false000105886700010588672025-01-212025-01-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report:

(Date of earliest event reported)

January 21, 2025

GUARANTY BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

Texas |

001-38087 |

75-1656431 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

16475 Dallas Parkway, Suite 600 Addison, Texas |

|

75001 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(888) 572-9881

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

Common Stock, par value $1.00 per share |

|

GNTY |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

In accordance with Item 2.02 of Form 8-K of the Securities and Exchange Commission (the “SEC”), Guaranty Bancshares, Inc., a Texas corporation (the “Company”), is furnishing to the SEC a press release that the Company issued on January 21, 2025 (the “Press Release”) announcing the Company’s financial results for the fiscal quarter and year ended December 31, 2024. A copy of the Press Release is attached as Exhibit 99.1.

Item 7.01. Regulation FD Disclosure.

On January 21, 2025, the Company will host a conference call with respect to financial results for the fiscal quarter and year ended December 31, 2024. A copy of the Earnings Call Presentation materials is attached as Exhibit 99.2.

In accordance with the General Instruction B.2 of Form 8-K, the information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 hereto, which are furnished herewith pursuant to and relate to Item 2.02 and Item 7.01, respectively, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of Section 18 of the Exchange Act. The information in Item 2.02 and Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 and Exhibit 99.2 hereto shall not be incorporated by reference into any filing or other document filed by the Company with the SEC pursuant to the Securities Act of 1933, as amended, the rules and regulations of the SEC thereunder, the Exchange Act, or the rules and regulations of the SEC thereunder, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following is furnished as an exhibit to this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Dated: |

|

January 21, 2025 |

|

|

|

|

|

GUARANTY BANCSHARES, INC. |

|

|

|

By: |

|

/s/ Tyson T. Abston |

Name: |

|

Tyson T. Abston |

Title: |

|

Chairman of the Board and Chief Executive Officer |

Press Release

For Immediate Release

Guaranty Bancshares, Inc. Reports

Fourth Quarter and Year-End 2024 Financial Results

Addison, Texas – January 21, 2025 / Business Wire / – Guaranty Bancshares, Inc. (NYSE: GNTY) (the "Company"), the parent company of Guaranty Bank & Trust, N.A. (the "Bank"), today reported financial results for the fiscal quarter and year ended December 31, 2024. The Company's net income available to common shareholders was $10.0 million, or $0.88 per basic share, for the quarter ended December 31, 2024, compared to $7.4 million, or $0.65 per basic share, for the quarter ended September 30, 2024 and $5.9 million, or $0.51 per basic share, for the quarter ended December 31, 2023. Return on average assets and average equity for the fourth quarter of 2024 were 1.27% and 12.68%, respectively, compared to 0.96% and 9.58%, respectively, for the third quarter of 2024 and 0.73% and 7.93%, respectively, for the fourth quarter of 2023. The increase in earnings during the fourth quarter of 2024 compared to the fourth quarter of 2023 was primarily due to a $2.4 million, or 10.1%, increase in net interest income, a $930,000, or 19.4%, increase in noninterest income, and a decrease in noninterest expense of $1.5 million, or 7.1%, compared to the prior year quarter. The increase in earnings as compared to the third quarter of 2024 was primarily driven by a $2.0 million, or 8.4%, increase in net interest income.

"We are very satisfied with our fourth quarter and year-end 2024 financial results. The decreases in Federal interest rates coupled with continued repricing of our loan and securities portfolio at higher yields allowed our net interest margin to grow to 3.54% for the fourth quarter of 2024 and 3.32% for the year ended December 31, 2024. We strategically shrunk our balance sheet during 2024 to build liquidity and capital, and to reduce credit risk, while maintaining our core deposits. As a result, we ended 2024 with strong key performance metrics and very low non-performing assets. We believe we are well positioned for loan growth and continued favorable results for our shareholders during 2025," said Ty Abston, the Company's Chairman and Chief Executive Officer.

QUARTERLY AND ANNUAL HIGHLIGHTS

•Increasing NIM and Stable Earnings. Net interest margin, on a fully taxable equivalent basis, continued to improve in the fourth quarter, increasing to 3.54%, compared to 3.33% in the third quarter and 3.11% in the prior year quarter. Net interest margin improved to 3.32% for the year compared to 3.15% in 2023. With our net earnings of $10.0 million in the fourth quarter, total net income for 2024 was $31.5 million, compared to $30.0 million in 2023, an increase of 5.0%. The improvements to net earnings resulted primarily from the decrease in interest bearing liability costs, while earning assets have repriced upward.

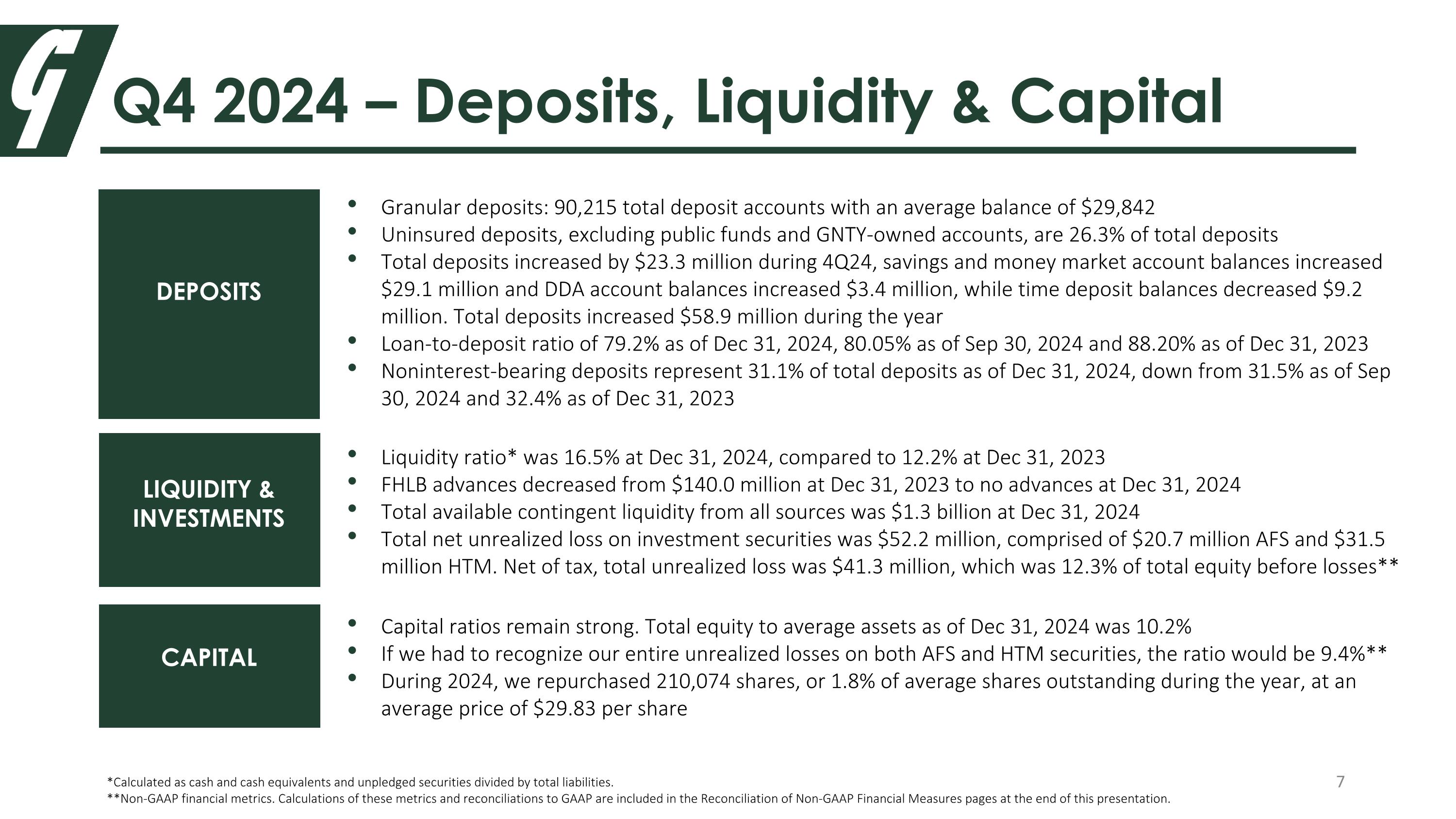

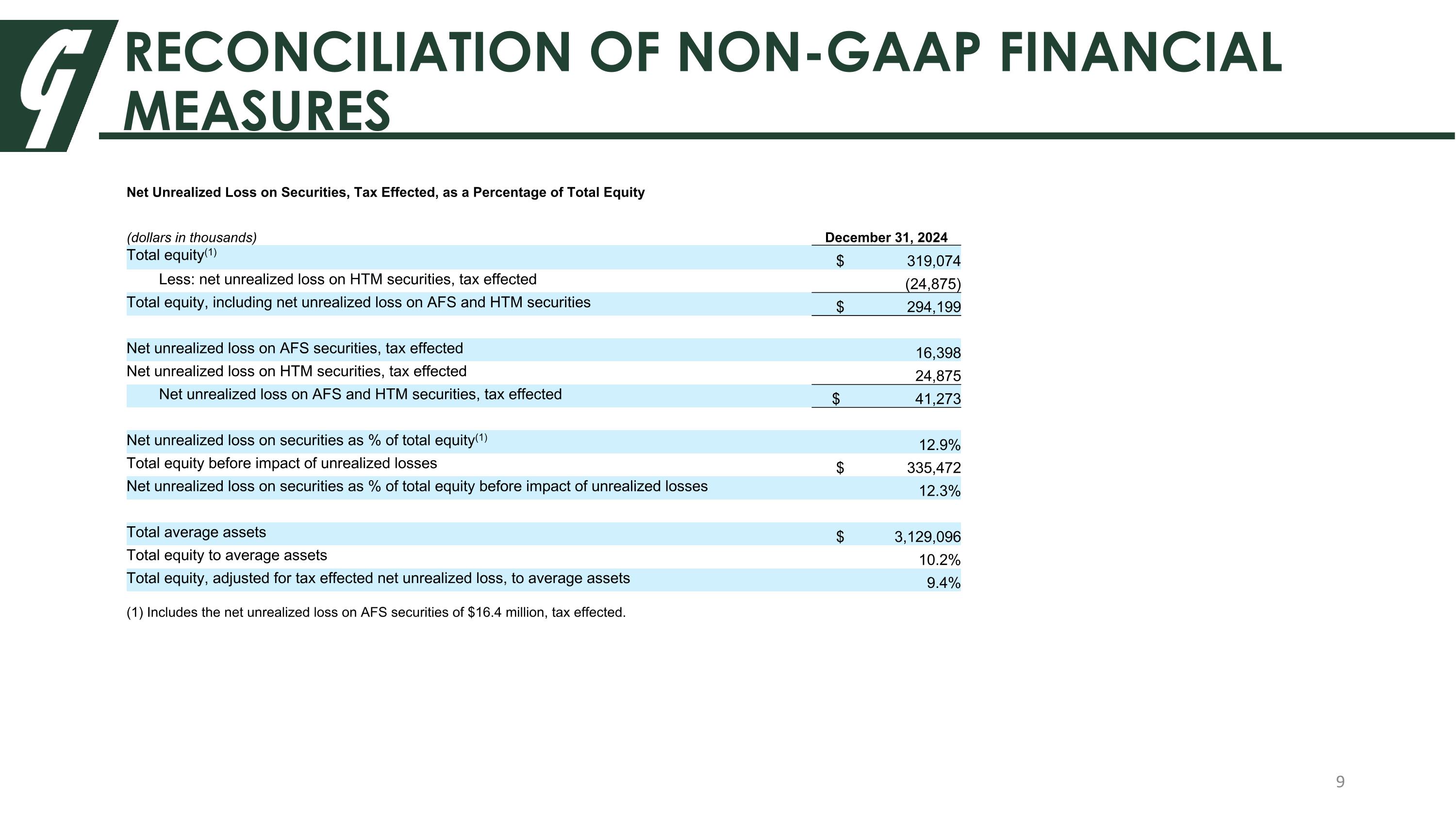

•Solid Balance Sheet, Capital and Liquidity. During the past year, we have strategically shrunk our balance sheet primarily by paying off debt and allowing transactional/non-relationship loans to pay off. We believe this strategy positions us to be on the offense when strong opportunities for growth or M&A are presented. Our capital and liquidity ratios, as well as contingent liquidity sources, remain very healthy. Our liquidity ratio, calculated as cash and cash equivalents and unpledged investments divided by total liabilities, was 16.5% as of December 31, 2024, compared to 12.2% as of December 31, 2023. Our total available contingent liquidity, net of current outstanding borrowings, was $1.3 billion, consisting of FHLB, FRB and correspondent bank fed funds and revolving lines of credit. Finally, our total equity to average quarterly assets as of December 31, 2024 was 10.2%. If we had to recognize our entire net unrealized losses on both AFS and HTM securities, our total equity to average assets ratio would be 9.4%†, which we believe represents a strong capital level under regulatory requirements.

•Excellent Asset Quality. Overall credit quality remains excellent and the expected losses on deteriorated credits are low due to the Bank's equity position and/or strong guarantor support. Nonperforming assets as a percentage of total assets were 0.16% at December 31, 2024, compared to 0.66% at September 30, 2024 and 0.18% at December 31, 2023. Net charge-offs (annualized) to average loans were 0.00% for the quarter ended December 31, 2024, compared to 0.04% for the quarter ended September 30, 2024, and 0.04% for the quarter ended December 31, 2023.

There was a reversal of the provision for credit losses of $250,000 during the fourth quarter, in addition to the $1.95 million reversal of provision for credit losses during the first three quarters of the year. Changes to historical and qualitative factors have been minimal during 2024, therefore the decrease in the allowance for credit losses was due primarily to the decreases in outstanding loan balances of $191.4 million, or 8.2%, since January 1, 2024. We continue to work with a relatively small number of stressed borrowers, which is reflected in the low $3.7 million and $2.4 million balances of nonaccrual loans and loans that are risk-rated Substandard, respectively, as of December 31, 2024.

Nonperforming assets consist of both nonaccrual loans and other real estate owned (ORE). Nonaccrual loans represented 0.17% of total outstanding loan balances as of December 31, 2024 and consisted primarily of smaller dollar consumer and small business loans. ORE at year end consisted of one real estate property, which we expect to resolve and sell in the first quarter of 2025 with minimal, if any, losses. Nonaccrual loans represented 0.24% of total outstanding loan balances as of both September 30, 2024 and December 31, 2023.

•Granular and Consistent Core Deposit Base. As of December 31, 2024, we have 90,215 total deposit accounts with an average account balance of $29,842. We have a historically reliable core deposit base, with strong and trusted banking

relationships. Total deposits increased by $23.3 million during the fourth quarter. Savings and money market account balances increased $29.1 million and DDA account balances increased $3.4 million, while time deposit balances decreased $9.2 million during the fourth quarter of 2024. Excluding public funds and Bank-owned accounts, our uninsured deposits as of December 31, 2024 were 26.3% of total deposits.

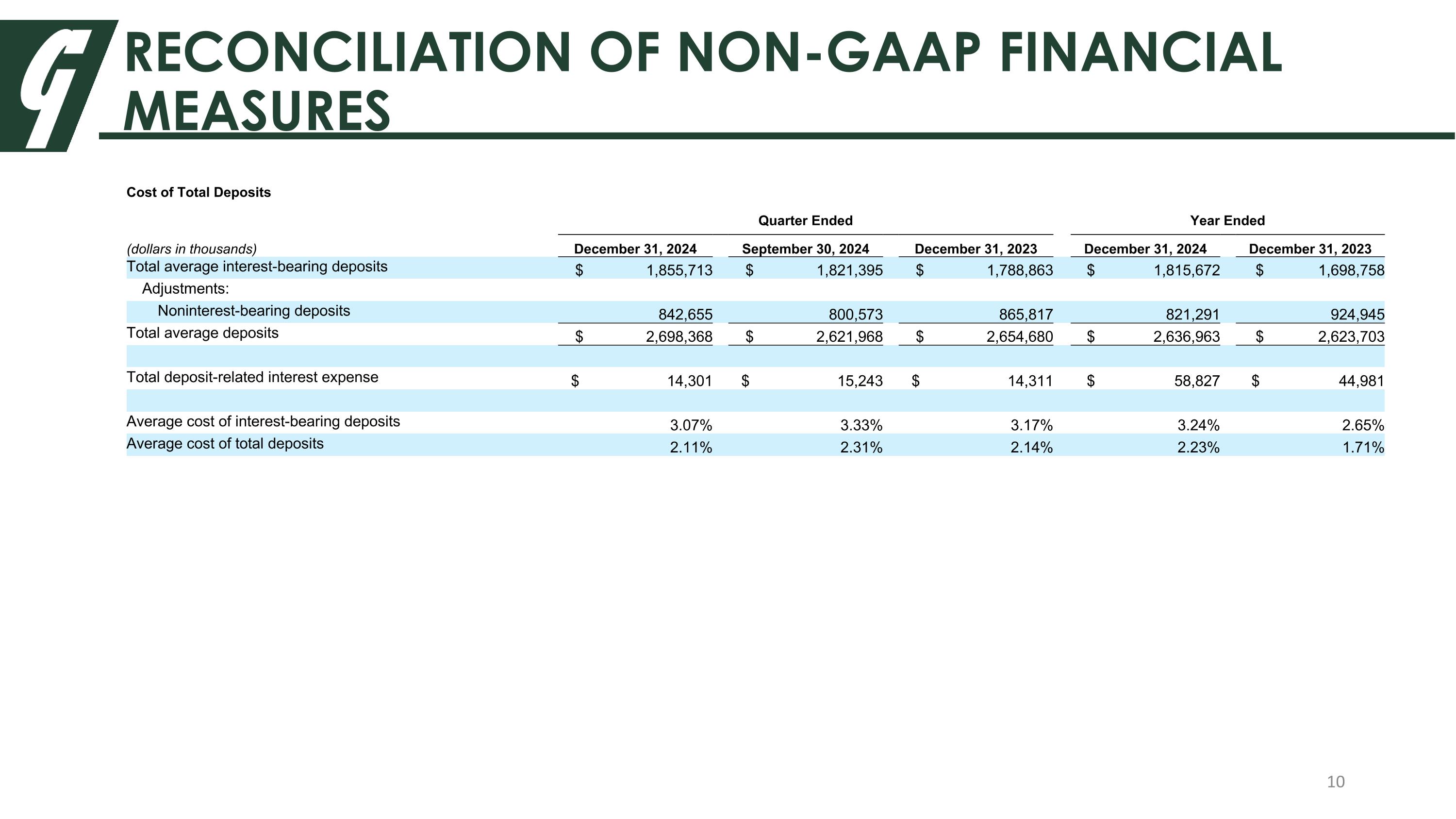

Interest rates paid on deposits during the quarter decreased as a result of lower federal funds rates. Our cost of interest-bearing deposits decreased 26 basis point during the quarter from 3.33% in the prior quarter to 3.07%. Our cost of total deposits for the fourth quarter of 2024 decreased 20 basis points from 2.31% in the prior quarter to 2.11%†. Noninterest-bearing deposits represent 31.1% of total deposits as of December 31, 2024.

† Non-GAAP financial metric. Calculations of this metric and reconciliations to GAAP are included in the schedules accompanying this release.

RESULTS OF OPERATIONS

Net interest income, before the reversal of the provision for credit losses, for the fourth quarter of 2024 and 2023 was $26.2 million and $23.8 million, respectively, an increase of $2.4 million, or 10.1%. The increase in net interest income resulted from an increase in interest income of $466,000, or 1.1%, and a decrease in interest expense of $1.9 million, or 11.4%, compared to the prior year quarter. The increase in interest income resulted primarily from a $1.2 million, or 29.9%, increase in interest income on securities and a $605,000, or 75.6%, increase in interest income on federal funds sold, and was offset somewhat by a decrease in loan interest income of $1.3 million, or 3.5%. The decrease in interest expense resulted primarily from a $1.8 million decrease in interest paid on FHLB borrowings. Our noninterest-bearing deposits to total deposits were 31.1% and 32.4% as of December 31, 2024 and 2023, respectively.

Net interest margin, on a fully taxable equivalent (FTE) basis, for the fourth quarter of 2024 and 2023 was 3.54% and 3.11%, respectively. The increase of 43 basis points was primarily due to a 21 basis point increase in interest-earning asset yields and a decrease of 27 basis points in the cost of interest-bearing liabilities from the prior year quarter. The increase in yield on interest-earning assets was primarily due to increases in loan portfolio yield from 6.06% to 6.42%, or 36 basis points, as well as a 54 basis point increase in yield on AFS securities during the period. The decrease in the cost of interest-bearing liabilities was due primarily to a decrease in the cost of interest-bearing deposits from 3.17% to 3.07%, a change of 10 basis points, along with a decrease in the average balance of advances from the FHLB and fed funds purchased since December 31, 2023.

Net interest income, before the reversal of the provision for credit losses, increased $2.0 million, or 8.4%, from $24.2 million in the third quarter of 2024 to $26.2 million for the fourth quarter of 2024. The increase in net interest income resulted primarily from an increase in interest income of $829,000, or 2.1%, combined with a decrease in interest expense of $1.2 million, or 7.4%, compared to the prior quarter.

Net interest margin, on an FTE basis, increased from 3.33% for the third quarter of 2024 to 3.54% for the fourth quarter of 2024, an increase of 21 basis points. The increase in net interest margin, on an FTE basis, was primarily due to a 26 basis point decrease in rates paid on interest-bearing deposits in the fourth quarter of 2024 compared to the prior quarter.

We recorded a reversal of the provision for credit losses of $250,000 during the fourth quarter of 2024, for a total reversal of provision for credit losses in 2024 of $2.2 million. The reversal of provision for credit losses resulted from a decline in gross loan balances of $5.4 million during the fourth quarter and of $191.4 million for the year ended December 31, 2024, while overall credit quality trends and economic forecast assumptions remained relatively stable during the year. As of both December 31, 2024 and 2023, our allowance for credit losses as a percentage of total loans was 1.33%.

Noninterest income increased $930,000, or 19.4%, for the fourth quarter of 2024 to $5.7 million, compared to $4.8 million for the fourth quarter of 2023. The increase from the same quarter in 2023 was primarily due to higher other noninterest income, resulting partially from a gain of $467,000 on the sale of the commercial ORE property in Austin, Texas, for which a valuation reserve of $900,000 had been recorded in the second quarter of 2024. Other noninterest income also increased due to rental income received during the fourth quarter from the ORE property sold during the fourth quarter and from our investment in an apartment/commercial building in Bryan, Texas which was not present in the prior year quarter.

Noninterest income for the fourth quarter of 2024 increased by $572,000, or 11.1%, from $5.2 million in the third quarter of 2024. The increase was primarily due to an increase in other noninterest income of $507,000, or 52.0%, resulting from the gain on the sale of the above mentioned ORE property during the fourth quarter of 2024.

Noninterest expense decreased $1.5 million, or 7.1%, during the fourth quarter of 2024 to $19.9 million, compared to $21.4 million for the fourth quarter of 2023. The decrease in noninterest expense during the fourth quarter of 2024 was driven primarily by a $1.7 million, or 13.1%, decrease in employee compensation and benefits and a $238,000, or 24.9%, decrease in legal and professional fees compared to the fourth quarter of 2023. These decreases were partially offset by a $366,000, or 13.3%, increase in occupancy expenses in the fourth quarter of 2024 compared to the same period in 2023. The decrease in employee compensation expense from the prior quarter is due to primarily to lower officer salaries, healthcare and bonus costs in the current year quarter. Legal expense decreased due to fewer loan and other items in the normal course of business, while the occupancy expense increased primarily due to depreciation, property taxes and a new lease for our location in Georgetown, Texas.

Noninterest expense decreased $798,000, or 3.9%, during the fourth quarter of 2024, from $20.7 million for the quarter ended September 30, 2024. The decrease resulted primarily from a $538,000, or 4.6%, decrease in employee compensation and benefits due to lower healthcare and salary expenses, as well as a $371,000, or 21.3%, decrease in other noninterest expense. This decrease was due to $360,000 in additional ORE-related holding costs incurred during the third quarter that were not present in the fourth quarter of 2024.

The Company’s efficiency ratio for the fourth quarter of 2024 was 62.23%, compared to 74.81% for the prior year quarter and 70.47% for the third quarter of 2024.

FINANCIAL CONDITION

Consolidated assets for the Company totaled $3.12 billion at December 31, 2024, compared to $3.10 billion at September 30, 2024 and $3.18 billion at December 31, 2023.

Gross loans decreased by $5.4 million, or 0.3%, during the quarter resulting in a gross loan balance of $2.13 billion at December 31, 2024, compared to $2.14 billion at September 30, 2024. The decline in loans resulted primarily from tighter underwriting and from lower demand from potential borrowers.

Gross loans decreased $191.4 million, or 8.2%, from $2.32 billion at December 31, 2023. The decrease in gross loans during the year resulted from tightened credit underwriting standards and loan terms, strategic non-renewal decisions and fewer borrower requests in response to higher interest rates and project costs.

Total deposits increased by $23.3 million, or 0.9%, to $2.69 billion at December 31, 2024, compared to $2.67 billion at September 30, 2024, and increased $58.9 million, or 2.2%, from $2.63 billion at December 31, 2023. The increase in deposits during the fourth quarter of 2024 compared to the third quarter of 2024 was the result of an increase in interest-bearing deposits of $25.4 million, partially offset by a decrease in noninterest-bearing deposits of $2.1 million. The increase in deposits during the year resulted primarily from an increase in interest-bearing deposits of $74.4 million, offset by a decrease in noninterest-bearing deposits of $15.5 million.

Nonperforming assets as a percentage of total loans were 0.23% at December 31, 2024, compared to 0.96% at September 30, 2024 and 0.25% at December 31, 2023. Nonperforming assets as a percentage of total assets were 0.16% at December 31, 2024, compared to 0.66% at September 30, 2024, and 0.18% at December 31, 2023. The Bank's nonperforming assets consist primarily of ORE and nonaccrual loans. The decrease in nonperforming assets compared to the prior quarter was primarily due to the resolution and sale of an ORE property in Austin, Texas. There is one remaining single family ORE property with a book balance of $1.2 million which is expected to be fully resolved in the first quarter of 2025, with minimal, if any, expected losses.

Total equity was $319.1 million at December 31, 2024, compared to $319.3 million at September 30, 2024 and $303.8 million at December 31, 2023. The decrease in total equity compared to the prior quarter resulted primarily from an increase in other comprehensive loss due to unrealized losses on investment securities of $8.1 million and $2.7 million of dividends paid, which was offset by net income of $10.0 million. The increase in total equity from the prior year was primarily due to net earnings of $31.5 million and was partially offset by $11.0 million in dividends paid, $6.4 million in treasury stock repurchases and $1.8 million in other comprehensive loss during 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

47,417 |

|

|

$ |

50,623 |

|

|

$ |

45,016 |

|

|

$ |

43,872 |

|

|

$ |

47,744 |

|

Federal funds sold |

|

|

94,750 |

|

|

|

108,350 |

|

|

|

40,475 |

|

|

|

24,300 |

|

|

|

36,575 |

|

Interest-bearing deposits |

|

|

3,797 |

|

|

|

3,973 |

|

|

|

4,721 |

|

|

|

4,921 |

|

|

|

5,205 |

|

Total cash and cash equivalents |

|

|

145,964 |

|

|

|

162,946 |

|

|

|

90,212 |

|

|

|

73,093 |

|

|

|

89,524 |

|

Securities available for sale |

|

|

340,304 |

|

|

|

277,567 |

|

|

|

242,662 |

|

|

|

228,787 |

|

|

|

196,195 |

|

Securities held to maturity |

|

|

334,732 |

|

|

|

341,911 |

|

|

|

347,992 |

|

|

|

363,963 |

|

|

|

404,208 |

|

Loans held for sale |

|

|

143 |

|

|

|

770 |

|

|

|

871 |

|

|

|

874 |

|

|

|

976 |

|

Loans, net |

|

|

2,102,565 |

|

|

|

2,107,597 |

|

|

|

2,185,247 |

|

|

|

2,234,012 |

|

|

|

2,290,881 |

|

Accrued interest receivable |

|

|

12,016 |

|

|

|

10,927 |

|

|

|

12,397 |

|

|

|

11,747 |

|

|

|

13,143 |

|

Premises and equipment, net |

|

|

56,010 |

|

|

|

56,964 |

|

|

|

57,475 |

|

|

|

56,921 |

|

|

|

57,018 |

|

Other real estate owned |

|

|

1,184 |

|

|

|

15,184 |

|

|

|

15,184 |

|

|

|

14,900 |

|

|

|

— |

|

Cash surrender value of life insurance |

|

|

42,883 |

|

|

|

42,623 |

|

|

|

42,369 |

|

|

|

42,119 |

|

|

|

42,348 |

|

Core deposit intangible, net |

|

|

994 |

|

|

|

1,100 |

|

|

|

1,206 |

|

|

|

1,312 |

|

|

|

1,418 |

|

Goodwill |

|

|

32,160 |

|

|

|

32,160 |

|

|

|

32,160 |

|

|

|

32,160 |

|

|

|

32,160 |

|

Other assets |

|

|

46,599 |

|

|

|

47,356 |

|

|

|

53,842 |

|

|

|

67,550 |

|

|

|

56,920 |

|

Total assets |

|

$ |

3,115,554 |

|

|

$ |

3,097,105 |

|

|

$ |

3,081,617 |

|

|

$ |

3,127,438 |

|

|

$ |

3,184,791 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing |

|

$ |

837,432 |

|

|

$ |

839,567 |

|

|

$ |

820,430 |

|

|

$ |

828,861 |

|

|

$ |

852,957 |

|

Interest-bearing |

|

|

1,854,735 |

|

|

|

1,829,347 |

|

|

|

1,805,732 |

|

|

|

1,798,983 |

|

|

|

1,780,289 |

|

Total deposits |

|

|

2,692,167 |

|

|

|

2,668,914 |

|

|

|

2,626,162 |

|

|

|

2,627,844 |

|

|

|

2,633,246 |

|

Securities sold under agreements to repurchase |

|

|

31,075 |

|

|

|

31,164 |

|

|

|

25,173 |

|

|

|

39,058 |

|

|

|

25,172 |

|

Accrued interest and other liabilities |

|

|

31,320 |

|

|

|

33,849 |

|

|

|

32,860 |

|

|

|

33,807 |

|

|

|

32,242 |

|

Line of credit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,500 |

|

Federal Home Loan Bank advances |

|

|

— |

|

|

|

— |

|

|

|

45,000 |

|

|

|

75,000 |

|

|

|

140,000 |

|

Subordinated debentures |

|

|

41,918 |

|

|

|

43,885 |

|

|

|

43,852 |

|

|

|

45,819 |

|

|

|

45,785 |

|

Total liabilities |

|

|

2,796,480 |

|

|

|

2,777,812 |

|

|

|

2,773,047 |

|

|

|

2,821,528 |

|

|

|

2,880,945 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to Guaranty Bancshares, Inc. |

|

|

318,498 |

|

|

|

318,784 |

|

|

|

308,043 |

|

|

|

305,371 |

|

|

|

303,300 |

|

Noncontrolling interest |

|

|

576 |

|

|

|

509 |

|

|

|

527 |

|

|

|

539 |

|

|

|

546 |

|

Total equity |

|

|

319,074 |

|

|

|

319,293 |

|

|

|

308,570 |

|

|

|

305,910 |

|

|

|

303,846 |

|

Total liabilities and equity |

|

$ |

3,115,554 |

|

|

$ |

3,097,105 |

|

|

$ |

3,081,617 |

|

|

$ |

3,127,438 |

|

|

$ |

3,184,791 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands, except per share data) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

STATEMENTS OF EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

$ |

41,262 |

|

|

$ |

40,433 |

|

|

$ |

40,713 |

|

|

$ |

40,752 |

|

|

$ |

40,796 |

|

Interest expense |

|

|

15,041 |

|

|

|

16,242 |

|

|

|

16,833 |

|

|

|

17,165 |

|

|

|

16,983 |

|

Net interest income |

|

|

26,221 |

|

|

|

24,191 |

|

|

|

23,880 |

|

|

|

23,587 |

|

|

|

23,813 |

|

Reversal of provision for credit losses |

|

|

(250 |

) |

|

|

(500 |

) |

|

|

(1,200 |

) |

|

|

(250 |

) |

|

|

— |

|

Net interest income after reversal of provision for credit losses |

|

|

26,471 |

|

|

|

24,691 |

|

|

|

25,080 |

|

|

|

23,837 |

|

|

|

23,813 |

|

Noninterest income |

|

|

5,726 |

|

|

|

5,154 |

|

|

|

4,599 |

|

|

|

5,258 |

|

|

|

4,796 |

|

Noninterest expense |

|

|

19,880 |

|

|

|

20,678 |

|

|

|

20,602 |

|

|

|

20,692 |

|

|

|

21,402 |

|

Income before income taxes |

|

|

12,317 |

|

|

|

9,167 |

|

|

|

9,077 |

|

|

|

8,403 |

|

|

|

7,207 |

|

Income tax provision |

|

|

2,309 |

|

|

|

1,788 |

|

|

|

1,654 |

|

|

|

1,722 |

|

|

|

1,341 |

|

Net earnings |

|

$ |

10,008 |

|

|

$ |

7,379 |

|

|

$ |

7,423 |

|

|

$ |

6,681 |

|

|

$ |

5,866 |

|

Net loss attributable to noncontrolling interest |

|

|

9 |

|

|

|

18 |

|

|

|

12 |

|

|

|

7 |

|

|

|

12 |

|

Net earnings attributable to Guaranty Bancshares, Inc. |

|

$ |

10,017 |

|

|

$ |

7,397 |

|

|

$ |

7,435 |

|

|

$ |

6,688 |

|

|

$ |

5,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER COMMON SHARE DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share, basic |

|

$ |

0.88 |

|

|

$ |

0.65 |

|

|

$ |

0.65 |

|

|

$ |

0.58 |

|

|

$ |

0.51 |

|

Earnings per common share, diluted |

|

|

0.87 |

|

|

|

0.65 |

|

|

|

0.65 |

|

|

|

0.58 |

|

|

|

0.51 |

|

Cash dividends per common share |

|

|

0.24 |

|

|

|

0.24 |

|

|

|

0.24 |

|

|

|

0.24 |

|

|

|

0.23 |

|

Book value per common share - end of quarter |

|

|

27.86 |

|

|

|

27.94 |

|

|

|

26.98 |

|

|

|

26.47 |

|

|

|

26.28 |

|

Tangible book value per common share - end of quarter(1) |

|

|

24.96 |

|

|

|

25.03 |

|

|

|

24.06 |

|

|

|

23.57 |

|

|

|

23.37 |

|

Common shares outstanding - end of quarter(2) |

|

|

11,431,568 |

|

|

|

11,408,908 |

|

|

|

11,417,270 |

|

|

|

11,534,960 |

|

|

|

11,540,644 |

|

Weighted-average common shares outstanding, basic |

|

|

11,422,063 |

|

|

|

11,383,027 |

|

|

|

11,483,091 |

|

|

|

11,539,167 |

|

|

|

11,536,878 |

|

Weighted-average common shares outstanding, diluted |

|

|

11,490,834 |

|

|

|

11,443,324 |

|

|

|

11,525,504 |

|

|

|

11,598,239 |

|

|

|

11,589,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (annualized) |

|

|

1.27 |

% |

|

|

0.96 |

% |

|

|

0.95 |

% |

|

|

0.85 |

% |

|

|

0.73 |

% |

Return on average equity (annualized) |

|

|

12.68 |

|

|

|

9.58 |

|

|

|

9.91 |

|

|

|

8.93 |

|

|

|

7.93 |

|

Net interest margin, fully taxable equivalent (annualized)(3) |

|

|

3.54 |

|

|

|

3.33 |

|

|

|

3.26 |

|

|

|

3.16 |

|

|

|

3.11 |

|

Efficiency ratio(4) |

|

|

62.23 |

|

|

|

70.47 |

|

|

|

72.34 |

|

|

|

71.74 |

|

|

|

74.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See Non-GAAP Reconciling Tables. |

|

(2) Excludes the dilutive effect, if any, of shares of common stock issuable upon exercise of outstanding stock options. |

|

(3) Net interest margin on a fully taxable equivalent basis is equal to net interest income adjusted for nontaxable income divided by average interest-earning assets, annualized, using a marginal tax rate of 21%. |

|

(4) The efficiency ratio was calculated by dividing total noninterest expense by net interest income plus noninterest income, excluding securities gains or losses. Taxes are not part of this calculation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Years Ended |

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

|

|

(dollars in thousands, except per share data) |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

STATEMENTS OF EARNINGS |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

$ |

163,160 |

|

|

$ |

156,492 |

|

|

|

|

|

|

|

Interest expense |

|

|

65,281 |

|

|

|

59,512 |

|

|

|

|

|

|

|

Net interest income |

|

|

97,879 |

|

|

|

96,980 |

|

|

|

|

|

|

|

Reversal of provision for credit losses |

|

|

(2,200 |

) |

|

|

— |

|

|

|

|

|

|

|

Net interest income after reversal of provision for credit losses |

|

|

100,079 |

|

|

|

96,980 |

|

|

|

|

|

|

|

Noninterest income |

|

|

20,737 |

|

|

|

22,513 |

|

|

|

|

|

|

|

Noninterest expense |

|

|

81,852 |

|

|

|

82,354 |

|

|

|

|

|

|

|

Income before income taxes |

|

|

38,964 |

|

|

|

37,139 |

|

|

|

|

|

|

|

Income tax provision |

|

|

7,473 |

|

|

|

7,130 |

|

|

|

|

|

|

|

Net earnings |

|

$ |

31,491 |

|

|

$ |

30,009 |

|

|

|

|

|

|

|

Net loss attributable to noncontrolling interest |

|

|

46 |

|

|

|

28 |

|

|

|

|

|

|

|

Net earnings attributable to Guaranty Bancshares, Inc. |

|

$ |

31,537 |

|

|

$ |

30,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER COMMON SHARE DATA |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share, basic |

|

$ |

2.75 |

|

|

$ |

2.57 |

|

|

|

|

|

|

|

Earnings per common share, diluted |

|

|

2.74 |

|

|

|

2.56 |

|

|

|

|

|

|

|

Cash dividends per common share |

|

|

0.96 |

|

|

|

0.92 |

|

|

|

|

|

|

|

Book value per common share - end of period |

|

|

27.86 |

|

|

|

26.28 |

|

|

|

|

|

|

|

Tangible book value per common share - end of period(1) |

|

|

24.96 |

|

|

|

23.37 |

|

|

|

|

|

|

|

Common shares outstanding - end of period(2) |

|

|

11,431,568 |

|

|

|

11,540,644 |

|

|

|

|

|

|

|

Weighted-average common shares outstanding, basic |

|

|

11,456,540 |

|

|

|

11,693,761 |

|

|

|

|

|

|

|

Weighted-average common shares outstanding, diluted |

|

|

11,502,683 |

|

|

|

11,738,605 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets |

|

|

1.01 |

% |

|

|

0.92 |

% |

|

|

|

|

|

|

Return on average equity |

|

|

10.30 |

|

|

|

10.10 |

|

|

|

|

|

|

|

Net interest margin, fully taxable equivalent(3) |

|

|

3.32 |

|

|

|

3.15 |

|

|

|

|

|

|

|

Efficiency ratio(4) |

|

|

69.01 |

|

|

|

68.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See Non-GAAP Reconciling Tables. |

(2) Excludes the dilutive effect, if any, of shares of common stock issuable upon exercise of outstanding stock options. |

(3) Net interest margin on a fully taxable equivalent basis is equal to net interest income adjusted for nontaxable income divided by average interest-earning assets, using a marginal tax rate of 21%. |

(4) The efficiency ratio was calculated by dividing total noninterest expense by net interest income plus noninterest income, excluding securities gains or losses. Taxes are not part of this calculation. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

LOAN PORTFOLIO COMPOSITION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

|

$ |

254,702 |

|

|

$ |

245,738 |

|

|

$ |

264,058 |

|

|

$ |

269,560 |

|

|

$ |

287,565 |

|

Real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction and development |

|

|

218,617 |

|

|

|

213,014 |

|

|

|

231,053 |

|

|

|

273,300 |

|

|

|

296,639 |

|

Commercial real estate |

|

|

866,684 |

|

|

|

866,112 |

|

|

|

899,120 |

|

|

|

906,684 |

|

|

|

923,195 |

|

Farmland |

|

|

147,191 |

|

|

|

169,116 |

|

|

|

180,126 |

|

|

|

180,502 |

|

|

|

186,295 |

|

1-4 family residential |

|

|

529,006 |

|

|

|

524,245 |

|

|

|

526,650 |

|

|

|

523,573 |

|

|

|

514,603 |

|

Multi-family residential |

|

|

51,538 |

|

|

|

54,158 |

|

|

|

47,507 |

|

|

|

44,569 |

|

|

|

44,292 |

|

Consumer |

|

|

51,394 |

|

|

|

52,530 |

|

|

|

53,642 |

|

|

|

54,375 |

|

|

|

57,059 |

|

Agricultural |

|

|

11,726 |

|

|

|

11,293 |

|

|

|

12,506 |

|

|

|

12,418 |

|

|

|

12,685 |

|

Overdrafts |

|

|

279 |

|

|

|

331 |

|

|

|

335 |

|

|

|

276 |

|

|

|

243 |

|

Total loans(1)(2) |

|

$ |

2,131,137 |

|

|

$ |

2,136,537 |

|

|

$ |

2,214,997 |

|

|

$ |

2,265,257 |

|

|

$ |

2,322,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

ALLOWANCE FOR CREDIT LOSSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at beginning of period |

|

$ |

28,543 |

|

|

$ |

29,282 |

|

|

$ |

30,560 |

|

|

$ |

30,920 |

|

|

$ |

31,140 |

|

Loans charged-off |

|

|

(281 |

) |

|

|

(272 |

) |

|

|

(115 |

) |

|

|

(310 |

) |

|

|

(242 |

) |

Recoveries |

|

|

278 |

|

|

|

33 |

|

|

|

37 |

|

|

|

200 |

|

|

|

22 |

|

Reversal of provision for credit losses |

|

|

(250 |

) |

|

|

(500 |

) |

|

|

(1,200 |

) |

|

|

(250 |

) |

|

|

— |

|

Balance at end of period |

|

$ |

28,290 |

|

|

$ |

28,543 |

|

|

$ |

29,282 |

|

|

$ |

30,560 |

|

|

$ |

30,920 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses / period-end loans |

|

|

1.33 |

% |

|

|

1.34 |

% |

|

|

1.32 |

% |

|

|

1.35 |

% |

|

|

1.33 |

% |

Allowance for credit losses / nonperforming loans |

|

|

758.6 |

|

|

|

560.2 |

|

|

|

470.4 |

|

|

|

496.0 |

|

|

|

552.9 |

|

Net charge-offs / average loans (annualized) |

|

|

0.00 |

|

|

|

0.04 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONPERFORMING ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual loans |

|

$ |

3,729 |

|

|

$ |

5,095 |

|

|

$ |

6,225 |

|

|

$ |

6,161 |

|

|

$ |

5,592 |

|

Other real estate owned |

|

|

1,184 |

|

|

|

15,184 |

|

|

|

15,184 |

|

|

|

14,900 |

|

|

|

— |

|

Repossessed assets owned |

|

|

22 |

|

|

|

154 |

|

|

|

331 |

|

|

|

236 |

|

|

|

234 |

|

Total nonperforming assets |

|

$ |

4,935 |

|

|

$ |

20,433 |

|

|

$ |

21,740 |

|

|

$ |

21,297 |

|

|

$ |

5,826 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual loans as a percentage of total loans(1)(2) |

|

|

0.17 |

% |

|

|

0.24 |

% |

|

|

0.28 |

% |

|

|

0.27 |

% |

|

|

0.24 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets as a percentage of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loans(1)(2) |

|

|

0.23 |

% |

|

|

0.96 |

% |

|

|

0.98 |

% |

|

|

0.94 |

% |

|

|

0.25 |

% |

Total assets |

|

|

0.16 |

|

|

|

0.66 |

|

|

|

0.71 |

|

|

|

0.68 |

|

|

|

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Excludes outstanding balances of loans held for sale of $143,000, $770,000, $871,000, $874,000, and $976,000 as of December 31, September 30, June 30 and March 31, 2024, and December 31, 2023, respectively. |

|

(2) Excludes deferred loan fees of $282,000, $397,000, $468,000, $685,000, and $775,000 as of December 31, September 30, June 30 and March 31, 2024, and December 31, 2023, respectively. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges |

|

$ |

1,142 |

|

|

$ |

1,165 |

|

|

$ |

1,098 |

|

|

$ |

1,069 |

|

|

$ |

1,123 |

|

Net realized gain on sale of loans |

|

|

240 |

|

|

|

252 |

|

|

|

227 |

|

|

|

272 |

|

|

|

196 |

|

Fiduciary and custodial income |

|

|

661 |

|

|

|

542 |

|

|

|

657 |

|

|

|

649 |

|

|

|

624 |

|

Bank-owned life insurance income |

|

|

258 |

|

|

|

255 |

|

|

|

250 |

|

|

|

251 |

|

|

|

249 |

|

Merchant and debit card fees |

|

|

1,775 |

|

|

|

1,817 |

|

|

|

2,122 |

|

|

|

1,706 |

|

|

|

1,760 |

|

Loan processing fee income |

|

|

131 |

|

|

|

102 |

|

|

|

136 |

|

|

|

118 |

|

|

|

116 |

|

Mortgage fee income |

|

|

37 |

|

|

|

46 |

|

|

|

43 |

|

|

|

41 |

|

|

|

30 |

|

Other noninterest income |

|

|

1,482 |

|

|

|

975 |

|

|

|

66 |

|

|

|

1,152 |

|

|

|

698 |

|

Total noninterest income |

|

$ |

5,726 |

|

|

$ |

5,154 |

|

|

$ |

4,599 |

|

|

$ |

5,258 |

|

|

$ |

4,796 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee compensation and benefits |

|

$ |

11,048 |

|

|

$ |

11,586 |

|

|

$ |

11,723 |

|

|

$ |

12,437 |

|

|

$ |

12,715 |

|

Occupancy expenses |

|

|

3,123 |

|

|

|

3,026 |

|

|

|

2,924 |

|

|

|

2,747 |

|

|

|

2,757 |

|

Legal and professional fees |

|

|

716 |

|

|

|

775 |

|

|

|

841 |

|

|

|

772 |

|

|

|

954 |

|

Software and technology |

|

|

1,733 |

|

|

|

1,649 |

|

|

|

1,653 |

|

|

|

1,642 |

|

|

|

1,740 |

|

Amortization |

|

|

142 |

|

|

|

142 |

|

|

|

142 |

|

|

|

143 |

|

|

|

145 |

|

Director and committee fees |

|

|

185 |

|

|

|

188 |

|

|

|

198 |

|

|

|

200 |

|

|

|

186 |

|

Advertising and promotions |

|

|

267 |

|

|

|

239 |

|

|

|

208 |

|

|

|

169 |

|

|

|

352 |

|

ATM and debit card expense |

|

|

819 |

|

|

|

791 |

|

|

|

785 |

|

|

|

609 |

|

|

|

763 |

|

Telecommunication expense |

|

|

153 |

|

|

|

178 |

|

|

|

159 |

|

|

|

173 |

|

|

|

175 |

|

FDIC insurance assessment fees |

|

|

320 |

|

|

|

359 |

|

|

|

365 |

|

|

|

360 |

|

|

|

321 |

|

Other noninterest expense |

|

|

1,374 |

|

|

|

1,745 |

|

|

|

1,604 |

|

|

|

1,440 |

|

|

|

1,294 |

|

Total noninterest expense |

|

$ |

19,880 |

|

|

$ |

20,678 |

|

|

$ |

20,602 |

|

|

$ |

20,692 |

|

|

$ |

21,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands) |

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Interest

Paid |

|

|

Average

Yield/ Rate |

|

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Interest

Paid |

|

|

Average

Yield/ Rate |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loans(1) |

|

$ |

2,126,414 |

|

|

$ |

34,319 |

|

|

|

6.42 |

% |

|

$ |

2,329,227 |

|

|

$ |

35,573 |

|

|

|

6.06 |

% |

Securities available for sale |

|

|

332,903 |

|

|

|

3,185 |

|

|

|

3.81 |

|

|

|

187,119 |

|

|

|

1,540 |

|

|

|

3.27 |

|

Securities held to maturity |

|

|

338,296 |

|

|

|

2,218 |

|

|

|

2.61 |

|

|

|

406,553 |

|

|

|

2,619 |

|

|

|

2.56 |

|

Nonmarketable equity securities |

|

|

19,173 |

|

|

|

135 |

|

|

|

2.80 |

|

|

|

26,314 |

|

|

|

264 |

|

|

|

3.98 |

|

Interest-bearing deposits in other banks |

|

|

115,669 |

|

|

|

1,405 |

|

|

|

4.83 |

|

|

|

56,207 |

|

|

|

800 |

|

|

|

5.65 |

|

Total interest-earning assets |

|

|

2,932,455 |

|

|

|

41,262 |

|

|

|

5.60 |

|

|

|

3,005,420 |

|

|

|

40,796 |

|

|

|

5.39 |

|

Allowance for credit losses |

|

|

(28,511 |

) |

|

|

|

|

|

|

|

|

(30,996 |

) |

|

|

|

|

|

|

Noninterest-earning assets |

|

|

225,152 |

|

|

|

|

|

|

|

|

|

223,204 |

|

|

|

|

|

|

|

Total assets |

|

$ |

3,129,096 |

|

|

|

|

|

|

|

|

$ |

3,197,628 |

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

1,855,713 |

|

|

$ |

14,301 |

|

|

|

3.07 |

% |

|

$ |

1,788,863 |

|

|

$ |

14,311 |

|

|

|

3.17 |

% |

Advances from FHLB and fed funds purchased |

|

|

6,522 |

|

|

|

85 |

|

|

|

5.18 |

|

|

|

140,761 |

|

|

|

1,915 |

|

|

|

5.40 |

|

Line of credit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,255 |

|

|

|

95 |

|

|

|

8.86 |

|

Subordinated debt |

|

|

42,570 |

|

|

|

513 |

|

|

|

4.79 |

|

|

|

46,438 |

|

|

|

534 |

|

|

|

4.56 |

|

Securities sold under agreements to repurchase |

|

|

29,959 |

|

|

|

142 |

|

|

|

1.89 |

|

|

|

23,860 |

|

|

|

128 |

|

|

|

2.13 |

|

Total interest-bearing liabilities |

|

|

1,934,764 |

|

|

|

15,041 |

|

|

|

3.09 |

|

|

|

2,004,177 |

|

|

|

16,983 |

|

|

|

3.36 |

|

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing deposits |

|

|

842,655 |

|

|

|

|

|

|

|

|

|

865,817 |

|

|

|

|

|

|

|

Accrued interest and other liabilities |

|

|

37,308 |

|

|

|

|

|

|

|

|

|

33,496 |

|

|

|

|

|

|

|

Total noninterest-bearing liabilities |

|

|

879,963 |

|

|

|

|

|

|

|

|

|

899,313 |

|

|

|

|

|

|

|

Equity |

|

|

314,369 |

|

|

|

|

|

|

|

|

|

294,138 |

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

3,129,096 |

|

|

|

|

|

|

|

|

$ |

3,197,628 |

|

|

|

|

|

|

|

Net interest rate spread(2) |

|

|

|

|

|

|

|

|

2.51 |

% |

|

|

|

|

|

|

|

|

2.03 |

% |

Net interest income |

|

|

|

|

$ |

26,221 |

|

|

|

|

|

|

|

|

$ |

23,813 |

|

|

|

|

Net interest margin(3) |

|

|

|

|

|

|

|

|

3.56 |

% |

|

|

|

|

|

|

|

|

3.14 |

% |

Net interest margin, fully taxable equivalent(4) |

|

|

|

|

|

|

|

|

3.54 |

% |

|

|

|

|

|

|

|

|

3.11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes average outstanding balances of loans held for sale of $820,000 and $799,000 for the quarter ended December 31, 2024 and 2023, respectively. |

|

(2) Net interest spread is the average yield on interest-earning assets minus the average rate on interest-bearing liabilities. |

|

(3) Net interest margin is equal to net interest income divided by average interest-earning assets, annualized. |

|

(4) Net interest margin on a fully taxable equivalent basis is equal to net interest income adjusted for nontaxable income divided by average interest-earning assets, annualized, using a marginal tax rate of 21%. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands) |

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Interest

Paid |

|

|

Average

Yield/

Rate |

|

|

Average

Outstanding

Balance |

|

|

Interest

Earned/

Interest

Paid |

|

|

Average

Yield/

Rate |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loans(1) |

|

$ |

2,207,359 |

|

|

$ |

139,434 |

|

|

|

6.32 |

% |

|

$ |

2,352,154 |

|

|

$ |

136,086 |

|

|

|

5.79 |

% |

Securities available for sale |

|

|

264,683 |

|

|

|

9,787 |

|

|

|

3.70 |

|

|

|

182,277 |

|

|

|

5,159 |

|

|

|

2.83 |

|

Securities held to maturity |

|

|

358,418 |

|

|

|

9,325 |

|

|

|

2.60 |

|

|

|

449,097 |

|

|

|

11,210 |

|

|

|

2.50 |

|

Nonmarketable equity securities |

|

|

21,536 |

|

|

|

857 |

|

|

|

3.98 |

|

|

|

27,371 |

|

|

|

1,288 |

|

|

|

4.71 |

|

Interest-bearing deposits in other banks |

|

|

71,673 |

|

|

|

3,757 |

|

|

|

5.24 |

|

|

|

51,507 |

|

|

|

2,749 |

|

|

|

5.34 |

|

Total interest-earning assets |

|

|

2,923,669 |

|

|

|

163,160 |

|

|

|

5.58 |

|

|

|

3,062,406 |

|

|

|

156,492 |

|

|

|

5.11 |

|

Allowance for credit losses |

|

|

(29,720 |

) |

|

|

|

|

|

|

|

|

(31,601 |

) |

|

|

|

|

|

|

Noninterest-earning assets |

|

|

232,391 |

|

|

|

|

|

|

|

|

|

220,230 |

|

|

|

|

|

|

|

Total assets |

|

$ |

3,126,340 |

|

|

|

|

|

|

|

|

$ |

3,251,035 |

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

1,815,672 |

|

|

$ |

58,827 |

|

|

|

3.24 |

% |

|

$ |

1,698,758 |

|

|

$ |

44,981 |

|

|

|

2.65 |

% |

Advances from FHLB and fed funds purchased |

|

|

64,699 |

|

|

|

3,498 |

|

|

|

5.41 |

|

|

|

226,214 |

|

|

|

11,626 |

|

|

|

5.14 |

|

Line of credit |

|

|

275 |

|

|

|

24 |

|

|

|

8.73 |

|

|

|

4,168 |

|

|

|

363 |

|

|

|

8.71 |

|

Subordinated debt |

|

|

44,175 |

|

|

|

2,047 |

|

|

|

4.63 |

|

|

|

47,873 |

|

|

|

2,143 |

|

|

|

4.48 |

|

Securities sold under agreements to repurchase |

|

|

37,386 |

|

|

|

885 |

|

|

|

2.37 |

|

|

|

20,635 |

|

|

|

399 |

|

|

|

1.93 |

|

Total interest-bearing liabilities |

|

|

1,962,207 |

|

|

|

65,281 |

|

|

|

3.33 |

|

|

|

1,997,648 |

|

|

|

59,512 |

|

|

|

2.98 |

|

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing deposits |

|

|

821,291 |

|

|

|

|

|

|

|

|

|

924,945 |

|

|

|

|

|

|

|

Accrued interest and other liabilities |

|

|

36,672 |

|

|

|

|

|

|

|

|

|

30,924 |

|

|

|

|

|

|

|

Total noninterest-bearing liabilities |

|

|

857,963 |

|

|

|

|

|

|

|

|

|

955,869 |

|

|

|

|

|

|

|

Equity |

|

|

306,170 |

|

|

|

|

|

|

|

|

|

297,518 |

|

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

3,126,340 |

|

|

|

|

|

|

|

|

$ |

3,251,035 |

|

|

|

|

|

|

|

Net interest rate spread(2) |

|

|

|

|

|

|

|

|

2.25 |

% |

|

|

|

|

|

|

|

|

2.13 |

% |

Net interest income |

|

|

|

|

$ |

97,879 |

|

|

|

|

|

|

|

|

$ |

96,980 |

|

|

|

|

Net interest margin(3) |

|

|

|

|

|

|

|

|

3.35 |

% |

|

|

|

|

|

|

|

|

3.17 |

% |

Net interest margin, fully taxable equivalent(4) |

|

|

|

|

|

|

|

|

3.32 |

% |

|

|

|

|

|

|

|

|

3.15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes average outstanding balances of loans held for sale of $806,000 and $1.2 million for the years ended December 31, 2024 and 2023, respectively. |

|

(2) Net interest spread is the average yield on interest-earning assets minus the average rate on interest-bearing liabilities. |

|

(3) Net interest margin is equal to net interest income divided by average interest-earning assets. |

|

(4) Net interest margin on a fully taxable equivalent basis is equal to net interest income adjusted for nontaxable income divided by average interest-earning assets, using a marginal tax rate of 21%. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-GAAP RECONCILING TABLES

Tangible Book Value per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

2024 |

|

|

2023 |

|

(dollars in thousands, except per share data) |

|

December 31 |

|

|

September 30 |

|

|

June 30 |

|

|

March 31 |

|

|

December 31 |

|

Equity attributable to Guaranty Bancshares, Inc. |

|

$ |

318,498 |

|

|

$ |

318,784 |

|

|

$ |

308,043 |

|

|

$ |

305,371 |

|

|

$ |

303,300 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

(32,160 |

) |

|

|

(32,160 |

) |

|

|

(32,160 |

) |

|

|

(32,160 |

) |

|

|

(32,160 |

) |

Core deposit intangible, net |

|

|

(994 |

) |

|

|

(1,100 |

) |

|

|

(1,206 |

) |

|

|

(1,312 |

) |

|

|

(1,418 |

) |

Total tangible common equity attributable to Guaranty Bancshares, Inc. |

|

$ |

285,344 |

|

|

$ |

285,524 |

|

|

$ |

274,677 |

|

|

$ |

271,899 |

|

|

$ |

269,722 |

|

Common shares outstanding(1) |

|

|

11,431,568 |

|

|

|

11,408,908 |

|

|

|

11,417,270 |

|

|

|

11,534,960 |

|

|

|

11,540,644 |

|

Book value per common share |

|

$ |

27.86 |

|

|

$ |

27.94 |

|

|

$ |

26.98 |

|

|

$ |

26.47 |

|

|

$ |

26.28 |

|

Tangible book value per common share(1) |

|

|

24.96 |

|

|

|

25.03 |

|

|

|

24.06 |

|

|

|

23.57 |

|

|

|

23.37 |

|

(1) Excludes the dilutive effect, if any, of shares of common stock issuable upon exercise of outstanding stock options.

Net Unrealized Loss on Securities, Tax Effected, as a Percentage of Total Equity

|

|

|

|

|

(dollars in thousands) |

|

December 31, 2024 |

|

Total equity(1) |

|

$ |

319,074 |

|

Less: net unrealized loss on HTM securities, tax effected |

|

|

(24,875 |

) |