0001636519false00016365192024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2024

MADISON SQUARE GARDEN SPORTS CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-36900 | | 47-3373056 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| 2 Penn Plaza | , | New York | , | New York | | 10121 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 465-4111

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock | | MSGS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On November 1, 2024, Madison Square Garden Sports Corp. (the “Company”) announced its financial results for its first quarter ended September 30, 2024. A copy of the press release containing the announcement is included as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| MADISON SQUARE GARDEN SPORTS CORP. |

| (Registrant) |

| | |

| By: | | /s/ Victoria M. Mink |

| Name: | | Victoria M. Mink |

| Title: | | Executive Vice President,

Chief Financial Officer and Treasurer |

Dated: November 1, 2024

MADISON SQUARE GARDEN SPORTS CORP. REPORTS

FISCAL 2025 FIRST QUARTER RESULTS

NEW YORK, N.Y., November 1, 2024 - Madison Square Garden Sports Corp. (NYSE: MSGS) today reported financial results for the fiscal first quarter ended September 30, 2024.

Last month, the New York Knicks (“Knicks”) and New York Rangers ("Rangers") began their 2024-25 regular seasons at the Madison Square Garden Arena. Recent Company operating highlights include:

•The combined average season ticket renewal rate for the Knicks and Rangers is approximately 97% for the 2024-25 seasons;

•The Company announced a new multi-year marketing partnership with the Department of Culture and Tourism – Abu Dhabi that includes naming ‘Experience Abu Dhabi’ as the Official Patch Partner of the New York Knicks;

•The Company also recently signed a new multi-year sponsorship deal with Lenovo and its subsidiary Motorola Mobility, as well as multi-year sponsorship renewals with Verizon and Benjamin Moore; and

•The suites business continues to benefit from strong renewals and new sales activity, including the event-level club space, which was introduced during the 2023-24 seasons and was recently expanded.

In the fiscal 2024 first quarter, the Company generated revenues of $53.3 million, an increase of $10.3 million, or 24%, as compared to the prior year period. In addition, the Company reported an operating loss of $8.3 million, an improvement of $6.6 million, or 44%, and an adjusted operating loss of $2.3 million, an improvement of $7.7 million, or 77%, both as compared to the prior year period.(1)

Madison Square Garden Sports Corp. Executive Chairman and CEO James L. Dolan said, “The new fiscal year already includes several operational highlights across our key revenue categories, including in ticketing, sponsorships and suites. We look forward to continuing this momentum through the Knicks' and Rangers' seasons and remain confident that we are well-positioned to generate long-term shareholder value.”

Financial Results for the Three Months Ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | | | | | | | |

| | September 30, | | Change | | | | |

| $ millions | | 2024 | | 2023 | | $ | | % | | | | | | | | |

| Revenues | | $ | 53.3 | | | $ | 43.0 | | | $ | 10.3 | | | 24 | % | | | | | | | | |

| Operating loss | | $ | (8.3) | | | $ | (14.8) | | | $ | 6.6 | | | 44 | % | | | | | | | | |

Adjusted operating loss(1) | | $ | (2.3) | | | $ | (10.0) | | | $ | 7.7 | | | 77 | % | | | | | | | | |

Note: Does not foot due to rounding

1.See page 3 of this earnings release for the definition of adjusted operating income (loss) included in the discussion of non-GAAP financial measures.

Summary of Financial Results

For the fiscal 2025 first quarter, revenues of $53.3 million increased $10.3 million, or 24%, as compared to the prior year period. This increase primarily reflects higher revenues of $9.7 million due to an increase in certain league distributions unrelated to national media rights fees.

Direct operating expenses of $8.2 million increased $4.7 million as compared to the prior year period. This increase primarily reflects higher net provisions for league revenue sharing expense (net of escrow and excluding playoffs) and NBA luxury tax of $4.1 million due to the net impact of adjustments to prior seasons' revenue sharing expense (net of escrow).

Selling, general and administrative expenses of $52.6 million decreased $1.0 million, or 2%, as compared to the prior year period.

Operating loss of $8.3 million improved $6.6 million, or 44%, and adjusted operating loss of $2.3 million improved $7.7 million, or 77%, both as compared to the prior year period, primarily due to the increase in revenues and, to a lesser extent, lower selling, general and administrative expenses, partially offset by higher direct operating expenses.

About Madison Square Garden Sports Corp.

Madison Square Garden Sports Corp. (MSG Sports) is a leading professional sports company, with a collection of assets that includes the New York Knicks (NBA) and the New York Rangers (NHL), as well as two development league teams – the Westchester Knicks (NBAGL) and the Hartford Wolf Pack (AHL). MSG Sports also operates a professional sports team performance center – the MSG Training Center in Greenburgh, NY. More information is available at www.msgsports.com.

Non-GAAP Financial Measures

We define adjusted operating income (loss), which is a non-GAAP financial measure, as operating income (loss) excluding (i) depreciation, amortization and impairments of property and equipment, goodwill and other intangible assets, (ii) share-based compensation expense or benefit, (iii) restructuring charges or credits, (iv) gains or losses on sales or dispositions of businesses, (v) the impact of purchase accounting adjustments related to business acquisitions, and (vi) gains and losses related to the remeasurement of liabilities under the Company’s Executive Deferred Compensation Plan. Because it is based upon operating income (loss), adjusted operating income (loss) also excludes interest expense (including cash interest expense) and other non-operating income and expense items. We believe that the exclusion of share-based compensation expense or benefit allows investors to better track the performance of our business without regard to the settlement of an obligation that is not expected to be made in cash. In addition, we believe that the exclusion of gains and losses related to the remeasurement of liabilities under the Company’s Executive Deferred Compensation Plan provides investors with a clearer picture of the Company’s operating performance given that, in accordance with U.S. generally accepted accounting principles (“GAAP”), gains and losses related to the remeasurement of liabilities under the Company’s Executive Deferred Compensation Plan are recognized in Operating (income) loss whereas gains and losses related to the remeasurement of the assets under the Company’s Executive Deferred Compensation Plan, which are equal to and therefore fully offset the gains and losses related to the remeasurement of liabilities, are recognized in Miscellaneous income (expense), net, which is not reflected in Operating income (loss).

We believe adjusted operating income (loss) is an appropriate measure for evaluating the operating performance of our Company. Adjusted operating income (loss) and similar measures with similar titles are common performance measures used by investors and analysts to analyze our performance. Internally, we use revenues and adjusted operating income (loss) as the most important indicators of our business performance, and evaluate management’s effectiveness with specific reference to these indicators. Adjusted operating income (loss) should be viewed as a supplement to and not a substitute for operating income (loss), net income (loss), cash flows from operating activities, and other measures of performance and/or liquidity presented in accordance with GAAP. Since adjusted operating income (loss) is not a measure of performance calculated in accordance with GAAP, this measure may not be comparable to similar measures with similar titles used by other companies. For a reconciliation of operating income (loss) to adjusted operating income (loss), please see page 5 of this earnings release.

Forward-Looking Statements

This press release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including financial community and rating agency perceptions of the Company and its business, operations, financial condition and the industry in which it operates, and the factors described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. The Company disclaims any obligation to update any forward-looking statements contained herein.

# # #

Contacts:

Ari Danes, CFA

Investor Relations and Financial Communications

(212) 465-6072

Justin Blaber

Financial Communications

(212) 465-6109

Grace Kaminer

Investor Relations

(212) 631-5076

MADISON SQUARE GARDEN SPORTS CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | September 30, | | |

| | 2024 | | 2023 | | | | |

| Revenues | | $ | 53,307 | | | $ | 43,046 | | | | | |

| Direct operating expenses | | 8,211 | | | 3,520 | | | | | |

| Selling, general and administrative expenses | | 52,587 | | | 53,556 | | | | | |

| Depreciation and amortization | | 782 | | | 794 | | | | | |

| Operating loss | | (8,273) | | | (14,824) | | | | | |

| Other income (expense): | | | | | | | | |

| Interest income | | 864 | | | 453 | | | | | |

| Interest expense | | (6,055) | | | (6,929) | | | | | |

| Miscellaneous expense, net | | (1,126) | | | (12,665) | | | | | |

| Loss before income taxes | | (14,590) | | | (33,965) | | | | | |

| Income tax benefit | | 7,048 | | | 15,144 | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss | | $ | (7,542) | | | $ | (18,821) | | | | | |

| | | | | | | | |

| Basic loss per common share attributable to Madison Square Garden Sports Corp.’s stockholders | | $ | (0.31) | | | $ | (0.79) | | | | | |

| Diluted loss per common share attributable to Madison Square Garden Sports Corp.’s stockholders | | $ | (0.31) | | | $ | (0.79) | | | | | |

| | | | | | | | |

Basic weighted-average number of common shares outstanding | | 24,049 | | | 23,971 | | | | | |

Diluted weighted-average number of common shares outstanding | | 24,049 | | | 23,971 | | | | | |

MADISON SQUARE GARDEN SPORTS CORP.

ADJUSTMENTS TO RECONCILE OPERATING INCOME (LOSS) TO

ADJUSTED OPERATING INCOME (LOSS)

(In thousands)

(Unaudited)

The following is a description of the adjustments to operating loss in arriving at adjusted operating loss as described in this earnings release:

•Depreciation and amortization. This adjustment eliminates depreciation, amortization and impairments of property and equipment, goodwill and other intangible assets in all periods.

•Share-based compensation. This adjustment eliminates the compensation expense related to restricted stock units and stock options granted under the Company's employee stock plan and non-employee director plan in all periods.

•Remeasurement of deferred compensation plan liabilities. This adjustment eliminates the impact of gains and losses related to the remeasurement of liabilities under the Company's executive deferred compensation plan.

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | September 30, | | |

| | 2024 | | 2023 | | | | |

| Operating loss | | $ | (8,273) | | | $ | (14,824) | | | | | |

| Depreciation and amortization | | 782 | | | 794 | | | | | |

| Share-based compensation | | 4,268 | | | 4,149 | | | | | |

| | | | | | | | |

| Remeasurement of deferred compensation plan liabilities | | 965 | | | (104) | | | | | |

| | | | | | | | |

Adjusted operating loss(1) | | $ | (2,258) | | | $ | (9,985) | | | | | |

____________________

(1) Adjusted operating loss includes operating lease costs which is comprised of a contractual cash component plus or minus a non-cash component for each period presented. Pursuant to GAAP, recognition of operating lease costs is recorded on a straight-line basis over the term of the agreement based upon the value of total future payments under the arrangement. Adjusted operating loss includes operating lease costs of (i) $854 and $829 of expense paid in cash for the three months ended September 30, 2024 and September 30, 2023, respectively, and (ii) a non-cash expense of $457 and $482 for the three months ended September 30, 2024 and September 30, 2023, respectively.

MADISON SQUARE GARDEN SPORTS CORP.

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30,

2024 | | June 30,

2024 |

| | | | |

| ASSETS | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | | $ | 52,252 | | | $ | 89,136 | |

| Restricted cash | | 5,832 | | | 5,771 | |

| Accounts receivable, net of allowance for doubtful accounts of $0 as of September 30, 2024 and June 30, 2024 | | 45,302 | | | 33,781 | |

| | | | |

| Net related party receivables | | 26,018 | | | 32,255 | |

| Prepaid expenses | | 84,260 | | | 30,956 | |

| | | | |

| Other current assets | | 22,116 | | | 25,043 | |

| Total current assets | | 235,780 | | | 216,942 | |

| Property and equipment, net of accumulated depreciation and amortization of $51,199 and $52,281 as of September 30, 2024 and June 30, 2024, respectively | | 28,282 | | | 28,541 | |

| Right-of-use lease assets | | 692,412 | | | 694,566 | |

| | | | |

| Indefinite-lived intangible assets | | 103,644 | | | 103,644 | |

| Goodwill | | 226,523 | | | 226,523 | |

| Investments | | 64,450 | | | 62,543 | |

| | | | |

| Other assets | | 22,206 | | | 13,533 | |

| Total assets | | $ | 1,373,297 | | | $ | 1,346,292 | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

MADISON SQUARE GARDEN SPORTS CORP.

CONSOLIDATED BALANCE SHEETS (continued)

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30,

2024 | | June 30,

2024 |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Current Liabilities: | | | | |

| Accounts payable | | $ | 5,334 | | | $ | 9,900 | |

| Net related party payables | | 4,658 | | | 6,718 | |

| Debt | | 30,000 | | | 30,000 | |

| | | | |

| Accrued liabilities: | | | | |

| Employee related costs | | 68,766 | | | 133,930 | |

| League-related accruals | | 98,215 | | | 120,876 | |

| Other accrued liabilities | | 11,064 | | | 21,613 | |

| Operating lease liabilities, current | | 49,799 | | | 50,267 | |

| | | | |

| Deferred revenue | | 306,839 | | | 148,678 | |

| Total current liabilities | | 574,675 | | | 521,982 | |

| | | | |

| Long-term debt | | 275,000 | | | 275,000 | |

| Operating lease liabilities, noncurrent | | 738,555 | | | 749,952 | |

| Defined benefit obligations | | 4,104 | | | 4,103 | |

| Other employee related costs | | 47,580 | | | 43,493 | |

| Deferred tax liabilities, net | | 9,792 | | | 16,925 | |

| Deferred revenue, noncurrent | | 1,120 | | | 1,147 | |

| | | | |

| Total liabilities | | 1,650,826 | | | 1,612,602 | |

| Commitments and contingencies | | | | |

| Madison Square Garden Sports Corp. Stockholders’ Equity: | | | | |

Class A Common Stock, par value $0.01, 120,000 shares authorized; 19,465 and 19,423 shares outstanding as of September 30, 2024 and June 30, 2024, respectively | | 204 | | | 204 | |

| Class B Common Stock, par value $0.01, 30,000 shares authorized; 4,530 shares outstanding as of September 30, 2024 and June 30, 2024 | | 45 | | | 45 | |

| Preferred stock, par value $0.01, 15,000 shares authorized; none outstanding as of September 30, 2024 and June 30, 2024 | | — | | | — | |

| Additional paid-in capital | | 8,353 | | | 19,079 | |

Treasury stock, at cost, 983 and 1,025 shares as of September 30, 2024 and June 30, 2024, respectively | | (162,504) | | | (169,547) | |

| Accumulated deficit | | (122,689) | | | (115,139) | |

| Accumulated other comprehensive loss | | (938) | | | (952) | |

| | | | |

| | | | |

| Total equity | | (277,529) | | | (266,310) | |

| Total liabilities and equity | | $ | 1,373,297 | | | $ | 1,346,292 | |

MADISON SQUARE GARDEN SPORTS CORP.

SELECTED CASH FLOW INFORMATION

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | September 30, |

| | 2024 | | 2023 |

| Net cash used in operating activities | | $ | (26,158) | | | $ | (54,141) | |

| Net cash used in investing activities | | (1,163) | | | (1,729) | |

| Net cash (used in) provided by financing activities | | (9,502) | | | 67,830 | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | | (36,823) | | | 11,960 | |

| Cash, cash equivalents and restricted cash at beginning of period | | 94,907 | | | 40,459 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 58,084 | | | $ | 52,419 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

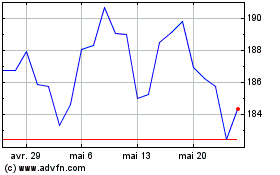

Madison Square Garden Sp... (NYSE:MSGS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Madison Square Garden Sp... (NYSE:MSGS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024