Workers Expect Employers to Care About Their Lives At and Outside of Work Amid a State of Permacrisis

18 Mars 2024 - 1:00PM

Business Wire

MetLife's 22nd Annual U.S. Employee Benefit

Trends Study underscores the need for ongoing employer support and

delivery of Enhanced Benefits to drive employee wellness,

engagement and productivity

Released today, MetLife’s 22nd Annual U.S. Employee Benefit

Trends Study (EBTS) finds employees are now more likely to

experience negative feelings at work, including stress (12% more

likely) and burnout (17% more likely) than they were pre-pandemic

(2019). Employees are also 51% more likely to feel depressed at

work than they were pre-pandemic as they face a complex macro

environment and permacrisis state.

Last year, MetLife unveiled “employee care” as a powerful tool

for employers to support their workforce and organization. This

year’s study finds delivering care during key work and life moments

and prioritizing the role of benefits has an outsized impact on

individuals and businesses alike. In fact, employees who understand

and use their benefits are significantly more likely to feel cared

for (88%) by their employer, compared to those who don’t (34%). In

return, employees who feel cared for are 60% more likely to intend

to be at their organization in 12 months and 55% more likely to

feel productive at work.

“Today’s workforce is navigating the pressures of their

day-to-day lives in parallel with ongoing macro challenges, and

it’s impacting their overall wellbeing and how they show up at

work,” said Todd Katz, executive vice president and head of Group

Benefits at MetLife. “As employees juggle a range of personal and

professional demands, our research affirms employers must provide

more tangible support – when and where it matters most.”

As Work-Life Divides Wane, Gaps in Care

Delivery Emerge

The majority of employees have come to expect a more consistent

delivery of care from their employers – not just at work (92%), but

also in their personal lives (79%). Consequently, when employers

provide support during key moments, employees are significantly

more likely to feel cared for (76% vs. 45%).

However, this year’s research unearthed care delivery gaps

wherein employees report not feeling adequately supported by their

employers, particularly during critical life moments with

significant personal impact. This includes:

- Navigating unplanned financial stress: Among employees

who went through a significant unplanned financial stress/expense,

86% said it had a high impact on them, but only 48% of them felt

that their employer demonstrated care during the experience.

- Experiencing a mental health condition: 81% of employees

who experienced an ongoing mental health condition said that it had

a major impact on them, yet just half (50%) agreed that their

employer demonstrated care toward them.

- Becoming the primary income earner: The vast majority of

employees who became the primary income earner for their household

(e.g., due to a partner exiting the workforce, etc.) said the

experience had a high impact on them (83%). However, only 58%

believed their employer demonstrated care during this

experience.

Unlocking Intentional Employee Care

Through Benefits

Benefits are a proven and effective tool for demonstrating care

to employees across a wide spectrum of impactful life moments, from

financial challenges to unforeseen loss. For employees facing

unexpected financial expenses, employers can support with benefits

that help alleviate and address financial burdens, including

financial wellness solutions, life insurance, or retirement

benefits. Similarly, for employees becoming their household’s

primary income earner, employers can prioritize awareness and

education of disability insurance or legal plans to help protect

employees’ income, support their families, and save for the

future.

Voluntary benefits also play a key role in improving

individuals’ holistic health, which drives employee care. MetLife’s

research found that employees who enrolled, used and had a good

experience with voluntary benefits are more holistically healthy

(53%) than individuals who were offered one or more benefits (44%)

– emphasizing the role of comprehension and utilization during

critical moments.

“Against the backdrop of a permacrisis, this year’s study

underscores the urgent need for employers to acknowledge the modern

challenges that impact their workforce and take steps to support

employees in new and bigger ways, resulting in more successful

workplaces,” said Katz.

To download MetLife’s 22nd Annual U.S. Employee Benefit Trends

Study, visit: www.metlife.com/2024EBTSreport

Research Methodology

MetLife’s 22nd Annual U.S. Employee Benefit Trends Study was

conducted in November 2023 and consists of two distinct studies

fielded by STRAT7 Rainmakers – a global strategy, insight and

planning consultancy. The employer survey includes 2,595 interviews

with benefits decision-makers and influencers at companies with at

least two employees. The employee survey consists of 2,809

interviews with full-time employees, ages 21 and over, at companies

with at least two employees.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and

affiliates ("MetLife"), is one of the world's leading financial

services companies, providing insurance, annuities, employee

benefits and asset management to help its individual and

institutional customers navigate their changing world. Founded in

1868, MetLife has operations in more than 40 countries and holds

leading market positions in the United States, Japan, Latin

America, Asia, Europe and the Middle East. For more information,

visit www.metlife.com.

About STRAT7 Rainmakers

STRAT7 Rainmakers is a UK-based global strategy, insight and

planning consultancy with a focus on delivering game-changing

commercial impact. Since our inception in 2007, we’ve worked

collaboratively with leading companies to help define opportunities

for brands, categories and businesses. Our expertise spans not only

Financial Services, but also Food and Drink, Beauty, Healthcare,

Telecoms, Technology, Entertainment, and Travel. Our programs and

client relationships span all continents, with 50% of our work

originating in the US. In April 2023, we joined the STRAT7 group.

For more information, visit www.rainmakerscsi.com.

L0324038677[exp0326][All States]

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240318711368/en/

Liz Harish 929-343-7473 elizabeth.harish@metlife.com

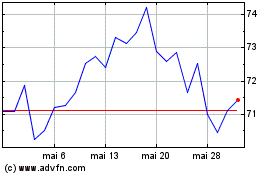

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

MetLife (NYSE:MET)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025