As filed with the Securities and Exchange Commission on June 9, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Lemonade, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 32-0469673 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

5 Crosby Street, 3rd Floor

New York, NY 10013

(844) 733-8666

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Daniel Schreiber

Co-Chief Executive Officer

5 Crosby Street, 3rd Floor

New York, NY 10013

(844) 733-8666

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Marc D. Jaffe, Esq.

John J. Slater, Esq.

Latham & Watkins LLP

1271 Avenue of the Americas

New York, NY 10020

(212) 906-1200 |

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

Lemonade, Inc.

3,352,025 Shares of Common Stock

(Issuable Upon Exercise of the Warrants)

This prospectus relates to the offer and sale from time to time by Chewy Insurance Services, LLC (the “Selling Securityholder”), of up to 3,352,025 shares (the “Warrant Shares”) of our common stock, $0.00001 par value per share (“Common Stock”). The shares of Common Stock are issuable to the Selling Securityholder on a private placement basis upon the exercise by the Selling Securityholder, in whole or in part, of a Warrant to purchase Common Stock (the “Warrants”) issued by us to the Selling Securityholder in a private placement on October 14, 2022.

Up to 3,352,025 shares of Common Stock under the Warrants will become vested and the Warrants will become exercisable for the Warrant Shares in installments on a yearly basis for a period of five years, subject to certain performance requirements, vesting events and thresholds as specified in the warrant agreement between us and the Selling Securityholder (the “Warrant Agreement”). See “Description of the Warrants” for further information on the Warrants.

We will not receive any proceeds from any resale of the Warrant Shares received by the Selling Securityholder in connection with any exercise of the Warrants pursuant to this prospectus. See “Use of Proceeds.”

We are registering the Warrant Shares for resale pursuant to the Selling Securityholder’s registration rights under the Warrants (the “Registration Rights”). Our registration of the Warrant Shares does not mean that the Selling Securityholder will offer or sell any of the Warrant Shares covered by this prospectus. The Selling Securityholder may sell the Warrant Shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Securityholder may sell the Warrant Shares in the section entitled “Plan of Distribution.”

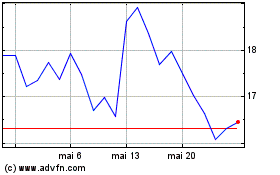

Our Common Stock is listed on the New York Stock Exchange (the “NYSE”), under the symbol “LMND.” On June 5, 2023, the closing price of our Common Stock was $18.08.

Investing in our securities involves a high degree of risk. Please carefully read the information under the heading “Risk Factors” beginning on page 2 of this prospectus before you invest in our securities. This information may also be included in any supplement, any related free writing prospectus and/or any other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this prospectus. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Selling Securityholder may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections entitled “Plan of Distribution” and “About This Prospectus” for more information. The price to the public of those securities and the net proceeds the Selling Securityholder expects to receive from that sale will also be set forth in a prospectus supplement.

The date of this prospectus is June 9, 2023.

TABLE OF CONTENTS

You should rely only on the information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable prospectus supplement. Neither we nor the Selling Securityholder have authorized anyone to provide you with different information. Neither we nor the Selling Securityholder are making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any applicable prospectus supplement is accurate as of any date other than the date of the applicable document. Since the date of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition, results of operations and prospects may have changed.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Securityholder may, from time to time, sell the securities offered by it described in this prospectus. We will not receive any proceeds from the sale by the Selling Securityholder of the securities offered by it described in this prospectus. We may receive in cash the proceeds from any payment of the exercise price of the Warrants.

Neither we nor the Selling Securityholder have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Securityholder take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Securityholder will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or, if appropriate, a post-effective amendment, to the registration statement of which this prospectus forms a part to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

Unless the context indicates otherwise, references in this prospectus to the “Company,” “Lemonade,” “we,” “us,” “our” and similar terms refer to Lemonade, Inc. and its consolidated subsidiaries, including Lemonade Insurance Company and Lemonade Insurance Agency, LLC. References in this prospectus to “Chewy” refer to Chewy Insurance Services, LLC.

FORWARD-LOOKING STATEMENTS

This prospectus and any accompanying prospectus supplement contain forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact contained in this prospectus and any accompanying prospectus supplement, including without limitation statements regarding our future results of operations and financial position, our ability to attract, retain and expand our customer base, our ability to operate under and maintain our business model, our ability to maintain and enhance our brand and reputation, our ability to effectively manage the growth of our business, the effects of seasonal trends on our results of operations, our ability to attain greater value from each customer, our ability to compete effectively in our industry, the future performance of the markets in which we operate, our ability to maintain reinsurance contracts, and the plans and objectives of management for future operations and capital expenditures are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this prospectus and any accompanying prospectus supplement are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including:

•We have a history of losses and we may not achieve or maintain profitability in the future.

•Our success and ability to grow our business depend on retaining and expanding our customer base. If we fail to add new customers or retain current customers, our business, revenue, operating results and financial condition could be harmed.

•The Lemonade brand may not become as widely known as incumbents' brands or the brand may become tarnished.

•Denial of claims or our failure to accurately and timely pay claims could materially and adversely affect our business, financial condition, results of operations, and prospects.

•Our future revenue growth and prospects depend on attaining greater value from each user.

•The novelty of our business model makes its efficacy unpredictable and susceptible to unintended consequences.

•We could be forced to modify or eliminate our Giveback, which could undermine our business model and have a material adverse effect on our results of operations and financial condition.

•Our limited operating history makes it difficult to evaluate our current business performance, implementation of our business model, and our future prospects.

•We may not be able to manage our growth effectively.

•Intense competition in the segments of the insurance industry in which we operate could negatively affect our ability to attain or increase profitability.

•Reinsurance may be unavailable at current levels and prices, which may limit our ability to write new business. Furthermore, reinsurance subjects us to counterparty risk and may not be adequate to protect us against losses, which could have a material effect on our results of operations and financial condition.

•Failure to maintain our risk-based capital at the required levels could adversely affect the ability of our insurance subsidiaries to maintain regulatory authority to conduct our business.

•If we are unable to expand our product offerings, our prospects for future growth may be adversely affected.

•Our proprietary artificial intelligence algorithms may not operate properly or as we expect them to, which could cause us to write policies we should not write, price those policies inappropriately or overpay claims that are made by our customers. Moreover, our proprietary artificial intelligence algorithms may lead to unintentional bias and discrimination.

•Regulators may limit our ability to develop or implement our proprietary artificial intelligence algorithms and/or may eliminate or restrict the confidentiality of our proprietary technology, which could have a material adverse effect on our financial condition and results of operations.

•New legislation or legal requirements may affect how we communicate with our customers, which could have a material adverse effect on our business model, financial condition, and results of operations.

•We rely on artificial intelligence, telematics, mobile technology and our digital platforms to collect data points that we evaluate in pricing and underwriting our insurance policies, managing claims and customer support, and improving business processes, and any legal or regulatory requirements that prohibit or restrict our ability to collect or use this data could thus materially and adversely affect our business, financial condition, results of operations and prospects.

•We depend on search engines, social media platforms, digital app stores, content-based online advertising and other online sources to attract consumers to our website and our online app, which may be affected by third-party interference beyond our control and as we grow our customer acquisition costs will continue to rise.

•We may require additional capital to grow our business, which may not be available on terms acceptable to us or at all.

•Security incidents or real or perceived errors, failures or bugs in our systems, website or app could impair our operations, result in loss of personal customer information, damage our reputation and brand, and harm our business and operating results.

•We are periodically subject to examinations by our primary state insurance regulators, which could result in adverse examination findings and necessitate remedial actions. In addition, insurance regulators of other states in which we are licensed to operate may also conduct examinations or other targeted investigations, which may also result in adverse examination findings and necessitate remedial actions.

•We collect, process, store, share, disclose and use customer information and other data, and our actual or perceived failure to protect such information and data, respect customers' privacy or comply with data privacy and security laws and regulations could damage our reputation and brand and harm our business and operating results.

•We may be unable to prevent or address the misappropriation of our data.

•We collect, process, store, share, disclose and use customer information and other data, and our actual or perceived failure to protect such information and data, respect customers' privacy or comply with data

privacy and security laws and regulations could damage our reputation and brand and harm our business and operating results.

•If we are unable to underwrite risks accurately and charge competitive yet profitable rates to our customers, our business, results of operations and financial condition will be adversely affected.

•Our product development cycles are complex and subject to regulatory approval, and we may incur significant expenses before we generate revenues, if any, from new products.

•Our expansion within the United States and any future international expansion strategy will subject us to additional costs and risks and our plans may not be successful.

•Combining the business of Lemonade and Metromile may be more difficult, costly or time-consuming than expected and the combined company may fail to realize the anticipated benefits of the mergers, which may adversely affect the combined company's business results and negatively affect the value of the company's common stock.

•The combined company may be exposed to increased litigation, which could have an adverse effect on the business and operations.

•The insurance business, including the market for renters, homeowners, pet and automobile insurance is historically cyclical in nature, and we may experience periods with excess underwriting capacity and unfavorable premium rates, which could adversely affect our business.

•We are subject to extensive insurance industry regulations.

•State insurance regulators impose additional reporting requirements regarding enterprise risk on insurance holding company systems, with which we must comply as an insurance holding company.

•Severe weather events and other catastrophes, including the effects of climate change and global pandemics, are inherently unpredictable and may have a material adverse effect on our financial results and financial condition.

•Climate risks, including risks associated with disruptions caused by the transition to a low carbon economy, could adversely affect our business, results of operations and financial condition.

•Increasing scrutiny, actions, and changing expectations from investors, clients, customers, regulators and our employees with respect to environmental, social and governance matters may impose additional costs on us, impact our access to capital, or expose us to new or additional risks.

•We expect our results of operations to fluctuate on a quarterly and annual basis. In addition, our operating results and operating metrics are subject to seasonality and volatility, which could result in fluctuations in our quarterly revenues and operating results or in perceptions of our business prospects.

•We rely on data from our customers and third parties for pricing and underwriting our insurance policies, handling claims and maximizing automation, the unavailability or inaccuracy of which could limit the functionality of our products and disrupt our business.

•Our results of operations and financial condition may be adversely affected due to limitations in the analytical models used to assess and predict our exposure to catastrophe losses.

•Our actual incurred losses may be greater than our loss and loss adjustment expense reserves, which could have a material adverse effect on our financial condition and results of operations.

•Our insurance subsidiaries are subject to minimum capital and surplus requirements, and our failure to meet these requirements could subject us to regulatory action. If a conflict between such interests arises, there is no guarantee such a conflict would be resolved in favor of our stockholders.

•SoftBank has sole voting and dispositive voting control over approximately 17.3% of our common stock as of March 31, 2023. This concentration of voting control could limit the ability of our stockholders to influence the outcome of important transactions, including a change in control.

•We are subject to assessments and other surcharges from state guaranty funds, and mandatory state insurance facilities, which may reduce our profitability.

•As a public benefit corporation, our focus on a specific public benefit purpose and producing a positive effect for society may negatively impact our financial performance.

•Our directors have a fiduciary duty to consider not only our stockholders' interests, but also our specific public benefit and the interests of other stakeholders affected by our actions.

•We conduct certain of our operations in Israel and therefore our results may be adversely affected by political, economic and military instability in Israel and the region.

•The factors described under the section titled “Risk Factors” in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Additional cautionary statements or discussions of risks and uncertainties that could affect our results or the achievement of the expectations described in forward-looking statements may also be contained in any accompanying prospectus supplement. There can be no assurance that future developments affecting us will be those that we have anticipated. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

These forward-looking statements made by us in this prospectus and any accompanying prospectus supplement speak only as of the date of this prospectus and the accompanying prospectus supplement. Except as required under the federal securities laws and rules and regulations of the SEC, we expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. You should, however, review additional disclosures we make in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

You should read this prospectus and any accompanying prospectus supplement completely and with the understanding that our actual future results, levels of activity and performance as well as other events and circumstances may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. Because it is a summary, it may not contain all of the information that may be important to you. To understand this offering fully, you should read this entire prospectus carefully, including the information set forth under the heading “Risk Factors” and our financial statements and related notes included in this prospectus or incorporated by reference into this prospectus, any applicable prospectus supplement and the documents to which we have referred to in the “Incorporation of Certain Documents by Reference” section below.

The Company

Lemonade is rebuilding insurance from the ground up on a digital substrate and an innovative business model. By leveraging technology, data, artificial intelligence, contemporary design, and social impact, we believe we are making insurance more delightful, more affordable, and more precise. To that end, we have built a vertically-integrated company with wholly-owned insurance carriers in the United States and Europe, and the full technology stack to power them.

A brief chat with our bot, AI Maya, is all it takes to get covered with renters, homeowners, pet, car or life insurance, and we expect to offer a similar experience for other insurance products over time. Claims are filed by chatting with another bot, AI Jim, who pays claims in as little as three seconds. This breezy experience belies the extraordinary technology that enables it: a state-of-the-art platform that spans marketing to underwriting, customer care to claims processing, finance to regulation. Our architecture melds artificial intelligence with the human kind, and learns from the prodigious data it generates to become ever better at delighting customers and evaluating risk.

In addition to digitizing insurance end-to-end, we also reimagined the underlying business model to minimize volatility while maximizing trust and social impact. To lessen the volatility inherent in an industry directly impacted by the weather, we utilize several forms of reinsurance, with the goal of dampening the impact on our gross margin. The result is that excess claims are generally offloaded to reinsurers, while excess premiums can be donated to nonprofits selected by our customers as part of our annual “Giveback.” These two ballasts, reinsurance and Giveback, reduce volatility, while creating an aligned, trustful, and values-rich relationship with our customers.

Warrants Issued to Chewy

On October 14, 2022, Lemonade entered into an omnibus agreement (the “Omnibus Agreement”) and the Warrant Agreement (together with the Omnibus Agreement, the “Agreements”) with Chewy in connection with the execution of an agency agreement (the “Agency Agreement”) between Lemonade, Lemonade Insurance Agency, LLC, Lemonade Insurance Company, and Chewy on the same date. In connection with the Agreements, Lemonade is authorized to issue to Chewy up to 3,352,025 shares of Lemonade’s Common Stock under the Warrant with an exercise price of $0.01 per share, which will vest in installments on a yearly basis for a period of five years, subject to certain performance requirements, vesting events and thresholds as specified in the Warrant Agreement.

This prospectus relates to the resale by the Selling Securityholder of up to 3,352,025 shares of Common Stock issuable pursuant to the Warrant Agreement.

Corporate Information

Lemonade, Inc. was incorporated as a Delaware corporation on June 17, 2015. Our corporate headquarters is located at 5 Crosby Street, 3rd Floor, New York, New York 10013. Our telephone number is (844) 733-8666. Our principal website address is www.lemonade.com. Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this prospectus or the registration statement of which it forms a part.

RISK FACTORS

An investment in our securities involves risks. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. If any of these risks occur, the value of our Common Stock and our other securities may decline. You should carefully consider the risk factors set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, as well as other information contained or incorporated by reference herein or any applicable prospectus supplement hereto, before making a decision to invest in our securities. See “Incorporation of Certain Documents by Reference.”

USE OF PROCEEDS

All of the Warrant Shares offered by the Selling Securityholder will be sold by it for its respective accounts. We will not receive any of the proceeds from these sales.

The Selling Securityholder will pay any underwriting fees, discounts, and selling commissions, incurred by the Selling Securityholder in disposing of the Warrant Shares, and we will bear all other costs, fees and expenses incurred in effecting the registration of such securities covered by this prospectus, including, without limitation, all registration and filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public accountants.

We may receive in cash the proceeds from any payment of the exercise price of the Warrants, but will not receive any of the proceeds from the sale of the Warrant Shares issuable upon such exercise.

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following unaudited pro forma condensed combined financial statements combine the separate historical financial information of Lemonade, Inc. (“Lemonade”) and Metromile, Inc. (“Metromile”) after giving effect to the Mergers (as described in Note 1 below), and the pro forma effects of certain assumptions and adjustments described in “Notes to the Unaudited Pro Forma Condensed Combined Financial Statements” below. The unaudited pro forma condensed combined financial statements give effect to the Mergers, as if they had been completed as of January 1, 2022 for the purposes of the unaudited pro forma condensed combined statements of operations and comprehensive loss.

The preparation of the unaudited pro forma condensed combined financial statements and related adjustments required management to make certain assumptions and estimates. The unaudited pro forma condensed combined financial statements should be read together with:

•the accompanying notes to the unaudited pro forma condensed combined financial statements;

•Lemonade’s separate audited historical consolidated financial statements and accompanying notes as of and for the year ended December 31, 2022, included in Lemonade’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 3, 2023;

•Lemonade’s separate unaudited historical consolidated financial statements and accompanying notes as of and for three months ended March 31, 2023, included in Lemonade’s Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2023 filed with the SEC on May 5, 2023;

•Lemonade’s separate unaudited historical consolidated financial statements and accompanying notes as of and for three months ended March 31, 2022, included in Lemonade’s Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2022 filed with the SEC on May 10, 2022; and

•Metromile’s separate unaudited historical condensed consolidated financial statements and accompanying notes as of and for the three months ended March 31, 2022 included herein.

In connection with the plan to integrate the operations of Lemonade and Metromile following the completion of the Mergers, Lemonade anticipates that nonrecurring charges will be incurred. Lemonade is not able to determine the timing, nature, and amount of these charges as of the date of this prospectus. However, these charges will affect the results of operations of Lemonade and Metromile, as well as those of the combined company following the completion of the mergers, in the period in which they are incurred.

The pro forma financial information reflects adjustments that management believes are necessary to present fairly, the combined pro forma results of operations following the closing of the transaction as of and for the periods indicated. The adjustments are based on currently available information and assumptions that management believes are, under the circumstances and given the information available at this time, reasonable. These adjustments are based on preliminary estimates and will be finalized within the measurement period that will not extend beyond 12 months from the close of the transaction. Differences between these preliminary estimates and the final acquisition accounting may arise, and these differences could have a material impact on the accompanying unaudited pro forma condensed combined consolidated financial information and the combined entity’s future results of operations and financial position.

The unaudited pro forma condensed combined financial information has been prepared to illustrate the effect of the Mergers. It has been prepared for informational purposes only and is subject to a number of uncertainties and assumptions. The pro forma financial information has been prepared by Lemonade in accordance with Regulation S-X Article 11, Pro Forma Financial information (“Article 11”). Additionally, the unaudited pro forma condensed combined financial statements are not necessarily, and should not be assumed to be, an indication of the results that would have been achieved had the transaction been completed as of the dates indicated or that may be achieved in the future.

Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

For the Three Months Ended March 31, 2022

(in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Transaction Accounting Adjustments | | Pro Forma Combined | | |

| Lemonade Historical | | Metromile Historical | | Reclassification Adjustments - Note 4 | | Pro Forma Adjustments - Note 7 | | | |

| Revenue | | | | | | | | | | | | |

Net earned premium | $ | 27.4 | | | $ | 19.2 | | | $ | — | | | $ | — | | | | $ | 46.6 | | | |

Ceding commission income | 14.0 | | | — | | | 0.1 | | | — | | | | 14.1 | | | |

Net investment income | 0.9 | | | — | | | — | | | — | | | | 0.9 | | | |

Commission and other income | 2.0 | | | — | | | 1.4 | | | — | | | | 3.4 | | | |

Other revenue | — | | | 1.5 | | | (1.5) | | | — | | | | — | | | |

| Total revenue | 44.3 | | | 20.7 | | | — | | | — | | | | 65.0 | | | |

| Expense | | | | | | | | | | | | |

Loss and loss adjustment expense, net | 24.4 | | | 22.1 | | | — | | | — | | | | 46.5 | | | |

Other insurance expense | 9.1 | | | 5.3 | | | 1.7 | | | (0.3) | | (B) | | 15.5 | | | |

| | | | | | | (0.3) | | (A) | | | | |

Sales and marketing | 38.3 | | | — | | | 6.1 | | | — | | | | 44.4 | | | |

Sales, marketing and other acquisition costs | — | | | 6.5 | | | (6.5) | | | — | | | | — | | | |

Technology development | 16.9 | | | 4.3 | | | — | | | — | | | | 21.2 | | | |

Amortization of capitalized software | — | | | 3.4 | | | (3.4) | | | — | | | | — | | | |

Other operating expenses | — | | | 13.6 | | | (13.6) | | | — | | | | — | | | |

General and administrative | 28.2 | | | — | | | 15.7 | | | (1.1) | | (C) | | 42.8 | | | |

Decrease in fair value of stock warrant liability | — | | | (0.1) | | | — | | | — | | | | (0.1) | | | |

| Total expenses | 116.9 | | | 55.1 | | | — | | | (1.7) | | | | 170.3 | | | |

| Loss before income taxes | (72.6) | | | (34.4) | | | — | | | 1.7 | | | | (105.3) | | | |

Income tax expense | 2.2 | | | — | | | — | | | — | | (D) | | 2.2 | | | |

| Net loss | $ | (74.8) | | | $ | (34.4) | | | $ | — | | | $ | 1.7 | | | | $ | (107.5) | | | |

| Other comprehensive income, net of tax | | | | | | | | | | | | |

Unrealized loss on investments | (14.3) | | | (0.3) | | | — | | | — | | | | (14.6) | | | |

Foreign currency translation adjustment | (1.1) | | | — | | | — | | | — | | | | (1.1) | | | |

| Comprehensive loss | $ | (90.2) | | | $ | (34.7) | | | $ | — | | | $ | 1.7 | | | | $ | (123.2) | | | |

| Per share data: | | | | | | | | | | | | |

Net loss per share attributable to common stockholders - basic and diluted | $ | (1.21) | | | $ | (0.27) | | | | | | (E) | | $ | (1.57) | | | |

Weighted average common shares outstanding - basic and diluted | 61,698,568 | | | 128,715,031 | | | | | | (E) | | 68,523,814 | | | |

See accompanying notes to the unaudited pro forma condensed combined financial statements.

Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

For the Year Ended December 31, 2022

(in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Transaction Accounting Adjustments | | |

| Lemonade Historical | | Metromile Historical | | Reclassification Adjustments - Note 4 | | Pro Forma Adjustments - Note 7 | | Pro Forma Combined |

| Revenue | | | | | | | | | | |

| Net earned premium | $ | 172.4 | | | $ | 46.1 | | | $ | — | | | $ | — | | | | $ | 218.5 | |

| Ceding commission income | 64.1 | | | — | | | 0.2 | | | — | | | | 64.3 | |

| Net investment income | 8.4 | | | 0.3 | | | — | | | — | | | | 8.7 | |

| Commission and other income | 11.8 | | | — | | | 2.9 | | | — | | | | 14.7 | |

| Other revenue | — | | | 3.1 | | | (3.1) | | | — | | | | — | |

| Total revenue | 256.7 | | | 49.5 | | | — | | | — | | | | 306.2 | |

| Expense | | | | | | | | | | |

| Loss and loss adjustment expense, net | 167.3 | | | 51.9 | | | — | | | (1.0) | | (A) | | 218.2 | |

| Other insurance expense | 44.0 | | | 12.1 | | | 3.8 | | | (0.6) | | (B) | | 61.0 | |

| | | | | | | 1.7 | | (B) | | |

| Sales and marketing | 138.3 | | | — | | | 9.6 | | | — | | | | 147.9 | |

| Sales and marketing and other acquisition costs | — | | | 10.4 | | | (10.4) | | | — | | | | — | |

| Technology development | 79.6 | | | 10.7 | | | — | | | — | | | | 90.3 | |

| Amortization of capitalized software | — | | | 7.9 | | | (7.9) | | | — | | | | — | |

| Other operating expenses | — | | | 33.5 | | | (33.5) | | | — | | | | — | |

| General and administrative | 122.3 | | | — | | | 38.4 | | | 1.4 | | (C) | | 162.1 | |

| Impairment on digital assets | — | | | 0.2 | | | — | | | — | | | | 0.2 | |

| Decrease in fair value of stock warrant liability | — | | | (0.6) | | | — | | | — | | | | (0.6) | |

| Total expense | 551.5 | | | 126.1 | | | — | | | 1.5 | | | | 679.1 | |

| Loss before income taxes | (294.8) | | | (76.6) | | | — | | | (1.5) | | | | (372.9) | |

| Income tax expense | 3.0 | | | — | | | — | | | — | | (D) | | 3.0 | |

| Net loss | $ | (297.8) | | | $ | (76.6) | | | $ | — | | | $ | (1.5) | | | | $ | (375.9) | |

| Other comprehensive income, net of tax | | | | | | | | | | |

Unrealized loss on investments | (18.4) | | | (0.4) | | | — | | | — | | | | (18.8) | |

Foreign currency translation adjustment | (5.8) | | | — | | | — | | | — | | | | (5.8) | |

| Comprehensive loss | $ | (322.0) | | | $ | (77.0) | | | $ | — | | | $ | (1.5) | | | | $ | (400.5) | |

| Per share data: | | | | | | | | | | |

Net loss per share attributable to common stockholders - basic and diluted | $ | (4.59) | | | — | | | | | | (E) | | $ | (5.79) | |

Weighted average common shares outstanding - basic and diluted | 64,921,524 | | | — | | | | | | (E) | | 64,921,524 | |

See accompanying notes to the unaudited pro forma condensed combined financial statements.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

1.Description of Transaction

On July 28, 2022 (the “Acquisition Date”), Lemonade, Inc., a Delaware corporation (the “Company,”) completed the acquisition of Metromile, Inc. (“Metromile”), a Delaware corporation (“Metromile”) pursuant to the Agreement and Plan of Merger, dated as of November 8, 2021 (the “Merger Agreement”), by and among the Company, Citrus Merger Sub A, Inc., a Delaware corporation and a direct, wholly owned subsidiary of the Company (“Acquisition Sub I”), Citrus Merger Sub B, LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of the Company (“Acquisition Sub II”) and Metromile. Pursuant to the Merger Agreement, Acquisition Sub I merged with and into Metromile, with Metromile surviving as a wholly-owned subsidiary of the Company (the “First Merger”) and following the First Merger, Metromile merged with and into Acquisition Sub II, with Acquisition Sub II surviving as “Metromile, LLC” (the “Second Merger,” and together with the First Merger, the “Mergers”). Pursuant to the Merger Agreement, on the closing date, the former shareholders of Metromile exchanged all of the issued and outstanding shares for a total of 6,901,934 shares of Lemonade common stock. On July 28, 2022, Metromile delisted the Metromile common stock and warrants from Nasdaq.

2.Basis of Presentation

The above unaudited pro forma condensed combined statements of operations and comprehensive loss for the three months ended March 31, 2022, and for the year ended December 31, 2022 are derived from the historical financial statements of Lemonade and Metromile after giving effect to the Mergers. The unaudited pro forma condensed combined statements operations and comprehensive loss for the three months ended March 31, 2022 and the year ended December 31, 2022 give pro forma effect to these transactions as if they had been completed on January 1, 2022. Certain amounts may not foot due to rounding to millions.

The transaction is accounted for under the acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) Topic 805, Business Combinations (“ASC 805”), with Lemonade considered the acquirer for accounting purposes. In business combination transactions in which the consideration given is not in the form of cash (that is, in the form of non-cash assets, liabilities incurred, or equity interests issued), measurement of the merger consideration is based on the fair value of the consideration given or the fair value of the assets (or net assets) acquired, whichever is more evident and, thus more reliably measurable.

Under ASC 805, all of the Metromile assets acquired and liabilities assumed in this business combination are recognized at their acquisition-date fair value, while transaction costs and integration costs associated with the business combination are expensed as incurred. The excess of purchase price over the estimated fair value of the net assets acquired is recorded as goodwill. Subsequent to the completion of the Mergers, Lemonade and Metromile implemented an integration plan which may affect how the assets acquired, including intangible assets, will be utilized by the combined company.

The purchase price consideration and estimated fair values of assets acquired and liabilities assumed from Metromile will be updated and finalized within the measurement period that will not extend beyond 12 months from the close of the transaction. Estimated fair value adjustments could change significantly from those allocations used in the unaudited pro forma condensed combined financial statements as presented below.

The estimated identifiable finite lived intangible assets include internally developed technology and value of business acquired (“VOBA”). The weighted average useful life of the internally developed technology intangible is estimated to be 3 years. VOBA is expected to be fully amortized in less than a year. Identifiable intangible assets also include insurance licenses which are estimated to have an indefinite life, and are therefore not amortized, but will be subject to periodic impairment testing and are subject to the same risks and uncertainties noted for the identifiable finite lived assets.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

Management has recorded reclassifications of Metromile’s financial information to conform to Lemonade’s financial statement presentation. In addition, Lemonade management reviewed Metromile’s accounting policies and determined that no significant differences in accounting policies require adjustment to conform to Lemonade’s accounting policies. Management however, may identify further differences that, when conformed, could have a material impact on these unaudited pro forma condensed combined financial statements.

3.Metromile Acquisition

As discussed and described above, Lemonade obtained unilateral control over Metromile on July 28, 2022. For the purposes of the unaudited pro forma condensed combined statements of operations for the year ended December 31, 2022, the Metromile historical unaudited condensed statement of operation for the six months ended June 30, 2022, was adjusted to include the results of operations for the month ended July 31, 2022.

“Metromile As Adjusted” for unaudited pro forma condensed combined statements of operations for the year ended December 31, 2022 was determined as follows:

| | | | | | | | | | | | | | | | | |

| | | | | Metromile As Adjusted |

| For the six-months ended June 30, 2022 | | For the month ended July 31, 2022 | | For the seven-months ended July 31, 2022 |

| Revenue | | | | | |

| Premium earned, net | $ | 39.4 | | | $ | 6.7 | | | $ | 46.1 | |

| Investment income | 0.2 | | | 0.1 | | | 0.3 | |

| Other revenue | 2.6 | | | 0.5 | | | 3.1 | |

| Total revenue | 42.2 | | | 7.3 | | | 49.5 | |

| Costs and expenses | | | | | |

| Losses and loss adjustment expenses | 44.1 | | | 7.8 | | | 51.9 | |

| Policy servicing expense and other | 10.4 | | | 1.7 | | | 12.1 | |

| Sales, marketing, and other acquisition costs | 10.1 | | | 0.3 | | | 10.4 | |

| Research and development | 9.6 | | | 1.1 | | | 10.7 | |

| Amortization of capitalized software | 6.7 | | | 1.2 | | | 7.9 | |

| Other operating expenses | 26.4 | | | 7.1 | | | 33.5 | |

| Total costs and expenses | 107.3 | | | 19.2 | | | 126.5 | |

| Loss from operations | (65.1) | | | (11.9) | | | (77.0) | |

| Other expense | | | | | |

| Impairment on digital assets | 0.4 | | | (0.2) | | | 0.2 | |

| Decrease in fair value of stock warrant liability | — | | | (0.6) | | | (0.6) | |

| Total other expense | 0.4 | | | (0.8) | | | (0.4) | |

| Loss before taxes | (65.5) | | | (11.1) | | | (76.6) | |

| Income tax expense | — | | | — | | | — | |

| Net loss | $ | (65.5) | | | $ | (11.1) | | | $ | (76.6) | |

| | | | | |

| Net loss | (65.5) | | | (11.1) | | | (76.6) | |

| Unrealized (loss) gain on marketable securities | (0.5) | | | 0.1 | | | (0.4) | |

| Total comprehensive loss | $ | (66.0) | | | $ | (11.0) | | | $ | (77.0) | |

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

4.Reclassification Adjustments

The Pro Forma Financial Statements have been adjusted to reflect reclassifications of Metromile’s historical financial statements to conform to Lemonade’s financial statement presentation, which is summarized below:

Pro Forma Statement of Operations and Comprehensive Loss for the three months ended March 31, 2022:

•Reclassification of $1.5 million from Other revenue to Ceding commission income and Commission and other income;

•Reclassification of $6.5 million from Sales, marketing and other acquisition costs to Sales and marketing and Other insurance expense;

•Reclassification of $13.6 million from Other operating expenses to General and administrative and Other insurance expense; and

•Reclassification of $3.4 million from Amortization of capitalized software to General and administrative.

Pro Forma Statement of Operations and Comprehensive Loss for the year ended December 31, 2022:

•Reclassification of $3.1 million of Other revenue to Ceding commission income and Commission and other income;

•Reclassification of $10.4 million from Sales, marketing and other acquisition costs to Sales and marketing and Other insurance expense;

•Reclassification of $33.5 million from Other operating expenses to General and administrative and Other insurance expense; and

•Reclassification of $7.9 million from Amortization of capitalized software to General and administrative.

5.Merger Consideration

Merger Consideration

The fair value of merger consideration, or the purchase price, in the unaudited pro forma financial information is approximately $137.7 million. This amount was derived based on the 131,140,667 issued and outstanding common stock of Metromile on July 28, 2022, and applying the exchange ratio of 0.05263 and closing price of Lemonade common stock of $19.84 per share as of closing date.

Replacement Equity Awards

The fair value of assumed Metromile equity awards which includes stock options and restricted stock units which are attributable to pre-combination service amounted to $0.8 million at the completion of the Merger, and is considered part of the purchase price.

Additional Shares

Additional Shares are considered to be contingent consideration which requires recognition of this consideration at fair value under ASC 805. Management has determined that the Additional Shares are equity-classified instruments. Given that the contingencies are not probable of being met within the contingency period, the fair value was assessed to be zero for these Additional Shares.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

For purposes of the pro forma financial information, the following table presents the components of the merger consideration (in millions, except for number of shares and per share amount):

| | | | | |

| Lemonade common stock issued to existing Metromile common stockholders | 6,901,934 | |

Lemonade common stock closing price at July 28, 2022 | $ | 19.84 | |

| Merger consideration exchange of Metromile common stock to Lemonade common stock | $ | 136.9 | |

| Fair value of Metromile assumed equity awards | 0.8 | |

| Total Merger Consideration | $ | 137.7 | |

6.Preliminary Fair Value Estimate of Assets Acquired and Liabilities Assumed

The table below represents an initial allocation of the merger consideration to Metromile’s tangible and intangible assets acquired and liabilities assumed based on Lemonade’s preliminary estimate of their respective fair values and the working capital balances that existed as of the Acquisition Date. The pro forma financial information do not give effect to normal course changes in our cash and other working capital balances through the closing date. Due to the pro forma financial statements being prepared based on preliminary estimates of fair value of the net assets acquired as of closing date, the final purchase allocation and the effect on our financial position and results of operations may differ significantly from the pro forma amounts included herein.

| | | | | |

| Preliminary Purchase Price Allocation |

| Assets acquired | |

| Fixed maturities, available for sale, at fair value | $ | 1.8 | |

| Short-term investments | 64.2 | |

| Cash, cash equivalents and restricted cash | 98.8 | |

| Premiums receivable | 17.4 | |

| Reinsurance recoverable | 14.5 | |

| Property and equipment | 4.6 | |

| VOBA | 1.7 | |

| Intangible assets, technology | 28.0 | |

| Intangible assets, insurance licenses | 7.5 | |

| Other Assets | 14.7 | |

Total assets acquired | $ | 253.2 | |

| Liabilities assumed | |

| Unpaid loss and loss adjustment expenses | $ | 84.4 | |

| Unearned premium | 15.1 | |

| Ceded premium payable | 0.8 | |

| Trade payables | 12.0 | |

| Other liabilities and accrued expenses | 22.2 | |

Total liabilities assumed | $ | 134.5 | |

Total identifiable net assets acquired | $ | 118.7 | |

| |

Total Purchase Consideration | $ | 137.7 | |

Goodwill | $ | 19.0 | |

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

The preliminary purchase price allocation has been used to prepare the pro forma adjustments in the pro forma condensed combined financial information. Final purchase price allocation is subject to change as more detailed analyses are completed and additional information about the fair value of assets acquired and liabilities assumed from Metromile becomes available, and finalized within the measurement period that will not extend beyond 12 months from the close of the transaction. The final allocation could differ materially from the preliminary allocation used in the pro forma adjustments which may include changes in valuation of assets acquired and liabilities assumed, including but not limited to intangible assets, fixed assets, and the residual goodwill.

7.Adjustments to Unaudited Pro Forma Condensed Combined Statement of Operations and Comprehensive Loss

Explanations of the adjustments to the unaudited pro forma condensed combined statement of operations and comprehensive loss are as follows:

A.Represents the amortization on the adjustment of the reserves to fair value.

B.Represents the removal of historical DAC amortization, offset by the amortization related to the newly established VOBA asset.

C.Represents the amortization of newly established intangible assets. Subsequent to the Mergers, the expected amortization expense relating to the preliminary fair value of the acquired intangible assets (excluding VOBA) is reflected in the table below. The pro forma amortization adjustment is $2.3 million and $9.3 million for the three months ended March 31, 2022 and the year ended December 31, 2022, respectively. The pro forma amortization adjustments include the removal of historical amortization expense of $3.4 million and $7.9 million for the three months ended March 31, 2022 and the year ended December 31, 2022, respectively.

| | | | | | | | | | | | | | | | | |

| Estimated fair value

($ in millions) | | Estimated average useful life

(in years) | | Estimated Annual Amortization Expense

($ in millions) |

| Technology Assets | $ | 28.0 | | | 3 | | $ | 9.3 | |

| Insurance Licenses | 7.5 | | | Indefinite | | — | |

| Total | $ | 35.5 | | | | | $ | 9.3 | |

D.After the acquisition, Lemonade will file a consolidated tax return that will include Metromile. Lemonade is expected to continue maintaining a full valuation allowance against net deferred tax assets. Metromile is also expected to have net deferred tax assets offset by a full valuation at acquisition date. As such, there were no pro forma adjustments related to taxes as tax effects of pro forma adjustments are fully offset by the valuation allowance.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

E.The pro forma basic and diluted net loss per share amounts presented in the unaudited pro forma condensed combined statements of operations are based upon the number of Lemonade’s shares outstanding as if the transaction occurred on January 1, 2022. The calculation of weighted average shares outstanding for pro forma basic and diluted net loss per share assumes that the shares issuable in connection with the transaction have been outstanding for the entirety of the period presented. Since Lemonade is in a net loss position in both the historical and pro forma results of operations, any dilutive shares that were identified in calculating the historical EPS would stay as anti-dilutive for the pro forma calculations. The following table sets forth the calculation of basic and diluted loss per share (in millions, except for number of shares and per share amounts):

| | | | | | | | | | | |

| Three Months Ended

March 31, 2022 | | Year Ended

December 31, 2022 |

| Numerator: | | | |

| Net loss attributable to common shareholders - Lemonade | $ | (74.8) | | | $ | (297.8) | |

| Net loss attributable to common shareholders - Metromile | $ | (34.4) | | | $ | (76.6) | |

| Pro forma transaction adjustments | $ | 1.7 | | | $ | (1.5) | |

| Pro forma net loss attributable to common shareholders | $ | (107.5) | | | $ | (375.9) | |

| Denominator: | | | |

| Pro forma weighted average common shares - basic and diluted | 68,523,814 | | | 64,921,524 | |

| Pro forma loss per share - basic and diluted | $ | (1.57) | | | $ | (5.79) | |

DETERMINATION OF OFFERING PRICE

We cannot currently determine the price or prices at which shares of our Common Stock may be sold by the Selling Securityholder under this prospectus.

SELLING SECURITYHOLDER

When we refer to the “Selling Securityholder” in this prospectus, we refer to Chewy Insurance Services, LLC and the pledgees, donees, transferees, assignees, successors and other permitted transferees that hold any of Chewy Insurance Services, LLC’s interest in the Warrant Shares.

On October 14, 2022, Lemonade entered into the Agreements with Chewy in connection with the execution of the Agency Agreement. In connection with the Agreements, Lemonade is authorized to issue to Chewy up to 3,352,025 shares of Lemonade’s Common Stock under the Warrant with an exercise price of $0.01 per share, which will vest in installments on a yearly basis for a period of five years, subject to certain performance requirements, vesting events and thresholds as specified in the Warrant Agreement. The Selling Securityholder has had no other material relationships with us within the past three years.

As of June 8, 2023 prior to this offering, the Selling Securityholder did not beneficially own any shares of Common Stock.

Assuming that the time and performance vesting requirements under the Warrant are fully satisfied and that the Warrant is exercised in full, we will issue 3,352,025 shares of Common Stock to the Selling Securityholder, which would increase the Selling Securityholder’s beneficial ownership of our Common Stock to 3,352,025 shares, representing beneficial ownership of approximately 4.6% of our issued and outstanding shares, based on 72,996,625 shares of Common Stock issued and outstanding as of June 8, 2023 (including the 3,352,025 Warrant Shares). The Selling Securityholder may from time to time offer and sell such shares of Common Stock pursuant to this prospectus. Assuming that the Selling Securityholder sells all of the shares of Common Stock it receives in connection with the exercise of the Warrant in full, the Selling Securityholder will not beneficially own any shares of Common Stock following this offering.

Our registration of the shares of Common Stock does not necessarily mean that the Selling Securityholder will sell all or any of such Common Stock and we cannot advise you as to whether the Selling Securityholder will in fact sell any or all of such shares of Common Stock. Because the Selling Securityholder may offer all or some of the shares of Common Stock pursuant to this offering, and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares, we cannot estimate the number of the shares of Common Stock that will be held by the Selling Securityholder after completion of the offering. Any changed or new information given to us by the Selling Securityholder will be set forth in a prospectus supplement or amendments to the registration statement of which this prospectus is a part, if and when necessary.

DESCRIPTION OF OUR COMMON STOCK

The description of our Common Stock is incorporated by reference to Exhibit 4.3 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 3, 2023.

DESCRIPTION OF THE WARRANTS

The following summary of the material terms of the Warrants is not intended to be a complete summary of the rights and preferences of such securities, and is qualified by reference to our Amended and Restated Certificate of Incorporation, our Amended and Restated Bylaws, the Warrant Agreement, dated October 14, 2022, by and between Lemonade, Inc. and Chewy Insurance Services, LLC (the “Warrant Agreement”) and the Omnibus Agreement, dated October 14, 2022, by and between Lemonade, Inc. and Chewy Insurance Services, LLC. For a complete description, you should refer to the Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws, Warrant Agreement and Omnibus Agreement, copies of which have been filed as exhibits to our Annual Report on Form 10-K or this registration statement, as well as the relevant provisions of the Delaware General Corporation Law.

The Warrants entitle Chewy Insurance Services, LLC or its permitted transferees, assigns and successors (the “Holder”) to purchase up to 3,352,025 Warrant Shares for an exercise price of $0.01 per share (the “Exercise Price”). The Warrant Shares and Exercise Price are subject to adjustment as discussed below. Pursuant to the Warrant Agreement, the Holder may exercise the Warrants, in whole or in part, for any vested shares at any time or from time to time, but in no event later than 5:00 p.m., New York City time, on the six-year anniversary of the Start Date, as defined in the Warrant Agreement (subject to a 60-day extension if certain conditions are met) (such time, the “Expiration Time”). The shares will vest in installments on a yearly basis for a period of five years, subject to certain performance requirements, vesting events and thresholds as specified in the Warrant Agreement.

The Warrants may be exercised upon surrender of the Warrants, together with a notice of exercise, to the Company. The Warrants may be exercised for cash or on a cashless basis. On or before the second business day after the Holder of the Warrants exercises the Warrants and, if applicable, the Company receives payment for the shares issuable upon such exercise, the Company’s transfer agent shall use the DTC Fast Automated Securities Transfer Program to credit such aggregate number of Warrant Shares to the Holder’s or its designee’s balance account with DTC through its DWAC system. If the Warrants have not been fully exercised and have not expired, the Holder shall be entitled to receive from the Company a new warrant of like tenor representing a warrant to purchase the number of Warrant Shares not yet acquired. If, upon exercise of the Warrants, the Holder would be entitled to receive a fractional interest in a share, we will, upon exercise, round up to the nearest whole number of shares of Common Stock.

The Holder does not have the rights or privileges of holders of our Common Stock and any voting rights until it exercises the Warrants and receives shares of Common Stock. After the issuance of shares of Common Stock upon exercise of the Warrants, in whole or in part, the Holder will be entitled to one (1) vote for each share held of record on all matters to be voted on by stockholders.

The Exercise Price and number of Warrant Shares issuable upon exercise of the Warrants are subject to adjustment from time to time if the Company (a) declares a dividend or makes a distribution on its Common Stock in additional shares of Common Stock, (b) splits, subdivides or reclassifies the outstanding shares of Common Stock into a greater number of shares, or (c) combines or reclassifies the outstanding shares of Common Stock into a smaller number of Shares. In such event, the number of Warrant Shares issuable upon exercise of the Warrants at the time of the record date for such dividend or distribution or the effective date of such split, subdivision, combination, or reclassification shall be proportionately adjusted so that the Holder shall be entitled to purchase the number of shares of Common Stock which such Holder would have owned or been entitled to receive had the Warrants been exercised in full immediately prior to such record date or effective date (disregarding whether or not the Warrants had been exercisable by its terms at such time). In such event, the Exercise Price shall be adjusted to the number obtained by dividing (x) the product of (1) the number of Warrant Shares issuable upon the exercise of the Warrants in full before the adjustment and (2) the Exercise Price in effect immediately prior to the record date or effective date, as the case may be, for the dividend, distribution, split, subdivision, combination or reclassification giving rise to such adjustment by (y) the new number of Warrant Shares issuable upon exercise of the Warrants in full determined by the immediately preceding sentence.

If the Company, at any time while the Warrants are outstanding, makes a Distribution (including, without limitation, any distribution of cash stock or other securities, property or options by way of a dividend, spin-off, reclassification, corporate rearrangement, scheme of arrangement, or other similar transaction) to holders of shares of Common Stock, but not to the Holder, the Holder will be entitled to participate in such Distribution and be deemed to have exercised, and be the holder of, vested Warrant Shares as of immediately before the record date of such Distribution and provision shall be made so that the Holder shall receive upon vesting of the Warrant Shares the kind and amount of cash or other property which the Holder would have been entitled to receive for the unvested Warrant Shares, in each case, had the Warrants been exercised in full into Warrant Shares on the date of such event.

In case of any Change of Control, as defined in the Omnibus Agreement, the Holder’s right to receive Warrant Shares upon exercise of these Warrants shall be converted into the right to exercise these Warrants to acquire the number of shares of stock or other securities or property (including cash) that a holder of the number of shares of Common Stock issuable pursuant to this warrant immediately before such Change of Control (including any shares that had not yet vested) would have been entitled to receive upon consummation of such Change of Control. Within thirty days following a change of control, the Company or the Holder may deliver a termination notice, which will become effective thirty days after the delivery of such notice.

PLAN OF DISTRIBUTION

We are registering the resale by the Selling Securityholder of the Warrant Shares. The Selling Securityholder, which as used herein includes Chewy's permitted transferees, assigns and successors, may from time to time, sell, transfer or otherwise dispose of any or all of their Warrant Shares or interests in the Warrant Shares on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

We will not receive any of the proceeds from the sale of the Warrant Shares by the Selling Securityholder. However, upon a cash exercise of the Warrants by the Selling Securityholder, we will receive, the exercise price of $0.01 per Warrant Share. If the Warrants are exercised in a cashless exercise, we will not receive any proceeds from the exercise of the Warrants. We are required to pay all fees and expenses incident to the registration of the Warrant Shares to be offered and sold pursuant to this prospectus.

The Selling Securityholder will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on one or more exchanges or in the over‑the‑counter market or otherwise, at prices and under terms then prevailing or at prices related to the then current market price or in negotiated transactions. The Selling Securityholder may sell its shares by one or more of, or a combination of, the following methods:

•purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus;

•ordinary brokerage transactions and transactions in which the broker solicits purchasers;

•block trades in which the broker-dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•an over-the-counter distribution in accordance with the rules of NYSE;

•through trading plans entered into by a Selling Securityholder pursuant to Rule 10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on the basis of parameters described in such trading plans;

•to or through underwriters or broker-dealers;

•in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

•in privately negotiated transactions;

•in options transactions;

•through a combination of any of the above methods of sale; or

•any other method permitted pursuant to applicable law.

In addition, any shares that qualify for sale pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus.

The Selling Securityholder may not sell all or any of the securities offered by this prospectus. In addition, the Selling Securityholder may also sell securities in other transactions exempt from registration, rather than under this prospectus.

The Selling Securityholder also may transfer the securities in other circumstances, in which case the permitted transferees, assignees or successors will be the selling beneficial owners for purposes of this prospectus. Upon being notified by the Selling Securityholder that a permitted transferee, assignee or successor intends to sell our securities, we will, to the extent required, promptly file a supplement to this prospectus to name specifically such person as a selling securityholder.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In connection with distributions of the shares or otherwise, the Selling Securityholder may enter into hedging transactions with broker-dealers or other financial institutions. In connection with such transactions, broker-dealers or other financial institutions may engage in short sales of shares of Common Stock in the course of hedging transactions. The Selling Securityholder may also sell shares of Common Stock short and redeliver the shares to close out such short positions. The Selling Securityholder may also enter into option or other transactions with broker-dealers or other financial institutions which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The Selling Securityholder may also pledge shares to a broker-dealer or other financial institution, and, upon a default, such broker-dealer or other financial institution, may effect sales of the pledged shares pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Securityholder may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by the Selling Securityholder or borrowed from the Selling Securityholder or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from the Selling Securityholder in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective amendment). In addition, the Selling Securityholder may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

In effecting sales, broker-dealers or agents engaged by the Selling Securityholder may arrange for other broker-dealers to participate. Broker-dealers or agents may receive commissions, discounts or concessions from the Selling Securityholder in amounts to be negotiated immediately prior to the sale.

In offering the shares covered by this prospectus, the Selling Securityholder and any broker -dealers who execute sales for the Selling Securityholder may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. Any profits realized by the Selling Securityholder and the compensation of any broker-dealer may be deemed to be underwriting discounts and commissions.

In order to comply with the securities laws of certain states, if applicable, the shares must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

In addition, we will make copies of this prospectus available to the Selling Securityholder for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The Selling Securityholder may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

At the time a particular offer of shares is made, if required, a prospectus supplement will be distributed that will set forth the number of shares being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

LEGAL MATTERS

The validity of any securities offered by this prospectus will be passed upon for us by Latham & Watkins LLP. Additional legal matters may be passed upon for us, the Selling Securityholder or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Lemonade, Inc. as of December 31, 2022 and 2021, and for each of the three years in the period ended December 31, 2022, incorporated by reference in this prospectus and elsewhere in the registration statement have been audited by Ernst & Young LLP, independent registered public accounting firm and are incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Metromile, Inc. as of December 31, 2021 and 2020, for the years then ended appearing in Lemonade, Inc.'s Current Report on Form 8-K/A filed with the SEC on October 11, 2022, have been audited by Moss Adams LLP, an independent registered public accounting firm, as stated in their report thereon included herein, and incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC as required by the Exchange Act. You can read Lemonade’s SEC filings, including this prospectus, over the Internet at the SEC’s website at http://www.sec.gov.

Our website address is www.lemonade.com. Through our website, we make available, free of charge, the following documents as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC, including our Annual Reports on Form 10-K, our proxy statements for our annual and special stockholder meetings, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, Forms 3, 4, and 5 and Schedules 13D with respect to our securities filed on behalf of our directors and our executive officers; and amendments to those documents. The information contained on, or that may be accessed through, our website is not a part of, and is not incorporated into, this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The following documents filed with the SEC by us pursuant to the Exchange Act are incorporated by reference in this prospectus, other than information furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K: