki, Manila, Rio de Janeiro,

Singapore, and Washington, DC. For more information, please visit

www.excelerateenergy.com.

USE OF NON-GAAP FINANCIAL MEASURES

The Company reports financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”). Included in this press release are certain financial

measures that are not calculated in accordance with GAAP. They are

designed to supplement, and not substitute, Excelerate’s financial

information presented in accordance with U.S. GAAP. The non-GAAP

measures as defined by Excelerate may not be comparable to similar

non-GAAP measures presented by other companies. The presentation of

such measures, which may include adjustments to exclude

non-recurring items, should not be construed as an inference that

Excelerate’s future results, cash flows or leverage will be

unaffected by other nonrecurring items. Management believes that

the following non-GAAP financial measures provide investors with

additional useful information in evaluating the Company's

performance and valuation. See the reconciliation of non-GAAP

financial measures to the most comparable GAAP financial measure,

including those measures presented as part of the Company’s 2023

Financial Outlook, in the section titled “Non-GAAP Reconciliation”

below.

Adjusted Gross Margin

We use Adjusted Gross Margin, a non-GAAP financial measure,

which we define as revenues less direct cost of sales and operating

expenses, excluding depreciation and amortization, to measure our

operational financial performance. Management believes Adjusted

Gross Margin is useful because it provides insight on profitability

and true operating performance excluding the implications of the

historical cost basis of our assets. Our computation of Adjusted

Gross Margin may not be comparable to other similarly titled

measures of other companies, and you are cautioned not to place

undue reliance on this information.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure included as a

supplemental disclosure because we believe it is a useful indicator

of our operating performance. We define Adjusted EBITDA as net

income before interest expense, income taxes, depreciation and

amortization, accretion, non-cash long-term incentive compensation

expense and items such as charges and non-recurring expenses that

management does not consider as part of assessing ongoing operating

performance. In the first quarter of 2023, we revised the

definition of Adjusted EBITDA to adjust for the impact of non-cash

accretion expense, which results in a metric that is consistent

with how management will review performance going forward.

Management believes accretion expense does not directly reflect our

ongoing operating performance.

Adjusted Net Income

The Company uses Adjusted Net Income, a non-GAAP financial

measure, which it defines as net income plus the early

extinguishment of lease liability related to the acquisition of the

Excellence vessel, the non-cash write-off of deferred financing

costs related to our prior credit agreement, and restructuring,

transition and transaction expenses. Management believes Adjusted

Net Income is useful because it provides insight on profitability

excluding the impact of non-recurring charges related to our

IPO.

The Company adjusts net income for the items listed above to

arrive at Adjusted EBITDA and Adjusted Net Income because these

amounts can vary substantially from company to company within its

industry depending upon accounting methods and book values of

assets, capital structures and the method by which the assets were

acquired. Adjusted EBITDA and Adjusted Net Income should not be

considered as an alternative to, or more meaningful than, net

income as determined in accordance with GAAP or as an indicator of

the Company's operating performance or liquidity. These measures

have limitations as certain excluded items are significant

components in understanding and assessing a company’s financial

performance, such as a company’s cost of capital and tax structure,

as well as the historic costs of depreciable assets, none of which

are components of Adjusted EBITDA. The Company's presentation of

Adjusted EBITDA and Adjusted Net Income should not be construed as

an inference that its results will be unaffected by unusual or

non-recurring items. The Company's computations of Adjusted EBITDA

and Adjusted Net Income may not be comparable to other similarly

titled measures of other companies. For the foregoing reasons, each

of Adjusted EBITDA and Adjusted Net Income has significant

limitations which affect its use as an indicator of its

profitability and valuation, and you are cautioned not to place

undue reliance on this information.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements, within

the meaning of the Private Securities Litigation Reform Act of 1995

as contained in Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, about Excelerate Energy, Inc. (“Excelerate,” and together

with its subsidiaries “we,” “us,” “our” or the “Company”) and our

industry that involve substantial risks and uncertainties. All

statements other than statements of historical fact contained in

this press release, including, without limitation, statements

regarding our future results of operations or financial condition,

business strategy and plans, expansion plans and strategy, economic

conditions, both generally and in particular in the regions in

which we operate or plan to operate, and objectives of management

for future operations, are forward-looking statements. In some

cases, you can identify forward-looking statements by terminology

such as “anticipate,” “believe,” “consider,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,”

“opportunity,” “plan,” “potential,” “predict,” “project,” “shall,”

“should,” “target,” “will,” or “would,” or the negative of these

words or other similar terms or expressions.

You should not rely on forward-looking statements as predictions

of future events. We have based the forward-looking statements

contained in this press release primarily on our current

expectations and projections about future events and trends that we

believe may affect our business, financial condition and operating

results. The outcome of the events described in these

forward-looking statements is subject to risks, uncertainties and

other factors described under “Risk Factors” in Excelerate’s Annual

Report on Form 10‐K for the year ended December 31, 2022, our other

filings with the Securities and Exchange Commission (the “SEC”),

and those identified in this press release, including, but not

limited to, the following: customers’ contract termination rights

or failure to perform their contractual obligations; risks and

technical complexities inherent in operating the Company’s floating

storage and regasification units (“FSRUs”) and other infrastructure

assets; unforeseen delays, cancellations, expenses or other

complications in developing the Company’s projects; regasification

terminal or other facility failures; the Company’s need for

substantial capital expenditures to maintain or replace FSRUs,

terminals or other associated assets; reliance on third parties,

including engineering, procurement and construction contractors;

officer and crew shortages; the Company’s ability to maintain

customer and supplier relationships and to source new suppliers;

the Company’s ability to connect with third-party infrastructure;

the Company’s ability to purchase or receive delivery of sufficient

quantities of liquified natural gas (“LNG”) to satisfy contractual

obligations and exposure to commodity price risk; changes in the

demand for and price of LNG; the competitive market for LNG

regasification services and fluctuations in hire rates for FSRUs;

community and political group resistance to existing and new LNG

and natural gas infrastructure due to concerns about the

environment, safety and terrorism; access to financing sources on

favorable terms; the Company’s debt level and finance lease

liabilities that could limit its flexibility to obtain additional

financing or refinance existing debt; catastrophic events,

political tensions, conflicts and wars (such as the ongoing

Russia-Ukraine war), health crises and pandemics; volatility of the

global financial markets and uncertain economic conditions,

including the impact of increased inflation and related

governmental monetary policies; our ability to pay dividends on our

Class A common stock; and the other risks, uncertainties and other

factors identified in the Company’s filings with the SEC. All

forward-looking statements are based on assumptions or judgments

about future events that may or may not be correct or necessarily

take place and that are by their nature subject to significant

uncertainties and contingencies, many of which are outside the

control of Excelerate. The occurrence of any such factors, events

or circumstances would significantly alter the results set forth in

these statements.

Moreover, we operate in a very competitive and rapidly changing

environment. New risks and uncertainties emerge from time to time,

and it is not possible for us to predict all risks and

uncertainties that could have an impact on the forward-looking

statements contained in this press release. For example, the

current global economic uncertainty and geopolitical climate,

including the Russia-Ukraine war, may give rise to risks that are

currently unknown or amplify the risks associated with many of the

foregoing events or factors. The results, events and circumstances

reflected in the forward-looking statements may not be achieved or

occur, and actual results, events or circumstances could differ

materially from those described in the forward-looking

statements.

In addition, statements that “we believe” and similar statements

reflect our beliefs and opinions on the relevant subject. These

statements are based on information available to us as of the date

of this press release. While we believe that information provides a

reasonable basis for these statements, that information may be

limited or incomplete. Our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all relevant information. These statements are

inherently uncertain, and investors are cautioned not to unduly

rely on these statements.

The forward-looking statements made in this press release relate

only to events as of the date on which the statements are made. We

undertake no obligation to update any forward-looking statements

made in this press release to reflect events or circumstances after

the date of this press release or to reflect new information or the

occurrence of unanticipated events, except as required by law. We

may not actually achieve the plans, intentions or expectations

disclosed in our forward-looking statements, and you should not

place undue reliance on our forward-looking statements. Our

forward-looking statements do not reflect the potential impact of

any future acquisitions, mergers, dispositions, joint ventures or

investments.

Excelerate Energy,

Inc.

Consolidated Statements of

Income (Unaudited)

For the three months

ended

June 30,

March 31,

June 30,

2023

2023

2022

(In thousands, except share and

per share amounts)

Revenues

FSRU and terminal services

$

125,462

$

118,577

$

110,072

Gas sales

306,910

92,479

512,857

Total revenues

432,372

211,056

622,929

Operating expenses

Cost of revenue and vessel operating

expenses

48,664

58,792

58,673

Direct cost of gas sales

277,693

55,185

485,023

Depreciation and amortization

30,772

25,193

24,296

Selling, general and administrative

expenses

21,563

22,317

13,064

Restructuring, transition and transaction

expenses

—

—

2,582

Total operating expenses

378,692

161,487

583,638

Operating income

53,680

49,569

39,291

Other income (expense)

Interest expense

(13,479

)

(11,955

)

(7,800

)

Interest expense – related party

(3,593

)

(3,592

)

(5,493

)

Earnings from equity method investment

392

416

732

Early extinguishment of lease liability on

vessel acquisition

—

—

(21,834

)

Other income (expense), net

2,268

3,904

(1,086

)

Income before income taxes

39,268

38,342

3,810

Provision for income taxes

(9,712

)

(7,603

)

(7,800

)

Net income (loss)

29,556

30,739

(3,990

)

Less net income (loss) attributable to

non-controlling interest

23,588

23,895

(831

)

Less net loss attributable to

non-controlling interest – ENE Onshore

—

—

(181

)

Less pre-IPO net loss attributable to

EELP

—

—

(947

)

Net income (loss) attributable to

shareholders

$

5,968

$

6,844

$

(2,031

)

Net income (loss) per common share –

basic

$

0.23

$

0.26

$

(0.08

)

Net income (loss) per common share –

diluted

$

0.23

$

0.26

$

(0.08

)

Weighted average shares outstanding –

basic

26,254,167

26,254,167

26,254,167

Weighted average shares outstanding –

diluted

26,266,312

26,269,862

26,254,167

Excelerate Energy,

Inc.

Consolidated Balance

Sheets

June 30, 2023

December 31, 2022

(Unaudited)

ASSETS

(In thousands)

Current assets

Cash and cash equivalents

$

462,001

$

516,659

Current portion of restricted cash

2,638

2,614

Accounts receivable, net

145,608

82,289

Inventories

28,072

173,603

Current portion of net investments in

sales-type leases

13,980

13,344

Other current assets

36,629

35,026

Total current assets

688,928

823,535

Restricted cash

19,482

18,698

Property and equipment, net

1,685,705

1,455,683

Operating lease right-of-use assets

10,252

78,611

Net investments in sales-type leases

392,007

399,564

Investment in equity method investee

25,096

24,522

Deferred tax assets, net

37,741

39,867

Other assets

40,681

26,342

Total assets

$

2,899,892

$

2,866,822

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

$

46,991

$

96,824

Accrued liabilities and other

liabilities

59,710

66,888

Current portion of deferred revenue

21,972

144,807

Current portion of long-term debt

29,507

20,913

Current portion of long-term debt –

related party

8,003

7,661

Current portion of operating lease

liabilities

5,982

33,612

Current portion of finance lease

liabilities

21,408

20,804

Total current liabilities

193,573

391,509

Derivative liabilities

598

—

Long-term debt, net

420,310

193,396

Long-term debt, net – related party

176,345

180,772

Operating lease liabilities

5,316

48,373

Finance lease liabilities

200,276

210,354

TRA liability

72,951

72,951

Asset retirement obligations

40,800

39,823

Long-term deferred revenue

35,007

32,947

Total liabilities

$

1,145,176

$

1,170,125

Commitments and contingencies

Class A Common Stock ($0.001 par value,

300,000,000 shares authorized, 26,254,167 shares issued and

outstanding as of June 30, 2023 and December 31, 2022)

$

26

$

26

Class B Common Stock ($0.001 par value,

150,000,000 shares authorized and 82,021,389 shares issued and

outstanding as of June 30, 2023 and December 31, 2022)

82

82

Additional paid-in capital

465,067

464,721

Retained earnings

23,489

12,009

Accumulated other comprehensive income

1,257

515

Non-controlling interest

1,264,795

1,219,344

Total equity

$

1,754,716

$

1,696,697

Total liabilities and equity

$

2,899,892

$

2,866,822

Excelerate Energy,

Inc.

Consolidated Statements of

Cash Flows (Unaudited)

For the six months

ended

June 30, 2023

June 30, 2022

Cash flows from operating activities

(In thousands)

Net income

60,295

$

8,854

Adjustments to reconcile net income to net

cash from operating activities

Depreciation and amortization

55,965

48,039

Amortization of operating lease

right-of-use assets

9,674

15,447

ARO accretion expense

877

738

Amortization of debt issuance costs

3,983

620

Deferred income taxes

1,980

(5,552

)

Share of net earnings in equity method

investee

(808

)

(1,510

)

Distributions from equity method

investee

—

2,700

Long-term incentive compensation

expense

1,431

270

Early extinguishment of lease liability on

vessel acquisition

—

21,834

Non-cash restructuring expense

—

1,574

(Gain)/loss on non-cash items

1,747

—

Changes in operating assets and

liabilities:

Accounts receivable

(67,420

)

76,399

Inventories

144,529

40,028

Other current assets and other assets

(13,889

)

(2,302

)

Accounts payable and accrued

liabilities

(50,251

)

(211,287

)

Derivative liabilities

193

1,295

Current portion of deferred revenue

(122,835

)

(1,669

)

Net investments in sales-type leases

6,921

5,790

Operating lease assets and liabilities

(9,973

)

(14,040

)

Other long-term liabilities

2,060

3,273

Net cash provided by (used in) operating

activities

$

24,479

$

(9,499

)

Cash flows from investing activities

Purchases of property and equipment

(292,788

)

(42,030

)

Sales of property and equipment

4,101

—

Net cash used in investing activities

$

(288,687

)

$

(42,030

)

Cash flows from financing activities

Proceeds from issuance of common stock,

net

—

412,183

Proceeds from long-term debt – related

party

—

649,400

Repayments of long-term debt – related

party

(4,085

)

(648,126

)

Repayments of long-term debt

(10,925

)

(9,561

)

Proceeds from revolving credit

facility

—

140,000

Repayments of revolving credit

facility

—

(140,000

)

Proceeds from Term Loan Facility

250,000

—

Payment of debt issuance costs

(7,018

)

(5,512

)

Collections of related party note

receivables

—

6,600

Settlement of finance lease liability –

related party

—

(25,000

)

Principal payments under finance lease

liabilities

(10,752

)

(10,806

)

Principal payments under finance lease

liabilities – related party

—

(2,912

)

Dividends paid

(1,313

)

—

Distributions

(6,101

)

—

Minority owner contribution – Albania

Power Project

657

—

Net cash provided by financing

activities

$

210,463

$

366,266

Effect of exchange rate on cash, cash

equivalents, and restricted cash

(105

)

—

Net increase (decrease) in cash, cash

equivalents and restricted cash

(53,850

)

314,737

Cash, cash equivalents and restricted

cash

Beginning of period

$

537,971

$

90,964

End of period

$

484,121

$

405,701

Excelerate Energy,

Inc.

Non-GAAP Reconciliation

(Unaudited)

The following table presents a

reconciliation of adjusted gross margin to the GAAP financial

measures of gross margin for each of the period indicated.

For the three months

ended

June 30, 2023

March 31, 2023

June 30, 2022

(In thousands)

FSRU and terminal services revenues

$

125,462

$

118,577

$

110,072

Gas sales revenues

306,910

92,479

512,857

Cost of revenue and vessel operating

expenses

(48,664

)

(58,792

)

(58,673

)

Direct cost of gas sales

(277,693

)

(55,185

)

(485,023

)

Depreciation and amortization expense

(30,772

)

(25,193

)

(24,296

)

Gross Margin

$

75,243

$

71,886

$

54,937

Depreciation and amortization expense

30,772

25,193

24,296

Adjusted Gross Margin

$

106,015

$

97,079

$

79,233

The following table presents a

reconciliation of Adjusted EBITDA to the GAAP financial measures of

net income for each of the period indicated.

For the three months

ended

June 30, 2023

March 31, 2023

June 30, 2022

(In thousands)

Net income (loss)

$

29,556

$

30,739

$

(3,990

)

Interest expense

17,072

15,547

13,293

Provision for income taxes

9,712

7,603

7,800

Depreciation and amortization expense

30,772

25,193

24,296

Accretion expense

441

436

371

Long-term incentive compensation

expense

1,074

357

270

Early extinguishment of lease liability on

vessel acquisition

—

—

21,834

Restructuring, transition and transaction

expenses

—

—

2,582

Adjusted EBITDA

$

88,627

$

79,875

$

66,456

The following table presents a

reconciliation of Adjusted Net Income to the GAAP financial

measures of net income for each of the period indicated.

For the three months

ended

June 30, 2023

March 31, 2023

June 30, 2022

(In thousands)

Net income

$

29,556

$

30,739

$

(3,990

)

Add back (deduct):

Restructuring, transition and transaction

expenses

—

—

2,582

Early extinguishment of lease liability on

vessel acquisition

—

—

21,834

Non-cash debt issuance costs

—

1,990

—

Adjusted net income

$

29,556

$

32,729

$

20,426

2023E

2023E

(In millions)

Low Case

High Case

Income before income taxes

$

134

$

154

Interest expense

70

65

Depreciation and amortization expense

116

111

Long-term incentive compensation

expense

3

4

Accretion expense

2

1

Adjusted EBITDA

325

335

Note: We have not reconciled the Adjusted

EBITDA outlook to net income, the most comparable measure, because

it is not possible to estimate, without unreasonable effort, our

income taxes with the level of required precision. Accordingly, we

have reconciled these non-GAAP measures to our estimated income

before taxes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230809621395/en/

Investors Craig Hicks Excelerate

Energy Craig.Hicks@excelerateenergy.com

Media Stephen Pettibone / Frances

Jeter FGS Global Excelerate@fgsglobal.com or

media@excelerateenergy.com

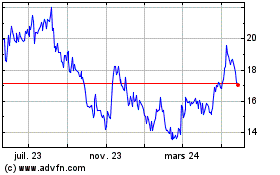

Excelerate Energy (NYSE:EE)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

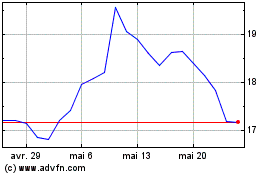

Excelerate Energy (NYSE:EE)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025