INFINT Acquisition Corporation (the “Company”) today announced

that, in connection with its proposed business combination (the

“Business Combination”) with Seamless Group Inc. (“Seamless”), it

intends to voluntarily delist its units and Class A ordinary shares

from the NYSE American LLC (“NYSE American”), subject to the

closing of the Business Combination.

The Company’s decision to voluntarily delist its

units and Class A ordinary shares from the NYSE American is due to

the fact that upon the consummation of the Business Combination,

the Company will change its corporate name to “CURRENC Group Inc.”

(“Currenc”), and Currenc’s ordinary shares are expected to be

traded on the Nasdaq Stock Market LLC (“Nasdaq”), subject to the

closing of the Business Combination.

Trading of Currenc’s ordinary shares is

currently expected to begin on Nasdaq at market open on or about

August 21, 2024 under the symbol “CURR” following the consummation

of the Business Combination. The last day of trading of the

Company’s securities on NYSE American is expected to be on or about

August 20, 2024. The delisting from NYSE American and the listing

on Nasdaq are subject to the closing of the Business Combination

and the fulfillment of all applicable listing requirements of

Nasdaq.

About INFINT Acquisition Corporation

INFINT Acquisition Corporation is a Special

Purpose Acquisition Corporation (SPAC) company on a mission to

bring the most promising financial technology company from North

America, Asia, Latin America, Europe and Israel to the U.S. public

market. As a result of the pandemic, the world is changing rapidly,

and in unique, unexpected ways. Thanks to growth and investment in

the global digital infrastructure, legal, healthcare, automotive,

financial, and other fields are evolving at a faster rate than ever

before. INFINT believes the greatest opportunities in the near

future lie in the global fintech space and are looking forward to

merging with an exceptional international fintech company.

Forward-Looking Statements

This document contains certain forward-looking

statements within the meaning of U.S. federal securities laws with

respect to the proposed transaction between the Company and

Seamless, including statements regarding the benefits of the

transaction, the anticipated benefits of the transaction, the

Company’s or Seamless’ expectations concerning the outlook for

Currenc’s business, productivity, future market conditions or

economic performance and developments in the capital and credit

markets and expected future financial performance, as well as any

information concerning possible or assumed future results of

operations. These forward-looking statements generally are

identified by the words “believe,” “project,” “expect,”

“anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions.

Forward-looking statements are their managements’ current

predictions, projections and other statements about future events

that are based on current expectations and assumptions available to

the Company and Seamless, and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

document, including but not limited to: (i) the risk that the

proposed transaction may not be completed within the prescribed

time frame, which may adversely affect the price of the Company’s

securities, (ii) the risk that investors of Seamless may not

receive the same benefits as an investor in an underwritten public

offering, (iii) the risk that Currenc’s securities may experience a

material price decline after the proposed transaction, (iv) the

risk of product liability or regulatory lawsuits or proceedings

relating to Seamless’ business; (v) a reduction of trust account

proceeds and the per share redemption amount received by

shareholders as a result of third-party claims, (vi) the risk that

the transaction may not be completed by the Company’s business

combination deadline and an extension period, (vii) the ability of

Currenc to get approval for listing of its ordinary shares and

comply with the continued listing standards of the Nasdaq, (viii)

the failure to satisfy the conditions to the consummation of the

transaction, certain of which may be outside of the Company or

Seamless’ control, (ix) the ability to attract new partners,

merchants and users and retain existing partners, merchants and

users in order to continue to expand, (x) Currenc’ ability to

integrate its services with a variety of operating systems,

networks and devices; (ix) the ability of Currenc to fund its

capital requirements through additional debt and equity financing

under commercially reasonable terms and the risk of shareholding

dilution as a result of additional capital raising, if applicable,

(x) the risk of cyber security or foreign exchange losses, (xi) the

risk that Currenc is unable to secure or protect its intellectual

property; and (xii) failure to maintain an effective system of

internal control over financial reporting and to accurately and

timely report Currenc’s financial condition, results of operations

or cash flows.

The foregoing list of factors is not exhaustive.

Forward-looking statements are not guarantees of future

performance. You should carefully consider the foregoing factors

and the other risks and uncertainties described in the “Risk

Factors” section of the Company’s registration statement on Form

S-4 filed by the Company with the U.S. Securities and Exchange

Commission (the “SEC”), the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, which was filed with the SEC

on March 27, 2024, and other documents filed by the Company from

time to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and all

forward-looking statements in this document are qualified by these

cautionary statements. The Company assumes no obligation and do not

intend to update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise. The Company does not give any assurance that either the

Company or Currenc will achieve its expectations. The inclusion of

any statement in this communication does not constitute an

admission by the Company or Currenc or any other person that the

events or circumstances described in such statement are

material.

Additional Information and Where to Find

It

This document relates to a proposed transaction

between the Company and Seamless. This document does not constitute

an offer to sell or exchange, or the solicitation of an offer to

buy or exchange, any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, sale or

exchange would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act. In connection with the

Business Combination, the Company filed a registration statement on

Form S-4 with the SEC (as may be amended from time to time, the

“Registration Statement”) on May 20, 2021, which included a proxy

statement/prospectus of the Company. The SEC declared the

Registration Statement effective on July 12, 2024.

The Registration Statement, including the proxy

statement/prospectus contained therein, contains important

information about the Business Combination and the other matters

voted upon at the meeting of the Company’s shareholders approving

the Business Combination (and related matters). The Company also

filed other documents regarding the proposed transaction with the

SEC. This document does not contain all the information that should

be considered concerning the proposed transactions and is not

intended to form the basis of any investment decision or any other

decision in respect of the transactions.

Investors and shareholders will be able to

obtain free copies of the registration statement, proxy

statement/prospectus and all other relevant documents filed or that

will be filed with the SEC by the Company through the website

maintained by the SEC at www.sec.gov. In addition, the documents

filed by the Company may be obtained free of charge from the

Company’s website at https://www.infintspac.com/ or by written

request to the Company at INFINT Acquisition Corporation, Suite

401, 32 Broadway, New York, NY 10004.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER

REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED

THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE

INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS

A CRIMINAL OFFENSE.

Participants in Solicitation

The Company and its respective directors and

officers may be deemed to be participants in the solicitation of

proxies from the Company’s shareholders in connection with the

proposed transaction. Information about the Company’s directors and

executive officers and their ownership of the Company’s securities

is set forth in the Company’s filings with the SEC, including the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, which was filed with the SEC on March 27, 2024, and the

Registration Statement. Additional information regarding the

interests of those persons and other persons who may be deemed

participants in the proposed transaction may be obtained by reading

the proxy statement/prospectus regarding the proposed transaction.

Shareholders, potential investors and other interested persons

should read the proxy statement/prospectus carefully before making

any voting or investment decisions. You may obtain free copies of

these documents as described in the preceding paragraph.

No Offer or Solicitation

This document is for informational purposes only

and shall not constitute an offer to sell or the solicitation of an

offer to buy any securities pursuant to the proposed transactions

or otherwise, nor shall there be any sale of securities in any

jurisdiction in which the offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended, or an exemption therefrom.

Contact

INFINT Acquisition CorporationAlexander

Edgarovsasha@inifntspac.com

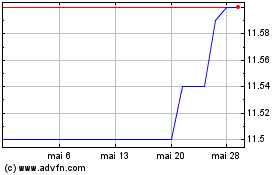

InFinT Acquisition (NYSE:IFIN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

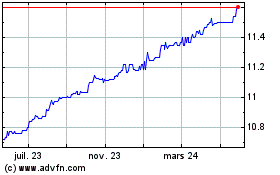

InFinT Acquisition (NYSE:IFIN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025