0001580905FALSE00015809052025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February 27, 2025

Date of Report (date of earliest event reported)

___________________________________

Installed Building Products, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-36307 (Commission File Number) | 45-3707650 (I.R.S. Employer Identification Number) |

495 South High Street, Suite 50 Columbus, OH 43215 |

(Address of principal executive offices and zip code) |

(614) 221-3399 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock | IBP | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2025, Installed Building Products, Inc. (the “Company”) issued a press release reporting the financial results for the fourth quarter and fiscal year ended December 31, 2024. The full text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Furthermore, the information contained in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed to be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

The February 27, 2025 press release also announced that the Board of Directors approved a quarterly cash dividend of $0.37 per share as well as an annual variable cash dividend of $1.70 both payable on March 31, 2025 to stockholders of record at the close of business on March 14, 2025.

One or more representatives of the Company will meet with prospective investors during the first quarter of 2025. The materials used in connection with these meetings have been posted on the Company’s website (www.installedbuildingproducts.com) under the Investor Relations section.

The information contained in this Item 7.01 is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Furthermore, the information contained in this Item 7.01 shall not be deemed to be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | Press Release, dated February 27, 2025, announcing results for the fourth quarter and year ended December 31, 2024 and quarterly dividend |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 27th day of February, 2025.

| | | | | |

| INSTALLED BUILDING PRODUCTS, INC. |

| |

By: | /s/ Michael T. Miller |

Name: | Michael T. Miller |

Title: | Chief Financial Officer |

INSTALLED BUILDING PRODUCTS REPORTS

RECORD FOURTH QUARTER 2024 RESULTS

Columbus, Ohio, February 27, 2025, Installed Building Products, Inc. (the "Company" or "IBP") (NYSE: IBP), an industry-leading installer of insulation and complementary building products, today announced results for the fourth quarter and fiscal year ended December 31, 2024.

Fourth Quarter 2024 Highlights (Comparisons are to Prior Year Period)

•Net revenue increased 4.1% to a fourth quarter record of $750.2 million

◦Installation revenue increased 3.8% to $695.0 million, as growth across all end markets combined with sales from IBP's recent acquisitions

◦Other revenue, net of eliminations, which includes IBP’s manufacturing and distribution operations, increased to $55.2 million from $50.9 million

•Net income increased 3.1% to $66.9 million

•Adjusted EBITDA* increased 2.9% to $132.0 million

•Net income per diluted share increased 4.4% to $2.39

•Adjusted net income* increased 4.3% to $80.6 million, or $2.88 per diluted share

•At December 31, 2024, IBP had $328 million in cash and cash equivalents

•Repriced Term Loan B facility, reducing the borrowing cost by over $1 million annually

•Repurchased 383 thousand shares of common stock at a total cost of approximately $79 million

•Declared fourth quarter dividend of $0.35 per share that was paid to shareholders on December 31, 2024

Recent Developments

•IBP’s Board of Directors declared the 2025 first quarter regular cash dividend of $0.37 per share, representing a 6% increase to the Company's regular dividend in the prior year period

•IBP’s Board of Directors also declared an annual variable dividend of $1.70 per share, an increase of $0.10 per share over last year’s variable dividend

•IBP's Board of Directors authorized a new stock repurchase program that allows for the repurchase of up to $500 million of the Company's outstanding common stock, which expires March 1, 2026

“Our fourth-quarter results capped off another record year for IBP, reinforcing our longstanding commitment to providing residential and commercial customers with high-quality, efficient building product installation services. Record profitability in 2024 drove another year of strong operating cash flow. During 2024, we continued to grow the company by adding over $100 million in annual revenue through acquisitions while distributing a combined $230 million to shareholders through dividends and share repurchases,” stated Jeff Edwards, Chairman and Chief Executive Officer.

Mr. Edwards continued: “Our Board of Directors approved a 6% increase to both our regular quarterly cash dividend and annual variable dividend to $0.37 per share and $1.70 per share, respectively. These actions reflect the Board’s confidence in our financial position and ability to support a strategy of returning capital to our shareholders.”

“The long-term view on demand for our installed service remains positive. Although housing affordability continues to be a challenge for potential buyers, U.S. economic growth and employment data is healthy. We will continue to focus on the aspects of our business we can control and remain flexible under prevailing market conditions to realize operational and financial improvements this year,” concluded Mr. Edwards.

Acquisition Update

IBP continues to prioritize profitable growth through its proven strategy of acquiring well-run installers of insulation and complementary building products. During 2024, IBP completed nine acquisitions representing over $100 million of annual revenue. For 2025, IBP expects to acquire at least $100 million of annual revenue.

During the 2024 fourth quarter, IBP completed the following acquisitions:

•In October, IBP acquired Wholesale Insulation Supply, Inc. doing business as Insulation Supplies, a specialty distributor focused on supplying fiberglass insulation, spray foam insulation, cellulose insulation, and related accessories and machinery to residential and commercial end markets with annual revenue of over $22 million.

•In November, IBP acquired Tatum Insulation III, LLC, a North Carolina-based installer of multiple building products including fiberglass insulation, shower doors, shelving, mirrors, and other products installed in the interior of new residential and commercial buildings with annual revenue of over $17 million.

•In December, IBP acquired Capital Insulation, LLC and CBS & Mirror, LLC (collectively “Capital”), a Houston, Texas based single-family, multifamily, and commercial installer of fiberglass and spray foam insulation with annual revenue of over $12 million.

2025 First Quarter Regular Cash Dividend and 2025 Annual Variable Dividend

IBP’s Board of Directors has approved the Company’s quarterly cash dividend of $0.37 per share, payable on March 31, 2025, to stockholders of record on March 14, 2025. In addition, IBP’s Board of Directors has approved the Company’s annual variable cash dividend at $1.70 per share, which will also be payable on March 31, 2025, to stockholders of record on March 14, 2025.

Share Repurchases

During the three months ended December 31, 2024, IBP repurchased 383 thousand shares of its common stock at a total cost of approximately $79 million. IBP's Board of Directors authorized a new stock repurchase program that allows for the repurchase of up to $500 million of the Company's outstanding common stock. The new program replaces the previous program and is in effect through March 1, 2026.

Fourth Quarter 2024 Results Overview

For the fourth quarter of 2024, net revenue was $750.2 million, an increase of 4.1% from $720.7 million for the fourth quarter of 2023. On a consolidated same branch basis, net revenue increased 1.1% from the prior year quarter, supported by growth in our residential end market. Residential sales growth within the Company's Installation segment was up 1.8% on a same branch basis in the quarter and both single-family and multi-family same branch sales increased from the prior year quarter. Commercial sales in the Installation segment were down 0.1% from the prior year quarter on a same branch basis.

Gross profit improved 2.5% to $251.8 million from $245.7 million in the prior year quarter. Gross profit and adjusted gross profit* as a percent of net revenue were both 33.6%, compared to 34.1% in the same period last year. Adjusted gross profit primarily adjusts for the Company’s share-based compensation expense.

Selling and administrative expense, as a percent of total revenue, was 19.0% compared to 19.1% in the prior year quarter. Adjusted selling and administrative expense*, as a percent of net revenue, was 18.1% compared to 18.3% in the prior year quarter.

Net income was $66.9 million, or $2.39 per diluted share, compared to $64.9 million, or $2.29 per diluted share in the prior year quarter. Net profit margin for the fourth quarter was 8.9% compared to 9.0% in the prior year quarter. Adjusted net income* was $80.6 million, or $2.88 per diluted share, compared to $77.3 million, or $2.72 per diluted share in the prior year quarter. Adjusted net profit margin* for the fourth quarter and the prior year quarter was 10.7%. Adjusted net income* accounts for the impact of non-core items in both periods, including an addback for non-cash amortization expense related to acquisitions.

EBITDA* was $125.2 million, a 2.3% increase from $122.4 million in the prior year quarter. Adjusted EBITDA* was $132.0 million, a 2.9% increase from $128.3 million in the prior year quarter, representing an adjusted EBITDA margin* of 17.6% and 17.8%, respectively.

Full Year 2024 Results Overview

For the year ended December 31, 2024, net revenue was a record $2.9 billion, an increase of 5.9% from $2.8 billion in 2023. On a consolidated same branch basis, net revenue improved 3.5% from the prior year, supported primarily by growth in our residential end market. Residential sales growth within the Company's Installation segment was up 4.0% on a same branch basis for 2024, as both single-family and multi-family same branch sales increased from the prior year. Commercial sales in the Installation segment was up 1.2% from the prior year on a same branch basis.

Gross profit improved 6.9% to $994.5 million from $930.7 million in the prior year. Gross profit and adjusted gross profit* as a percent of total revenue were both 33.8%, up from 33.5% last year. Adjusted gross profit primarily adjusts for the Company’s share-based compensation expense.

Selling and administrative expense, as a percent of net revenue, was 19.2%, compared to 18.6% in the prior year. Adjusted selling and administrative expense*, as a percent of net revenue, was 18.5%, compared to 18.0% in the prior year.

Net income was $256.6 million, or $9.10 per diluted share, compared to $243.7 million, or $8.61 per diluted share in the prior year. Net profit margin was 8.7%, compared to 8.8% in the prior year. Adjusted net income* was $311.4 million, or $11.05 per diluted share, compared to $290.8 million or $10.27 per diluted share in the prior year quarter. Adjusted net income margin* for year ended December 31, 2024 was 10.6% compared to 10.5% in the prior year. Adjusted net income accounts for the impact of non-core items in both periods, including an addback for non-cash amortization expense related to acquisitions.

For the full year of 2024, EBITDA* was $484.9 million, a 3.9% increase from $466.8 million in the prior year. Adjusted EBITDA* was $511.4 million for the year ended December 31, 2024, a 5.2% increase from $485.9 million in the prior year, representing adjusted EBITDA margins* of 17.4% and 17.5%, respectively.

Net cash provided by operating activities was $340.0 million, compared to $340.2 million in the prior year as higher net income and non-cash items were offset by changes in working capital for the full year ended December 31, 2024.

Conference Call and Webcast

The Company will host a conference call and webcast on February 27, 2025, at 10:00 a.m. Eastern Time to discuss these results. To participate in the call, please dial 877-407-0792 (domestic) or 201-689-8263 (international). The live webcast will be available at www.installedbuildingproducts.com in the investor relations section. A replay of the conference call will be available through March 27, 2025, by dialing 844-512-2921 (domestic) or 412-317-6671 (international) and entering the passcode 13750306.

Alternatively, participants can register for the call 15 minutes prior to the event by using the call me option for a faster connection to join the conference call. You can enter your phone number and let the system call you right away. Click here for the call me option:

https://callme.viavid.com/viavid/?$Y2FsbG1lPXRydWUmcGFzc2NvZGU9MTM3NDY3NTImaD10cnVlJmluZm89Y29tcGFueSZyPXRydWUmQj02

About Installed Building Products

Installed Building Products, Inc. is one of the nation's largest new residential insulation installers and is a diversified installer of complementary building products, including waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors and other products for residential and commercial builders located in the continental United States. The Company manages all aspects of the installation process for its customers, from direct purchase and receipt of materials from national manufacturers to its timely supply of materials to job sites and quality installation. The Company offers its portfolio of services for new and existing single-family and multi-family residential and

commercial building projects in all 48 continental states and the District of Columbia from its national network of over 250 branch locations.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws, including with respect to the housing market and the commercial market, our operations, industry and economic conditions, our financial and business model, payment of dividends, the demand for our services and product offerings, expansion of our national footprint and end markets, diversification of our products, our ability to grow and strengthen our market position, our ability to pursue and integrate value-enhancing acquisitions and the expected amount of acquired revenue, our ability to improve sales and profitability, and expectations for demand for our services and our earnings. Forward-looking statements may generally be identified by the use of words such as "anticipate," "believe," "expect," "intends," "plan," and "will" or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Any forward-looking statements that we make herein and in any future reports and statements are not guarantees of future performance, and actual results may differ materially from those expressed in or suggested by such forward-looking statements as a result of various factors, including, without limitation, general economic and industry conditions; increases in mortgage interest rates and rising home prices; inflation and interest rates; the material price and supply environment; increased tariffs; the timing of increases in our selling prices; the risk that the Company may reduce, suspend or eliminate dividend payments in the future; and the factors discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as the same may be updated from time to time in our subsequent filings with the Securities and Exchange Commission. In addition, any future declaration of dividends will be subject to the final determination of our Board of Directors. Any forward-looking statement made by the Company in this press release speaks only as of the date hereof. New risks and uncertainties arise from time to time, and it is impossible for the Company to predict these events or how they may affect it. The Company has no obligation, and does not intend, to update any forward-looking statements after the date hereof, except as required by federal securities laws.

*Use of Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this press release contains the non-GAAP financial measures of EBITDA, Adjusted EBITDA, Adjusted EBITDA, net of dispositions, Adjusted EBITDA margin (i.e., Adjusted EBITDA divided by net revenue), Adjusted Net Income, Adjusted Net Income, net of dispositions, Adjusted Net Income per diluted share, Adjusted Gross Profit and Adjusted Selling and Administrative expense. The reasons for the use of these measures, reconciliations of EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per diluted share, Adjusted Gross Profit, and Adjusted Selling and Administrative expense to the most directly comparable GAAP measures and other information relating to these measures are included below following the unaudited condensed consolidated financial statements. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for IBP’s financial results prepared in accordance with GAAP.

During the three months ended June 30, 2024, we decided to wind down the operations of a single new commercial end market-oriented branch that focused on the installation of a non-core end product, due to shifting market conditions, an unfavorable contract settlement, and sub-standard operating performance. All dispositions figures reflect the results of this single branch. All net of dispositions figures reflect the exclusion of the results of this single branch.

Additional Information - Stock Repurchase Program

Under the repurchase program, the Company may purchase shares of its common stock through open market transactions, accelerated share repurchase transactions, privately negotiated transactions, block purchases or otherwise in accordance with applicable federal securities laws, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended and pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934, as amended. The timing and amount of any repurchases under this program will be determined by the Company’s management at its discretion based on a variety of factors, including the market price of our common stock, corporate considerations, general market and economic conditions, and legal requirements. The program may be modified, discontinued or suspended at any time or from time to time. The Company anticipates funding for this program to come from available corporate funds, including cash on hand and future cash flow.

INSTALLED BUILDING PRODUCTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(unaudited, in millions, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenue | $ | 750.2 | | | $ | 720.7 | | | $ | 2,941.3 | | | $ | 2,778.6 | |

| Cost of sales | 498.4 | | | 475.0 | | | 1,946.8 | | | 1,847.9 | |

| Gross profit | 251.8 | | | 245.7 | | | 994.5 | | | 930.7 | |

| Operating expenses | | | | | | | |

| Selling | 36.2 | | | 34.3 | | | 139.8 | | | 131.8 | |

| Administrative | 106.3 | | | 103.0 | | | 424.8 | | | 385.3 | |

| Asset impairment | — | | | — | | | 4.9 | | | — | |

| Amortization | 10.8 | | | 10.8 | | | 42.5 | | | 44.5 | |

| | | | | | | |

| Operating income | 98.5 | | | 97.6 | | | 382.5 | | | 369.1 | |

| Other expense, net | | | | | | | |

| Interest expense, net | 9.1 | | | 7.8 | | | 36.9 | | | 37.0 | |

| Other (income) | — | | | (0.5) | | | (0.8) | | | (1.0) | |

| Income before income taxes | 89.4 | | | 90.3 | | | 346.4 | | | 333.1 | |

| Income tax provision | 22.5 | | | 25.4 | | | 89.8 | | | 89.4 | |

| Net income | $ | 66.9 | | | $ | 64.9 | | | $ | 256.6 | | | $ | 243.7 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Net change on cash flow hedges, net of tax (provision) benefit of $(2.7) and $4.1 for the three months ended December 31, 2024 and 2023, respectively, and $(0.6) and $2.5 for the years ended December 31, 2024 and 2023, respectively | 7.2 | | | (11.4) | | | 1.3 | | | (6.9) | |

| Comprehensive income | $ | 74.1 | | | $ | 53.5 | | | $ | 257.9 | | | $ | 236.8 | |

| Earnings Per Share: | | | | | | | |

| Basic | $ | 2.41 | | | $ | 2.30 | | | $ | 9.16 | | | $ | 8.65 | |

| Diluted | $ | 2.39 | | | $ | 2.29 | | | $ | 9.10 | | | $ | 8.61 | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 27,790,735 | | | 28,190,317 | | | 28,030,187 | | | 28,161,583 | |

| Diluted | 27,945,360 | | | 28,353,334 | | | 28,190,404 | | | 28,306,313 | |

| | | | | | | |

| Cash dividends declared per share | $ | 0.35 | | | $ | 0.33 | | | $ | 3.00 | | | $ | 2.22 | |

| | | | | | | |

INSTALLED BUILDING PRODUCTS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in millions, except share and per share amounts)

| | | | | | | | | | | |

| | December 31, | | December 31, |

| | 2024 | | 2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 327.6 | | | $ | 386.5 | |

| | | |

| Accounts receivable (less allowance for credit losses of $10.7 and $11.2 at December 31, 2024 and 2023, respectively) | 433.9 | | | 423.3 | |

| Inventories | 194.6 | | | 162.8 | |

| Prepaid expenses and other current assets | 98.8 | | | 97.4 | |

| Total current assets | 1,054.9 | | | 1,070.0 | |

| Property and equipment, net | 174.8 | | | 137.2 | |

| Operating lease right-of-use assets | 95.6 | | | 78.1 | |

| Goodwill | 432.6 | | | 398.8 | |

| Customer relationships, net | 178.8 | | | 179.6 | |

| Other intangibles, net | 91.7 | | | 89.1 | |

| Other non-current assets | 31.5 | | | 28.5 | |

| Total assets | $ | 2,059.9 | | | $ | 1,981.3 | |

| LIABILITIES AND STOCKHOLDER'S EQUITY | | | |

| Current liabilities | | | |

| Current maturities of long-term debt | $ | 32.4 | | | $ | 32.2 | |

| Current maturities of operating lease obligations | 34.3 | | | 28.3 | |

| Current maturities of finance lease obligations | 2.8 | | | 2.7 | |

| Accounts payable | 146.6 | | | 158.6 | |

| Accrued compensation | 66.4 | | | 59.6 | |

| Other current liabilities | 76.5 | | | 65.0 | |

| Total current liabilities | 359.0 | | | 346.4 | |

| Long-term debt | 842.4 | | | 835.1 | |

| Operating lease obligations | 61.0 | | | 49.9 | |

| Finance lease obligations | 5.4 | | | 6.6 | |

| Deferred income taxes | 26.3 | | | 24.5 | |

| Other long-term liabilities | 60.5 | | | 48.5 | |

| Total liabilities | 1,354.6 | | | 1,311.0 | |

Commitments and contingencies | | | |

| Stockholders’ equity | | | |

| Preferred Stock; $0.01 par value: 5,000,000 authorized and 0 shares issued and outstanding at December 31, 2024 and 2023, respectively | — | | | — | |

| Common stock; $0.01 par value: 100,000,000 authorized, 33,713,662 and 33,587,701 issued and 27,758,491 and 28,367,338 shares outstanding at December 31, 2024 and 2023, respectively | 0.3 | | | 0.3 | |

| Additional paid in capital | 261.3 | | | 244.7 | |

| Retained earnings | 865.5 | | | 693.8 | |

| Treasury stock; at cost: 5,955,171 and 5,220,363 shares at December 31, 2024 and 2023, respectively | (456.8) | | | (302.2) | |

| Accumulated other comprehensive income | 35.0 | | | 33.7 | |

| Total stockholders’ equity | 705.3 | | | 670.3 | |

| Total liabilities and stockholders’ equity | $ | 2,059.9 | | | $ | 1,981.3 | |

INSTALLED BUILDING PRODUCTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in millions)

| | | | | | | | | | | |

| Twelve months ended December 31, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income | $ | 256.6 | | | $ | 243.7 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | |

| Depreciation and amortization of property and equipment | 59.1 | | | 52.2 | |

| Amortization of operating lease right-of-use assets | 32.9 | | | 29.0 | |

| Amortization of intangibles | 42.5 | | | 44.5 | |

| Amortization of deferred financing costs and debt discount | 1.6 | | | 1.9 | |

| Provision for credit losses | 6.0 | | | 6.3 | |

| Write-off of debt issuance costs | 1.5 | | | 0.9 | |

| Gain on sale of property and equipment | (1.9) | | | (1.9) | |

| Non-cash stock compensation | 19.4 | | | 15.9 | |

| Asset impairment | 4.9 | | | — | |

| | | |

| Deferred income taxes | 1.7 | | | 0.5 | |

| Other, net | (13.1) | | | (12.2) | |

| Changes in assets and liabilities, excluding effects of acquisitions | | | |

| Accounts receivable | (10.8) | | | (25.1) | |

| Inventories | (26.3) | | | 16.5 | |

| | | |

| Other assets | (7.9) | | | (11.0) | |

| Accounts payable | (18.8) | | | 5.1 | |

| Income taxes receivable/payable | 3.4 | | | (5.7) | |

| Other liabilities | (10.8) | | | (20.4) | |

| Net cash provided by operating activities | 340.0 | | | 340.2 | |

| Cash flows from investing activities | | | |

| | | |

| | | |

| | | |

| Purchases of property and equipment | (88.6) | | | (61.6) | |

| Acquisitions of businesses, net of cash acquired of $— in 2024 and 2023, respectively | (88.6) | | | (59.6) | |

| Proceeds from sale of property and equipment | 2.9 | | | 2.7 | |

| Settlements with interest rate swap counterparties | 17.5 | | | 16.7 | |

| Other | (2.3) | | | (1.6) | |

| Net cash used in investing activities | $ | (159.1) | | | $ | (103.4) | |

INSTALLED BUILDING PRODUCTS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(unaudited, in millions)

| | | | | | | | | | | |

| Twelve months ended December 31, |

| 2024 | | 2023 |

| Cash flows from financing activities | | | |

| | | |

| Proceeds from Term Loan | $ | 186.0 | | | $ | — | |

| Payments on Term Loan | (179.8) | | | (5.0) | |

| Proceeds from vehicle and equipment notes payable | 28.7 | | | 38.7 | |

| Debt issuance costs | (1.5) | | | (0.5) | |

| Principal payments on long-term debt | (30.0) | | | (29.5) | |

| Principal payments on finance lease obligations | (3.0) | | | (2.9) | |

| Acquisition-related obligations | (2.2) | | | (4.7) | |

| Dividends paid | (84.7) | | | (63.1) | |

| Repurchase of common stock | (145.3) | | | (6.3) | |

| Surrender of common stock awards by employees | (8.0) | | | (6.6) | |

| Net cash used in financing activities | (239.8) | | | (79.9) | |

| Net change in cash and cash equivalents | (58.9) | | | 156.9 | |

| Cash and cash equivalents at beginning of period | 386.5 | | | 229.6 | |

| Cash and cash equivalents at end of period | $ | 327.6 | | | $ | 386.5 | |

| Supplemental disclosures of cash flow information | | | |

| Net cash paid during the period for: | | | |

| Interest | $ | 43.7 | | | $ | 42.5 | |

| Income taxes, net of refunds | 83.6 | | | 92.5 | |

| Supplemental disclosure of non-cash activities | | | |

| Right-of-use assets obtained in exchange for operating lease obligations | $ | 49.4 | | | $ | 30.7 | |

| | | |

| Property and equipment obtained in exchange for finance lease obligations | 2.0 | | | 3.3 | |

| Seller obligations in connection with acquisition of businesses | 5.6 | | | 9.3 | |

| Unpaid purchases of property and equipment included in accounts payable | 5.7 | | | 3.1 | |

| Accrued excise tax on common stock repurchases | 1.3 | | | — | |

INSTALLED BUILDING PRODUCTS, INC.

SEGMENT INFORMATION

(unaudited, in millions)

Information on Segments

Our Company has three operating segments consisting of Installation, Distribution and Manufacturing. The Other category reported below reflects the operations of our Distribution and Manufacturing operating segments.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

Installation Segment | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 695.0 | | $ | 669.8 | | $ | 2,761.9 | | $ | 2,605.6 |

Cost of sales (1) | 441.6 | | 426.2 | | 1,759.9 | | 1,674.7 |

| Segment gross profit | $ | 253.4 | | $ | 243.6 | | $ | 1,002.0 | | $ | 930.9 |

| Segment gross profit percentage | 36.5% | | 36.4% | | 36.3% | | 35.7% |

(1) Cost of sales included in the Installation segment gross profit is exclusive of depreciation and amortization for the three and twelve months ended December 31, 2024 and 2023.

The reconciliation of Installation revenue and segment gross profit for each period as shown in the tables above to consolidated net revenue and income before income taxes is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Reconciliation of revenue: | | | | | | | |

Installation segment revenue | $ | 695.0 | | | $ | 669.8 | | | $ | 2,761.9 | | | $ | 2,605.6 | |

Other revenue (1) | 60.9 | | | 53.6 | | | 196.9 | | | 182.0 | |

Elimination of inter-segment revenue | (5.7) | | | (2.7) | | | (17.5) | | | (9.0) | |

Total consolidated net revenue | $ | 750.2 | | | $ | 720.7 | | | $ | 2,941.3 | | | $ | 2,778.6 | |

Reconciliation of segment gross profit: | | | | | | | |

Installation segment gross profit | $ | 253.4 | | | $ | 243.6 | | | $ | 1,002.0 | | | $ | 930.9 | |

Other gross profit (1) | 15.1 | | | 15.6 | | | 53.1 | | | 51.3 | |

Elimination of inter-segment gross profit | (1.8) | | | (0.8) | | | (5.2) | | | (2.3) | |

Less: | | | | | | | |

| Depreciation and amortization | 14.9 | | | 12.7 | | | 55.4 | | | 49.2 | |

| Total consolidated gross profit, as reported | 251.8 | | | 245.7 | | | 994.5 | | | 930.7 | |

| Operating expenses | 153.3 | | | 148.1 | | | 612.0 | | | 561.6 | |

| Operating income | 98.5 | | | 97.6 | | | 382.5 | | | 369.1 | |

| Other expense, net | 9.1 | | | 7.3 | | | 36.1 | | | 36.0 | |

| Income before income taxes | $ | 89.4 | | | $ | 90.3 | | | $ | 346.4 | | | $ | 333.1 | |

(1) Other revenue and other gross profit include the remaining two operating segments, Distribution and Manufacturing before inter-segment eliminations. These operating segments are each below the quantitative thresholds for being reported as a reportable segment for the three and twelve months ended December 31, 2024 and 2023.

INSTALLED BUILDING PRODUCTS, INC.

REVENUE BY END MARKET

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Installation | | | | | | | | | | | | | | | |

| Residential new construction | $ | 533.3 | | | 71 | % | | $ | 510.5 | | | 71 | % | | $ | 2,127.3 | | | 72 | % | | $ | 1,999.4 | | | 72 | % |

| Repair and remodel | 46.5 | | | 6 | % | | 44.6 | | | 6 | % | | 174.0 | | | 6 | % | | 159.0 | | | 6 | % |

| Commercial | 115.2 | | | 16 | % | | 114.7 | | | 16 | % | | 460.6 | | | 16 | % | | 447.2 | | | 16 | % |

| Net revenues - Installation | $ | 695.0 | | | 93 | % | | $ | 669.8 | | | 93 | % | | $ | 2,761.9 | | | 94 | % | | $ | 2,605.6 | | | 94 | % |

| Other | 55.2 | | | 7 | % | | 50.9 | | | 7 | % | | 179.4 | | | 6 | % | | 173.0 | | | 6 | % |

| Net revenue, as reported | $ | 750.2 | | | 100 | % | | $ | 720.7 | | | 100 | % | | $ | 2,941.3 | | | 100 | % | | $ | 2,778.6 | | | 100 | % |

Reconciliation of Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, Adjusted Gross Profit and Adjusted Selling and Administrative Expense measure performance by adjusting GAAP net income, EBITDA, gross profit and selling and administrative expense, respectively, for certain income or expense items that are not considered part of our core operations. We believe that the presentation of these measures provides useful information to investors regarding our results of operations because it assists both investors and us in analyzing and benchmarking the performance and value of our business.

We believe the Adjusted EBITDA measure is useful to investors and us as a measure of comparative operating performance from period to period as it measures our changes in pricing decisions, cost controls and other factors that impact operating performance, and removes the effect of our capital structure (primarily interest expense), asset base (primarily depreciation and amortization), items outside our control (primarily income taxes) and the volatility related to the timing and extent of other activities such as asset impairments and non-core income and expenses. Accordingly, we believe that this measure is useful for comparing general operating performance from period to period. In addition, we use various EBITDA-based measures in determining the achievement of awards under certain of our incentive compensation programs. Other companies may define Adjusted EBITDA differently and, as a result, our measure may not be directly comparable to measures of other companies. In addition, Adjusted EBITDA may be defined differently for purposes of covenants contained in our revolving credit facility or any future facility.

Although we use the Adjusted EBITDA measure to assess the performance of our business, the use of the measure is limited because it does not include certain material expenses, such as interest and taxes, necessary to operate our business. Adjusted EBITDA should be considered in addition to, and not as a substitute for, GAAP net income as a measure of performance. Our presentation of this measure should not be construed as an indication that our future results will be unaffected by unusual or non-recurring items. This measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Because of these limitations, this measure is not intended as an alternative to net income as an indicator of our operating performance, as an alternative to any other measure of performance in conformity with GAAP or as an alternative to cash flow provided by operating activities as a measure of liquidity. You should therefore not place undue reliance on this measure or ratios calculated using this measure.

We also believe the Adjusted Net Income measure is useful to investors and us as a measure of comparative operating performance from period to period as it measures our changes in pricing decisions, cost controls and other factors that impact operating performance, and removes the effect of certain non-core items such as discontinued operations, acquisition related expenses, amortization expense, the tax impact of these certain non-core items, and the volatility related to the timing and extent of other activities such as asset impairments and non-core income and expenses. To make the financial presentation more consistent with other public building products companies, beginning in the fourth quarter 2016 we included an addback for non-cash amortization expense related to acquisitions. Accordingly, we believe that this measure is useful for comparing general operating performance from period to period. Other companies may define Adjusted Net Income differently and, as a result, our measure may not be directly comparable to measures of other companies. In addition, Adjusted Net Income may be defined differently for purposes of covenants contained in our revolving credit facility or any future facility.

INSTALLED BUILDING PRODUCTS, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

ADJUSTED NET INCOME CALCULATIONS

(unaudited, in millions, except share and per share amounts)

The tables below reconcile Adjusted Net Income, Adjusted Net Income, net of dispositions, and Adjusted Net Loss, dispositions to the most directly comparable GAAP financial measure, net income, for the periods presented therein. We have included Adjusted Net Income, net of dispositions, in this press release because it is a key measure used by our management team to understand the operating performance and profitability of our business. During the three months ended June 30, 2024, we decided to wind down the operations of a single new commercial end market-oriented branch that focused on the installation of a non-core end product, due to shifting market conditions, an unfavorable contract settlement, and sub-standard operating performance. Accordingly, we believe that excluding the financial results of this branch from our typical Adjusted Net Income measure of profitability provides useful insight and metrics relevant to understanding and evaluating the results of our ongoing operations. The Adjusted Net Loss, dispositions line item included below represents the Adjusted Net Loss of this single branch. We currently expect the closing of this branch to be substantially complete by March 31, 2025.

Per share figures may reflect rounding adjustments and consequently totals may not appear to sum.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | 2023 | | | | | | 2024 | | 2023 |

Net income, as reported | | $ | 66.9 | | | $ | 64.9 | | | | | | | $ | 256.6 | | | $ | 243.7 | |

| Adjustments for adjusted net income | | | | | | | | | | | | |

| Share-based compensation expense | | 6.2 | | | 5.3 | | | | | | | 19.4 | | | 15.9 | |

| Acquisition related expenses | | 0.6 | | | 0.6 | | | | | | | 2.2 | | | 1.9 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Amortization expense (1) | | 10.8 | | | 10.8 | | | | | | | 42.5 | | | 44.5 | |

Legal reserve | | — | | | — | | | | | | | — | | | 1.3 | |

Loan refinancing expenses (2) | | 0.9 | | | — | | | | | | | 5.0 | | | — | |

Asset impairment (3) | | — | | | — | | | | | | | 4.9 | | | — | |

Tax impact of adjusted items at a normalized tax rate (4) | | (4.8) | | (4.3) | | (4.3) | | | | | | | (19.2) | | | (16.5) | |

| Adjusted net income | | $ | 80.6 | | | $ | 77.3 | | | | | | | $ | 311.4 | | | $ | 290.8 | |

Less: Adjusted net loss, dispositions (5) | | (0.6) | | | (2.7) | | | | | | | (7.0) | | | (4.3) | |

Adjusted net income, net of dispositions | | $ | 81.2 | | | $ | 80.0 | | | | | | | $ | 318.4 | | | $ | 295.1 | |

| Weighted average shares outstanding (diluted) | | 27,945,360 | | | 28,353,334 | | | | | | | 28,190,404 | | | 28,306,313 | |

Diluted net income per share, as reported | | $ | 2.39 | | | $ | 2.29 | | | | | | | $ | 9.10 | | | $ | 8.61 | |

Adjustments for diluted adjusted net income, net of tax impact, per share (6) | | 0.49 | | | 0.43 | | | | | | | 1.95 | | | 1.66 | |

Diluted adjusted net income per share | | $ | 2.88 | | | $ | 2.72 | | | | | | | $ | 11.05 | | | $ | 10.27 | |

Less: Diluted adjusted net loss, dispositions, net of tax impact, per share (5) | | (0.02) | | | (0.10) | | | | | | | (0.25) | | | (0.15) | |

Diluted adjusted net income, net of dispositions per share | | $ | 2.90 | | | $ | 2.82 | | | | | | | $ | 11.30 | | | $ | 10.42 | |

(1) Addback of all non-cash amortization resulting from business combinations.

(2) Includes $0.4 and $1.5 million of non-cash write-off of capitalized loan expense and $0.5 and $3.5 million of cash paid to third parties in connection with loan refinancing for the three and twelve months ended December 31, 2024, respectively.

(3) During the twelve months ended December 31, 2024, we recognized intangible and asset impairment charges for a combined amount of $4.9 million related to winding down the operations of a branch that installs one of our non-core building products.

(4) Normalized effective tax rate of 26.0% applied to periods presented.

(5) Represents adjusted net loss and diluted adjusted net loss, per share of a single branch. Please see preceding paragraph at the beginning of this section for additional information.

(6) Includes adjustments related to the items noted above, net of tax.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | 2023 | | | | | | 2024 | | 2023 |

| Net loss, dispositions, as reported | | $ | (0.6) | | | $ | (2.8) | | | | | | | $ | (10.8) | | | $ | (4.7) | |

| Amortization expense | | — | | | 0.1 | | | | | | | 0.2 | | | 0.5 | |

Asset impairment (1) | | — | | | — | | | | | | | 4.9 | | | — | |

Tax impact of adjusted items at a normalized tax rate (2) | | — | | | — | | | | | | | (1.3) | | | (0.1) | |

Adjusted net loss, dispositions (3) | | $ | (0.6) | | | $ | (2.7) | | | | | | | $ | (7.0) | | | $ | (4.3) | |

| | | | | | | | | | | | |

(1) During the twelve months ended December 31, 2024, we recognized intangible and asset impairment charges for a combined amount of $4.9 million related to winding down the operations of a branch that installs one of our non-core building products.

(2) Normalized effective tax rate of 26.0% applied to periods presented.

(3) Represents Adjusted net loss of a single branch. Please see preceding paragraph at the beginning of this section for additional information.

INSTALLED BUILDING PRODUCTS, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

ADJUSTED GROSS PROFIT CALCULATIONS

(unaudited, in millions)

The table below reconciles Adjusted Gross Profit to the most directly comparable GAAP financial measure, gross profit, for the periods presented therein.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | 2023 | | | | | | 2024 | | 2023 |

| Gross profit | | $ | 251.8 | | $ | 245.7 | | | | | | $ | 994.5 | | $ | 930.7 |

| Share-based compensation expense | | 0.3 | | 0.2 | | | | | | 1.1 | | 0.9 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted gross profit | | $ | 252.1 | | $ | 245.9 | | | | | | $ | 995.6 | | $ | 931.6 |

| | | | | | | | | | | | |

| Gross profit margin | | 33.6% | | 34.1% | | | | | | 33.8% | | 33.5% |

| Adjusted gross profit margin | | 33.6% | | 34.1% | | | | | | 33.8% | | 33.5% |

INSTALLED BUILDING PRODUCTS, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

ADJUSTED SELLING AND ADMINISTRATIVE EXPENSE CALCULATIONS

(unaudited, in millions)

The table below reconciles Adjusted Selling and Administrative to the most directly comparable GAAP financial measure, selling and administrative, for the periods presented therein.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | 2023 | | | | | | 2024 | | 2023 |

| Selling expense | | $ | 36.2 | | $ | 34.3 | | | | | | $ | 139.8 | | $ | 131.8 |

| Administrative expense | | 106.3 | | 103.0 | | | | | | 424.8 | | 385.3 |

| Selling and Administrative expense, as reported | | 142.5 | | 137.3 | | | | | | 564.6 | | 517.1 |

| Share-based compensation expense | | 5.9 | | 5.0 | | | | | | 18.2 | | 15.0 |

| Acquisition related expenses | | 0.6 | | 0.6 | | | | | | 2.2 | | 1.9 |

| | | | | | | | | | | | |

| Legal reserve | | — | | — | | | | | | — | | 1.3 |

| | | | | | | | | | | | |

| Adjusted Selling and Administrative expense | | $ | 136.0 | | $ | 131.7 | | | | | | $ | 544.2 | | $ | 498.9 |

| | | | | | | | | | | | |

| Selling and Administrative expense - % Net revenue | | 19.0% | | 19.1% | | | | | | 19.2% | | 18.6% |

| Adjusted Selling and Administrative expense - % Net revenue | | 18.1% | | 18.3% | | | | | | 18.5% | | 18.0% |

| | | | | | | | | | | | |

INSTALLED BUILDING PRODUCTS, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

EBITDA AND ADJUSTED EBITDA CALCULATIONS

(unaudited, in millions)

The tables below reconcile EBITDA, Adjusted EBITDA, Adjusted EBITDA, net of dispositions and Adjusted EBITDA, dispositions to the most directly comparable GAAP financial measure, net income, for the periods presented therein. We have included Adjusted EBITDA, net of dispositions, in this press release because it is a key measure used by our management team to understand the operating performance and profitability of our business. During the three months ended June 30, 2024, we decided to wind down the operations of a single new commercial end market-oriented branch that focused on the installation of a non-core end product, due to shifting market conditions, an unfavorable contract settlement, and sub-standard operating performance. Accordingly, we believe that excluding the financial results of this branch from our typical Adjusted EBITDA measure of profitability provides useful insight and metrics relevant to understanding and evaluating the results of our ongoing operations. The Adjusted EBITDA, dispositions line item included below represents the Adjusted EBITDA of this single branch. We currently expect the closing of this branch to be substantially complete by March 31, 2025.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | 2023 | | | | | | 2024 | | 2023 |

| Net income, as reported | | $ | 66.9 | | $ | 64.9 | | | | | | $ | 256.6 | | $ | 243.7 |

| Interest expense | | 9.1 | | 7.8 | | | | | | 36.9 | | 37.0 |

| Provision for income tax | | 22.5 | | 25.4 | | | | | | 89.8 | | 89.4 |

| Depreciation and amortization | | 26.7 | | 24.3 | | | | | | 101.6 | | 96.7 |

| EBITDA | | 125.2 | | 122.4 | | | | | | 484.9 | | 466.8 |

| Acquisition related expenses | | 0.6 | | 0.6 | | | | | | 2.2 | | 1.9 |

| Share based compensation expense | | 6.2 | | 5.3 | | | | | | 19.4 | | 15.9 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Legal reserve | | — | | — | | | | | | — | | 1.3 |

Asset impairment (1) | | — | | — | | | | | | 4.9 | | — |

| Adjusted EBITDA | | $ | 132.0 | | $ | 128.3 | | | | | | $ | 511.4 | | $ | 485.9 |

Adjusted EBITDA, dispositions (2) | | (0.8) | | (3.5) | | | | | | (9.1) | | (5.1) |

Adjusted EBITDA, net of dispositions (3) | | $ | 132.8 | | $ | 131.8 | | | | | | $ | 520.5 | | $ | 491.0 |

| | | | | | | | | | | | |

| Net profit margin | | 8.9 | % | | 9.0 | % | | | | | | 8.7 | % | | 8.8 | % |

| EBITDA margin | | 16.7 | % | | 17.0 | % | | | | | | 16.5 | % | | 16.8 | % |

| Adjusted EBITDA margin | | 17.6 | % | | 17.8 | % | | | | | | 17.4 | % | | 17.5 | % |

Adjusted EBITDA margin, net of dispositions (3) | | 17.7 | % | | 18.3 | % | | | | | | 17.7 | % | | 17.8 | % |

(1) During the twelve months ended December 31, 2024, we recognized intangible and asset impairment charges for a combined amount of $4.9 million related to winding down the operations of a branch that installs one of our non-core building products.

(2) Represents Adjusted EBITDA of a single branch. Please see preceding paragraph at the beginning of this section for additional information.

(3) Adjusted EBITDA, net of dispositions and Adjusted EBITDA margin, net of dispositions exclude the results of a single branch. Please see preceding paragraph at the beginning of this section for additional information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | 2023 | | | | | | 2024 | | 2023 |

Net revenue, as reported | | $ | 750.2 | | | $ | 720.7 | | | | | | | $ | 2,941.3 | | | $ | 2,778.6 | |

Less: net revenue, dispositions (1) | | 1.5 | | | 2.1 | | | | | | | 4.3 | | | 16.9 | |

Net revenue, net of dispositions | | $ | 748.7 | | | $ | 718.6 | | | | | | | $ | 2,937.0 | | | $ | 2,761.7 | |

(1) Represents net revenue of a single branch. Please see preceding paragraph at the beginning of this section for additional information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | 2023 | | | | | | 2024 | | 2023 |

Net loss, dispositions, as reported | | $ | (0.6) | | | $ | (2.8) | | | | | | | $ | (10.8) | | | $ | (4.7) | |

| Interest expense | | — | | | 0.1 | | | | | | | 0.2 | | | 0.5 | |

(Benefit) for income tax | | (0.2) | | | (1.0) | | | | | | | (3.8) | | | (1.7) | |

| Depreciation and amortization | | — | | | 0.2 | | | | | | | 0.4 | | | 0.8 | |

EBITDA, dispositions | | (0.8) | | | (3.5) | | | | | | | (14.0) | | | (5.1) | |

| | | | | | | | | | | | |

Asset impairment (1) | | — | | | — | | | | | | | 4.9 | | | — | |

Adjusted EBITDA, dispositions (2) | | $ | (0.8) | | | $ | (3.5) | | | | | | | $ | (9.1) | | | $ | (5.1) | |

(1) During the twelve months ended December 31, 2024, we recognized intangible and asset impairment charges for a combined amount of $4.9 million related to winding down the operations of a branch that installs one of our non-core building products.

(2) Represents Adjusted EBITDA of a single branch. Please see preceding paragraph at the beginning of this section for additional information.

INSTALLED BUILDING PRODUCTS, INC.

SUPPLEMENTARY TABLE

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Twelve months ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Period-over-period Growth | | | | | | | | |

| Consolidated Sales Growth | | 4.1% | | 5.0% | | 5.9% | | 4.1% |

| Consolidated Same Branch Sales Growth | | 1.1% | | 1.9% | | 3.5% | | 0.2% |

| | | | | | | | |

| Installation | | | | | | | | |

| Sales Growth | | 3.8% | | 4.5% | | 6.0% | | 3.7% |

| Same Branch Sales Growth | | 1.5% | | 1.2% | | 3.8% | | (0.1)% |

| | | | | | | | |

| Single-Family Sales Growth | | 4.8% | | (3.6)% | | 6.4% | | (5.4)% |

| Single-Family Same Branch Sales Growth | | 1.6% | | (6.7)% | | 3.6% | | (9.0)% |

| | | | | | | | |

| Multi-Family Sales Growth | | 3.3% | | 31.1% | | 6.5% | | 35.0% |

| Multi-Family Same Branch Sales Growth | | 2.5% | | 29.5% | | 5.6% | | 33.3% |

| | | | | | | | |

| Residential Sales Growth | | 4.5% | | 2.1% | | 6.4% | | 1.0% |

| Residential Same Branch Sales Growth | | 1.8% | | (0.8)% | | 4.0% | | (2.3)% |

| | | | | | | | |

Commercial Sales Growth(1) | | 0.4% | | 15.9% | | 3.0% | | 17.2% |

| Commercial Same Branch Sales Growth | | (0.1)% | | 10.6% | | 1.2% | | 11.5% |

| | | | | | | | |

Other (2) | | | | | | | | |

| Sales Growth | | 13.6% | | 12.2% | | 8.2% | | 12.1% |

| Same Branch Sales Growth | | 1.3% | | 12.2% | | 3.6% | | 6.7% |

| | | | | | | | |

| Same Branch Sales Growth - Installation | | | | | | | | |

Volume Growth(3) | | (0.8)% | | (5.8)% | | (0.2)% | | (9.0)% |

Price/Mix Growth(3) | | 1.2% | | 4.9% | | 3.7% | | 7.7% |

| | | | | | | | |

U.S. Housing Market(4) | | | | | | | | |

| Total Completions Growth | | 8.5% | | 2.1% | | 12.3% | | 4.2% |

| Single-Family Completions Growth | | (2.4)% | | (2.7)% | | 1.8% | | (2.3)% |

| Multi-Family Completions Growth | | 33.0% | | 15.5% | | 35.4% | | 22.1% |

(1) Our commercial end market consists of heavy and light commercial projects.

(2) Other business segment category includes our manufacturing and distribution businesses operating segments.

(3) The heavy commercial end market is excluded from these metrics given its much larger per-job revenue compared to our average job.

(4) U.S. Census Bureau data, as revised.

INSTALLED BUILDING PRODUCTS, INC.

INCREMENTAL REVENUE AND ADJUSTED EBITDA MARGINS

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue Increase | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | % Total | | 2023 | | % Total | | | | | | | | | | 2024 | | % Total | | 2023 | | % Total |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Same Branch | | $ | 7.6 | | | 25.8 | % | | $ | 13.1 | | | 38.2 | % | | | | | | | | | | $ | 96.1 | | | 59.1 | % | | $ | 6.6 | | | 6.1 | % |

| Acquired | | 21.9 | | | 74.2 | % | | 21.2 | | | 61.8 | % | | | | | | | | | | 66.6 | | | 40.9 | % | | 102.2 | | | 93.9 | % |

| Total | | $ | 29.5 | | | 100.0 | % | | $ | 34.3 | | | 100.0 | % | | | | | | | | | | $ | 162.7 | | | 100.0 | % | | $ | 108.8 | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA Margin Contributions * |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | % Margin | | 2023 | | % Margin | | | | | | | | | | 2024 | | % Margin | | 2023 | | % Margin |

| | | | | | | | | | | | | | | | | | | | |

Same Branch(1) | | $ | 0.1 | | | 1.3 | % | | $ | 8.8 | | | 67.2 | % | | | | | | | | | | $ | 13.8 | | | 14.4 | % | | $ | 27.9 | | | 422.7 | % |

| Acquired | | 3.4 | | | 15.5 | % | | 4.1 | | | 19.3 | % | | | | | | | | | | 11.5 | | | 17.3 | % | | 18.8 | | | 18.4 | % |

| Total | | $ | 3.5 | | | 11.9 | % | | $ | 12.9 | | | 37.6 | % | | | | | | | | | | $ | 25.3 | | | 15.6 | % | | $ | 46.7 | | | 42.9 | % |

(1) Same branch adjusted EBITDA margin contribution percentage is a percentage of same branch revenue increase.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue Increase, Net of Dispositions (1) | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | | | Twelve months ended December 31, | | | | | | | | |

| | 2024 | | % Total | | 2023 | | % Total | | | | | | | | | | 2024 | | % Total | | 2023 | | % Total | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Branch | | $ | 8.2 | | | 27.2 | % | | $ | 18.9 | | | 47.1 | % | | | | | | | | | | $ | 108.7 | | | 62.0 | % | | $ | 17.8 | | | 14.8 | % | | | | | | | | |

| Acquired | | 21.9 | | | 72.8 | % | | 21.2 | | | 52.9 | % | | | | | | | | | | 66.6 | | | 38.0 | % | | 102.2 | | | 85.2 | % | | | | | | | | |

| Total | | $ | 30.1 | | | 100.0 | % | | $ | 40.1 | | | 100.0 | % | | | | | | | | | | $ | 175.3 | | | 100.0 | % | | $ | 120.0 | | | 100.0 | % | | | | | | | | |

(1) Please see the section - Reconciliation of GAAP to Non-GAAP measures EBITDA and Adjusted EBITDA calculations - in this press release for additional information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA, Net of Dispositions Margin Contributions (1) * |

| | Three months ended December 31, | | | | Twelve months ended December 31, |

| | 2024 | | % Margin | | 2023 | | % Margin | | | | | | | | | | 2024 | | % Margin | | 2023 | | % Margin |

| | | | | | | | | | | | | | | | | | | | |

Same Branch(2) | | $ | (2.6) | | | (31.7) | % | | $ | 11.1 | | | 58.7 | % | | | | | | | | | | $ | 17.8 | | | 16.4 | % | | $ | 30.4 | | | 170.8 | % |

| Acquired | | 3.4 | | | 15.5 | % | | 4.1 | | | 19.3 | % | | | | | | | | | | 11.5 | | | 17.3 | % | | 18.8 | | | 18.4 | % |

| Total | | $ | 0.8 | | | 2.7 | % | | $ | 15.2 | | | 37.9 | % | | | | | | | | | | $ | 29.3 | | | 16.7 | % | | $ | 49.2 | | | 41.0 | % |

(1) Please see the section - Reconciliation of GAAP to Non-GAAP measures EBITDA and Adjusted EBITDA calculations - in this press release for additional information.

(2) Same branch adjusted EBITDA margin contribution percentage is a percentage of same branch revenue increase.

* During the three months ended December 31, 2024, same branch revenue, net of dispositions increased while same branch adjusted EBITDA, net of dispositions decreased. The negative % margin result does not reflect a decremental margin, but rather, a quotient with mixed signs for the numerator and denominator.

Source: Installed Building Products, Inc.

Contact Information:

Investor Relations:

614-221-9944

investorrelations@installed.net

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

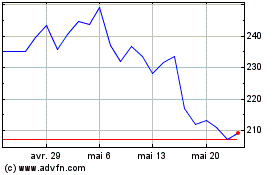

Installed Building Produ... (NYSE:IBP)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Installed Building Produ... (NYSE:IBP)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025