MeridianLink Technology Drives Efficiency and Enhances Customer Experience for Broadway Bank, Reducing Loan Processing Time by Up to Six Days

05 Septembre 2024 - 10:05PM

Business Wire

The San Antonio-Based Bank Speeds Up

Decisioning, Boosting Banker Efficiency and Client Satisfaction

MeridianLink, Inc. (NYSE: MLNK), a leading provider of modern

software platforms for financial institutions and consumer

reporting agencies, today announced Broadway Bank has achieved

significant efficiency gains and an enhanced customer experience

through the implementation of MeridianLink® Mortgage. By automating

routine backend tasks and streamlining the application and

decisioning process, Broadway Bank has reduced its loan processing

time by up to six days, improving both banker productivity and

client satisfaction.

Prior to MeridianLink Mortgage, Broadway Bank loan officers were

responsible for the input and accuracy of closing costs on loan

estimates, as well as disclosing fees to clients. With MeridianLink

Mortgage, all operations are centralized under one loan origination

system (LOS), facilitating real-time messaging with borrowers, and

allowing for quick document uploads. The platform has also led to

the automation of four manual administrative processes and the

implementation of improved customer data reporting tools, resulting

in increased efficiency for both consumers and Broadway Bank staff.

To date, these process improvements have helped to reduce the

application timeline for some consumers by almost a week. Broadway

Bank staff can now use the time saved to communicate directly with

customers, allowing for more personalized customer service and

creating stronger banking experiences.

“The accuracy of data and efficiency gains from the automation

of booking and the disclosure process is key to our ongoing

relationships with employees and our clients,” said Lynn Yznaga,

Senior Vice President, Broadway Bank. “We've not only had a

reduction in our turnaround time from application to underwriting,

but also from underwriting to closing, enhancing our customer

response times. We've had tremendous results from the voice of the

customer survey.”

Broadway Bank also utilizes MeridianLink® Consumer, the retail

lending product from the comprehensive MeridianLink® One platform,

to facilitate a frictionless consumer experience. The product

consolidates data from all existing channels, including in-person

and digital services, into one single origination point. Since

first utilizing MeridianLink One in early 2023, the bank has seen

significant improvements in the account opening and application

decisioning processes.

“Our partnership with Broadway Bank and the commitment the

institution has shown to leveraging technology to enhance its

customer experience and operational efficiencies is a testament to

its forward-thinking approach,” said Devesh Khare, chief product

officer at MeridianLink. “We’re thrilled to see our solutions

supporting community banks at every stage of their digital journey,

and we look forward to continuing our collaboration with Broadway

Bank to help them remain a step ahead of their competitors.”

Broadway Bank customers have indicated a high level of

satisfaction with the bank’s use of MeridianLink products,

according to Net Promoter Score surveys, citing the ability to

upload documents quickly and receive timely responses from their

financial institution.

For more information about MeridianLink’s innovative solutions,

visit the Company website.

ABOUT BROADWAY BANK

Since 1941, Broadway Bank has been an integral part of Texas,

evolving into one of the largest privately-owned banks in the Lone

Star State. With more than $5.5 billion in assets and $3 billion in

Wealth Management assets, Broadway Bank offers a comprehensive

suite of personal, private, business, mortgage banking and wealth

management services. With financial centers and offices across San

Antonio, Austin, the Hill Country, Dallas and Houston, Broadway

Bank delivers a modern banking experience that’s locally sourced

and personally delivered.

ABOUT MERIDIANLINK

MeridianLink® (NYSE: MLNK) empowers financial institutions and

consumer reporting agencies to drive efficient growth.

MeridianLink’s cloud-based digital lending, account opening,

background screening, and data verification solutions leverage

shared intelligence from a unified data platform, MeridianLink®

One, to enable customers of all sizes to identify growth

opportunities, effectively scale up, and support compliance

efforts, all while powering an enhanced experience for staff and

consumers alike.

For more than 25 years, MeridianLink has prioritized the

democratization of lending for consumers, businesses, and

communities. Learn more at www.meridianlink.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905849072/en/

PRESS CONTACT Sydney Wishnow meridianlinkPR@clyde.us

(508) 808-9060

INVESTOR RELATIONS CONTACT Gianna Rotellini (714)

332-6357 InvestorRelations@meridianlink.com

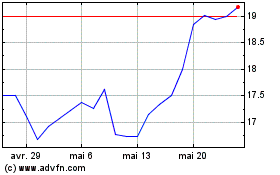

MeridianLink (NYSE:MLNK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

MeridianLink (NYSE:MLNK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024