Elme Communities Announces 2022 Dividend Income Tax Treatment

18 Janvier 2023 - 10:16PM

Elme Communities (“Elme”) (NYSE:ELME) announced the income tax

treatment of its 2022 dividend distributions. This information

represents final income allocations. Shareholders are encouraged to

consult with their personal tax advisors as to their specific tax

treatment of Elme Communities dividend distributions. Beginning in

2018, Ordinary Taxable Income Per Share is equal to the 199A

dividend that was created by the 2017 Tax Cuts and Jobs Act.

|

Dividend Paid Date |

Gross Distribution Per Share |

Ordinary Taxable Income Per Share |

Section 199A Dividends Per Share |

(Return of Capital) Non-Taxable Distribution Per

Share |

|

1/5/2022 |

$0.17000 |

$0.03409 |

$0.03409 |

$0.13591 |

|

4/5/2022 |

$0.17000 |

$0.03409 |

$0.03409 |

$0.13591 |

|

7/6/2022 |

$0.17000 |

$0.03409 |

$0.03409 |

$0.13591 |

|

10/5/2022 |

$0.17000 |

$0.03409 |

$0.03409 |

$0.13591 |

|

TOTALS: |

$0.68000 |

$0.13636 |

$0.13636 |

$0.54364 |

|

|

100.00% |

20.05% |

20.05% |

79.95% |

About Elme Communities

Elme Communities (formerly known as Washington

Real Estate Investment Trust or WashREIT) is committed to elevating

what home can be for middle-income renters by providing a higher

level of quality, service, and experience. The company is a

multifamily real estate investment trust that owns and operates

approximately 8,900 apartment homes in the Washington, DC metro and

the Sunbelt, and approximately 300,000 square feet of commercial

space. Focused on providing quality, affordable homes to a deep,

solid, and underserved base of mid-market demand, Elme Communities

is building long-term value for shareholders.

Contact:Investor RelationsAmy

Hopkins202-774-3253ahopkins@elmecommunities.com

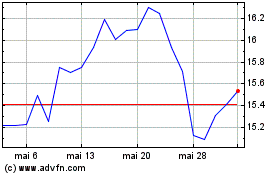

Elme Communities (NYSE:ELME)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Elme Communities (NYSE:ELME)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024