Form 424B3 - Prospectus [Rule 424(b)(3)]

26 Février 2024 - 9:52PM

Edgar (US Regulatory)

EATON VANCE TAX-MANAGED BUY-WRITE OPPORTUNITIES FUND

Supplement to Prospectus dated April 29, 2022, Prospectus

Supplement dated May 9, 2022, and Statement of Additional Information dated April 29, 2022, each as supplemented (respectively, the “Prospectus”,

the “Prospectus Supplement” and the “SAI”)

In connection with the April 14, 2023 reorganization

of Eaton Vance Tax-Managed Buy-Write Strategy Fund (NYSE: EXD) (“Acquired Fund”) with and into Eaton Vance Tax-Managed Buy-Write

Opportunities Fund (NYSE: ETV) (the “Fund”), in which the Fund acquired all of the assets of the Acquired Fund in exchange

for newly-issued common shares of the Fund and the assumption by the Fund of all the liabilities of the Acquired Fund, breakpoints were

implemented in the advisory fee borne by the Fund. Accordingly, effective April 14, 2023, the following supplements any references to

the Fund’s advisory fee rate contained in the Prospectus, Prospectus Supplement, and SAI:

| Advisory Fee Schedule |

| Average Daily Gross Assets |

Annual Fee Rate |

| Up to and including $1.5 billion |

1.000% |

| Over $1.5 billion up to and including $3 billion |

0.980% |

| Over $3 billion up to and including $5 billion |

0.960% |

| Over $5 billion |

0.940% |

The Fund continues to be managed in accordance with its existing investment

objectives and strategies as described in the Prospectus and SAI.

February 26, 2024

Investors Should Retain This Supplement for Future

Reference

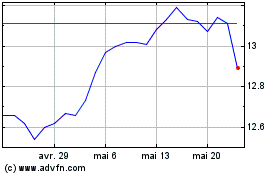

Eaton Vance Tax Managed ... (NYSE:ETV)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Eaton Vance Tax Managed ... (NYSE:ETV)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024