The U.S. is the world’s largest aerospace and defense market,

and also home to the world’s largest military budget. The industry

largely depends on U.S. government contracts. As such, the outlook

for the industry is closely tied to the outlook for defense

spending by the government. The spending component of the ongoing

budget debate and the ‘Fiscal Cliff’ is heavily weighted towards

the defense budget.

Defense spending is the major source of revenue for the top nine

global aerospace and defense companies, with the US accounting for

more than 40% of total global defense spending. Given the uncertain

macroeconomic environment, not just in the U.S. but also globally,

the industry faces the risk of fewer new orders as customers are

more likely to postpone or cancel contractual orders and/or

payments.

In December this year, the U.S. Senate unanimously approved the

fiscal 2013 budget worth $633.3 billion. Of this, $527.5 billion

was allotted to fund basic national defense and the Energy

Department, $17.4 billion was for nuclear weapons projects and

$88.5 billion more for overseas operations.

Currently, the U.S. defense spending is negatively impacted by the

Budget Control Act of 2011. The Budget Control Act of 2011 has two

main parts that would affect future defense spending. The first

part dictates a $487.0 billion reduction to previously-planned

defense spending over the next decade. The second part is a

sequester mechanism that would impose an additional $500.0 billion

of cuts on defense spending if Congress is not able to reduce the

U.S. deficit by $1.2 trillion by January 2, 2013.

With just days to go before the deadline hits, the issue is as

uncertain now as it was immediately after the November elections.

While a ‘grand bargain’ doesn’t appear to be on the table anymore,

a non-resolution of the ‘Cliff’ issue would be a major blow to the

aerospace industry. In fact, the Congressional Budget Office

expects the economy to slide into a recession if the automatic

spending cuts and tax increases associated with the ‘Fiscal Cliff’

are not averted.

Since the September 2001 WTC and Pentagon attacks, the U.S.

government has spent significant amounts on military campaigns

overseas. The country has already decided to gradually move out of

Afghanistan, and the war in Iraq has already ended, which is

expected to lower its expenditure on foreign campaigns. In addition

to budgetary constraints, including the Budget Control Act, defense

spending will come down with the draw-down of U.S. force levels

tied to current major overseas deployments.

OPPORTUNITIES

Acquisition, Merger, Spin-offs and Strategic Alliances

The big defense operators armed with strong balance sheets are

expanding their operations inorganically through acquisitions. The

U.S. Defense department also endorses mergers among U.S. defense

companies, provided they don’t involve the top five or six

suppliers acquiring each other. For that matter, the industry

encourages acquisitions as the highest-priority investment area for

a company with a sizeable cash balance looking for growth amid

significant defense budget cuts.

In fact, the four main strategies to stimulate that growth are

joint ventures, foreign military sales, international expansion and

mergers and alliances.

Recently, Lockheed Martin Corporation (LMT)

announced the acquisition of Chandler/May Inc., an unmanned aerial

systems manufacturer. Lockheed Martin’s prudent acquisition of

Chandler/May would expand its expertise in the design, development,

integration, manufacturing and support of fully integrated mission

critical systems for unmanned aerial systems (“UAS”) and Command,

Control, Communications, Computers, Intelligence, Surveillance,

Reconnaissance (“C4ISR”) missions. Lockheed would leverage the

expertise of Chandler/May Inc. to carry out the October contract

for Coast Guard Super Hercules C4ISR planes.

The Boeing Corporation (BA) recently completed the

acquisition of Miro Technologies. Miro is a privately held software

company that specializes in enterprise asset and supply chain

management; MRO services; and Performance-Based Logistics (“PBL”)

management for government and commercial customers worldwide. This

acquisition would bolster the company’s defense logistics support

strategies. Prior deals made by the company include acquisition of

Tapestry Solutions, Federated Software Group, and CDM

Technologies.

In December this year, General Dynamics

Corporation (GD) completed the acquisition of Applied

Physical Sciences Corp. of Groton, Connecticut. Applied Physical

Sciences is a leading provider of applied research and development

services. It will become a part of General Dynamics Electric Boat

and help in various engineering programs.

Again in December, Raytheon Company (RTN)

completed the acquisition of the Government Solutions business of

SafeNet Inc. for an undisclosed amount. The need for acquiring a

privately held data security firm comes in the light of supporting

the U.S. government's growing need for protected and encrypted

data. In October 2012, Raytheon had also completed the acquisition

of Teligy, Inc. that has improved the company’s cybersecurity

offerings in wireless communications, vulnerability analysis,

reverse engineering and custom kernel software/device driver

development.

In September, Northrop Grumman Corporation (NOC)

completed the acquisition of M5 Network Security Pty Ltd.

Australia-based M5 Network Security is a provider of cybersecurity

and secure mobile communications products and services, and

advanced analytics to Australian military and intelligence

organizations.

These acquisitions help the defense pros in fulfilling task orders

and contracts. For instance, in December 2012, Raytheon received a

contract to develop new techniques to perform research and develop

tools to integrate new and individual facts into existing large

information stores. In this case, the company would be helped by

the acquisition of SafeNet Inc. The acquired unit would help the

company in performing this task order while maintaining its

relationship with various customers.

Agreements and Contracts

In the light of defense budget cuts and risks to high-budget

programs, the companies often fall back on joint ventures and

strategic alliances to pool their resources giving them access to

new markets. Moreover, these alliances help to cut down on

competition in a densely competitive space.

Sometimes two aerospace companies that are in a strategic alliance

benefit from a single contract. Boeing and Textron

Inc. (TXT) together recently received a contract from the

U.S. Marine Corps for seven Osprey ground-based trainers, which

will reduce fuel usage and aircraft wear-and-tear, maximizing

lifecycle cost savings. In this case both the parties were

benefited.

Also, aerospace majors are known to venture beyond the pale of

their universe to find future aerospace solutions. These domestic

and international agreements are made to bring in new technology

and expertise. In November this year, Lockheed Martin had signed a

three-year agreement under the Department of Defense (“DoD”)

Mentor-Protégé Program. Per the agreement, Lockheed will assist

IERUS Technologies in further developing its government contract

accounting system, quality and procurement processes and export

control processes.

In December this year, Boeing signed a collaboration agreement with

BMW Group as per which they will make a joint research on carbon

fiber recycling. Moreover, they will also share information about

carbon fiber materials and manufacturing. This would allow Boeing

to develop the use and end use of carbon fiber materials.

Then there are international agreements that are done in order to

bring in new technology and expertise. In September this year,

Boeing entered into an agreement with Sojitz Corporation, a

Japanese company. Per the agreement, Boeing will provide training

to support Japan's need for more cybersecurity experts. In turn,

Sojitz will contribute its Japanese market expertise, information

technology professionals and strong local partnerships.

To respond to anticipated requests for both the new U.S. Air Force

Combat Rescue Helicopter and the U.S. Navy's recently announced

program to develop a new "Marine One" presidential helicopter,

Northrop Grumman entered into an agreement with Finmeccanica

SpA.

In November this year, General Dynamics received a contract

modification from the government of Canada for the upgrade of 66

more LAV III vehicles. Meanwhile Huntington Ingalls

Industries (HII) in December received a

cost-plus-fixed-fee contract to provide life-cycle engineering and

support services for USS San Antonio (LPD 17) class of amphibious

transport docks of the U.S. Navy. The contract is the third of the

four annual options that was associated with a base contract

awarded in February 2010.

These types of contract modifications and execution of options

indicate the U.S. Navy’s as well as other federal bodies’

confidence in the aerospace and defense companies.

International Orders

The aerospace and defense companies generate revenue from

international orders and foreign military sales (”FMS”). With a

continually challenged domestic defense sector and decline in

contracts from the U.S. government, the industry remains focused on

international growth. Foreign sales of U.S. military aircraft

provide an important growth area. Currently, the C-17, F-15 and

F-16 have huge international export demand.

The rapidly evolving security challenges and the need for countries

to modernize aging inventories keep demand alive in international

markets. However, in Europe, the continuous financial crisis is

forcing governments to institute austerity measures that will

negatively impact defense spending in the near term. The

initiatives taken up would constrain their defense budgets and

fiscal priorities in current and future periods.

Over the next few years, demand for U.S. military exports is

expected to remain strong. A truculent Iran, with increasing

potential for nuclear capacity and relatively strong oil prices,

has of late spurred the demand for U.S. military aerospace products

by Gulf countries. Similarly, increasing Chinese defense budgets

have led to significant, new U.S. sales in South and East Asia.

Going forward, these sales would more than offset diminishing sales

to European countries that have significantly cut their defense

budgets.

In November this year, Northrop Grumman announced that it will

supply advanced shipboard navigation systems for 20 fast patrol

vessels under a contract with Indian reseller Marine Electricals

Ltd. The systems will be supplied to Indian Coast Guard. Then in

September this year, Northrop Grumman received a contract to supply

navigation bridge equipment for a series of 39,500-dwt dry bulk

cargo ships from China Navigation Company Pte. Ltd., Singapore.

In November this year, Raytheon has received a contract from the

Kingdom of Saudi Arabia to deliver a Command, Control,

Communications, Computers and Intelligence (C4I) system.

Recently, in December, Lockheed has received an FMS contract to

support integration of the Joint Air-to-Surface Standoff Missile

(“JASSM”) onto the Finnish Air Force (“FiAF”) F-18C/D aircraft.

Cutting-Edge Innovation and New Products

At the macro level, a gradual shift in defense spending patterns

can be discerned. In response to asymmetric terrorist threats, the

emphasis appears to have shifted to high-tech intelligence

equipment, replacing demand for conventional big guns and heavy

armor. The major industry players have, in response, resorted to

bolt-on acquisitions to plug gaps in their product offerings.

Among state-of-the-art products, the latest radar and

telecommunication systems, new ballistic missiles, unmanned

warplanes, development of fighter jets and sophisticated

surveillance equipment are on the priority list of most countries.

These help enhance the preparedness of a nation to detect, preempt

and counter hostile situations.

Contemporary warfare has seen a paradigm shift from traditional

forms of waging a war. There is high demand for new defense

products that help the military in locating and eliminating

terrorists before they strike.

Busy Repositioning

The aerospace and defense industry is experiencing continued

consolidation. The companies are also busy restructuring in order

to streamline their operations. Lockheed Martin announced such a

restructuring in October this year which would enhance customer

alignment.

The other way out for U.S. weapon makers who are under pressure to

cut costs and preserve profit margins amid dwindling defense

spending in the U.S is layoffs. Recently, Boeing reduced the number

of defense executives by 30% from 2010 levels, closed facilities in

California and consolidated several business units to cut costs.

After almost completing work on special armor for military vehicles

and a decline in demand for its guns, General Dynamics has also

decided to lay off about 50 employees in Vermont and 30 in

Maine.

Closure of the F-22 production line and decisions not to fund

additional C-17 transport purchases or development of a future

strategic lifter cast a negative impact on the industry. However,

the F-35 Joint Strike Fighter program, the KC-46 tanker, the P-8

maritime patrol aircraft and other platforms continue to receive

funding.

Meanwhile, Northrop Grumman is also planning to cut up to 350 jobs

from its electronics systems sector, with most of the reductions

likely in the Baltimore area. These companies are also

contemplating additional layoffs.

Headwinds

Global Downturn

The global economic downturn that started in late 2008 has

significantly weakened the financial profiles of all major

industrialized countries. The growth and development of the

aerospace and defense industry is tied to the defense budgets of

the different nations around the globe, especially the U.S. The

general trend in this context is to cut national defense

expenditures.

Austerity Drive

The major defense spenders throughout the world are on an austerity

drive. They are gradually lowering their defense budgets and

concentrating on other avenues to fix their ailing economies. The

U.S. defense department has reduced the defense budget

significantly. These cutbacks will impact the big contractors, as

the lion’s share of their revenues comes from domestic defense

spending.

Acquisition and Program Risk

Taking into account the huge number of acquisition deals, the

industry faces risks associated with the completion, integration,

and financing of these acquisitions. Then with the majority of

revenue coming from government contracts, the industry could be

adversely affected by the cancellation and delay of major

government contracts.

Others

Going forward, regulatory and legislative pressures are the most

significant barrier to growth. Besides, energy prices and a lack of

consumer demand could act as obstacles to the growth curve.

Intense Competition

The aerospace and defense companies compete amongst themselves in

the information and services markets for a number of small and

large programs. The major defense players are Boeing, Raytheon,

General Dynamics, L-3 Communications (LLL),

SAIC, Inc. (SAI), BAE Systems plc, European

Aeronautic Defense and Space Company EADS N.V., Finmeccanica SpA,

Airbus, Embraer SA (ERJ) and Bombardier Inc. In

addition, Canada, China, Japan and Russia are all making efforts to

enter or re-enter the large civil aircraft market. Therefore, with

new competitors coming in, it has become important for the U.S.

pros to stay ahead in technology.

Earnings Review and Zacks Rank

The Zacks Industry Rank, which relies on the same estimate

revisions methodology that drives the Zacks Rank for stocks,

currently puts the aerospace industry at 101 out of 259 industries

in our expanded industry classification, broadly qualifying the

industry in the Neutral category. None of the 16 companies in the

aerospace industry has the coveted Zacks Rank #1 (Strong Buy).

However, 2 have Zacks Rank #2 (Buy), 1 has a Zacks Rank #4 (Sell)

rating and the remaining 13 hold a Zacks Rank #3 (Hold).

The majority of stocks in the aerospace industry, such as Boeing,

General Dynamics, Raytheon, Lockheed, Rockwell Collins

Inc. (COL), L-3 Communications, Northrop, Huntington

Ingalls Industries, MTU Aero Engines Holding AG, Safran SA,

Wesco Aircraft Holdings, Inc. (WAIR), Embraer SA,

European Aeronautic Defense and Space Company, presently retain a

Zacks #3 Rank (Hold). However, we have Alliant Techsystems

Inc. (ATK) and Erickson Air-Crane

Incorporated (EAC) on the Zacks #2 Rank (Buy) list, with

Textron at Zacks Rank #4 (Sell).

The earnings results of Boeing, Raytheon, Lockheed, Rockwell

Collins, L-3 Communications and Northrop surpassed the Zacks

Consensus Estimates. The highest positive surprise of 46 cents came

from Lockheed, while General Dynamics and Textron missed

expectations. Overall, total aerospace industry earnings were down

3.3% in the third quarter, but are expected to be down 16.9% in the

fourth quarter. For full-year 2013, the industry is expected to see

a modest earnings growth of about 1.1%.

Our Take

The aerospace & defense industry has been a keystone of the

U.S. economy for decades and has provided well paying jobs for a

variety of skill levels. The industry’s position is now challenged

by global competition, changes in technology, national and

worldwide economic conditions, and global policies affecting

defense, civilian and commercial aviation. To maintain this

important sector of the U.S. economy, the U.S. Commercial Service

strives to provide assistance to increase the industry’s

competitiveness.

The U.S. aerospace industry continues to contribute significantly

to the country’s economy and provides capabilities vital for

national security. It generates new technology in fields such as

advanced materials, sensors, information processing and sharing.

Finally, aerospace continues to generate the largest positive trade

balance of any U.S. manufacturing sector.

The U.S. is the leader in global defense spending. The major super

power also has strategic alliances in place with other foreign

nations with considerable military strengths. The country shares

its military technology and supplies sophisticated weapons to its

allies. These activities, in turn, boost the revenue of the defense

operators.

However, on the flip side, the costs for executing projects for the

aerospace and defense companies due to order delays would increase

leading to an imbalance between the cost and revenue structure.

This would not only hurt profitability but also lead to delays and

even cancellations of orders and/or programs.

Moreover, in the forthcoming years, the industry will face

challenges, particularly in the defense sector, as the federal

government looks for solutions to an ongoing budget crisis.

Sequestration is creating uncertainty in both the civil and

military sectors.

Despite the uncertainty related to sequestration, huge defense

budget cuts and cancellation of big-ticket programs, we have a

mixed outlook for the sector based on product progress,

opportunities, acquisition benefits and cost-cutting efforts of

individual companies.

ALLIANT TECHSYS (ATK): Free Stock Analysis Report

BOEING CO (BA): Free Stock Analysis Report

ROCKWELL COLLIN (COL): Free Stock Analysis Report

ERICKSON AIR-CR (EAC): Free Stock Analysis Report

EMBRAER AIR-ADR (ERJ): Free Stock Analysis Report

GENL DYNAMICS (GD): Free Stock Analysis Report

HUNTINGTON INGL (HII): Free Stock Analysis Report

L-3 COMM HLDGS (LLL): Free Stock Analysis Report

LOCKHEED MARTIN (LMT): Free Stock Analysis Report

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

RAYTHEON CO (RTN): Free Stock Analysis Report

SAIC INC (SAI): Free Stock Analysis Report

TEXTRON INC (TXT): Free Stock Analysis Report

WESCO AIRCRAFT (WAIR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

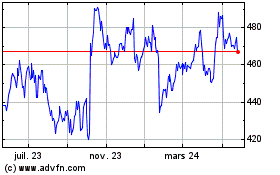

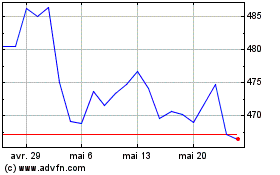

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024