Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

24 Janvier 2024 - 8:28PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

Voya

Global

Advantage

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

97.6%

Australia

:

2.9%

18,630

Ampol

Ltd.

$

419,822

0.3

31,476

ANZ

Group

Holdings

Ltd.

506,332

0.3

185,452

Aurizon

Holdings

Ltd.

432,595

0.3

66,444

Brambles

Ltd.

585,544

0.4

109,458

Medibank

Pvt

Ltd.

250,255

0.2

50,174

QBE

Insurance

Group

Ltd.

510,520

0.3

92,460

Scentre

Group

161,687

0.1

330,061

Telstra

Group

Ltd.

834,016

0.6

74,902

Transurban

Group

639,963

0.4

4,340,734

2.9

Canada

:

3.3%

5,919

iA

Financial

Corp.,

Inc.

395,240

0.3

10,518

Parkland

Corp.

344,231

0.2

5,329

Rogers

Communications,

Inc.

-

Class

B

229,466

0.1

11,130

Royal

Bank

of

Canada

1,005,756

0.7

18,267

Suncor

Energy,

Inc.

602,281

0.4

15,923

TELUS

Corp.

284,911

0.2

6,235

Thomson

Reuters

Corp.

871,094

0.6

14,915

Toronto-Dominion

Bank

909,442

0.6

3,572

West

Fraser

Timber

Co.

Ltd.

259,078

0.2

4,901,499

3.3

China

:

0.5%

191,000

BOC

Hong

Kong

Holdings

Ltd.

510,681

0.3

150,000

SITC

International

Holdings

Co.

Ltd.

226,509

0.2

737,190

0.5

Denmark

:

0.4%

22,724

Danske

Bank

A/S

588,767

0.4

Finland

:

0.1%

3,988

Elisa

Oyj

178,325

0.1

France

:

2.9%

27,483

AXA

SA

856,926

0.6

4,971

BNP

Paribas

SA

312,511

0.2

851

Dassault

Aviation

SA

169,014

0.1

6,183

Edenred

336,768

0.2

20,190

Getlink

SE

368,933

0.3

5,537

(1)

La

Francaise

des

Jeux

SAEM

200,361

0.1

77,559

Orange

SA

955,593

0.7

5,074

Sanofi

473,224

0.3

2,766

Thales

SA

413,315

0.3

18,966

Vivendi

SE

179,511

0.1

4,266,156

2.9

Germany

:

0.4%

9,188

BASF

SE

427,400

0.3

2,717

(1)

Scout24

SE

189,320

0.1

616,720

0.4

Hong

Kong

:

1.0%

106,000

CK

Hutchison

Holdings

Ltd.

531,805

0.4

167,000

Hang

Lung

Properties

Ltd.

223,273

0.1

5,100

Jardine

Matheson

Holdings

Ltd.

199,104

0.1

48,700

Link

REIT

240,521

0.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Hong

Kong

(continued)

66,500

Power

Assets

Holdings

Ltd.

$

346,912

0.2

1,541,615

1.0

Israel

:

0.1%

16,299

Bank

Leumi

Le-Israel

BM

122,170

0.1

16,314

Israel

Discount

Bank

Ltd.

-

Class

A

78,557

0.0

200,727

0.1

Italy

:

1.2%

239,802

Intesa

Sanpaolo

SpA

691,249

0.5

33,157

(1)

Poste

Italiane

SpA

357,360

0.2

51,533

Snam

SpA

259,658

0.2

16,675

UniCredit

SpA

454,805

0.3

1,763,072

1.2

Japan

:

7.9%

26,000

Asahi

Kasei

Corp.

180,518

0.1

34,900

Central

Japan

Railway

Co.

837,257

0.6

22,900

Chubu

Electric

Power

Co.,

Inc.

282,917

0.2

10,500

Daiwa

House

Industry

Co.

Ltd.

298,352

0.2

176,600

ENEOS

Holdings,

Inc.

695,092

0.5

1,500

Hirose

Electric

Co.

Ltd.

168,016

0.1

9,800

Inpex

Corp.

135,205

0.1

44,700

Japan

Post

Bank

Co.

Ltd.

440,862

0.3

121,500

Japan

Post

Holdings

Co.

Ltd.

1,073,491

0.7

43,000

Japan

Tobacco,

Inc.

1,105,735

0.7

4,200

McDonald's

Holdings

Co.

Japan

Ltd.

178,788

0.1

6,400

NEC

Corp.

356,710

0.2

436,200

Nippon

Telegraph

&

Telephone

Corp.

510,461

0.4

4,900

Nitto

Denko

Corp.

348,221

0.2

10,500

ORIX

Corp.

191,825

0.1

20,000

Osaka

Gas

Co.

Ltd.

389,767

0.3

11,200

Secom

Co.

Ltd.

778,515

0.5

16,200

Sekisui

Chemical

Co.

Ltd.

230,240

0.2

38,200

Sekisui

House

Ltd.

782,160

0.5

8,900

Sompo

Holdings,

Inc.

408,273

0.3

16,100

Sumitomo

Mitsui

Financial

Group,

Inc.

792,079

0.5

32,600

Takeda

Pharmaceutical

Co.

Ltd.

924,143

0.6

18,800

Tokio

Marine

Holdings,

Inc.

465,528

0.3

12,200

USS

Co.

Ltd.

238,561

0.2

11,812,716

7.9

Jordan

:

0.2%

13,295

Hikma

Pharmaceuticals

PLC

289,713

0.2

Netherlands

:

1.4%

87,538

Koninklijke

KPN

NV

299,845

0.2

20,574

NN

Group

NV

785,183

0.5

5,454

OCI

NV

117,490

0.1

6,464

Wolters

Kluwer

NV

890,365

0.6

2,092,883

1.4

New

Zealand

:

0.1%

54,979

Spark

New

Zealand

Ltd.

175,371

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Global

Advantage

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Norway

:

0.4%

19,104

Aker

BP

ASA

$

544,083

0.4

Singapore

:

0.4%

285,800

Genting

Singapore

Ltd.

195,476

0.1

78,400

Keppel

Corp.

Ltd.

391,102

0.3

15,900

Keppel

REIT

10,283

0.0

596,861

0.4

Spain

:

2.4%

9,685

ACS

Actividades

de

Construccion

y

Servicios

SA

387,130

0.3

2,622

(1)

Aena

SME

SA

450,920

0.3

8,433

Enagas

SA

154,340

0.1

18,371

Industria

de

Diseno

Textil

SA

758,076

0.5

22,794

Red

Electrica

Corp.

SA

382,075

0.3

62,754

Repsol

SA

963,605

0.6

117,067

Telefonica

SA

504,820

0.3

3,600,966

2.4

Switzerland

:

1.3%

9,723

Holcim

AG

715,221

0.5

3,221

Julius

Baer

Group

Ltd.

162,976

0.1

7,983

Novartis

AG,

Reg

779,207

0.5

1,154

Roche

Holding

AG

310,451

0.2

1,619

(2)

Sandoz

Group

AG

46,239

0.0

2,014,094

1.3

United

Kingdom

:

4.3%

77,976

BAE

Systems

PLC

1,034,533

0.7

153,960

BP

PLC

936,027

0.6

26,925

British

American

Tobacco

PLC

856,754

0.6

133,268

Centrica

PLC

251,148

0.2

3,853

DCC

PLC

260,478

0.2

23,595

GSK

PLC

423,943

0.3

37,332

Imperial

Brands

PLC

872,783

0.6

87,887

NatWest

Group

PLC

231,214

0.1

72,480

Sage

Group

PLC

1,037,093

0.7

15,399

Smiths

Group

PLC

321,297

0.2

165,668

Vodafone

Group

PLC

148,964

0.1

6,374,234

4.3

United

States

:

66.4%

15,211

AbbVie,

Inc.

2,165,894

1.5

974

Acuity

Brands,

Inc.

174,599

0.1

8,339

AECOM

741,004

0.5

82,157

AGNC

Investment

Corp.

724,625

0.5

13,354

Agree

Realty

Corp.

790,690

0.5

7,246

ALLETE,

Inc.

402,008

0.3

3,492

Allison

Transmission

Holdings,

Inc.

186,752

0.1

27,658

Altria

Group,

Inc.

1,162,742

0.8

86,450

Amcor

PLC

819,546

0.5

8,533

Amdocs

Ltd.

714,809

0.5

13,097

American

Electric

Power

Co.,

Inc.

1,041,866

0.7

8,085

American

International

Group,

Inc.

532,074

0.4

478

Ameriprise

Financial,

Inc.

168,978

0.1

4,956

AMETEK,

Inc.

769,320

0.5

6,440

Amgen,

Inc.

1,736,482

1.2

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

2,510

Aon

PLC

-

Class

A

$

824,510

0.6

6,192

AptarGroup,

Inc.

785,703

0.5

4,656

Assurant,

Inc.

782,301

0.5

3,552

Automatic

Data

Processing,

Inc.

816,676

0.5

16,730

Avnet,

Inc.

782,295

0.5

11,321

Axis

Capital

Holdings

Ltd.

637,825

0.4

21,831

Baker

Hughes

Co.

736,796

0.5

24,680

Bristol-Myers

Squibb

Co.

1,218,698

0.8

5,372

Brown

&

Brown,

Inc.

401,503

0.3

11,852

Cardinal

Health,

Inc.

1,269,112

0.9

4,953

Cheniere

Energy,

Inc.

902,189

0.6

8,439

Church

&

Dwight

Co.,

Inc.

815,461

0.5

3,018

Cigna

Group

793,372

0.5

937

Cintas

Corp.

518,395

0.3

36,260

Cisco

Systems,

Inc.

1,754,259

1.2

15,568

Citigroup,

Inc.

717,685

0.5

5,223

CME

Group,

Inc.

1,140,494

0.8

8,001

CNO

Financial

Group,

Inc.

212,027

0.1

8,475

Coca-Cola

Co.

495,279

0.3

13,198

Colgate-Palmolive

Co.

1,039,606

0.7

13,551

Commerce

Bancshares,

Inc.

685,274

0.5

24,083

Coterra

Energy,

Inc.

632,179

0.4

19,877

CSX

Corp.

642,027

0.4

12,765

CVS

Health

Corp.

867,382

0.6

20,107

Dow,

Inc.

1,040,537

0.7

13,148

DT

Midstream,

Inc.

753,249

0.5

7,313

DTE

Energy

Co.

761,356

0.5

11,284

Edison

International

755,915

0.5

8,027

Electronic

Arts,

Inc.

1,107,806

0.7

1,569

Elevance

Health,

Inc.

752,320

0.5

12,383

Emerson

Electric

Co.

1,100,849

0.7

4,164

EOG

Resources,

Inc.

512,464

0.3

56,038

Equitrans

Midstream

Corp.

525,636

0.4

2,613

Erie

Indemnity

Co.

-

Class

A

772,507

0.5

2,935

Essent

Group

Ltd.

141,878

0.1

2,388

Everest

Re

Group

Ltd.

980,393

0.7

13,318

Evergy,

Inc.

679,751

0.5

10,796

First

Hawaiian,

Inc.

212,141

0.1

7,313

Fortive

Corp.

504,451

0.3

17,229

Gaming

and

Leisure

Properties,

Inc.

805,111

0.5

15,420

General

Mills,

Inc.

981,637

0.7

5,193

General

Motors

Co.

164,099

0.1

21,908

Genpact

Ltd.

743,996

0.5

22,396

Gentex

Corp.

681,062

0.5

5,741

Genuine

Parts

Co.

762,290

0.5

16,850

Gilead

Sciences,

Inc.

1,290,710

0.9

15,036

H&R

Block,

Inc.

682,935

0.5

4,119

Hanover

Insurance

Group,

Inc.

511,992

0.3

13,031

Hartford

Financial

Services

Group,

Inc.

1,018,503

0.7

1,525

Humana,

Inc.

739,412

0.5

5,764

International

Bancshares

Corp.

258,631

0.2

6,930

Iridium

Communications,

Inc.

264,033

0.2

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Global

Advantage

and

Premium

Opportunity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

17,921

Johnson

&

Johnson

$

2,771,662

1.9

4,124

JPMorgan

Chase

&

Co.

643,674

0.4

29,559

Juniper

Networks,

Inc.

840,954

0.6

8,223

Kimberly-Clark

Corp.

1,017,432

0.7

9,119

Leidos

Holdings,

Inc.

978,651

0.7

7,528

LKQ

Corp.

335,222

0.2

485

Lockheed

Martin

Corp.

217,168

0.1

13,108

Loews

Corp.

921,361

0.6

5,727

Marsh

&

McLennan

Cos.,

Inc.

1,142,078

0.8

4,735

McDonald's

Corp.

1,334,512

0.9

2,170

McKesson

Corp.

1,021,115

0.7

21,874

Merck

&

Co.,

Inc.

2,241,648

1.5

7,126

MetLife,

Inc.

453,427

0.3

45,938

MGIC

Investment

Corp.

808,049

0.5

10,100

Mondelez

International,

Inc.

-

Class

A

717,706

0.5

8,446

MSC

Industrial

Direct

Co.,

Inc.

-

Class

A

822,809

0.6

21,029

National

Retail

Properties,

Inc.

854,198

0.6

834

(2)

NET

Lease

Office

Properties

13,636

0.0

8,272

NetApp,

Inc.

755,978

0.5

24,019

NiSource,

Inc.

615,847

0.4

10,178

NorthWestern

Corp.

512,055

0.3

1,081

NVIDIA

Corp.

505,584

0.3

8,553

OneMain

Holdings,

Inc.

361,792

0.2

9,644

ONEOK,

Inc.

663,989

0.4

15,298

Patterson

Cos.,

Inc.

388,722

0.3

11,785

PepsiCo,

Inc.

1,983,298

1.3

21,989

Pfizer,

Inc.

670,005

0.4

16,603

Philip

Morris

International,

Inc.

1,550,056

1.0

8,939

Phillips

66

1,152,148

0.8

9,683

Pinnacle

West

Capital

Corp.

725,644

0.5

3,149

PPG

Industries,

Inc.

447,127

0.3

12,759

Procter

&

Gamble

Co.

1,958,762

1.3

3,574

Qualcomm,

Inc.

461,225

0.3

3,446

Reinsurance

Group

of

America,

Inc.

561,905

0.4

2,837

Reliance

Steel

&

Aluminum

Co.

780,913

0.5

69,054

Rithm

Capital

Corp.

716,781

0.5

18,941

Rollins,

Inc.

771,656

0.5

9,997

Sempra

Energy

728,481

0.5

2,686

Sherwin-Williams

Co.

748,857

0.5

3,342

Snap-on,

Inc.

918,014

0.6

10,869

Sonoco

Products

Co.

599,534

0.4

14,211

SS&C

Technologies

Holdings,

Inc.

799,511

0.5

7,581

Synchrony

Financial

245,321

0.2

9,354

Texas

Instruments,

Inc.

1,428,449

1.0

3,768

TJX

Cos.,

Inc.

331,998

0.2

6,051

Travelers

Cos.,

Inc.

1,092,932

0.7

851

UnitedHealth

Group,

Inc.

470,577

0.3

16,547

Unum

Group

711,521

0.5

3,304

Valero

Energy

Corp.

414,189

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

States

(continued)

45,390

Verizon

Communications,

Inc.

$

1,739,799

1.2

24,700

VICI

Properties,

Inc.

738,283

0.5

12,663

Virtu

Financial,

Inc.

-

Class

A

227,681

0.2

13,769

Wells

Fargo

&

Co.

613,960

0.4

40,316

Wendy's

Co.

755,925

0.5

4,073

Willis

Towers

Watson

PLC

1,003,180

0.7

12,340

WP

Carey,

Inc.

768,042

0.5

17,005

Xcel

Energy,

Inc.

1,034,584

0.7

99,197,728

66.4

Total

Common

Stock

(Cost

$137,975,202)

145,833,454

97.6

EXCHANGE-TRADED

FUNDS

:

1.9%

18,238

iShares

MSCI

EAFE

Value

ETF

921,201

0.6

11,971

iShares

Russell

1000

Value

ETF

1,885,313

1.3

2,806,514

1.9

Total

Exchange-Traded

Funds

(Cost

$2,733,200)

2,806,514

1.9

Total

Long-Term

Investments

(Cost

$140,708,402)

148,639,968

99.5

SHORT-TERM

INVESTMENTS

:

0.7%

Mutual

Funds

:

0.7%

1,043,000

(3)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.260%

(Cost

$1,043,000)

$

1,043,000

0.7

Total

Short-Term

Investments

(Cost

$1,043,000)

1,043,000

0.7

Total

Investments

in

Securities

(Cost

$141,751,402)

$

149,682,968

100.2

Liabilities

in

Excess

of

Other

Assets

(319,443)

(0.2)

Net

Assets

$

149,363,525

100.0

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2023.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Global

Advantage

and

Premium

Opportunity

Fund

Sector

Diversification

Percentage

of

Net

Assets

Financials

21.9

%

Health

Care

14.5

Industrials

13.7

Consumer

Staples

9.7

Energy

7.3

Utilities

6.2

Information

Technology

5.9

Consumer

Discretionary

5.1

Communication

Services

5.1

Materials

4.9

Real

Estate

3.3

Exchange-Traded

Funds

1.9

Short-Term

Investments

0.7

Liabilities

in

Excess

of

Other

Assets

(0.2)

Net

Assets

100.0%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Global

Advantage

and

Premium

Opportunity

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Australia

$

—

$

4,340,734

$

—

$

4,340,734

Canada

4,901,499

—

—

4,901,499

China

—

737,190

—

737,190

Denmark

—

588,767

—

588,767

Finland

178,325

—

—

178,325

France

—

4,266,156

—

4,266,156

Germany

—

616,720

—

616,720

Hong

Kong

199,104

1,342,511

—

1,541,615

Israel

—

200,727

—

200,727

Italy

—

1,763,072

—

1,763,072

Japan

—

11,812,716

—

11,812,716

Jordan

—

289,713

—

289,713

Netherlands

—

2,092,883

—

2,092,883

New

Zealand

—

175,371

—

175,371

Norway

—

544,083

—

544,083

Singapore

—

596,861

—

596,861

Spain

—

3,600,966

—

3,600,966

Switzerland

46,239

1,967,855

—

2,014,094

United

Kingdom

—

6,374,234

—

6,374,234

United

States

99,197,728

—

—

99,197,728

Total

Common

Stock

104,522,895

41,310,559

—

145,833,454

Exchange-Traded

Funds

2,806,514

—

—

2,806,514

Short-Term

Investments

1,043,000

—

—

1,043,000

Total

Investments,

at

fair

value

$

108,372,409

$

41,310,559

$

—

$

149,682,968

Other

Financial

Instruments+

Forward

Foreign

Currency

Contracts

—

206,605

—

206,605

Total

Assets

$

108,372,409

$

41,517,164

$

—

$

149,889,573

Liabilities

Table

Other

Financial

Instruments+

Forward

Foreign

Currency

Contracts

$

—

$

(436,957)

$

—

$

(436,957)

Written

Options

—

(3,217,482)

—

(3,217,482)

Total

Liabilities

$

—

$

(3,654,439)

$

—

$

(3,654,439)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

At

November

30,

2023,

the

following

forward

foreign

currency

contracts

were

outstanding

for

Voya

Global

Advantage

and

Premium

Opportunity

Fund:

Currency

Purchased

Currency

Sold

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

USD

12,132,361

JPY

1,767,800,000

Standard

Chartered

Bank

12/19/23

$

178,225

USD

4,893,545

CAD

6,600,000

State

Street

Bank

and

Trust

Co.

12/19/23

28,380

USD

4,395,110

AUD

6,800,000

State

Street

Bank

and

Trust

Co.

12/19/23

(100,328)

USD

6,816,042

GBP

5,500,000

State

Street

Bank

and

Trust

Co.

12/19/23

(128,491)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Global

Advantage

and

Premium

Opportunity

Fund

Currency

Purchased

Currency

Sold

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

USD

12,536,550

EUR

11,700,000

State

Street

Bank

and

Trust

Co.

12/19/23

$

(208,138)

$

(230,352)

At

November

30,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Global

Advantage

and

Premium

Opportunity

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

Consumer

Staples

Select

Sector

SPDR

Fund

JPMorgan

Chase

Bank

N.A.

Call

12/29/23

USD

70.180

119,442

USD

8,439,771

$

74,699

$

(132,763)

Financial

Select

Sector

SPDR

Fund

Citibank

N.A.

Call

12/01/23

USD

32.520

698,758

USD

25,085,412

540,000

(2,362,630)

FTSE

100

Index

UBS

AG

Call

12/15/23

GBP

7,491.910

1,685

GBP

12,559,569

180,637

(108,097)

Health

Care

Select

Sector

SPDR

Fund

UBS

AG

Call

12/01/23

USD

129.340

77,307

USD

10,151,182

174,490

(155,296)

Industrial

Select

Sector

SPDR

Fund

Citibank

N.A.

Call

12/29/23

USD

106.670

101,316

USD

10,845,878

131,072

(181,402)

Nikkei

225

Index

BNP

Paribas

Call

12/15/23

JPY

32,269.390

31,584

JPY

1,057,649,934

138,888

(277,294)

$

1,239,786

$

(3,217,482)

Currency

Abbreviations:

AUD

—

Australian

Dollar

CAD

—

Canadian

Dollar

EUR

—

EU

Euro

GBP

—

British

Pound

JPY

—

Japanese

Yen

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

13,751,650

Gross

Unrealized

Depreciation

(5,820,084)

Net

Unrealized

Appreciation

$

7,931,566

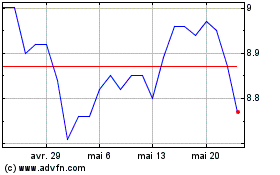

Voya Global Advantage an... (NYSE:IGA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

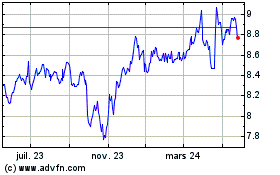

Voya Global Advantage an... (NYSE:IGA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024