- Fourth quarter 2024 revenue of approximately $699 million

increased 4 percent compared to prior year (5 percent on a constant

currency basis)

- Fourth quarter 2024 reported gross margin of approximately 43.7

percent. Adjusted gross margin of approximately 44.7 percent

increased 160 basis points compared to prior year on an adjusted

basis, excluding the out-of-period duty charge in that period

- Fourth quarter 2024 reported EPS of approximately $1.14.

Adjusted EPS of approximately $1.38 increased 2 percent compared to

prior year on an adjusted basis, excluding the out-of-period duty

charge in that period. Adjusted EPS in the prior year was

positively impacted by a discrete tax benefit. Excluding these

impacts, fourth quarter 2024 adjusted EPS increased approximately

23 percent

- Full year 2024 cash flow from operations of approximately $368

million

- Inventory at year end 2024 of approximately $390 million

decreased 22 percent compared to prior year

Kontoor Brands, Inc. (NYSE: KTB), a global lifestyle apparel

company, with a portfolio led by two of the world’s most iconic

consumer brands, Wrangler® and Lee®, today reported preliminary

financial results for its fourth quarter ended December 28,

2024.

“I am pleased with our strong finish to the year, driven by

better-than-expected revenue, earnings, and cash generation,” said

Scott Baxter, President, Chief Executive Officer and Chairman of

Kontoor Brands. “Full year 2024 was an incredible year for Kontoor,

driven by consistent execution, investments in our brands, and the

remarkable efforts of our global team. Supported by the benefits of

Project Jeanius and the acquisition of Helly Hansen announced this

morning, as we look ahead to 2025 we are well positioned to deliver

another year of strong returns and value creation.”

Webcast Information

Kontoor will release its fourth quarter and full fiscal year

2024 financial results on Tuesday, February 25, 2025, at

approximately 6:50 a.m. ET. Following the news release, Kontoor

management will host a conference call at approximately 8:30 a.m.

ET to review results.

The conference call will be broadcast live and accessible at

kontoorbrands.com/investors. For those unable to listen to the live

broadcast, an archived version will be available at the same

location.

The Company has not yet filed its Annual Report on Form 10-K for

the year ended December 28, 2024. Accordingly, all financial

results described in this press release should be considered

unaudited preliminary results until such time as the Company files

its Form 10-K on or prior to the due date.

Non-GAAP Financial Measures

Adjusted Amounts - This release

refers to “adjusted” amounts. Adjustments during 2024 represent

charges related to business optimization activities and actions to

streamline and transfer select production within our internal

manufacturing network. Adjustments during 2023 represent charges

related to strategic actions taken by the Company to drive

efficiencies in our operations, which included reducing our global

workforce, streamlining and transferring select production within

our internal manufacturing network and optimizing and globalizing

our operating model. Additional information regarding adjusted

amounts is provided in notes to the supplemental preliminary

financial information included with this release.

Reconciliations of these non-GAAP measures to the most

comparable GAAP measures are presented in the supplemental

preliminary financial information included with this release that

identifies and quantifies all reconciling adjustments and provides

management's view of why this non-GAAP information is useful to

investors. While management believes that these non-GAAP measures

are useful in evaluating the business, this information should be

viewed in addition to, and not as an alternate for, reported

results under GAAP. The non-GAAP measures used by the Company in

this release may be different from similarly titled measures used

by other companies.

About Kontoor Brands

Kontoor Brands, Inc. (NYSE: KTB) is a global lifestyle apparel

company, with a portfolio led by two of the world’s most iconic

consumer brands: Wrangler® and Lee®. Kontoor designs, manufactures,

distributes, and licenses superior high-quality products that look

good and fit right, giving people around the world the freedom and

confidence to express themselves. Kontoor Brands is a purpose-led

organization focused on leveraging its global platform, strategic

sourcing model and best-in-class supply chain to drive brand growth

and deliver long-term value for its stakeholders. For more

information about Kontoor Brands, please visit

www.KontoorBrands.com.

Forward-Looking Statements

Certain statements included in this release and attachments are

"forward-looking statements" within the meaning of the federal

securities laws. Forward-looking statements are made based on our

expectations and beliefs concerning future events impacting the

Company and therefore involve several risks and uncertainties. You

can identify these statements by the fact that they use words such

as “will,” “anticipate,” “estimate,” “expect,” “should,” “may” and

other words and terms of similar meaning or use of future dates. We

caution that forward-looking statements are not guarantees and that

actual results could differ materially from those expressed or

implied in the forward-looking statements. We do not intend to

update any of these forward-looking statements or publicly announce

the results of any revisions to these forward-looking statements,

other than as required under the U.S. federal securities laws.

Potential risks and uncertainties that could cause the actual

results of operations or financial condition of the Company to

differ materially from those expressed or implied by

forward-looking statements in this release include, but are not

limited to: macroeconomic conditions, including elevated interest

rates, moderating inflation, fluctuating foreign currency exchange

rates, global supply chain issues and inconsistent consumer demand,

continue to adversely impact global economic conditions and have

had, and may continue to have, a negative impact on the Company’s

business, results of operations, financial condition and cash flows

(including future uncertain impacts); the level of consumer demand

for apparel; reliance on a small number of large customers;

potential difficulty in completing the acquisition of Helly Hansen,

in successfully integrating it and/or in achieving the expected

growth, cost savings and/or synergies from such acquisition; supply

chain and shipping disruptions, which could continue to result in

shipping delays, an increase in transportation costs and increased

product costs or lost sales; intense industry competition; the

ability to accurately forecast demand for products; the Company’s

ability to gauge consumer preferences and product trends, and to

respond to constantly changing markets; the Company’s ability to

maintain the images of its brands; changes to trade policy,

including tariff and import/export regulation; disruption and

volatility in the global capital and credit markets and its impact

on the Company's ability to obtain short-term or long-term

financing on favorable terms; the Company maintaining satisfactory

credit ratings; restrictions on the Company’s business relating to

its debt obligations; increasing pressure on margins; e-commerce

operations through the Company’s direct-to-consumer business; the

financial difficulty experienced by the retail industry; possible

goodwill and other asset impairment; the ability to implement the

Company’s business strategy; the stability of manufacturing

facilities and foreign suppliers; fluctuations in wage rates and

the price, availability and quality of raw materials and contracted

products; the reliance on a limited number of suppliers for raw

material sourcing and the ability to obtain raw materials on a

timely basis or in sufficient quantity or quality; disruption to

distribution systems; seasonality; unseasonal or severe weather

conditions; potential challenges with the Company’s implementation

of Project Jeanius; the Company's and its vendors’ ability to

maintain the strength and security of information technology

systems; the risk that facilities and systems and those of

third-party service providers may be vulnerable to and unable to

anticipate or detect data security breaches and data or financial

loss or maintain operational performance; ability to properly

collect, use, manage and secure consumer and employee data; legal,

regulatory, political and economic risks; the impact of climate

change and related legislative and regulatory responses;

stakeholder response to sustainability issues, including those

related to climate change; compliance with anti-bribery,

anti-corruption and anti-money laundering laws by the Company and

third-party suppliers and manufacturers; changes in tax laws and

liabilities; the costs of compliance with or the violation of

national, state and local laws and regulations for environmental,

consumer protection, employment, privacy, safety and other matters;

continuity of members of management; labor relations; the ability

to protect trademarks and other intellectual property rights; the

ability of the Company’s licensees to generate expected sales and

maintain the value of the Company’s brands; volatility in the price

and trading volume of the Company’s common stock; anti-takeover

provisions in the Company’s organizational documents; and

fluctuations in the amount and frequency of our share repurchases.

Many of the foregoing risks and uncertainties will be exacerbated

by any worsening of the global business and economic

environment.

More information on potential factors that could affect the

Company's financial results are described in detail in the

Company’s most recent Annual Report on Form 10-K and in other

reports and statements that the Company files with the SEC.

KONTOOR BRANDS, INC.

Supplemental Preliminary

Financial Information

Reconciliation of Preliminary

GAAP and Adjusted Financial Measures - Quarter-to-Date

(Non-GAAP)

(Unaudited)

Three Months Ended

December

(Dollars in millions, except per share

amounts)

2024

2023

Preliminary net revenues - as reported

under GAAP

$

699

$

670

Preliminary cost of goods sold - as

reported under GAAP

$

394

$

390

Preliminary restructuring and

transformation costs (a)

(7

)

(3

)

Preliminary adjusted cost of goods

sold

$

387

$

387

Preliminary gross margin - as reported

under GAAP

$

306

$

279

As a percentage of preliminary net

revenues

43.7

%

41.7

%

Preliminary adjusted gross

margin

$

313

$

283

As a percentage of preliminary net

revenues

44.7

%

42.2

%

Preliminary diluted earnings per share

- as reported under GAAP

$

1.14

$

1.21

Preliminary restructuring and

transformation costs (a)

0.24

0.07

Preliminary adjusted diluted earnings

per share

$

1.38

$

1.28

Preliminary Unaudited GAAP and Adjusted

Financial Information: The preliminary unaudited financial

information included in the table above is approximate and subject

to change. This information has been presented on a GAAP basis and

on an adjusted basis. These adjusted presentations are non-GAAP

measures. Amounts herein may not recalculate due to the use of

unrounded numbers.

Management uses non-GAAP financial

measures internally in its budgeting and review process and, in

some cases, as a factor in determining compensation. While

management believes that these non-GAAP measures are useful in

evaluating the business, this information should be considered

supplemental in nature and should be viewed in addition to, and not

as an alternate for, reported results under GAAP. In addition,

these non-GAAP measures may be different from similarly titled

measures used by other companies.

(a) During the three months ended December

2024, preliminary restructuring and transformation costs included

approximately $10 million related to business optimization

activities and approximately $7 million related to

streamlining and transferring select production within our internal

manufacturing network. Total preliminary restructuring and

transformation costs resulted in a corresponding tax impact of

approximately $4 million.

During the three months ended December

2023, restructuring costs included $3.3 million related to

streamlining and transferring select production within our internal

manufacturing network, $1.5 million related to optimizing and

globalizing our operating model and $0.7 million related to

reductions in our global workforce. Total restructuring costs

resulted in a corresponding tax impact of $1.5 million.

KONTOOR BRANDS, INC.

Supplemental Preliminary

Financial Information

Preliminary Net Revenues –

Constant Currency Basis (Non-GAAP)

(Unaudited)

Three Months Ended December

2024

As Reported

Adjust for Foreign

(In millions)

under GAAP

Currency Exchange

Constant Currency

Preliminary net revenues

$

699

$

3

$

702

Constant Currency Financial

Information

The Company is a global company that reports financial

information in U.S. dollars in accordance with GAAP. Foreign

currency exchange rate fluctuations affect the amounts reported by

the Company from translating its foreign revenues and expenses into

U.S. dollars. These rate fluctuations can have a significant effect

on reported operating results. As a supplement to our reported

operating results, we present constant currency financial

information, which is a non-GAAP financial measure that excludes

the impact of translating foreign currencies into U.S. dollars. We

use constant currency information to provide a framework to assess

how our business performed excluding the effects of changes in the

rates used to calculate foreign currency translation. Management

believes this information is useful to investors to facilitate

comparison of operating results and better identify trends in our

businesses. To calculate foreign currency translation on a constant

currency basis, operating results for the current year period for

entities reporting in currencies other than the U.S. dollar are

translated into U.S. dollars at the average exchange rates in

effect during the comparable period of the prior year (rather than

the actual exchange rates in effect during the current year

period). Preliminary constant currency net revenues should be

viewed in addition to, and not as an alternative for, reported

results under GAAP. The constant currency information presented may

not be comparable to similarly titled measures reported by other

companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219560555/en/

Investors: Michael Karapetian, (336) 332-4263 Vice

President, Corporate Development, Strategy, and Investor Relations

Michael.Karapetian@kontoorbrands.com

or

Media: Julia Burge, (336) 332-5122 Director, External

Communications Julia.Burge@kontoorbrands.com

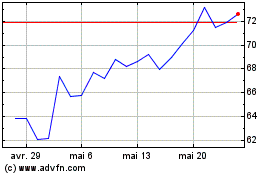

Kontoor Brands (NYSE:KTB)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Kontoor Brands (NYSE:KTB)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025