Kohl’s Corporation (NYSE:KSS) today reported results for the

second quarter ended August 3, 2024.

- Net sales decreased 4.2% and comparable sales decreased

5.1%

- Gross margin increased 59 basis points

- Diluted earnings per share of $0.59 versus $0.52 in the

prior year

- Inventory declined 9%

- Updates full year 2024 financial outlook

- Committed to returning capital to shareholders through the

dividend and further strengthening balance sheet

Tom Kingsbury, Kohl’s chief executive officer, said, “We have

taken significant action to reposition Kohl’s for future growth.

However, our efforts have yet to fully yield the intended outcome

due in part to a continued challenging consumer environment and

softness in our core business. During the second quarter, our

customers exhibited more discretion in their spending, which

pressured our sales even as customers transacted more frequently.

This overshadowed strong performance in our key growth areas,

including Sephora, home decor, gifting, and impulse. In spite of

this, we continued to execute well operationally, enabling us to

deliver a 13% increase in earnings driven by gross margin expansion

and strong inventory and expense management.”

“Looking ahead, we are focused on ensuring that the substantial

work that we’ve done across product, value, and experience is fully

recognized by both new and existing customers. We will also

capitalize on new opportunities such as our partnership with Babies

“R” Us and expect to continue to benefit from our key growth areas.

Our conviction in our strategy remains strong and our operating

discipline, solid cash flow generation, and healthy balance sheet

will continue to support us as we work to return Kohl’s to growth,”

Kingsbury continued.

Second Quarter 2024

Results

Comparisons refer to the 13-week period ended August 3, 2024

versus the 13-week period ended July 29, 2023

- Net sales decreased 4.2% year-over-year, to $3.5

billion, with comparable sales down 5.1%.

- Gross margin as a percentage of net sales was 39.6%, an

increase of 59 basis points.

- Selling, general & administrative (SG&A)

expenses decreased 4.2% year-over-year, to $1.2 billion. As a

percentage of total revenue, SG&A expenses were 33.5%, a

decrease of 1 basis point year-over-year.

- Operating income was $166 million compared to $163

million in the prior year. As a percentage of total revenue,

operating income was 4.4%, an increase of 26 basis points

year-over-year.

- Net income was $66 million, or $0.59 per diluted share.

This compares to net income of $58 million, or $0.52 per diluted

share in the prior year.

- Inventory was $3.2 billion, a decrease of 9%

year-over-year.

- Operating cash flow was $254 million as compared

to $430 million in the prior year.

- Long-term debt was reduced by $113 million through the

redemption of the remaining 9.50% notes due May 15, 2025.

Six Months Fiscal Year 2024

Results

Comparisons refer to the 26-week period ended August 3, 2024

versus the 26-week period ended July 29, 2023

- Net sales decreased 4.7% year-over-year, to $6.7

billion, with comparable sales down 4.8%.

- Gross margin as a percentage of net sales was 39.6%, an

increase of 54 basis points.

- Selling, general & administrative (SG&A)

expenses decreased 2.5% year-over-year, to $2.5 billion. As a

percentage of total revenue, SG&A expenses were 34.8%, an

increase of 78 basis points year-over-year.

- Operating income was $209 million compared to $261

million in the prior year. As a percentage of total revenue,

operating income was 2.9%, a decrease of 56 basis points

year-over-year.

- Net income was $39 million, or $0.35 per diluted share.

This compares to net income of $72 million, or $0.65 per diluted

share in the prior year.

- Operating cash flow was $247 million as

compared to $228 million in the prior year.

- Long-term debt was reduced by $113 million through the

redemption of the remaining 9.50% notes due May 15, 2025.

Updated 2024 Financial and Capital

Allocation Outlook

For the full year 2024, which has 52 weeks compared to 53 weeks

in full year 2023, the Company’s guidance excludes the

potential impact from credit card late fee regulatory changes. The

Company currently expects the following:

- Net sales: A decrease of (4%) to a decrease of (6%)

- Comparable sales: A decrease of (3%) to a decrease of

(5%)

- Operating margin: In the range of 3.4% to 3.8%

- Diluted EPS: In the range of $1.75 to $2.25

- Capital Expenditures: Approximately $500 million,

including expansion of Sephora partnership and other store-related

investments

- Dividend: On August 13, 2024, Kohl’s Board of Directors

declared a quarterly cash dividend on the Company’s common stock of

$0.50 per share. The dividend is payable September 25, 2024 to

shareholders of record at the close of business on September 11,

2024.

Second Quarter 2024 Earnings Conference

Call

Kohl’s will host its quarterly earnings conference call at 9:00

am ET on August 28, 2024. A webcast of the conference call and the

related presentation materials will be available via the Company's

web site at investors.kohls.com, both live and after the call.

Cautionary Statement Regarding

Forward-Looking Information

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. The Company intends forward-looking terminology such as

“believes,” “expects,” “may,” “will,” “should,” “anticipates,”

“plans,” or similar expressions to identify forward-looking

statements. Forward-looking statements include the information

under “Updated 2024 Financial and Capital Allocation Outlook.” Such

statements are subject to certain risks and uncertainties, which

could cause the Company's actual results to differ materially from

those anticipated by the forward-looking statements. These risks

and uncertainties include, but are not limited to, risks described

more fully in Item 1A in the Company’s Annual Report on Form 10-K,

which are expressly incorporated herein by reference, and other

factors as may periodically be described in the Company’s filings

with the SEC. Forward-looking statements relate to the date

initially made, and the Company undertakes no obligation to update

them.

About Kohl's

Kohl’s (NYSE: KSS) is a leading omnichannel retailer built on a

foundation that combines great brands, incredible value and

convenience for our customers. Kohl’s is uniquely positioned to

deliver against its long-term strategy and its purpose to take care

of families’ realest moments. Kohl's serves millions of families in

its more than 1,100 stores in 49 states, online at Kohls.com, and

through the Kohl's App. With a large national footprint, Kohl’s is

committed to making a positive impact in the communities it serves.

For a list of store locations or to shop online, visit Kohls.com.

For more information about Kohl’s impact in the community or how to

join our winning team, visit Corporate.Kohls.com.

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended

Six Months Ended

(Dollars in Millions, Except per Share

Data)

August 3, 2024

July 29, 2023

August 3, 2024

July 29, 2023

Net sales

$ 3,525

$ 3,678

$ 6,703

$ 7,033

Other revenue

207

217

411

433

Total revenue

3,732

3,895

7,114

7,466

Cost of merchandise sold

2,128

2,242

4,051

4,289

Gross margin rate

39.6%

39.0%

39.6%

39.0%

Operating expenses:

Selling, general, and administrative

1,250

1,304

2,478

2,542

As a percent of total revenue

33.5%

33.5%

34.8%

34.1%

Depreciation and amortization

188

186

376

374

Operating income

166

163

209

261

Interest expense, net

86

89

169

173

Income before income taxes

80

74

40

88

Provision for income taxes

14

16

1

16

Net income

$ 66

$ 58

$ 39

$ 72

Average number of shares:

Basic

111

110

111

110

Diluted

112

111

112

111

Earnings per share:

Basic

$ 0.59

$ 0.52

$ 0.35

$ 0.65

Diluted

$ 0.59

$ 0.52

$ 0.35

$ 0.65

KOHL’S CORPORATION

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(Dollars in Millions)

August 3, 2024

July 29, 2023

Assets

Current assets:

Cash and cash equivalents

$ 231

$ 204

Merchandise inventories

3,151

3,474

Other

331

296

Total current assets

3,713

3,974

Property and equipment, net

7,502

7,945

Operating leases

2,507

2,493

Other assets

458

382

Total assets

$ 14,180

$ 14,794

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$ 1,317

$ 1,376

Accrued liabilities

1,185

1,246

Borrowings under revolving credit

facility

410

560

Current portion of:

Long-term debt

353

111

Finance leases and financing

obligations

81

84

Operating leases

92

93

Total current liabilities

3,438

3,470

Long-term debt

1,173

1,637

Finance leases and financing

obligations

2,574

2,730

Operating leases

2,795

2,777

Deferred income taxes

95

121

Other long-term liabilities

275

324

Shareholders’ equity:

3,830

3,735

Total liabilities and shareholders’

equity

$ 14,180

$ 14,794

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Six Months Ended

(Dollars in Millions)

August 3, 2024

July 29, 2023

Operating activities

Net income

$ 39

$ 72

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

376

374

Share-based compensation

16

20

Deferred income taxes

(15)

(7)

Non-cash lease expense

44

48

Other non-cash items

11

(2)

Changes in operating assets and

liabilities:

Merchandise inventories

(269)

(283)

Other current and long-term assets

(59)

61

Accounts payable

183

46

Accrued and other long-term

liabilities

(25)

(52)

Operating lease liabilities

(54)

(49)

Net cash provided by operating

activities

247

228

Investing activities

Acquisition of property and equipment

(239)

(338)

Proceeds from sale of real estate

—

4

Other

2

(1)

Net cash used in investing activities

(237)

(335)

Financing activities

Net borrowings under revolving credit

facility

318

475

Shares withheld for taxes on vested

restricted shares

(9)

(13)

Dividends paid

(111)

(110)

Repayment of long-term borrowings

(113)

(164)

Premium paid on redemption of debt

(5)

—

Finance lease and financing obligation

payments

(42)

(47)

Proceeds from financing obligations

—

17

Net cash provided by financing

activities

38

158

Net increase in cash and cash

equivalents

48

51

Cash and cash equivalents at beginning of

period

183

153

Cash and cash equivalents at end of

period

$ 231

$ 204

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240828786951/en/

Investor Relations: Mark Rupe, (262) 703-1266,

mark.rupe@kohls.com

Media: Jen Johnson, (262) 703-5241,

jen.johnson@kohls.com

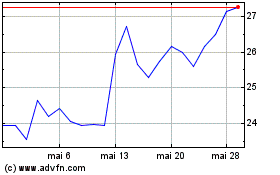

Kohls (NYSE:KSS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Kohls (NYSE:KSS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024