Form 424B3 - Prospectus [Rule 424(b)(3)]

10 Octobre 2024 - 10:13PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

File No. 333-265180

EATON VANCE NATIONAL MUNICIPAL OPPORTUNITIES

TRUST

Supplement to Prospectus dated July 28, 2022

| 1. | The following replaces “COMMON SHARES” under

“Description of Capital Structure” in the Trust’s Prospectus: |

The Declaration of Trust permits the Trust to issue an unlimited number

of full and fractional Common Shares. Each Common Share represents an equal proportionate interest in the assets of the Trust with each

other Common Share in the Trust. Common Shareholders are entitled to the payment of distributions when, as, and if declared by the Board.

The 1940 Act or the terms of any future borrowings or issuance of preferred shares may limit the payment of distributions to the Common

Shareholder. Each whole Common Share shall be entitled to one vote as to matters on which it is entitled to vote pursuant to the terms

of the Declaration of Trust on file with the SEC.

The By-Laws establish qualification criteria applicable to prospective Trustees

and generally require that advance notice be given to the Trust in the event a shareholder desires to nominate a person for election to

the Board or to transact any other business at a meeting of shareholders. Any notice by a shareholder must be accompanied by certain information

as required by the By-Laws. No shareholder proposal will be considered at any meeting of shareholders of the Trust if such proposal is

submitted by a shareholder who does not satisfy all applicable requirements set forth in the By-Laws.

In the event of the liquidation of the Trust, after paying or adequately

providing for the payment of all liabilities of the Trust and the liquidation preference with respect to any outstanding preferred shares,

and upon receipt of such releases, indemnities and refunding agreements as they deem necessary for their protection, the Board may distribute

the remaining assets of the Trust among the Common Shareholders. The Declaration of Trust provides that Common Shareholders are not liable

for any liabilities of the Trust and permits inclusion of a clause to that effect in every agreement entered into by the Trust and, in

coordination with the Trust’s By-Laws, indemnifies shareholders against any such liability. Although shareholders of an unincorporated

business trust established under Massachusetts law may, in certain limited circumstances, be held personally liable for the obligations

of the business trust as though they were general partners, the provisions of the Trust’s Organizational Documents described in

the foregoing sentence make the likelihood of such personal liability remote.

The Trust has no current intention to issue preferred shares or to

borrow money. However, if at some future time there are any borrowings or preferred shares outstanding, the Trust may not be

permitted to declare any cash distribution on its Common Shares, unless at the time of such declaration, (i) all accrued

distributions on preferred shares or accrued interest on borrowings have been paid and (ii) the value of the Trust’s total

assets (determined after deducting the amount of such distribution), less all liabilities and indebtedness of the Trust not

represented by senior securities, is at least 300% of the aggregate amount of such securities representing indebtedness and at least

200% of the aggregate amount of securities representing indebtedness plus the aggregate liquidation value of the outstanding

preferred shares. In addition to the requirements of the 1940 Act, the Trust may be required to comply with other asset coverage

requirements as a condition of the Trust obtaining a rating of preferred shares from a nationally recognized statistical rating

agency (a “Rating Agency”). These requirements may include an asset coverage test more stringent than under the 1940

Act. This limitation on the Trust’s ability to make distributions on its Common Shares could in certain circumstances impair

the ability of the Trust to maintain its qualification for taxation as a regulated investment company for federal income tax

purposes. If the Trust were in the future to issue preferred shares or borrow money, it would intend, however, to the extent

possible to purchase or redeem preferred shares or reduce borrowings from time to time to maintain compliance with such asset

coverage requirements and may pay special distributions to the holders of the preferred shares in certain circumstances in

connection with any potential impairment of the Trust’s status as a regulated investment company. See “Federal Income

Tax Matters.” Depending on the timing of any such redemption or repayment, the Trust may be required to pay a premium in

addition to the liquidation preference of the preferred shares to the holders thereof.

The Trust has no present intention of offering additional Common Shares,

except as described herein. Other offerings of its Common Shares, if made, will require approval of the Board. Any additional offering

will not be sold at a price per Common Share below the then current NAV (exclusive of underwriting discounts and commissions) except in

connection with an offering to existing Common Shareholders or with the consent of a majority of the outstanding Common Shares. The Common

Shares have no preemptive rights.

The Trust generally will not issue Common Share certificates. However, upon

written request to the Trust’s transfer agent, a share certificate will be issued for any or all of the full Common Shares credited

to an investor’s account. Common Share certificates that have been issued to an investor may be returned at any time.

| 2. | The last sentence of the second paragraph under “CERTAIN

PROVISIONS OF THE DECLARATION OF TRUST” under “Description of Capital Structure” is deleted in the Trust’s Prospectus. |

October 10, 2024

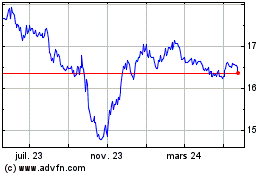

Eaton Vance National Mun... (NYSE:EOT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

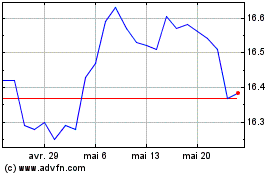

Eaton Vance National Mun... (NYSE:EOT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025