GD Gets $49.4M Order for DDG 51 - Analyst Blog

20 Décembre 2012 - 2:15PM

Zacks

Bath Iron Works (“BIW”), a business

wing of General Dynamics Corporation (GD), has

received two contracts worth $49.4 million from the U.S Navy under

the DDG 51 Arleigh Burke-class guided missile destroyer

program.

Per the first contract, General Dynamics will be responsible for

providing lead yard services to the DDG 51 program. The

contract, worth $28.3 million, is a modification pact that follows

a contract initially received by the company earlier in 2012.

The second contract, worth $21.1 million, under the DDG 51 program

was for post-shakedown availability (“PSA”) for USS Michael Murphy

(DDG 112). The total value of the contract is $27.1 million, if all

the options are exercised. Though BIW will remain the prime

contractor, Bath Iron Works has teamed up with BAE Systems, a

subsidiary of BAE Systems plc (BAESY), for this contract. The task

is expected to be completed by August 2013.

DDG 51 Arleigh Burke-class features Aegis combat system, the

vertical launching system, advanced anti-submarine warfare system,

two embarked SH-60 helicopters, advanced anti-aircraft missiles and

Tomahawk anti-ship and land-attack missiles. This makes it the most

powerful surface combatant positioned in sea. DDG 51 multi-mission

guided missile destroyers provide a complete array of

anti-submarine, anti-air and anti-surface capabilities by operating

in support of carrier battle groups, surface action groups,

amphibious groups and replenishment groups.

Bath Iron Works is the lead shipyard and design agent for the DDG

51 Arleigh Burke-class. It has been providing design and technical

assistance for design upgrades and major changes to the two

shipyards that are currently building DDG 51-class destroyers since

1987. Under the Navy's DDG 51 continuation program, BIW is working

on the construction of Rafael Peralta (DDG 115) and Thomas Hudner

(DDG 116). It had received a contract modification worth $663

million for the construction of DDG 116 in February 2012.

This contract proves the company’s capability of providing high

quality support and services anytime for the fleet of DDG 51-class

of ships.

Based in Falls Church, Virginia, General Dynamics engages in

mission-critical information systems and technologies; land and

expeditionary combat vehicles, armaments and munitions;

shipbuilding and marine systems; and business aviation.

General Dynamics’ revenue exposure is spread over a broad portfolio

of products and services in business aviation; combat vehicles,

weapons systems and munitions; shipbuilding design, repair and

construction; and information systems, technologies and services.

Diversification of revenue through exposure to a number of

uncorrelated markets will keep the overall growth momentum steady.

However, with possibility of a cut in the defense budget, the

company presently retains a short-term Zacks #3 Rank (Hold) that

corresponds with our long-term Neutral recommendation on the

stock.

Some of its major peers are Northrop Grumman

Corporation (NOC) and Lockheed Martin

Corporation (LMT).

GENL DYNAMICS (GD): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

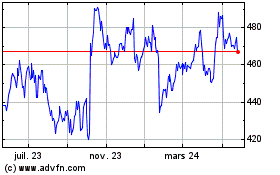

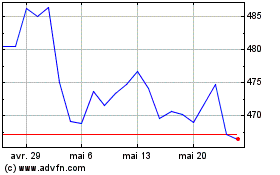

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024