00013505938-KFALSE00013505932024-12-092024-12-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): December 9, 2024

MUELLER WATER PRODUCTS, INC.

(Exact Name of Registrant as Specified in Its Charter) | | | | | | | | |

| Delaware | 001-32892 | 20-3547095 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1200 Abernathy Road N.E.

Suite 1200

Atlanta, Georgia 30328

(Address of Principal Executive Offices)

(770) 206-4200

(Registrant’s telephone number, including area code)

Not Applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240-14d-2(b)) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | MWA | New York Stock Exchange |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| |

| Emerging growth company | ☐ |

| | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 9, 2024, Mueller Water Products, Inc. (the “Company”) entered into a letter agreement (the “Letter Agreement”) with Marietta Edmunds Zakas, the Company’s Chief Executive Officer, which supplements Ms. Zakas’ existing Employment Agreement, dated September 15, 2008 and as thereafter amended, and Executive Change-in-Control Severance Agreement, dated September 30, 2018 (the “CIC Agreement”).

In addition, the Letter Agreement supersedes the Company’s prior letter agreement with Ms. Zakas, dated August 21, 2023 (the “Prior Letter Agreement”). As a result, the Prior Letter Agreement, including Section 4 thereof, is of no further force or effect. The Prior Letter Agreement had provided that Ms. Zakas would receive full severance benefits under the CIC Agreement in the event her employment was terminated without cause or for good reason – in each instance, regardless of whether or not the Company had experienced a Change-in-Control (as defined in the CIC Agreement). Pursuant to the Letter Agreement, Ms. Zakas has agreed to forego these benefits and the terms of the CIC Agreement will now only apply following a Change-in-Control.

Ms. Zakas will continue to (i) receive an annual base salary of no less than $900,000, a target annual bonus equal to no less than 110% of annual base salary and target annual long-term incentive opportunity equal to no less than 333% of annual base salary, (ii) be entitled to a severance multiple of three in connection with a Qualifying Termination (as defined in the CIC Agreement), (iii) be entitled to a base salary severance of 300% of her then-current base salary upon a termination without “cause” or resignation for “good reason”, (iv) receive a monthly car allowance of $2,000 per month and (v) receive reimbursement of financial planning expenses in accordance with the Company’s policy for executive financial planning.

The Letter Agreement further provides that, in the event Ms. Zakas terminates her employment as a result of a retirement in which she has provided six months prior written notice to the Company of her intent to retire or her employment is terminated as a result of death, disability, a termination by the Company (other than for “cause”) or a termination by Ms. Zakas for “good reason”, she will be entitled to (i) a prorated annual bonus for the fiscal year in which the termination occurs, determined based on actual performance, (ii) COBRA continuation coverage for up to 18 months following termination, (iii) monthly payments equal to 150% of the applicable monthly COBRA rate for the coverage that is extended and (iv) continued group life insurance coverage for 24 months following termination.

The foregoing description of the Letter Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Letter Agreement, a copy of which filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | |

| |

| 104 | The cover page of this Current Report on Form 8-K, formatted in Inline XBRL

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, Mueller Water Products, Inc. has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | |

| Dated: December 11, 2024 | MUELLER WATER PRODUCTS, INC. |

| | | |

| | | |

| | By: | /s/ Chason A. Carroll | |

| | | Chason A. Carroll |

| | | Senior Vice President, General Counsel and Corporate Secretary |

Exhibit 10.1

MUELLER WATER PRODUCTS, INC.

VIA EMAIL

Marietta Edmunds Zakas

mzakas@muellerwp.com

Dear Martie:

Reference is made to the Employment Agreement, dated as of September 15, 2008, and as thereafter amended, between you and Mueller Water Products, Inc. (the “Company”, and such agreement, the “Employment Agreement”), the Executive Change-in-Control Severance Agreement, dated as of September 30, 2019, between you and the Company (the “CIC Agreement”) and that Side Letter, dated as of August 21, 2023, between you and the Company (the “Side Letter”). Unless otherwise defined herein, all capitalized terms shall have the meanings ascribed to them in the Employment Agreement.

This letter memorializes our discussions regarding your continued employment with the Company on and following December 4, 2024 (the “Effective Date”). This letter fully supersedes and replaces the Side Letter and following the Effective Date, the Side Letter, including Section 4 of the Side Letter, will be of no further force or effect.

As discussed, on the Effective Date, you will continue in the role of Chief Executive Officer of the Company, reporting directly to the Board of Directors of the Company (the “Board”). In consideration of your role, and as a supplement to the payments and benefits provided under the Employment Agreement and CIC Agreement, the following provisions apply to your employment with the Company (as initially agreed to in the Side Letter):

1.During your service as Chief Executive Officer of the Company, you will continue to be eligible for an annual base salary equal to no less than $900,000, target annual bonus equal to no less than 110% of annual base salary and target annual long-term incentive opportunity equal to no less than 333% of annual base salary.

2.Section 2.3(c) of the CIC Agreement continues to be amended to replace “two (2)” with “three (3)” where it appears therein.

3.Article I, Section 5(ii) of the Employment Agreement continues to be amended to replace “262.5%” with “300%”.

4.Article I, Section 3(e) of the Employment Agreement continues to be amended to replace “$1,500” with “$2,000”.

5.During your service as Chief Executive Officer of the Company, you will continue to be eligible for an annual reimbursement of up to $10,000 for financial planning services in accordance with the Company’s policy for executive financial planning, as well as other perquisites and personal benefits that are no less favorable than those provided to the Chief Executive Officer serving in such position prior to you.

6.In the event (i) you terminate your employment with the Company as a result of Retirement (as defined in the Mueller Water Products, Inc. Second Amended and Restated 2006 Stock Incentive Plan) in which you have provided six (6) months prior written notice to the Company of your intent to retire or (ii) since you currently are eligible for Retirement, your termination is the result of death, Disability, a termination by the Company other than for Cause or a termination by you for Good Reason, you shall be entitled to the following benefits, which shall be in addition to any benefits under any plan or agreement that you otherwise may be entitled to,

(a)A Bonus for the year which includes the date of your termination based on actual results for such year and pro rated based on the days employed in such year. In addition, to the extent not yet paid, a Bonus for the preceding year based on actual results for such year. Any such Bonuses shall be paid in the normal course at such time as other executives are paid.

(b)The Company will allow you to elect to continue medical and dental coverage for you and your eligible dependents (for the same coverages as provided to its active employees) for a period of 18 months (the “COBRA Period”) following the date of your termination, provided you (i) timely elect COBRA continuation coverage, and (ii) timely pay the applicable COBRA premiums, subject to the rules and limitations that apply to COBRA coverages.

As part of your benefits hereunder, you shall be paid during the COBRA Period an amount each month equal to 150% of the applicable monthly COBRA rate for the coverage that is elected, reduced by applicable withholdings. For this purpose, the applicable COBRA rate is the cost of COBRA coverage, determined as of the date of your termination, for the level of medical and/or dental coverage you have in effect on the date of your termination; provided, however, this monthly payment shall cease and shall not be payable after the month in which you cease to be eligible for COBRA coverage.

At the end of the COBRA Period and provided COBRA coverage has not been terminated earlier, the Company will provide you with the right to elect coverage under the Company’s group medical and dental plans for active employees at a monthly cost equal to the then COBRA rate for a period of up to 24 months (the “Extended Coverage Period”), provided, however, the Company’s obligation to offer you the right to elect such coverages and the Extended Coverage Period shall cease upon the date you become eligible for coverage under another employer provided group health plan, including an employer of your spouse, whether or not you elect such coverage.

(c)The Company will continue at its expense your group life insurance coverage for a period of 18 months following the date of your termination on the same terms and conditions and in the same amount as prior to such date.

The Company shall withhold all applicable federal, state and local taxes, social security and workers’ compensation contributions and other amounts as may be required by law with respect to compensation payable pursuant to this letter. The Company also agrees to make payment directly to your advisors with respect to your reasonable legal fees and expenses incurred in connection with reviewing this letter and related compensation arrangements, as well as any subsequent disputes.

To the extent necessary to comply with Section 409A of the Code, any severance payments or other benefits to which you may become entitled pursuant to this letter, the Employment Agreement, the CIC Agreement, or otherwise, will be paid at the time and in the form provided for the non-”Change in Control” severance benefits under the Employment Agreement. In addition, the Company is responsible for ensuring that any severance payments or other benefits to which you may become entitled pursuant to this letter, the Employment Agreement, the CIC Agreement, or otherwise will be paid at a time and manner that complies with, or is exempt from, Section 409A of the Code.

Except as expressly amended by this letter, all terms and conditions of the Employment Agreement and CIC Agreement shall remain in full force and effect. In the event of any conflict between the terms of this letter and the terms of the Employment Agreement or the CIC Agreement, the terms of this letter shall control. This letter shall be construed in accordance with the internal laws of the State of Georgia, without regard to the conflict of law provisions of any state. This letter may be executed in two or more counterparts, each of which shall be deemed to be an original, but all of which together shall constitute one and the same instrument.

| | | | | | | | |

| | MUELLER WATER PRODUCTS, INC. |

| | |

| | |

| | /s/ Chason A. Carroll |

| | Name: Chason A. Carroll |

| | Title: General Counsel |

| | | | | |

| ACCEPTED AND AGREED | |

| | |

| | |

| /s/ Marietta Edmunds Zakas | |

| Marietta Edmunds Zakas | |

v3.24.3

Cover Page Document

|

Dec. 09, 2024 |

| Document Information [Line Items] |

|

| Entity Central Index Key |

0001350593

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Written Communications |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-32892

|

| Entity Tax Identification Number |

20-3547095

|

| Entity Address, Address Line One |

1200 Abernathy Road N.E.

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

(770)

|

| Local Phone Number |

206-4200

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

MWA

|

| Security Exchange Name |

NYSE

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 09, 2024

|

| Entity Registrant Name |

MUELLER WATER PRODUCTS, INC.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

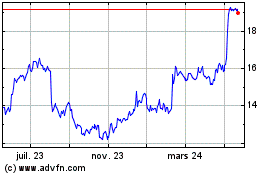

Mueller Water Products (NYSE:MWA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

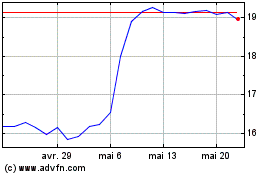

Mueller Water Products (NYSE:MWA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025