INFINT Acquisition Corporation (NYSE: IFIN, IFIN.WS)

(“

INFINT” or the “

Company”)

announced today that, in connection with its previously announced

extraordinary general meeting of shareholders of the Company to be

held at 12:00 p.m. Eastern Time on August 18, 2023 (the

“

Extraordinary Meeting”) for the purpose of

considering and voting on, among other proposals, a proposal to

extend the date by which the Company must consummate an initial

business combination (the “

Extension”) from August

23, 2023 (the “

Current Termination Date”) to

February 23, 2024 or such earlier date as may be determined by the

Company’s board of directors, in its sole discretion (such later

date, the “

Extension Date”), additional

contributions to the Company’s trust account will be made following

the approval and implementation of the Extension.

If the requisite shareholder proposals are

approved at the Extraordinary Meeting and the Extension is

implemented, on the Current Termination Date, and the 23rd day of

each subsequent calendar month until the Extension Date, the lesser

of (x) $160,000 and (y) $0.04 per public share multiplied by the

number of public shares outstanding on such applicable date (each

date on which a Contribution is to be deposited into the trust

account, a “Contribution Date”) will be deposited

into the Company’s trust account (a

“Contribution”).

If a Contribution is not made by an applicable

Contribution Date, the Company will liquidate and dissolve as soon

as practicable after such date and in accordance with the Company’s

Amended and Restated Memorandum and Articles of Association, as

amended. Any Contribution is conditioned on the approval of the

requisite shareholder proposals at the Extraordinary Meeting and

the implementation of the Extension. No Contribution will occur if

such proposals are not approved or the Extension is not

implemented. If the Company has consummated an initial business

combination or announced its intention to commence winding up prior

to any Contribution Date, any obligation to make Contributions will

terminate.

The Company expects that the proceeds held in

the trust account will continue to be invested in United States

government treasury bills with a maturity of 185 days or less or in

money market funds investing solely in U.S. Treasuries and meeting

certain conditions under Rule 2a-7 under the Investment Company Act

of 1940, as amended, as determined by the Company, or in an

interest bearing demand deposit account, until the earlier of: (i)

the completion of the Company’s initial business combination, and

(ii) the liquidation of, and distribution of the proceeds from, the

trust account.

Further information related to attendance,

voting and the proposals to be considered and voted on at the

Extraordinary Meeting is described in the definitive proxy

statement related to the Extraordinary Meeting filed by the Company

with the Securities and Exchange Commission (the

“SEC”) on August 2, 2023(the “Definitive

Proxy Statement”).

About INFINT Acquisition

Corporation

INFINT Acquisition Corporation is a Special

Purpose Acquisition Corporation (SPAC) company on a mission to

bring the most promising financial technology company from North

America, Asia, Latin America, Europe and Israel to the U.S. public

market. As a result of the pandemic, the world is changing rapidly,

and in unique, unexpected ways. Thanks to growth and investment in

the global digital infrastructure, legal, healthcare, automotive,

financial, and other fields are evolving at a faster rate than ever

before. INFINT believes the greatest opportunities in the near

future lie in the global fintech space and are looking forward to

merging with an exceptional international fintech company. On

August 3, 2022, INFINT entered into a definitive business

combination agreement with Seamless Group Inc., a Cayman Islands

exempted company and a global fintech platform, and FINTECH Merger

Sub Corp., a Cayman Islands exempted company and a wholly owned

subsidiary of INFINT.

Forward Looking Statements

This press release includes “forward-looking

statements” within the meaning of the safe harbor provisions of the

United States Private Securities Litigation Reform Act of 1995.

Certain of these forward-looking statements can be identified by

the use of words such as “believes,” “expects,” “intends,” “plans,”

“estimates,” “assumes,” “may,” “should,” “will,” “seeks,” or other

similar expressions. Such statements may include, but are not

limited to, statements regarding the approval of certain

shareholder proposals at the Extraordinary Meeting, the

implementation of the Extension or any Contributions to the trust

account. These statements are based on current expectations on the

date of this press release and involve a number of risks and

uncertainties that may cause actual results to differ

significantly, including those risks set forth in the Definitive

Proxy Statement, the Company’s most recent Annual Report on Form

10-K and subsequent Quarterly Reports on Form 10-Q and other

documents filed with the SEC. Copies of such filings are available

on the SEC’s website at www.sec.gov. The Company does not assume

any obligation to update or revise any such forward-looking

statements, whether as the result of new developments or otherwise.

Readers are cautioned not to put undue reliance on forward-looking

statements.

Additional Information and Where to Find

It

The Definitive Proxy Statement has been mailed

to the Company’s shareholders of record as of the record date for

the Extraordinary Meeting. Investors and security holders of the

Company are advised to read the Definitive Proxy Statement because

it contains important information about the Extraordinary Meeting

and the Company. Investors and security holders of the Company may

also obtain a copy of the Definitive Proxy Statement, as well as

other relevant documents that have been or will be filed by the

Company with the SEC, without charge and once available, at the

SEC’s website at www.sec.gov or by directing a request to: Morrow

Sodali LLC, 333 Ludlow Street, 5th Floor, South Tower, Stamford,

CT; email: IFIN.info@investor.morrowsodali.com.

Participants in the

Solicitation

The Company and certain of its directors and

executive officers and other persons may be deemed to be

participants in the solicitation of proxies from the Company’s

shareholders in respect of the proposals to be considered and voted

on at the Extraordinary Meeting. Information concerning the

interests of the directors and executive officers of the Company is

set forth in the Definitive Proxy Statement, which may be obtained

free of charge from the sources indicated above.

Contacts

Alexander Edgarov, INFINT Acquisition

Corporation– sasha@infintspac.com

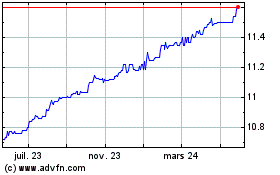

InFinT Acquisition (NYSE:IFIN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

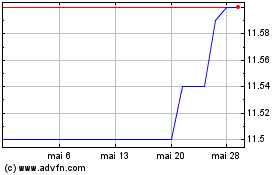

InFinT Acquisition (NYSE:IFIN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025