false

--12-31

0001862935

0001862935

2024-08-30

2024-08-30

0001862935

dei:FormerAddressMember

2024-08-30

2024-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of report (Date of earliest event reported): August 30, 2024

Currenc

Group Inc.

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

001-41079 |

|

98-1602649 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

410

North Bridge Road,

SPACES

City Hall,

Singapore

|

|

188726 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

+65

6407-7362

(Registrant’s

telephone number, including area code)

INFINT

Acquisition Corporation

32

Broadway, Suite 401

New York, New York 10004

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary

shares, par value $0.0001 per share |

|

CURR |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Introductory

Note

On

August 30, 2024, INFINT Acquisition Corporation (“INFINT”) completed a series of transactions that resulted in the

combination (the “Business Combination”) of INFINT with Seamless Group Inc., a Cayman Islands exempted company (“Seamless”),

pursuant to the previously announced Business Combination Agreement, dated August 13, 2022, amended by an amendment dated October

20, 2022, an amendment dated November 29, 2022 and an amendment dated February 20, 2023 (the “BCA”), by and among

INFINT, FINTECH Merger Sub Corp., a Cayman Islands exempted company and a wholly owned subsidiary of INFINT (“Merger Sub”),

and Seamless, following the approval at the extraordinary general meeting of the shareholders of INFINT held on August 6, 2024 (the “Special

Meeting”). On August 30, 2024, pursuant to the BCA, and as described in greater detail in the Company’s final prospectus

and definitive proxy statement, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on July

12, 2024 (the “Proxy Statement/Prospectus”), Merger Sub merged with and into Seamless, with Seamless surviving the

merger as a wholly owned subsidiary of INFINT, and INFINT changed its name to Currenc Group Inc. (“New Seamless”).

As consideration for the Business Combination, New Seamless issued to Seamless shareholders an aggregate of 40,000,000 ordinary shares,

par value $0.0001 (the “Ordinary Shares”) of New Seamless (the “Exchange Consideration”). In addition,

New Seamless issued 400,000 commitment shares to the PIPE investor (as described below) and an aggregate of 200,000 shares to

vendors in connection with the Closing, issued promissory notes for approximately $5.7 million to EF Hutton LLC, approximately $3.2 million

to Greenberg Traurig LLP, and $603,623 to INFINT Capital LLC, and entered into a $1.75 million PIPE Offering, as set forth below.

Unless

otherwise defined herein, capitalized terms used in this Current Report on Form 8-K have the same meaning as set forth in the Proxy Statement/Prospectus.

Simultaneous

with the closing of the Business Combination, New Seamless also completed a series of private financings, issuing a Convertible Note

for $1.94 million, 400,000 commitment shares, and warrants to purchase 136,110 Ordinary Shares in a private placement to a PIPE

investor (the “PIPE Offering”), which raised $1.75 million in net proceeds.

In

connection with the Special Meeting, INFINT shareholders holding 4,652,105 of INFINT’s Class A ordinary shares (the “Public

Shares”) (after giving effect to redemption reversal requests) exercised their right to redeem their shares for a pro rata

portion of the funds in INFINT’s trust account (the “Trust Account”). Prior to the Closing (as defined below)

approximately $54,846,559 (approximately $11.79 per Public Share) was removed from the Trust Account to pay such holders.

Item

1.01. Entry into Material Definitive Agreement.

Business

Combination Agreement

As

disclosed under the section titled “Proposal No. 1—The Business Combination Proposal” of the Proxy Statement/Prospectus,

INFINT entered into the BCA, dated August 13, 2022, as amended, by and among INFINT, Merger Sub and Seamless.

Accordingly,

Merger Sub, a wholly owned subsidiary of INFINT, merged with and into Seamless, with Seamless surviving the merger as a wholly owned

subsidiary of INFINT and INFINT changed its name to Currenc Group Inc.

Item

2.01 of this Current Report discusses the consummation of the Business Combination and events contemplated by the BCA which were completed

on August 30, 2024 (the “Closing”) and is incorporated herein by reference.

Lock-up

Agreements

On

August 30, 2024, INFINT entered into Lock-Up Agreements (the “Lock-up Agreements”) by and between INFINT and certain

shareholders of Seamless (such shareholders, the “Company Holders”), pursuant to which, among other things, each Company

Holder agreed not to, during the Lock-up Period (as defined below), lend, offer, pledge, hypothecate, encumber, donate, assign, sell,

contract to sell, sell any option or contract to purchase, purchase an option or contract to sell, grant any option, right or warrant

to purchase, or otherwise transfer or dispose of, directly or indirectly, any of the shares issued to such Company Holder in connection

with the Business Combination (the “Lock-up Shares”), enter into any swap or other arrangement that transfers to another,

in whole or in part, any of the economic consequences of ownership of such shares, or publicly disclose the intention to do any of the

foregoing, whether any of these transactions are to be settled by delivery of any such shares or other securities, in cash, or otherwise,

subject to limited exceptions. As used herein, “Lock-Up Period” means the period commencing on the date of the Closing

and ending on the earlier of: (i) six months after the Closing and (ii) the date after the Closing on which New Seamless consummates

a liquidation, merger, share exchange or other similar transaction with an unaffiliated third party that results in all of New Seamless’

shareholders having the right to exchange their New Seamless Class A ordinary shares for cash, securities or other property.

The

foregoing description of the Lock-Up Agreements is subject to and qualified in its entirety by reference to the full text of the form

of the Lock-Up Agreement, a copy of which is included as Exhibit 10.2 hereto, and the terms of which are incorporated by reference.

In

connection with the Closing, in order to meet Nasdaq unrestricted public float requirements, the parties agreed to waive lock-up restrictions

on 2,100,000 shares held by the Sponsor.

Registration

Rights Agreement

In

connection with the Closing, on August 30, 2024, INFINT and certain existing shareholders of INFINT and Seamless (such parties,

the “Holders”) entered into a registration rights agreement (the “Registration Rights Agreement”)

to provide for the registration of New Seamless’ Ordinary Shares issued to them in connection with the Business Combination. The

Holders are entitled “piggy-back” registration rights with respect to registration statements filed following the consummation

of the Business Combination, subject to certain requirements and customary conditions. New Seamless will bear the expenses incurred in

connection with the filing of any such registration statements.

The

foregoing description of the Registration Rights Agreement is subject to and qualified in its entirety by reference to the full text

of the Registration Rights Agreement, a copy of which is included as Exhibit 10.4 hereto, and the terms of which are incorporated by

reference.

PIPE

In

connection with the PIPE Offering, New Seamless entered into a Convertible Note Purchase Agreement (the “PIPE Agreement”)

with Seamless and Pine Mountain Holdings Limited, a company organized under the laws of the British Virgin Islands, or its designated

Affiliate (the “Purchaser”), to issue 194,444 Ordinary Shares convertible at $10.00 per share. Pursuant to

the PIPE Agreement entered into by and between New Seamless, Seamless, and the Purchaser, New Seamless agreed to issue an aggregate principal

amount of USD $1,944,444 (the “Principal Amount”) in convertible promissory note to the Purchaser at an issue price

of USD $1,750,000, which represents a 10% discount to the Principal Amount (the “Note Issuance”). Subject to the conditions

to the Parties’ obligation to close, the PIPE Agreement shall close on the earlier of (i) the date which is no more than three

(3) days after the signing of the Term Sheet (as defined in the PIPE Agreement); (ii) the date of the Business Combination Closing; or

(iii) such other date and time as may be mutually agreed in writing by New Seamless and Purchaser. In certain circumstances, the Purchaser

will be entitled to certain piggyback registration rights. The PIPE Agreement is subject to customary closing conditions and customary

representations and warranties. As of the date hereof, the Ordinary Shares to be issued in connection with the Note Issuance have not

been registered under the Securities Act of 1933, as amended (the “Securities Act”). In the event New Seamless proposes

to register any of its securities under the Securities Act, it shall give prompt written notice to the Purchaser, who within twenty (20)

days after receiving such written notice provide New Seamless with written notice to use best efforts to cause all Ordinary Shares held

by Purchaser (the “Piggyback Shares”) to be included in such registration, subject to the PIPE Agreement. Except with

the written consent of New Seamless, the Purchaser shall not own more than 4.99% of the Ordinary Shares of New Seamless in issue from

time to time (the “Ownership Limit”). In addition, the Note will not be convertible to the extent that such issuance

of shares, together with any issuance of shares upon the exercise of Warrants, would require shareholder approval under Nasdaq

rules, until and unless such shareholder approval is obtained.

In

connection with the Note Issuance, and as consideration of the Purchaser’s subscription of the convertible promissory note following

the Business Combination Closing, the Purchaser was also issued (i) 400,000 Ordinary Shares, credited as fully-paid, (the “Commitment

Shares”) and (ii) a five-year warrant (the “Warrant”) to purchase up to an aggregate of 136,110 Ordinary

Shares at an exercise price of USD $11.50 (the “Warrant Shares”). The Warrants shall have anti-dilution protection

on the price with respect to future equity offerings of New Seamless priced at or above $2.00 per share and full anti-dilution protection

on price and quantity with respect to future equity offerings of New Seamless priced below $2.00 per share. In the event the Warrant

Shares are not registered within 12 months, Warrant holders have the option to cashless exercise each warrant for 0.8 Ordinary Shares.

In addition, the Warrants will not be exercisable to the extent that such issuance of shares together with any issuance of shares upon

the conversion of the Note, would require shareholder approval under Nasdaq rules, until and unless such shareholder approval

is obtained.

The

foregoing description of the PIPE Agreement, Note and Warrant is qualified in its entirety by reference to the full text of such PIPE

Agreement, Note and Warrant, copies of which are attached hereto as Exhibits 10.5, 10.6, and 10.7, respectively, and are incorporated

herein in their entirety by reference.

Promissory

Notes

EF

Hutton Note:

In

connection with the Business Combination Closing, on August 30, 2024, INFINT issued a promissory note in the principal amount of $5,700,000

to EF Hutton LLC (the “EF Hutton Note”). The principal amount and any accrued interest on the EF Hutton Note is payable

in six (6) equal monthly installments of $950,000 commencing on the third (3rd) month after the closing of the Business Combination

Agreement and ending on or about April 30, 2025. In the event of a default, the EF Hutton Note shall bear an interest at a rate of ten

percent (10%) per annum until such event of default is cured. The EF Hutton Note is subject to customary events of default, the occurrence

of certain of which entitles EF Hutton LLC to declare, by written notice to Company, the unpaid principal balance of the EF Hutton Note

and all other sums payable with regard to the EF Hutton Note becoming immediately due and payable.

GT

Note:

In

connection with the Business Combination Closing, on August 30, 2024, New Seamless issued a promissory note in the principal amount of

$3,200,000 to Greenberg Traurig LLP (the “GT Note”). The principal amount and any accrued interest on the GT Note

is payable in ten (10) equal monthly installments of $320,000 with the (i) first payment commencing on October 30, 2024 and the remaining

payments continuing regularly and monthly thereafter on the 30th day of each such month (unless the 30th is not

a business day in which case the payment shall be made on the first business day prior to the 30th day of such month) and

(ii) last payment being made on July 30, 2025; provided, that, if New Seamless closes on equity or debt financing of at least $10,000,000

prior to Maturity Date, the full amount outstanding under the GT Note will be paid by Greenberg Traurig LLP on the closing date of such

financing. In the event of a default, the GT Note shall bear an interest at a rate of fifteen percent (15%) per annum until such event

of default is cured. The GT Note is subject to customary events of default, the occurrence of certain of which entitles Greenberg Traurig

LLC to declare, automatically the unpaid principal balance of the GT Note and all other sums payable with regard to the GT Note become

immediately due and payable.

INFINT

Capital Note:

In

connection with the Business Combination Closing working capital loans, on August 30, 2024, New Seamless issued a promissory note in

the principal amount of $603,623 to INFINT Capital LLC (the “INFINT Capital Note”). This INFINT Capital Note amends,

replaces and supersedes in its entirety that certain unsecured promissory note, dated September 13, 2024, issued by New Seamless in favor

of INFINT Capital LLC in the principal amount of up to $400,000 (the “Original INFINT Capital Note”), and any unpaid

principal balance of the indebtedness evidenced by the Original INFINT Capital Note is merged into and evidenced by the INFINT Capital

Note. The INFINT Capital Note is due and payable in 10 equal monthly installments of $60,362.30 with the (i) first payment commencing

on October 30, 2024 and the remaining payments continuing regularly and monthly thereafter on the 30th day of each such month (unless

the 30th is not on a business day in which case the payment shall be made on the first business day prior to the 30th day of such month)

and (ii) last payment being made on July 30, 2025; provided, that, if New Seamless closes an equity or debt financing of at least $10,000,000

prior to the Maturity Date, the full amount outstanding under the Loan will be paid by the INFINT Capital LLC on the closing date of

such financing. In the event of a default, the INFINT Capital Note shall bear an interest at a rate of fifteen percent (15%) per annum

until such event of default is cured. The INFINT Capital Note is subject to customary events of default, the occurrence of certain of

which entitles INFINT Capital LLC to declare, automatically the unpaid principal balance of the INFINT Capital Note and all other sums

payable with regard to the INFINT Capital Note become immediately due and payable.

Copies

of the EF Hutton Note, GT Note, and INFINT Capital Note are attached as Exhibits 10.8, 10.9, and 10.10 to this Current Report on Form

8-K, respectively, and are incorporated herein by reference. The disclosure set forth in this Item 1.02 is intended to be a summary

only and is qualified in its entirety by reference to the EF Hutton Note, GT Note, and INFINT Capital Note.

Item

2.01. Completion of Acquisition or Disposition of Assets.

The

disclosure set forth in the “Introductory Note” and “Business Combination Agreement” above is incorporated

into this Item 2.01 by reference.

Pursuant

to the terms of the BCA, the total consideration for the Business Combination and related transactions (the “Exchange Consideration”)

was approximately $400 million. In connection with the Special Meeting, holders of 4,652,105 INFINT Public Shares sold in its

initial public offering exercised their right to redeem those shares for cash prior to the redemption deadline of August 2, 2024 (and

did not subsequently reverse the redemption election), at a price of $11.79 per share, for an aggregate payment from INFINT’s

Trust Account of approximately $54,846,559. On or about September 3, 2024, Currenc Group Inc., f/k/a INFINT’s units ceased

trading, and New Seamless’ Ordinary Shares began trading on the Nasdaq Capital Market under the symbol “CURR”.

After

taking into account the aggregate payment in respect of the redemptions, INFINT’s Trust Account had a balance immediately

prior to the Closing of approximately $1,119,024. Such balance in the Trust Account, together with approximately $1.75 million

in proceeds from the PIPE Offering, were used to pay transaction expenses and other liabilities of INFINT.

In

connection with the Closing, 4,483,026 Class B ordinary shares of INFINT held by INFINT

Capital LLC, a Delaware limited liability company (the “Sponsor”),

were automatically exchanged for 4,483,026 Ordinary Shares. In

addition, 1,250,058 Class B shares held by other Class B shareholders were automatically exchanged for 1,250,058 Ordinary

Shares and 99,999 Class B shares held by the Underwriters (defined below) were automatically exchanged for 99,999 Ordinary

Shares.

Simultaneous

with the closing of the Business Combination, as discussed in the Introductory Note above, New Seamless also completed a series

of private financings, issuing a Convertible Note for $1.94 million, 400,000 commitment shares, and warrants to purchase 136,110 Ordinary

Shares in a private placement to a PIPE investor (the “PIPE Offering”), which raised $1.75 million in net proceeds.

In addition, New Seamless issued promissory notes for approximately $5.7 million to EF Hutton LLC, approximately $3.2 million to Greenberg

Traurig LLP, and $603,623 to INFINT Capital LLC (the “Promissory Notes”). Additionally, New Seamless issued (i)

100,000 Ordinary Shares to Roth Capital Partners, LLC for advisory services, and (ii) 100,000 Ordinary Shares to KEMP Services Limited

for legal advisory services (the “Vendor Shares”). Finally, in accordance with the New Seamless Equity Incentive Plan,

New Seamless has reserved 4,636,091 Ordinary Shares for the New Seamless Incentive Plan.

Divestiture

of Subsidiaries:

Prior

to the Closing, on August 30, 2024, Seamless completed its previously disclosed divestitures of its subsidiaries TNG (Asia) Ltd. and

GEA Holdings Limited.

As

of the Closing: public shareholders own approximately 0.20% of the outstanding New

Seamless Ordinary Shares; the Sponsor and its affiliates own approximately 9.63% of the

outstanding New Seamless Ordinary Shares; other Class B shareholders own approximately

2.69% of the outstanding New Seamless Ordinary Shares; Seamless’ former shareholders collectively own approximately 85.97% of

the New Seamless Ordinary Shares; EF Hutton LLC and JonesTrading (together, the “Underwriters”) own approximately 0.22%

of the outstanding New Seamless Ordinary Shares; Roth Capital Partners, LLC and KEMP Services

Limited (together, the “Vendors”) own approximately 0.43% of the outstanding New Seamless Ordinary Shares;

and approximately 0.86% of the outstanding New Seamless Ordinary Shares are held by the PIPE investor.

FORM

10 INFORMATION

Item

2.01(f) of Form 8-K states that if the predecessor registrant was a shell company, as INFINT was immediately before the Business Combination,

then the registrant must disclose the information that would be required if the registrant were filing a general form for registration

of securities on Form 10. Accordingly, New Seamless is providing the information below that would be included in a Form 10 if New Seamless

were to file a Form 10. Please note that the information provided below relates to New Seamless as the combined company after the consummation

of the Business Combination, unless otherwise specifically indicated or the context otherwise requires.

Forward-Looking

Statements

The

information in this Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “aim,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result” and similar

expressions, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions,

projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject

to risks and uncertainties. Actual results may differ from their expectations, estimates and projections and consequently, you should

not rely on these forward-looking statements as predictions of future events. Many factors could cause actual future events to differ

materially from the forward-looking statements in this Current Report on Form 8-K, including but not limited to: (i) changes in the markets

in which New Seamless competes, including with respect to its competitive landscape, technology evolution or regulatory changes; (ii)

the risk that New Seamless will need to raise additional capital to execute its business plans, which may not be available on acceptable

terms or at all; (iii) the ability of the parties to recognize the benefits of the BCA and the Business Combination; (iv) the lack of

useful financial information for an accurate estimate of future capital expenditures and future revenue; (v) statements regarding New

Seamless’ industry and market size; (vi) financial condition and performance of New Seamless, including the anticipated benefits,

the implied enterprise value, the expected financial impacts of the Business Combination, the financial condition, liquidity, results

of operations, the products, the expected future performance and market opportunities of New Seamless; (vii) New Seamless’ ability

keep pace with rapid technological developments to provide new and innovative products and services; (viii) the ability to attract new

partners, merchants and users and retain existing partners, merchants and users in order to continue to expand; (x) New Seamless’

ability to integrate its services with a variety of operating systems, networks and devices; and (xi) those factors discussed in our

filings with the SEC. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described

in the “Risk Factors” section of the Proxy Statement/Prospectus and other documents to be filed by New Seamless from time

to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they

are made. Readers are cautioned not to put undue reliance on forward- looking statements, and while New Seamless may elect to update

these forward-looking statements at some point in the future, they assume no obligation to update or revise these forward-looking statements,

whether as a result of new information, future events or otherwise, unless required by applicable law. New Seamless does not give any

assurance that New Seamless will achieve its expectations.

Actual

results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements

and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is

reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor

of future performance as projected financial information and other information are based on estimates and assumptions that are inherently

subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth

herein speaks only as of the date hereof in the case of information about New Seamless or the date of such information in the case of

information from persons other than New Seamless, and New Seamless disclaims any intention or obligation to update any forward looking

statements as a result of developments occurring after the date of this Current Report on Form 8-K, except as required by law. Forecasts

and estimates regarding New Seamless’ industry and end markets are based on sources New Seamless believes to be reliable, however

there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected and

estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

Business

The

business of New Seamless is described in the Proxy Statement/Prospectus in the section titled “Seamless’ Business”

and that information is incorporated herein by reference.

Risk

Factors

The

risks associated with New Seamless are described in the Proxy Statement/Prospectus in the section titled “Risk Factors,”

which is incorporated herein by reference.

Financial

Information

Reference

is made to the disclosure set forth in Item 9.01 of this Current Report on Form 8-K concerning the financial information of New Seamless.

Reference is further made to the disclosure contained in the Proxy Statement/Prospectus in the sections titled “Summary Historical

Financial Information of Seamless,” and “Unaudited Pro Forma Condensed Consolidated Combined Financial Information”

which are incorporated herein by reference. In addition, the Unaudited Pro Forma Condensed Combined Financial Information, and Management’s

Discussion and Analysis of Financial Condition and Results of Operations of Seamless, for the period ended June 30, 2024, are

included as Exhibits 99.1 and 99.3 to this Current Report on Form 8-K, respectively, and are incorporated herein by reference.

Properties

New

Seamless’ corporate headquarters are located in Singapore under a lease that expires in May 2025. New Seamless also has offices

in Kuala Lumpur consisting of 14,096 square feet of space in the same building under two separate tenancies which both expire in October

2024. New Seamless has offices in several other locations and believes its facilities are sufficient for its current needs.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

The

disclosure contained under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations

of Seamless” in the Proxy Statement/Prospectus is incorporated herein by reference. In addition, Management’s Discussion

and Analysis of Financial Condition and Results of Operations for the period ended June 30, 2024, is included as Exhibit 99.3 to this

Current Report on Form 8-K and is incorporated herein by reference.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth information regarding the beneficial ownership of shares of New Seamless shareholders upon the completion

of the Business Combination by:

| |

● |

each

person known by New Seamless to be the beneficial owner of more than 5% of any class of New Seamless’ Ordinary Shares; |

| |

● |

each

director of New Seamless; |

| |

● |

each

named executive officer of New Seamless; |

| |

● |

New

Seamless’ officers and directors as a group. |

Beneficial

ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security

if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently

exercisable or exercisable within 60 days.

The

beneficial ownership of New Seamless Ordinary Shares in the table below is based on 46,527,999 New Seamless Ordinary Shares issued

and outstanding as of August 30, 2024, including 40,000,000 New Seamless Ordinary Shares issued to the former shareholders of Seamless

in the Business Combination as Exchange Consideration, 400,000 New Seamless Ordinary Shares issued in connection with the PIPE financing,

200,000 New Seamless Ordinary Shares issued to the vendors in connection with the Business Combination Closing, and reflects the valid

redemption of 4,652,105 INFINT Public Shares and the issuance of all shares under the Seamless Incentive Plan, which shares have

been reserved under the Seamless Incentive Plan and are a part of the Aggregate Consideration. The below table excludes the Ordinary

Shares underlying the warrants and Private Warrants, and PIPE Warrants because these securities are not exercisable until registered,

which may or may not occur within sixty (60) days. Further, it assumes no issuance of the 4,636,091 shares reserved under

the New Seamless Equity Incentive Plan.

Unless

otherwise indicated, New Seamless believes that all persons named in the table have sole voting and investment power with respect to

all common shares beneficially owned by them. Unless otherwise noted, the business address of each of the following entities or individuals

is 410 North Bridge Road, SPACES City Hall, Singapore 188726.

| Name

and Address of Beneficial Owner | |

Number

of New Seamless

ordinary

shares | | |

%

of Total Voting Power | |

| Directors

and Named Executive Officers: | |

| | | |

| | |

| Alexander

King Ong Kong(1) | |

| 27,401,643 | | |

| 58.89 | % |

| Ronnie

Ka Wah Hui(2) | |

| 144,211 | | |

| * | |

| Hagay Ravid | |

| - | | |

| - | |

| Eng

Ho Ng(2) | |

| 10,383 | | |

| * | |

| Kevin Chen | |

| - | | |

| - | |

| Eric

Weinstein(2) | |

| 60,000 | | |

| * | |

| Kanagaraj Lorenz | |

| - | | |

| - | |

| | |

| | | |

| | |

| All Executive Officers and

Directors as a Group (7 individuals) | |

| 27,616,237 | | |

| 59.35 | % |

| Greater

than Five Percent Holders: | |

| | | |

| | |

| Regal

Planet Limited(3) | |

| 26,912,897 | | |

| 57.84 | % |

| InFinT Capital LLC(4) | |

| 4,483,026 | | |

| 9.63 | % |

| Alexander Edgarov(4) | |

| 4,483,026 | | |

| 9.63 | % |

| (1) |

Includes:

(a) 26,912,897 New Seamless shares to be held by Regal Planet Limited, (b) 152,249 New Seamless shares to be held by Mr. Kong personally

and (c) 336,497 New Seamless shares that were vested to Mr. Kong pursuant to Seamless Incentive Plan upon consummation of

the Business Combination. Mr. Kong’s business address is 21/F, Olympia Plaza, 255 King’s Road, North Point, Hong Kong. |

| (2) |

Includes

New Seamless shares that were vested pursuant to Seamless Incentive Plan upon consummation

of the Business Combination.

|

| (3) |

Regal

Planet Limited’s business address is 21/F, Olympia Plaza, 255 King’s Road, North Point, Hong Kong. |

| (4) |

InFinT

Capital LLC, the Sponsor, is the record holder of such shares. Alexander Edgarov is the managing member of the Sponsor and has dispositive

and voting control of the securities held of record by the Sponsor, and may be deemed to beneficially own such securities. Mr. Edgarov

disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein. Interests shown consist

solely of founder shares, classified as Class B ordinary shares. Such shares automatically converted into Class A ordinary shares

concurrently with or immediately following the consummation of our initial business combination on a one-for-one basis. The business

address of the directors and executive officers of INFINT is 32 Broadway, Suite 401 New York, New York 10004. |

Directors

and Executive Officers

Other

than as set forth below, New Seamless’ directors

and executive officers after the Closing are described in the Proxy Statement/Prospectus in the section titled “Management of

New Seamless Following the Business Combination,” which is incorporated herein by reference. Kevin Chen was elected to serve

as New Seamless director effective as of Closing in lieu of Alexander Edgarov.

For

information concerning Mr. Kevin Chen, see the disclosure in the Proxy Statement/Prospectus in the sections titled “Information

About INFINT – Directors and Officers,” which is incorporated herein by reference.

Executive

Compensation

The

compensation of the named executive officers of Seamless before the Business Combination is set forth in the Proxy Statement/Prospectus

in the section titled “Executive Compensation — Seamless Executive Officer and Director Compensation,” which

is incorporated herein by reference.

The

information set forth in this Current Report on Form 8-K under Item 5.02 is incorporated in this Item 2.01 by reference.

At

the Special Meeting, INFINT’s shareholders approved the New Seamless Incentive Plan. A description of the material terms of the

New Seamless Incentive Plan is set forth in the section of the Proxy Statement/Prospectus titled “Proposal 4 – The Incentive

Plan Proposal,” which is incorporated herein by reference. This summary is qualified in its entirety by reference to the complete

text of the New Seamless Incentive Plan, a copy of which is attached as Exhibit 10.1 to this Current Report on Form 8-K.

Certain

Relationships and Related Transactions, and Director Independence

The

certain relationships and related party transactions of INFINT and Seamless are described in the Proxy Statement/Prospectus in the section

titled “Certain Relationships and Related Party Transactions” and are incorporated herein by reference.

Reference

is made to the disclosure regarding director independence in the section of the Proxy Statement/Prospectus titled “Management

of New Seamless Following the Business Combination,” which is incorporated herein by reference.

The

information set forth under Item 5.02 “Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers—Employment Agreements” of this Current Report on Form 8-K is

incorporated into this Item 2.01 by reference.

The

information set forth in the section titled “Registration Rights Agreements” in Item 1.01 of this Current Report on

Form 8-K are incorporated herein by reference.

Legal

Proceedings

From

time to time, we may be subject to legal proceedings and claims in the ordinary course of business.

Reference

is made to the disclosure regarding GEA’s obligations to Ripple Labs Singapore Pte. Ltd., which obligations are guaranteed for

6 months by Seamless under the Deed of Guarantee in the section of the Proxy Statement/Prospectus titled “Certain Relationships

and Related Party Transactions—Seamless Related Party Transactions—Master XRP Commitment to Sell Agreement between Ripple

Labs Singapore Pte. Ltd. and GEA,” which is incorporated herein by reference.

On

August 17, 2024, Ripple Markets APAC Pte. Ltd., the successor to Ripple Labs Singapore Pte. Ltd. (“RMA”), sent a default

letter to GEA demanding payment totaling $27,257,540.64, and sent a demand letter to Seamless, as guarantor, for the full amount of the

payment by August 19, 2024. On August 19, 2024, RMA filed a claim in Singapore naming Seamless and demanding that the defendants, jointly

and severally, pay the demanded payment plus late payments and certain costs. As disclosed herein, Seamless has subsequently divested

GEA, and intends to defend the claim.

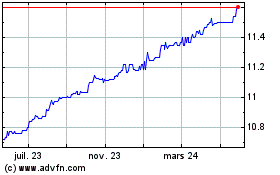

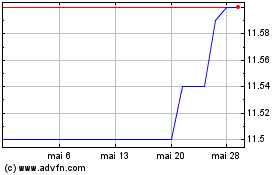

Market

Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

New

Seamless’ Ordinary Shares began trading on the Nasdaq Capital Market under the symbol “CURR.” INFINT has not paid any

cash dividends on its ordinary shares to date. The payment of cash dividends by New Seamless in the future will be dependent upon New

Seamless’ revenues and earnings, if any, capital requirements and general financial condition subsequent to completion of the Business

Combination. The payment of any dividends subsequent to the Business Combination will be within the discretion of the board of directors

of New Seamless.

Information

regarding New Seamless’ Ordinary Shares, rights and related shareholder matters are described in the Proxy Statement/Prospectus

in the section titled “Description of New Seamless Securities” and such information is incorporated herein by reference.

Recent

Sales of Unregistered Securities

Reference

is made to the disclosure set forth under Item 3.02 and Item 2.01 of this Current Report on Form 8-K concerning the issuance of INFINT’s

and New Seamless’ Ordinary Shares in connection with the Business Combination and the PIPE financing, which is incorporated herein

by reference. In connection with the Note Issuance, and as consideration of the Purchaser’s subscription of the convertible promissory

note following the Business Combination Closing, the Purchaser was also issued (i) 400,000 Ordinary shares, credited as fully-paid, (the

“Commitment Shares”) and (ii) a five-year warrant (the “Warrant”) to purchase up to an aggregate of 136,110 Ordinary

Shares at an exercise price of USD $11.50 (the “Warrant Shares”). Additionally, New Seamless issued (i) 100,000 Ordinary

Shares to Roth Capital Partners, LLC for advisory services, and (ii) 100,000 Ordinary Shares to KEMP Services Limited for legal advisory

services.

Description

of Registrant’s Securities to be Registered

The

description of New Seamless’ securities is contained in the Proxy Statement/Prospectus in the sections titled “Description

of New Seamless Securities.”

Financial

Statements and Supplementary Data

Reference

is made to the disclosure set forth in Item 9.01 of this Current Report on Form 8-K concerning the financial information of Seamless.

Reference is further made to the disclosure contained in the Proxy Statement/Prospectus in the sections titled “Summary Historical

Financial Information of INFINT” and “Summary Historical Financial Information of Seamless,” “Unaudited

Pro Forma Condensed Consolidated Combined Financial Information,” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations of Seamless,” which are incorporated herein by reference.

Financial

Statements and Exhibits

The

information set forth under Item 9.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under the section titled “Promissory Notes” under Item 1.01 of this Current Report on Form 8-K is incorporated

herein by reference.

Item

3.02. Unregistered Sales of Equity Securities.

The

PIPE Financing

In

connection with the PIPE Offering, New Seamless entered into a Convertible Note Purchase Agreement (the “PIPE Agreement”)

with Seamless and Pine Mountain Holdings Limited, a company organized under the laws of the British Virgin Islands, or its designated

Affiliate (the “Purchaser”), to issue 194,444 Ordinary Shares convertible at $10.00 per share. Pursuant to

the PIPE Agreement entered into by and between New Seamless, Seamless, and the Purchaser, New Seamless agreed to issue an aggregate principal

amount of USD $1,944,444 (the “Principal Amount”) in convertible promissory note to the Purchaser at an issue price

of USD $1,750,000, which represents a 10% discount to the Principal Amount (the “Note Issuance”). Subject to the conditions

to the Parties obligation to close, the PIPE Agreement shall close on the earlier of (i) the date which is no more than three (3) days

after the signing of the Term Sheet (as defined in the PIPE Agreement); (ii) the date of the Business Combination Closing; or (iii) such

other date and time as may be mutually agreed in writing by New Seamless and Purchaser. In certain circumstances, the Purchaser will

be entitled to certain piggyback registration rights. The PIPE Agreement is subject to customary closing conditions and customary representations

and warranties. As of the date hereof, the Ordinary Shares to be issued in connection with the Note Issuance have not been registered

under the Securities Act of 1933, as amended (the “Securities Act”). In the event, New Seamless proposes to register

any of its securities under the Securities Act, it shall give prompt written notice to the Purchaser, who within twenty (20) days after

receiving such written notice provide New Seamless with written notice to use best efforts to cause all Ordinary Shares held by Purchaser

(the “Piggyback Shares”) to be included in such registration, subject to the PIPE Agreement. Except with the written

consent of New Seamless, the Purchaser shall not own more than 4.99% of the Ordinary Shares of New Seamless in issue from time to time

(the “Ownership Limit”). In addition, the Note will not be convertible to the extent that such issuance of shares

together with any issuance of shares upon the exercise of Warrants, would require shareholder approval under Nasdaq rules, until and

unless such shareholder approval is obtained.

In

connection with the Note Issuance, and as consideration of the Purchaser’s subscription of the convertible promissory note following

the Business Combination Closing, the Purchaser was also issued (i) 400,000 Ordinary Shares, credited as fully-paid, (the “Commitment

Shares”) and (ii) a five-year warrant (the “Warrant”) to purchase up to an aggregate of 136,110 Ordinary

Shares at an exercise price of USD $11.50 (the “Warrant Shares”). The Warrants shall have anti-dilution protection

on the price with respect to future equity offerings of New Seamless priced at or above $2.00 per share and full anti-dilution protection

on price and quantity with respect to future equity offerings of New Seamless priced below $2.00 per share. In the event the Warrant

Shares are not registered within 12 months, Warrant holders have the option to cashless exercise each warrant for 0.8 Ordinary Shares.

In addition, the Warrants will not be exercisable to the extent that such issuance of shares together with any issuance of shares upon

the conversion of the Note, would require shareholder approval under Nasdaq rules, until and unless such shareholder approval

is obtained.

The

foregoing description of the PIPE Agreement, Note and Warrant is qualified in its entirety by reference to the full text of such PIPE

Agreement, Note and Warrant, copies of which are attached hereto as Exhibits 10.5, 10.6, and Exhibit 10.7, respectively, and are

incorporated herein in their entirety by reference.

Initial

Public Offering

On

November 23, 2021, INFINT consummated its initial public offering (the “Initial Public Offering”) of 17,391,200 units

(each a “Unit”) at a price of $10.00 per Unit and the sale of 7,032,580 private placement warrants (the “Private

Warrants”) at a price of $1.00 per Private Warrant in a private placement (the “Private Placement”) to the

Sponsor that closed simultaneously with the closing of the Initial Public Offering. On November 23, 2021, the Underwriters exercised

their over-allotment option in full, according to which INFINT consummated the sale of an additional 2,608,680 Units, at $10.00 per Unit,

and the sale of an additional 764,262 Private Warrants, at $1.00 per Private Warrant. Following the closing of the over-allotment option,

INFINT generated total gross proceeds of $207,795,642 from the Initial Public Offering and the Private Placement, of which INFINT raised

$199,998,800 in the Initial Public Offering, $7,796,842 in the Private Placement and of which $202,998,782 was placed in INFINT’s

Trust Account with Continental Stock Transfer & Company as trustee, established for the benefit of INFINT’s public shareholders.

The Underwriters received a cash underwriting discount of (i) one and one-quarter percent (1.25%) of the gross proceeds of the Initial

Public Offering, or $2,499,985, and (ii) one half of a percent (0.5%) in the form of representative shares (69,999 INFINT Class B ordinary

shares to EF Hutton and 30,000 INFINT Class B ordinary shares to JonesTrading). In addition, the Underwriters were entitled to a deferred

fee of three percent (3.00%) of the gross proceeds of the Initial Public Offering, or $5,999,964, upon the closing of the Business

Combination, pursuant to the underwriting agreement dated November 18, 2021 (the “Underwriting Agreement”). The deferred

fee was partially paid in cash from the amounts held in the Trust Account and partially settled through a promissory note issued

upon the closing of the Business Combination.

Vendor

Shares

In

connection with the Business Combination Closing, New Seamless issued (i) 100,000 Ordinary Shares to Roth Capital Partners, LLC for advisory

services, and (ii) 100,000 Ordinary Shares to KEMP Services Limited for legal advisory services.

Item

3.03. Material Modification to Rights of Security Holders.

The

shareholders of INFINT approved the proposed fifth amended and restated memorandum and articles of association of New Seamless (the “Amended

and Restated Articles”) at the Special Meeting. In connection with the Closing, INFINT adopted the Amended and Restated Articles

effective as of the Closing Date. Reference is made to the disclosure described in the Proxy Statement/Prospectus in the sections titled

“Proposal 1 – The Business Combination Proposal,” “Proposal 2 – The Articles Amendment Proposal,”

and “Proposal 5 – The Advisory Governance Proposals,” which is incorporated herein by reference.

The

full text of the Amended and Restated Articles, which are included as Exhibit 3.1 to this Current Report on Form 8-K, are incorporated

herein by reference.

Item

5.01. Changes in Control of Registrant.

Reference

is made to the disclosure in the Proxy Statement/Prospectus in the section titled “Proposed 1 – The Business Combination

Proposal,” which is incorporated herein by reference. Further reference is made to the information contained in Item 2.01 to

this Current Report on Form 8-K, which is incorporated herein by reference.

As

of the Closing: public shareholders own approximately 0.20% of the outstanding New

Seamless Ordinary Shares; the Sponsor and its affiliates own approximately 9.63% of the

outstanding New Seamless Ordinary Shares; other Class B shareholders own approximately

2.69% of the outstanding New Seamless Ordinary Shares; Seamless’ former shareholders collectively own approximately 85.97% of

the New Seamless Ordinary Shares; the Underwriters own approximately 0.22% of the

outstanding New Seamless Ordinary Shares; the Vendors own approximately 0.43% of the outstanding

New Seamless Ordinary Shares; and approximately 0.86% of the outstanding New Seamless Ordinary Shares are held by the PIPE

investor.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Election

of Directors and Appointment of Officers

The

following persons are serving as executive officers and directors following the Closing. For information concerning the executive officers

and directors, see the disclosure in the Proxy Statement/Prospectus in the sections titled “Information about INFINT,”

“Management of New Seamless Following the Business Combination” and “Certain Relationships and Related

Party Transactions,” which are incorporated herein by reference.

| Name | |

Age | |

Position |

| Alexander

King Ong Kong | |

54 | |

Executive

Chairman of the Board, Director |

| Ronnie

Ka Wah Hui | |

60 | |

Chief

Executive Officer |

| Hagay

Ravid | |

63 | |

Chief

Financial Officer |

| Eng

Ho Ng | |

70 | |

Director |

| Kevin

Chen | |

47 | |

Director |

| Kanagaraj

Lorenz | |

66 | |

Director |

| Eric

Weinstein | |

69 | |

Director |

Each

director will hold office until his or her term expires at the next annual meeting of shareholders for such director’s class or

until his or her death, resignation, removal or the earlier termination of his or her term of office.

New

Seamless Incentive Plan

At

the Special Meeting, INFINT shareholders approved the New Seamless Incentive Plan and reserved an amount of New Seamless Ordinary Shares

equal to 10% of the number of common shares of New Seamless following the Business Combination for issuance thereunder. The New Seamless

Incentive Plan was approved by the INFINT board of directors on August 30, 2024. The New Seamless Incentive Plan became effective immediately

upon the Closing of the Business Combination, and New Seamless has reserved 4,636,091 ordinary shares for issuance thereunder.

A

more complete summary of the terms of the New Seamless Incentive Plan is set forth in the Proxy Statement/Prospectus in the section titled

“Proposal 4 – The Incentive Plan Proposal.” That summary and the foregoing description are qualified in their

entirety by reference to the text of the New Seamless Incentive Plan, which is filed as Exhibit 10.1 to this Current Report on Form 8-K

and incorporated herein by reference.

Employment

Agreements

New

Seamless plans to enter into employment agreements with Ronnie Ka Wah Hui (Chief Executive Officer) and Alexander King Ong Kong (Chairman),

and Seamless has entered into an employment agreement with Hagay Ravid (Chief Financial Officer), (each an “Employment Agreement,

and collectively, the “Employment Agreements”). Messer Hui and Kong are not currently party to any employment agreement

with the Company, nor is there any current compensation arrangement. The employment agreement for Mr. Ravid is set forth in the Proxy

Statement/Prospectus in the section titled “Executive Compensation—Seamless Executive Officer and Director Compensation—Hagay

Ravid,” which summary is incorporated by reference herein.

The

Employment Agreements are expected to provide for a base salary of $300,000 for each of Mr. Hui and Mr. Kong, and any possible annual

performance bonuses and equity grants under the New Seamless Incentive Plan are to be determined by New Seamless’ compensation

committee.

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The

information set forth in Item 3.03 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

Item

5.06. Change in Shell Company Status.

As

a result of the Business Combination, INFINT ceased being a shell company. Reference is made to the disclosure in the Proxy Statement/Prospectus

in the section titled “Proposal 1 – The Business Combination Proposal,” which is incorporated herein by reference.

The information contained in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.06.

Item

9.01. Financial Statements and Exhibits.

(a)

Financial statements of businesses acquired.

Information

responsive to Item 9.01(a) of Form 8-K is set forth in the financial statements included in the Proxy Statement/Prospectus beginning

on page F-1, which are incorporated herein by reference, and the unaudited financial statements of Seamless as of and for the six

months ended June 30, 2024, together with the notes thereto, are set forth in Exhibit 99.2 and are incorporated herein by reference.

(b)

Pro forma financial information.

The

unaudited pro forma condensed combined financial information as of and for the six months ended June 30, 2024 is

filed as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

(d)

Exhibits.

Exhibit

Number |

|

Description |

| 2.1+ |

|

Business

Combination Agreement, dated as of August 3, 2022, by and among INFINT Acquisition Corporation, FINTECH Merger Sub Corp. and Seamless

Group Inc. (included as Annex A to the proxy statement/prospectus filed by the Company with the SEC on July 11, 2024) |

| 2.2 |

|

Amendment

No. 1 to the Business Combination Agreement, dated as of October 20, 2022, by and among INFINT, Merger Sub and Seamless (included

as Annex A to the proxy statement/prospectus filed by the Company with the SEC on July 11, 2024) |

| 2.3 |

|

Amendment

No. 2 to the Business Combination Agreement, dated as of November 29, 2022, by and among INFINT, Merger Sub and Seamless (included

as Annex A to the proxy statement/prospectus filed by the Company with the SEC on July 11, 2024) |

| 2.4 |

|

Amendment

No. 3 to the Business Combination Agreement, dated as of February 20, 2023, by and among INFINT, Merger Sub and Seamless (included

as Annex A to the proxy statement/prospectus filed by the Company with the SEC on July 11, 2024) |

| 3.1* |

|

Fifth

Amended and Restated Memorandum and Articles of Association of Currenc Group Inc. |

| 3.2* |

|

Specimen

Ordinary Share Certificate |

| 10.1*† |

|

Currenc

Group Inc. 2024 Equity Incentive Plan |

| 10.2 |

|

Form

of Lock-up Agreement |

| 10.3 |

|

Registration

Rights Agreement, dated November 23, 2021, among INFINT Acquisition Corporation and certain security holders named therein (incorporated

herein by reference to Exhibit 10.2 to Form 8-K (File No. 001-41079) as filed with the SEC on December 1, 2021) |

| 10.4 |

|

Form

of Registration Rights Agreement |

| 10.5* |

|

Convertible

Note Purchase Agreement, dated August 30, 2024, by and between Currenc Group Inc., Seamless Group Inc, and Pine Mountain Holdings

Limited. |

| 10.6* |

|

Form

of Note. |

| 10.7* |

|

Form

of Warrant Agreement dated August 30, 2024, by and between Currenc Group Inc., Seamless Group Inc, and Pine Mountain Holdings Limited. |

| 10 .8* |

|

Promissory

Note dated August 30, 2024 by and between INFINT Acquisition Corp. and EF Hutton LLC |

| 10.9* |

|

Promissory

Note dated August 30, 2024 by and between INFINT Acquisition Corp. and Greenberg Traurig LLP |

| 10.10* |

|

Promissory

Note dated August 30, 2024 by and between INFINT Acquisition Corp. and INFINT Capital LLC |

| 21.1* |

|

List

of Subsidiaries of Currenc Group Inc. |

| 99.1* |

|

Unaudited

Pro Forma Condensed Combined Financial Information |

| 99.2* |

|

Unaudited

financial statements of Seamless as of and for the six months ended June 30, 2024 |

| 99.3* |

|

Management’s

Discussion and Analysis of Financial Condition and Results of Operations of Seamless for the six

months ended June 30, 2024 |

| 104* |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

| * | Filed

herewith. |

| † | Indicates

a management or compensatory plan. |

| + | Schedules

to this exhibit have been omitted pursuant to Item 601(b)(2) of Registration S-K. The Registrant

hereby agrees to furnish a copy of any omitted schedules to the Commission upon request. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

September 6, 2024

| |

CURRENC

GROUP INC. |

| |

|

|

| |

By: |

/s/

Ronnie Ka Wah Hui |

| |

Name:

|

Ronnie

Ka Wah Hui |

| |

Title: |

Chief

Executive Officer |

Exhibit

3.1

THE

COMPANIES ACT (AS REVISED)

OF

THE CAYMAN ISLANDS

COMPANY

LIMITED BY SHARES

FIFTH

AMENDED AND RESTATED

MEMORANDUM

AND ARTICLES OF ASSOCIATION

OF

CURRENC

GROUP INC.

(Adopted

by a Special Resolution passed on August 6, 2024 and effective on August 30, 2024)

THE

COMPANIES ACT (AS REVISED)

OF

THE CAYMAN ISLANDS

COMPANY

LIMITED BY SHARES

FIFTH

AMENDED AND RESTATED

MEMORANDUM

OF ASSOCIATION

OF

CURRENC

GROUP INC.

(Adopted

by a Special Resolution passed on August 6, 2024 and effective on August 30, 2024)

| 1 |

The

name of the Company is Currenc Group Inc. |

| |

|

| 2 |

The

Registered Office of the Company shall be at the offices of Mourant Governance Services (Cayman) Limited, 94 Solaris Avenue, Camana

Bay, PO Box 1348, Grand Cayman KY1-1108, Cayman Islands, or at such other place within the Cayman Islands as the Directors may decide. |

| |

|

| 3 |

The

objects for which the Company is established are unrestricted and the Company shall have full power and authority to carry out any

object not prohibited by the laws of the Cayman Islands. |

| |

|

| 4 |

The

liability of each Member is limited to the amount unpaid on such Member’s shares. |

| |

|

| 5 |

The

share capital of the Company is US$55,500 divided into 555,000,000 ordinary shares with a par value of US$0.0001 each. |

| |

|

| 6 |

The

Company has power to register by way of continuation as a body corporate limited by shares under the laws of any jurisdiction outside

the Cayman Islands and to be deregistered in the Cayman Islands. |

| |

|

| 7 |

Capitalised

terms that are not defined in this Memorandum of Association bear the respective meanings given to them in the Articles of Association

of the Company. |

THE

COMPANIES ACT (AS REVISED)

OF

THE CAYMAN ISLANDS

COMPANY

LIMITED BY SHARES

FIFTH

AMENDED AND RESTATED

ARTICLES

OF ASSOCIATION

OF

CURRENC

GROUP INC.

(Adopted

by a Special Resolution passed on August 6, 2024 and effective on August 30, 2024)

| 1 |

Interpretation |

| |

|

| 1.1 |

In

the Articles Table A in the First Schedule to the Statute does not apply and, unless there is something in the subject or context

inconsistent therewith: |

| |

“Articles” |

means

these articles of association of the Company. |

| |

|

|

| |

“Audit

Committee” |

means

the audit committee of the board of directors of the Company established pursuant to the Articles, or any successor committee. |

| |

|

|

| |

“Auditor” |

means

the person for the time being performing the duties of auditor of the Company (if any). |

| |

|

|

| |

“Company” |

means

the above named company. |

| |

|

|

| |

“Communication

Facilities” |

shall

mean video, video-conferencing, internet or online conferencing applications, telephone or tele-conferencing and/or any other video-communication,

internet or online conferencing application or telecommunications facilities by means of which all Persons participating in a meeting

are capable of hearing and be heard by each other. |

| |

|

|

| |

“Designated

Stock Exchange” |

means

any national securities exchange or automated quotation system on which the Company’s securities are traded, including but

not limited to the New York Stock Exchange. |

| |

|

|

| |

“Directors” |

means

the directors for the time being of the Company. |

| |

|

|

| |

“Dividend” |

means

any dividend (whether interim or final) resolved to be paid on Shares pursuant to the Articles. |

| |

“Electronic

Means” |

means

sending or otherwise making the communication available to the intended recipients in electronic format. |

| |

|

|

| |

“Electronic

Record” |

has

the same meaning as in the Electronic Transactions Act. |

| |

|

|

| |

“Electronic

Transactions Act” |

means

the Electronic Transactions Act (As Revised) of the Cayman Islands. |

| |

|

|

| |

“Member” |

has

the same meaning as in the Statute. |

| |

|

|

| |

“Memorandum” |

means

the memorandum of association of the Company. |

| |

|

|

| |

“Ordinary

Resolution” |

means

a resolution passed by a simple majority of the Members as, being entitled to do so, vote in person or, where proxies are allowed,

by proxy at a general meeting, and includes a unanimous written resolution. In computing the majority when a poll is demanded regard

shall be had to the number of votes to which each Member is entitled by the Articles. |

| |

|

|

| |

“Person” |

shall

mean any natural person, firm, company, joint venture, partnership, corporation, association or other entity (whether or not having

a separate legal personality) or any of them as the context so requires. |

| |

|

|

| |

“Present” |

shall

mean, in respect of any Person, such Person’s presence at a general meeting of members, which may be satisfied by means of

such Person or, if a corporation or other non-natural Person, its duly authorised representative (or, in the case of any member,

a proxy which has been validly appointed by such member in accordance with these Articles), being: |

| |

(a) |

physically

present at the meeting; or |

| |

|

|

| |

(b) |

in

the case of any meeting at which Communication Facilities are permitted in accordance with these Articles connected by means of the

use of such Communication Facilities. |

| |

“Register

of Members” |

means

the register of Members maintained in accordance with the Statute and includes (except where otherwise stated) any branch or duplicate

register of Members. |

| |

“Registered

Office” |

means

the registered office for the time being of the Company. |

| |

|

|

| |

“Rules

of the Designated Stock Exchange” |

means

the rules and regulations of the Designated Stock Exchange which are applicable to the Company from time to time. |

| |

|

|

| |

“Seal” |

means

the common seal of the Company and includes every duplicate seal. |

| |

|

|

| |

“Share” |

means

a share in the Company and includes a fraction of a share in the Company. |

| |

|

|

| |

“Special

Resolution” |

has

the same meaning as in the Statute, and includes a unanimous written resolution. |

| |

|

|

| |

“Statute” |

means

the Companies Act (As Revised) of the Cayman Islands. |

| |

|

|

| |

“Treasury

Share” |

means

a Share held in the name of the Company as a treasury share in accordance with the Statute. |

| |

(a) |

words

importing the singular number include the plural number and vice versa; |

| |

|

|

| |

(b) |

words

importing the masculine gender include the feminine gender; |

| |

|

|

| |

(c) |

words

importing persons include corporations as well as any other legal or natural person; |

| |

(d) |

“written”

and “in writing” include all modes of representing or reproducing words in visible form, including in the form of an

Electronic Record; |

| |

|

|

| |

(e) |

“shall”

shall be construed as imperative and “may” shall be construed as permissive; |

| |

|

|

| |

(f) |

references

to provisions of any law or regulation shall be construed as references to those provisions as amended, modified, re-enacted or replaced; |

| |

|

|

| |

(g) |

any

phrase introduced by the terms “including”, “include”, “in particular” or any similar expression

shall be construed as illustrative and shall not limit the sense of the words preceding those terms; |

| |

|

|

| |

(h) |

the

term “and/or” is used herein to mean both “and” as well as “or.” The use of “and/or”

in certain contexts in no respects qualifies or modifies the use of the terms “and” or “or” in others. The

term “or” shall not be interpreted to be exclusive and the term “and” shall not be interpreted to require

the conjunctive (in each case, unless the context otherwise requires); |

| |

(i) |

headings

are inserted for reference only and shall be ignored in construing the Articles; |

| |

|

|

| |

(j) |

any

requirements as to delivery under the Articles include delivery in the form of an Electronic Record; |

| |

|

|

| |

(k) |

any

requirements as to execution or signature under the Articles including the execution of the Articles themselves can be satisfied

in the form of an electronic signature as defined in the Electronic Transactions Act; |

| |

|

|

| |

(l) |

sections

8 and 19(3) of the Electronic Transactions Act shall not apply; |

| |

|

|

| |

(m) |

the

term “clear days” in relation to the period of a notice means that period excluding the day when the notice is received

or deemed to be received and the day for which it is given or on which it is to take effect; and |

| |

|

|

| |

(n) |

the

term “holder” in relation to a Share means a person whose name is entered in the Register of Members as the holder of

such Share. |

| 2 |

Commencement

of Business |

| 2.1 |

The

business of the Company may be commenced as soon after incorporation of the Company as the Directors shall see fit. |

| |

|

| 2.2 |

The

Directors may pay, out of the capital or any other monies of the Company, all expenses incurred in or about the formation and establishment

of the Company, including the expenses of registration. |

| 3.1 |

Subject

to the provisions, if any, in the Memorandum (and to any direction that may be given by the Company in general meeting) and without

prejudice to any rights attached to any existing Shares, the Directors may allot, issue, grant options over or otherwise dispose

of Shares (including fractions of a Share) with or without preferred, deferred or other rights or restrictions, whether in regard

to Dividend or other distribution, voting, return of capital or otherwise and to such persons, at such times and on such other terms

as they think proper, and may also (subject to the Statute and the Articles) vary such rights. |

| |

|

| 3.2 |

The

Company shall not issue Shares to bearer. |

| 4.1 |

The

Company shall maintain or cause to be maintained the Register of Members in accordance with the Statute. |

| |

|

| 4.2 |

The

Directors may determine that the Company shall maintain one or more branch registers of Members in accordance with the Statute. The

Directors may also determine which register of Members shall constitute the principal register and which shall constitute the branch

register or registers, and to vary such determination from time to time. |

| 5 |

Closing

Register of Members or Fixing Record Date |

| 5.1 |

For

the purpose of determining Members entitled to notice of, or to vote at any meeting of Members or any adjournment thereof, or Members

entitled to receive payment of any Dividend or other distribution, or in order to make a determination of Members for any other purpose,

the Directors may provide that the Register of Members shall be closed for transfers for a stated period which shall not in any case

exceed forty days. |

| |

|

| 5.2 |

In

lieu of, or apart from, closing the Register of Members, the Directors may fix in advance or arrears a date as the record date for

any such determination of Members entitled to notice of, or to vote at any meeting of the Members or any adjournment thereof, or

for the purpose of determining the Members entitled to receive payment of any Dividend or other distribution, or in order to make

a determination of Members for any other purpose. |

| |

|

| 5.3 |

If

the Register of Members is not so closed and no record date is fixed for the determination of Members entitled to notice of, or to

vote at, a meeting of Members or Members entitled to receive payment of a Dividend or other distribution, the date on which notice

of the meeting is sent or the date on which the resolution of the Directors resolving to pay such Dividend or other distribution

is passed, as the case may be, shall be the record date for such determination of Members. When a determination of Members entitled

to vote at any meeting of Members has been made as provided in this Article, such determination shall apply to any adjournment thereof. |

| 6 |

Certificates

for Shares |

| 6.1 |

A

Member shall only be entitled to a share certificate if the Directors resolve that share certificates shall be issued. Share certificates

representing Shares, if any, shall be in such form as the Directors may determine. Share certificates shall be signed by one or more

Directors or other person authorised by the Directors. The Directors may authorise certificates to be issued with the authorised

signature(s) affixed by mechanical process. All certificates for Shares shall be consecutively numbered or otherwise identified and

shall specify the Shares to which they relate. All certificates surrendered to the Company for transfer shall be cancelled and subject

to the Articles no new certificate shall be issued until the former certificate representing a like number of relevant Shares shall

have been surrendered and cancelled. |

| 6.2 |

The

Company shall not be bound to issue more than one certificate for Shares held jointly by more than one person and delivery of a certificate

to one joint holder shall be a sufficient delivery to all of them. |

| |

|

| 6.3 |

If

a share certificate is defaced, worn out, lost or destroyed, it may be renewed on such terms (if any) as to evidence and indemnity

and on the payment of such expenses reasonably incurred by the Company in investigating evidence, as the Directors may prescribe,

and (in the case of defacement or wearing out) upon delivery of the old certificate. |

| |

|

| 6.4 |

Every

share certificate sent in accordance with the Articles will be sent at the risk of the Member or other person entitled to the certificate.

The Company will not be responsible for any share certificate lost or delayed in the course of delivery. |

| 7.1 |

Except

where permitted by the Statute, the Memorandum, these Articles, the Rules of the Designated Stock Exchange, any relevant securities

laws or the common law, and to any rights and restrictions for the time being attached to any Share, the board of Directors shall

not decline to register any transfer of Shares and shall, upon making any decision to decline to register any transfer of Shares,

within three (3) months after the date on which the relevant instrument of transfer was lodged with the Company, send to the transferor

and transferee notice of the refusal. Notwithstanding the foregoing, the board of Directors may, in its absolute discretion, decline

to register any transfer of any Share which is not fully paid up, or which is issued under any share incentive scheme for employees

upon which a restriction on transfer imposed thereby still subsists, or on which the Company has a lien. |

| |

|

| 7.2 |

The

registration of transfers may, after compliance with any notice required of the Rules of the Designated Stock Exchange, be suspended

at such times and for such periods as the Board may from time to time determine. |

| |

|

| 7.3 |

All