0000928054FALSE00009280542023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 14, 2023

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-13270 | 90-0023731 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

8846 N. Sam Houston Parkway W. Houston, TX, 77064

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of Exchange on which registered |

| Common Stock, $0.0001 par value | FTK | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On August 14, 2023, Flotek Industries, Inc. (the “Company”) entered into a revolving loan and security agreement (the “Loan Agreement”) with Flotek Chemistry, LLC and JP3 Measurement, LLC, wholly owned subsidiaries of the Company (collectively with the Company, the “Borrowers”), and Amerisource Funding, Inc. ( “Amerisource”), as lender.

The Loan Agreement provides for a twenty-four month term with up to $10 million of initial credit availability (the “Account Limit”) based on 85% of eligible accounts receivable and 60% of eligible inventory (not to exceed the amount of eligible accounts receivable). Borrowings under the Loan Agreement bear interest at the Wall Street Journal Prime Rate (subject to a floor of 5.50%) plus 2.5% per annum. After closing and subject to certain conditions, including an acceptable appraisal and the pledge of real estate collateral by the Borrowers, the credit availability is expected to be increased by the lesser of 50% of the appraised value of the real estate and $5 million.

The Loan Agreement contemplates the following fees: (i) a collateral management fee of 0.10% assessed monthly on the Account Limit, (ii) a non-usage fee of 0.25% assessed quarterly on the average unused portion of the Account Limit, and (iii) a commitment fee of 1.0% of the Account Limit, paid at closing and annually thereafter. If the Loan Agreement is terminated prior to the end of its twenty-four month term, the Borrowers are required to pay an early termination fee of 2.50% of the Account Limit (if terminated with more than 12 months remaining until the maturity date) or 1.50% of the Account Limit (if terminated with less than 12 months remaining until the maturity date).

The Loan Agreement requires the Borrowers to maintain a minimum Tangible Net Worth (as defined in the Loan Agreement) of not less than $11 million. In addition, the Loan Agreement provides Amerisource a blanket security interest on all or substantially all of the Borrowers’ assets. Proceeds from the Loan Agreement are expected to be used for working capital and other general corporate purposes. The foregoing description of the Loan Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Loan Agreement, which is filed herewith as Exhibit 10.1 and incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information provided under Item 1.01 of this Current Report on Form 8-K regarding each of the transactions described therein is also responsive to Item 2.03 of this Current Report on Form 8-K and is hereby incorporated by reference into this Item 2.03.

Item 7.01 Regulation FD Disclosure

On August 14, 2023, the Company issued a press release announcing the closing of the Loan Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not subject to the liabilities of that section and is not deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | |

| Exhibit No. | Description |

| 10.1 | Revolving Loan and Security Agreement dated as of August 14, 2023, among Flotek Industries, Inc., Flotek Chemistry, LLC and JP3 Measurement, LLC, as borrowers, and Amerisource Funding, Inc., as lender. |

| 99.1 | |

| |

| |

| |

| |

| |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| FLOTEK INDUSTRIES, INC. |

| Date: August 14, 2023 | /s/ Bond Clement |

| Name: | Bond Clement |

| Title: | Chief Financial Officer |

EXHIBIT 10.1

EXHIBIT 99.1

Flotek Announces Entry into Asset Based Loan Agreement

HOUSTON, August 14, 2023 - Flotek Industries, Inc. (“Flotek” or the “Company”) (NYSE: FTK) today announced that it has entered into a revolving loan and security agreement in connection with an Asset Based Loan (“ABL”) with Amerisource Funding, Inc. (“Lender”). The ABL provides for a 24-month term with up to $10 million of initial credit availability for eligible accounts receivable and eligible inventory. After closing and subject to certain conditions, including an acceptable appraisal and the pledge of real estate collateral by the Company, the credit availability is expected to be increased by the lesser of 50% of the appraised value of the real estate and $5 million. Borrowings under the ABL bear interest at the Wall Street Journal Prime Rate plus 2.5% per annum. The ABL also contains customary administrative and facility fees.

Borrowings under the ABL are expected to be used for working capital and other general corporate purposes. Roth Capital Partners, LLC served as financial advisor to Flotek.

Ryan Ezell Chief Executive Officer said, “Securing this loan is a significant step along the Company’s path to profitability. Our ability to secure this liquidity highlights the substantial improvement in the Company’s balance sheet and financial performance including the conversion of debt to equity driving a working capital improvement from negative $70 million at year end to positive $26 million at June 30, 2023. When combined with eight consecutive quarters of improvement in operating cash flow and our expectation of achieving positive adjusted EBITDA before year-end, this new credit facility provides us incremental momentum toward our goal of increasing shareholder value.”

About Flotek Industries, Inc.

Flotek Industries, Inc. is an advanced technology-driven, green chemical and data analytics company providing unique and innovative completion solutions that have a proven, positive impact on sustainability and reducing the overall environmental impact of energy on air, land, water and people. Flotek has an intellectual property portfolio of over 170 patents and a global presence in more than 15 countries throughout North America, Latin America, the Middle East and North Africa. Flotek has established collaborative partnerships focused on sustainable and optimized chemistry and data solutions which improve well performance and allow its customers to generate higher returns on invested capital.

Flotek is based in Houston, Texas and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK”. For additional information, please visit www.flotekind.com.

Forward -Looking Statements

Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release. Although forward-looking statements in this press release reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements.

Company Contact

Bond Clement

Chief Financial Officer

E: ir@flotekind.com

P: (713) 726-5322

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

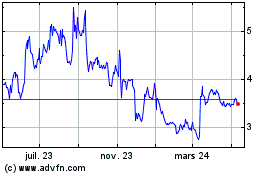

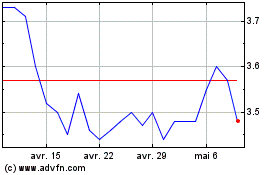

Flotek Industries (NYSE:FTK)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Flotek Industries (NYSE:FTK)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024