Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 Novembre 2023 - 3:46PM

Edgar (US Regulatory)

The Korea Fund, Inc.

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF SEPTEMBER 30,

2023 (Unaudited)

|

|

|

|

|

|

|

|

|

| Investments |

|

Shares |

|

|

Value ($) |

|

| |

|

|

|

|

|

|

| COMMON STOCKS—99.3% |

|

| Automobile Components—4.8% |

|

| Hankook Tire & Technology Co. Ltd. |

|

|

54,900 |

|

|

|

1,605,882 |

|

| Hyundai Mobis Co. Ltd. |

|

|

23,850 |

|

|

|

4,244,784 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,850,666 |

|

|

|

|

|

|

|

|

|

|

| Automobiles—4.0% |

|

| Hyundai Motor Co. (Preference) |

|

|

46,000 |

|

|

|

3,605,919 |

|

| Kia Corp. |

|

|

21,600 |

|

|

|

1,300,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,906,029 |

|

|

|

|

|

|

|

|

|

|

| Banks—7.3% |

|

| Hana Financial Group, Inc. |

|

|

103,400 |

|

|

|

3,239,367 |

|

| KakaoBank Corp. |

|

|

34,000 |

|

|

|

588,404 |

|

| KB Financial Group, Inc. |

|

|

126,800 |

|

|

|

5,171,779 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,999,550 |

|

|

|

|

|

|

|

|

|

|

| Biotechnology—1.1% |

|

| Hugel, Inc.* |

|

|

14,900 |

|

|

|

1,376,652 |

|

|

|

|

|

|

|

|

|

|

| Capital Markets—2.4% |

|

| KIWOOM Securities Co. Ltd. |

|

|

19,853 |

|

|

|

1,387,275 |

|

| Korea Investment Holdings Co. Ltd. |

|

|

38,500 |

|

|

|

1,511,682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,898,957 |

|

|

|

|

|

|

|

|

|

|

| Chemicals—11.0% |

|

| DL Holdings Co. Ltd. |

|

|

37,000 |

|

|

|

1,160,856 |

|

| Dongsung Finetec Co. Ltd. |

|

|

62,300 |

|

|

|

562,940 |

|

| Hansol Chemical Co. Ltd. |

|

|

7,000 |

|

|

|

866,362 |

|

| Kumho Petrochemical Co. Ltd. |

|

|

11,300 |

|

|

|

1,121,240 |

|

| LG Chem Ltd. |

|

|

16,230 |

|

|

|

5,942,390 |

|

| Lotte Chemical Corp. |

|

|

7,200 |

|

|

|

730,981 |

|

| SK IE Technology Co. Ltd.*(a) |

|

|

25,600 |

|

|

|

1,398,650 |

|

| SKC Co. Ltd. |

|

|

30,800 |

|

|

|

1,729,204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,512,623 |

|

|

|

|

|

|

|

|

|

|

| Consumer Staples Distribution & Retail—1.2% |

|

| BGF retail Co. Ltd. |

|

|

14,650 |

|

|

|

1,531,545 |

|

|

|

|

|

|

|

|

|

|

| Electronic Equipment, Instruments & Components—3.8% |

|

| Samsung Electro-Mechanics Co. Ltd. |

|

|

24,600 |

|

|

|

2,499,712 |

|

| Samsung SDI Co. Ltd. |

|

|

5,650 |

|

|

|

2,135,207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,634,919 |

|

|

|

|

|

|

|

|

|

|

| Entertainment—2.9% |

|

| NCSoft Corp. |

|

|

8,400 |

|

|

|

1,381,050 |

|

| Nexon Games Co. Ltd.* |

|

|

45,100 |

|

|

|

506,222 |

|

| SM Entertainment Co. Ltd. |

|

|

11,200 |

|

|

|

1,064,862 |

|

| YG Entertainment, Inc. |

|

|

13,500 |

|

|

|

628,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,580,905 |

|

|

|

|

|

|

|

|

|

|

| Food Products—2.5% |

|

| CJ CheilJedang Corp. |

|

|

7,550 |

|

|

|

1,713,869 |

|

| Orion Corp. |

|

|

13,900 |

|

|

|

1,324,974 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,038,843 |

|

|

|

|

|

|

|

|

|

|

| Health Care Equipment & Supplies—0.4% |

|

| Suheung Co. Ltd. |

|

|

24,000 |

|

|

|

510,373 |

|

|

|

|

|

|

|

|

|

|

| Household Durables—0.6% |

|

| Coway Co. Ltd. |

|

|

8,600 |

|

|

|

262,545 |

|

| Zinus, Inc. |

|

|

32,446 |

|

|

|

533,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

795,702 |

|

|

|

|

|

|

|

|

|

|

| Industrial Conglomerates—1.2% |

|

| SK, Inc. |

|

|

14,000 |

|

|

|

1,513,775 |

|

|

|

|

|

|

|

|

|

|

| Insurance—3.5% |

|

| Hyundai Marine & Fire Insurance Co. Ltd. |

|

|

48,300 |

|

|

|

1,159,733 |

|

| Samsung Fire & Marine Insurance Co. Ltd. |

|

|

9,000 |

|

|

|

1,730,936 |

|

| Samsung Life Insurance Co. Ltd. |

|

|

26,500 |

|

|

|

1,378,553 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,269,222 |

|

|

|

|

|

|

|

|

|

|

| Interactive Media & Services—5.2% |

|

| AfreecaTV Co. Ltd. |

|

|

14,900 |

|

|

|

925,484 |

|

| Kakao Corp. |

|

|

17,600 |

|

|

|

574,404 |

|

| NAVER Corp. |

|

|

33,080 |

|

|

|

4,945,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,445,836 |

|

|

|

|

|

|

|

|

|

|

| Life Sciences Tools & Services—3.0% |

|

| Samsung Biologics Co. Ltd.*(a) |

|

|

5,200 |

|

|

|

2,624,893 |

|

| ST Pharm Co. Ltd. |

|

|

18,900 |

|

|

|

1,069,818 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,694,711 |

|

|

|

|

|

|

|

|

|

|

| Machinery—1.1% |

|

| HSD Engine Co. Ltd.* |

|

|

110,000 |

|

|

|

719,475 |

|

| Hy-Lok Corp. |

|

|

33,222 |

|

|

|

670,094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,389,569 |

|

|

|

|

|

|

|

|

|

|

| Marine Transportation—0.7% |

|

| Pan Ocean Co. Ltd. |

|

|

231,500 |

|

|

|

847,614 |

|

|

|

|

|

|

|

|

|

|

| Metals & Mining—2.4% |

|

| POSCO Holdings, Inc. |

|

|

7,500 |

|

|

|

2,954,766 |

|

|

|

|

|

|

|

|

|

|

| Oil, Gas & Consumable Fuels—3.2% |

|

| SK Innovation Co. Ltd.* |

|

|

16,150 |

|

|

|

1,771,986 |

|

| S-Oil Corp. |

|

|

37,300 |

|

|

|

2,181,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,953,522 |

|

|

|

|

|

|

|

|

|

|

| Passenger Airlines—1.1% |

|

| Korean Air Lines Co. Ltd. |

|

|

81,900 |

|

|

|

1,318,540 |

|

|

|

|

|

|

|

|

|

|

| Personal Care Products—0.5% |

|

| LG H&H Co. Ltd. |

|

|

1,880 |

|

|

|

620,230 |

|

|

|

|

|

|

|

|

|

|

| Pharmaceuticals—1.3% |

|

| HK inno N Corp. |

|

|

26,852 |

|

|

|

837,874 |

|

| Yuhan Corp. |

|

|

14,233 |

|

|

|

798,956 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,636,830 |

|

|

|

|

|

|

|

|

|

|

| Professional Services—0.4% |

|

| NICE Information Service Co. Ltd. |

|

|

71,554 |

|

|

|

523,931 |

|

|

|

|

|

|

|

|

|

|

| Semiconductors & Semiconductor Equipment—8.2% |

|

| SK Hynix, Inc. |

|

|

118,800 |

|

|

|

10,058,165 |

|

|

|

|

|

|

|

|

|

|

| Specialty Retail—1.7% |

|

| Hotel Shilla Co. Ltd. |

|

|

21,200 |

|

|

|

1,326,763 |

|

| K Car Co. Ltd.* |

|

|

98,213 |

|

|

|

785,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,112,165 |

|

|

|

|

|

|

|

|

|

|

| Technology Hardware, Storage & Peripherals—23.6% |

|

| Samsung Electronics Co. Ltd. |

|

|

443,900 |

|

|

|

22,440,980 |

|

| Samsung Electronics Co. Ltd. (Preference) |

|

|

163,300 |

|

|

|

6,578,781 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29,019,761 |

|

|

|

|

|

|

|

|

|

|

| Textiles, Apparel & Luxury Goods—0.2% |

|

| Hwaseung Enterprise Co. Ltd. |

|

|

54,206 |

|

|

|

302,189 |

|

|

|

|

|

|

|

|

|

|

| TOTAL COMMON STOCKS

(COST $106,589,866) |

|

|

|

122,297,590 |

|

|

|

|

|

|

|

| Total Investments—99.3% (Cost $106,589,866) |

|

|

|

122,297,590 |

|

| Other Assets Less Liabilities—0.7% |

|

|

|

841,119 |

|

|

|

|

|

|

|

| Net Assets—100.0% |

|

|

|

123,138,709 |

|

|

|

|

|

|

|

Percentages indicated are based on net assets.

The Korea Fund, Inc.

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF

SEPTEMBER 30, 2023 (Unaudited) (continued)

|

|

|

| Abbreviations |

| Preference |

|

A special type of equity investment that shares in the earnings of the company, has limited voting rights, and may have a dividend preference. Preference shares may also have liquidation preference. |

|

|

|

| (a) |

|

Security exempt from registration pursuant to Regulation S under the Securities Act of 1933, as amended. Regulation S applies to securities offerings that are made outside of the United States and do not involve direct selling

efforts in the United States and as such may have restrictions on resale. |

| * |

|

Non-income producing security. |

The Korea Fund, Inc.

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF

SEPTEMBER 30, 2023 (Unaudited) (continued)

A. Valuation of Investments – Investments are valued in accordance with U.S. generally accepted

accounting principles (“GAAP”) and the Fund’s valuation policies set forth by, and under the supervision and responsibility of, the Board of Trustees of the Trust (the “Board”), which established the following approach to

valuation, as described more fully below: (i) investments for which market quotations are readily available shall be valued at their market value and (ii) all other investments for which market quotations are not readily available shall be

valued at their fair value as determined in good faith by the Board.

Under Section 2(a)(41) of the Investment Company Act of 1940 Act, the

Board is required to determine fair value for securities that do not have readily available market quotations. Under SEC Rule 2a-5 (Good Faith Determinations of Fair Value), the Board may designate the

performance of these fair valuation determinations to a valuation designee. The Board has designated the Adviser as the “Valuation Designee” to perform fair valuation determinations for the Fund on behalf of the Board subject to

appropriate oversight by the Board. The Adviser, as Valuation Designee, leverages the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to help oversee and carry out the policies for the valuation of investments held in the

Funds. The Adviser, as Valuation Designee, remains responsible for the valuation determinations. This oversight by the AVC includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight including, but not

limited to, consideration of macro or security specific events, market events, and pricing vendor and broker due diligence. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis,

and, at least on a quarterly basis, with the AVC and the Board.

Equities and other exchange-traded instruments are valued at the last sale price or

official market closing price on the primary exchange on which the instrument is traded before the net asset values (“NAV”) of the Fund are calculated on a valuation date.

Certain foreign equity instruments are valued by applying international fair value factors provided by an approved Pricing Service. The factors seek to adjust

the local closing price for movements of local markets post-closing, but prior to the time the NAVs are calculated.

Valuations reflected in this report

are as of the report date. As a result, changes in valuation due to market events and/or issuer-related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the valuation of the Fund’s investments are summarized into the three broad levels listed below.

| |

• |

|

Level 1 — Unadjusted inputs using quoted prices in active markets for identical investments.

|

| |

• |

|

Level 2 — Other significant observable inputs including, but not limited to, quoted prices for similar

investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risk, etc.) or other market corroborated inputs. |

| |

• |

|

Level 3 — Significant inputs based on the best information available in the circumstances, to the

extent observable inputs are not available (including the Fund’s assumptions in determining the fair value of investments). |

A

financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing

instruments are not necessarily an indication of the risk associated with investing in those instruments.

The following table represents each valuation

input as presented on the Schedule of Portfolio Investments (“SOI”):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 1

Quoted prices |

|

|

Level 2

Other significant

observable

inputs |

|

|

Level 3

Significant

unobservable

inputs |

|

|

Total |

|

| Total Investments in Securities (a) |

|

$ |

— |

|

|

$ |

122,297,590 |

|

|

|

— |

|

|

|

122,297,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Please refer to the SOI for specifics of portfolio holdings. |

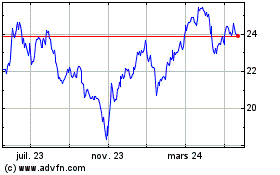

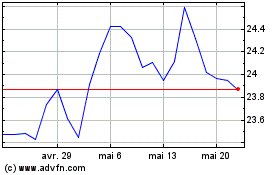

Korea (NYSE:KF)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Korea (NYSE:KF)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024