XA Investments Non-Listed Closed End Funds Fourth Quarter 2024 Market Update Shows Record Growth

23 Janvier 2025 - 3:00PM

XA Investments LLC (“XAI”), an alternative investment management

and consulting firm, has released its Non-Listed Closed-End Funds

Fourth Quarter 2024 Market Update, which is a comprehensive

research report detailing current market trends and industry

highlights. The non-listed closed-end funds (CEF) market includes

all interval and tender offer funds. The report covers recent

M&A activity for private asset managers, 2024 success stories,

and expanded coverage on the infrastructure fund category.

“The non-listed CEF market had a record year in 2024 with 50

funds launching and many more entering the SEC registration

process,” stated Kimberly Flynn, the President of XAI. “Such robust

growth is great for the interval / tender offer fund market, and

while challenges remain, particularly in investor education and

navigating regulatory complexities, we believe the market's

trajectory will remain positive, with significant opportunities for

expansion in 2025,” she added.

“XAI predicts market trends for 2025 include a strong demand for

evergreen products, the market coalescing around market leaders,

and technology changes for ease of use,” Flynn said. Additionally,

“XAI anticipates alternative investments will be more widely

available to investors in all accounts, allowing the market to

continue at an accelerated pace of growth in 2025.”

The non-listed CEF market reached a new peak with 257 interval

and tender offer funds with a total of $172 billion in net assets

and $208 billion in total managed assets, inclusive of leverage as

of December 31, 2024. The market includes 124 interval funds which

comprise 60% of the total managed assets at $124.3 billion and 133

tender offer funds which comprise the other 40% with $83.3 billion

in total managed assets. In 2024, 50 new funds entered the market,

representing an increase of 22 funds compared to the 28 funds

launched in 2023. Market wide net assets increased $37 billion in

2024.

Flynn noted, “In total, there are 146 unique fund sponsors in

the interval and tender offer fund space, which is an increase of

24 new fund sponsors from 122 unique sponsors at the end of 2023.

The market has continued to diversify with 49% of the funds

launched in 2024 sponsored by new entrants. Some of these new fund

sponsors in the non-listed CEF market include MA Asset Management,

Rockefeller Asset Management, and Wellington Management.”

There are 44 fund sponsors that have two or more interval and/or

tender offer funds currently in the market. Additionally, there are

26 funds in the Securities and Exchange Commission (SEC)

registration process from fund sponsors looking to launch another

fund. While the top 20 funds held their 65% market share from Q3

2024, there were 11 new fund sponsors that entered the market in Q4

2024, with 24 new fund sponsors in total entering the market this

year.

Many interval and tender offer funds had a strong 2024 with

positive net flows and large increases in fund assets. Some of

these include the Brookfield Infrastructure Fund, which had over

$1bn in net flows in the first three quarters of 2024, and the

Hamilton Lane Private Assets Fund which raised over $1bn in their

first interval / tender offer fund, with three additional funds in

registration. Other recently launched funds that had notable

success in 2024 include the AMG Pantheon Credit Solutions Fund, the

Cascade Private Capital Fund, and the StepStone Private Credit

Income Fund.

“The non-listed CEF market continues to grow with a total of 53

funds in the SEC registration process at the end of 2024,”

according to Flynn. “Due to a record number of 22 funds launched in

Q4, the SEC backlog stayed the same compared to the third quarter,

when there were also 53 funds in registration. In 2024, there was a

record 80 new SEC filings, compared to 45 SEC filings in 2023,

representing a 73% increase in registrations. Newly launched

non-listed CEFs spent around six months in the SEC registration

process, with the fund’s asset class continuing to be the main

driver of time spent in the SEC review process. Real Estate / Real

Asset funds were the quickest to launch, at 139 days on average

spent in registration,” she added.

The majority of interval and tender offer funds (47%) do not

have any suitability restrictions for investors imposed at the fund

level - 32% of funds are available to accredited investors and 21%

are only available to qualified clients. Alternative funds without

suitability restrictions also prove to be more accessible and have

gathered more assets at $108.8bn in managed assets or 52% of market

wide assets.

For more information on the interval fund market and to read our

full quarterly report on non-listed CEFs, please visit the CEF

Market research page linked here and click ‘Subscribe’ for access

to XA Investments’ online research portal and pricing information.

In addition, please contact info@xainvestments.com or 888-903-3358

with questions.

About XA InvestmentsXA Investments LLC (“XAI”)

is a Chicago-based firm founded by XMS Capital Partners in 2016.

XAI serves as the investment adviser for two listed closed-end

funds and an interval closed-end fund, respectively the XAI Octagon

Floating Rate & Alternative Income Trust (NYSE: XFLT), the XAI

Madison Equity Premium Income Fund (NYSE: MCN), and the Octagon XAI

CLO Income Fund (OCTIX). In addition to investment advisory

services, the firm also provides investment fund structuring and

consulting services focused on registered closed-end funds to meet

institutional client needs. XAI offers custom product build and

consulting services, including product development and market

research, marketing and fund management. XAI believes that the

investing public can benefit from new vehicles to access a broad

range of alternative investment strategies and managers. For more

information, please visit www.xainvestments.com.

Sources: XA Investments; CEFData.com; SEC Filings.

Notes: All information as of 12/31/2024 unless otherwise noted.

Total managed assets is inclusive of leverage. The non-listed CEF

market is subject to lags in reporting and limited data

availability. Data such as asset levels, net flows, and performance

are delayed up to 90 days after quarter-end and are not available

for all funds. All data in the report is the most current

available. Please contact our team if you have any questions about

the non-listed CEF marketplace.

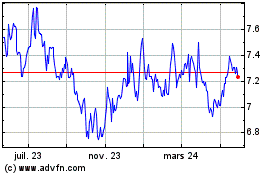

XAI Madison Equity Premi... (NYSE:MCN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

XAI Madison Equity Premi... (NYSE:MCN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025