- Net sales of $5.2 billion were up 2 percent; organic net

sales1 increased 1 percent

- Operating profit of $1.1 billion was up 33 percent; adjusted

operating profit of $1.1 billion increased 7 percent in constant

currency

- Diluted earnings per share (EPS) of $1.42 was up 39 percent;

adjusted diluted EPS of $1.40 increased 12 percent in constant

currency

- Second-quarter results included certain timing benefits that

are expected to reverse in the second half

- Company updates full-year fiscal 2025 outlook to reflect

increased investment to fund improved volume and market share

trends

¹ Please see Note 7 to the Consolidated Financial Statements

below for reconciliation of this and other non-GAAP measures used

in this release.

General Mills, Inc. (NYSE: GIS) today reported results for its

fiscal 2025 second quarter.

“We made important progress accelerating our volume growth and

market share trends in the first half of the year, including

returning our North America Pet business to growth,” said General

Mills Chairman and Chief Executive Officer Jeff Harmening. “To

achieve and build on these enterprise-wide gains, we’ve made

incremental investments to bring consumers greater value. While

these investments lower our profit outlook for fiscal 2025, they

better position General Mills for sustainable growth in fiscal 2026

and beyond. Amidst a dynamic external environment, I’m not only

confident in our plans, but especially our teams, who are operating

with agility and doing what’s right for our consumers.”

Guided by its purpose to make food the world loves, General

Mills is executing its Accelerate strategy to drive sustainable,

profitable growth and top-tier shareholder returns over the long

term. The strategy focuses on four pillars to create competitive

advantages and win: boldly building brands, relentlessly

innovating, unleashing scale, and standing for good. The company is

prioritizing its core markets, global platforms, and local gem

brands that have the best prospects for profitable growth and is

committed to reshaping its portfolio with strategic acquisitions

and divestitures to further enhance its growth profile.

Second Quarter Results

Summary

- Results in the quarter were impacted by certain favorable

timing items that are expected to reverse in the second half of

fiscal 2025. These include an increase in retailer inventory in

North America Retail due in part to the Thanksgiving holiday

shifting from the final week of the second quarter of fiscal 2024

to the first week of the third quarter of fiscal 2025, as well as

favorable trade and other expense timing. These items represented

approximately a 1.5-point benefit to net sales and a 6-point

benefit to operating profit in the quarter.

- Net sales increased 2 percent to $5.2 billion, driven by

higher pound volume partially offset by unfavorable net price

realization and mix. Organic net sales were up 1 percent.

- Gross margin was up 250 basis points to 36.9 percent of

net sales, driven primarily by Holistic Margin Management (HMM)

cost savings and favorable mark-to-market effects, partially offset

by input cost inflation. Adjusted gross margin was up 130 basis

points to 36.3 percent of net sales, driven primarily by HMM cost

savings, partially offset by input cost inflation and unfavorable

net price realization and mix.

- Operating profit of $1.1 billion was up 33 percent,

driven primarily by higher gross profit dollars and a goodwill

impairment charge a year ago, partially offset by higher selling,

general, and administrative (SG&A) expenses. Operating

profit margin of 20.6 percent was up 480 basis points. Adjusted

operating profit of $1.1 billion increased 7 percent in constant

currency, driven by higher adjusted gross profit dollars, partially

offset by higher adjusted SG&A expenses. Adjusted operating

profit margin was up 100 basis points to 20.3 percent.

- Net earnings attributable to General Mills of $796

million were up 34 percent and diluted EPS was up 39 percent

to $1.42, driven primarily by higher operating profit and lower net

shares outstanding, partially offset by a higher effective tax

rate. Adjusted diluted EPS of $1.40 was up 12 percent in constant

currency, driven primarily by higher adjusted operating profit,

lower net shares outstanding, and a lower adjusted effective tax

rate.

Six Month Results

Summary

- Net sales of $10.1 billion essentially matched year-ago

results, with higher pound volume offset by unfavorable net price

realization and mix. Organic net sales were also essentially in

line with year-ago results.

- Gross margin and adjusted gross margin were each up 70

basis points to 35.9 percent of net sales, driven primarily by HMM

cost savings, partially offset by input cost inflation.

- Operating profit of $1.9 billion was up 10 percent,

driven primarily by a goodwill impairment charge a year ago and

higher gross profit dollars this year, partially offset by higher

SG&A expenses. Operating profit margin of 18.9 percent

was up 160 basis points. Adjusted operating profit of $1.9 billion

increased 2 percent in constant currency, driven by higher adjusted

gross profit dollars, partially offset by higher adjusted SG&A

expenses. Adjusted operating profit margin was up 30 basis points

to 19.1 percent.

- Net earnings attributable to General Mills of $1.4

billion were up 8 percent and diluted EPS was up 13 percent

to $2.45, driven primarily by higher operating profit and lower net

shares outstanding, partially offset by a higher effective tax

rate. Adjusted diluted EPS of $2.47 was up 6 percent in constant

currency, driven primarily by higher adjusted operating profit and

lower net shares outstanding.

Operating Segment

Results

- The acquisition of the Edgard & Cooper pet food business in

the fourth quarter of fiscal 2024 impacted the comparability of

second-quarter and year-to-date International segment operating

results between fiscal 2024 and fiscal 2025.

- Tables may not foot due to rounding.

Components of Fiscal 2025

Reported Net Sales Growth

Second Quarter

Volume

Price/Mix

Foreign

Exchange

Reported

Net Sales

North America Retail

(1) pt

1 pt

--

Flat

North America Pet

9 pts

(5) pts

--

5%

North America Foodservice

5 pts

3 pts

--

8%

International

5 pts

(4) pts

--

1%

Total

3 pts

(1) pt

--

2%

Six Months

North America Retail

(2) pts

1 pt

--

(1)%

North America Pet

6 pts

(4) pts

--

2%

North America Foodservice

3 pts

1 pt

--

4%

International

6 pts

(5) pts

(1) pt

1%

Total

1 pt

(1) pt

--

Flat

Components of Fiscal 2025

Organic Net Sales Growth

Second Quarter

Organic

Volume

Organic

Price/Mix

Organic

Net Sales

Foreign

Exchange

Acquisitions &

Divestitures

Reported

Net Sales

North America Retail

(1) pt

1 pt

1%

--

--

Flat

North America Pet

9 pts

(5) pts

5%

--

--

5%

North America Foodservice

5 pts

3 pts

8%

--

--

8%

International

3 pts

(5) pts

(3)%

--

4 pts

1%

Total

2 pts

(1) pt

1%

--

--

2%

Six Months

North America Retail

(2) pts

1 pt

Flat

--

--

(1)%

North America Pet

6 pts

(4) pts

2%

--

--

2%

North America Foodservice

3 pts

1 pt

4%

--

--

4%

International

4 pts

(6) pts

(2)%

(1) pt

3 pts

1%

Total

1 pt

(1) pt

Flat

--

--

Flat

Fiscal 2025 Segment Operating

Profit Growth

Second Quarter

% Change as Reported

% Change in Constant

Currency

North America Retail

Flat

Flat

North America Pet

36%

36%

North America Foodservice

24%

24%

International

(31)%

(45)%

Total

5%

4%

Six Months

North America Retail

(3)%

(3)%

North America Pet

21%

21%

North America Foodservice

23%

23%

International

(47)%

(56)%

Total

Flat

(1)%

North America Retail Segment

Second-quarter net sales for General Mills’ North America Retail

segment of $3.3 billion essentially matched year-ago results, with

favorable net price realization and mix offset by lower pound

volume. Organic net sales were up 1 percent. Net sales outpaced

Nielsen-measured retail sales by approximately 2 points in the

quarter, reflecting an increase in retailer inventory due in part

to the impact of the later Thanksgiving holiday in fiscal 2025, as

well as stronger growth in non-measured channels. Net sales were up

mid-single digits for the U.S. Morning Foods operating unit and up

low-single digits for U.S. Snacks. Net sales were down low-single

digits for U.S. Meals & Baking Solutions and were down

mid-single digits for Canada in constant currency. Segment

operating profit of $862 million essentially matched year-ago

results as reported and in constant currency, driven primarily by

HMM cost savings and favorable net price realization and mix,

offset by input cost inflation, higher other supply chain costs,

and lower volume.

Through six months, North America Retail segment net sales were

down 1 percent to $6.3 billion. Organic net sales essentially

matched year-ago levels. Segment operating profit of $1.6 billion

was down 3 percent as reported and in constant currency, driven

primarily by input cost inflation, higher other supply chain costs,

and lower volume, partially offset by HMM cost savings and

favorable net price realization and mix.

North America Pet Segment

Second-quarter net sales for the North America Pet segment were

up 5 percent to $596 million, driven by higher pound volume,

partially offset by unfavorable net price realization and mix.

Organic net sales were also up 5 percent. Net sales performance

outpaced all-channel retail sales results by roughly 4 points,

reflecting a rebuild of retailer inventory after significant

prior-year reductions. Net sales in the quarter were up high-single

digits for dry pet food, up mid-single digits for wet pet food, and

up low-single digits for pet treats. Segment operating profit of

$139 million was up 36 percent, driven primarily by HMM cost

savings, higher volume, and lower other supply chain costs,

partially offset by unfavorable net price realization and mix and

higher SG&A expenses including increased media investment.

Through six months, North America Pet segment net sales were up

2 percent to $1.2 billion. Organic net sales were also up 2

percent. Segment operating profit was up 21 percent to $259

million, driven primarily by HMM cost savings, lower other supply

chain costs, and higher volume, partially offset by unfavorable net

price realization and mix, higher SG&A expenses including

increased media investment, and input cost inflation.

North America Foodservice

Segment

Second-quarter net sales for the North America Foodservice

segment were up 8 percent to $630 million. Organic net sales were

also up 8 percent, with growth on breads, cereal, and frozen meals.

Segment operating profit increased 24 percent to $118 million,

driven primarily by favorable net price realization and mix.

Through six months, North America Foodservice net sales

increased 4 percent to $1.2 billion. Organic net sales were also up

4 percent. Segment operating profit was up 23 percent to $190

million, driven primarily by favorable net price realization and

mix.

International Segment

Second-quarter net sales for the International segment increased

1 percent to $691 million, including a 4-point benefit from the

Edgard & Cooper acquisition. Organic net sales were down 3

percent, driven primarily by declines in China and Brazil,

partially offset by growth in distributor markets and Europe &

Australia. Segment operating profit totaled $24 million versus $35

million a year ago, driven primarily by unfavorable net price

realization and mix and higher SG&A expenses, partially offset

by HMM cost savings.

Through six months, International net sales increased 1 percent

to $1.4 billion, including a 3-point benefit from the Edgard &

Cooper acquisition. Organic net sales were down 2 percent. Segment

operating profit totaled $45 million versus $85 million a year ago,

driven primarily by unfavorable net price realization and mix and

input cost inflation, partially offset by HMM cost savings and

higher volume.

Joint Venture Summary

Second-quarter constant-currency net sales increased 2 percent

for Cereal Partners Worldwide (CPW) and were up 1 percent for

Häagen-Dazs Japan (HDJ). Combined after-tax earnings from joint

ventures were up 24 percent to $30 million, driven primarily by

lower input costs and favorable net price realization and mix at

CPW, partially offset by higher SG&A expenses and lower volume

at CPW and higher input costs at HDJ.

Other Income Statement

Items

Second-quarter unallocated corporate items totaled $65 million

net expense in fiscal 2025 compared to $157 million net expense a

year ago. Excluding mark-to-market valuation effects and other

items affecting comparability, unallocated corporate items totaled

$80 million net expense this year compared to $103 million net

expense a year ago.

Restructuring, impairment, and other exit costs totaled $1

million in the second quarter compared to $124 million a year ago

(please see Note 3 below for more information on these

charges).

Net interest expense totaled $125 million in the second quarter

compared to $118 million a year ago, driven primarily by higher

average long-term debt levels. The effective tax rate in the

quarter was 20.1 percent compared to 19.0 percent last year (please

see Note 6 below for more information on our effective tax rate).

The second-quarter adjusted effective tax rate was 20.1 percent

compared to 20.8 percent a year ago, driven primarily by favorable

earnings mix by jurisdiction in the second quarter of fiscal

2025.

Cash Flow Generation and Cash

Returns

Cash provided by operating activities totaled $1.8 billion

through six months of fiscal 2025 and was up 19 percent from a year

ago, driven primarily by a change in accounts payable, partially

offset by changes in inventory and other current assets. Capital

investments totaled $301 million compared to $294 million a year

ago. Dividends paid of $676 million were down 2 percent, reflecting

lower average shares outstanding. General Mills repurchased

approximately 9 million shares of common stock through six months

of fiscal 2025 for a total of $600 million compared to $1.3 billion

in share repurchases a year ago. Average diluted shares outstanding

in the first half decreased 4 percent to 562 million.

Fiscal 2025 Outlook

Amid an uncertain macroeconomic backdrop for consumers across

its core markets, General Mills is focused on delivering remarkable

experiences across its leading food brands, resulting in

sustainable improvement in volume growth and market share trends

over time. Through the first six months of fiscal 2025, General

Mills generated 1 percent growth in organic pound volume, which

represented a 4-point improvement versus its fiscal 2024

performance. Additionally, it grew or maintained dollar market

share in 38 percent of its priority businesses in the second

quarter, which represented a significant improvement from fiscal

2024 levels. To support these improvements, the company has added

targeted promotional investment – above its original plans – in

certain priority categories to deliver greater value for consumers,

while continuing to invest in brand building above fiscal 2024

levels.

Based on the above assumptions, the company updated its

full-year fiscal 2025 financial targets²:

- Organic net sales are still expected to range between

flat and up 1 percent, with the company now targeting the lower end

of the range due to increased promotional investment. Organic net

sales results in the second half are expected to include a 1-point

headwind from the reversal of timing-related benefits in the second

quarter.

- Adjusted operating profit is now expected to range

between down 4 percent and down 2 percent in constant currency,

compared to the previous range of between down 2 percent and flat

in constant currency, reflecting higher investment levels. Adjusted

operating profit results in the second half are expected to include

a 3-point headwind from the reversal of timing-related benefits in

the second quarter, a 3-point headwind from incremental growth

investments, and a 2-point headwind from a partial reset of

incentive compensation.

- Adjusted diluted EPS is now expected to range between

down 3 percent and down 1 percent in constant currency, compared to

the previous range of between down 1 percent and up 1 percent in

constant currency.

- Free cash flow conversion is still expected to be at

least 95 percent of adjusted after-tax earnings.

- These targets do not reflect an impact from the proposed North

American Yogurt divestitures nor the acquisition of Whitebridge Pet

Brands’ North American portfolio. The company expects to

incorporate these transactions into its outlook after they are

closed.

² Financial targets are provided on a non-GAAP basis because

certain information necessary to calculate comparable GAAP measures

is not available. Please see Note 7 to the Consolidated Financial

Statements below for discussion of the unavailable information.

General Mills will issue pre-recorded management remarks today,

December 18, 2024, at approximately 6:30 a.m. Central time (7:30

a.m. Eastern time) and will hold a live, webcasted question and

answer session beginning at 8:00 a.m. Central time (9:00 a.m.

Eastern time). The pre-recorded remarks and the webcast will be

made available at www.generalmills.com/investors.

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that are based on our current expectations and assumptions. These

forward-looking statements, including the statements under the

caption “Fiscal 2025 Outlook,” and statements made by Mr.

Harmening, are subject to certain risks and uncertainties that

could cause actual results to differ materially from the potential

results discussed in the forward-looking statements. In particular,

our predictions about future net sales and earnings could be

affected by a variety of factors, including: disruptions or

inefficiencies in the supply chain; competitive dynamics in the

consumer foods industry and the markets for our products, including

new product introductions, advertising activities, pricing actions,

and promotional activities of our competitors; economic conditions,

including changes in inflation rates, interest rates, tax rates, or

the availability of capital; product development and innovation;

consumer acceptance of new products and product improvements;

consumer reaction to pricing actions and changes in promotion

levels; acquisitions or dispositions of businesses or assets;

changes in capital structure; changes in the legal and regulatory

environment, including tax legislation, labeling and advertising

regulations, and litigation; impairments in the carrying value of

goodwill, other intangible assets, or other long-lived assets, or

changes in the useful lives of other intangible assets; changes in

accounting standards and the impact of critical accounting

estimates; product quality and safety issues, including recalls and

product liability; changes in consumer demand for our products;

effectiveness of advertising, marketing, and promotional programs;

changes in consumer behavior, trends, and preferences, including

weight loss trends; consumer perception of health-related issues,

including obesity; consolidation in the retail environment; changes

in purchasing and inventory levels of significant customers;

fluctuations in the cost and availability of supply chain

resources, including raw materials, packaging, energy, and

transportation; effectiveness of restructuring and cost saving

initiatives; volatility in the market value of derivatives used to

manage price risk for certain commodities; benefit plan expenses

due to changes in plan asset values and discount rates used to

determine plan liabilities; failure or breach of our information

technology systems; foreign economic conditions, including currency

rate fluctuations; and political unrest in foreign markets and

economic uncertainty due to terrorism or war. The company

undertakes no obligation to publicly revise any forward-looking

statement to reflect any future events or circumstances.

# # #

Consolidated Statements of

Earnings and Supplementary Information

GENERAL MILLS, INC. AND

SUBSIDIARIES

(Unaudited) (In Millions, Except

per Share Data)

Quarter Ended

Six-Month Period Ended

Nov. 24,

Nov. 26,

Nov. 24,

Nov. 26,

2024

2023

% Change

2024

2023

% Change

Net sales

$

5,240.1

$

5,139.4

2

%

$

10,088.2

$

10,044.1

Flat

Cost of sales

3,309.0

3,373.5

(2

)

%

6,468.3

6,507.7

(1

)

%

Selling, general, and administrative

expenses

852.0

830.5

3

%

1,707.1

1,669.8

2

%

Restructuring, impairment, and other

exit costs

1.2

123.6

(99

)

%

3.4

124.8

(97

)

%

Operating profit

1,077.9

811.8

33

%

1,909.4

1,741.8

10

%

Benefit plan non-service income

(13.8

)

(20.1

)

(31

)

%

(27.7

)

(37.1

)

(25

)

%

Interest, net

124.6

117.8

6

%

248.2

234.8

6

%

Earnings before income taxes and

after-tax

earnings from joint

ventures

967.1

714.1

35

%

1,688.9

1,544.1

9

%

Income taxes

194.8

136.0

43

%

352.2

309.2

14

%

After-tax earnings from joint ventures

30.0

24.2

24

%

49.2

47.7

3

%

Net earnings, including earnings

attributable to

noncontrolling interests

802.3

602.3

33

%

1,385.9

1,282.6

8

%

Net earnings attributable to

noncontrolling interests

6.6

6.8

(3

)

%

10.3

13.6

(24

)

%

Net earnings attributable to General

Mills

$

795.7

$

595.5

34

%

$

1,375.6

$

1,269.0

8

%

Earnings per share – basic

$

1.43

$

1.03

39

%

$

2.46

$

2.18

13

%

Earnings per share – diluted

$

1.42

$

1.02

39

%

$

2.45

$

2.16

13

%

Quarter Ended

Six-Month Period Ended

Nov. 24,

Nov. 26,

Basis Pt

Nov. 24,

Nov. 26,

Basis Pt

Comparisons as a % of net sales:

2024

2023

Change

2024

2023

Change

Gross margin

36.9

%

34.4

%

250

35.9

%

35.2

%

70

Selling, general, and administrative

expenses

16.3

%

16.2

%

10

16.9

%

16.6

%

30

Operating profit

20.6

%

15.8

%

480

18.9

%

17.3

%

160

Net earnings attributable to General

Mills

15.2

%

11.6

%

360

13.6

%

12.6

%

100

Quarter Ended

Six-Month Period Ended

Comparisons as a % of net sales

excluding

Nov. 24,

Nov. 26,

Basis Pt

Nov. 24,

Nov. 26,

Basis Pt

certain items affecting comparability

(a):

2024

2023

Change

2024

2023

Change

Adjusted gross margin

36.3

%

35.0

%

130

35.9

%

35.2

%

70

Adjusted operating profit

20.3

%

19.3

%

100

19.1

%

18.8

%

30

Adjusted net earnings attributable to

General Mills

15.0

%

14.1

%

90

13.8

%

13.7

%

10

(a) See Note 7 for a reconciliation of

these measures not defined by generally accepted accounting

principles (GAAP).

See accompanying notes to consolidated

financial statements.

Operating Segment Results and

Supplementary Information

GENERAL MILLS, INC. AND

SUBSIDIARIES

(Unaudited) (In Millions)

Quarter Ended

Six-Month Period Ended

Nov. 24,

2024

Nov. 26,

2023

% Change

Nov. 24,

2024

Nov. 26,

2023

% Change

Net sales:

North America Retail

$

3,321.5

$

3,305.0

Flat

$

6,338.1

$

6,378.0

(1

)

%

International

690.6

683.1

1

%

1,407.6

1,398.9

1

%

North America Pet

595.8

569.3

5

%

1,171.9

1,149.2

2

%

North America Foodservice

630.0

582.0

8

%

1,166.2

1,118.0

4

%

Total segment net sales

$

5,237.9

$

5,139.4

2

%

$

10,083.8

$

10,044.1

Flat

Corporate and other

2.2

-

NM

4.4

-

NM

Total net sales

$

5,240.1

$

5,139.4

2

%

$

10,088.2

$

10,044.1

Flat

Operating profit:

North America Retail

$

862.3

$

859.9

Flat

$

1,608.0

$

1,658.1

(3

)

%

International

23.8

34.6

(31

)

%

44.7

84.6

(47

)

%

North America Pet

139.3

102.5

36

%

258.7

213.7

21

%

North America Foodservice

118.5

95.5

24

%

190.0

154.6

23

%

Total segment operating profit

$

1,143.9

$

1,092.5

5

%

$

2,101.4

$

2,111.0

Flat

Unallocated corporate items

64.8

157.1

(59

)

%

188.6

244.4

(23

)

%

Restructuring, impairment, and other

exit costs

1.2

123.6

(99

)

%

3.4

124.8

(97

)

%

Operating profit

$

1,077.9

$

811.8

33

%

$

1,909.4

$

1,741.8

10

%

Quarter Ended

Six-Month Period Ended

Nov. 24,

2024

Nov. 26,

2023

Basis Pt

Change

Nov. 24,

2024

Nov. 26,

2023

Basis Pt

Change

Segment operating profit as a % of net

sales:

North America Retail

26.0

%

26.0

%

Flat

25.4

%

26.0

%

(60

)

International

3.4

%

5.1

%

(170

)

3.2

%

6.0

%

(280

)

North America Pet

23.4

%

18.0

%

540

22.1

%

18.6

%

350

North America Foodservice

18.8

%

16.4

%

240

16.3

%

13.8

%

250

Total segment operating profit

21.8

%

21.3

%

50

20.8

%

21.0

%

(20

)

See accompanying notes to consolidated

financial statements.

Consolidated Balance

Sheets

GENERAL MILLS, INC. AND

SUBSIDIARIES

(In Millions, Except Par

Value)

Nov. 24, 2024

Nov. 26, 2023

May 26, 2024

(Unaudited)

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

2,292.8

$

593.8

$

418.0

Receivables

1,781.9

1,758.8

1,696.2

Inventories

1,967.9

2,166.0

1,898.2

Prepaid expenses and other current

assets

458.0

527.0

568.5

Assets held for sale

880.8

-

-

Total current assets

7,381.4

5,045.6

4,580.9

Land, buildings, and equipment

3,457.0

3,598.9

3,863.9

Goodwill

14,427.7

14,441.8

14,750.7

Other intangible assets

6,743.3

6,963.3

6,979.9

Other assets

1,386.7

1,183.8

1,294.5

Total assets

$

33,396.1

$

31,233.4

$

31,469.9

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

4,068.8

$

3,824.4

$

3,987.8

Current portion of long-term debt

1,821.5

1,321.0

1,614.1

Notes payable

264.3

799.2

11.8

Other current liabilities

1,804.5

1,957.6

1,419.4

Liabilities held for sale

65.2

-

-

Total current liabilities

8,024.3

7,902.2

7,033.1

Long-term debt

12,435.8

10,530.5

11,304.2

Deferred income taxes

2,232.9

2,026.6

2,200.6

Other liabilities

1,253.9

1,142.2

1,283.5

Total liabilities

23,946.9

21,601.5

21,821.4

Stockholders’ equity:

Common stock, 754.6 shares issued, $0.10

par value

75.5

75.5

75.5

Additional paid-in capital

1,182.0

1,201.8

1,227.0

Retained earnings

21,340.3

20,080.9

20,971.8

Common stock in treasury, at cost, shares

of 202.4, 185.7, and 195.5

(10,873.3

)

(9,677.4

)

(10,357.9

)

Accumulated other comprehensive loss

(2,523.8

)

(2,302.0

)

(2,519.7

)

Total stockholders’ equity

9,200.7

9,378.8

9,396.7

Noncontrolling interests

248.5

253.1

251.8

Total equity

9,449.2

9,631.9

9,648.5

Total liabilities and equity

$

33,396.1

$

31,233.4

$

31,469.9

See accompanying notes to consolidated

financial statements.

Consolidated Statements of

Cash Flows

GENERAL MILLS, INC. AND

SUBSIDIARIES

(Unaudited) (In Millions)

Six-Month Period Ended

Nov. 24, 2024

Nov. 26, 2023

Cash Flows - Operating Activities

Net earnings, including earnings

attributable to noncontrolling interests

$

1,385.9

$

1,282.6

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

269.1

265.8

After-tax earnings from joint ventures

(49.2

)

(47.7

)

Distributions of earnings from joint

ventures

23.1

23.5

Stock-based compensation

46.6

58.5

Deferred income taxes

(11.5

)

(58.7

)

Pension and other postretirement benefit

plan contributions

(15.2

)

(12.5

)

Pension and other postretirement benefit

plan costs

(6.5

)

(13.5

)

Restructuring, impairment, and other exit

costs

(0.9

)

123.1

Changes in current assets and liabilities,

excluding the effects of

acquisitions and

divestitures

172.3

(166.1

)

Other, net

(39.0

)

40.8

Net cash provided by operating

activities

1,774.7

1,495.8

Cash Flows - Investing Activities

Purchases of land, buildings, and

equipment

(301.2

)

(293.9

)

Acquisition, net of cash acquired

(7.7

)

(25.5

)

Investments in affiliates, net

6.6

(1.5

)

Proceeds from disposal of land, buildings,

and equipment

0.9

0.1

Other, net

(4.5

)

4.6

Net cash used by investing activities

(305.9

)

(316.2

)

Cash Flows - Financing Activities

Change in notes payable

254.3

766.9

Issuance of long-term debt

1,500.0

500.0

Payment of long-term debt

-

(400.0

)

Proceeds from common stock issued on

exercised options

33.8

5.7

Purchases of common stock for treasury

(600.4

)

(1,301.4

)

Dividends paid

(675.8

)

(691.0

)

Distributions to noncontrolling interest

holders

(12.8

)

(12.0

)

Other, net

(77.0

)

(41.8

)

Net cash provided (used) by financing

activities

422.1

(1,173.6

)

Effect of exchange rate changes on cash

and cash equivalents

(16.1

)

2.3

Increase in cash and cash equivalents

1,874.8

8.3

Cash and cash equivalents - beginning of

year

418.0

585.5

Cash and cash equivalents - end of

period

$

2,292.8

$

593.8

Cash Flows from changes in current assets

and liabilities, excluding the effects of

acquisitions and

divestitures:

Receivables

$

(109.3

)

$

(69.2

)

Inventories

(169.5

)

13.8

Prepaid expenses and other current

assets

83.4

209.0

Accounts payable

266.4

(329.1

)

Other current liabilities

101.3

9.4

Changes in current assets and

liabilities

$

172.3

$

(166.1

)

See accompanying notes to consolidated

financial statements.

GENERAL MILLS, INC. AND

SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL

STATEMENTS

(Unaudited)

(1)

The accompanying Consolidated Financial

Statements of General Mills, Inc. (we, us, our, General Mills, or

the Company) have been prepared in accordance with accounting

principles generally accepted in the United States for annual and

interim financial information. In the opinion of management, all

adjustments considered necessary for a fair presentation have been

included and are of a normal recurring nature.

(2)

During the second quarter of fiscal 2025,

we entered into a definitive agreement to acquire NX Pet Holding,

Inc., representing Whitebridge Pet Brands’ North America premium

cat feeding and pet treating business for approximately $1 billion

(Whitebridge Pet Brands acquisition). We expect to close the

transaction in the third quarter of fiscal 2025, subject to

regulatory approval and other customary closing conditions. We

intend to fund the acquisition with cash on hand.

During the second quarter of fiscal 2025,

we entered into definitive agreements to sell our North American

yogurt businesses to affiliates of Group Lactalis S.A. (Lactalis)

and Sodiaal International (Sodiaal) for approximately $2 billion.

We expect to close these divestitures in calendar year 2025,

subject to regulatory approvals and other customary closing

conditions. We have classified all assets and liabilities

associated with our North American yogurt business as held for sale

in our Consolidated Balance Sheets as of November 24, 2024.

During the fourth quarter of fiscal 2024,

we acquired a pet food business in Europe for a purchase price of

$434 million, net of cash acquired. During the first quarter of

fiscal 2025, we paid $8 million related to a purchase price

holdback after certain closing conditions were met. We financed the

transaction with cash on hand. We consolidated the business into

our Consolidated Balance Sheets and recorded goodwill of $318

million, an indefinite-lived brand intangible asset of $118

million, and a finite-lived customer relationship asset of $14

million. The goodwill is included in the International segment and

is not deductible for tax purposes. The pro forma effects of this

acquisition were not material. We have conducted a preliminary

assessment of the fair value of the acquired assets and liabilities

of the business and we are continuing our review of these items

during the measurement period. If new information is obtained about

facts and circumstances that existed at the acquisition date, the

acquisition accounting will be revised to reflect the resulting

adjustments to current estimates of those items. The consolidated

results are reported in our International operating segment on a

one-month lag beginning in fiscal 2025.

(3)

Restructuring and impairment charges and

project-related costs are recorded in our Consolidated Statement of

Earnings as follows:

Quarter Ended

Six-Month Period Ended

In Millions

Nov. 24, 2024

Nov. 26, 2023

Nov. 24, 2024

Nov. 26, 2023

Restructuring, impairment, and other exit

costs

$

1.2

$

123.6

$

3.4

$

124.8

Cost of sales

0.1

8.3

0.8

16.9

Total restructuring and impairment

charges

$

1.3

$

131.9

$

4.2

$

141.7

Project-related costs classified in cost

of sales

$

0.1

$

0.3

$

0.2

$

1.1

In the six-month period ended November 24,

2024, we did not undertake any new restructuring actions. We

recorded $1 million of restructuring charges in the second quarter

of fiscal 2025 and $4 million of restructuring charges in the

six-month period ended November 24, 2024, related to restructuring

actions previously announced. We recorded $15 million of

restructuring charges in the second quarter of fiscal 2024 and $25

million of restructuring charges in the six-month period ended

November 26, 2023, related to previously announced restructuring

actions. We expect these actions to be completed by the end of

fiscal 2026.

In the second quarter of fiscal 2024, we

recorded a $117 million non-cash goodwill impairment charge related

to our Latin America reporting unit.

(4)

Unallocated corporate expenses totaled $65

million in the second quarter of fiscal 2025, compared to $157

million in the same period in fiscal 2024. In the second quarter of

fiscal 2025, we recorded a $29 million net decrease in expense

related to the mark-to-market valuation of certain commodity

positions and grain inventories, compared to a $25 million net

increase in expense in the same period last year. We recorded $3

million of net losses related to valuation adjustments on certain

corporate investments in the second quarter of fiscal 2025,

compared to $20 million of net losses related to valuation

adjustments of certain corporate investments in the second quarter

of fiscal 2024. In addition, we recorded $9 million of transaction

costs related to the definitive agreement for the Whitebridge Pet

Brands acquisition and definitive agreements to sell our North

American yogurt businesses in the second quarter of fiscal 2025,

compared to $1 million of transaction costs in the same period last

year. We recorded $8 million of restructuring charges in the second

quarter of fiscal 2024. In addition, we recorded $2 million of

integration costs related to the acquisition of a pet food business

in Europe in the second quarter of fiscal 2025.

Unallocated corporate expenses totaled

$189 million in the six-month period ended November 24, 2024,

compared to $244 million in the same period in fiscal 2024. In the

six-month period ended November 24, 2024, we recorded a $1 million

net decrease in expense related to the mark-to-market valuation of

certain commodity positions and grain inventories, compared to a

$20 million net decrease in expense in the same period last year.

We recorded $4 million of net losses related to valuation

adjustments on certain corporate investments in the six-month

period ended November 24, 2024, compared to $22 million of net

losses related to valuation adjustments and the loss on sale of

certain corporate investments in the same period in fiscal 2024. In

addition, we recorded $1 million of restructuring charges and an

immaterial amount of restructuring initiative project-related costs

in cost of sales in the six-month period ended November 24, 2024,

compared to $17 million of restructuring charges and $1 million of

restructuring initiative project-related costs in cost of sales in

the same period last year. Compensation expense related to

stock-based payments decreased in the six-month period ended

November 24, 2024, compared to the same period in fiscal 2024. In

the six-month period ended November 24, 2024, we recorded $9

million of transaction costs related to the definitive agreement

for the Whitebridge Pet Brands acquisition and definitive

agreements to sell our North American yogurt businesses, compared

to $1 million of transaction costs in the same period last year. We

recorded $4 million of integration costs related to the acquisition

of a pet food business in Europe in the six-month period ended

November 24, 2024.

(5)

Basic and diluted earnings per share (EPS)

were calculated as follows:

Quarter Ended

Six-Month Period Ended

In Millions, Except per Share

Data

Nov. 24, 2024

Nov. 26, 2023

Nov. 24, 2024

Nov. 26, 2023

Net earnings attributable to General

Mills

$

795.7

$

595.5

$

1,375.6

$

1,269.0

Average number of common shares – basic

EPS

556.9

580.1

558.7

583.2

Incremental share effect from: (a)

Stock options

1.9

1.4

1.7

2.1

Restricted stock units and performance

share units

1.6

1.9

1.8

2.1

Average number of common shares – diluted

EPS

560.4

583.4

562.2

587.4

Earnings per share – basic

$

1.43

$

1.03

$

2.46

$

2.18

Earnings per share – diluted

$

1.42

$

1.02

$

2.45

$

2.16

(a) Incremental shares from stock options,

restricted stock units, and performance share units are computed by

the treasury stock method.

(6)

The effective tax rate for the second

quarter of fiscal 2025 was 20.1 percent compared to 19.0 percent

for the second quarter of fiscal 2024. The 1.1 percentage point

increase was primarily due to certain nonrecurring discrete tax

benefits in the second quarter of fiscal 2024, partially offset by

favorable earnings mix by jurisdiction in the second quarter of

fiscal 2025. Our effective tax rate excluding certain items

affecting comparability was 20.1 percent in the second quarter of

fiscal 2025, compared to 20.8 percent in the same period last year

(see Note 7 below for a description of our use of measures not

defined by GAAP). The 0.7 percentage point decrease was primarily

due to favorable earnings mix by jurisdiction in the second quarter

of fiscal 2025.

The effective tax rate of the six-month

period ended November 24, 2024, was 20.9 percent compared to 20.0

percent for the six-month period ended November 26, 2023. The 0.9

percentage point increase was primarily due to certain nonrecurring

discrete tax benefits in fiscal 2024, partially offset by favorable

earnings mix by jurisdiction in fiscal 2025. Our effective tax rate

excluding certain items affecting comparability was 20.9 percent in

the six-month period ended November 24, 2024, compared to 21.0

percent in the same period last year (see Note 7 below for a

description of our use of measures not defined by GAAP). The 0.1

percentage point decrease was primarily due to favorable earnings

mix by jurisdiction in fiscal 2025, partially offset by certain

nonrecurring discrete tax benefits in fiscal 2024.

(7)

We have included measures in this release

that are not defined by GAAP. We believe that these measures

provide useful information to investors, and include these measures

in other communications to investors. For each of these non-GAAP

financial measures, we are providing below a reconciliation of the

differences between the non-GAAP measure and the most directly

comparable GAAP measure, an explanation of why we believe the

non-GAAP measure provides useful information to investors, and any

additional material purposes for which our management or Board of

Directors uses the non-GAAP measure. These non-GAAP measures should

be viewed in addition to, and not in lieu of, the comparable GAAP

measure.

We provide organic net sales growth rates

for our consolidated net sales and segment net sales. This measure

is used in reporting to our Board of Directors and executive

management and as a component of the Board of Directors’

measurement of our performance for incentive compensation purposes.

We believe that organic net sales growth rates provide useful

information to investors because they provide transparency to

underlying performance in our net sales by excluding the effect

that foreign currency exchange rate fluctuations, acquisitions,

divestitures, and a 53rd fiscal week, when applicable, have on

year-to-year comparability. A reconciliation of these measures to

reported net sales growth rates, the relevant GAAP measures, are

included in our Operating Segment Results above.

Certain measures in this release are

presented excluding the impact of foreign currency exchange

(constant-currency). To present this information, current period

results for entities reporting in currencies other than United

States dollars are translated into United States dollars at the

average exchange rates in effect during the corresponding period of

the prior fiscal year, rather than the actual average exchange

rates in effect during the current fiscal year. Therefore, the

foreign currency impact is equal to current year results in local

currencies multiplied by the change in the average foreign currency

exchange rate between the current fiscal period and the

corresponding period of the prior fiscal year. We believe that

these constant-currency measures provide useful information to

investors because they provide transparency to underlying

performance by excluding the effect that foreign currency exchange

rate fluctuations have on period-to-period comparability given

volatility in foreign currency exchange markets.

Our fiscal 2025 outlook for organic net

sales growth, adjusted operating profit growth, adjusted diluted

EPS growth, and free cash flow conversion are non-GAAP financial

measures that exclude, or have otherwise been adjusted for, items

impacting comparability, including the effect of foreign currency

exchange rate fluctuations, acquisitions, divestitures, and a 53rd

week, when applicable. We are not able to reconcile these

forward-looking non-GAAP financial measures to their most directly

comparable forward-looking GAAP financial measure without

unreasonable efforts because we are unable to predict with a

reasonable degree of certainty the actual impact of changes in

foreign currency exchange rates and the timing of acquisitions and

divestitures throughout fiscal 2025. The unavailable information

could have a significant impact on our fiscal 2025 GAAP financial

results.

For fiscal 2025, we currently expect:

foreign currency exchange rates (based on a blend of forward and

forecasted rates and hedge positions) and acquisitions and

divestitures will have no material impact to net sales growth and

restructuring charges to be immaterial.

Significant Items Impacting Comparability

Several measures below are presented on an adjusted basis. The

adjustments are either items resulting from infrequently occurring

events or items that, in management’s judgement, significantly

affect the year-to-year assessment of operating results.

The following are descriptions of significant items impacting

comparability of our results.

Transaction

costs Fiscal 2025 transaction costs related to the

definitive agreement for the Whitebridge Pet Brands acquisition and

definitive agreements to sell our North American yogurt businesses.

Immaterial transaction costs incurred in fiscal 2024. Please see

Note 2.

Restructuring charges

and project-related costs Restructuring charges and

project-related costs related to previously announced restructuring

actions recorded in fiscal 2025 and fiscal 2024. Please see Note

3.

Acquisition integration

costs Integration costs resulting from the acquisition of a

pet food business in Europe recorded in fiscal 2025. Integration

costs primarily resulting from the acquisition of TNT Crust

recorded in fiscal 2024. Please see Note 2.

Investment activity,

net Valuation adjustments of certain corporate investments

in fiscal 2025 and fiscal 2024. Please see Note 4.

Mark-to-market

effects Net mark-to-market valuation of certain commodity

positions recognized in unallocated corporate items. Please see

Note 4.

Goodwill

impairment Non-cash goodwill impairment charge related to

our Latin America reporting unit in fiscal 2024. Please see Note

3.

Product recall

Costs related to the fiscal 2023 voluntary recall of certain

international Häagen-Dazs ice cream products recorded in fiscal

2024.

CPW restructuring

charges CPW restructuring charges related to previously

announced restructuring actions.

Adjusted Operating Profit Growth and

Related Constant-currency Growth Rate

This measure is used in reporting to our Board of Directors and

executive management and as a component of the measurement of our

performance for incentive compensation purposes. We believe that

this measure provides useful information to investors because it is

the operating profit measure we use to evaluate operating profit

performance on a comparable year-to-year basis. The measure is

evaluated on a constant-currency basis by excluding the effect that

foreign currency exchange rate fluctuations have on year-to-year

comparability given the volatility in foreign currency exchange

rates.

Our adjusted operating profit growth on a constant-currency

basis is calculated as follows:

Quarter Ended

Six-Month Period Ended

Nov. 24, 2024

Nov. 26, 2023

Change

Nov. 24, 2024

Nov. 26, 2023

Change

Operating profit as reported

$

1,077.9

$

811.8

33

%

$

1,909.4

$

1,741.8

10

%

Transaction costs

8.9

0.6

8.9

0.6

Restructuring charges

1.3

14.8

4.2

24.6

Acquisition integration costs

2.3

-

3.9

0.2

Investment activity, net

2.8

19.6

3.2

22.5

Mark-to-market effects

(29.4

)

25.1

(0.6

)

(19.8

)

Project-related costs

0.1

0.3

0.2

1.1

Goodwill impairment

-

117.1

-

117.1

Product recall

-

0.2

-

0.4

Adjusted operating profit

$

1,064.0

$

989.4

8

%

$

1,929.3

$

1,888.4

2

%

Foreign currency exchange impact

Flat

Flat

Adjusted operating profit growth,

on a constant-currency

basis

7

%

2

%

Note: Table may not foot due to

rounding.

For more information on the reconciling

items, please refer to the Significant Items Impacting

Comparability section above.

Adjusted Diluted EPS and Related

Constant-currency Growth Rate

This measure is used in reporting to our Board of Directors and

executive management. We believe that this measure provides useful

information to investors because it is the profitability measure we

use to evaluate earnings performance on a comparable year-to-year

basis.

The reconciliation of our GAAP measure, diluted EPS, to adjusted

diluted EPS and the related constant-currency growth rates

follows:

Quarter Ended

Six-Month Period Ended

Per Share Data

Nov. 24, 2024

Nov. 26, 2023

Change

Nov. 24, 2024

Nov. 26, 2023

Change

Diluted earnings per share, as

reported

$

1.42

$

1.02

39

%

$

2.45

$

2.16

13

%

Transaction costs

0.01

-

0.01

-

Restructuring charges

0.01

0.02

0.01

0.03

Acquisition integration costs

0.01

-

0.01

-

Goodwill impairment

-

0.14

-

0.14

Mark-to-market effects

(0.04

)

0.03

-

(0.03

)

Investment activity, net

-

0.03

-

0.03

Adjusted diluted earnings per share

$

1.40

$

1.25

12

%

$

2.47

$

2.34

6

%

Foreign currency exchange impact

Flat

Flat

Adjusted diluted earnings per share

growth, on a constant-currency

basis

12

%

6

%

Note: Table may not foot due to

rounding.

For more information on the reconciling

items, please refer to the Significant Items Impacting

Comparability section above.

See our reconciliation below of the effective income tax rate as

reported to the adjusted effective income tax rate for the tax

impact of each item affecting comparability.

Adjusted Earnings Comparisons as a Percent

of Net Sales

We believe that these measures provide useful information to

investors because they are important for assessing our adjusted

earnings comparisons as a percent of net sales on a comparable

year-to-year basis.

Our adjusted earnings comparisons as a percent of net sales are

calculated as follows:

Quarter Ended

In Millions

Nov. 24, 2024

Nov. 26, 2023

Comparisons as a % of Net Sales

Value

Percent of

Net Sales

Value

Percent of

Net Sales

Gross margin as reported (a)

$

1,931.1

36.9

%

$

1,765.9

34.4

%

Restructuring charges

0.1

-

%

8.3

0.2

%

Mark-to-market effects

(29.4

)

(0.6

)

%

25.1

0.5

%

Project-related costs

0.1

-

%

0.3

-

%

Adjusted gross margin

$

1,902.0

36.3

%

$

1,799.6

35.0

%

Operating profit as reported

$

1,077.9

20.6

%

$

811.8

15.8

%

Transaction costs

8.9

0.2

%

0.6

-

%

Restructuring charges

1.3

-

%

14.8

0.3

%

Acquisition integration costs

2.3

-

%

-

-

%

Investment activity, net

2.8

0.1

%

19.6

0.4

%

Mark-to-market effects

(29.4

)

(0.6

)

%

25.1

0.5

%

Project-related costs

0.1

-

%

0.3

-

%

Goodwill impairment

-

-

%

117.1

2.3

%

Product recall

-

-

%

0.2

-

%

Adjusted operating profit

$

1,064.0

20.3

%

$

989.4

19.3

%

Net earnings attributable to General Mills

as reported

$

795.7

15.2

%

$

595.5

11.6

%

Transaction costs, net of tax (b)

6.9

0.1

%

0.6

-

%

Restructuring charges, net of tax (b)

1.0

-

%

10.4

0.2

%

Acquisition integration costs, net of tax

(b)

1.8

-

%

0.1

-

%

Investment activity, net, net of tax

(b)

2.2

-

%

15.3

0.3

%

Mark-to-market effects, net of tax (b)

(22.7

)

(0.4

)

%

19.3

0.4

%

CPW restructuring charges

0.1

-

%

1.4

-

%

Project-related costs, net of tax (b)

0.1

-

%

0.2

-

%

Goodwill impairment, net of tax (b)

-

-

%

82.4

1.6

%

Product recall, net of tax (b)

-

-

%

0.2

-

%

Adjusted net earnings attributable to

General Mills

$

785.2

15.0

%

$

725.4

14.1

%

Note: Table may not foot due to

rounding.

For more information on the reconciling

items, please refer to the Significant Items Impacting

Comparability section above.

(a) Net sales less cost of sales. (b) See reconciliation of

adjusted effective income tax rate below for tax impact of each

adjustment.

Six-Month Period Ended

In Millions

Nov. 24, 2024

Nov. 26, 2023

Comparisons as a % of Net Sales

Value

Percent of

Net Sales

Value

Percent of

Net Sales

Gross margin as reported (a)

$

3,619.9

35.9

%

$

3,536.4

35.2

%

Restructuring charges

0.8

-

%

16.9

0.2

%

Mark-to-market effects

(0.6

)

-

%

(19.8

)

(0.2

)

%

Project-related costs

0.2

-

%

1.1

-

%

Adjusted gross margin

$

3,620.4

35.9

%

$

3,534.6

35.2

%

Operating profit as reported

$

1,909.4

18.9

%

$

1,741.8

17.3

%

Transaction costs

8.9

0.1

%

0.6

-

%

Restructuring charges

4.2

-

%

24.6

0.2

%

Acquisition integration costs

3.9

-

%

0.2

-

%

Investment activity, net

3.2

-

%

22.5

0.2

%

Mark-to-market effects

(0.6

)

-

%

(19.8

)

(0.2

)

%

Project-related costs

0.2

-

%

1.1

-

%

Goodwill impairment

-

-

%

117.1

1.2

%

Product recall

-

-

%

0.4

-

%

Adjusted operating profit

$

1,929.3

19.1

%

$

1,888.4

18.8

%

Net earnings attributable to General Mills

as reported

$

1,375.6

13.6

%

$

1,269.0

12.6

%

Transaction costs, net of tax (b)

6.9

0.1

%

0.6

-

%

Restructuring charges, net of tax (b)

3.2

-

%

15.5

0.2

%

Acquisition integration costs, net of tax

(b)

3.0

-

%

0.2

-

%

Investment activity, net, net of tax

(b)

2.5

-

%

17.2

0.2

%

Mark-to-market effects, net of tax (b)

(0.5

)

-

%

(15.3

)

(0.2

)

%

CPW restructuring charges

0.2

-

%

1.7

-

%

Project-related costs, net of tax (b)

0.2

-

%

0.7

-

%

Goodwill impairment, net of tax (b)

-

-

%

82.4

0.8

%

Product recall, net of tax (b)

-

-

%

0.3

-

%

Adjusted net earnings attributable to

General Mills

$

1,391.1

13.8

%

$

1,372.4

13.7

%

Note: Table may not foot due to

rounding.

For more information on the reconciling

items, please refer to the Significant Items Impacting

Comparability section above.

(a) Net sales less cost of sales.

(b) See reconciliation of adjusted

effective income tax rate below for tax impact of each

adjustment.

Constant-currency Segment Operating Profit

Growth Rates

We believe that this measure provides useful information to

investors because it provides transparency to underlying

performance of our segments by excluding the effect that foreign

currency exchange rate fluctuations have on year-to-year

comparability given volatility in foreign currency exchange

markets.

Our segments’ operating profit growth rates on a

constant-currency basis are calculated as follows:

Quarter Ended Nov. 24,

2024

Percentage Change in

Operating Profit

as Reported

Impact of Foreign

Currency

Exchange

Percentage Change in

Operating Profit on

Constant-Currency

Basis

North America Retail

Flat

Flat

Flat

International

(31

)

%

14

pts

(45

)

%

North America Pet

36

%

Flat

36

%

North America Foodservice

24

%

Flat

24

%

Total segment operating profit

5

%

Flat

4

%

Six-Month Period Ended Nov.

24, 2024

Percentage Change in

Operating Profit

as Reported

Impact of Foreign

Currency Exchange

Percentage Change in

Operating Profit on

Constant-Currency

Basis

North America Retail

(3

)

%

Flat

(3

)

%

International

(47

)

%

9

pts

(56

)

%

North America Pet

21

%

Flat

21

%

North America Foodservice

23

%

Flat

23

%

Total segment operating profit

Flat

Flat

(1

)

%

Note: Table may not foot due to

rounding.

Net Sales Growth Rates for our Canada

Operating Unit on a Constant-currency Basis

We believe that this measure of our Canada operating unit net

sales provides useful information to investors because it provides

transparency to underlying performance of our Canada operating unit

within our North America Retail segment by excluding the effect

that foreign currency exchange rate fluctuations have on

year-to-year comparability given volatility in foreign currency

exchange markets.

Net sales growth rates for our Canada operating unit on a

constant-currency basis are calculated as follows:

Percentage Change in

Net Sales

as Reported

Impact of Foreign

Currency

Exchange

Percentage Change in

Net Sales on Constant-

Currency Basis

Quarter Ended Nov. 24, 2024

(4

)

%

Flat

(4

)

%

Six-Month Period Ended Nov. 24, 2024

(1

)

%

(2

)

pts

1

%

Note: Table may not foot due to

rounding.

Adjusted Effective Income Tax

Rate

We believe this measure provides useful information to investors

because it presents the adjusted effective income tax rate on a

comparable year-to-year basis.

Adjusted effective income tax rates are calculated as

follows:

Quarter Ended

Six-Month Period Ended

Nov. 24, 2024

Nov. 26, 2023

Nov. 24, 2024

Nov. 26, 2023

In Millions

(Except Per Share Data)

Pretax

Earnings

(a)

Income

Taxes

Pretax

Earnings

(a)

Income

Taxes

Pretax

Earnings

(a)

Income

Taxes

Pretax

Earnings

(a)

Income

Taxes

As reported

$

967.1

$

194.8

$

714.1

$

136.0

$

1,688.9

$

352.2

$

1,544.1

$

309.2

Transaction costs

8.9

2.0

0.6

-

8.9

2.0

0.6

-

Restructuring charges

1.3

0.3

14.8

4.5

4.2

1.0

24.6

9.2

Acquisition integration costs

2.3

0.5

-

-

3.9

0.9

0.2

0.1

Investment activity, net

2.8

0.6

19.6

4.2

3.2

0.7

22.5

5.2

Mark-to-market effects

(29.4

)

(6.7

)

25.1

5.7

(0.6

)

(0.1

)

(19.8

)

(4.6

)

Project-related costs

0.1

0.1

0.3

0.1

0.2

0.1

1.1

0.4

Goodwill impairment

-

-

117.1

34.7

-

-

117.1

34.7

Product recall

-

-

0.2

-

-

-

0.4

0.1

As adjusted

$

953.2

$

191.6

$

891.7

$

185.2

$

1,708.8

$

356.9

$

1,690.8

$

354.2

Effective tax rate:

As reported

20.1

%

19.0

%

20.9

%

20.0

%

As adjusted

20.1

%

20.8

%

20.9

%

21.0

%

Sum of adjustments to income taxes

$

(3.2

)

$

49.4

$

4.6

$

45.1

Average number of common

shares - diluted EPS

560.4

583.4

562.2

587.4

Impact of income tax adjustments

on adjusted diluted EPS

$

0.01

$

(0.08

)

$

(0.01

)

$

(0.08

)

Note: Table may not foot due to

rounding.

(a) Earnings before income taxes and after-tax earnings from joint

ventures.

For more information on the reconciling

items, please refer to the Significant Items Impacting

Comparability section above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217574855/en/

(Investors) Jeff Siemon: +1-763-764-2301 (Media) Chelcy Walker:

+1-763-764-6364

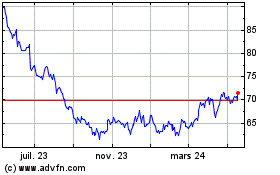

General Mills (NYSE:GIS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

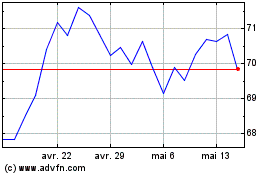

General Mills (NYSE:GIS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024