false

0001839839

0001839839

2024-12-16

2024-12-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 16, 2024

JANUS INTERNATIONAL GROUP, INC.

(Exact name of Registrant as Specified in

Its Charter)

| Delaware |

|

001-40456 |

|

86-1476200 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS

Employer

Identification No.) |

135 Janus International Blvd., Temple, GA 30179

(Address of Principal

Executive Offices, Zip Code)

Registrant’s

Telephone Number, Including Area Code: (866)

562-2580

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

JBI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

December 16, 2024 (the “Grant Date”), the Compensation Committee (the “Committee”) of the Board of Directors of

Janus International Group, Inc. (the “Company”) approved the grant of a special, one-time award of performance stock units

to Ramey Jackson, Chief Executive Officer, Anselm Wong, Executive Vice President and Chief Financial Officer, Morgan Hodges, Executive

Vice President, and Vic Nettie, Vice President of Manufacturing (and to certain other key employees) under the Company’s 2021 Omnibus

Incentive Plan (the “Plan”) (the “Special PSU Awards”). The Special PSU Awards granted to Messrs. Jackson,

Wong, Hodges and Nettie have a grant date target value of $2,000,000, $750,000, $500,000 and $500,000, respectively. The Committee approved

the Special PSU Awards for the purposes of: (i) promoting the motivation, commitment, and focus of the grantees on achieving financial

performance objectives that are important to the Company’s success, (ii) providing retention incentives for the grantees, and (iii)

increasing the alignment of the interests of the grantees with the interests of the Company’s stockholders.

Vesting of the Special PSU Awards is contingent upon the Company’s

level of achievement with respect to two equally-weighted performance metrics, cumulative adjusted EBITDA and cumulative revenue, measured

over a two year performance period consisting of fiscal years 2025 and 2026, as well as the grantee’s continued employment until

the date of the Committee’s certification of the achievement of those performance metrics. The number of performance stock units

vesting pursuant to the Special PSU Awards, if any, may range from 0% to 200% of the target number of performance stock units, depending

on the level of performance achieved.

The foregoing description of the terms of the Special PSU Awards is

a summary only, does not purport to be a complete description, and is qualified in its entirety by reference to the full text of the form

of performance stock unit agreement for the Special PSU Awards, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and

is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL

document) |

* Management compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

JANUS INTERNATIONAL GROUP, INC. |

| |

|

|

| Date: |

December 17, 2024 |

By: /s/ Ramey Jackson |

| |

|

Name: Ramey Jackson |

| |

|

Chief Executive Officer |

Exhibit 10.1

Form (December 2024 Special Award)

Janus

International Group, INC.

2021 OMNIBUS INCENTIVE PLAN

PERFORMANCE STOCK UNIT GRANT NOTICE

Pursuant to the terms and

conditions of the Janus International Group, Inc. 2021 Omnibus Incentive Plan, as amended, restated or otherwise modified from time to

time (the “Plan”), Janus International Group, Inc., a Delaware corporation (the “Company”),

hereby grants to the individual listed below (“Participant”) the target number of performance stock units (the “PSUs”)

set forth below. This award of PSUs (this “Award”) is subject to the terms and conditions set forth herein and

in the Performance Stock Unit Agreement attached hereto as Exhibit A (the “Agreement”), which is incorporated

herein by reference. Capitalized terms used but not defined herein shall have the meanings set forth in the Plan.

| Grant Date: |

December [Date], 2024 |

| Target Number of PSUs: |

[Number of PSUs] (the “Target PSUs”) |

| Vesting Schedule: |

Subject to the terms and conditions set forth in the Plan, the Agreement and herein, the number of Target PSUs, if any, that become Earned

PSUs (as defined below) will be determined in accordance with Exhibit B. Participant’s right to receive settlement

of this Award in an amount ranging from 0% to 200% of the Target PSUs shall vest and become earned and nonforfeitable upon (i) Participant’s

satisfaction of the continued employment requirement described below under “Continued Employment Requirement” and (ii) the

Committee’s certification of the level of achievement of the performance metrics in accordance with Exhibit B. The portion

of the Target PSUs actually earned upon satisfaction of the foregoing requirements is referred to herein as the “Earned PSUs”. |

|

Continued Employment Requirement:

|

Except as expressly provided in Exhibit B, Participant must remain continuously employed by the Company or an Affiliate from the Grant Date through the Certification Date (as defined in Exhibit B). |

By Participant’s

signature below, Participant agrees to be bound by the terms of this Grant Notice (including all exhibits thereto), the Plan and the

Agreement. Participant has reviewed the Plan, this Grant Notice and the Agreement in their entirety, has had an opportunity to

obtain the advice of counsel prior to executing this Grant Notice and fully understands all provisions of the Plan, this Grant

Notice and the Agreement. Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of

the Committee upon any questions arising under the Plan, this Grant Notice or the Agreement. This Grant Notice may be executed in

one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which shall be deemed to be

an original, but all of which together shall constitute one and the same agreement.

Notwithstanding any provision

of this Grant Notice or the Agreement, if Participant has not executed this Grant Notice within 90 days following the Grant Date set forth

above, Participant will be deemed to have accepted this Award, subject to all of the terms and conditions of this Grant Notice, the Agreement

and the Plan.

[Signature Page Follows]

IN WITNESS WHEREOF, the Company has caused

this Grant Notice to be executed by an officer thereunto duly authorized, and Participant has executed this Grant Notice, effective for

all purposes as provided above.

| JANUS

INTERNATIONAL |

|

|

| GROUP,

INC. |

|

PARTICIPANT |

| |

|

|

| By: |

|

|

|

| Name: |

|

|

|

| Title: |

|

|

|

Exhibit A

PERFORMANCE STOCK UNIT AGREEMENT

Capitalized terms not specifically

defined in this Agreement have the meanings specified in the Grant Notice or, if not defined in the Grant Notice, in the Plan.

Article

I.

GENERAL

1.1 Award

of PSUs. The Company has granted the PSUs to Participant effective as of the grant date set forth in the Grant Notice (the “Grant

Date”). Each PSU represents the right to receive one Share as set forth in this Agreement. Participant will have no right to

the distribution of any Shares or payment of any cash until the time (if ever) the PSUs have vested.

1.2 Incorporation

of Terms of Plan. The PSUs are subject to the terms and conditions set forth in this Agreement and the Plan, which is incorporated

herein by reference. In the event of any inconsistency between the Plan and this Agreement, the terms of the Plan will control.

1.3 Unsecured

Promise. The PSUs will at all times prior to settlement represent an unsecured Company obligation payable only from the Company’s

general assets.

Article

II.

VESTING; FORFEITURE AND SETTLEMENT

2.1 Vesting;

Forfeiture. The PSUs will vest according to the vesting terms set forth in the Grant Notice.

2.2 Forfeiture.

In the event of Participant’s Termination of Service for any reason, any PSUs that have not yet settled in accordance with Section

2.4 will immediately and automatically be cancelled and forfeited as of the date of such Termination of Service at no cost to the Company,

except as otherwise determined by the Committee or provided in a binding written agreement between Participant and the Company.

2.3 Settlement.

As soon as administratively practicable following the end of the Performance Period (as defined in Exhibit B) but in no event

later than 60 days following the Certification Date (as defined in Exhibit B), the Company shall deliver to Participant a number

of Shares equal to the number of Earned PSUs, if any, that become vested (provided that the Participant has not incurred a Termination

of Service prior to such settlement date). All Shares issued hereunder shall be delivered either

by delivering one or more certificates for such shares to Participant or by entering such shares in book-entry form, as determined by

the Committee in its sole discretion. The value of Shares shall not bear any interest owing to the passage of time.

2.4 Clawback.

Notwithstanding any other provision of the Plan, the Grant Notice or this Agreement to the contrary, in the event of Participant’s

Termination of Service for Cause, in addition to and without limiting the remedies set forth in the Plan:

(a)

All PSUs that have not been settled as of the date of such Termination of Service (and all rights arising from such PSUs and from

being a holder thereof) will terminate automatically without any further action by the Company and will be forfeited without further notice

and at no cost to the Company; and

(b)

Participant shall, within 30 days following the date of such Termination of Service, pay to the Company a cash amount equal to

(i) the Fair Market Value of any shares of Common Stock previously received by Participant pursuant to this Award within 4 years prior

to such Termination of Service as of the date of receipt of such shares, plus (ii) the gross amount of any payment(s) previously received

in respect of Dividend Equivalents pursuant to this Award.

Article

III.

DIVIDEND EQUIVALENTS

3.1 In

the event that the Company declares and pays a dividend in respect of its outstanding Shares and, on the record date for such dividend,

Participant holds PSUs granted pursuant to this Agreement that have not been settled, the Company shall record the amount of such dividend

in a bookkeeping account and pay to Participant an amount in cash equal to the cash dividends Participant would have received if Participant

was the holder of record, as of such record date, of a number of Shares equal to the number of PSUs that become Earned PSUs, such payment

to be made on the date on which the PSUs are settled in accordance with Section 2.3 (the “Dividend Equivalents”).

For purposes of clarity, if the PSUs (or any portion thereof) are forfeited by Participant pursuant to the terms of this Agreement, then

Participant shall also forfeit the Dividend Equivalents, if any, accrued with respect to such forfeited PSUs. No interest will accrue

on the Dividend Equivalents between the declaration and payment of the applicable dividends and the settlement of the Dividend Equivalents.

Article

IV.

TAXATION AND TAX WITHHOLDING

4.1 Representation.

Participant represents to the Company that Participant has reviewed with Participant’s own tax advisors the tax consequences of

this Award and the transactions contemplated by the Grant Notice and this Agreement. Participant is relying solely on such advisors and

not on any statements or representations of the Company or any of its agents.

4.2 Tax

Withholding. To the extent that the receipt, vesting or settlement of this Award results in compensation income or wages to Participant

for federal, state, local and/or foreign tax purposes, Participant shall make arrangements satisfactory to the Company regarding the

payment of, any income tax, social insurance contribution or other applicable taxes that are required to be withheld in respect of this

Award, which arrangements include the delivery of cash or cash equivalents, Shares (including previously owned Shares (which is not subject

to any pledge or other security interest), net settlement, a broker-assisted sale, or other cashless withholding or reduction of the

amount of shares otherwise issuable or delivered pursuant to this Award), other property, or any other legal consideration the Committee

deems appropriate. If such tax obligations are satisfied through net settlement or the surrender of previously owned Shares, the maximum

number of Shares that may be so withheld (or surrendered) shall be the number of Shares that have an aggregate Fair Market Value on the

date of withholding or surrender equal to the aggregate amount of such tax liabilities determined based on the greatest withholding rates

for federal, state, local and/or foreign tax purposes, including payroll taxes, that may be utilized without creating adverse accounting

treatment for the Company with respect to this Award, as determined by the Committee. Any fraction of a Share required to satisfy such

tax obligations shall be disregarded and the amount due shall be paid instead in cash to Participant. Participant acknowledges that there

may be adverse tax consequences upon the receipt, vesting or settlement of this Award or disposition of the underlying shares and that

Participant has been advised, and hereby is advised, to consult a tax advisor. Participant represents that Participant is in no manner

relying on the Board, the Committee, the Company or an Affiliate or any of their respective managers, directors, officers, employees

or authorized representatives (including attorneys, accountants, consultants, bankers, lenders, prospective lenders and financial representatives)

for tax advice or an assessment of such tax consequences.

Article

V.

OTHER PROVISIONS

5.1 Adjustments.

Participant acknowledges that the PSUs and the Shares subject to the PSUs are subject to adjustment, modification and termination in

certain events as provided in this Agreement and the Plan.

5.2 Notices.

All notices and other communications under this Agreement shall be in writing and shall be delivered to the parties at the following

addresses (or at such other address for a party as shall be specified by like notice):

If to the Company, unless

otherwise designated by the Company in a written notice to Participant (or other holder):

Janus International Group,

Inc.

Attn: General Counsel

135 Janus International

Blvd.

Temple, GA 30179

If to Participant, at Participant’s

last known address on file with the Company. Any notice that is delivered personally or by overnight courier or telecopier in the manner

provided herein shall be deemed to have been duly given to Participant when it is mailed by the Company or, if such notice is not mailed

to Participant, upon receipt by Participant. Any notice that is addressed and mailed in the manner herein provided shall be conclusively

presumed to have been given to the party to whom it is addressed at the close of business, local time of the recipient, on the fourth

day after the day it is so placed in the mail.

5.3 Titles.

Titles are provided herein for convenience only and are not to serve as a basis for interpretation or construction of this Agreement.

5.4 Conformity

to Securities Laws. Participant acknowledges that the Plan, the Grant Notice and this Agreement are intended to conform to the extent

necessary with all Applicable Laws and, to the extent Applicable Laws permit, will be deemed amended as necessary to conform to Applicable

Laws.

5.5 Successors

and Assigns. The Company may assign any of its rights under this Agreement to single or multiple assignees, and this Agreement will

inure to the benefit of the successors and assigns of the Company. Subject to the restrictions on transfer set forth in the Plan, this

Agreement will be binding upon and inure to the benefit of the heirs, legatees, legal representatives, successors and assigns of the

parties hereto.

5.6 Limitations

Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if Participant is subject to

Section 16 of the Exchange Act, the Plan, the Grant Notice, this Agreement, the PSUs will be subject to any additional limitations set

forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3) that are requirements

for the application of such exemptive rule. To the extent Applicable Laws permit, this Agreement will be deemed amended as necessary

to conform to such applicable exemptive rule.

5.7 Entire

Agreement. The Plan, the Grant Notice and this Agreement (in each case, including the exhibits hereto) constitute the entire agreement

of the parties and supersede in their entirety all prior undertakings and agreements of the Company and Participant with respect to the

subject matter hereof; provided¸ however, that the terms of this Agreement shall not modify and shall be subject to the terms and

conditions of any employment, consulting and/or severance agreement between the Company or an Affiliate and Participant in effect as

of the date a determination is to be made under this Agreement.

5.8 Agreement

Severable. In the event that any provision of the Grant Notice or this Agreement is held illegal or invalid, the provision will be

severable from, and the illegality or invalidity of the provision will not be construed to have any effect on, the remaining provisions

of the Grant Notice or this Agreement.

5.9 Limitation

on Participant’s Rights. Participation in the Plan confers no rights or interests other than as herein provided. This Agreement

creates only a contractual obligation on the part of the Company as to amounts payable and may not be construed as creating a trust.

Neither the Plan nor any underlying program, in and of itself, has any assets. Participant will have only the rights of a general unsecured

creditor of the Company with respect to amounts credited and benefits payable, if any, with respect to the PSUs, and rights no greater

than the right to receive cash or the Shares as a general unsecured creditor with respect to the PSUs, as and when settled pursuant to

the terms of this Agreement.

5.10 Non-Transferability.

During the lifetime of Participant, the PSUs may not be sold, pledged, assigned or transferred in any manner other than by will or the

laws of descent and distribution, unless and until the Shares underlying the PSUs have been issued, and all restrictions applicable to

such Shares have lapsed. Neither the PSUs nor any interest or right therein shall be liable for the debts, contracts or engagements of

Participant or his or her successors in interest or shall be subject to disposition by transfer, alienation, anticipation, pledge, encumbrance,

assignment or any other means whether such disposition be voluntary or involuntary or by operation of law by judgment, levy, attachment,

garnishment or any other legal or equitable proceedings (including bankruptcy), and any attempted disposition thereof shall be null and

void and of no effect, except to the extent that such disposition is permitted by the preceding sentence.

5.11 Legends.

If a stock certificate is issued with respect to the Shares delivered hereunder, such certificate shall bear such legend or legends as

the Committee deems appropriate in order to reflect the restrictions set forth in this Agreement and to ensure compliance with the terms

and provisions of this Agreement, the rules, regulations and other requirements of the Securities and Exchange Commission and any other

Applicable Laws. If the Shares issued hereunder are held in book-entry form, then such entry will reflect that the Shares are subject

to the restrictions set forth in this Agreement.

5.12 No

Right to Continued Service or Awards. Nothing in the Plan, the Grant Notice or this Agreement confers upon Participant any right

to continue in the service of the Company or any Affiliate or interferes with or restricts in any way the rights of the Company and its

Subsidiaries, which rights are hereby expressly reserved, to discharge or terminate the services of Participant at any time for any reason

whatsoever, with or without Cause, except to the extent expressly provided otherwise in a written agreement between the Company or an

Affiliate and Participant. The grant of the PSUs is a one-time benefit and does not create any contractual or other right to receive

a grant of Awards or benefits in lieu of Awards in the future. Any future Awards will be granted at the sole discretion of the Company.

5.13 Satisfaction

of Claims. Any issuance or transfer of Shares or other property to Participant or Participant’s legal representative, heir,

legatee or distribute, in accordance with the Plan, the Grant Notice and this Agreement shall be in full satisfaction of all claims of

such person hereunder.

5.14 Counterparts.

The Grant Notice may be executed in one or more counterparts, including by way of any electronic signature, subject to Applicable Law,

each of which will be deemed an original and all of which together will constitute one instrument.

5.15 Company

Recoupment of Awards. Participant’s rights with respect to this Award shall in all events be subject to (a) any right that

the Company may have under any Company recoupment policy or other agreement or arrangement with Participant, or (b) any right or obligation

that the Company may have regarding the clawback of “incentive-based compensation” under Section 10D of the Exchange Act

and any applicable rules and regulations promulgated thereunder from time to time by the U.S. Securities and Exchange Commission.

5.16 Governing

Law. THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE APPLICABLE TO CONTRACTS

MADE AND TO BE PERFORMED THEREIN, EXCLUSIVE OF THE CONFLICT OF LAWS PROVISIONS OF DELAWARE LAW.

5.17 Section

409A. Notwithstanding anything herein or in the Plan to the contrary, the PSUs granted pursuant to this Agreement are intended to

be exempt from the applicable requirements of Section 409A of the Code and shall be limited, construed and interpreted in accordance

with such intent Nevertheless, to the extent that the Committee determines that the PSUs may not be exempt from Section 409A of the Code,

then, if Participant is deemed to be a “specified employee” within the meaning of Section 409A of the Code, as determined

by the Committee, at a time when Participant becomes eligible for settlement of the PSUs upon his or her “separation from service”

within the meaning of Section 409A of the Code, then to the extent necessary to prevent any accelerated or additional tax under Section

409A of the Code, such settlement will be delayed until the earlier of: (a) the date that is six months following Participant’s

separation from service and (b) Participant’s death. Notwithstanding the foregoing, the Company and its Affiliates make no representations

that the PSUs provided under this Agreement are exempt from or compliant with Section 409A of the Code and in no event shall the Company

or any Affiliate be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by Participant

on account of non-compliance with Section 409A of the Code.

* * * * *

Exhibit B

VESTING SCHEDULE AND PERFORMANCE METRICS

Article

I.

GENERAL TERMS

1.1 General.

This Exhibit B contains the performance vesting conditions and methodology applicable to the PSUs. Subject to the terms and conditions

set forth in the Grant Notice, the Plan and the Agreement, the portion of the Target PSUs subject to this Award that become vested, if

any, with respect to the Performance Period will be determined upon the Committee’s certification of achievement of the performance

criteria in accordance with this Exhibit B (the “Certification Date”). Any PSUs that do not vest hereunder

shall be terminated and forfeited without consideration as of the end of the Performance Period. Except as specifically set forth in

this Exhibit B, all PSUs shall immediately and automatically be cancelled and forfeited without consideration upon Participant’s

Termination of Service that occurs before the end of the Performance Period.

1.2 Vesting

Requirements.

(a)

General. On the Certification Date, the Committee shall determine the Company’s Cumulative Adjusted EBITDA and Cumulative

Revenue for the Performance Period and the portion or multiple of the Target PSUs (if any) that shall become vested on the Certification

Date, in accordance with the Performance Vesting Schedule set out below.

| Performance Vesting Schedule |

| Performance Metric |

Weighting |

Performance Goal

Achievement Levels |

Percentage of

Weighted Number

of Target PSUs that

Vest |

| Cumulative Adjusted EBITDA |

50% |

115% or more of Target Cumulative Adjusted EBITDA (maximum) |

200% |

| 100% of Target Cumulative Adjusted EBITDA (target) |

100% |

| 80% of Target Cumulative Adjusted EBITDA (threshold) |

50% |

|

Less than 80% of Target Cumulative Adjusted EBITDA

(below threshold) |

0% |

| Cumulative Revenue |

50% |

115% or more of Target Cumulative Revenue (maximum) |

200% |

| 100% of Target Cumulative Revenue (target) |

100% |

| 80% of Target Cumulative Revenue (threshold) |

50% |

|

Less than 80% of Target Cumulative Revenue

(below threshold) |

0% |

(b) Interpolation.

To the extent that the Cumulative Adjusted EBITDA or Cumulative Revenue for the Performance Period is between the threshold and target

levels, or between the target and maximum levels set forth in the Performance Vesting Schedule above, the applicable portion of the Target

PSUs that shall vest shall be determined on a pro rata basis using straight-line interpolation. In no event shall the maximum portion

of the Target PSUs that may vest hereunder exceed 200% of the Target PSUs. Further, in no event will any portion of the allocable Target

PSUs become vested to the extent that the Cumulative Adjusted EBITDA or Cumulative Revenue for the Performance Period is below the applicable

threshold level set forth in the Performance Vesting Schedule above, and all rights arising from such PSUs shall immediately and automatically

be cancelled and forfeited without consideration and Participant shall have no further rights with respect to the forfeited PSUs.

1.3 Change

in Control.

(a) Notwithstanding

any provision contained in this Exhibit B to the contrary, in the event a Change in Control is consummated prior to the end

of the Performance Period and the PSUs are not Assumed (as defined below), any unvested PSUs outstanding as of immediately prior to

the consummation of such Change in Control will automatically vest upon the consummation of the Change in Control in an amount equal

to the greater of (i) the Target PSUs and (ii) the portion of the Target PSUs that would have vested based on actual achievement of

Cumulative Adjusted EBITDA and Cumulative Revenue if the Performance Period ended as of the Change in Control.

(b)

Notwithstanding any provision contained in this Exhibit B to the contrary, in the event a Change in Control is consummated

prior to the end of the Performance Period and the PSUs are Assumed, but Participant incurs a Termination of Service within one (1) year

following the consummation of a Change in Control due to (i) an involuntary termination without Cause (and not due to Participant’s

death or Disability), or (ii) Participant’s resignation for Good Reason, any unvested PSUs outstanding as of immediately prior to

such Termination of Service will automatically vest in an amount equal to the greater of (i) the Target PSUs and (ii) the portion of the

Target PSUs that would otherwise be vested based on actual achievement of Cumulative Adjusted EBITDA and Cumulative Revenue if the Performance

Period ended as of the Change in Control.

For purposes of this Section

1.3, “Assumed” means that all of the following conditions are met with respect to the PSUs that remain outstanding as of a

Change in Control: (a) such PSUs are converted into a replacement award that preserves their value at the time of the Change in Control,

(b) the replacement award contain provisions for vesting and treatment upon Termination of Service (including the definition of Cause)

that are no less favorable to Participant than applicable to the PSUs, and all other terms of the replacement award (other than the security

and number of shares represented by the replacement awards) are substantially similar to, or more favorable to Participant than, the terms

of this Agreement and the Grant Notice and (c) the security represented by the replacement awards is of a class that is publicly held

and traded on The New York Stock Exchange or The Nasdaq Stock Market LLC.

1.4 Definitions.

(a)

“Adjusted EBITDA” means, with respect to each applicable fiscal year of the Company, the Company’s consolidated

earnings before interest, taxes, depreciation and amortization, as calculated by the Committee, all as determined in accordance with U.S.

generally accepted accounting principles consistently applied, as adjusted. In connection with any Adjusted EBITDA determination required

hereunder, the Committee may exclude, or adjust to reflect, the impact of any event or occurrence that the Committee determines in

its sole discretion should be appropriately excluded or adjusted, including (A) restructurings, discontinued operations, extraordinary

items or events (including acquisitions and divestitures), and other unusual or non-recurring charges (including expenses incurred with

acquisitions and divestitures, and expenses associated with compensatory equity grants), (B) an event either not directly related to the

operations of the Company or not within the reasonable control of the Company’s management, (C) losses incurred as a result of any

goodwill impairment or (D) a change in tax law or accounting standards required by U.S. generally accepted accounting principles.

(b) “Cumulative Adjusted EBITDA” means the cumulative Adjusted EBITDA achieved by the Company during the Performance

Period, as determined by the Committee in its sole discretion.

(c)

“Cumulative Revenue” means the cumulative Revenue achieved by the Company during the Performance Period, as

determined by the Committee in its sole discretion.

(d)

“Good Reason” means Participant’s resignation due to the occurrence of any of the following events, unless

Participant consents to the applicable event: (i) a material diminution in authority, duties, or responsibilities of Participant, as compared

to the authority, duties, or responsibilities of Participant immediately before the applicable Change in Control; (ii) a requirement that

Participant relocate his or her principal place of employment by more than fifty (50) miles from Participant’s principal place of

employment immediately before the applicable Change in Control; or (iii) a reduction of the sum of the Participant’s base salary

and target annual bonus opportunity by more than ten percent (10%) compared to the rates in effect immediately before the applicable Change

in Control (or such higher rates as may have been in effect after such Change in Control); provided, that a general reduction in base

salaries and/or target annual bonus opportunities that applies to similarly situated executives or managers shall not constitute Good

Reason under this Agreement. Notwithstanding the foregoing, any assertion by Participant of a resignation for Good Reason will not be

effective unless and until the following conditions are met: (A) Participant must provide written notice to the Company (in accordance

with Section 5.2 of the Agreement) of the existence of the circumstances underlying the Good Reason event within thirty (30) days of the

initial existence of such grounds, (B) the Company fails to cure such circumstances within thirty (30) days of receiving such notice,

and (C) Participant actually terminates his or her employment no later than ninety (90) days after the first occurrence of the circumstances

underlying the Good Reason event if such circumstances are not cured by the Company in accordance with the foregoing.

(e)

“Performance Period” shall be the two fiscal year period from December 29, 2024 through January 2, 2027.

(f) “Revenue” means the Company’s total revenue, as reported in the Company’s financial statements for

the applicable fiscal year in accordance with U.S. generally accepted accounting principles; provided that, in connection with any Revenue

determination required hereunder, the Committee may exclude, or adjust to reflect, the impact of any event or occurrence that the

Committee determines in its sole discretion should be appropriately excluded or adjusted, including (i) restructurings, discontinued operations,

extraordinary items or events (including acquisitions and divestitures), and other unusual or non-recurring events, (ii) an event either

not directly related to the operations of the Company or not within the reasonable control of the Company’s management, or (iii)

a change in tax law or accounting standards required by U.S. generally accepted accounting principles.

(g)

“Target Cumulative Adjusted EBITDA” means Cumulative Adjusted EBITDA equal to [Percentage]% of Adjusted EBITDA actually

achieved for the Company’s 2024 fiscal year, as determined by the Committee in its sole discretion.

(h)

“Target Cumulative Revenue” means Cumulative Revenue equal to [Percentage]% of Revenue actually achieved for the

Company’s 2024 fiscal year, as determined by the Committee in its sole discretion.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

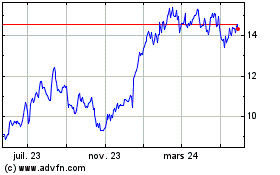

Janus (NYSE:JBI)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

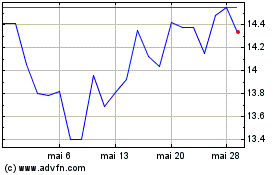

Janus (NYSE:JBI)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025