UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2024

Mistras Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34481 | | 22-3341267 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| 195 Clarksville Road | | |

| Princeton Junction, | New Jersey | | 08550 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (609) 716-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d 2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Executive Leadership Transition

On December 5, 2024, the Board of Directors (“Board”) of Mistras Group, Inc. (the “Company”), in furtherance of its management succession planning, appointed Natalia Shuman-Fabbri, age 51, as the Company’s President and Chief Executive Officer, effective as of January 1, 2025. In these positions, Ms. Shuman-Fabbri will succeed Manuel N. Stamatakis, who has served as the Company’s interim President and Chief Executive Officer since October 9, 2023. Mr. Stamatakis will continue as the Executive Chairman of the Company and, in this position, will continue to lead the Board and exercise supervisory responsibility over the strategic direction of the Company, oversee, and receive reports from, the new President and Chief Executive Officer, and perform such other duties from time to time that may be assigned to him by the Board.

In connection with the appointment of Ms. Shuman-Fabbri as the Company’s President and Chief Executive Officer, the Board increased the number of directors on the Board from seven to eight, effective as of January 1, 2025, and appointed Ms. Shuman-Fabbri as a director to fill the vacancy effective as of January 1, 2025. Ms. Shuman-Fabbri will serve as a director until the next annual meeting of stockholders of the Company or until her successor is elected and qualified.

From October 2021 until October 2024, Ms. Shuman-Fabbri was an executive at Eurofins Scientific Group (“Eurofins), a global leader in the testing, inspection, and certification (“TIC”) industry. Ms. Shuman-Fabbri served as Executive Vice President - Europe and Asia and as President - Biopharma and AgTech Services at Eurofins, and also served as a member of the Group Operating Council during her tenure at Eurofins. Prior to joining Eurofins, Ms. Shuman-Fabbri served from April 2017 to September 2021 as the Chief Executive Officer of Bureau Veritas - North America, Inc. (“Bureau Veritas”), also a leader in the TIC industry, where she oversaw approximately 7,000 people, 130 branches and laboratories across the US, Canada and Mexico and served on the Company’s executive committee. Prior to joining Bureau Veritas, Ms. Shuman-Fabbri spent over 20 years at Kelly Services, a US-based staffing and HR outsourcing company. At Kelly Services, Ms. Shuman-Fabbri served as a head of international business, overseeing Asia Pacific and EMEA regions and led large accounts operations serving Kelly’s customers. Ms. Shuman-Fabbri’s 20+ year tenure at Kelly included progressive leadership positions in New York, and several international assignments including leading Kelly’s JV with a Japanese staffing company, the largest in North Asia. On behalf of Kelly Services, Ms. Shuman-Fabbri served on the board of directors of the World Employment Confederation (WEC) in Brussels during part of her time at Kelly Services.

Ms. Shuman-Fabbri received a dual MBA from Columbia Business School and London Business School.

There are no family relationships between Ms. Shuman-Fabbri and any director or executive officer of the Company. Except as described in this Form 8-K, there are no arrangements or understandings between Ms. Shuman-Fabbri or any other persons pursuant to which Ms. Shuman-Fabbri was appointed as a director or as President and Chief Executive Officer of the Company. Ms. Shuman-Fabbri has no direct or indirect material interests in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Biographical information for Mr. Stamatakis is set forth in the Company’s 2024 definitive proxy statement on Schedule 14A, filed with the Securities and Exchange Commission (the “SEC”) on April 4, 2024, and such biographical information is incorporated herein by reference. There are no family relationships between Mr. Stamatakis and any director or executive officer of the Company. Mr. Stamatakis is the former owner and a current executive officer of Capital Management Enterprises, Inc. (“CME”), which provides benefits consulting services to the Company. The Company did not pay any fees to, or accrue any fees to pay to, CME in 2023, or during 2024 through the date of this Current Report on Form 8-K. The compensation received by CME in 2023 and during 2024 through the date of this Current Report on Form 8-K for work related to the Company was paid directly to CME by the third-party benefits providers in the form of normal and customary commissions. Except as described in this Form 8-K, there are no other direct or indirect material interests in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Employment Agreement with Ms. Shuman-Fabbri

In connection with Ms. Shuman-Fabbri’s hire, the Company and Ms. Shuman-Fabbri entered into an employment agreement on December 5, 2024 (the “Employment Agreement”).

Pursuant to the Employment Agreement, Ms. Shuman-Fabbri will commence employment on January 1, 2025, will have an initial annual base salary of $850,000 and will have a target annual bonus opportunity equal to 100% of her base salary (with actual payout ranging between 0% and 200% of target, depending on actual performance). Ms. Shuman-Fabbri will also be eligible for annual equity awards and, for 2025, the target amount of her equity incentive opportunity will be 200% of her base salary (with the resulting award ranging between 0% and 200% of target, depending on actual performance). The size of subsequent annual equity awards to Ms. Shuman-Fabbri will be determined by the Compensation Committee of the Company’s Board of Directors, in its discretion.

In addition, Ms. Shuman-Fabbri will receive an annual automobile allowance of $15,000, annual reimbursement of her tax preparation expenses up to $7,500, and a one-time relocation bonus of $70,000 to help defray the costs of her relocation to the Princeton, New Jersey area. If Ms. Shuman-Fabbri’s employment ceases on or prior to December 31, 2026, due to a termination by the Company for cause, or a resignation by her without good reason (as those terms are defined in the Employment Agreement), she will be required to repay the relocation bonus to the Company.

The Employment Agreement also provides that if Ms. Shuman-Fabbri’s employment ceases due to a termination by the Company without cause or her resignation with good reason, she will receive the following severance benefits: (i) continuation of her base salary for 24 months; (ii) payment of any earned but unpaid annual incentive award for the preceding calendar year; (iii) a pro rata annual incentive award for the year of her cessation of employment; (iv) accelerated vesting of any performance-based restricted stock units previously earned and scheduled to vest in the 18 month period following her cessation of employment; and (v) COBRA continuation coverage at the Company’s expense for 12 months. However, if such cessation occurs during the 90 days preceding or 12 months following a change in control (as defined in the Company’s Amended and Restated 2016 Long-Term Incentive Plan), then in lieu of the pro-rata annual incentive award referenced in clause (iii) above, she will receive a lump sum payment equal to two times her target annual bonus opportunity. Any severance benefits payable under the Employment Agreement are conditioned on Ms. Shuman-Fabbri’s execution of a release of claims against the Company and its affiliates.

The Employment Agreement also contains customary provisions regarding confidentiality and ownership of intellectual property, an 18-month post-termination non-competition covenant, and a 24-month post-termination non-solicitation covenant.

The foregoing summary of the Employment Agreement is qualified in its entirety by reference to the Employment Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Indemnification Agreement with Ms. Shuman-Fabbri

In connection with Ms. Shuman-Fabbri’s appointments to the Board and as President and Chief Executive Officer, the Company and Ms. Shuman-Fabbri will enter into an indemnification agreement with the Company in the form attached as Exhibit 10.3 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Compensation of Mr. Stamatakis

In connection with the appointment of Mr. Stamatakis as interim President and Chief Executive Officer of the Company on October 9, 2023, the Company and Mr. Stamatakis entered into a Letter Agreement dated October 29, 2023 (the “Original Agreement”), a copy of which was attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 10, 2023. The Company and Mr. Stamatakis are in the process of finalizing

Mr. Stamatakis’ role and compensation as Executive Chairman of the Board commencing January 1, 2025. Upon such finalization, an amendment to this Form 8-K will be filed disclosing the foregoing and attaching, as an exhibit, the amendments to, or replacement of, the Original Agreement.

Item 7.01 Regulation FD Disclosure

On December 5, 2024, the Company issued a press release announcing the matters described in Item 5.02 above. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included herein that address activities, events or developments that the company expects, believes or anticipates will or may occur in the future are forward-looking statements. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “outlook,” “project,” “plan,” “position,” “believe,” “intend,” “achievable,” “forecast,” “assume,” “anticipate,” “will,” “continue,” “potential,” “likely,” “should,” “could,” and similar terms and phrases. However, the absence of these words does not mean that the statements are not forward-looking. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, we do not undertake any obligation and expressly disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”) is entered into on December 5, 2024 between Mistras Group, Inc., a Delaware corporation (such entity or its successor, the “Company”), and Natalia Shuman-Fabbri (“Executive”).

Recital

WHEREAS, this Agreement sets forth the terms and conditions of the Company’s employment of Executive.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties agree as follows:

1.Employment. The Company shall employ Executive and Executive shall be employed by the Company upon the terms and conditions set forth in this Agreement.

2.Term. Executive’s employment pursuant to this Agreement will commence on January 1, 2025 or such other date agreed between the parties (the “Effective Date”) and will continue until terminated in accordance with Section 10 hereof.

3.Position and Duties; Full Time Commitment.

(a)Executive shall serve as the President and Chief Executive Officer of the Company, and in this position, Executive will report to Manuel N. Stamatakis, the Chairman (the “Chairman”) of the Company’s Board of Directors (the “Board”) and carry out such duties and responsibilities as are customarily performed by persons in Executive’s position generally for public companies within the industry, and such other duties and responsibilities as the Chairman or the Board may reasonably assign to Executive from time to time; provided that if during the term of Executive’s employment pursuant to this Agreement Manuel N. Stamatakis ceases to serve as the Executive or Non-Executive Chairman of the Board, then Executive will report to the Board. The Chairman and/or the Board will from time to time communicate key expectations to Executive, and Executive agrees to exercise good faith diligent efforts to fulfill those key expectations.

(b)Executive agrees to devote his or her full business time and best efforts to the performance of Executive’s duties and responsibilities hereunder and in furtherance of the Company’s interests and will not engage in any other employment, consulting or business services; provided that Executive may engage in charitable activities so long as such activities do not interfere with the performance of Executive’s duties and responsibilities hereunder; and provided further that, following the second anniversary of the Effective Date and subject to the consent of the Board or its Chairman, Executive may serve as a non-employee director of one other for-profit enterprise.

4.Company Policies. Executive will comply with all policies of the Company in effect from time to time, including (without limitation) policies regarding ethics, personal conduct, stock ownership, securities trading, compensation clawbacks and hedging and pledging of securities.

5.Place of Performance. Executive will be working at the Company’s Princeton Junction, New Jersey headquarters and is expected to travel to various labs and facilities of the Company

and its subsidiaries, from time to time based on the needs of the business. While employed by the Company, the Company will provide Executive with such computer and other electronic equipment and services as are reasonably required to enable Executive to tend to the business of the Company outside of regular business hours when Executive is otherwise away from the Company's offices, including at home.

6.Salary. Executive’s position with the Company is a full-time exempt position. The Company will pay Executive a salary (the “Base Salary”) at an initial annual rate of $850,000, payable in accordance with the Company’s standard payroll schedule and subject to applicable deductions and withholdings. The amount of the Base Salary shall be reviewed on an annual basis in conjunction with an annual performance assessment of Executive and may be increased or decreased from time to time by the Board or the Compensation Committee of the Board (the “Compensation Committee”), in consultation with the Chairman.

7.Annual Incentive Awards. For each calendar year during Executive’s employment (beginning with 2025), Executive will have the opportunity to earn an annual incentive award under the Company’s “executive annual incentive plan” (sometimes referred to as the “bonus plan”) applicable to senior executives generally, with Executive’s annual incentive target opportunity amount (and range of potential payouts, if any) for each calendar year to be set by the Compensation Committee. Any annual incentive award that is earned by Executive will be payable consistent with the Company’s regular payroll practices applicable to annual incentive awards for senior executives generally. The actual amount that will be earned will depend upon the extent to which performance targets established by the Compensation Committee under the bonus plan are or are not achieved. Except as otherwise expressly provided in Section 11(a), payment of any otherwise earned annual incentive award will be conditioned on Executive’s continued employment with the Company through the payment date of that award. Executive’s annual incentive target opportunity amount (the “Target Bonus Opportunity”) will be 100% of Base Salary, with the actual incentive award ranging from 0% to 200% of target based on actual performance results.

8.Long-Term Equity Incentive Grants. For each calendar year during Executive’s employment, Executive will be eligible to receive a grant of performance-based equity, which, as of the Effective Date, is contemplated to be in the form of performance-based Restricted Stock Unit Awards (“Performance-Based RSUs”) under the Company’s Long-Term Incentive Plan as in effect from time to time. For calendar year 2025, Executive’s equity incentive target opportunity amount will be 200% of Base Salary, with the actual incentive award ranging from 0% to 200% of target based on actual performance results. The Compensation Committee of the Board shall establish all terms and conditions and make all determinations regarding such equity incentive award opportunity, consistent with the terms of the Company’s Long-Term Incentive Plan, which in all events shall control.

9.Benefits; Business Expenses.

(a)Executive shall be entitled to participate in Company benefit plans that are generally available to other employees of the Company of similar rank and tenure, in accordance with and subject to the terms and conditions of such plans, as in effect from time to time. These benefits include opportunities to enroll in the Company’s medical, dental, vision, supplemental life insurance and dependent life insurance plans. Moreover, on the first day of the month following three (3) months of continuous employment, Executive may elect to participate in the Company’s 401(k) Salary Savings plan. Executive will be eligible for vacation under the Paid Time Off Policy for other Company executives. In addition, as of the date of this Agreement, the Company offers eligible employees basic life insurance, accidental death and dismemberment (AD&D) insurance, short-term and long-term disability insurance and identity theft protection at no additional cost. Notwithstanding the foregoing, Executive will not participate in the

Company’s Executive Severance Plan or any other severance plan, policy or arrangement maintained by the Company or its affiliates (other than the terms of Section 11 below).

(b)The Company will pay or reimburse Executive for all reasonable business expenses incurred or paid by Executive in the performance of his or her duties and responsibilities for the Company. In addition, the Company will reimburse Executive for (i) the cost of membership in the Young President’s Organization, and (ii) up to $7,500 per year in tax preparation expenses. All such reimbursements will be made subject to the expense reimbursement policies of the Company, as may be amended from time to time.

(c)For each calendar year during Executive’s employment, Executive shall receive an annual vehicle allowance of $15,000, which shall be paid ratably in accordance with the Company’s standard payroll schedule and subject to applicable deductions and withholdings; provided that the annual vehicle allowance will be pro-rated during any partial year of employment. Executive acknowledges that (except for “excess business mileage” and parking and toll expenses incurred in business travel-related outside of normal commuting, which shall be reimbursable in accordance with Section 9(b)) the annual vehicle allowance is inclusive of all fuel, insurance, maintenance and other costs and expenses associated with Executive’s acquisition (whether by lease or otherwise) and maintenance of the selected vehicle and that payments on account of the annual vehicle allowance may result in Executive’s recognition of additional taxable income.

(d)The Company’s group health plans have an enrollment waiting period. Given this, the Company will reimburse Executive for his or her out-of-pocket costs of continuing healthcare benefits under the plan of Executive’s prior employer pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), less the amount Executive would contribute for healthcare benefits for comparable coverage under the Company’s plans, until Executive is eligible to enroll in the Company’s healthcare benefit plans, subject to Executive’s eligibility for COBRA coverage and to his or her continued employment by the Company until the first day of the applicable month. Such reimbursements will be reported as taxable income. Alternatively, the Company will waive the waiting period for enrollment in its group health plans and, to the extent Executive elects to enroll in the Company’s group health plans prior to the end of the otherwise applicable waiting period, the value of the group health coverage received during that period by Executive and his or her eligible dependents under the Company’s group health plans will be imputed to Executive as taxable income.

(e)Executive agrees that she will establish a residence in the Princeton area no later than April 1, 2025. In lieu of relocation assistance or any other reimbursement of expenses incurred by Executive in connection with her relocation to the Princeton area, the Company will within 30 days following the Effective Date pay Executive a one-time relocation bonus of $70,000. The gross amount of such relocation bonus will be repaid by Executive to the Company within 30 days following the cessation of her employment, if such cessation occurs on or before December 31, 2026 and is due to either a termination by the Company for Cause or a resignation by Executive without Good Reason (as those terms are defined below).

10.Termination.

(a)Executive’s employment hereunder shall terminate on the earliest of: (i) on the date set forth in a written notice to Executive from the Company that Executive’s employment with the Company has been or will be terminated, (ii) on the date not less than 30 days following written notice from Executive to the Company that Executive is resigning from the Company, (iii) on the date of Executive’s death, or (iv) on the date set forth in a written notice to Executive from the Company that Executive’s employment is terminated on account of Executive’s Disability, as determined by the Company. Notwithstanding the foregoing, in the event that

Executive gives notice of termination to the Company, the Company may unilaterally accelerate the date of termination and such acceleration shall not constitute a termination by the Company for purposes of this Agreement.

(b)Upon cessation of Executive’s employment for any reason, unless otherwise consented to in writing by the Company, Executive will resign immediately from any and all officer, director and other positions Executive then holds with the Company and its affiliates and agrees to execute such documents as may be requested by the Company to confirm that resignation.

(c)Upon any cessation of Executive’s employment with the Company, Executive will be entitled only to such compensation and benefits as described in Section 11 below.

(d)Executive agrees that, following any cessation of his or her employment and subject to reimbursement of his or her reasonable expenses, Executive will cooperate with the Company and its counsel with respect to any matter (including litigation, investigations, or governmental proceedings) in which Executive was in any way involved during his or her employment with the Company. Executive agrees to render such cooperation in a timely manner on reasonable notice from the Company, provided the Company exercises reasonable efforts to limit and schedule the need for Executive’s cooperation so as not to materially interfere with his or her other professional obligations. For periods following the second anniversary of Executive’s cessation of employment, to the extent Executive’s service under this paragraph exceeds five hours per calendar month, the Company will pay Executive a fee of $400 per hour.

(e)Executive agrees that, upon any cessation of his or her employment, Executive will deliver to the Company (and will not retain in his or her possession or control, or deliver to anyone else) all property and equipment of the Company, including without limitation (i) all keys, books, records, computer hardware, software, cellphones, access cards, credit cards and identification, and (ii) all other Company materials (including copies thereof), including without limitation any records, data, notes, reports, proposals, lists or correspondence.

11.Rights Upon Termination.

(a)Termination without Cause or Resignation for Good Reason. If Executive’s employment by the Company ceases due to a termination by the Company without Cause (as defined in Section 14) or a resignation by Executive for Good Reason (as defined in Section 14):

(i)the Company shall pay to Executive all accrued and unpaid Base Salary through the date of such cessation of employment at the time such Base Salary would otherwise be paid according to the Company’s usual payroll practices;

(ii)the Company shall pay to Executive any business expenses that were incurred prior to the date of such cessation of employment but not reimbursed and that are otherwise eligible for reimbursement;

(iii)to the extent then unpaid, the Company shall pay to Executive the annual incentive award (if any) earned with respect to the calendar year ended immediately prior to the date of such cessation of employment;

(iv)the Company shall pay to the Executive a total of 200% of the Base Salary as in effect immediately prior to such cessation of employment (or, if such cessation is due to the Good Reason described in clause (i) of that definition, 200% of the Base Salary in effect immediately prior to such material diminution), which amount will be paid ratably in

installments at customary payroll intervals over the 24 month period following such cessation of employment; and

(v)the Company shall pay to Executive a lump sum cash payment equal to a pro rata portion of the annual incentive award, if any, that Executive would have earned for the calendar year of his or her termination based on achievement of the applicable performance targets for such year (the “Terminal Award”) and, for the avoidance of doubt, if and to the extent that any portion of such achievement is based on subjective or judgmental factors, the Company’s determination of the extent of such achievement (if any) shall be final and binding. The pro-rated portion of the Terminal Award shall be determined by multiplying the Terminal Award by a fraction, the numerator of which is the number of days during which Executive was employed by the Company in the calendar year of his or her termination of employment and the denominator of which is three hundred sixty-five (365).

Notwithstanding the foregoing, if the cessation of Executive’s employment with the Company due to a termination by the Company without Cause or a resignation by Executive for Good Reason occurs within ninety (90) days preceding or twelve (12) months after the date of a Change in Control, then in lieu of the foregoing, Executive shall receive a lump sum payment under this clause (v) equal to two times his or her Target Bonus Opportunity for the calendar year of Executive’s termination of employment.

The payment under this clause (v) shall be made on the date that annual incentive awards are paid to similarly situated executives for the calendar year in which Executive’s termination occurs (or if later, the Settlement Date (as defined below)), but in no event later than two-and-a-half months following the end of the calendar year in which Executive’s termination date occurs.

(vi)if, immediately before the cessation of Executive’s employment, Executive participates (other than pursuant to COBRA) in a Company group health plan, then, for the twelve (12) months following the date of such cessation (or, if less, until Executive becomes eligible to obtain coverage under another employer plan), the Company will provide COBRA continuation coverage under such plan to Executive and his or her spouse at the Company’s expense, if and to the extent they or either of them shall have elected and shall be entitled to receive COBRA continuation coverage. Executive shall provide immediate notice to the Company of such election of COBRA coverage and the date of such entitlement, and upon Executive becoming eligible for coverage under another employer plan. The Company may impute income to Executive in an amount determined by the Company, in its sole discretion, to the extent the Company determines that such imputation of income is necessary to mitigate the risk of penalties and/or taxes to Executive or the Company, or to otherwise comply with applicable law; and

(vii)Executive will immediately vest in any Performance-Based RSUs earned for any performance period that ended prior to the date of such cessation of employment and that (but for such cessation of employment) are scheduled to vest during (but not after) the 18 month period following such cessation date.

Except as and solely to the extent otherwise provided in this Section 11(a), all compensation and benefits will cease at the time of Executive’s cessation of employment and the Company will have no further liability or obligation by reason of such cessation of employment. The payments and benefits described in this Section 11(a) are in lieu of, and are not in addition to, any other severance plans, policies or arrangements maintained by the Company, including but not limited to severance plans applicable to other Company executives. Notwithstanding any provision of

this Agreement, the payments and benefits described in Sections 11(a)(iii) - 11(a)(vii) are conditioned on Executive’s execution and delivery to the Company and the expiration of all applicable statutory revocation periods, by the 60th day following the effective date of Executive’s cessation of employment, of a general release of claims against the Company and its affiliates in substantially the form attached hereto as Exhibit A (but subject to such revisions as may be required, in the judgment of Company counsel, to reflect then applicable legal or regulatory requirements) (the “Release”) and on Executive’s continued compliance with the provisions of Section 15 below.

Subject to Section 12 below (to the extent applicable) and provided the Release requirement described above has been timely satisfied: (x) the payment described in Section 11(a)(iii) will be paid on the later of the sixty-fifth (65th) day following Executive’s cessation of employment (the “Settlement Date”) or the date such annual incentive award would have otherwise been paid; and (y) the payments described in Section 11(a)(iv) will commence to be paid on the Settlement Date, provided that the initial payment will include any payments that, but for the above-described timing rule, would have otherwise been paid since the date of Executive’s related cessation of employment.

(b)Other Terminations. If Executive’s employment with the Company ceases for any reason other than as described in Section 11(a) above (including but not limited to (i) termination by the Company for Cause, (ii) resignation by Executive without Good Reason, (iii) termination as a result of Executive’s Disability (as defined in Section 14), or (iv) Executive’s death), then the Company’s obligation to Executive will be limited solely to the payment of accrued and unpaid Base Salary through the date of such cessation of employment and payment of any business expenses that were previously incurred but not reimbursed and are otherwise eligible for reimbursement. Except as otherwise provided by COBRA, all compensation and benefits will cease at the time of such cessation of employment and the Company will have no further liability or obligation by reason of such termination; and, unless otherwise determined by the Committee at or after the time of the grant, all unvested and/or unearned equity and equity-based awards then held by Executive will be forfeited. The foregoing will not be construed to limit Executive’s right to payment or reimbursement for claims incurred prior to the date of such termination under any insurance contract funding an employee benefit plan or arrangement of the Company in accordance with the terms of such insurance contract.

12.Section 409A.

(a)The parties intend for this Agreement to comply with or be exempt from Section 409A of the Code, and all provisions of this Agreement will be interpreted and applied accordingly. Nonetheless, the Company does not guaranty the tax treatment of any compensation payable to Executive.

(b)Notwithstanding anything to the contrary in this Agreement, to the extent necessary to facilitate compliance with Section 409A of the Code, no portion of the benefits or payments to be made under Section 11(a) above will be payable until Executive has a “separation from service” from the Company within the meaning of Section 409A of the Code. In addition, to the extent compliance with the requirements of Treas. Reg. § 1.409A-3(i)(2) (or any successor provision) is necessary to avoid the application of an additional tax under Section 409A of the Code to payments due to Executive upon or following his or her “separation from service,” then notwithstanding any other provision of this Agreement (or any otherwise applicable plan, policy, agreement or arrangement), any such payments that are otherwise due within six months

following Executive’s “separation from service” (taking into account the preceding sentence of this paragraph) will be deferred without interest and paid to Executive in a lump sum immediately following that six month period. This paragraph should not be construed to prevent the application of Treas. Reg. § 1.409A-1(b)(9)(iii) (or any successor provision) to amounts payable hereunder. For purposes of the application of Section 409A of the Code, each payment in a series of installments will be deemed a separate payment.

(c)Notwithstanding anything in this Agreement to the contrary, to the extent an expense, reimbursement or in-kind benefit provided to Executive pursuant to this Agreement or otherwise constitutes a “deferral of compensation” within the meaning of Section 409A of the Code: (i) the amount of expenses eligible for reimbursement or in-kind benefits provided to Executive during any calendar year will not affect the amount of expenses eligible for reimbursement or in-kind benefits provided to Executive in any other calendar year, (ii) the reimbursements for expenses for which Executive is entitled to be reimbursed shall be made on or before the last day of the calendar year following the calendar year in which the applicable expense is incurred, and (iii) the right to payment or reimbursement or in-kind benefits hereunder may not be liquidated or exchanged for any other benefit.

13.Section 280G. Notwithstanding any contrary provision of this Agreement (or any plan, policy, agreement or other arrangement covering Executive), if any payment, right or benefit paid, provided or due to Executive, whether pursuant to this Agreement or otherwise (each, a “Payment,” and collectively, the “Total Payments”), would subject Executive to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then the Total Payments will be reduced to the minimum extent necessary to avoid the imposition of the Excise Tax, but only if (i) the amount of such Total Payments, as so reduced, is greater than or equal to (ii) the amount of such Total Payments without reduction (in each case, determined by the Company on an after-tax basis). Any reduction of the Total Payments required by this paragraph will be implemented by determining the Parachute Ratio (as defined below and determined by the Company) for each Payment and then by reducing the Payments in order, beginning with the Payment with the highest Parachute Ratio. For Payments with the same Parachute Ratio, later Payments will be reduced before earlier Payments. For Payments with the same Parachute Ratio and the same time of payment, each Payment will be reduced proportionately. For purposes of this paragraph, “Parachute Ratio” means a fraction, (x) the numerator of which is the value of the applicable Payment, as calculated for purposes of Section 280G of the Code, and (y) the denominator of which is the economic value of the applicable Payment.

14.Certain Definitions. For purposes of this Agreement:

(a)“Cause” means any of the following: (i) failure of Executive to perform his or her duties and responsibilities to the Company, including, but not limited to, failure of Executive to follow the lawful directives of the Chairman or the Board (other than by reason of Executive’s physical or mental illness, incapacity or disability), which failure is not cured within fifteen (15) days following written notice of such non-performance from the Company; (ii) misconduct by Executive in connection with the performance of his or her duties and responsibilities to the Company, including, without limitation, a breach of fiduciary duties or a misappropriation of funds or property; (iii) the commission by Executive of any felony; (iv) the commission by Executive of a misdemeanor involving moral turpitude, deceit, dishonesty or fraud; (v) any conduct by Executive that would reasonably be expected to result in injury or reputational harm to the Company or any of its subsidiaries and affiliates; (vi) a breach by Executive of any agreement with or duty owed to the Company or its affiliates, which breach is not cured within fifteen (15) days after the delivery of written notice thereof (provided that, in the case of the breach of an agreement, if such agreement includes a cure period and such cure period is less than fifteen (15) days, such shorter cure period shall apply); (vii) a violation by Executive of the Company’s written employment policies, which violation is not cured within fifteen (15) days

after the delivery of written notice thereof (provided that if any such policies include a cure period and if such cure period is less than fifteen (15) days, such shorter cure period shall apply); (viii) a determination by the Board that Executive has failed to exercise good faith diligent efforts to fulfill one or more key expectations communicated to Executive in writing by the Chairman or the Board, which determination is made after affording Executive an opportunity to appear before the Board (which may include appearance via videoconference) with at least fifteen (15) days written notice and describe his or her efforts to fulfill such key expectation(s); or (ix) Executive’s failure to cooperate with a bona fide internal investigation or an investigation by regulatory or law enforcement authorities, after being instructed by the Company to cooperate, or the willful destruction or failure to preserve documents or other materials known to be relevant to such investigation or the inducement of others to fail to cooperate or to produce documents or other materials in connection with such investigation. In regard to each of those clauses in this definition of “Cause” that afford Executive a “cure right,” such cure right will apply only where the relevant failure, breach or violation is curable and will apply only to the first failure, breach or violation by Executive that gives rise to the cure right and shall not apply to any repeat or subsequent failure, breach or violation involving similar actions or omissions, whether or not related to the first failure, breach or violation. For avoidance of doubt, a termination of Executive’s employment due to his or her Disability will not constitute a termination without Cause.

(b)“Change in Control” has the meaning given to this term in the Company’s 2016 Long-Term Incentive Plan, as in effect on the Effective Date.

(c)“Code” means the Internal Revenue Code of 1986, as amended.

(d)“Disability” means a condition entitling Executive to benefits under the Company’s long term disability plan, policy or arrangement; provided, however, that if no such plan, policy or arrangement is then maintained by the Company and applicable to Executive, “Disability” will mean Executive’s inability to perform his or her duties under this Agreement due to a mental or physical condition (other than alcohol or substance abuse) that can be expected to result in death or that can be expected to last (or has already lasted) for a continuous period of 90 days or more, or for 120 days in any 180 consecutive-day period. Termination as a result of a Disability will not be construed as a termination by the Company “without Cause.”

(e)“Good Reason” means: (i) a reduction in the Base Salary that exceeds ten percent (10%) of the Base Salary as in effect immediately prior to the reduction (excluding, however, the impact of across-the-board salary reductions similarly affecting other senior executives of the Company); (ii) a reduction in Executive’s Target Bonus Opportunity that exceeds ten percent (10%) of the Target Bonus Opportunity as in effect immediately prior to the reduction (excluding, however, (A) the impact on the Target Bonus Opportunity of any reduction in Base Salary that does not give rise to “Good Reason” hereunder, and (B) the impact of across-the-board target bonus reductions similarly affecting other senior executives of the Company); (iii) a Company-mandated relocation of Executive’s principal place of employment to a location that is more than 50 miles from Princeton Junction, New Jersey; (iv) the assignment to Executive of non-executive duties, an adverse change in Executive’s title, or a requirement that Executive report to anyone other than the Board or its Chairperson; or (v) any other material breach of this Agreement by the Company; provided, however, that no such event will constitute Good Reason unless (x) Executive provides the Company with written objection to such event within 30 days after the initial occurrence thereof, (y) such event is not reversed or corrected by the Company within 30 days of its receipt of such written objection, and (z) Executive separates from service within 30 days following the expiration of that cure period.

15.Restrictive Covenants.

(a)Access to Secret and Confidential Information. The Company has furnished and shall furnish to Executive secret and confidential information with respect to the Company and its affiliates (collectively “Secret and Confidential Information”), to which Executive would not otherwise have access and of which Executive would not otherwise have knowledge. Secret and Confidential Information includes, without limitation, technical and business information, whether patentable or not, which is of a confidential, trade secret or proprietary character, and which is either developed by Executive alone, with other or by others; lists of customers; identity of customers; identity of prospective customers; contract terms; bidding information and strategies; pricing methods or information; computer software; computer software methods and documentation; hardware; methods of operation; the procedures, forms and techniques used in servicing accounts; and other information or documents that the Company or any of its affiliates requires to be maintained in confidence for its or their continued business success.

(b)Non-Disclosure of Secret and Confidential Information.

(i)Executive shall not, during the period of his or her employment with the Company or at any time thereafter, disclose to anyone, including, without limitation, any person, firm, corporation, or other entity, or publish, or use for any purpose, any Secret and Confidential Information, except as properly required in the ordinary course of the Company’s business or as directed and authorized by the Company or as required by court order, law or subpoena, or other legal compulsion to disclose, it being understood that information that is known generally in the industry or is otherwise available to the public (other than as a result of a violation of Executive’s obligation under this Section 15) shall not be considered Secret and Confidential Information.

(ii)Notwithstanding the foregoing, pursuant to 18 U.S.C. Section 1833(b), Executive shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that: (A) is made in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal.

(iii)Similarly, notwithstanding anything herein to the contrary, Executive understands that this Agreement will not (1) prohibit him from making reports of possible violations of federal law or regulation to any governmental agency or entity in accordance with the provisions of and rules promulgated under Section 21F of the Securities Exchange Act of 1934, as amended, or Section 806 of the Sarbanes-Oxley Act of 2002, or of any other whistleblower protection provisions of federal law or regulation, or (2) require notification or prior approval by the Company of any such report; provided that, Executive is not authorized to disclose communications with counsel that were made for the purpose of receiving legal advice or that contain legal advice or that are protected by the attorney work product or similar privilege.

(c)Duty to Return Company Documents and Property. Upon the termination of Executive’s employment with the Company for any reason, Executive shall immediately return and deliver to the Company any and all papers, books, records, documents, memoranda and manuals, e-mail, electronic or magnetic recordings or data, including all copies thereof, belonging to the Company or relating to its business, in Executive’s possession or control, whether prepared by Executive or others. If at any time after the termination of employment, Executive determines that Executive has any Secret and Confidential Information in his or her possession or control, Executive shall immediately return to the Company all such Secret and Confidential Information, including all copies and portions thereof.

(d)Inventions. Any and all writings, computer software, inventions, improvements, processes, procedures and/or techniques which Executive may make, conceive, discover, or develop, either solely or jointly with any other person or persons, at any time during the term of his or her employment, whether at the request or upon the suggestion of the Company or otherwise, which relate to or are useful in connection with any business now or hereafter carried on or contemplated by the Company, including developments or expansions of its present fields of operations, shall be the sole and exclusive property of the Company. Executive shall take all actions necessary so that the Company can prepare and present applications for copyright or letters patent therefor, and can secure such copyright or letters patent wherever possible, as well as reissue renewals, and extensions thereof, and can obtain the record title to such copyright or patents. Executive shall not be entitled to any additional or special compensation or reimbursement regarding any such writings, computer software, inventions, improvements, processes, procedures and techniques. Executive acknowledges that the Company from time to time may have agreements with other persons or entities which impose obligations or restrictions on the Company regarding inventions made during the course of work thereunder or regarding the confidential nature of such work. Executive shall be bound by all such obligations and restrictions and take all action necessary to discharge the obligations of the Company.

(e)Non-Solicitation and Non-Competition Restrictions. To protect the Company’s Secret and Confidential Information, and in the event of Executive’s termination of employment for any reason whatsoever, whether by Executive or the Company, Executive will be subject to the following restrictive covenants during and for the stated period following the termination of his or her employment.

(i)Non-Competition. During Executive’s employment by the Company and for eighteen (18) months following the cessation of Executive’s employment with the Company for any reason, Executive shall not, without the prior written consent of the Company, knowingly or intentionally (1) personally engage in Competitive Activities (as defined below) or (2) work for, own, manage, operate, control, or participate in the ownership, management, operation, or control of, or provide consulting or advisory services to, any person, partnership, firm, corporation, institution or other entity engaged in Competitive Activities, or any company or person affiliated with such person or entity engaged in Competitive Activities; provided that Executive’s purchase or holding, for investment purposes, of securities of a publicly traded company shall not constitute “ownership” or “participation in the ownership” for purposes of this paragraph so long as such equity interest in any such company is not more than 2% of the value of the outstanding stock or 2% of the outstanding voting securities of said publicly traded company. For the avoidance of doubt, this Section 15(e)(i) shall not prohibit Executive from being employed by, or providing services to, a consulting firm, provided that Executive does not personally engage in Competitive Activities or provide consulting or advisory services to any individual, partnership, firm, corporation, institution or other entity engaged in Competitive Activities, or any person entity affiliated with such individual, partnership, firm, corporation, institution or other entity engaged in Competitive Activities.

(ii)Competitive Activities. For the purposes hereof, the term “Competitive Activities” means activities relating to products or services of the same or similar type as the products or services which are sold (or, pursuant to an existing business plan, will be sold) to paying customers of the Company or any of its subsidiaries. Notwithstanding the previous sentence, an activity shall not be treated as a Competitive Activity if the geographic marketing area of the relevant products or services does not overlap with the geographic marketing area for the applicable products and services of the Company and its subsidiaries.

(iii)Interference With Business Relations. For two (2) years following the termination of Executive’s employment with the Company, Executive shall not, without the prior written consent of the Company, knowingly or intentionally, directly or indirectly: (1) recruit,

induce or solicit any individual who is or who, within the preceding six (6) months, was a non-clerical employee of the Company (including any of its subsidiaries) (“Covered Service Providers”) for employment or for retention as a consultant or service provider, or hire any such individual; or (2) solicit or induce any client, customer, or prospect of the Company (including any subsidiary of the Company) (x) to cease being, or not to become, a customer of the Company (or any such subsidiary), or (y) to divert any business of such customer or prospect from the Company (or any such subsidiary). For avoidance of doubt, this paragraph will not prohibit Executive from advertising employment openings to the general public (but does, during the restriction period specified above, prohibit Executive from directly or indirectly hiring or engaging Covered Service Providers who respond to any such advertisements).

(f)Reformation. If a court concludes that any time period and/or the geographic area specified in Section 15(e) is unenforceable, then the time period will be reduced by the number of months, or the geographic area will be reduced by the elimination of the overbroad portion, or both, as the case may be, so that the restrictions may be enforced in the geographic area and for the time to the fullest extent permitted by law.

(g)Remedies. Executive acknowledges and agrees that, in view of the nature of the Company’s business, the restrictions contained in this Section 15 of the Agreement are reasonable and necessary to protect the Company’s legitimate business interests and that any violation of these restrictions would result in irreparable injury to the Company. In the event of a breach or a threatened breach by Executive of any restrictive covenant contained herein, the Company shall be entitled to a temporary restraining order and injunctive relief restraining Executive from the commission of any breach, and upon the entry of final judgment by a court of competent jurisdiction that Executive breached or threatened to breach this Section 15, the Company will be entitled to recover the reasonable attorneys’ fees, costs and expenses the Company incurred related to the breach or threatened breach. Nothing contained herein shall be construed as prohibiting the Company from pursuing any other remedies available to it for any breach or threatened breach, including, without limitation, the other remedies specified in this Agreement and/or the recovery of money damages, attorneys' fees, and costs. These covenants and restrictions shall each be construed as independent of any other provisions in the Agreement, and the existence of any claim or cause of action by Executive against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company of such covenants and restrictions.

(h)Severability. Should a court determine that any paragraph or sentence, or any portion of a paragraph or sentence of this Section 15 is invalid, unenforceable or void, this determination shall not have the effect of invalidating the remainder of the paragraph, sentence or any other provision of this Section 15. Further, it is intended that the court should construe this Section 15 by limiting and reducing it only to the extent necessary to be enforceable under then applicable law, taking into account the intent of the parties.

(i)Future Employment. If, before the expiration of the period covered by Section 15(e)(iii) hereof, Executive seeks or is offered employment or engagement by any other company, firm, person or entity, Executive shall provide a copy of this Section 15 to the prospective service recipient before accepting employment with that prospective employer.

16.No Duty to Mitigate. Except as otherwise specifically provided herein, Executive’s entitlement to payments or benefits upon or following the termination of his or her employment will not be subject to mitigation or a duty to mitigate by Executive.

17.No Conflicting Agreements. Executive represents and warrants that Executive is not a party to or otherwise bound by any agreement or restriction that could conflict with, or be violated by, the performance of his or her duties to the Company or his or her obligations under

this Agreement. Executive will not use or misappropriate any intellectual property, trade secrets or confidential information belonging to any third party.

18.Taxes. All compensation payable to Executive is subject to reduction to reflect applicable withholding and payroll taxes and other deductions required by law. Executive hereby acknowledges that the Company does not have a duty to design its compensation policies in a manner that minimizes Executive’s tax liabilities, and Executive not make any claim against the Company or its board of directors related to tax liabilities arising from his or her compensation.

19.Entire Agreement; Assignment; Amendment.

(a)This Agreement, including the exhibits, schedules and other documents referred to herein, constitutes the final and entire agreement of the parties with respect to the matters covered hereby and supersedes any prior and/or contemporaneous agreements, arrangements discussions, negotiations, representations or understandings (whether written, oral or implied) relating to the subject matter hereof; and, for the avoidance of doubt, Executive confirms there are no agreements, arrangements, discussions, negotiations, representations or understandings between Executive and the Company, or any affiliates of the Company, not referred to herein.

(b)The rights and obligations of Executive hereunder are personal and may not be assigned. The Company may assign this Agreement, and its rights and obligations hereunder, to any entity to which the Company transfers substantially all of its assets (or an affiliate thereof). Notwithstanding any other provision of this Agreement, any such assignment of this Agreement by the Company will not entitle Executive to severance benefits under Section 11(a) or otherwise, whether or not Executive accepts employment with the assignee.

(c)This Agreement may be amended or modified only by a written instrument signed by a duly authorized officer of the Company and Executive.

20.Arbitration. In the event of any dispute under the provisions of this Agreement or otherwise regarding Executive’s employment or compensation (other than a dispute in which the primary relief sought is an injunction or other equitable remedy, such as an action to enforce compliance with Section 15), the parties shall be required to have the dispute, controversy or claim settled by arbitration in Princeton Junction, New Jersey in accordance with the National Rules for the Resolution of Employment Disputes then in effect of the American Arbitration Association (“AAA”), by one arbitrator mutually agreed upon by the parties (or, if no agreement can be reached within thirty (30) days after names of potential arbitrators have been proposed by the AAA, then by one arbitrator having relevant experience who is chosen by the AAA). Any award or finding will be confidential. The arbitrator may not award attorneys’ fees to either party unless a statute or contract at issue specifically authorizes such an award. Any award entered by the arbitrators will be final, binding and non-appealable and judgment may be entered thereon by either party in accordance with applicable law in any court of competent jurisdiction. This arbitration provision will be specifically enforceable. Each party will be responsible for its own expenses relating to the conduct of the arbitration (including reasonable attorneys’ fees and expenses) and will share equally the fees of the arbitrator.

21.Notices. All notices, demands or other communications hereunder shall be in writing and shall be deemed to have been duly given if delivered in person, by e-mail or fax, by United States mail, certified or registered with return receipt requested, or by a nationally recognized overnight courier service: (a) if to Executive, at the most recent address contained in the Company’s personnel files; (b) if to the Company, to the attention of its Legal Department at the address of its principal executive office; or (c) or at such other address as may have been furnished by such person in writing to the other party. Any such notice, demand or

communication shall be deemed given on the date given, if delivered in person, e-mailed or faxed, on the date received, if given by registered or certified mail, return receipt requested or by overnight delivery service.

22.Company-Owned Life Insurance. Executive agrees that the Company may obtain life insurance on Executive in an amount determined by the Company, at the sole expense of the Company, with the Company as the sole beneficiary thereof. Executive will (a) cooperate fully in obtaining such life insurance, (b) sign any necessary consents, applications and other related forms or documents, and (c) at the Company’s expense, take any reasonably required medical examinations.

23.Headings. The headings of the sections of this Agreement are inserted for convenience only and shall not affect the meaning of this Agreement.

24.Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of New Jersey, without regard to its choice of law provisions.

25.Counterparts. This Agreement may be executed in separate counterparts, any one of which need not contain signatures of more than one party, but all of which taken together will constitute one and the same Agreement.

[Signature Page Follows]

This Agreement has been executed and delivered on the date first above written.

MISTRAS GROUP, INC.

By:

Name: Manuel N. Stamatakis

Title: Chairman of the Board

EXECUTIVE

Natalia Shuman-Fabbri

Exhibit A

GENERAL RELEASE

This General Release (this “Release”) is executed by _____________ (“Employee”) on this _____, 20__.

WHEREAS, Employee’s employment with MISTRAS GROUP, INC. (“Mistras”) terminated on __________, ___; and

WHEREAS, in connection with the termination of Employee’s employment with Mistras, Employee is entitled to the severance benefits described in Sections 11(a)(iii) - 11(a)(vii) of that certain Employment Agreement by and between Mistras and Employee dated December ___, 2024 (the “Employment Agreement”), subject to the execution of this Release (the “Severance Benefits”).

NOW THEREFORE, in consideration of these premises and intending to be legally bound hereby:

1.Employee acknowledges that, in the absence of his/her execution of this Release, the Severance Benefits would not otherwise be due to him/her. Employee further acknowledges and agrees that (a) other than the Severance Benefits, Employee has no entitlement under any other severance or similar arrangement maintained by Mistras, and (b) except as otherwise provided specifically in this Release, the Released Parties (as defined below) do not and will not have any other liability or obligation to Employee.

2.Employee, for himself/herself and his/her estate, heirs, legal representatives, and assigns, releases and forever discharges Mistras and its related entities, parent companies, subsidiaries, and affiliates, and each of their respective current and former officers, directors, stockholders, members or other equity holders, agents, representatives, insurers, plan administrators, employees, predecessors, successors, and assigns (collectively, the “Released Parties”) from any and all claims, liabilities, obligations, promises, agreements, demands, damages, actions, and causes of action of every kind which Employee ever had, now has, hereafter shall or may have or assert against Released Parties for any matter, cause, or thing which may have occurred before and up to the date of the execution of this Release. This Release specifically includes, but is not limited to:

(a)any and all claims and matters which arose or otherwise relate to Employee’s employment with Mistras or the terms, conditions, circumstances and/or termination of that employment;

(b)any and all claims for wages or benefits (including, without limitation, salary, stock, commissions, bonuses, severance pay, health and welfare benefits, vacation pay and any other fringe-type benefits), including but not limited to claims under the Employee Retirement Income Security Act of 1974;

(c)any and all claims for employment discrimination, harassment or retaliation on the basis of any protected category, including but not limited to age, race, color, religion, sex, pregnancy, national origin, ancestry, veteran status, disability, medical condition and/or handicap, or genetics, in violation of any federal, state or local statute, ordinance, judicial precedent or executive order, including but not limited to claims for discrimination under the following statutes (as amended): Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e et seq., the Civil Rights Act of 1866, 42 U.S.C. § 1981 et seq., the Equal Pay Act, 29 U.S.C. § 206(d), et seq., the Age Discrimination in Employment Act, 29 U.S.C. § 621 et seq., the Older Workers Benefit Protection Act, 29 U.S.C. § 626(f), the Americans with Disabilities Act, 42 U.S.C. § 12101 et seq., the Pregnancy Discrimination Act, 42 U.S.C. Ch. 21, § 701(k), the Rehabilitation Act of 1973, the Immigration Reform Control Act, the Occupational Safety and Health Act, the Family and Medical Leave Act, 29 U.S.C. § 2601 et seq., the Genetic Information Nondiscrimination Act, 42 U.S.C. § 2000ff, et seq., New Jersey Law Against Discrimination, New Jersey Family Leave Act, New Jersey Paid Sick Leave Law, New Jersey Conscientious Employee Protection Act, the New Jersey Wage Payment Law, the New Jersey Wage and Hour Law, and all other applicable statutes of any state, county, or locality;

(d)any and all claims for breach of contract;

(e)any and all claims in tort (including but not limited to any claims for misrepresentation, defamation, interference with contract or prospective economic advantage, intentional infliction of emotional distress and negligence);

(f)any and all claims arising under any federal, state or local statute, ordinance, rule, regulation or common law principle;

(g)any and all claims for additional compensation or damages of any kind including, but not limited to, compensatory and punitive damages; and

(h)any and all claims for attorney’s fees and costs.

Employee understands that the general release of claims set forth herein covers claims that Employee knows about and those that he/she may not know about. Employee expressly accepts and assumes the risk that additional or different facts or claims may be discovered after execution of this Release, and Employee agrees that this Release shall remain effective notwithstanding such discovery.

3.This Release does not apply to any claim: (a) that cannot be waived by law; (b) that arose after the date Employee signs this Release; (c) to challenge the validity of this Release and the knowing and voluntary nature of Employee’s release under the Age Discrimination in Employment Act and/or the Older Workers’ Benefit Protection Act; (d) to elect COBRA continuation coverage; or (e) for indemnification under the By-Laws of Mistras, any agreement with Mistras for indemnification, or applicable law for Employee’s acts or omissions as an officer or director of Mistras, or for the benefit of any applicable directors and officers insurance policy.

4.Employee expressly warrants that he/she has no charges, complaints, lawsuits, actions, summons or other legal proceedings pending in any court or administrative or investigative body against any Released Party and promises not to file any lawsuit or claim asserting any cause of action released by this Release. Similarly, to the fullest extent of the law, Employee agrees to not initiate, cause, encourage, induce, suggest, or threaten the filing of any claims, complaints, charges, or lawsuits against Mistras, by or on behalf of another person.

5.Employee agrees not to disparage any Released Party or otherwise take any action which could reasonably be expected to adversely affect the personal or professional reputation of any Released Party.

6.Notwithstanding the foregoing or any other provision hereof, this Release does not:

(a)prohibit Employee from providing truthful testimony in response to a subpoena or in defense of any claim against him/her

(b)prohibit or restrict Employee’s ability to file a charge or complaint with or participate, testify, or assist in any investigation, hearing or other proceeding before the Equal Employment Opportunity Commission, Occupational Safety and Health Administration, National Labor Relations Board, or similar state or local agency (but does preclude his/her ability to obtain personal relief in connection with such activities); or

(c)prohibit Employee from (i) communicating with the U.S. Department of Justice, the U.S. Securities and Exchange Commission, the Commodity Futures Trading Commission, the Financial Industry Regulatory Authority or any similar state or federal government or regulatory authority; (ii) making any other disclosures that are protected under the whistleblower provisions of federal or other law or regulation; (iii) participating in any investigation or proceeding that may be conducted by an such agency or authority, in connection with reporting a possible securities law violation without notice to Mistras; and (iv) receiving an individual monetary award or other individual relief by virtue of participating in such governmental whistleblower program.

7.All remedies at law and equity shall be available for the enforcement of this Release and this Release may be pled as a full bar to the enforcement of any claim that Employee brings against any Released Party that, either in form or substance, is covered by this Release.

8.Employee acknowledges that his/her obligations under the Employment Agreement survive the termination of his/her employment, including (without limitation) his/her obligations under Sections 10(b), 10(d), 10(e) and 15 of the Employment Agreement. Employee affirms that the restrictive covenants contained in Section 15 of the Employment Agreement are reasonable and necessary to protect the legitimate interests of Mistras, that he/she received adequate consideration in exchange for agreeing to those provisions and that he/she will abide by those provisions.

9.Employee expressly acknowledges and recites that: (a) he/she has read and understands the terms of this Release in its entirety; (b) he/she has entered into this Release knowingly and voluntarily, without any duress or coercion; (c) he/she has been advised orally and is hereby advised in writing to consult with an attorney with respect to this Release before signing it; (d) he/she was provided 21 calendar days after receipt of the Release to consider its terms before signing it, which 21 day period may be waived; (e) he/she is provided an unwaivable seven calendar days from the date of signing this Release to terminate and revoke this Release; and (f) in the case of a written revocation during those seven days, this Release shall be unenforceable, null and void. Employee may revoke this Release during those seven days by providing written notice of revocation to Mistras at the following address:

Mistras Group, Inc.

ATTN: General Counsel

195 Clarksville Road

Princeton Junction, New Jersey 08550

Any such notice of revocation will be deemed provided on the date actually received by Mistras. If Employee revokes this Release, he/she will forfeit the Separation Benefits and will not be entitled to any other severance benefits.

10.Employee agrees that this Release should not be construed as evidence of any wrongdoing by any Released Party.

11.Sections 20 and 24 of the Employment Agreement (regarding governing law and arbitration) are incorporated herein by reference and will govern any dispute regarding this Release.

IN WITNESS WHEREOF, Employee has executed this Release on the day and year first above written.

[EMPLOYEE]

Exhibit 99.1

MISTRAS GROUP APPOINTS NATALIA SHUMAN AS

PRESIDENT AND CHIEF EXECUTIVE OFFICER

Manuel (Manny) N. Stamatakis Continues as Executive Chairman of the Board

PRINCETON JUNCTION, N.J. – December 5th, 2024 (GLOBE NEWSWIRE) – MISTRAS Group, Inc. (NYSE: MG)—a leading "one source" multinational provider of integrated technology-enabled asset protection solutions—today announced that the Company’s Board of Directors has appointed Natalia Shuman as MISTRAS Group’s new President and Chief Executive Officer (CEO), effective January 1, 2025.

Ms. Shuman brings over two decades of leadership experience to MISTRAS Group, having held executive roles at prominent global organizations in the Testing, Inspection, and Certification (TIC) industry. Most recently, as Group Executive Vice President and Group Operating Council Member for Eurofins Scientific, she led over 12,000 employees, driving growth strategies, operational excellence, and strategic value creation. Known for scaling billion-dollar enterprises through organic growth and M&A, Ms. Shuman has a proven track record of fostering strong teams and delivering innovative, value-driven solutions.

Building on a Strong Foundation

Ms. Shuman succeeds Manuel (Manny) N. Stamatakis as the CEO, who has been serving as both Interim CEO and the Executive Chairman of the Board since October 2023. Mr. Stamatakis will continue in the role of Executive Chairman of the Board, providing strategic oversight and support to the CEO and the Company’s leadership team.

The Board of Directors extends its gratitude to Mr. Stamatakis for his exemplary service as Interim CEO during a pivotal time for the Company, helping to advance key initiatives and positioning MISTRAS Group for future growth.

Mr. Stamatakis expressed the Board’s confidence, stating: "Today's announcement is the result of a deliberate, rigorous search to find the right leader to continue MISTRAS Group’s pursuit of profitable growth and sustainable improvement in shareholder value. Natalia’s extensive experience, proven leadership, and fresh perspective make her the ideal choice to guide MISTRAS toward achieving its strategic goals and unlocking its full potential.”

“I’m honored to join MISTRAS Group to lead the Company into its next phase of growth,” said Ms. Shuman. “Working alongside Manny, the Board of Directors, and the leadership team, I am committed to building on the strong foundation established and driving meaningful value for all our stakeholders."

Leadership Excellence in TIC and Across Global Industries

A global business leader with extensive experience across diverse industries and cultural landscapes, Ms. Shuman has demonstrated a strong ability to achieve results in business-to-business services, spanning manufacturing, energy, chemicals, pharmaceuticals, industrial services, and construction.

As North American CEO for Bureau Veritas, Ms. Shuman oversaw 7,000 employees across 130 offices and laboratories in the U.S., Canada, and Mexico. She spearheaded a period of significant growth and transformation, steering the company

to a diversified, more resilient business model. She also championed a unified “one company” culture, elevating brand recognition in North America.

Before joining Bureau Veritas, Ms. Shuman led international business operations at Kelly Services, a global staffing and human resources outsourcing company. She is also recognized as a vocal advocate for diversity and inclusion, receiving accolades from several prominent organizations.

Ms. Shuman earned a dual Master of Business Administration (MBA) from Columbia Business School and London Business School.

About MISTRAS Group, Inc. - One Source for Asset Protection Solutions®

MISTRAS Group, Inc. (NYSE: MG) is a leading "one source" multinational provider of integrated technology-enabled asset protection solutions, helping to maximize the safety and operational uptime for civilization’s most critical industrial and civil assets.

Backed by an innovative, data-driven asset protection portfolio, proprietary technologies, strong commitment to Environmental, Social, and Governance (ESG) initiatives, and a decades-long legacy of industry leadership, MISTRAS leads clients in the oil and gas, aerospace and defense, renewable and nonrenewable power, civil infrastructure, and manufacturing industries towards achieving operational and environmental excellence. By supporting these organizations that help fuel our vehicles and power our society; inspecting components that are trusted for commercial, defense, and space craft; building real-time monitoring equipment to enable safe travel across bridges; and helping to propel sustainability, MISTRAS helps the world at large.

MISTRAS enhances value for its clients by integrating asset protection throughout supply chains and centralizing integrity data through a suite of Industrial IoT-connected digital software and monitoring solutions. The company’s core capabilities also include non-destructive testing field and in-line inspections enhanced by advanced robotics, laboratory quality control and assurance testing, sensing technologies and NDT equipment, asset and mechanical integrity engineering services, and light mechanical maintenance and access services.

For more information about how MISTRAS helps protect civilization’s critical infrastructure and the environment, visit https://www.mistrasgroup.com/.

Contact:

Nestor S. Makarigakis

Group Vice President, Marketing and Communications

MISTRAS Group, Inc.

marcom@mistrasgroup.com

+1 (609) 716-4000

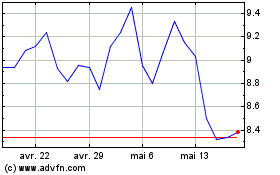

Mistras (NYSE:MG)

Graphique Historique de l'Action