Filed by John Bean Technologies Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Companies:

John Bean

Technologies Corporation

(Commission File No. 001-34036)

Marel hf.

JBT & MAREL FIRESIDE DISCUSSION December 11, 2024

Forward-Looking and Non-GAAP Statements This presentation contains

forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are information of a non-historical nature and are subject to risks and uncertainties that are beyond JBT’s ability to

control. These forward-looking statements include, among others, statements relating to our business and our results of operations, a potential transaction with Marel, our strategic plans, our restructuring plans and expected cost savings from those

plans, and our liquidity. The factors that could cause our actual results to differ materially from expectations include, but are not limited to, the following factors: the occurrence of any event, change or other circumstances that could give rise

to the termination or abandonment of the voluntary takeover offer to acquire all issued and outstanding shares of Marel (the “Offer”); the expected timing and likelihood of completion of the proposed transaction with Marel, including the

timing, receipt and terms and conditions of any required governmental and regulatory approvals for the Offer that could reduce anticipated benefits or cause the parties to abandon the transaction; the risk that Marel and/or JBT may not be able to

satisfy the conditions to the Offer in a timely manner or at all; the risk that the Offer and its announcement could have an adverse effect on the ability of JBT and Marel to retain customers and retain and hire key personnel and maintain

relationships with their suppliers and customers, and on their operating results and businesses generally; the risk that problems may arise in successfully integrating the businesses of Marel and JBT, which may result in the combined company not

operating as effectively and efficiently as expected; the risk that the combined company may be unable to achieve cost-cutting synergies or that it may take longer than expected to achieve those synergies; fluctuations in our financial results;

unanticipated delays or accelerations in our sales cycles; deterioration of economic conditions, including impacts from supply chain delays and reduced material or component availability; inflationary pressures, including increases in energy, raw

material, freight and labor costs; disruptions in the political, regulatory, economic and social conditions of the countries in which we conduct business; changes to trade regulation, quotas, duties or tariffs; fluctuations in currency exchange

rates; changes in food consumption patterns; impacts of pandemic illnesses, food borne illnesses and diseases to various agricultural products; weather conditions and natural disasters; the impact of climate change and environmental protection

initiatives; acts of terrorism or war, including the ongoing conflicts in Ukraine and the Middle East; termination or loss of major customer contracts and risks associated with fixed-price contracts, particularly during periods of high inflation;

customer sourcing initiatives; competition and innovation in our industries; our ability to develop and introduce new or enhanced products and services and keep pace with technological developments; difficulty in developing, preserving and

protecting our intellectual property or defending claims of infringement; catastrophic loss at any of our facilities and business continuity of our information systems; cyber-security risks such as network intrusion or ransomware schemes; loss of

key management and other personnel; potential liability arising out of the installation or use of our systems; our ability to comply with U.S. and international laws governing our operations and industries; increases in tax liabilities; work

stoppages; fluctuations in interest rates and returns on pension assets; a systemic failure of the banking system in the United States or globally impacting our customers’ financial condition and their demand for our goods and services;

availability of and access to financial and other resources; the risk factors discussed in our proxy statement/prospectus filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”), on June 25, 2024

(the “Proxy Statement/Prospectus”), forming part of the Registration Statement on Form S-4 (File No. 333-279438) (the “Registration Statement”), initially filed by us on May 15, 2024 and declared effective on June 25, 2024;

and other factors described under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in JBT’s most recent Annual Report on Form 10-K filed with

the U.S. Securities and Exchange Commission (the “SEC”) and in any subsequently filed Quarterly Reports on Form 10-Q. JBT cautions shareholders and prospective investors that actual results may differ materially from those indicated by

the forward-looking statements. JBT undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future developments, subsequent events or changes in circumstances or otherwise. JBT

provides non-GAAP financial measures in order to increase transparency in our operating results and trends. These non-GAAP measures eliminate certain costs or benefits from, or change the calculation of, a measure as calculated under U.S. GAAP. By

eliminating these items, JBT provides a more meaningful comparison of our ongoing operating results, consistent with how management evaluates performance. Management uses these non-GAAP measures in financial and operational evaluation, planning and

forecasting. These calculations may differ from similarly-titled measures used by other companies. The non-GAAP financial measures disclosed are not intended to be used as a substitute for, nor should they be considered in isolation of, financial

measures prepared in accordance with U.S. GAAP. 2

Important Additional Information Important Notices This presentation is not

intended to and does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such jurisdiction. In particular, this presentation is not an offer of securities for sale in the United States, Iceland, the Netherlands or Denmark. Note to U.S. Shareholders It is

important that U.S. shareholders understand that the Offer and any related offer documents are subject to disclosure and takeover laws and regulations in Iceland and other European jurisdictions, which may be different from those of the United

States. The Offer will be made in compliance with the U.S. tender offer rules, including Regulation 14E under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and any exemption available to JBT in respect of

securities of foreign private issuers provided by Rule 14d-1(d) under the Exchange Act. Important Additional Information No offer of JBT securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, or an exemption from registration, and applicable European regulations, including the Icelandic Prospectus Act no. 14/2020 and the Icelandic Takeover Act no. 108/2007 on takeovers. In connection with the Offer,

JBT filed with the SEC a registration statement on Form S-4 (File No. 333-279438) (the “Registration Statement”) that included a proxy statement/prospectus (the “Proxy Statement/Prospectus”). The Registration Statement was

declared effective by the SEC on June 25, 2024. Additionally, JBT filed with the Financial Supervisory Authority of the Central Bank of Iceland (the “FSA”) an offer document and a prospectus, which have been approved by the FSA and which

have been published. SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE PROSPECTUS, AND THE OFFER DOCUMENT, AS APPLICABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE

SEC OR THE FSA CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the Proxy Statement/Prospectus, as well as other filings containing information about JBT, without

charge, at the SEC’s website at www.sec.gov, and on JBT’s website at https://ir.jbtc.com/overview/default.aspx. You may obtain a free copy of the prospectus on the FSA’s website at www.fme.is and on JBT’s website at

https://www.jbtc.com/jbt-marel-offer- launch/ as well as a free copy of the offer document. 3

Presenters Brian Deck Arni Sigurdsson Matt Meister President and Chief

Executive Officer, Chief Executive Officer, EVP and Chief Financial Officer, JBT Marel JBT 4

Strategic Rationale for Combination of JBT and Marel Markets: Greater end

market participation in resilient and growing food & beverage markets 1 Solutions: Compelling platform to accelerate growth by offering broader solutions, utilizing 2 holistic application knowledge, and leveraging R&D capabilities Service:

Increased customer focus and aftermarket revenue opportunities as scale of global 3 sales and service network will improve customer care reach and service levels Digital: Complementary leading digital tools provide insights to optimize and improve 4

customers’ operational efficiency, leading to reduced downtime events Sustainability: Greater collective impact on sustainability with innovative customer 5 solutions rooted in reducing waste, energy efficiency, and improved food traceability

Talent: Tremendous combined talent representing the best in the industry, with deep 6 knowledge in technology, markets, and applications across various end markets Scale: Enhanced operational scale expected to generate meaningful value creation

through operational efficiencies and cost synergies together with revenue synergies from cross- 7 selling, enhanced service, and an overall improved value proposition 5

Regulatory Clearances Now Complete; Closing Requires At Least 90% of Marel

Shareholders Tendering 2024 2025 May June July August September October November December January November 26: Completed: Received all Preparation and submission Regulatory review Regulatory outstanding of required filings clearances May 15: June

25: Filed preliminary S-4 went S-4 S-4 effective August 8: JBT Stockholder JBT stockholders approved Marel Vote transaction Voluntary June 24: December 20 Launched Acceptance period extended to December 20, 2024 Expiration of VTO at Takeover Offer

VTO 12:00 PM GMT (VTO) August: Before Year-end 2024: Nasdaq Iceland Submitted request Target secondary Preparation and review of Nasdaq Iceland application to begin secondary listing approval prior to Listing listing process YE 2024 Targeting to

close transaction no later than January 3, 2025, subject to at least 90% of the outstanding Marel shares being tendered by Marel shareholders and satisfaction or waiver of other closing conditions 6

Secured Deal-Contingent Financing Commitments, Providing Ample Liquidity

for Combined Company Amount Maturity Deal-Contingent Financing Commitments ($B) Schedule Interest Rate Swaps $0.2 May 2025 ▪ Structured long-term financing to provide flexibility and ample liquidity for the combined company Convertible Senior

Notes $0.4 May 2026 (1) Revolving Credit Facility $1.8 ~2030 ▪ 5-year, $1.8B revolving credit facility (RCF) at same pricing grid as JBT’s current RCF (1) Term Loan B $0.9 ~2032 ▪ 7-year, $0.9B Term Loan B with pricing of SOFR +

225 Credit Ratings basis points; TLB was over 3 times oversubscribed ▪ S&P: BB (for both issuer & secured debt) ▪ Term Loan B pricing will step down to SOFR + 200 basis ▪ Moody’s: Ba3 (issuer) and Ba2 (secured debt)

points when leverage is below 3.25x ▪ Secured leverage holiday provides flexibility and steps down over time; 5.0x at timing of close, stepping down to 4.0x at 12 months and 3.5x at 18 months Figures may have immaterial differences due to

rounding. 7 (1) Deal-contingent financing includes 5-year Revolving Credit Facility and 7-year Term Loan B. Maturity date will be based on issuance.

Designing Best-In-Class Organizational Structure Focused On Delivering

Customer Value & Synergy Execution Central Focus on Serving Customer Needs Purpose-Built Talent Aligned Go-To- Dedicated Organization Market Strategy Integration Leaders Enhanced scale with deep Will support integrated Spearheading Day 1

application knowledge and customer solutions and readiness planning along with innovation capabilities to cross-selling capabilities synergy identification best serve customers process & execution Supported by Continuous Improvement Mindset and

Operational Excellence 8

Cultural Alignment Enables Purpose-Driven Talent Organization Transforming

Aligned Purpose Food Processing We will be the global leader in food In partnership with our customers, we and beverage technology by are transforming the way food is harnessing the full power of JBT to processed. Our vision is of a world

Complementary Vision partner with our customers and where quality food is produced pioneer sustainable innovation. sustainably and affordably. Shared Values SERVE WITH INTEGRITY Our People, Customers, UNITY COLLABORATE WITH

HUMILITY and Partners GROW WITH AGILITY Our Platform and Performance EXCELLENCE Our Impact On Food INNOVATE WITH IMPACT INNOVATION and Beverage Industry 9

Combined Company Will Have Broad Exposure To Diverse End Markets &

Improved Capabilities to Better Support Customers (1) Pro Forma Diverse End Markets Improved Customer Value Proposition Poultry 37% Deep application knowledge and holistic solutions Meat 16% capabilities to support customers’ needs, including

Seafood 8% automation, operational efficiency, and sustainability Beverages 7% Fruit & Veg 7% Scaled global customer care and service Pet Food 6% organizations improve customers’ uptime with more Ready Meals 5% frequent touch points,

improved monitoring, and Warehouse Automation 4% proactive maintenance Pharma & Nutraceuticals 4% Other 6% Complementary digital tools enhance customers’ operations and efficiency through both line control ▪ Greater end market

participation allows combined company to benefit from and product-specific solutions various secular growth trends ▪ Solutions in winning protein and pet food categories coupled with enhanced Processing and engineering know-how enables

capabilities to offer fuller line solutions and customer care support scaled R&D to create leading customer solutions ▪ Positioned upstream of the ultimate consumer decision provides better resiliency Figures may have immaterial

differences due to rounding. 10 (1) Pro forma end market mix is based on 2023 equipment orders only.

Complementary Core Technologies in Protein and Pet Food Processing Support

Broader Portfolio Offering for Customers Benefits of Fuller Solutions Primary processing Secondary Further End of line Cut-up, de-boning, Forming, coating, Handling, Killing, stunning, eviscerating, cooking, freezing, etc. packaging, etc. skinning,

portioning, etc. chilling, etc. ✓ Deeper portfolio of market leading Poultry technology, with advanced application (Illustrative) and process knowledge ✓ Ability to better address customer needs with line solutions that offer seamless

flow and efficiency ✓ Allows similar customer base to access Primary processing Further End of line Secondary broader solution set globally Food safety, inspection, Mixing, extrusion, filling, Cooking, Tray sealing, clipping & raw

material handling, etc. forming, etc. freezing, etc. packaging, etc. ✓ Utilize scaled combined service and Pet aftermarket support organization to Food improve performance and customer (Illustrative) uptime JBT equipment offering Marel

equipment offering JBT and Marel offerings 11

End Market Update: As of Q3 2024 Earnings, Respectively “We feel

good about what the order strength means “We encouragingly delivered a strong improvement for the current state of our business, and it in poultry orders, and while other parts of our positions JBT well as we plan for 2025. We enjoyed business

remained softer, we expect orders overall continued recovery in demand from the poultry end to improve…We have a good pipeline of healthy market, which showed improvement globally… projects in poultry. The market fundamentals While there

were pockets of weakness, including continue to be solid in the industry. So that’s why certain CPG areas like beverages, our overall we’re confident despite the strong quarter in poultry strength is a function of JBT’s broad

portfolio and to say that we expect the orders received to trend end market/customer exposure.” upward.” Brian Deck, President and CEO of JBT Corporation Arni Sigurdsson, CEO of Marel Quotes are sourced from JBT and Marel Q3 2024

earnings materials, which include press releases and earnings conference calls. 12

Integration Planning Supports Cost Synergy Targets Direct Materials: ~$25

- $35M ▪ Supplier consolidation Anticipated Cost Synergies ▪ Best cost country sourcing ▪ Value add / value engineering >$125M Indirect: ~$15 - $25M Cost of Goods Sold: ▪ Logistics efficiencies (1) >$55M ▪ Spend

reduction ▪ Supplier consolidation and center-led programs ~$70M Plant & Other: ~$10M ▪ Operating footprint ▪ Factory flow optimization Sales and Marketing: ~$10 - $20M ▪ Streamline organizational structure ▪

Optimize consolidated spend Annual Run-Rate Savings Total Annual Run-Rate Savings Operating Expense: General & Administrative: ~$55 - $65M 12-Months Post-Close by End of Year 3 Post-Close (1) ▪ Certain back-office resource rationalization

>$70M Estimating ~65% in one-time costs to achieve ▪ Redundant systems, public company costs, and third-party contracts total expected annual run-rate cost synergies ▪ Optimize overlapping R&D programs (1) These estimated

synergies are based on mid-point of the expected ranges. 13

Opportunity to Generate Meaningful Revenue Synergies Potential Revenue

Uplift Serve as better partner for protein customers, offering integrated solutions and enhanced line coverage to drive our customer overall equipment effectiveness Leverage customer base with improved cross-selling through broader portfolio of

>$75M complementary equipment to deliver fuller solutions and reduce customer complexity by end of third year Utilize scale of combined company to create a platform to drive local growth, efficiency, and post-close at service density in LATAM

& APAC normal contribution Combining dry pet food and wet pet food processing expertise offers complete set of solutions margins and capabilities to customers Illustrative Equipment Opportunity: Target ~300 Protein Customers in the U.S. for

Secondary/Further Processing Cross-Selling Coating / Check Grinding Mixing Forming Cooking Freezing Inspection Packaging Frying Weighing CombiGrind SoftMix RevoPortioner S Stei tein n Stein Self GYRo X-Ray C Check heck ProSeal Tray Seal Co Coa ati

ting ng Li Line ne Stacking Oven Compact W Wei eigher gher Packaging Marel product JBT product 14

Creating a Leading Food and Beverage Technology Company with a Platform

for Enhanced Value Creation Greater exposure to Deep customer Enhanced scale and Operationally focused Expecting to deliver resilient and growing relationships, greater complementary core organization with attractive returns for end markets and

density of service technology enables continuous shareholders and geographies technicians, and digital improved cross-selling, improvement mindset provide meaningful offerings support aftermarket support, to drive efficiencies and upside potential

customers’ uptime and innovation synergy capture 15

Q&A 16

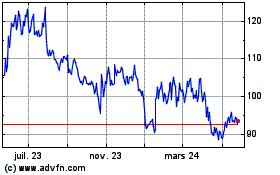

John Bean Technologies (NYSE:JBT)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

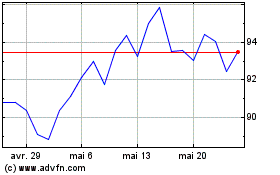

John Bean Technologies (NYSE:JBT)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024