| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM 6-K |

|

| REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO |

| RULE 13A-16 OR 15D-16 UNDER THE SECURITIES |

| EXCHANGE ACT OF 1934 |

|

| For the month of November 2024 |

|

| Commission File Number: 001-38904 |

|

| FLEX LNG Ltd. |

| (Translation of registrant's name into English) |

|

| Par-La-Ville Place |

| 14 Par-La-Ville Road |

| Hamilton |

| Bermuda |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Attached hereto as Exhibit 99.1 and Exhibit 99.2 is a copy of the press release issued by FLEX LNG Ltd (the "Company"), dated November 29, 2024, announcing that the Company has entered into a new time charter agreement for Flex Constellation for a period of 15 years, which will commence in the first or second quarter of 2026.

The information contained in Exhibit 99.1, excluding the commentary of Øystein Kalleklev, attached to this Report on Form 6-K is hereby incorporated by reference into the Company’s Registration Statement on Form F-3 (File No. 333-268367) with an effective date of December 7, 2022, the Company's Registration Statement on Form F-3ASR (File No. 333-282473) with an effective date of October 2, 2024 and the Company’s Registration Statement on Form S-8 (File No. 333-275460) with an effective date of November 9, 2023.

FORWARD-LOOKING STATEMENTS

Matters discussed in this press release may constitute forward-looking statements. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with this safe harbor legislation. The words "believe," "expect," "forecast," "anticipate," "estimate," "intend," "plan," "possible," "potential," "pending," "target," "project," "likely," "may," "will," "would," "should," "could" and similar expressions identify forward-looking statements.

The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although management believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond the Company’s control, there can be no assurance that the Company will achieve or accomplish these expectations, beliefs or projections. As such, these forward-looking statements are not guarantees of the Company’s future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements. The Company undertakes no obligation, and specifically declines any obligation, except as required by applicable law or regulation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for the Company to predict all of these factors. Further, the Company cannot assess the effect of each such factor on its business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

In addition to these important factors, other important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward-looking statements include: unforeseen liabilities, future capital expenditures, the strength of world economies and currencies, general market conditions, including fluctuations in charter rates and vessel values, changes in demand in the LNG tanker market, the impact of public health threats, changes in the Company’s operating expenses, including bunker prices, drydocking and insurance costs, the fuel efficiency of the Company’s vessels, the market for the Company’s vessels, availability of financing and refinancing, ability to comply with covenants in such financing arrangements, failure of counterparties to fully perform their contracts with the Company, changes in governmental rules and regulations or actions taken by regulatory authorities, including those that may limit the commercial useful lives of LNG tankers, customers' increasing emphasis on environmental and safety concerns, potential liability from pending or future litigation, general domestic and international political conditions or events, including the war between Russia and Ukraine, as well as the developments in the Middle East, including continued conflicts between Israel and Hamas and the conflict regarding the Houthi attack in the Red Sea, business disruptions, including supply chain disruption and congestion, due to natural or other disasters or otherwise, potential physical disruption of shipping routes due to accidents, climate-related incidents, or political events, vessel breakdowns and instances of off-hire, and other factors, including those that may be described from time to time in the reports and other documents that the Company files with or furnishes to the U.S. Securities and Exchange Commission (“Other Reports”). For a more complete discussion of certain of these and other risks and uncertainties associated with the Company, please refer to the Other Reports.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

FLEX LNG Ltd. (registrant) |

| By: | /s/ Oystein Kalleklev |

| Name: Oystein Kalleklev |

| Title: Chief Executive Officer of Flex LNG Management AS (Principal Executive Officer of FLEX LNG Ltd.) |

Date: November 29, 2024

Hamilton, Bermuda

November 29, 2024

Flex LNG Ltd (“Flex LNG” or the “Company”) (NYSE/OSE: FLNG) is pleased to announce it has agreed a new Time Charter Agreement (“TC”) for Flex Constellation for 15-years. Commencement of the charter will occur during the first or second quarter of 2026 with maturity in 2041. The TC also include an extension option for the charterer until 2043.

Flex Constellation, built 2019, is a advanced 173,400 cbm LNG carrier with ME-GI two stroke propulsion and partial reliquefaction system (PRS) making her ideal for the current requirements. She is currently on a 10-month TC with a large Asian utility and asset backed LNG trader until end of first quarter 2025. The current charterer is a subsidiary of the new charterer.

As communicated in connection with our third quarter results on November 12, the existing charterer of Flex Constellation did not exercise its one-year extension option. Hence, Flex Constellation will be open for trading spot and/or short-term TC from the end of first quarter 2025 for a period of approx. 12 months before commencing this new 15-year TC.

Øystein Kalleklev, CEO of Flex LNG Management commented:

“We are pleased to announce another substantial long-term charter, this time for Flex Constellation which will be fixed for a firm period of minimum 15 years from 2026 to 2041 with possibility of extension to 2043. We really much appreciate returning customer who appreciate the service and quality level that Flex LNG delivers.

With this Time Charter, we further increase our backlog and earnings visibility with a charter rate for the new period in line with the existing charter rate for the vessel. Following this agreement, Flex LNG has in total 64 years of firm backlog which may increase to 98 years in the event charterers utilize all their extension options.

Consequently, Flex LNG is very well positioned to navigate near term market weakness with 11.2 out of our 13 ships on firm Time Charter for the next year at an average Time Charter rate of close to $80,000 per day. Additionally, we also have one ship on variable hire until minimum Q3-2025, but where the charterer has the option to extend this variable hire to 2030. Hence, close to 90 per cent of our income days for 2025 is already covered with backlog stretching all the way into 2041.”

Please find the updated contract overview attached.

For further information, please contact:

Media contact: Mr. Øystein Kalleklev, Chief Executive Officer of Flex LNG Management

Investor and Analyst contact: Mr. Knut Traaholt, Chief Financial Officer of Flex LNG Management

Telephone: +47 23 11 40 00

Email: ir@flexlng.com

This information constitutes inside information pursuant to article 7 in the EU Market Abuse Regulation, was published by Petter Eng, Senior Vice President Finance, on the date and at the time indicated above, and is subject to disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.

1 HIGH CONTRACT COVERAGE AND EARNINGS VISIBILITY 64 years of min. charter backlog which may grow to 98 years with charterer’s extension options

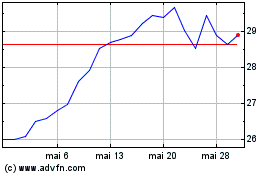

FLEX LNG (NYSE:FLNG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

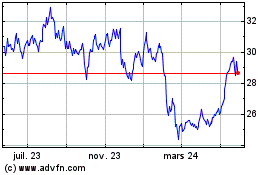

FLEX LNG (NYSE:FLNG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024