As filed with the Securities and Exchange Commission

on March 5, 2024

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

THE MARCUS CORPORATION

(Exact name of registrant

as specified in its charter)

| Wisconsin |

39-1139844 |

| (State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification No.) |

100 East Wisconsin Avenue, Suite 1900

Milwaukee, Wisconsin 53202

(414) 905-1000

(Address, including zip code, and

telephone number, including area code, of

registrant’s principal executive offices)

Thomas F. Kissinger

Senior Executive Vice President, General

Counsel and Secretary

100 East Wisconsin Avenue, Suite 1900

Milwaukee, Wisconsin 53202

(414) 905-1000

(Name, address, including zip code, and telephone

number,

including area code, of agent for service) |

with a copy to:

Steven R. Barth

Spencer T. Moats

Garrett F. Bishop

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

(414) 271-2400

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please

check the following box: x

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check

the following box: ¨

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act,

please check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering: ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box:¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ¨ |

Accelerated

filer x |

| Non-accelerated

filer ¨ |

Smaller

reporting company ¨ |

| |

Emerging

growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of

the Securities Act. ¨

PROSPECTUS

THE MARCUS CORPORATION

DIVIDEND REINVESTMENT PLAN

250,000 Shares of Common Stock

This prospectus relates

to 250,000 shares of common stock, $1.00 par value per share (“Common Stock”) of The Marcus Corporation (the “Company”)

reserved for issuance under the Company’s Dividend Reinvestment Plan (the “Plan”). Eligible shareholders under the

Plan may reinvest all or a portion of their cash dividends in shares of Common Stock as well as make optional cash investments of $50

or more per investment in Common Stock up to a total of $1,500 per calendar month. In addition, dividends on all shares acquired and

held in the accounts of participants under the Plan will be automatically reinvested in additional shares of Common Stock.

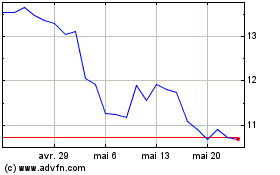

The Common Stock is traded

on the New York Stock Exchange under the symbol “MCS.” On February 29, 2024, the last reported sale price of the Common Stock

on the New York Stock Exchange was $14.45 per share.

The Plan provides that shares

of Common Stock may be purchased for participants from the Company or in the open market or in privately negotiated transactions. The

price of newly issued shares purchased from the Company will be the average (computed to three decimal places) of the high and low prices

of shares of Common Stock on the New York Stock Exchange on the date of purchase. The price of shares of Common Stock purchased for participants

on the open market or in privately negotiated transactions will be the weighted average of the prices paid for such shares. No brokerage

commissions, fees or service charges will be incurred by participants in connection with purchases of shares under the Plan (whether

from the Company or on the open market or in privately negotiated transactions) or for participating in the Plan. For a detailed summary

of the Plan, see the section “The Plan” in this Prospectus.

In

reviewing this prospectus, you should carefully consider the matters described under the caption “Risk Factors ”

on page 5.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy

or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus does

not constitute an offer to sell or the solicitation of an offer to buy any securities in any state where offers or sales are not permitted.

The date of this prospectus is March 5, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) relating

to the shares of our Common Stock offered under the Plan. This prospectus does not include all of the information in the registration

statement. The registration statement containing this prospectus, including exhibits to the registration statement, provides additional

information regarding The Marcus Corporation. (the “Company”), the Plan, and the shares of Common Stock offered under the

Plan. Before making a decision to invest in shares of Common Stock, you should carefully read this prospectus, especially the sections

entitled “Risk Factors” on page 5 and “Where You Can Find More Information” beginning on page 26.

We have not authorized anyone

to provide you with information that is different from that contained in this prospectus. No dealer, salesperson or other person is authorized

to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information

or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. You should assume that the information in this prospectus is accurate only as of the date on the front of

the document, regardless of the time of delivery of this prospectus or any sale of a security.

Unless otherwise mentioned

or unless the context requires otherwise, all references in this prospectus to “the Company”, “MCS”, “we”,

“us”, “our” and similar terms refer to The Marcus Corporation and its consolidated subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION

Certain matters discussed

in this prospectus are “forward-looking statements” intended to qualify for the safe harbors from liability established by

the Private Securities Litigation Reform Act of 1995. These forward-looking statements may generally be identified as such because the

context of such statements include words such as we “believe,” “anticipate,” “expect” or words of

similar import. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking

statements are subject to certain risks and uncertainties which may cause results to differ materially from those expected, including,

but not limited to, the following: (1) the adverse effects the COVID-19 pandemic, or future pandemics, may have on our theatre and

hotels and resorts businesses, results of operations, liquidity, cash flows, financial condition, access to credit markets and ability

to service our existing and future indebtedness; (2) the availability, in terms of both quantity and audience appeal, of motion

pictures for our theatre division (including disruptions in the production of films due to events such as a strike by actors, writers

or directors); (3) the effects of theatre industry dynamics such as the maintenance of a suitable window between the date such motion

pictures are released in theatres and the date they are released to other distribution channels; (4) the effects of adverse economic

conditions in our markets; (5) the effects of adverse economic conditions on our ability to obtain financing on reasonable and acceptable

terms, if at all; (6) the effects on our occupancy and room rates caused by the relative industry supply of available rooms at comparable

lodging facilities in our markets; (7) the effects of competitive conditions in our markets; (8) our ability to achieve expected

benefits and performance from our strategic initiatives and acquisitions; (9) the effects of increasing depreciation expenses, reduced

operating profits during major property renovations, impairment losses, and preopening and start-up costs due to the capital intensive

nature of our business; (10) the effects of changes in the availability of and cost of labor and other supplies essential to the

operation of our business; (11) the effects of weather conditions, particularly during the winter in the Midwest and in our other markets;

(12) our ability to identify properties to acquire, develop and/or manage and the continuing availability of funds for such development;

(13) the adverse impact on business and consumer spending on travel, leisure and entertainment resulting from terrorist attacks in the

United States, other incidents of violence in public venues such as hotels and movie theatres or epidemics; and (14) a disruption in

our business and reputational and economic risks associated with civil securities claims brought by shareholders. These statements are

not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control

and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking

statements. Our forward-looking statements are based upon our assumptions, which are based upon currently available information. Shareholders,

potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and

are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are made only

as of the date of this prospectus and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent

events or circumstances. See “Risk Factors” in this prospectus for more information. You should consider these factors and

other cautionary statements made in this prospectus and in the documents we incorporate by reference as being applicable to all related

forward-looking statements wherever they appear in this prospectus and in the documents incorporated by reference.

SUMMARY

This summary highlights

information contained elsewhere in this prospectus or incorporated by reference therein. This summary is not complete and does not contain

all of the information that you should consider before buying our shares in this offering. You should read this entire prospectus carefully,

including the section entitled “Risk Factors” on page 8 of this prospectus and all other information, including our

consolidated financial statements and the related notes, that are included or incorporated by reference in this prospectus before you

decide to purchase shares of our Common Stock.

About the Company

We are engaged primarily

in two business segments: movie theatres and hotels and resorts.

As of December 28,

2023, our theatre operations included 79 movie theatres with 993 screens throughout 17 states (Wisconsin, Illinois, Iowa, Minnesota,

Missouri, Nebraska, North Dakota, Ohio, Arkansas, Colorado, Georgia, Kentucky, Louisiana, New York, Pennsylvania, Texas and Virginia).

We also operate a family entertainment center, Funset Boulevard, that is adjacent to one of our theatres in Appleton, Wisconsin. As of

the date of this Annual Report, we are the 4th largest theatre circuit in the United States.

As of December 28,

2023, our hotels and resorts operations included seven wholly-owned and operated hotels and resorts in Wisconsin, Illinois, and

Nebraska. We also manage eight hotels, resorts and other properties for third parties in Wisconsin, California, Minnesota, Nevada, Nebraska, Illinois, Iowa,

and Pennsylvania. As of December 28, 2023, we owned or managed approximately 4,400 hotel and resort rooms.

Stock Listing

Our Common Stock is listed

on the New York Stock Exchange under the symbol “MCS”.

Principal Executive Offices and Telephone

Number

Our headquarters are located

at 100 East Wisconsin Avenue, Suite 1900, Milwaukee, Wisconsin 53202, and our telephone number is (414) 905-1000.

Internet Address

Our internet address is

www.marcuscorp.com. The contents of our internet website are not a part of, and are not incorporated by reference into, this prospectus

or any accompanying prospectus supplement.

About the Plan and this Offering

The Company is offering

to its shareholders the opportunity to purchase shares of the Company’s Common Stock, by reinvesting dividends and/or by making

optional cash investments pursuant to the Plan. Eligible shareholders under the Plan may reinvest all or a portion of their cash dividends

in shares of Common Stock as well as make optional cash investments of $50 or more per investment in Common Stock up to a total of $1,500

per calendar month. In addition, dividends on all shares acquired and held in the accounts of participants under the Plan will be automatically

reinvested in additional shares of Common Stock.

Equiniti Trust Company,

LLC (“EQ”) is the Administrator of the Plan. The Administrator will purchase the Common Stock under the Plan directly from

the Company out of authorized but unissued shares.

The Plan provides that shares

of Common Stock may be purchased for participants from the Company or in the open market or in privately negotiated transactions. The

price of newly issued shares purchased from the Company will be the average (computed to three decimal places) of the high and low prices

of shares of Common Stock on the New York Stock Exchange on the date of purchase. The price of shares of Common Stock purchased for participants

on the open market or in privately negotiated transactions will be the weighted average of the prices paid for such shares. No brokerage

commissions, fees or service charges will be incurred by participants in connection with purchases of shares under the Plan (whether

from the Company or on the open market or in privately negotiated transactions) or for participating in the Plan. For a detailed summary

of the Plan, see “The Plan.”

CONTACT INFORMATION

Internet

shareowneronline.com

Available

24 hours a day, 7 days a week for access to your account information and answers for many common questions and general inquiries.

To register for online access:

If you are an existing, registered shareowner:

| 1. | Go to shareowneronline.com |

| 2. | Click Register then I want to register for online access |

| 3. | Select The Marcus Corporation and enter your EQ Account Number |

| 4. | Select your Authentication* method |

| 5. | Follow the steps to provide your information, create your secure

profile, and access your online account. |

*If you need your

Authentication ID to continue, select Authentication ID and Please send my Authentication ID, the click Send ID.

For security, this number is required for first time sign on.

Email

Login to your account at shareowneronline.com

and select Contact Us.

Telephone

1-800-468-9716

Toll-Free

651-450-4064

outside the United States

Customer

Care Specialists are available Monday through Friday, from 7:00 a.m. to 7:00 p.m. Central Time.

You

may also access your account information 24 hours a day, 7 days a week using our automated voice response system.

Written

correspondence and deposit of certificated shares:

EQ

Shareowner Services

P.O. Box

64856

St.

Paul, MN 55164-0856

Certified

and overnight delivery

EQ Shareowner Services

1110 Centre Pointe Curve, Suite 101 Mendota

Heights, MN 55120-4100

RISK FACTORS

Investing in our securities

involves significant risks. Before making an investment decision, you should carefully consider the risks and other information we include

or incorporate by reference in this prospectus. In particular, you should consider the risk factors under the heading "Risk Factors"

included in our most recent Annual Report on Form 10-K, as may be revised or supplemented by our subsequent Quarterly Reports on

Form 10-Q or Current Reports on Form 8-K, each of which are on file with the SEC and are incorporated herein by reference,

and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. The risks

and uncertainties we have described are not the only ones facing our company. Additional risks and uncertainties not currently known

to us or that we currently deem immaterial may also affect our business operations.

Risks Related to the Plan

You will not know the price of the Common

Stock you are purchasing under the Plan at the time you elect to have your dividends reinvested, and you may not be able to direct the

time or price at which the Common Stock you hold is sold under the Plan.

The

price of our Common Stock may fluctuate between the time you decide to purchase Common Stock under the Plan and the time of actual purchase.

If an Account Authorization Card is received by the Administrator on or before the record

date for the payment of the next dividend, the dividend or distribution, as applicable, will be reinvested as of the dividend payment

date. If an Account Authorization Card is not received by the record date, reinvestment of dividends

or distributions, as applicable, will not begin until the next following dividend payment date. In addition, during this time period,

you may become aware of additional information that might affect your investment decision.

EQ serves as the Administrator

of the Plan. If you instruct the Administrator to sell Common Stock under the Plan, you will not be able to direct the time or price

at which the Common Stock is sold. The price of our Common Stock may decline between the time you decide to sell Common Stock and the

time of actual sale.

The issuance of additional shares of Common Stock could dilute

or depress the value of your shares of the Company’s Common Stock.

Sales of additional shares of stock, or the perception

that shares may be sold, could negatively affect the market price of our Common Stock. The issuance of additional shares also could dilute

the percentage ownership interest and corresponding voting power of the prior shareholders.

THE PLAN

Purpose

The purpose

of the Plan is to provide shareholders of record of the Common Stock of the Company with a simple and convenient method of purchasing

shares of Common Stock. Once enrolled in the Plan, eligible shareholders may use dividends and/or make optional cash investments to acquire

additional shares of Common Stock without incurring purchase fees, such as brokerage commissions or service charges.

Administration of the Plan

Equiniti

Trust Company, LLC (“EQ”) has been appointed by the Company as its agent to administer the Plan, maintain records, send statements

of account to participants and perform other duties relating to the Plan, subject to the direction of the Company. EQ will hold for safekeeping

the shares of Common Stock acquired under the Plan for each participant until termination of participation in the Plan or receipt of

a request in writing from a participant for all or part of his or her Plan shares. Shares held by EQ will be registered in the name of

EQ or one of its nominees, as Plan Administrator for the Plan. The Company acting through its Board of Directors may, at any time and

in its sole discretion, appoint a successor administrator of the Plan upon 30 days’ written notice to EQ.

Advantages of Participating in the Plan

Participants in the Plan

may:

| · | Automatically

reinvest dividends on all or a portion of their shares of Common Stock held of record in

additional shares of Common Stock. |

| · | Invest

additional cash (in amounts of not less than $50 per investment, up to a maximum of $1,500

per calendar month) to purchase additional shares of Common Stock. |

Participants in the Plan

will:

| · | Have

dividends on shares credited to their Plan accounts automatically reinvested in additional

shares of Common Stock. |

| · | Participate

without incurring fees in connection with purchases of additional shares of Common Stock

under the Plan, including brokerage commissions or service charges. |

| · | Benefit

from full investment of funds under the Plan because fractional shares, as well as whole

shares, will be credited to their accounts; dividends on such fractional shares, as well

as on whole shares, will be reinvested in additional shares. |

| · | Avoid

the need for safekeeping of certificates for shares of Common Stock credited to their accounts

under the Plan. |

| · | Receive

periodic statements from EQ reflecting all current activity in their Plan account, thereby

affording participant’s simplified recordkeeping. |

Participation by Shareholders of Record

Eligibility.

Any shareholder who has shares of Common Stock registered in his or her own name on the books of the Company is eligible to participate

in the Plan. (Shareholders owning Class B Common Stock will not, solely as a result of such ownership, be eligible to participate

in the Plan.) A beneficial owner of Common Stock, whose shares are registered in the name of another (e.g., in a broker’s “street

name” or in the name of a bank nominee or trustee) and who desires to participate in the Plan, must either make appropriate arrangements

with the record holder to participate on behalf of the beneficial owner or must become a shareholder of record by having part or all

of such shares transferred into his or her own name. Shares held by an individual in the Company’s 401(k) retirement savings

plan are not registered in the name of the individual and are not eligible for participation in the Plan.

Participation by shareholders

of record of Common Stock in the Plan is completely voluntary. Shareholders who do not elect to participate in the Plan will continue

to receive their cash dividends if, when and as declared by the Board of Directors of the Company. Payment of cash dividends in the future

by the Company will depend on its future earnings, financial requirements and other factors. There can be no assurance that the Company

will continue to pay cash dividends or pay cash dividends at the same rates or in the same amounts as in prior years.

Investment

Options. An eligible shareholder of record of Common Stock may elect to participate in the Plan through the following dividend

reinvestment and/or optional cash investment options:

Full

Dividend Reinvestment – All cash dividends payable on shares held in the Plan, along with any shares held in physical

certificate form or through book-entry Direct Registration Shares (“DRS”) will be used to purchase additional shares. The

participant will not receive cash dividends from the Company; instead, all dividends will be reinvested. Whole and fractional shares

will be allocated to the participant’s Plan account. (RD)

Partial

Dividend Reinvestment – A participant may elect to reinvest a portion of the dividend and receive the remainder in cash.

The partial elected to reinvestment will be applied to the total shares held in the Plan, along with any shares held in physical certificate

form or held through book-entry DRS. The cash portion of dividends will be sent by check unless the participant has elected to have those

dividends deposited directly into a designated bank account. (RPN)

Cash

Dividends – All dividends payable to the participant will be paid in cash. This includes the dividends payable on all

shares held in the Plan, any shares held in physical certificate form or held through book-entry DRS. The participant’s dividend

payment will be sent by check unless the participant has elected to have those dividends deposited directly into a designated bank account.

For electronic direct deposit of any dividend funds, contact the Plan Administrator to request a Direct Deposit of Dividends Authorization

card. The participant should include a voided check or deposit slip from the bank account for which to set up direct deposit. If the

shares are jointly owned, all owners must sign the form. (RP0)

Optional

Cash Investments – A participant may make optional cash investments to purchase additional shares of Common Stock with

any of the above options. A participant must first be a shareholder of record before being allowed to make optional cash investments.

All shares acquired by a

shareholder through dividend reinvestment and optional cash investments will be credited to the participant’s account under the

Plan. Dividends on shares (including any fractional share interest) of Common Stock held in the participant’s account under the

Plan will be reinvested in additional shares of Common Stock in accordance with the investment options described above.

Enrollment.

An eligible shareholder may join the Plan at any time by properly completing and signing an Account Authorization Card and sending it

to EQ. If the shares of Common Stock are registered in more than one name (e.g., joint tenants or trustees), all registered holders must

sign. A shareholder may obtain an Account Authorization Card by contacting EQ by telephone or in writing.

The reinvestment of a participant’s

dividends will begin with the dividend payment date immediately following the date on which a signed and properly completed Account Authorization

Card specifying reinvestment of dividends is received by EQ, provided that the Account Authorization Card is received by EQ at least

two business days before the record date for a dividend payment. If the Account Authorization Card is received by EQ after that time,

the reinvestment of dividends will begin with the next dividend payment and will be completed no later than 30 trading days following

the dividend payment date. Dividend payment dates in the future for the Common Stock are expected to be on or about the 15th day of February,

May, August and November (or the closest business day thereto if such dividend payment date is not a business day). Each corresponding

record date is expected to be 21 days in advance of such dividend payment date. There can be no assurance that these dates will not change

or that the Company will continue paying quarterly dividends.

Each participant is fully

responsible for the proper completion and timely delivery to EQ of his or her Account Authorization Card. Neither EQ nor the Company

may be held responsible for Account Authorization Cards which are not properly completed or timely delivered.

Participation in the Plan

by an eligible shareholder making optional cash investments is described below under “Optional Cash Investments.”

Change

of Investment Option. A participant may change his or her investment option at any time online, by telephone or by obtaining

and properly completing a new Account Authorization Card and sending it to EQ. With respect to the reinvestment of dividends, the new

Account Authorization Card must be received by EQ at least two business days before the record date for a dividend payment in order to

be effective for such payment.

Optional Cash Investments

How the Cash Investment

Option Works. An optional cash investment may be made by an eligible shareholder when enrolling in the Plan by sending a check (payable

to EQ Shareowner Services) to EQ with a properly completed and signed Account Authorization Card. Once enrolled, the participant may

use the Transaction Request Form attached to any statement of account supplied by EQ to make additional optional cash investments.

Optional cash investments, if made by participants in such manner, need not be in the same amount each time and such investments need

not be made on a regular basis.

Checks – To make an

investment by mail, payments must be in U.S. dollars and drawn on a U.S. or Canadian financial institution. Cash, money orders, traveler’s

checks and third-party checks are not accepted.

Automatic

Investments – A participant may setup a one-time or monthly automatic withdrawal from a designated bank account. The

request may be submitted online, by telephone or by sending an Account Authorization Card by mail (see “Contact Information”).

Requests are processed and become effective as promptly as administratively possible. Once the automatic withdrawal is initiated, funds

will be debited from the participant’s designated bank account on or about the 9th of each month and will be invested in the Company’s

Common Stock on the next investment date. Changes or a discontinuation of automatic withdrawals can be made online, by telephone or by

using the Transaction Request Form attached to the participant’s statement. To be effective with respect to a particular investment

date, a change request must be received by the Plan Administrator at least 15 trading days prior to the investment date.

Optional cash investments

received from participants will be applied by EQ to the purchase of additional shares of Common Stock as of the Investment Date (as such

term is defined under “Purchase of Shares” below) following the receipt of such payments, except as otherwise provided herein.

To be reinvested on the next Investment Date, optional cash investments must be received by EQ no later than the business day prior to

the Investment Date. Any optional cash received thereafter will be held by EQ and invested on the next succeeding Investment Date. NO

INTEREST WILL BE PAID BY THE COMPANY OR EQ ON OPTIONAL CASH INVESTMENTS. THEREFORE, OPTIONAL CASH INVESTMENTS WHICH ARE MAILED TO EQ

SHOULD BE SENT SO AS TO REACH EQ SHORTLY BEFORE THE DEADLINE. PARTICIPANTS SHOULD ALLOW ADEQUATE TIME FOR MAILING. PARTICIPANTS WHO MAIL

PAYMENTS TO EQ ARE RESPONSIBLE FOR PROPER COMPLETION AND TIMELY DELIVERY.

During the period that an

optional cash investment is pending, the Plan Administrator may invest the collected funds in its possession in certain Permitted Investments.

For purposes of this Plan, “Permitted Investments” shall mean the Plan Administrator may hold the funds uninvested or invested

in select Wells Fargo deposit products. The risk of any loss from such Permitted Investments will be the responsibility of the Plan Administrator.

Investment income from such Permitted Investments will be retained by the Plan Administrator.

Limitations

on Amounts of Optional Investments by Shareholders. Each optional cash investment by a participant must be at least $50 per

investment and may not exceed $1,500 per calendar month. All amounts received by EQ for investment under the Plan must be denominated

in United States dollars and drawn on a United States or Canadian financial institution.

In the case of a nominee

who holds Common Stock for more than one beneficial owner, optional cash investments of more than $1,500 per calendar month may be made,

provided such nominee certifies to EQ and the Company, accompanied by such documentation as the Company may require, that each beneficial

owner is not making optional cash investments in excess of the per investment maximum.

Return

of Uninvested Optional Cash Payments. A participant may, without terminating participation in the Plan, obtain the return

(without interest) of any uninvested optional cash upon written request received by EQ at least two business days prior to the applicable

Investment Date; provided that it is verified that good funds were originally received by EQ. If any optional cash investment is returned

for any reason, the Plan Administrator will remove from the participant’s account any shares of Common Stock purchased with such

funds and will sell these shares. The Plan Administrator may also sell additional shares of Common Stock in the account to recover a

returned funds fee for each optional cash investment returned unpaid for any reason and may sell additional shares of Common Stock as

necessary to cover any market loss incurred by the Plan Administrator.

Costs and Expenses

All costs and expenses associated

with the operation of the Plan, including service charges, will be paid by the Company. However, a participant who instructs EQ to sell

any Common Stock then held in the Plan for his or her account will be responsible for his or her pro rata share of applicable brokerage

commissions relating to such sale, plus any service fees. A participant will also be responsible to pay other fees, as specified below.

Investment Summary and Fees

Summary

| Minimum

Cash Investments |

|

| Minimum one-time optional

cash purchase |

$50.00 |

| Minimum recurring automatic

investments |

$50.00 |

| Maximum Cash Investments |

|

| Maximum monthly investment |

$1,500.00 |

| Dividend Reinvestment

Options |

|

| Reinvest options |

Full, Partial, None |

| |

|

| Fees |

|

| Investment Fees |

|

| Dividend reinvestment |

Company Paid |

| Check investment |

Company Paid |

| One-time automatic investment |

Company Paid |

| Recurring automatic investment |

Company Paid |

| Dividend purchase trading

commission per share |

Company Paid |

| Optional cash purchase

trading commission per share |

Company Paid |

| Sales Fees |

|

| Batch order |

$15.00 per Transaction |

| Market order |

$25.00 per Transaction |

| Limit order per transaction

(Day/GTD/GTC) |

$30.00 per Transaction |

| Stop order |

$30.00 per Transaction |

| Sale trading commission

per share |

$0.12 per Transaction |

| Direct deposit of sale

proceeds |

$5.00 per Transaction |

| Other Fees |

|

| Certificate issuance |

Company Paid |

| Certificate deposit |

Company Paid |

| Returned check / Rejected

automatic bank withdrawals |

$35.00 per item |

| Prior year duplicate statements |

$15.00 per year |

Purchase of Shares

Reinvested Common Stock dividends, optional cash

investments and proceeds (which will be treated as optional cash investments) from the sale or redemption of Common Stock subscription

or other rights, if any, received by EQ on behalf of participants will be used to acquire either outstanding Common Stock, or authorized

and previously unissued Common Stock from the Company, provided that the Company is then willing to sell additional stock. In making

purchases for a participant’s account, EQ will combine the participant’s funds with those of other participants. It is understood

that governmental regulations may require the temporary curtailment or suspension of purchases of Common Stock under the Plan. No interest

will be paid on funds held by EQ pending investment under the Plan.

Purchases of Common Stock under the Plan will

be made on or as soon as administratively possible after the following applicable “Investment Dates”:

| (a) | Each Common Stock dividend payment date is an Investment Date for

the reinvestment of dividends. |

| (b) | The 15th day of each month (or the next closest business day if the

15th is not a business day) is an Investment Date for the investment of optional cash by

participants and no later than 35 trading days, except where postponement is necessary to

comply with the rules and regulations of the Securities and Exchange Commission. |

The number of shares of Common Stock to be purchased

for a participant under the Plan depends on the purchase price of Common Stock on the applicable Investment Date and on the amount of

the participant’s dividends and optional cash to be invested. A participant’s account will be credited with that number of

shares of Common Stock (including any fractional share interest, computed to three decimal places) equal to the total amount to be invested

divided by the applicable purchase price per share.

Share Purchase Prices

If shares of Common Stock

are purchased under the Plan for participants from the Company (including as newly-issued shares), then the purchase price of the shares

will be the average (computed to three decimal places) of the high and low prices of shares of Common Stock on the New York Stock Exchange

on the applicable Investment Date. If no trading occurs on the New York Stock Exchange in the Common Stock on the applicable Investment

Date, the price will be determined with reference to the next preceding date on which the Common Stock was traded on the New York Stock

Exchange. If shares of Common Stock are purchased under the Plan for participants on the open market or in privately negotiated transactions,

then the purchase price of the shares will be the weighted average of the prices paid for such shares on the date the shares are purchased.

If shares are purchased on the open market or in privately negotiated transactions on more than one date, a weighted average of such

averages will be used. In the event that a purchase under the Plan is made both in newly-issued and previously-issued shares, the shares

purchased will be allocated proportionately among the accounts of all participants for whom funds are being invested at that time.

Reports to Participants

EQ will maintain an account

for each participant. All shares of Common Stock (including any fractional shares, computed to three decimal places) purchased for a

participant under the Plan will be credited to his or her account. Each participant in the Plan will receive a quarterly statement of

his or her account from EQ as soon as administratively possible following each dividend payment date. EQ will also furnish a participant

with an account statement as soon as administratively possible following the investment of any optional cash.

If desired (as indicated

on the participant’s Account Authorization Card), each participant may with respect to his or her Plan shares receive copies of

quarterly reports and certain other communications generally sent by the Company to holders of Common Stock. Each participant will receive

copies of the Company’s Annual Report and Notice of Annual Meeting and Proxy Statement. Information needed for reporting dividend

income for federal income tax purposes will be provided to each participant in the Plan over the prior calendar year.

The participant may elect

to have their statements and other information sent to them automatically by initiating eDelivery through shareowneronline.com.

Sale of Shares

Sales are usually made through

a broker, who will receive brokerage commissions. Typically, the shares are sold through the exchange on which the common shares of the

Company are traded. Depending on the number of shares of Common Stock to be sold and current trading volume, sale transactions may be

completed in multiple transactions and over the course of more than one day. All sales are subject to market conditions, system availability,

restrictions, and other factors. The actual sale date, time or price received for any shares sold through the Plan cannot be guaranteed.

Participants may instruct

the Plan Administrator to sell shares under the Plan through a Batch Order, Market Order, Day Limit Order, Good-‘Til-Date/Canceled

Limit Order or Stop Order.

Batch

Order (online, telephone, mail) – The Plan Administrator will combine each request to sell through the Plan with other

Plan participant sale requests for a Batch Order. Shares are then periodically submitted in bulk to a broker for sale on the open market.

Shares will be sold no later than five business days (except where deferral is necessary under state or federal regulations). Bulk sales

may be executed in multiple transactions and over more than one day depending on the number of shares being sold and current trading

volumes. Once entered, a Batch Order request cannot be canceled.

Market

Order (online or telephone) – The participant’s request to sell shares in a Market Order will be at the prevailing

market price when the trade is executed. If such an order is placed during market hours, the Plan Administrator will promptly submit

the shares to a broker for sale on the open market. Once entered, a Market Order request cannot be canceled. Sales requests submitted

near the close of the market may be executed on the next trading day, along with other requests received after market close.

Day

Limit Order (online or telephone) – The participant’s request to sell shares in a Day Limit Order will be promptly

submitted by the Plan Administrator to a broker. The broker will execute as a Market Order when and if the stock reaches, or exceeds

the specified price on the day the order was placed (for orders placed outside of market hours, the next trading day). The order is automatically

canceled if the price is not met by the end of that trading day. Depending on the number of shares being sold and current trading volumes,

the order may only be partially filled and the remainder of the order canceled. Once entered, a Day Limit Order request cannot be canceled

by the participant.

Good-‘Til-Date/Canceled

(GTD/GTC) Limit Order (online or telephone) – A GTD/GTC Limit Order request will be promptly submitted by the Plan Administrator

to a broker. The broker will execute as a Market Order when and if the stock reaches, or exceeds the specified price at any time while

the order remains open (up to the date requested or 90 days for GTC). Depending on the number of shares being sold and current trading

volumes, sales may be executed in multiple transactions and may be traded on more than one day. The order or any unexecuted portion will

be automatically canceled if the price is not met by the end of the order period. The order may also be canceled by the applicable stock

exchange or the participant.

Stop

Order (online or telephone) – The Plan Administrator will promptly submit a participant’s request to sell shares

in a Stop Order to a broker. A sale will be executed when the stock reaches a specified price, at which time the Stop Order becomes a

Market Order and the sale will be at the prevailing market price when the trade is executed. The price specified in the order must be

below the current market price (generally used to limit a market loss).

Sales proceeds will be net

of any fees to be paid by the participant (see “Investment Fees” for details). The Plan Administrator will deduct any fees

or applicable tax withholding from the sale proceeds. Sales processed on accounts without a valid Form W-9 for U.S. citizens or

Form W-8BEN for non-U.S. citizens will be subject to Federal Backup Withholding. This tax can be avoided by furnishing the appropriate

and valid form prior to the sale.

A check for the proceeds

of the sale of shares (in U.S. dollars), less applicable taxes and fees, will generally be mailed by first class mail as soon as administratively

possible after settlement date. If a participant submits a request to sell all or part of the Plan shares, and the participant requests

net proceeds to be automatically deposited to a checking or savings account, the participant must provide a voided blank check for a

checking account or blank savings deposit slip for a savings account. If the participant is unable to provide a voided check or deposit

slip, the participant’s written request must have the participant’s signature(s) medallion guaranteed by an eligible

financial institution for direct deposit. Requests for automatic deposit of sale proceeds that do not provide the required documentation

will not be processed and a check for the net proceeds will be issued.

A participant who wishes

to sell shares currently held in certificate form may send them in for deposit to the Plan Administrator and then proceed with the sale.

To sell shares through a broker of their choice, the participant may request the broker to transfer shares electronically from the Plan

account to their brokerage account. Alternatively, a stock certificate can be requested in writing that the participant can deliver to

their broker.

The Company’s share

price may fluctuate between the time the sale request is received and the time the sale is completed on the open market. The Plan Administrator

shall not be liable for any claim arising out of failure to sell on a certain date or at a specific price. Neither the Plan Administrator

nor any of its affiliates will provide any investment recommendations or investment advice with respect to transactions made through

the Plan. This risk should be evaluated by the participant and is a risk that is borne solely by the participant.

The Company’s insider

trading policy provides that the participant may not trade in the Company’s common stock if in possession of material, non-public

information about the Company. Share sales by employees, affiliates and Section 16 officers must be made in compliance with the

Company’s insider trading policy.

Withdrawal from the Plan

Timing

and Effect of Withdrawal. A participant may withdraw from the Plan at any time by notifying EQ in writing. A participant will

be deemed to have withdrawn from the Plan upon EQ receiving notice in writing of the participant’s death. Termination of participation

in the Plan by a shareholder of record will immediately stop all reinvestment of the participant’s dividends if the properly completed

and signed notice of withdrawal is received by EQ no later than one business day prior to the record date for the next dividend payment.

Investment of optional cash will stop immediately if notification of withdrawal from the Plan is received by EQ at least two business

days prior to the applicable Investment Date. The entire amount of any optional cash received for which investment has been stopped by

termination of participation in the Plan will be refunded to the participant. In addition to the foregoing, EQ may terminate any account

by written notice to the participant and the Company.

Sale

of Shares or Issuance of Certificates upon Withdrawal from the Plan. Upon termination of a participant’s account, the

participant (or his or her personal representative or other authorized agent) may elect to receive either stock or cash for all the full

shares in the participant’s account. If the participant’s account with EQ is terminated and the participant (or his or her

personal representative or other authorized agent) elects to have the participant’s shares in the Plan sold, EQ will make such

sale and send to the participant (or his or her personal representative or other authorized agent) the proceeds less any applicable commissions

and any service fees. Sales requests may be accumulated by EQ, but no sales transactions will be delayed (except to the extent otherwise

required by law). If funds are available, such shares may be purchased by EQ for investment under the Plan at their current market value

(determined in the same manner as the price of newly-issued shares is determined) as of the date of such sale to EQ. If a participant

does not make an election, the participant’s Plan shares will be moved to book-entry DRS form until the Plan Administrator receives

further instructions from the participant. In any event, any fractional interest in a share will be converted to cash at the market value

as of the date of the sale thereof (determined in the same manner as the price of newly-issued shares is determined).

Rejoining

the Plan. Any eligible shareholder of record may rejoin the Plan at any time by completing a new Account Authorization Card.

However, the Company or EQ may reject any such Account Authorization Card from a previous participant on grounds of excessive termination

and rejoining.

Certificates for Shares

Shares

Held by EQ. Certificates for shares of Common Stock purchased under the Plan will not be issued to a participant unless specifically

requested in writing by the participant. The number of shares credited to a participant’s account under the Plan will be shown

on each account statement mailed to the participant. While in the custody of EQ, shares of Common Stock purchased under the Plan will

be registered in the name of EQ or one of its nominees. This convenience protects against loss, theft, or destruction of stock certificates.

At any time a participant

may, without terminating participation in the Plan, request in writing that EQ issue a certificate for all or part of the whole shares

credited to his or her Plan account. Any remaining whole shares and fractional share interest will continue to be credited to the participant’s

account. A participant must request issuance of a certificate, in writing, for any shares of Common Stock purchased under the Plan which

he or she desires to sell, pledge or transfer.

Certificates for fractional

share interests will not be issued under any circumstances.

Name

in Which Certificates will be Issued. Shareholder accounts under the Plan will be maintained in the names in which certificates

for shares of Common Stock of such participants are registered at the time they enter the Plan. Certificates for whole shares, when issued,

will be registered in the names in which accounts under the Plan are maintained.

Should a participant want

his or her shares registered in any other name upon the withdrawal of the shares from the Plan, the participant must so indicate in his

or her request to EQ and comply with all appropriate transfer requirements. In the event of such a request, the participant will be responsible

for any taxes that may be due and for compliance with any applicable transfer restrictions.

No

Transfer of Shares Held in Plan; No Right to Draw Against Account. Shares of Common Stock credited to the account of a participant

under the Plan may not be assigned, pledged as collateral, or otherwise transferred. A participant who wishes to assign, pledge, or otherwise

transfer such shares must execute and deliver to EQ a written request (with signature guaranteed if the certificate will be registered

in other than the participant’s name) that a certificate for such shares be issued in his or her name. In addition, participants

will not have the right to draw checks or drafts against their accounts under the Plan.

General Information

Sale

or Transfer of Registered Shares. If a participant disposes of all the shares of Common Stock registered in his or her name,

but retains shares in the Plan, EQ will continue to reinvest the dividends on shares in the Plan, subject to a participant’s right

to withdraw from the Plan at any time.

If a participant who has

selected the partial dividend reinvestment option disposes of a portion of the shares registered in his or her name, to the extent that

such participant has registered in his or her name fewer shares than the number of shares designated as participating in the Plan, dividends

on all shares remaining in the name of the participant will be reinvested under the Plan. If such participant subsequently acquires additional

shares registered in his or her name, such additional shares shall be deemed to participate in the Plan until the number of shares equals

the number of shares designated as participating in the Plan on the participant’s then current Account Authorization Card.

Stock

Dividends and Issuance of Rights. Any shares distributed pursuant to stock dividends or stock splits effected by the Company

on shares held by EQ for a participant will be credited to such participant’s account. In the event that the Company makes available

to the holders of its Common Stock subscription or other rights to purchase additional shares of Common Stock or other securities, EQ

will (if and when such rights trade independently) sell the rights accruing to all shares held by EQ for the participants and will apply

the net proceeds of such sale to the purchase of additional shares of Common Stock. The Company will notify each participant in advance

of any such offer. If the participant does not want EQ to sell his or her rights and invest the proceeds, it will be necessary for such

participant to transfer all full shares held under the Plan to his or her own name by a given date. This will permit the participant

to exercise, transfer or sell the rights on such shares. In the event that rights issued by the Company are redeemed prior to the date

that such rights trade independently, EQ will invest the resultant funds in additional shares of Common Stock.

Voting

of Shares Held in Plan. If a participant is a record holder of shares of Common Stock, the participant will be sent a proxy

card (together with applicable proxy solicitation materials) or a notice of availability of proxy materials in connection with any annual

or special meeting of shareholders. The proxy provided to the participant will apply to all shares registered in the participant’s

name and to all whole shares credited to the participant’s account under the Plan. If the participant is not a record holder of

shares of Common Stock, the participant will receive a voting instruction form or proxy card (together with applicable proxy solicitation

materials), or a notice of availability of proxy materials, if applicable, on which to indicate how the shares held by EQ in the participant’s

Plan account are to be voted. Fractional shares may not be voted.

A proxy card or voting instruction

form that is properly signed and returned will be voted in the manner directed therein. If the proxy card or voting instruction form

is properly signed and returned but no voting instructions are given with respect to any or all items on the card or form, all of the

participant’s shares of Common Stock covered by such proxy card or form will be voted in accordance with the recommendations of

the Company’s management or Board of Directors. If the card or form is not returned or is returned unsigned, the participant’s

shares will not be voted.

Duties

and Responsibilities of the Company and EQ. Other than for willful misconduct, neither the Company nor EQ nor its nominees

will have any responsibility for any action taken or omitted pursuant to the Plan, nor will they have any duties, responsibilities, or

liabilities except as expressly set forth in the Plan. Other than for willful misconduct, the Company and EQ will not be liable under

the Plan for any act or for any omission to act, including without limitation, any claims of liability (a) with respect to the time

or prices at which shares are purchased or sold for a participant’s account, or any inability to purchase or sell shares; (b) for

any fluctuation in the market value after purchase or sale of shares; (c) delays resulting from the improper completion or delivery

of Account Authorization Cards, changes thereto or withdrawal requests; or (d) arising out of a failure to terminate a participant’s

account upon such participant’s death prior to receipt of notice in writing of such death.

Amendment

and Termination of the Plan. The Company reserves the right to suspend, modify or terminate the Plan at any time. All participants

will be notified of any suspension, termination, or significant modification of the Plan within a reasonable time prior to such change.

FEDERAL INCOME TAX CONSIDERATIONS

The following

summary sets forth the general federal income tax consequences for an individual participating in the Plan and holding shares of Common

Stock as a capital asset within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended. This discussion is

not, however, intended to be an exhaustive treatment of such tax considerations. Future legislative changes or changes in administrative

or judicial interpretations, some or all of which may be retroactive, could significantly alter the tax treatment discussed herein. Accordingly,

and because tax consequences may differ among participants in the Plan, each participant is urged to consult his or her own tax advisor

to determine the particular tax consequences (including state income tax consequences) that may result from participation in and the

subsequent disposal of shares purchased under the Plan.

General Considerations

In general,

participants reinvesting dividends under the Plan have the same federal income tax consequences with respect to their dividends as do

shareholders who are not participants in the Plan. On the dividend payment date, participants will receive a taxable dividend equal to

the cash dividend reinvested, to the extent the Company has earnings and profits. This treatment applies with respect to both the shares

of Common Stock held of record by such participants and such participants’ Plan account shares and even though the dividend amount

is not actually received in cash but is instead applied to the purchase of shares of Common Stock under the Plan. If shares are purchased

on the open market or in a privately negotiated transaction, each participant’s share of brokerage fees, if any, paid by the Company

will also be taxed as an additional dividend to that participant, to the extent the Company has earnings and profits.

Shares or

any fraction thereof of Common Stock purchased on the open market or in a privately negotiated transaction with reinvested dividends

will have a tax basis equal to the amount paid therefor, increased by any brokerage fees treated as a dividend to the participant. Shares

or any fraction thereof of Common Stock purchased from the Company with reinvested dividends will have a tax basis equal to the amount

of the dividend. Whether purchased on the open market or in a privately negotiated transaction or from the Company, the shares or any

fraction thereof will have a holding period beginning on the day following the purchase date.

Participants

that make optional cash investments under the Plan will be deemed to have received an additional taxable dividend in the amount of the

participant’s pro rata share of the brokerage commissions, if any, paid by the Company on the shares acquired under the Plan, to

the extent the Company has earnings and profits. Such brokerage commissions may only be incurred on the purchase of Common Stock in the

open market or in privately negotiated transactions. Shares or any fraction thereof purchased with optional cash investments will have

a tax basis equal to the amount of such payments increased by the amount of brokerage fees, if any, treated as a taxable dividend to

the participant with respect to those shares or fraction thereof. The holding period for such shares or fraction thereof will begin on

the day following the purchase date.

Participants

should not be treated as receiving an additional taxable distribution relating to their pro rata share of EQ’s fees or other costs

of administering the Plan, all of which will be paid by the Company. However, there can be no assurance that the Internal Revenue Service

(“IRS”) will concur with this position. The Company has no present plans to seek formal advice from the IRS on this issue.

Participants

will not recognize taxable income when they receive certificates for whole shares credited to their account, either upon their request

for such certificates or upon withdrawal from or termination of the Plan. However, participants will generally recognize gain or loss

when whole shares acquired under the Plan are sold or exchanged either through the Plan at their request or by the participants after

withdrawal from or termination of the Plan. Participants will also generally recognize gain or loss when they receive cash payments for

fractional shares credited to their account upon withdrawal from or termination of the Plan. The amount of gain or loss will be the difference

between the amount a participant receives for his or her whole shares or fractional shares and the tax basis for such shares. Generally,

the gain or loss will be a capital gain or loss, long-term or short-term depending on the holding period. Currently, net long-term capital

gains of certain taxpayers are taxed at lower rates than other items of taxable income.

The tax

basis of shares of Common Stock acquired under the Plan will be reported by the Plan Administrator in accordance with the current Treasury

Regulations. The Plan Administrator intends to use the first-in, first-out (FIFO) method for determining the tax basis of any shares

sold in the absence of a participant’s written designation to the Plan Administrator to use the specific identification method.

Account statements, which contain a detailed record of a participant’s purchases and sales, should be retained for tax purposes

to assist with determining tax basis.

Participants

who have taxable income over a certain threshold amount are subject to an additional 3.8% tax on all or a portion of their “net

investment income,” which includes dividends and gain from the sale or disposition of Common Stock. Participants are urged to consult

their tax advisors regarding the application of the additional 3.8% tax to their particular tax situation.

Information Reporting and

Backup Withholding

Participants

may be subject, under certain circumstances, to information reporting and backup withholding (currently at a rate of 28%) on payments

of dividends and gross proceeds from disposition of shares of Common Stock. Backup withholding generally applies only if the participant:

| · | fails

to furnish its social security or other taxpayer identification number within a reasonable

time after a request for such information; |

| · | furnishes

an incorrect taxpayer identification number; |

| · | fails

to report interest or dividends properly; or |

| · | fails,

under certain circumstances, to provide a certified statement, signed under penalties of

perjury, that the taxpayer identification number provided is its correct number and that

the participant is not subject to backup withholding. |

Certain

persons are exempt from backup withholding, including corporations and financial institutions. Exempt recipients that are not subject

to backup withholding and do not provide an IRS Form W-9 may nonetheless be treated as foreign payees subject to withholding under

“FATCA” and may be withheld upon at the 30% rate discussed below under “Foreign Account Tax Compliance Act.”

Participants

who are not United States citizens or residents will need to be provide a valid Form W-8BEN and may be subject to withholding on

all payments reportable on an IRS Form 1099 or Form 1042-S, as applicable, at the current backup withholding rate of 28% or

the normal withholding rate of 30% (or lesser tax treaty rate if applicable), respectively. Effective for accounts opened on or after

January 1, 2015, participants that are not individuals who do not provide either a type of Form W-8 (for foreign entities,

a Form W-8BEN-E, W-8EXP, W-8ECI or W-8IMY) or Form W-9 (for U.S. entities), will be subject to withholding at a 30% rate as

discussed below under “Foreign Account Tax Compliance Act.” In particular, foreign entities should consult with their internal

tax advisors or counsel as to which type of Form W-8 they should provide based on their status under Chapters 3 and 4 of the Internal

Revenue Code.

The Plan

Administrator will file annually with the IRS, and to participants to whom the Plan Administrator is required to furnish such information,

information relating to the amount of dividends and gross proceeds and the amount of withholding, if any. Copies of these information

returns also may be made available under the provisions of a specific treaty or other agreement to the tax authorities of the country

in which the non-U.S. participant resides.

Backup and

other withholding is not an additional tax. Any amount withheld from a payment to a participant under the backup withholding rules is

allowable as a credit against such participant’s U.S. federal income tax liability and may entitle such participant to a refund

provided such participant timely furnishes the required information to the IRS.

If a participant

is subject to withholding, the tax required to be withheld will be deducted from the amount of cash dividends reinvested. Since such

withholding tax applies also to a dividend on shares credited to the participant’s Plan account, only the net dividend on such

shares will be applied to the purchase of additional shares of Common Stock. Regular statements sent to such participants will indicate

the amount of tax withheld. Likewise, participants selling shares through the Plan who are subject to backup or other withholding will

receive only the net cash proceeds from such sale as required by the Internal Revenue Code and the regulations thereunder. The Company

cannot refund amounts withheld. Participants should consult their tax advisors as to their qualification for exemption from backup and

other withholding, reduced rates of withholding under applicable tax treaties, and the procedures for obtaining and applicable exemption

or reduced rate of withholding.

Foreign Account Tax Compliance

Act

Provisions

of the Hiring Incentives to Restore Employment Act regarding foreign account U.S. tax compliance, known as the “Foreign Account

Tax Compliance Act” or “FATCA,” impose a U.S. federal withholding tax of 30% on certain types of payments made after

December 31, 2012 to “foreign financial institutions” (including non-U.S. investment funds) and certain other “non-financial

foreign entities” (each as defined in the Internal Revenue Code), including where such foreign financial institutions or non-financial

foreign entities are acting as intermediaries, unless they meet the information reporting requirements of FATCA. Although FATCA provides

that these withholding provisions will apply to applicable payments made after December 31, 2012, final Treasury Regulations issued

by the United States Treasury provide that the withholding provisions will apply only to payments of dividends made on or after July 1,

2014 and to gross proceeds from the sale or other disposition of Common Stock paid on or after January 1, 2017. Accordingly, under

the final Treasury Regulations, although dividends will be subject to withholding under FATCA, gross proceeds from a sale or other disposition

occurring prior to January 1, 2017 will not be.

To avoid

withholding under FATCA, a foreign financial institution will need to enter into an agreement with the IRS that states that it will provide

the IRS certain information, including the names, addresses and taxpayer identification numbers of direct and indirect U.S. account holders,

comply with due diligence procedures with respect to the identification of U.S. accounts, report to the IRS certain information with

respect to U.S. accounts maintained, agree to withhold tax on certain payments made to non-compliant foreign financial institutions or

to account holders who fail to provide the required information and determine certain other information as to its account holders. An

intergovernmental agreement between the United States and an applicable foreign country, or future Treasury Regulations, may modify these

requirements for foreign financial institutions in the applicable foreign country. To avoid withholding, a non-financial foreign entity

will need to provide either (i) the name, address, and taxpayer identification number of each substantial U.S. owner or (ii) certifications

of no substantial U.S. ownership, unless certain other exceptions apply.

If an amount

in respect of United States withholding tax is deducted or withheld from dividends or gross proceeds as a result of a holder’s

failure to comply with these rules or the presence in the payment chain of an intermediary that does not comply with these rules,

neither the Company nor any other person is required to pay any additional amount as a result of the deduction or withholding of such

tax. As a result, investors may receive less dividends (and thus, only the net amount of the dividend will be applied to the purchase

of additional shares of Common Stock) or gross proceeds from a sale or other disposition than expected. Certain countries have entered

into, and the Company expects other countries to enter into, agreements with the United States to facilitate the type of information

reporting required under FATCA. While the existence of such agreements will not eliminate the risk that the Common Stock will be subject

to the withholding described above, these agreements are expected to reduce the risk of the withholding for investors in (or indirectly

holding Common Stock through financial institutions in) those countries that have entered into agreements with the United States.

Prospective

investors should consult their tax advisors regarding the FATCA withholding provisions as well as any changes to the final Treasury Regulations.

USE OF PROCEEDS

The proceeds from the sale

of the newly issued shares of Common Stock offered by this prospectus will be used for general corporate purposes. Pending any such uses,

we may invest the net proceeds from the sale of any securities in interest-bearing short-term investments, including money market accounts.

We cannot estimate the amount of any such proceeds at this time.

DESCRIPTION OF CAPITAL STOCK

The following description

of our capital stock summarizes general terms and provisions that apply to our capital stock. Because this is only a summary it does

not contain all of the information that may be important to you. The summary is subject to and qualified in its entirety by reference

to our articles of incorporation and bylaws, which are filed as exhibits to the registration statement of which this prospectus is a

part and incorporated by reference into this prospectus. See “Where You Can Find More Information.”

General

Our authorized capital stock

consists of 50,000,000 shares of Common Stock, $1.00 par value per share, 33,000,000 shares of class B Common Stock, $1.00 par value per

share, and 1,000,000 shares of preferred stock, $1.00 par value per share. As of February 27, 2024, there were 24,706,056 shares of Common

Stock and 7,016,354 shares of class B Common Stock outstanding. As of the date of this prospectus, no shares of our preferred stock were

outstanding. As of December 28, 2023, we had outstanding options to purchase a total of 3,172,700 shares of Common Stock at a weighted

average exercise price of $22.69 per share. Of this total, options to purchase 1,988,780 were vested and 1,183,920 remain unvested. As

of December 28, 2023, we had outstanding 238,273 shares of restricted Common Stock or restricted stock units subject to vesting conditions.

As of December 28, 2023, an additional 1,085,339 shares of Common Stock were available for future award grants under our stock incentive

plan.

Comparison of Common Stock and Class B

Common Stock

The following table compares

our Common Stock and class B common stock.

| | |

Common Stock | |

Class B Common Stock |

| Voting rights per share | |

1 | |

10 |

| | |

| |

|

| Cash dividend rights per share | |

110% of any cash dividend paid on class B Common Stock (subject to rounding) | |

In an amount as may be determined by board of directors |

| | |

| |

|

| Transferability | |

Freely transferable* | |

May only be transferred to permitted transferees (as described below)* |

| | |

| |

|

| Conversion rights | |

None | |

Share-for-share into Common Stock at the option of the holder** |

| | |

| |

|

| Liquidation rights | |

Same as class B common stock | |

Pro rata sharing of assets remaining after payment of all liabilities and preferred stock claims (if any) |

| | |

| |

|

| Preemptive rights | |

None | |

None |

| | |

| |

|

| Redemption rights | |

None | |

None |

| | |

| |

|

| Sinking fund rights | |

None | |

None |

| * |

Subject

to applicable federal and state securities law restrictions. |

| ** |

Automatically

converts into Common Stock if total outstanding shares of class B common stock becomes less than 2% of the aggregate number of outstanding

shares of Common Stock and class B common stock. |

Holders of class B common

stock are entitled to ten votes per share on all matters brought before a vote of our shareholders and holders of Common Stock are entitled

to one vote per share on all such matters. Both classes vote as a single class on all such matters, unless otherwise required by law.

Voting rights are not cumulative.

Holders of our Common Stock

are entitled (subject to rounding) to 110% of any cash dividends per share declared by our board of directors to be payable with respect

to our class B common stock (but not with respect to distributions in partial or complete liquidation of us or one or more of our subsidiaries).

The declaration and payment of cash dividends is solely within the discretion of our board of directors. If cash dividends are not paid

on the class B common stock for any reason whatsoever, then the holders of Common Stock are not entitled to any cash dividends. Holders

of our preferred stock, if any, are entitled to receive dividends at the rate fixed by our board of directors, payable when and as declared,

in preference to the holders of our Common Stock and class B common stock.

Holders of Common Stock have

the same rights as holders of class B common stock with respect to stock dividends, stock splits and non-cash distributions, except that

in the event of a stock dividend or stock split payable other than in preferred stock, only Common Stock can be distributed with respect