Turtle Creek Asset Management Releases Open Letter to Gildan Board Calling on it to Hold the Annual Meeting Without Delay

25 Mars 2024 - 1:00PM

Turtle Creek Asset Management Inc. (“Turtle Creek”), a

Canadian independent investment management firm with a 25-year

history and a decade-long shareholder of Gildan Activewear Inc.

(GIL: TSX and NYSE) (“Gildan” or the “Company”), today issued an

open letter to the board of directors (the “Board”) of Gildan.

The full text of the open letter to the Board

follows:

Donald C. BergMaryse BertrandDhaval BuchMarc

CairaShirley E. CunninghamSharon DriscollCharles M. HeringtonLuc

JobinCraig A. LeavittAnne Martin-VachonChristopher S.

ShackeltonVince Tyra

c/o Donald C. Berg, Chair of the Board and Arun Bajaj, EVP,

Chief HR Officer & Legal Affairs600 de Maisonneuve Boulevard

West, 33rd FloorMontréal, Québec, H3A 3J2

Dear Directors,

Turtle Creek is a long-term and engaged owner of

Gildan. We are deeply troubled with the Board’s latest attempt to

avoid the judgement of its shareholders through a purported process

to sell the Company. This Board does not have a mandate, nor the

confidence of Gildan shareholders, to run a process that could

result in the sale of Gildan. The Board’s outrageous and

unprecedented actions to date, in the face of massive shareholder

opposition are wholly-disqualifying. In fact, we strongly believe

that the Board has initiated a sale process in a desperate attempt

to avoid the profound professional embarrassment that will befall

the directors once they are voted off the board by Gildan’s

shareholders. If a meeting of Gildan shareholders were held today,

we have a high level of confidence that the shareholders would vote

overwhelmingly in favor of the individuals nominated by Browning

West LP.

Even the release of the news of the sale process

was characteristic of the Board’s slapdash approach to governance.

The material disclosure that the Board was attempting to sell the

Company was reported on by the news media, during regular market

hours, citing an emailed statement from a Gildan spokesperson.

Unsurprisingly, this prompted regulators to halt trading in Gildan

shares approximately 20 minutes later for the duration of the

trading day. In the ensuing hours, detailed information about the

names of third parties who had indicated interest in purchasing

Gildan, along with indicative pricing levels, began appearing in

the news media, demonstrating a lack of integrity in the purported

process. These leaks ran counter to the interests of potential

buyers, which led us to speculate that they originated from Gildan

or its advisors.

To even a casual market observer, it is so

obviously a bad time to initiate a sale process that we have been

left stunned in disbelief. Public companies frequently receive

unsolicited purchase offers. Just because an offer has been

received does not require the Board to seriously entertain it,

especially when the Company is in the midst of a boardroom battle.

Turtle Creek believes that the process led by the Special Committee

is yet another attempt by the Board to evade accountability for its

actions. We are concerned that the “sale process” is, at best, a

hasty attempt to sell the Company at a price that does not reflect

Gildan’s long term potential, or, at worst, a cynical and

irresponsible tactic intended to provide a pretext to further delay

or influence the annual meeting of Gildan shareholders.

For over 25 years, Turtle Creek has done the

hard work of analyzing and valuing the companies in which we

invest. We think about what the future holds for our companies and

the future cash flows the companies could generate. When we do our

analysis of Gildan, we arrive at a value of over US$60 per share.

Clearly, Gildan is trading at a substantial discount to our view of

its value.

We and other shareholders do not trust the

current Board to act as independent fiduciaries for us. We demand

the Board hold the annual meeting of shareholders on an urgent

basis and allow shareholders to elect a new Board before further,

permanent harm is caused to the Company.

We remain steadfast in our resolve to see

substantial Board change. The Board still has an opportunity to do

the right thing and put an end to an unfortunate chapter in the

Company’s history.

Sincerely,

Turtle Creek Asset Management

No Solicitation

This press release does not constitute a solicitation of a proxy

within the meaning of applicable laws, and accordingly, Gildan

shareholders are not being asked to give, withhold or revoke a

proxy.

Advisors

Davies Ward Phillips & Vineberg LLP is

serving as Canadian legal counsel, Cleary Gottlieb Steen &

Hamilton LLP is serving as United States legal counsel and Gagnier

Communications is serving as communications advisor to Turtle

Creek.

About Turtle Creek Asset Management

Inc.

Turtle Creek is an independent investment

management firm with a 25-year history. We manage over $5 billion

for a clientele of high-net-worth families, institutions and wealth

advisors. Turtle Creek is not your typical value investor. We are

engaged shareholders focused on the long term. Turtle Creek is

where the partners and our senior employees have all of their

investable wealth. As a result, we are aligned with our fellow

investors to an extent that few other firms can match.

For further information, please visit:

https://www.turtlecreek.ca/

Contact:

Riyaz Lalani & Dan GagnierGagnier Communications(416)

305-1459TurtleCreek@gagnierfc.com

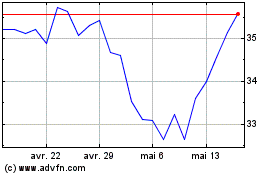

Gildan Activewear (NYSE:GIL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Gildan Activewear (NYSE:GIL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024