0000928054FALSE00009280542023-06-272023-06-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

June 27, 2023

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-13270 | 90-0023731 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

8846 N. Sam Houston Parkway W. Houston, TX, 77064

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Exchange on which registered |

| Common Stock, $0.0001 par value | FTK | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

On June 27, 2023, the Board of Directors (the “Board”) of Flotek Industries, Inc. (the “Company”) adopted an amendment to the Flotek Industries, Inc. 2012 Employee Stock Purchase Plan (as amended, the “Plan”) to allow highly compensated employees (within the meaning of Section 423(b)(4)(D) of the Internal Revenue Code of 1986, as amended) to participate in the Plan and to remove the 1,000 shares of Company common stock limit per employee per offering period under the Plan. In addition, the Board removed the prior prohibition on executive officers participating in the Plan.

The foregoing summary of the amendment to the Plan does not purport to be a complete description of the amendment to the Plan and is qualified in its entirety by reference to the full text of the amendment to the Plan, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | | | | | | | |

Exhibit Number | | Description | |

10.1 | | | |

| | | |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| FLOTEK INDUSTRIES, INC. |

| Date: June 30, 2023 | /s/ Bond Clement |

| Name: | Bond Clement |

| Title: | Chief Financial Officer |

Exhibit 10.1

FLOTEK INDUSTRIES, INC.

AMENDED AND RESTATED 2012 EMPLOYEE STOCK PURCHASE PLAN

Whereas Flotek Industries, Inc. sponsors the Amended 2012 Employee Stock Purchase Plan (the “Prior Amended Plan”) which was amended in 2022 and approved by shareholders on June 9, 2022, to increase Shares issuable under the Plan to 1,500,000; and

Whereas the Company desires to amend and restate the Plan to incorporate the amendment of the Plan effective June 27, 2023, to remove the last sentence of Section 3(a) of the “Prior Amended Plan” and to remove the 1000 Share limit in Section 7(a) of the Prior Amended Plan.

Now, therefore, the following constitute the provisions of the Amended and Restated 2012 Employee Stock Purchase Plan of Flotek Industries, Inc.

1. Purpose. The purpose of the Plan is to provide eligible employees of the Company and its Subsidiaries with an opportunity to purchase Common Stock of the Company through payroll deductions, to enhance such employees’ sense of participation in the affairs of the Company and its Subsidiaries, and to provide an incentive for continued employment. It is the intention of the Company to have the Plan qualify as an “Employee Stock Purchase Plan” under Section 423 of the Code. The provisions of the Plan shall, accordingly, be construed so as to extend and limit participation in a manner consistent with the requirements of that section of the Code.

2. Definitions.

a.“Board” means the Board of Directors of the Company.

a.“Code” means the Internal Revenue Code of 1986, as amended.

a.“Common Stock” means the common stock, par value $.0001 per share, of the Company.

a.“Company” means Flotek Industries, Inc., a Delaware corporation.

a.“Compensation” means salary and/or wages received by an Employee from the Company or a Subsidiary. By way of illustration, but not limitation, Compensation excludes bonuses, commissions, incentive compensation, relocation, expense reimbursements, or other reimbursements and income realized as a result of participation in any stock option, stock purchase, or similar plan of the Company or any Subsidiary.

a.“Continuous Status as an Employee” means the absence of any interruption or termination of service as an Employee. Continuous Status as an Employee shall not be considered interrupted in the case of (i) sick leave; (ii) military leave; (iii) any other leave of absence approved by the Company, provided that such leave is for a period of not more than 90 days, unless reemployment upon the expiration of such leave is guaranteed by contract or statute, or unless provided otherwise pursuant to Company policy adopted from

time to time; or (iv) transfers between locations of the Company or between the Company and its Subsidiaries.

a.“Contributions” means all amounts credited to the account of a participant pursuant to the Plan.

a.“Corporate Transaction” shall be deemed to have occurred upon any of the following events: (a) any “person” or “persons” (as defined in Section 3(a)(9) of the Exchange Act, and as modified in Sections 13(d) and 14(d) of the Exchange Act) other than and excluding (i) the Company or any of its Subsidiaries, (ii) any employee benefit plan of the Company or any of its subsidiaries, (iii) any Subsidiary of the Company, (iv) an entity owned, directly or indirectly, by stockholders of the Company in substantially the same proportions as their ownership of the Company or (v) an underwriter temporarily holding securities pursuant to an offering of such securities, becomes the “beneficial owner” (as defined in Rule 13d-3 of the Exchange Act), directly or indirectly, of securities of the Company representing more than 50% of the shares of voting stock of the Company then outstanding; (b) the consummation of any merger, organization, business combination or consolidation of the Company with or into any other entity, other than a merger, reorganization, business combination or consolidation which would result in the holders of the voting securities of the Company outstanding immediately prior thereto and their respective affiliates holding securities which represent immediately after such merger, reorganization, business combination or consolidation more than 50% of the combined voting power of the voting securities of the Company or the surviving company or the parent of such surviving company; or (c) the consummation of a sale or disposition by the Company of all or substantially all of the Company’s assets, other than a sale or disposition if the holders of the voting securities of the Company outstanding immediately prior thereto and their respective affiliates hold securities immediately thereafter which represent more than 50% of the combined voting power of the voting securities of the acquirer, or parent of the acquiror, of such assets.

a.“Employee” means any person, including an Officer, who is an employee of the Company or one of its Subsidiaries for tax purposes and who is customarily employed for at least twenty (20) hours per week by the Company or one of its Subsidiaries.

a.“Exchange Act” means the Securities Exchange Act of 1934, as amended.

a.“First Offering Period” means the three (3) month period commencing on October 1, 2012.

a.“Offering Date” means the first business day of each calendar quarter.

a.“Offering Period” means each continuous three (3) month period commencing on January 1, April 1, July 1 and October 1 of each year except for the First Offering Period as set forth in Section 4 of this Plan.

a.“Officer” means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

a.“Plan” means this Amended 2012 Employee Stock Purchase Plan.

a.“Purchase Date” means the last day of each Offering Period of the Plan.

a.“Purchase Price” means with respect to an Offering Period an amount equal to 85% of the Fair Market Value (as defined in Section 7(b) below) of a Share of Common Stock on the Purchase Date.

a.“Share” means a share of Common Stock, as adjusted in accordance with Section 19 of the Plan.

a.“Subsidiary” means any corporation in which the Company, directly or indirectly, owns 50% or more of the combined voting power whether or not such corporation now exists or is hereafter organized or acquired by the Company or a Subsidiary.

3. Eligibility.

a.Any person who is an Employee as of the Offering Date of a given Offering Period (including the First Offering Period) shall be eligible to participate in such Offering Period under the Plan, subject to the requirements of Section 5(a) and the limitations imposed by Section 423(b) of the Code.

a.Any provisions of the Plan to the contrary notwithstanding, no Employee shall be granted an option under the Plan (i) if, immediately after the grant, such Employee (or any other person whose stock would be attributed to such Employee pursuant to Section 424(d) of the Code) would own capital stock of the Company and/or hold outstanding options to purchase stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company or of any subsidiary of the Company, or (ii) if, as specified in Section 423(b)(8) and applicable regulations of the Code, such option would permit his or her rights to purchase stock under all employee stock purchase plans (described in Section 423 of the Code) of the Company and its Subsidiaries to accrue at a rate that exceeds Twenty-Five Thousand Dollars ($25,000) of the Fair Market Value (as defined in Section 7(b) below) of such stock (determined at the time such option is granted) for each calendar year in which such option is outstanding at any time.

4. Offering Periods. The Plan shall be implemented by a series of Offering Periods of three (3) months’ duration, with new Offering Periods commencing on the 1st day of each calendar quarter (or at such other time or times as may be determined by the Board) except for the First Offering Period which shall be three (3) months’ duration commencing on October 1, 2012 and continuing until December 31, 2012. The Plan shall continue for a term of [Delete: ten] [Insert: thirteen] years per Section 22 or until terminated earlier in accordance with Section 19 hereof. The Board shall have the power to change the duration and/or the frequency of Offering Periods with respect to future offerings without stockholder approval if such change is announced at least five (5) days prior to the scheduled beginning of the first Offering Period to be affected.

5. Participation.

a.An eligible Employee may become a participant in the Plan by completing a subscription agreement and any other required documents (“Enrollment Documents”) provided by the Company and submitting them to the Company’s Human Resources Department or the stock brokerage or other financial services firm designated by the Company (“Designated Broker”) prior to the applicable Offering Date, unless a later time for submission of the Enrollment Documents is set by the Board for all eligible Employees with respect to a

given Offering Period. The Enrollment Documents and their submission may be electronic, as directed by the Company. The Enrollment Documents shall set forth the percentage of the participant’s Compensation (subject to Section 6(a) below) to be paid as Contributions pursuant to the Plan. A participant’s payroll deductions shall remain in effect for all future Offering Periods unless changed by the participant.

a.Payroll deductions shall commence on the first full payroll following an Offering Date and shall end on the last payroll paid on or prior to the Purchase Date of the Offering Period to which the Enrollment Documents are applicable, unless sooner terminated by the participant as provided in Section 10.

6. Method of Payment of Contributions.

a.A participant shall elect to have payroll deductions made on each payday during the Offering Period in an amount not less than one percent (1%) and not more than ten percent (10%) (or such greater percentage as the Board may establish from time to time before an Offering Date) of such participant’s Compensation on each payday during the Offering Period. All payroll deductions made by a participant shall be credited to his or her account under the Plan. A participant may not make any additional payments into such account.

a.A participant may discontinue his or her participation in the Plan as provided in Section 10.

a.Notwithstanding the foregoing, to the extent necessary to comply with Section 423(b)(8) of the Code and Section 3(b) herein, a participant’s payroll deductions may be decreased during any Offering Period scheduled to end during the current calendar year to 0%. Payroll deductions shall re-commence at the rate provided in such participant’s Enrollment Documents at the beginning of the first Offering Period that is scheduled to end in the following calendar year, unless terminated by the participant as provided in Section 10.

7. Grant of Option.

a.On each Offering Date of each Offering Period, each eligible Employee participating in such Offering Period shall be granted an option to purchase on the Purchase Date a number of Shares of the Company’s Common Stock determined by dividing such Employee’s Contributions accumulated prior to such Purchase Date and retained in the participant’s account as of the Purchase Date by the applicable Purchase Price provided, however, that such purchase shall be subject to the limitations set forth in Sections 3(b) and 12.

a.The fair market value of the Company’s Common Stock on a given date (the “Fair Market Value”) shall be determined by the Board in its discretion based on the closing sales price of the Common Stock on the New York Stock Exchange for such date (or, in the event that the Common Stock is not traded on such date, on the immediately preceding trading date).

8. Exercise of Option. Unless a participant withdraws from the Plan as provided in Section 10, his or her option for the purchase of Shares will be exercised automatically on the Purchase Date of an Offering Period, and the maximum number of Shares subject to the option will be purchased at the applicable Purchase Price with the accumulated Contributions in his or her account. Fractional Shares shall be issued, as necessary. The Shares

purchased upon exercise of an option hereunder shall be deemed to be transferred to the participant on the Purchase Date. During his or her lifetime, a participant’s option to purchase Shares hereunder is exercisable only by him or her.

9. Delivery. As promptly as practicable after a Purchase Date, the number of Shares purchased by each participant upon exercise of his or her option shall be deposited into an account established in the participant’s name with the Designated Broker. Any payroll deductions accumulated in a participant’s account that are not applied toward the purchase of Shares on a Purchase Date due to limitations imposed by the Plan shall be returned to the participant.

10. Voluntary Withdrawal; Termination of Employment.

a.A participant may withdraw all but not less than all the Contributions credited to his or her account under the Plan at any time prior to a Purchase Date by submitting a completed “Notice of Withdrawal” form to the Company’s Human Resources Department or electronically completing the required documentation provided by the Company through the Designated Broker, as directed by the Company’s Human Resources Department. All of the participant’s Contributions credited to his or her account will be paid to him or her promptly after receipt of his or her notice of withdrawal and his or her option for the current period will be automatically terminated, and no further Contributions for the purchase of Shares will be made during the Offering Period.

a.Upon termination of the participant’s Continuous Status as an Employee prior to the Purchase Date of an Offering Period for any reason, whether voluntary or involuntary, including retirement or death, the Contributions credited to his or her account will be returned to him or her or, in the case of his or her death, to the person or persons entitled thereto under Section 14, and his or her option will be automatically terminated.

a.In the event an Employee fails to remain in Continuous Status as an Employee of the Company for at least twenty (20) hours per week during the Offering Period in which the employee is a participant, he or she will be deemed to have elected to withdraw from the Plan and the Contributions credited to his or her account will be returned to him or her and his or her option terminated.

a.A participant’s withdrawal from an offering will not have any effect upon his or her eligibility to participate in a succeeding offering or in any similar plan that may hereafter be adopted by the Company.

11. Interest. No interest shall accrue on the Contributions of a participant in the Plan.

12. Stock.

a.Subject to adjustment as provided in Section 18, the maximum number of Shares that shall be made available for sale under the Plan shall be 1,500,000 Shares. If the Board determines that, on a given Purchase Date, the number of shares with respect to which options are to be exercised may exceed (1) the number of shares of Common Stock that were available for sale under the Plan on the Offering Date of the applicable Offering Period, or (2) the number of shares available for sale under the Plan on such Purchase Date, the Board may in its sole discretion provide (x) that the Company shall make a pro rata allocation of

the Shares of Common Stock available for purchase on such Offering Date or Purchase Date, as applicable, in as uniform a manner as shall be practicable and as it shall determine in its sole discretion to be equitable among all participants exercising options to purchase Common Stock on such Purchase Date, and continue the Plan as then in effect, or (y) that the Company shall make a pro rata allocation of the Shares available for purchase on such Offering Date or Purchase Date, as applicable, in as uniform a manner as shall be practicable and as it shall determine in its sole discretion to be equitable among all participants exercising options to purchase Common Stock on such Purchase Date, and terminate the Plan pursuant to Section 19 below. The Company may make a pro rata allocation of the Shares available on an Offering Date of any applicable Offering Period pursuant to the preceding sentence, notwithstanding any authorization of additional Shares for issuance under the Plan by the Company’s stockholders subsequent to such Offering Date.

a.The participant shall have no interest or voting right in Shares covered by his or her option until such option has been exercised.

a.Shares to be delivered to a participant under the Plan will be registered in the name of the participant or in the name of the participant and his or her spouse.

13. Administration. The Board, or a committee named by the Board, shall supervise and administer the Plan and shall have full power to adopt, amend and rescind any rules deemed desirable and appropriate for the administration of the Plan and not inconsistent with the Plan, to construe and interpret the Plan, and to make all other determinations necessary or advisable for the administration of the Plan.

14. Designation of Beneficiary.

a.A participant may designate a beneficiary who is to receive any Shares and cash, if any, from the participant’s account under the Plan in the event of such participant’s death subsequent to the end of an Offering Period but prior to delivery to him or her of such Shares and cash. In addition, a participant may designate a beneficiary who is to receive any cash from the participant’s account under the Plan in the event of such participant’s death prior to the Purchase Date of an Offering Period. If a participant is married and the designated beneficiary is not the spouse, spousal consent shall be required for such designation to be effective. Beneficiary designations under this Section 14(a) shall be made as directed by the Human Resources Department of the Company, which may require electronic submission of the required documentation with the Designated Broker.

a.Such designation of beneficiary may be changed by the participant (and his or her spouse, if any) at any time by submission of the required notice, which required notice may be electronic. In the event of the death of a participant and in the absence of a beneficiary validly designated under the Plan who is living at the time of such participant’s death, the Company shall deliver such Shares and/or cash to the executor or administrator of the estate of the participant, or if no such executor or administrator has been appointed (to the knowledge of the Company), the Company, in its discretion, may deliver such Shares and/or cash to the spouse or to any one or more dependents or relatives of the participant, or if no spouse, dependent or relative is known to the Company, then to such other person as the Company may designate.

15. Transferability. Neither Contributions credited to a participant’s account nor any rights with regard to the exercise of an option or to receive Shares under the Plan may be assigned, transferred, pledged or otherwise disposed of in any way (other than by will, the laws of descent and distribution, or as provided in Section 14) by the participant. Any such attempt at assignment, transfer, pledge or other disposition shall be without effect, except that the Company may treat such act as an election to withdraw funds in accordance with Section 10.

16. Use of Funds. All Contributions received or held by the Company under the Plan may be used by the Company for any corporate purpose, and the Company shall not be obligated to segregate such Contributions.

17. Reports. Individual accounts will be maintained for each participant in the Plan. Statements of account will be provided to participating Employees by the Company or the Designated Broker at least annually, which statements will set forth the amounts of Contributions, the per Share Purchase Price, the number of Shares purchased and the remaining cash balance, if any.

18. Adjustments Upon Changes in Capitalization; Corporate Transactions.

a.Adjustment. Subject to any required action by the stockholders of the Company, the number of Shares covered by each option under the Plan that has not yet been exercised, the number of Shares that have been authorized for issuance under the Plan but have not yet been placed under option (collectively, the “Reserves”), the maximum number of Shares of Common Stock that may be purchased by a participant in an Offering Period, the number of Shares of Common Stock set forth in Section 12(a)(i) above, and the price per Share of Common Stock covered by each option under the Plan that has not yet been exercised, shall be proportionately adjusted for any increase or decrease in the number of issued Shares resulting from a stock split, reverse stock split, stock dividend, combination or reclassification of the Common Stock (including any such change in the number of Shares of Common Stock effected in connection with a change in domicile of the Company), or any other increase or decrease in the number of Shares effected without receipt of consideration by the Company; provided however that conversion of any convertible securities of the Company shall not be deemed to have been “effected without receipt of consideration.” Such adjustment shall be made by the Board, whose determination in that respect shall be final, binding and conclusive. Except as expressly provided herein, no issue by the Company of shares of stock of any class, or securities convertible into shares of stock of any class, shall affect, and no adjustment by reason thereof shall be made with respect to, the number or price of Shares subject to an option.

a.Corporate Transactions. In the event the stockholders of the Company approve a plan of complete dissolution or liquidation of the Company, any Offering Period then in progress will terminate immediately prior to the consummation of such action, unless otherwise provided by the Board. In the event of a Corporate Transaction, each option outstanding under the Plan shall be assumed or an equivalent option shall be substituted by the successor corporation or a parent or subsidiary of such successor corporation. In the event that the successor corporation refuses to assume or substitute for outstanding options, each Offering Period then in progress shall be shortened and a new Purchase Date shall be set (the “New Purchase Date”), as of which date any Offering Period then in progress will terminate. The New Purchase Date shall be on or before the date of consummation of the transaction and the Board shall notify each participant in writing, at least ten (10) days prior to the New Purchase Date, that the Purchase Date for his or her option has been changed to the New Purchase Date and that his or her option will be exercised automatically on the New Purchase Date, unless prior to such date he or she has withdrawn from the

Offering Period as provided in Section 10. For purposes of this Section 18, an option granted under the Plan shall be deemed to be assumed, without limitation, if, at the time of issuance of the stock or other consideration upon a Corporate Transaction, each holder of an option under the Plan would be entitled to receive upon exercise of the option the same number and kind of shares of stock or the same amount of property, cash or securities as such holder would have been entitled to receive upon the occurrence of the transaction if the holder had been, immediately prior to the transaction, the holder of the number of Shares of Common Stock covered by the option at such time (after giving effect to any adjustments in the number of Shares covered by the option as provided for in this Section 18); provided however that if the consideration received in the transaction is not solely common stock of the successor corporation or its parent (as defined in Section 424(e) of the Code), the Board may, with the consent of the successor corporation, provide for the consideration to be received upon exercise of the option to be solely common stock of the successor corporation or its parent equal in Fair Market Value to the per Share consideration received by holders of Common Stock in the transaction. The Board may, if it so determines in the exercise of its sole discretion, also make provision for adjusting the Reserves, as well as the price per Share of Common Stock covered by each outstanding option, in the event that the Company effects one or more reorganizations, recapitalizations, rights offerings or other increases or reductions of Shares of its outstanding Common Stock, and in the event of the Company’s being consolidated with or merged into any other corporation.

19. Amendment or Termination.

a.The Board may at any time and for any reason terminate or amend the Plan. Except as provided in Section 18, no such termination of the Plan may affect options previously granted, provided that the Plan or an Offering Period may be terminated by the Board on a Purchase Date or by the Board’s setting a new Purchase Date with respect to an Offering Period then in progress if the Board determines that termination of the Plan and/or the Offering Period is in the best interests of the Company and the stockholders or if continuation of the Plan and/or the Offering Period would cause the Company to incur adverse accounting charges as a result of a change after the effective date of the Plan in the generally accepted accounting rules applicable to the Plan. Except as provided in Section 18 and in this Section 19, no amendment to the Plan shall make any change in any option previously granted that adversely affects the rights of any participant. In addition, to the extent necessary to comply with Rule 16b-3 under the Exchange Act, or under Section 423 of the Code (or any successor rule or provision or any applicable law or regulation), the Company shall obtain stockholder approval in such a manner and to such a degree as so required.

a.Without stockholder consent and without regard to whether any participant rights may be considered to have been adversely affected, the Board (or its committee) shall be entitled to change the Offering Periods, limit the frequency and/or number of changes in the amount withheld during an Offering Period, establish the exchange ratio applicable to amounts withheld in a currency other than U.S. dollars, permit payroll withholding in excess of the amount designated by a participant in order to adjust for delays or mistakes in the Company’s processing of properly completed withholding elections, establish reasonable waiting and adjustment periods and/or accounting and crediting procedures to ensure that amounts applied toward the purchase of Common Stock for each participant properly correspond with amounts withheld from the participant’s Compensation, and establish such other limitations or procedures as the Board (or its committee) determines in its sole discretion advisable that are consistent with the Plan.

20. Notices. All notices or other communications by a participant to the Company under or in connection with the Plan shall be deemed to have been duly given when received in the form specified by the Company at the location, or by the person, designated by the Company for the receipt thereof.

21. Conditions Upon Issuance of Shares. Shares shall not be issued with respect to an option unless the exercise of such option and the issuance and delivery of such Shares pursuant thereto shall comply with all applicable provisions of law, domestic or foreign, including, without limitation, the Securities Act of 1933, as amended, the Exchange Act, the rules and regulations promulgated thereunder, applicable state securities laws and the requirements of any stock exchange upon which the Shares may then be listed, and shall be further subject to the approval of counsel for the Company with respect to such compliance. As a condition to the exercise of an option, the Company may require the person exercising such option to represent and warrant at the time of any such exercise that the Shares are being purchased only for investment and without any present intention to sell or distribute such Shares if, in the opinion of counsel for the Company, such a representation is required by any of the aforementioned applicable provisions of law.

22. Term of Plan; Effective Date. The Plan shall become effective upon approval by the Company’s stockholders, which approval must be within twelve (12) months after the date the Plan is adopted by the Board. No option to purchase Shares of the Company’s Common Stock hereunder will be granted unless and until the Plan has been approved by the Company’s stockholders. The Plan shall continue in effect for a term of [Delete: ten (10)] [Insert: thirteen (13)] years from the effective date unless sooner terminated under Section 19.

23. Additional Restrictions of Rule 16b-3. The terms and conditions of options granted hereunder to, and the purchase of Shares by, persons subject to Section 16 of the Exchange Act shall comply with the applicable provisions of Rule 16b-3. This Plan shall be deemed to contain, and such options shall contain, and the Shares issued upon exercise thereof shall be subject to, such additional conditions and restrictions as may be required by Rule 16b-3 to qualify for the maximum exemption from Section 16 of the Exchange Act with respect to Plan transactions.

24. Notice of Disposition of Shares. Each participant shall notify the Company in writing if the participant disposes of any of the Shares purchased on the Purchase Date of any Offering Period if such disposition occurs within two (2) years from the Offering Date or within one (1) year from the Purchase Date on which such shares were purchased and the Shares are not held by the Designated Broker. The Company may place a legend on any certificate representing Shares acquired pursuant to this Plan requesting the Company’s transfer agent to notify the Company of any transfer of the Shares. The obligation of the participant to provide such notice shall continue notwithstanding the placement of any such legend on the certificates.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

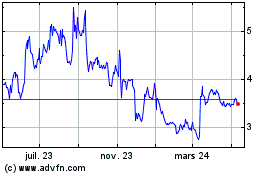

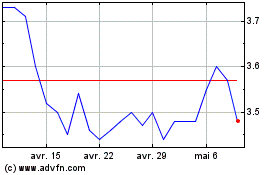

Flotek Industries (NYSE:FTK)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Flotek Industries (NYSE:FTK)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024