McEwen Mining Inc. (NYSE: MUX) (the “Company”)

today announced the pricing of $95 million aggregate principal

amount of its convertible senior notes due 2030 (the “Notes”) in a

private placement to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the Securities Act

of 1933, as amended (the “Securities Act”). The Company also

granted to the initial purchasers of the Notes an option to

purchase, for settlement within 13 days from the date of initial

issuance of the Notes, up to an additional $15 million aggregate

principal amount of Notes. The sale of the Notes is scheduled to

close on February 11, 2025, subject to satisfaction of customary

closing conditions.

Key Elements of the

Transaction:

- $95 million of

attractively priced capital raised ($110 million if the initial

purchasers fully exercise their option to purchase additional

Notes)

- Initial

conversion price of $11.25 per share represents a conversion

premium of approximately 30% over the closing sale price of $8.65

per share of the Company’s shares on February 6, 2025

- Separate capped

call transactions have the potential to synthetically increase the

effective conversion price for conversions at maturity to

$17.30 per share, which represents a 100% premium to the

closing sale price of the Company’s common stock on February

6, 2025

- The Offering

provides strategic benefits to the Company including re-financing

$20 million of higher-interest debt and an attractive coupon rate

of 5.25%

The Notes will be senior, unsecured obligations

of the Company, and will pay interest semi-annually in arrears on

February 15 and August 15 of each year, beginning on August 15,

2025, at a rate of 5.25% per year. The Notes will mature on August

15, 2030, unless earlier converted, redeemed or repurchased.

Prior to the close of business on the business

day immediately preceding May 15, 2030, the Notes will be

convertible only under certain circumstances and during certain

periods, and thereafter, at any time until the close of business on

the second scheduled trading day immediately preceding the maturity

date. The initial conversion rate for the Notes will be 88.9284

shares per $1,000 principal amount of Notes, which is equivalent to

an initial conversion price of approximately $11.25 per share, and

will be subject to adjustment upon the occurrence of certain

events. The initial conversion price represents a conversion

premium of approximately 30% over the last reported sale price of

$8.65 per share of the Company’s common stock on the New York Stock

Exchange on February 6, 2025. The Company will settle conversions

of the Notes by paying or delivering, as the case may be, cash, its

common stock, or a combination thereof, at its election.

Prior to August 21, 2028, the Notes will not be

redeemable. The Company may redeem for cash all or any portion of

the Notes (subject to certain limitations), at its option, on or

after August 21, 2028 and prior to the 46th scheduled trading day

immediately preceding the maturity date, if the last reported sale

price of its common stock has been at least 130% of the conversion

price then in effect for at least 20 trading days (whether or not

consecutive) during any 30 consecutive trading day period

(including the last trading day of such period) ending on, and

including, the trading day immediately preceding the date on which

the Company provides notice of redemption at a redemption price

equal to 100% of the principal amount of the notes to be redeemed,

plus accrued and unpaid interest to, but excluding, the redemption

date. Noteholders may require the Company to repurchase their Notes

upon the occurrence of a fundamental change (as defined in the

indenture that will govern the Notes), subject to certain

conditions, at a purchase price equal to 100% of the principal

amount of the Notes to be repurchased, plus accrued and unpaid

interest to, but excluding, the fundamental change repurchase date.

In addition, the Company will under certain circumstances increase

the conversion rate for noteholders who elect to convert their

Notes in connection with the occurrence of certain corporate events

or convert their Notes called (or deemed called) for redemption

during the related redemption period, as the case may be.

The Company estimates that the net proceeds from

this offering will be approximately $91.3 million (or

approximately $105.9 million if the initial purchasers

exercise their option to purchase additional notes in full), after

deducting the initial purchasers’ discounts and commissions and

estimated offering expenses payable by the Company. The Company

intends to use the net proceeds from the offering (including any

additional proceeds resulting from the exercise by the initial

purchasers of their option to purchase the additional Notes) to pay

the cost of capped call overlay (approximately $13.1 million), to

repay a portion of the outstanding borrowings under the Company’s

existing credit agreement, and the remainder for general corporate

purposes.

In connection with the pricing of the Notes, the

Company entered into privately negotiated capped call transactions

with certain other financial institutions (the “Option

Counterparties”). The capped call transactions cover, subject to

customary adjustments substantially similar to those applicable to

the Notes, the number of shares of the Company’s common stock

initially underlying the Notes. The capped call transactions are

generally expected to reduce the potential dilution to the

Company’s common stock upon any conversion of the Notes or, at the

Company’s election (subject to certain conditions), offset any cash

payments the Company is required to make in excess of the principal

amount of converted Notes, as the case may be, with such reduction

and/or offset subject to a cap. If the initial purchasers of the

Notes exercise their option to purchase the additional Notes, the

Company expects to use a portion of the proceeds from the sale of

the additional Notes to enter into additional capped call

transactions with the Option Counterparties.

In connection with establishing their initial

hedges of the capped call transactions, the Company expects the

Option Counterparties or their respective affiliates will enter

into various derivative transactions with respect to the Company’s

common stock and/or purchase shares of the Company’s common stock

concurrently with or shortly after the pricing of the Notes,

including with, or from, as the case may be, certain investors in

the Notes. This activity could increase (or reduce the size of any

decrease in) the market price of the Company’s common stock or the

Notes at that time.

In addition, the Option Counterparties or their

respective affiliates may modify their hedge positions by entering

into or unwinding various derivatives with respect to the Company’s

common stock and/or purchasing or selling shares of the Company’s

common stock or other securities of the Company in secondary market

transactions following the pricing of the Notes and prior to the

maturity of the Notes (and are likely to do so during the relevant

valuation period under the capped call transactions, which is

scheduled to occur during a 45 day trading day period commencing on

the 46th trading day prior to the maturity date of the Notes, or,

to the extent the Company exercises the relevant election under the

capped call transactions, following any repurchase, redemption or

early conversion of the Notes). This activity could also cause or

avoid an increase or a decrease in the market price of the

Company’s common stock or the Notes, which could affect the ability

of noteholders to convert the Notes, and, to the extent the

activity occurs during any observation period related to a

conversion of the Notes, it could affect the number of shares of

common stock, if any, and value of the consideration that

noteholders will receive upon conversion of the Notes.

The Notes are being offered only to persons

reasonably believed to be qualified institutional buyers pursuant

to Rule 144A promulgated under the Securities Act by means of a

private offering memorandum. The offer and sale of the Notes and

any shares of the Company’s common stock upon conversion of the

Notes have not been and will not be registered under the Securities

Act or the securities laws of any other jurisdiction and, unless so

registered, such Notes and shares may not be offered or sold in the

United States except pursuant to an applicable exemption from such

registration requirements. This press release does not constitute

an offer to sell or the solicitation of an offer to buy securities

and shall not constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale is

unlawful.

The Company is an “Eligible Interlisted Issuer”

as such term is defined in the TSX Company Manual. As an Eligible

Interlisted Issuer, the Company has relied on an exemption pursuant

to Section 602.1 of the TSX Company Manual, the effect of which is

that the Company was not required to comply with certain

requirements relating to the issuance of securities in connection

with the transaction.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as of the date of this news

release, are the Company’s estimates, forecasts, projections,

expectations, or beliefs as to future events and results. These

forward-looking statements include statements regarding the

completion of the proposed offering, the intended use of net

proceeds from the offering, and the effects of entering into the

capped call transactions described above and the actions of the

Option Counterparties and their respective affiliates.

Forward-looking statements and information are necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by management, are inherently subject to significant

business, economic, and competitive uncertainties, risks, and

contingencies, and there can be no assurance that such statements

and information will prove to be accurate. Therefore, actual

results and future events could differ materially from those

anticipated in such statements and information. Among the important

factors that the Company thinks could cause its actual results to

differ materially from those expressed in or contemplated by the

forward-looking statements include risks related to or associated

with whether the Company will consummate the offering, whether the

capped call transactions become effective, market conditions, and

risks relating to the Company’s business, including those described

in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31st, 2023 and in the Company’s subsequent

filings under the Securities Exchange Act of 1934, as amended. All

forward-looking statements and information made in this news

release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not

accept responsibility for the adequacy or accuracy of the contents

of this news release, which has been prepared by the management of

McEwen Mining Inc.

CONTACT INFORMATION150 King

Street WestSuite 2800, PO Box 24Toronto, ON, CanadaM5H 1J9

RELATIONSHIP WITH

INVESTORS:(866)-441-0690 - Toll free

line(647)-258-0395Mihaela Iancu ext. 320info@mcewenmining.com

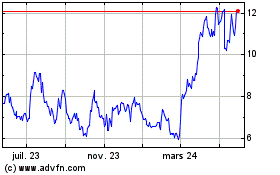

McEwen Mining (NYSE:MUX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

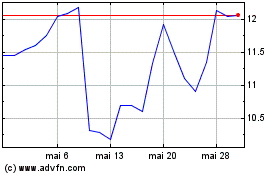

McEwen Mining (NYSE:MUX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025