false

0001592000

0001592000

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

November 6, 2024

ENLINK

MIDSTREAM, LLC

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36336 |

|

46-4108528 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer Identification No.) |

1722

ROUTH STREET, SUITE

1300

DALLAS,

Texas |

|

75201 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (214) 953-9500

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECURITIES REGISTERED PURSUANT TO SECTION 12(b)

OF THE SECURITIES EXCHANGE ACT OF 1934:

| Title of Each Class |

|

Symbol |

|

Name of Exchange on which Registered |

Common

Units Representing Limited Liability Company Interests |

|

ENLC |

|

The

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 2.02 Results of Operations and Financial Condition.

On November 6,

2024, EnLink Midstream, LLC (the “Company”) issued a press release reporting its financial results for the third quarter of

2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and will be published on the

Company’s website at www.enlink.com. In accordance with General Instruction B.2 of Form 8-K, the information set forth in this

Item 2.02 and in such exhibit are deemed to be furnished and shall not be deemed to be “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| Item 7.01. |

Regulation FD Disclosure. |

On November 6,

2024, the Company published an investor presentation, which is available on the Company’s website, www.enlink.com, under “Investors

— News & Events — Presentations.” The Company may from time to time publish additional materials for investors

at the same website address. In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 7.01

shall be deemed to be furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

|

| (d) |

Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENLINK

MIDSTREAM, LLC |

| |

|

| |

By: |

EnLink

Midstream Manager, LLC, |

| |

|

its

Managing Member |

| Date: November 6, 2024 |

By: |

/s/ Benjamin D.

Lamb |

| |

|

Benjamin D. Lamb |

| |

|

Executive Vice President and Chief Financial

Officer |

Exhibit 99.1

FOR

IMMEDIATE RELEASE

NOVEMBER 6,

2024

Investor

Relations: Brian Brungardt, Senior Director of Investor Relations, 214-721-9353, brian.brungardt@enlink.com

Media

Relations: Megan Wright, Director of Corporate Communications, 214-721-9694, megan.wright@enlink.com

EnLink

Midstream Reports Third Quarter 2024 Results

DALLAS,

November 6, 2024 — EnLink Midstream, LLC (NYSE: ENLC) (EnLink) today reported financial results for the third quarter

of 2024.

Highlights

| ● | Reported

net income of $43.1 million and net cash provided by operating activities of $260.1 million

for the third quarter of 2024. |

| ● | Generated

adjusted EBITDA, net to EnLink, of $345.0 million for the third quarter of 2024. |

| ● | Delivered

$122.4 million of free cash flow after distributions (FCFAD) for the third quarter of

2024. |

| ● | Repurchased

approximately $45.4 million1 of common units in the third quarter of 2024. EnLink

has repurchased approximately $145 million of common units through the first nine months

of 2024. |

| ● | Contracted

an additional 200,000 million British thermal units per day (MMBtu/d) of long-term transportation

capacity delivering natural gas to end users in Louisiana. |

| ● | Subsequent

to the quarter, EnLink continued to simplify its capital structure with the redemption of

all remaining Series C preferred units. |

| ● | Subsequent

to the ONEOK transaction closing, S&P Global Ratings upgraded EnLink's credit rating

to "BBB" from "BBB-." EnLink remains on "Credit Watch Positive"

at Fitch Ratings Inc. with a "BBB-" credit rating. |

“EnLink

delivered a very strong third quarter due to the consistent execution of our strategy,” EnLink President and Chief Executive Officer

Jesse Arenivas said. “In Louisiana, we continue to move forward with our natural gas capacity expansions and storage projects,

and, in the Permian, where we completed our third plant relocation earlier this year, we see consistent producer activity that will drive

our next phase of growth. While we execute these growth strategies, we remain focused on our primary goal of creating unitholder value

and financial flexibility by generating solid free cash flow after distributions."

Adjusted

EBITDA and FCFAD used in this press release are non-GAAP measures and are explained in greater detail under "Non-GAAP Financial

Information" below.

1

Includes $20.4 million of common units repurchased from GIP pursuant to our Unit Repurchase Agreement, which settled on October

2, 2024. The Unit Repurchase Agreement was terminated on October 2, 2024.

Third

Quarter 2024 Financial Results and Highlights

| $MM,

unless noted | |

Third

Quarter 2024 | | |

Second

Quarter 2024 | | |

Third

Quarter 2023 | |

| Net

Income (1) | |

| 43 | | |

| 67 | | |

| 66 | |

| Adjusted

EBITDA, net to EnLink | |

| 345 | | |

| 306 | | |

| 342 | |

| Net

Cash Provided by Operating Activities | |

| 260 | | |

| 163 | | |

| 274 | |

| Capex,

Plant Relocation Costs, net to EnLink & Investment Contributions | |

| 78 | | |

| 103 | | |

| 126 | |

| Free

Cash Flow After Distributions | |

| 122 | | |

| 53 | | |

| 66 | |

| Debt

to Adjusted EBITDA, net to EnLink (2) | |

| 3.3 | x | |

| 3.3 | x | |

| 3.4 | x |

| Common

Units Outstanding (3) | |

| 457,073,081 | | |

| 461,449,461 | | |

| 456,851,424 | |

(1)

Net income is before non-controlling interest.

(2)

Calculated according to credit facility leverage covenant.

(3)

Outstanding common units as of October 31, 2024, August 1, 2024, and October 26, 2023, respectively.

2024

Financial Guidance Update

EnLink

remains on pace to achieve the midpoint of its previously announced 2024 adjusted EBITDA guidance range of $1.31 billion to $1.41 billion.

Capital expenditures, plant relocation costs, net to EnLink, and investment contributions are expected to be near the midpoint of the

guidance range of $435 million to $485 million. FCFAD is on pace to achieve the upper end of the 2024 guidance range of $265 million

to $315 million.

Third

Quarter 2024 Segment Updates

Permian

Basin:

| ● | Segment

profit for the third quarter of 2024 was $142.9 million, including operating expenses related

to plant relocation of $2.1 million and unrealized derivative gains of $2.6 million. Excluding

plant relocation operating expenses and unrealized derivative activity, segment profit in

the third quarter of 2024 grew approximately 28% sequentially and grew approximately 26%

over the third quarter of 2023. |

| ● | Average

natural gas gathering volumes for the third quarter of 2024 were flat compared to the second

quarter of 2024 but were approximately 10% higher compared to the third quarter of 2023. |

| ● | Average

natural gas processing volumes for the third quarter of 2024 were approximately 1% higher

compared to the second quarter of 2024 and approximately 10% higher compared to the third

quarter of 2023. EnLink continues to benefit from consistent producer drilling and completion

activity from its diversified customer mix of more than 15 producers. |

| ● | Average

crude gathering volumes for the third quarter of 2024 were approximately 2% higher compared

to the second quarter of 2024 and approximately 11% higher compared to the third quarter

of 2023. |

Louisiana:

| ● | Segment

profit for the third quarter of 2024 was $99.7 million, including unrealized derivative gains

of $11.3 million. Excluding unrealized derivative activity, segment profit in the third quarter

of 2024 grew approximately 12% sequentially but decreased 5% compared to the third quarter

of 2023. |

| ● | Average

natural gas transportation volumes for the third quarter of 2024 were approximately 9% lower

compared to the second quarter of 2024 but were approximately 4% higher compared to the third

quarter of 2023. |

| ● | Natural

gas liquids (NGL) fractionation volumes for the third quarter of 2024 were approximately

6% lower compared to the second quarter of 2024 and 9% lower compared to the third quarter

of 2023. |

| ● | EnLink

continues to experience robust demand for last mile delivery of natural gas to end users

in southeast Louisiana. EnLink successfully executed 200,000 MMBtu/d of long-term transportation

contracts, and the new contracted capacity is expected to generate approximately $15 million

of incremental annual cash flows beginning in the fourth quarter of 2024. |

| ● | EnLink

expects to benefit from normal seasonal strength in the NGL business in the fourth quarter

of 2024. |

Oklahoma:

| ● | Segment

profit for the third quarter of 2024 was $105.4 million, including unrealized derivative

gains of $3.0 million. Excluding unrealized derivative activity, segment profit in the third

quarter of 2024 was flat sequentially but decreased approximately 6% over the third quarter

of 2023. The prior-year quarter comparison reflects the impact of the previously disclosed

one-time contract reset in the first quarter of 2024. |

| ● | Average

natural gas gathering volumes for the third quarter of 2024 were approximately 2% higher

compared to the second quarter of 2024 and approximately 2% higher compared to the third

quarter of 2023. |

| ● | Average

natural gas processing volumes for the third quarter of 2024 were approximately 2% higher

compared to the second quarter of 2024 and approximately 1% higher compared to the third

quarter of 2023. |

| ● | Average

crude gathering volumes during the third quarter of 2024 were approximately 1% lower compared

to the second quarter of 2024 and approximately 19% lower compared to the third quarter of

2023. |

North

Texas:

| ● | Segment

profit for the third quarter of 2024 was $58.8 million, including unrealized derivative gains

of $1.1 million. Excluding unrealized derivative activity, segment profit in the third quarter

of 2024 grew approximately 8% sequentially but decreased approximately 17% compared to the

third quarter of 2023. The prior-year quarter comparison reflects the impact from the previously

disclosed one-time contract reset in the first quarter of 2024. |

| ● | Average

natural gas gathering and transportation volumes for the third quarter of 2024 were approximately

3% higher compared to the second quarter of 2024 but were approximately 3% lower compared

to the third quarter of 2023. |

| ● | Average

natural gas processing volumes for the third quarter of 2024 were approximately 4% higher

compared to the second quarter of 2024 but were approximately 3% lower compared to the third

quarter of 2023. |

About

EnLink Midstream

Headquartered

in Dallas, EnLink Midstream (NYSE: ENLC) provides integrated midstream infrastructure services for natural gas, crude oil, and NGLs,

as well as CO2 transportation for carbon capture and sequestration (CCS). Our large-scale, cash-flow-generating asset platforms

are in premier production basins and core demand centers, including the Permian Basin, Louisiana, Oklahoma, and North Texas. EnLink is

focused on maintaining the financial flexibility and operational excellence that enables us to strategically grow and create sustainable

value. Visit www.EnLink.com to learn how EnLink connects energy to life.

Non-GAAP

Financial Information

This

press release contains non-generally accepted accounting principles financial measures that we refer to as adjusted EBITDA and free cash

flow after distributions (FCFAD).

We

define adjusted EBITDA as net income (loss) plus (less) interest expense, net of interest income; depreciation and amortization; impairments;

(income) loss from unconsolidated affiliate investments; distributions from unconsolidated affiliate investments; (gain) loss on disposition

of assets; (gain) loss on extinguishment of debt; (gain) loss on litigation settlement; unit-based compensation; income tax expense (benefit);

unrealized (gain) loss on commodity derivatives; costs associated with the relocation of processing facilities; accretion expense associated

with asset retirement obligations; transaction costs; non-cash expense related to changes in the fair value of contingent consideration;

(non-cash rent); and (non-controlling interest share of adjusted EBITDA from joint ventures).

We

define free cash flow after distributions as adjusted EBITDA, net to ENLC, plus (less) (growth and maintenance capital expenditures,

excluding capital expenditures that were contributed by other entities and relate to the non-controlling interest share of our consolidated

entities); (interest expense, net of interest income); (distributions declared on common units); (cash distributions earned by the Series

B Preferred Units and the Series C Preferred Units); (payment to redeem mandatorily redeemable non-controlling interest); (costs associated

with the relocation of processing facilities, excluding costs that were contributed by other entities and relate to the non-controlling

interest share of our consolidated entities); non-cash interest (income)/expense; (contributions to investment in unconsolidated affiliates);

(payments to terminate interest rate swaps); (current income taxes); (earnout payments related to the Amarillo Rattler Acquisition and

the Central Oklahoma Acquisition); (non-cash gain associated with a lease modification); and proceeds from the sale of equipment and

land.

EnLink

believes these measures are useful to investors because they may provide users of this financial information with meaningful comparisons

between current results and previously-reported results and a meaningful measure of the company’s cash flow after it has satisfied

the capital and related requirements of its operations. In addition, adjusted EBITDA is used as a metric in our short-term incentive

program for compensating employees and in our performance awards for executives.

Adjusted

EBITDA and free cash flow after distributions, as defined above, are not measures of financial performance or liquidity under GAAP. They

should not be considered in isolation or as an indicator of EnLink’s performance. Furthermore, they should not be seen as a substitute

for metrics prepared in accordance with GAAP. Reconciliations of these measures to their most directly comparable GAAP measures are included

in the following tables. See EnLink’s filings with the Securities and Exchange Commission for more information.

Other

definitions and explanations of terms used in this press release:

Segment

profit (loss) is defined as revenues, less cost of sales (exclusive of operating expenses and depreciation and amortization), less operating

expenses. Segment profit (loss) includes non-cash compensation expenses reflected in operating expenses. See “Item 8. Financial

Statements and Supplementary Data - Note 16 - Segment Information” in ENLC’s Annual Report on Form 10-K for the year ended

December 31, 2023, and, when available, “Item 1. Financial Statements - Note 11—Segment Information” in ENLC’s

Quarterly Report on Form 10-Q for the three months ended September 30, 2024, for further information about segment profit (loss).

The

Ascension JV is a joint venture between a subsidiary of EnLink and a subsidiary of Marathon Petroleum Corporation in which EnLink owns

a 50% interest and Marathon Petroleum Corporation owns a 50% interest. The Ascension JV, which began operations in April 2017, owns an

NGL pipeline that connects EnLink’s Riverside fractionator to Marathon Petroleum Corporation’s Garyville refinery.

The

Delaware Basin JV is a joint venture between EnLink and an affiliate of NGP Natural Resources XI, L.P. ("NGP") in which EnLink

owns a 50.1% interest and NGP owns a 49.9% interest. The Delaware Basin JV, which was formed in August 2016, owns the Lobo processing

facilities and the Tiger processing plant located in the Delaware Basin in Texas.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the federal securities laws. Although these statements reflect

the current views, assumptions and expectations of our management, the matters addressed herein involve certain assumptions, risks and

uncertainties that could cause actual activities, performance, outcomes and results to differ materially from those indicated herein.

Therefore, you should not rely on any of these forward-looking statements. All statements, other than statements of historical fact,

included in this press release constitute forward-looking statements, including, but not limited to statements identified by the words

“forecast,” “may,” “believe,” “will,” “shall,” “should,” “plan,”

“predict,” “anticipate,” “intend,” “estimate,” “expect,” “continue,”

and similar expressions. Such forward-looking statements include, but are not limited to, statements about ONEOK's pursuit of a Public

Unit Transaction (as defined herein), guidance, projected or forecasted financial and operating results, future results and growth of

our CCS business, potential financial arrangements with CCS counterparties, acquisitions, or growth capital expenditures, timing for

completion of construction or expansion projects, results in certain basins, cost savings or operational, environmental, and climate

change initiatives, profitability, financial or leverage metrics, repurchases of common or preferred units, our future capital structure

and credit ratings, objectives, strategies, expectations, and intentions, and other statements that are not historical facts. Factors

that could result in such differences or otherwise materially affect our financial condition, results of operations, or cash flows include,

without limitation (a) potential conflicts of interest of ONEOK, with us and the potential for ONEOK to compete with us or favor ONEOK’s

own interests to the detriment of our other unitholders, (b) adverse developments in the midstream business that may reduce our ability

to make distributions, (c) competition for crude oil, condensate, natural gas, and NGL supplies and any decrease in the availability

of such commodities, (d) decreases in the volumes that we gather, process, fractionate, or transport, (e) our ability or our customers’

ability to receive or renew required government or third party permits and other approvals, (f) increased federal, state, and local legislation,

and regulatory initiatives, as well as government reviews relating to hydraulic fracturing resulting in increased costs and reductions

or delays in natural gas production by our customers, (g) climate change legislation and regulatory initiatives resulting in increased

operating costs and reduced demand for the natural gas and NGL services we provide, (h) changes in the availability and cost of capital,

(i) volatile prices and market demand for crude oil, condensate, natural gas, and NGLs that are beyond our control, (j) debt levels that

could limit our flexibility and adversely affect our financial health or limit our flexibility to obtain financing and to pursue other

business opportunities, (k) operating hazards, natural disasters, weather-related issues or delays, casualty losses, and other matters

beyond our control, (l) reductions in demand for NGL products by the petrochemical, refining, or other industries or by the fuel markets,

(m) our dependence on significant customers for a substantial portion of the natural gas and crude that we gather, process, and transport,

(n) construction risks in our major development projects, (o) challenges we may face in connection with our strategy to build a CCS transportation

business and to enter into other new lines of business related to the energy transition, (p)our ability to effectively integrate and

manage assets we acquire through acquisitions, (q) the impact of the coronavirus (COVID-19) pandemic (including the impact of any new

variants of the virus) and similar pandemics, (r) impairments to goodwill, long-lived assets and equity method investments, (s) the effects

of existing and future laws and governmental regulations, and other uncertainties and (t) whether ONEOK is able to consummate its publicly

announced intention to pursue an acquisition of the remaining ENLC common units not held by it (a "Public Unit Transaction").

These and other applicable uncertainties, factors, and risks are described more fully in EnLink Midstream, LLC’s filings with the

Securities and Exchange Commission, including EnLink Midstream, LLC’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q,

and Current Reports on Form 8-K. EnLink assumes no obligation to update any forward-looking statements.

The

EnLink management team based the forecasted financial information included herein on certain information and assumptions, including,

among others, the producer budgets / forecasts to which EnLink has access as of the date of this press release and the projects / opportunities

expected to require capital expenditures as of the date of this press release. The assumptions, information, and estimates underlying

the forecasted financial information included in the guidance information in this press release are inherently uncertain and, though

considered reasonable by the EnLink management team as of the date of its preparation, are subject to a wide variety of significant business,

economic, and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the forecasted

financial information. Accordingly, there can be no assurance that the forecasted results are indicative of EnLink's future performance

or that actual results will not differ materially from those presented in the forecasted financial information. Inclusion of the forecasted

financial information in this press release should not be regarded as a representation by any person that the results contained in the

forecasted financial information will be achieved.

EnLink

Midstream, LLC

Selected

Financial Data

(All

amounts in millions except per unit amounts)

(Unaudited)

| | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Total

revenues | |

$ | 1,608.4 | | |

$ | 1,746.2 | | |

$ | 4,807.4 | | |

$ | 5,043.8 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating

costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost

of sales, exclusive of operating expenses and depreciation and amortization | |

| 1,067.6 | | |

| 1,244.7 | | |

| 3,280.6 | | |

| 3,535.6 | |

| Operating

expenses | |

| 134.0 | | |

| 143.3 | | |

| 441.8 | | |

| 412.5 | |

| Depreciation

and amortization | |

| 186.1 | | |

| 163.8 | | |

| 514.0 | | |

| 489.5 | |

| Impairments | |

| 71.0 | | |

| 20.7 | | |

| 85.2 | | |

| 20.7 | |

| (Gain)

loss on disposition of assets | |

| 0.7 | | |

| (0.6 | ) | |

| (0.1 | ) | |

| (1.8 | ) |

| General

and administrative | |

| 30.0 | | |

| 30.4 | | |

| 115.4 | | |

| 87.8 | |

| Total

operating costs and expenses | |

| 1,489.4 | | |

| 1,602.3 | | |

| 4,436.9 | | |

| 4,544.3 | |

| Operating

income | |

| 119.0 | | |

| 143.9 | | |

| 370.5 | | |

| 499.5 | |

| Other

income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest

expense, net of interest income | |

| (67.7 | ) | |

| (67.9 | ) | |

| (199.8 | ) | |

| (205.2 | ) |

| Gain

on extinguishment of debt | |

| 9.5 | | |

| — | | |

| 9.5 | | |

| — | |

| Income

(loss) from unconsolidated affiliate investments | |

| (11.6 | ) | |

| 1.0 | | |

| (12.1 | ) | |

| (3.7 | ) |

| Other

income (expense) | |

| 0.9 | | |

| (0.6 | ) | |

| 5.2 | | |

| (0.2 | ) |

| Total

other expense | |

| (68.9 | ) | |

| (67.5 | ) | |

| (197.2 | ) | |

| (209.1 | ) |

| Income

before non-controlling interest and income taxes | |

| 50.1 | | |

| 76.4 | | |

| 173.3 | | |

| 290.4 | |

| Income

tax expense | |

| (7.0 | ) | |

| (10.6 | ) | |

| (13.2 | ) | |

| (40.5 | ) |

| Net

income | |

| 43.1 | | |

| 65.8 | | |

| 160.1 | | |

| 249.9 | |

| Net

income attributable to non-controlling interest | |

| 29.1 | | |

| 36.3 | | |

| 93.5 | | |

| 107.9 | |

| Net

income attributable to ENLC | |

$ | 14.0 | | |

$ | 29.5 | | |

$ | 66.6 | | |

$ | 142.0 | |

| Net

income attributable to ENLC per unit: | |

| | | |

| | | |

| | | |

| | |

| Basic

common unit | |

$ | (0.03 | ) | |

$ | 0.06 | | |

$ | 0.08 | | |

$ | 0.31 | |

| Diluted

common unit | |

$ | (0.03 | ) | |

$ | 0.06 | | |

$ | 0.08 | | |

$ | 0.30 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted

average common units outstanding (basic) | |

| 458.6 | | |

| 459.3 | | |

| 453.8 | | |

| 464.1 | |

| Weighted

average common units outstanding (diluted) | |

| 458.6 | | |

| 463.9 | | |

| 456.4 | | |

| 468.4 | |

EnLink

Midstream, LLC

Reconciliation

of Net Income to Adjusted EBITDA

(All

amounts in millions)

(Unaudited)

| | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net

income | |

$ | 43.1 | | |

$ | 65.8 | | |

$ | 160.1 | | |

$ | 249.9 | |

| Interest

expense, net of interest income | |

| 67.7 | | |

| 67.9 | | |

| 199.8 | | |

| 205.2 | |

| Depreciation

and amortization | |

| 186.1 | | |

| 163.8 | | |

| 514.0 | | |

| 489.5 | |

| Impairments | |

| 71.0 | | |

| 20.7 | | |

| 85.2 | | |

| 20.7 | |

| (Income)

loss from unconsolidated affiliate investments | |

| 11.6 | | |

| (1.0 | ) | |

| 12.1 | | |

| 3.7 | |

| Distributions

from unconsolidated affiliate investments | |

| — | | |

| 0.1 | | |

| — | | |

| 2.4 | |

| (Gain)

loss on disposition of assets | |

| 0.7 | | |

| (0.6 | ) | |

| (0.1 | ) | |

| (1.8 | ) |

| Gain

on extinguishment of debt | |

| (9.5 | ) | |

| — | | |

| (9.5 | ) | |

| — | |

| Loss

on litigation settlement (1) | |

| — | | |

| — | | |

| 23.0 | | |

| — | |

| Unit-based

compensation | |

| 5.7 | | |

| 5.7 | | |

| 16.5 | | |

| 14.2 | |

| Income

tax expense | |

| 7.0 | | |

| 10.6 | | |

| 13.2 | | |

| 40.5 | |

| Unrealized

(gain) loss on commodity derivatives | |

| (18.0 | ) | |

| 22.9 | | |

| 4.1 | | |

| 19.0 | |

| Costs

associated with the relocation of processing facilities (2) | |

| 2.1 | | |

| 2.9 | | |

| 28.3 | | |

| 5.0 | |

| Other

(3) | |

| 0.1 | | |

| 0.1 | | |

| 1.6 | | |

| 0.6 | |

| Adjusted

EBITDA before non-controlling interest | |

| 367.6 | | |

| 358.9 | | |

| 1,048.3 | | |

| 1,048.9 | |

| Non-controlling

interest share of adjusted EBITDA from joint ventures (4) | |

| (22.6 | ) | |

| (17.0 | ) | |

| (59.6 | ) | |

| (49.7 | ) |

| Adjusted

EBITDA, net to ENLC | |

$ | 345.0 | | |

$ | 341.9 | | |

$ | 988.7 | | |

$ | 999.2 | |

| (1) | Relates

to the loss incurred to settle litigation that arose from Winter Storm Uri and is not part

of our ongoing operations. |

| (2) | Represents

cost incurred to execute discrete, project-based strategic initiatives aimed at realigning

available processing capacity from our Oklahoma and North Texas segments to the Permian segment.

These costs are not part of our ongoing operations. |

| (3) | Includes

transaction costs, non-cash expense related to changes in the fair value of contingent consideration,

accretion expense associated with asset retirement obligations, and non-cash rent, which

relates to lease incentives pro-rated over the lease term. |

| (4) | Non-controlling

interest share of adjusted EBITDA from joint ventures includes NGP Natural Resources XI,

L.P. ("NGP")’s 49.9% share of adjusted EBITDA from the Delaware Basin JV

and Marathon Petroleum Corporation’s 50% share of adjusted EBITDA from the Ascension

JV. |

EnLink

Midstream, LLC

Reconciliation

of Net Cash Provided by Operating Activities to Adjusted EBITDA

and

Free Cash Flow After Distributions

(All

amounts in millions except ratios and per unit amounts)

(Unaudited)

| | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net

cash provided by operating activities | |

$ | 260.1 | | |

$ | 274.2 | | |

$ | 716.0 | | |

$ | 862.0 | |

| Interest

expense (1) | |

| 66.1 | | |

| 66.3 | | |

| 195.2 | | |

| 200.3 | |

| Costs

associated with the relocation of processing facilities (2) | |

| 2.1 | | |

| 2.9 | | |

| 28.3 | | |

| 5.0 | |

| Loss

on litigation settlement (3) | |

| — | | |

| — | | |

| 23.0 | | |

| — | |

| Other

(4) | |

| 1.3 | | |

| 0.9 | | |

| 5.3 | | |

| 1.7 | |

| Changes

in operating assets and liabilities which (provided) used cash: | |

| | | |

| | | |

| | | |

| | |

| Accounts

receivable, accrued revenues, inventories, and other | |

| (63.5 | ) | |

| 156.9 | | |

| (52.0 | ) | |

| (92.8 | ) |

| Accounts

payable, accrued product purchases, and other accrued liabilities | |

| 101.5 | | |

| (142.3 | ) | |

| 132.5 | | |

| 72.7 | |

| Adjusted

EBITDA before non-controlling interest | |

| 367.6 | | |

| 358.9 | | |

| 1,048.3 | | |

| 1,048.9 | |

| Non-controlling

interest share of adjusted EBITDA from joint ventures (5) | |

| (22.6 | ) | |

| (17.0 | ) | |

| (59.6 | ) | |

| (49.7 | ) |

| Adjusted

EBITDA, net to ENLC | |

| 345.0 | | |

| 341.9 | | |

| 988.7 | | |

| 999.2 | |

| Growth

capital expenditures, net to ENLC (6) | |

| (48.9 | ) | |

| (97.4 | ) | |

| (192.3 | ) | |

| (264.7 | ) |

| Maintenance

capital expenditures, net to ENLC (6) | |

| (21.6 | ) | |

| (18.3 | ) | |

| (55.9 | ) | |

| (52.5 | ) |

| Interest

expense, net of interest income | |

| (67.7 | ) | |

| (67.9 | ) | |

| (199.8 | ) | |

| (205.2 | ) |

| Distributions

declared on common units | |

| (62.4 | ) | |

| (57.5 | ) | |

| (183.0 | ) | |

| (174.3 | ) |

| ENLK

preferred unit cash distributions earned (7) | |

| (13.7 | ) | |

| (24.6 | ) | |

| (61.9 | ) | |

| (72.2 | ) |

| Payment

to redeem mandatorily redeemable non-controlling interest (8) | |

| — | | |

| — | | |

| — | | |

| (10.5 | ) |

| Costs

associated with the relocation of processing facilities, net to ENLC (2)(6) | |

| (1.9 | ) | |

| (1.7 | ) | |

| (17.7 | ) | |

| 5.0 | |

| Contributions

to investment in unconsolidated affiliates | |

| (5.3 | ) | |

| (8.7 | ) | |

| (25.4 | ) | |

| (58.4 | ) |

| Other

(9) | |

| (1.1 | ) | |

| 0.4 | | |

| (3.0 | ) | |

| 1.2 | |

| Free

cash flow after distributions | |

$ | 122.4 | | |

$ | 66.2 | | |

$ | 249.7 | | |

$ | 167.6 | |

| | |

| | | |

| | | |

| | | |

| | |

| Actual

declared distribution to common unitholders | |

$ | 62.4 | | |

$ | 57.5 | | |

$ | 183.0 | | |

$ | 174.3 | |

| Distribution

coverage | |

| 3.94

x | | |

| 3.98 x | | |

| 3.64

x | | |

| 3.75 x | |

| Distributions

declared per ENLC unit | |

$ | 0.1325 | | |

$ | 0.1250 | | |

$ | 0.3975 | | |

$ | 0.3750 | |

| (1) | Net

of amortization of debt issuance costs, net discount of senior unsecured notes, and designated

cash flow hedge, which are included in interest expense but not included in net cash provided

by operating activities, and non-cash interest income, which is netted against interest expense

but not included in adjusted EBITDA. |

| (2) | Represents

cost incurred to execute discrete, project-based strategic initiatives aimed at realigning

available processing capacity from our Oklahoma and North Texas segments to the Permian segment.

These costs are not part of our ongoing operations. |

| (3) | Relates

to the loss incurred to settle litigation that arose from Winter Storm Uri and is not part

of our ongoing operations. |

| (4) | Includes

utility credits redeemed, distributions from unconsolidated affiliate investments in excess

of earnings, transaction costs, current income tax expense, and non-cash rent, which relates

to lease incentives pro-rated over the lease term. |

| (5) | Non-controlling

interest share of adjusted EBITDA from joint ventures includes NGP's 49.9% share of adjusted

EBITDA from the Delaware Basin JV and Marathon Petroleum Corporation's 50% share of adjusted

EBITDA from the Ascension JV. |

| (6) | Excludes

capital expenditures and costs associated with the relocation of processing facilities that

were contributed by other entities and relate to the non-controlling interest share of our

consolidated entities. |

| (7) | Represents

the cash distributions earned by the Series B Preferred Units and Series C Preferred

Units, which are not available to common unitholders. |

| (8) | In

January 2023, we settled the redemption of the mandatorily redeemable non-controlling

interest in one of our non-wholly owned subsidiaries. |

| (9) | Includes

current income tax expense, earnout payments related to the Amarillo Rattler Acquisition

and the Central Oklahoma Acquisition, a reduction for non-cash gain associated with a lease

modification, and proceeds from the sale of surplus or unused equipment and land, which occurred

in the normal operation of our business. |

EnLink

Midstream, LLC

Operating

Data

(Unaudited)

| | |

Three

Months Ended

September 30, | | |

Nine

Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Midstream

Volumes: | |

| | | |

| | | |

| | | |

| | |

| Permian

Segment | |

| | | |

| | | |

| | | |

| | |

| Gathering

and Transportation (MMBtu/d) | |

| 2,029,700 | | |

| 1,840,800 | | |

| 1,987,600 | | |

| 1,752,800 | |

| Processing

(MMBtu/d) | |

| 1,864,700 | | |

| 1,699,700 | | |

| 1,820,300 | | |

| 1,626,500 | |

| Crude

Oil Handling (Bbls/d) | |

| 195,500 | | |

| 176,100 | | |

| 183,800 | | |

| 158,100 | |

| Louisiana

Segment | |

| | | |

| | | |

| | | |

| | |

| Gathering

and Transportation (MMBtu/d) | |

| 2,561,500 | | |

| 2,468,900 | | |

| 2,711,100 | | |

| 2,501,900 | |

| Crude

Oil Handling (Bbls/d) | |

| — | | |

| 18,600 | | |

| — | | |

| 17,800 | |

| NGL

Fractionation (Bbls/d) | |

| 164,400 | | |

| 180,800 | | |

| 174,400 | | |

| 181,000 | |

| Brine

Disposal (Bbls/d) | |

| — | | |

| 3,400 | | |

| — | | |

| 3,000 | |

| Oklahoma

Segment | |

| | | |

| | | |

| | | |

| | |

| Gathering

and Transportation (MMBtu/d) | |

| 1,242,900 | | |

| 1,223,000 | | |

| 1,202,200 | | |

| 1,218,600 | |

| Processing

(MMBtu/d) | |

| 1,192,700 | | |

| 1,178,200 | | |

| 1,152,400 | | |

| 1,182,400 | |

| Crude

Oil Handling (Bbls/d) | |

| 17,700 | | |

| 21,900 | | |

| 18,700 | | |

| 25,300 | |

| North

Texas Segment | |

| | | |

| | | |

| | | |

| | |

| Gathering

and Transportation (MMBtu/d) | |

| 1,516,400 | | |

| 1,563,100 | | |

| 1,479,900 | | |

| 1,591,100 | |

| Processing

(MMBtu/d) | |

| 705,300 | | |

| 729,000 | | |

| 683,900 | | |

| 737,800 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

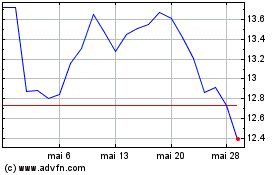

EnLink Midstream (NYSE:ENLC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

EnLink Midstream (NYSE:ENLC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024