– Net Income Per Fully Diluted Share of

$0.07 in 4Q and $0.28 in 2024 –

– Core FFO Per Fully Diluted Share of $0.24

in 4Q and $0.95 in 2024 –

– Signed 1.325M Rentable Square Feet of

Leases in 2024 and 379K in 4Q –

– $0.9B of Liquidity, No Floating Rate Debt

Exposure –

– Provides 2025 Outlook –

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused

REIT that owns and operates a portfolio of well-leased, top of

tier, modernized, amenitized, and well-located office, retail, and

multifamily assets. ESRT’s flagship Empire State Building, the

“World's Most Famous Building,” features its iconic Observatory

that was declared the #1 Attraction in the World – and the #1

Attraction in the U.S. for the third consecutive year– in

Tripadvisor’s 2024 Travelers’ Choice Awards: Best of the Best

Things to Do. The Company is the recognized leader in energy

efficiency and indoor environmental quality. Today the Company

reported its operational and financial results for the fourth

quarter and the full year. All per share amounts are on a fully

diluted basis, where applicable.

Fourth Quarter and Full Year 2024 Recent Highlights

- Net Income of $0.07 per share for the fourth quarter of 2024

and $0.28 per share for the full year.

- Core Funds From Operations (“Core FFO”) of $0.24 per share for

the fourth quarter of 2024 and $0.95 per share for the full year,

compared to $0.25 per share and $0.93 per share for the same

respective periods in 2023.

- Same-Store Property Cash Net Operating Income (“NOI”), which

excludes lease termination fees, decreased 2.9% for the fourth

quarter and increased 5.2% for the full year as compared to the

same periods in 2023. The fourth quarter change was primarily

attributed to a decrease in positive non-recurring items by

approximately $1.9 million relative to the prior period and

increases in operating expenses. Adjusted for non-recurring items,

fourth quarter Same-Store Property Cash NOI was flat.

- Manhattan office leased rate increased by 160bps year-over-year

to 94.2%. The total commercial portfolio is 93.5% leased as of

December 31, 2024. This is the 12th consecutive quarter of positive

commercial leased rate absorption.

- Manhattan office occupancy increased by 130bps year-over-year

to 89.0%. The total commercial portfolio is 88.6% occupied as of

December 31, 2024.

- Signed approximately 379 thousand rentable square feet of

office leases in the fourth quarter and 1.325 million rentable

square feet of office and retail leases in the full year. In our

Manhattan office portfolio, blended leasing spreads were +10.8%,

the 14th consecutive quarter of positive leasing spreads.

- Empire State Building Observatory generated year-over-year NOI

growth of 6.0% to $28.5 million in the fourth quarter and 5.8% NOI

growth to $99.5 million for the full year.

Property Operations

As of December 31, 2024, the Company’s property portfolio

contained 7.8 million rentable square feet of office space, 0.8

million rentable square feet of retail space and 732 residential

units, which were occupied and leased as shown below.

December

31, 20241

September 30, 20241

December

31, 20231

Percent occupied:

Total commercial portfolio

88.6%

89.1%

86.6%

Total office

88.4%

88.9%

86.3%

Manhattan office

89.0%

89.6%

87.7%

Total retail

90.4%

91.1%

90.4%

Percent leased (includes signed leases

not commenced):

Total commercial portfolio

93.5%

93.4%

91.0%

Total office

93.5%

93.3%

90.9%

Manhattan office

94.2%

94.1%

92.6%

Total retail

94.1%

94.0%

92.1%

Total multifamily portfolio

98.5%

96.8%

98.1%

1 All occupancy and leased percentages

exclude broadcasting and storage space. September 30, 2024 and

December 31, 2024 exclude First Stamford Place.

Leasing

The tables that follow summarize leasing activity for the fourth

quarter of 2024. During this period, the Company signed 20 leases

that totaled 378,913 square feet with an average lease duration of

8.0 years. Average lease duration excluding early renewals and

extensions was 12.3 years.

Total Portfolio

Total Portfolio

Leases executed

Square footage

executed

Average cash rent psf – leases

executed

Previously escalated cash

rents psf

% of new cash rent over /

under previously escalated rents

Office

20

378,913

78.40

71.03

10.4 %

Retail

0

0

0.00

0.00

— %

Total Overall

20

378,913

78.40

71.03

10.4 %

Manhattan Office Portfolio

Manhattan Office Portfolio

Leases executed

Square footage

executed

Average cash rent psf – leases

executed

Previously escalated cash

rents psf

% of new cash rent over /

under previously escalated rents

New Office

11

184,258

71.07

59.54

19.4 %

Renewal Office

7

182,464

86.98

83.14

4.6 %

Total Office

18

366,722

78.99

71.28

10.8 %

Leasing Activity Highlights

- A 16-year 78,704 square foot expansion lease and a 141,224

square foot early 2-year lease extension at One Grand Central Place

with an investment management tenant.

- A 16-year 38,550 square foot expansion lease with NYSERDA at

1333 Broadway.

- An 11-year 37,186 square foot expansion lease and a 27,377

square foot early 7-year lease extension with Booking Holdings at

the Empire State Building.

Balance Sheet

The Company had $0.9 billion of total liquidity as of December

31, 2024, which was comprised of $385 million of cash, plus $500

million available under its revolving credit facility. At December

31, 2024, the Company had total debt outstanding of approximately

$2.3 billion, no floating rate debt exposure, and a weighted

average interest rate of 4.27%. At December 31, 2024, the Company’s

ratio of net debt to adjusted EBITDA was 5.3x.

Dividend

On December 31, 2024, the Company paid a quarterly dividend of

$0.035 per share or unit, as applicable, for the fourth quarter of

2024 to holders of the Company’s Class A common stock (NYSE: ESRT)

and Class B common stock and to holders of the Series ES, Series

250 and Series 60 partnership units (NYSE Arca: ESBA, FISK and

OGCP, respectively) and Series PR partnership units of Empire State

Realty OP, L.P., the Company’s operating partnership (the

“Operating Partnership”).

On December 31, 2024, the Company paid quarterly preferred

dividends of $0.15 and $0.175 per unit for the fourth quarter to

holders of the Operating Partnership’s Series 2014 and 2019 private

perpetual preferred units, respectively.

2025 Earnings Outlook

The Company provides 2025 guidance and key assumptions, as

summarized in the table below. The Company’s guidance does not

include the impact of any significant future lease termination fee

income or any unannounced acquisition, disposition or other capital

markets activity.

Key Assumptions 2025Guidance 2024ActualResults

Comments Earnings

Core FFO Per Fully Diluted Share $0.86 to $0.89

$0.95($0.91 ex non-recurring items)

• 2024 FFO included approximately $0.04 of one-time items and

lease termination income • 2025 FFO includes a net $0.04 y/y

decline from changes in interest income, G&A, interest expense,

transaction income, and non cash adjustments • 2025 includes ~$0.05

from multifamily assets

Commercial Property Drivers

Commercial Occupancy at year-end 89% to 91%

88.6%

SS Property Cash NOI(excluding lease termination fees)

-2.0% to +1.5%

5.2%

• Assumes positive revenue y/y growth • Assumes a ~2.0 to 4.0%

y/y increase in operating expenses and real estate taxes • 2025 SS

NOI y/y growth is expected to range from ~0.5 to 4.0% relative to

2024 excluding one-time items

Observatory Drivers

Observatory NOI $97M to $102M $99.5M • Reflects

average quarterly expenses of ~$9 to 10M

Low

High

Net Income (Loss) Attributable to Common Stockholders and the

Operating Partnership

$0.21

$0.24

Add: Impairment Charge

0.00

0.00

Real Estate Depreciation & Amortization

0.64

0.64

Less: Private Perpetual Distributions

0.02

0.02

Gain on Disposal of Real Estate, net

0.00

0.00

FFO Attributable to Common Stockholders and the Operating

Partnership

$0.83

$0.86

Add: Amortization of Below Market Ground Lease

0.03

0.03

Core FFO Attributable to Common Stockholders and the Operating

Partnership

$0.86

$0.89

The estimates set forth above may be subject to fluctuations as

a result of several factors, including continued impacts of changes

in the use of office space and remote work on our business and our

market, our ability to complete planned capital improvements in

line with budget, costs of integration of completed acquisitions,

costs associated with future acquisitions or other transactions,

straight-line rent adjustments and the amortization of above and

below-market leases. There can be no assurance that the Company’s

actual results will not differ materially from the estimates set

forth above.

Investor Presentation Update

The Company has posted on the “Investors” section of ESRT’s

website the latest investor presentation, which contains additional

information on its businesses, financial condition and results of

operations.

Webcast and Conference Call Details

Empire State Realty Trust, Inc. will host a webcast and

conference call, open to the general public, on Thursday, February

20, 2025 at 12:00 pm Eastern time.

The webcast will be accessible on the “Investors” section of

ESRT’s website. To listen to the live webcast, go to the site at

least five minutes prior to the scheduled start time in order to

register and download and install any necessary audio software. The

conference call can also be accessed by dialing 1-877-407-3982 for

domestic callers or 1-201-493-6780 for international callers.

Starting shortly after the call until February 27, 2025, a

replay of the webcast will be available on the Company’s website,

and a dial-in replay will be available by dialing 1-844-512-2921

for domestic callers or 1-412-317-6671 for international callers.

The passcode for this dial-in replay is 13741464.

The Supplemental Report and Investor Presentation are additional

components of the quarterly earnings announcement and are now

available on the “Investors” section of ESRT’s website.

The Company uses, and intends to continue to use, the

“Investors” page of its website, which can be found at

www.esrtreit.com, as a means to disclose material nonpublic

information and to comply with its disclosure obligations under

Regulation FD, including, without limitation, through the posting

of investor presentations that may include material nonpublic

information. Accordingly, investors should monitor the “Investors”

page, in addition to following our press releases, SEC filings,

public conference calls, presentations and webcasts. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document.

About Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused

REIT that owns and operates a portfolio of well-leased, top of

tier, modernized, amenitized, and well-located office, retail, and

multifamily assets. ESRT’s flagship Empire State Building, the

“World's Most Famous Building,” features its iconic Observatory

that was declared the #1 Attraction in the World – and the #1

Attraction in the U.S. for the third consecutive year – in

Tripadvisor’s 2024 Travelers’ Choice Awards: Best of the Best

Things to Do. The Company is the recognized leader in energy

efficiency and indoor environmental quality. As of December 31,

2024, ESRT’s portfolio is comprised of approximately 7.8 million

rentable square feet of office space, 0.8 million rentable square

feet of retail space and 732 residential units. More information

about Empire State Realty Trust can be found at esrtreit.com and by

following ESRT on Facebook, Instagram, TikTok, X, and LinkedIn.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act"), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We intend

these forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and are including this

statement for purposes of complying with those safe harbor

provisions. You can identify forward-looking statements by the use

of forward-looking terminology such as “aims," "anticipates,"

"approximately," "believes," "contemplates," "continues,"

"estimates," "expects," "forecasts," "hope," "intends," "may,"

"plans," "seeks," "should," "thinks," "will," "would" or the

negative of these words and phrases or similar words or phrases.

For the avoidance of doubt, any projection, guidance, or similar

estimation about the future or future results, performance or

achievements is a forward-looking statement.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are difficult to predict and are

generally beyond our control, and you should not rely on them as

predictions of future events. Forward-looking statements depend on

assumptions, data or methods which may be incorrect or imprecise,

and we may not be able to realize them. We do not guarantee that

the transactions and events described will happen as described (or

that they will happen at all).

Many important factors could cause our actual results,

performance, achievements, and future events to differ materially

from those set forth, implied, anticipated, expected, projected,

assumed or contemplated in our forward-looking statements,

including, among other things: (i) economic, market, political and

social impact of, and uncertainty relating to, any catastrophic

events, including pandemics, epidemics or other outbreaks of

disease, climate-related risks such as natural disasters and

extreme weather events, terrorism and other armed hostilities, as

well as cybersecurity threats and technology disruptions; (ii) a

failure of conditions or performance regarding any event or

transaction described herein; (iii) resolution of legal proceedings

involving the Company; (iv) reduced demand for office, multifamily

or retail space, including as a result of the changes in the use of

office space and remote work; (v) changes in our business strategy;

(vi) a decline in Observatory visitors due to changes in domestic

or international tourism, including due to health crises,

geopolitical events, currency exchange rates, and/or competition

from other observatories; (vii) defaults on, early terminations of,

or non-renewal of, leases by tenants; (viii) increases in the

Company’s borrowing costs as a result of changes in interest rates

and other factors; (ix) declining real estate valuations and

impairment charges; (x) termination of our ground leases; (xi)

limitations on our ability to pay down, refinance, restructure or

extend our indebtedness or borrow additional funds; (xii) decreased

rental rates or increased vacancy rates; (xiii) difficulties in

executing capital projects or development projects successfully or

on the anticipated timeline or budget; (xiv) difficulties in

identifying and completing acquisitions; (xv) impact of changes in

governmental regulations, tax laws and rates and similar matters;

(xvi) our failure to qualify as a REIT; (xvii) incurrence of

taxable capital gain on disposition of an asset due to failure of

compliance with a 1031 exchange program; (xviii) our disclosure

controls and internal control over financial reporting, including

any material weakness; and (xix) failure to achieve sustainability

metrics and goals, including as a result of tenant collaboration,

and impact of governmental regulation on our sustainability

efforts. For a further discussion of these and other factors that

could impact the company's future results, performance, or

transactions, see the section entitled “Risk Factors” of our annual

report on Form 10-K for the year ended December 31, 2023 and any

additional factors that may be contained in any filing we make with

the SEC.

While forward-looking statements reflect the Company's good

faith beliefs, they do not guarantee future performance. Any

forward-looking statement contained in this press release speaks

only as of the date on which it was made, and we assume no

obligation to update or revise publicly any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data or methods, future events, or other changes

after the date of this press release, except as required by

applicable law. Prospective investors should not place undue

reliance on any forward-looking statements, which are based only on

information currently available to the Company (or to third parties

making the forward-looking statements).

Empire Start Realty Trust,

Inc.

Condensed Consolidated

Statements of Operations

(unaudited and amounts in

thousands, except per share data)

Three Months Ended December

31,

2024

2023

Revenues

Rental revenue

$

155,127

$

151,167

Observatory revenue

38,275

36,217

Lease termination fees

—

—

Third-party management and other fees

258

275

Other revenue and fees

3,942

5,223

Total revenues

197,602

192,882

Operating expenses

Property operating expenses

46,645

42,944

Ground rent expenses

2,332

2,332

General and administrative expenses

17,870

16,144

Observatory expenses

9,730

9,282

Real estate taxes

32,720

31,809

Depreciation and amortization

45,365

49,599

Total operating expenses

154,662

152,110

Total operating income

42,940

40,772

Other income (expense):

Interest income

5,068

4,740

Interest expense

(27,380

)

(25,393

)

Interest expense associated with property

in receivership

(1,921

)

—

Gain (loss) on disposition of

properties

1,237

(2,497

)

Income before income taxes

19,944

17,622

Income tax expense

(1,151

)

(1,792

)

Net income

18,793

15,830

Net (income) loss attributable to

non-controlling interests:

Non-controlling interest in the Operating

Partnership

(6,575

)

(5,670

)

Non-controlling interests in other

partnerships

—

1

Preferred unit distributions

(1,050

)

(1,050

)

Net income attributable to common

stockholders

$

11,168

$

9,111

Total weighted average shares

Basic

166,671

161,974

Diluted

270,251

267,003

Earnings per share attributable to

common stockholders

Basic and Diluted

$

0.07

$

0.06

Empire Start Realty Trust,

Inc.

Condensed Consolidated

Statements of Operations

(unaudited and amounts in

thousands, except per share data)

Year ended December

31,

2024

2023

Revenues

Rental revenue

$

614,596

$

597,319

Observatory revenue

136,377

129,366

Lease termination fees

4,771

—

Third-party management and other fees

1,170

1,351

Other revenue and fees

11,009

11,536

Total revenues

767,923

739,572

Operating expenses

Property operating expenses

179,175

167,324

Ground rent expenses

9,326

9,326

General and administrative expenses

70,234

63,939

Observatory expenses

36,834

35,265

Real estate taxes

128,826

127,101

Depreciation and amortization

184,818

189,911

Total operating expenses

609,213

592,866

Total operating income

158,710

146,706

Other income (expense):

Interest income

21,298

15,136

Interest expense

(105,239

)

(101,484

)

Interest expense associated with property

in receivership

(4,471

)

—

Loss on early extinguishment of debt

(553

)

—

Gain on disposition of properties

13,302

26,764

Income before income taxes

83,047

87,122

Income tax expense

(2,688

)

(2,715

)

Net income

80,359

84,407

Net income attributable to non-controlling

interests:

Non-controlling interest in the Operating

Partnership

(28,713

)

(31,094

)

Non-controlling interests in other

partnerships

(4

)

(68

)

Preferred unit distributions

(4,201

)

(4,201

)

Net income attributable to common

stockholders

$

47,441

$

49,044

Total weighted average shares

Basic

164,902

161,122

Diluted

269,019

265,633

Earnings per share attributable to

common stockholders

Basic

$

0.29

$

0.30

Diluted

$

0.28

$

0.30

Empire State Realty Trust,

Inc.

Reconciliation of Net Income

to Funds From Operations (“FFO”),

Modified Funds From Operations

(“Modified FFO”) and Core Funds From Operations (“Core

FFO”)

(unaudited and amounts in

thousands, except per share data)

Three Months Ended December

31,

2024

2023

Net income

$

18,793

$

15,830

Non-controlling interests in other

partnerships

—

1

Preferred unit distributions

(1,050

)

(1,050

)

Real estate depreciation and

amortization

44,386

48,548

(Gain) loss on disposition of

properties

(1,237

)

2,497

FFO attributable to common stockholders

and Operating Partnership units

60,892

65,826

Amortization of below-market ground

leases

1,958

1,958

Modified FFO attributable to common

stockholders and Operating Partnership units

62,850

67,784

Interest expense associated with property

in receivership

1,921

—

Core FFO attributable to common

stockholders and Operating Partnership units

$

64,771

$

67,784

Total weighted average shares and

Operating Partnership units

Basic

264,798

262,775

Diluted

270,251

267,003

FFO per share

Basic

$

0.23

$

0.25

Diluted

$

0.23

$

0.25

Modified FFO per share

Basic

$

0.24

$

0.26

Diluted

$

0.23

$

0.25

Core FFO per share

Basic

$

0.24

$

0.26

Diluted

$

0.24

$

0.25

Empire State Realty Trust,

Inc.

Reconciliation of Net Income

to Funds From Operations (“FFO”),

Modified Funds From Operations

(“Modified FFO”) and Core Funds From Operations (“Core

FFO”)

(unaudited and amounts in

thousands, except per share data)

Year ended December

31,

2024

2023

Net income

$

80,359

$

84,407

Non-controlling interests in other

partnerships

(4

)

(68

)

Preferred unit distributions

(4,201

)

(4,201

)

Real estate depreciation and

amortization

180,513

184,633

Gain on disposition of properties

(13,302

)

(26,764

)

FFO attributable to common stockholders

and Operating Partnership units

243,365

238,007

Amortization of below-market ground

leases

7,831

7,831

Modified FFO attributable to common

stockholders and Operating Partnership units

251,196

245,838

Interest expense associated with property

in receivership

4,471

—

Loss on early extinguishment of debt

553

—

Core FFO attributable to common

stockholders and Operating Partnership units

$

256,220

$

245,838

Total weighted average shares and

Operating Partnership units

Basic

264,706

263,226

Diluted

269,019

265,633

FFO per share

Basic

$

0.92

$

0.90

Diluted

$

0.90

$

0.90

Modified FFO per share

Basic

$

0.95

$

0.93

Diluted

$

0.93

$

0.93

Core FFO per share

Basic

$

0.97

$

0.93

Diluted

$

0.95

$

0.93

Empire State Realty Trust,

Inc.

Condensed Consolidated Balance

Sheets

(unaudited and amounts in

thousands)

December 31, 2024

December 31, 2023

Assets

Commercial real estate properties, at

cost

$

3,786,653

$

3,655,192

Less: accumulated depreciation

(1,274,193

)

(1,250,062

)

Commercial real estate properties, net

2,512,460

2,405,130

Contract asset2

170,419

—

Cash and cash equivalents

385,465

346,620

Restricted cash

43,837

60,336

Tenant and other receivables

31,427

39,836

Deferred rent receivables

247,754

255,628

Prepaid expenses and other assets

101,852

98,167

Deferred costs, net

183,987

172,457

Acquired below market ground leases,

net

313,410

321,241

Right of use assets

28,197

28,439

Goodwill

491,479

491,479

Total assets

$

4,510,287

$

4,219,333

Liabilities and equity

Mortgage notes payable, net

$

692,176

$

877,388

Senior unsecured notes, net

1,197,061

973,872

Unsecured term loan facility, net

268,731

389,286

Unsecured revolving credit facility

120,000

—

Debt associated with property in

receivership

177,667

—

Accrued interest associated with property

in receivership

5,433

—

Accounts payable and accrued expenses

132,016

99,756

Acquired below market leases, net

19,497

13,750

Ground lease liabilities

28,197

28,439

Deferred revenue and other liabilities

62,639

70,298

Tenants’ security deposits

24,908

35,499

Total liabilities

2,728,325

2,488,288

Total equity

1,781,962

1,731,045

Total liabilities and equity

$

4,510,287

$

4,219,333

2 This contract asset represents the

amount of obligation we expect to be released upon the final

resolution of the foreclosure process on First Stamford Place.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219249014/en/

Investors and Media

Empire State Realty Trust Investor Relations (212) 850-2678

IR@esrtreit.com

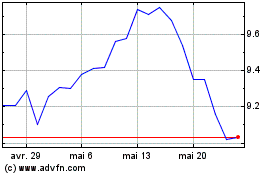

Empire State Realty (NYSE:ESRT)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Empire State Realty (NYSE:ESRT)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025